Independence Realty Trust, Inc. (“IRT”) (NYSE: IRT), a

multifamily apartment REIT, today announced the closing of its

previously announced underwritten public offering of 11,500,000

shares of common stock at a public offering price of $19.75 per

share, including 1,500,000 shares sold pursuant to the exercise in

full of the underwriters’ option to purchase additional shares of

common stock. In connection with the offering, IRT entered into

forward sale agreements with Citigroup.

Citigroup, KeyBanc Capital Markets Inc., RBC Capital Markets,

LLC, BofA Securities, Barclays, BMO Capital Markets Corp., Baird,

Capital One Securities, Inc., Citizens JMP Securities, LLC,

Jefferies LLC, Regions Securities LLC and Truist Securities, Inc.

acted as joint book-running managers for the offering.

IRT will not initially receive any proceeds from the sale of

shares of its common stock by the forward purchaser or its

affiliate in the offering. IRT expects to contribute any cash net

proceeds it receives upon the future settlement of the forward sale

agreements to IRT’s operating partnership, Independence Realty

Operating Partnership, LP (“IROP”), in exchange for common units in

IROP. Through IROP, IRT intends to use substantially all of such

cash net proceeds to fund potential acquisitions and other

investment opportunities or for general corporate purposes,

including the reduction of outstanding borrowings under IRT’s

unsecured credit facility.

A registration statement relating to the offered securities has

been declared effective by the Securities and Exchange Commission.

The offering was made only by means of a prospectus supplement and

an accompanying prospectus. Copies of the prospectus and the

prospectus supplement relating to the offering, may be obtained by

visiting EDGAR on the SEC’s website at www.sec.gov or contacting

Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island

Avenue, Edgewood, NY 11717 telephone: 800-831-9146, KeyBanc Capital

Markets: Attn: Equity Syndicate, 127 Public Square, 7th Floor,

Cleveland, OH 44114, telephone: 1.800.859.1783 and RBC Capital

Markets, LLC, Brookfield Place, 200 Vesey Street, 8th Floor, New

York, New York 10281, Attention: Equity Syndicate Desk.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful before registration

or qualification thereof under the securities laws of any such

state or jurisdiction.

About Independence Realty Trust, Inc.

Independence Realty Trust, Inc. (NYSE: IRT) is a real estate

investment trust that owns and operates multifamily communities,

across non-gateway U.S. markets including Atlanta, GA, Dallas, TX,

Denver, CO, Columbus, OH, Indianapolis, IN, Raleigh-Durham, NC,

Oklahoma City, OK, Nashville, TN, Houston, TX, and Tampa, FL. IRT’s

investment strategy is focused on gaining scale near major

employment centers within key amenity rich submarkets that offer

good school districts and high-quality retail. IRT aims to provide

stockholders with attractive risk-adjusted returns through diligent

portfolio management, strong operational performance, and a

consistent return on capital through distributions and capital

appreciation. More information may be found on the Company’s

website www.irtliving.com.

Forward-Looking Statements

This release contains certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Such forward-looking statements include, but are not

limited to, the expected use of proceeds from the equity offering

and the settlement of the forward sale agreements. All statements

in this release that address financial and operating performance,

events or developments that we expect or anticipate will occur or

be achieved in the future are forward-looking statements. The

Company intends such forward-looking statements to be covered by

the safe harbor provisions for forward-looking statements contained

in the Private Securities Litigation Reform Act of 1995 and

includes this statement for purposes of complying with the safe

harbor provisions.

Our forward-looking statements are not guarantees of future

performance and involve estimates, projections, forecasts,

strategies and assumptions, including as to matters that are not

within our control, and are subject to risks and uncertainties

including, without limitation, risks and uncertainties related to

changes in market demand for rental apartment homes and pricing

pressures, including from competitors, that could lead to declines

in occupancy and rent levels, uncertainty and volatility in capital

and credit markets, including changes that reduce availability, and

increase costs, of capital, unexpected changes in our intention or

ability to repay certain debt prior to maturity, increased costs on

account of inflation, increased competition in the labor market,

failure to realize cost savings, efficiencies and other benefits

that we expect to result from our Portfolio Optimization and

Deleveraging Strategy, inability to sell certain assets, including

those assets designated as held for sale, within the time frames or

at the pricing levels expected, failure to achieve expected

benefits from the redeployment of proceeds from asset sales, delays

in completing, and cost overruns incurred in connection with, our

value add initiatives and failure to achieve rent increases and

occupancy levels on account of the value add initiatives,

unexpected impairments or impairments in excess of our estimates,

increased regulations generally and specifically on the rental

housing market, including legislation that may regulate rents and

fees or delay or limit our ability to evict non-paying residents,

risks endemic to real estate and the real estate industry

generally, the impact of potential outbreaks of infectious diseases

and measures intended to prevent the spread or address the effects

thereof, the effects of natural and other disasters, unknown or

unexpected liabilities, including the cost of legal proceedings,

costs and disruptions as the result of a cybersecurity incident or

other technology disruption, unexpected capital needs, inability to

obtain appropriate insurance coverages at reasonable rates, or at

all, or losses from catastrophes in excess of our insurance

coverages, and share price fluctuations. Please refer to the

documents filed by us with the SEC, including specifically the

“Risk Factors” sections of our Annual Report on Form 10-K for the

year ended December 31, 2023, and our other filings with the SEC,

which identify additional factors that could cause actual results

to differ from those contained in forward-looking statements. IRT

undertakes no obligation to update these forward-looking statements

to reflect events or circumstances after the date hereof or to

reflect the occurrence of unanticipated events, except as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905886255/en/

Independence Realty Trust, Inc. Edelman Smithfield Lauren

Torres 917-365-7979 IRT@edelman.com

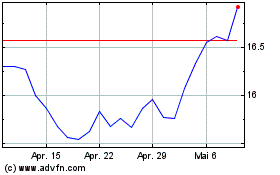

Independence Realty (NYSE:IRT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Independence Realty (NYSE:IRT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024