FORM

6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated December 23, 2020

BRASILAGRO

– COMPANHIA BRASILEIRA DE PROPRIEDADES AGRÍCOLAS

(Exact Name as Specified in its Charter)

BrasilAgro

– Brazilian Agricultural Real Estate Company

(Translation

of Registrant’s Name)

1309

Av. Brigadeiro Faria Lima, 5th floor, São Paulo, São Paulo 01452-002, Brazil

(Address

of principal executive offices)

Gustavo

Javier Lopez,

Administrative

Officer and Investor Relations Officer,

Tel.

+55 11 3035 5350, Fax +55 11 3035 5366, ri@brasil-agro.com

1309

Av. Brigadeiro Faria Lima, 5th floor

São

Paulo, São Paulo 01452-002, Brazil

(Name,

Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Indicate

by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Indicate

by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes

☐ No ☒

If

“Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not

applicable.

Material Fact

BRASILAGRO – COMPANHIA BRASILEIRA

DE PROPRIEDADES AGRÍCOLAS

Publicly-Held Company with Authorized Capital

Corporate Taxpayer’s ID (CNPJ/MF)

No. 07.628.528/0001-59

State Registry (NIRE) 35.300.326.237

BrasilAgro – Companhia Brasileira

de Propriedades Agrícolas (B3: AGRO3) (NYSE: LND), in compliance with the provisions of Article 157, Paragraph 4 of

Law 6404/76 and of Instruction No. 358/02 of the Brazilian Securities and Exchange Commission (“CVM”), as amended,

hereby informs its shareholders and the market in general that it is considering the possibility of conducting a public offering

for a primary distribution of common shares, which may also include a secondary portion of shareholders of the Company (“Potential

Offer”).

The Company also informs that, the Board

approved at a meeting held on December 22nd, (with the abstention of the members legally prevented) the acquisitions,

by the Company and its subsidiaries Agrifirma Agro Ltda. and Imobiliária Engenho de Maracajú Ltda., of 100% of the

outstanding shares of the following companies headquartered in Bolivia: (a) Agropecuaria Acres del Sud S.A.; (b) Ombu Agropecuaria

S.A.; (c) Yatay Agropecuaria S.A.; and (d) Yuchan Agropecuarian S.A. (collectively, “Target Companies”), all indirectly

controlled by Cresud S.A.C.I.F.Y.A (“Acquisition”), . The respective Share Purchase Agreement is subject to certain

precedent conditions, including the approval of the Acquisition at an Extraordinary Shareholders’ Meeting.

The acquisition consists of an area of

approximately 9,900 hectares. The properties are located in the central region of Bolivia and are suitable for a second crop. The

Acquisition value totals approximately USD30.0 million (~USD3,000/hectare).

With the Acquisition, the Company intends

to continue its internationalization strategy, starting to operate in a new country (Bolivia) and consolidating itself as the main

vehicle of its economic group for this purpose, providing an increase in revenues and the strengthening of its competitive position.

Finally, based on the assessment carried

out, it was concluded that the Acquisition will not give rise to the right to withdraw under the terms of Article 256 of the Brazilian

Corporations Law.

This Material Fact is not an offer,

solicitation or sale of securities in the United States or any other state or jurisdiction, and there shall not be any offer, solicitation

or sale of securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or jurisdiction. Holders of the Company’s American Depositary

Receipts will not be eligible to participate in any such offer, solicitation, sale or placement.

The Company will keep its shareholders

and the market in general duly informed of any developments or resolutions regarding the Potential Offer, respecting the restrictions

contained in CVM rules and applicable legislation.

São Paulo, December 23, 2020.

Gustavo Javier Lopez

CAO & IRO

Investor Relations:

Phone: +55 (11) 3035-5374

E-mail: ri@brasil-agro.com

|

1

|

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

Date: December

23, 2020

|

|

|

|

By:

|

/s/

Gustavo Javier Lopez

|

|

|

|

Name:

|

Gustavo

Javier Lopez

|

|

|

|

Title:

|

Administrative

Officer and

Investor

Relations Officer

|

2

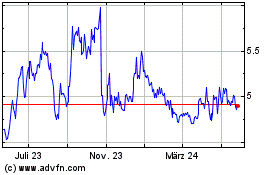

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

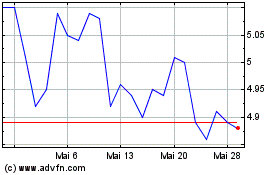

Brasilagro Cia Brasileir... (NYSE:LND)

Historical Stock Chart

Von Jan 2024 bis Jan 2025