Carlyle and KKR Strategic Partnerships Agree to Acquire Approximately $10.1 Billion Prime Student Loan Portfolio from Discover Financial Services

17 Juli 2024 - 2:59PM

Business Wire

Global investment firms Carlyle (NASDAQ: CG) and KKR (NYSE: KKR)

today announced that one or more strategic partnerships comprised

of funds and accounts managed by Carlyle and KKR’s respective

credit businesses have agreed to purchase an approximately $10.1

billion portfolio of prime student loans from Discover Financial

Services (NYSE: DFS).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240717003713/en/

“This acquisition highlights Carlyle’s proven expertise in

private student loans and asset-backed finance, demonstrating our

Global Credit business’s ability to provide scaled, tailored

solutions to meet our clients’ dynamic needs,” said Akhil Bansal,

Head of Credit Strategic Solutions at Carlyle. “As the lending

space evolves, we believe private markets are well-positioned to

offer financial institutions increased flexibility amidst this

transformation.”

“We are pleased to leverage our scale, deep experience in ABF

investing and capital markets capabilities to be a capital

solutions provider of choice to financial institutions that are

focusing on optimizing their balance sheets,” said RJ Madden, a

Managing Director at KKR. “This transaction demonstrates the value

that scaled private lenders can bring to key areas of the economy

as the priorities of traditional lenders continue to evolve.”

“We're very pleased to consummate this transaction with two

outstanding strategic partners in Carlyle and KKR," said Dan

Capozzi, Executive Vice President and President of Consumer Banking

at Discover. "This agreement represents an important milestone in

our journey to simplify our operations and business mix.”

Carlyle’s investment in the portfolio was led by its Credit

Strategic Solutions (“CSS”) team, a group within its Global Credit

business focused on asset-backed investments. The highly

experienced team seeks to leverage the knowledge, sourcing,

structuring, and breadth of the entire Carlyle investment platform

to deliver tailored asset-focused financing solutions to

businesses, specialty finance companies, banks, asset managers, and

other originators and owners of diversified pools of assets.

KKR’s investment in the portfolio comes primarily from its

asset-based finance strategy and other credit vehicles and

accounts. KKR has made more than 80 ABF investments globally since

2016 through a combination of portfolio acquisitions, platform

investments and structured investments. The firm has approximately

$54 billion in ABF assets under management and a team of more than

50 professionals directly involved in the ABF effort globally.

The transaction is expected to close by the end of 2024 subject

to customary closing conditions.

KKR Capital Markets and TCG Capital Markets structured and

arranged the debt for the transaction. Monogram LLC, a portfolio

company of Carlyle, will serve as portfolio manager for the student

loan portfolio. Firstmark Services, a subsidiary of Nelnet, Inc.

will service the loans in the portfolio. Sidley Austin LLP served

as legal advisor to KKR and Carlyle. Paul Hastings LLP also served

as a legal advisor to Carlyle and Clifford Chance LLP also served

as a legal advisor to KKR. Wells Fargo served as exclusive

financial advisor, and Skadden, Arps, Slate, Meagher & Flom LLP

served as legal counsel to Discover Financial Services in

connection with the transaction.

About Carlyle

Carlyle (NASDAQ: CG) is a global investment firm with deep

industry expertise that deploys private capital across three

business segments: Global Private Equity, Global Credit and Global

Investment Solutions. With $425 billion of assets under management

as of March 31, 2024, Carlyle’s purpose is to invest wisely and

create value on behalf of its investors, portfolio companies and

the communities in which we live and invest. Carlyle employs more

than 2,200 people in 28 offices across four continents. Further

information is available at www.carlyle.com. For more, follow

Carlyle on X and LinkedIn.

About KKR

KKR is a leading global investment firm that offers alternative

asset management as well as capital markets and insurance

solutions. KKR aims to generate attractive investment returns by

following a patient and disciplined investment approach, employing

world-class people, and supporting growth in its portfolio

companies and communities. KKR sponsors investment funds that

invest in private equity, credit and real assets and has strategic

partners that manage hedge funds. KKR’s insurance subsidiaries

offer retirement, life and reinsurance products under the

management of Global Atlantic Financial Group. References to KKR’s

investments may include the activities of its sponsored funds and

insurance subsidiaries. For additional information about KKR &

Co. Inc. (NYSE: KKR), please visit KKR’s website at www.kkr.com.

For additional information about Global Atlantic Financial Group,

please visit Global Atlantic Financial Group’s website at

www.globalatlantic.com.

About Discover Financial

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The company issues the Discover® card, America's cash rewards

pioneer, and offers personal loans, home loans, checking and

savings accounts and certificates of deposit through its banking

business. It operates the Discover Global Network® comprised of

Discover Network, with millions of merchants and cash access

locations; PULSE®, one of the nation's leading ATM/debit networks;

and Diners Club International®, a global payments network with

acceptance around the world. For more information, visit

www.discover.com/company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240717003713/en/

Media Contacts: For Carlyle: Kristen Ashton 212-813-4763

Kristen.ashton@carlyle.com

For KKR: Julia Kosygina 212-230-9722 media@kkr.com

For Discover Financial: Matthew Towson 224-405-5649

matthewtowson@discover.com

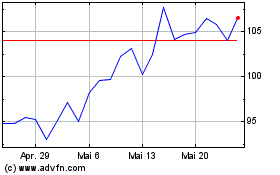

KKR (NYSE:KKR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

KKR (NYSE:KKR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024