UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

ISSUER PURSUANT TO RULE 13a -16 OR

15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of

January 2024

Commission File Number: 001-15002

ICICI Bank Limited

(Translation of registrant’s name into English)

ICICI Bank Towers,

Bandra-Kurla Complex

Mumbai, India 400 051

(Address of principal executive office)

Indicate by check

mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

| Form

20-F X |

|

Form 40-F ___ |

Table of Contents

| Items: |

|

| 1. |

Other

news. |

| 2. |

Unaudited

financial results (standalone and consolidated) for the quarter and nine months ended December 31, 2023. |

| 3. |

Limited

review reports on the unaudited financial results (standalone and consolidated) issued by M S K A & Associates, Chartered Accountants

and KKC & Associates LLP, Chartered Accountants, the joint statutory auditors of the Bank for the corresponding period. |

| 4. |

News

Release on the unaudited financial results for the quarter and nine months ended December 31, 2023. |

ICICI Bank

Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India.

|

Tel.: (91-22)

2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012

|

Regd. Office:

ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India

|

OTHER

NEWS

Subject: Outcome

of Board Meeting held on January 20, 2024

IBN

ICICI Bank Limited

(the ‘Bank’) Report on Form 6-K

The Bank has made

the below announcement to the Indian stock exchanges:

In terms of Regulation

30, 33, 52(4) and other applicable provisions of the SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, (SEBI

Listing Regulations), we write to inform you that the Board of Directors of ICICI Bank Limited (the Bank), at its meeting held today,

inter alia, approved unaudited financial results (standalone and consolidated) for the quarter and nine months ended December

31, 2023. We enclose herewith the following:

| 1. | Unaudited financial

results (standalone and consolidated) for the quarter and nine months ended December 31,

2023; |

| 2. | Limited review

reports on the unaudited financial results (standalone and consolidated) issued by M S K

A & Associates, Chartered Accountants and KKC & Associates LLP, Chartered Accountants,

the joint statutory auditors of the Bank for the corresponding period; and |

| 3. | News Release

on the unaudited financial results for the quarter and nine months ended December 31, 2023. |

Additionally, pursuant

to the changes in the organization structure, the Board, at its meeting held today, also approved the inclusion of Mr. Atul Kumar, Mr.

Divyesh Shah, Mr. Manish Maheshwari, Mr. Pankaj Kohli, Mr. Pramod Dubey, Mr. Rohit Poddar, Ms. Shamala Potnis, Ms. Swanandi Phalnikar

and Mr. Vikas Singhvi in the category of senior management personnel. The details as required under Regulation 30 read with para A of

part A of Schedule III of the SEBI (Listing Obligations & Disclosure Requirements) Regulations, 2015, as amended, read with SEBI

circular no. SEBI/HO/CFD/CFD-PoD-1/P/CIR/2023/123 dated July 13, 2023 are provided in Annexure A.

Please take the

above information on record.

ICICI Bank

Limited

ICICI Bank Towers

Bandra-Kurla Complex

Mumbai 400 051, India.

|

Tel.: (91-22)

2653 1414

Fax: (91-22) 2653 1122

Website www.icicibank.com

CIN.: L65190GJ1994PLC021012

|

Regd. Office:

ICICI Bank Tower,

Near Chakli Circle,

Old Padra Road

Vadodara 390007. India

|

|

| ICICI Bank Limited |

| CIN-L65190GJ1994PLC021012 |

| Registered Office: ICICI Bank Tower,

Near Chakli Circle, Old Padra Road, Vadodara - 390 007. |

| Corporate Office: ICICI Bank Towers,

Bandra-Kurla Complex, Bandra (East), Mumbai - 400 051. |

Phone:

022-26538900, Fax: 022-26531228, Email:

companysecretary@icicibank.com

Website: www.icicibank.com |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| STANDALONE FINANCIAL RESULTS |

| (Rs. in crore) |

| Sr.

no. |

Particulars |

Three

months ended |

Nine months

ended |

Year

ended |

December

31, 2023

(Q3-2024) |

September

30, 2023

(Q2-2024) |

December

31, 2022

(Q3-2023) |

December

31, 2023

(9M-2024) |

December

31, 2022

(9M-2023) |

March

31, 2023

(FY2023) |

| (Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

| 1. |

Interest

earned (a)+(b)+(c)+(d) |

36,694.58 |

34,920.39 |

28,505.63 |

104,942.58 |

78,210.21 |

109,231.34 |

| |

a) |

Interest/discount

on advances/bills |

28,557.51 |

27,118.87 |

22,180.28 |

81,520.53 |

59,743.47 |

83,942.97 |

| |

b) |

Income

on investments |

7,210.67 |

7,020.31 |

5,343.57 |

20,848.98 |

15,048.71 |

20,888.46 |

| |

c) |

Interest

on balances with Reserve Bank of India and other inter-bank funds |

454.19 |

494.34 |

470.08 |

1,361.23 |

1,299.76 |

1,850.51 |

| |

d) |

Others |

472.21 |

286.87 |

511.70 |

1,211.84 |

2,118.27 |

2,549.40 |

| 2. |

Other

income |

6,097.06 |

5,776.68 |

5,023.63 |

17,308.99 |

14,743.70 |

19,831.45 |

| 3. |

TOTAL

INCOME (1)+(2) |

42,791.64 |

40,697.07 |

33,529.26 |

122,251.57 |

92,953.91 |

129,062.79 |

| 4. |

Interest

expended |

18,016.03 |

16,612.48 |

12,040.65 |

49,729.66 |

33,748.40 |

47,102.74 |

| 5. |

Operating

expenses (e)+(f) |

10,051.99 |

9,855.32 |

8,217.39 |

29,429.90 |

23,945.08 |

32,873.24 |

| |

e) |

Employee

cost |

3,812.67 |

3,725.42 |

2,921.18 |

11,421.75 |

8,658.92 |

12,059.93 |

| |

f) |

Other

operating expenses |

6,239.32 |

6,129.90 |

5,296.21 |

18,008.15 |

15,286.16 |

20,813.31 |

| 6. |

TOTAL

EXPENDITURE (4)+(5) |

|

|

|

|

|

|

| |

(excluding

provisions and contingencies) |

28,068.02 |

26,467.80 |

20,258.04 |

79,159.56 |

57,693.48 |

79,975.98 |

| 7. |

OPERATING

PROFIT (3)–(6) |

14,723.62 |

14,229.27 |

13,271.22 |

43,092.01 |

35,260.43 |

49,086.81 |

| |

(Profit

before provisions and contingencies) |

| 8. |

Provisions

(other than tax) and contingencies (refer note no. 3 and 4) |

1,049.37 |

582.63 |

2,257.44 |

2,924.44 |

5,045.78 |

6,665.58 |

| 9. |

PROFIT

FROM ORDINARY ACTIVITIES BEFORE EXCEPTIONAL ITEMS AND TAX (7)–(8) |

13,674.25 |

13,646.64 |

11,013.78 |

40,167.57 |

30,214.65 |

42,421.23 |

| 10. |

Exceptional

items |

.. |

.. |

.. |

.. |

.. |

.. |

| 11. |

PROFIT

FROM ORDINARY ACTIVITIES BEFORE TAX (9)–(10) |

13,674.25 |

13,646.64 |

11,013.78 |

40,167.57 |

30,214.65 |

42,421.23 |

| 12. |

Tax

expense (g)+(h) |

3,402.71 |

3,385.64 |

2,701.93 |

9,986.83 |

7,440.02 |

10,524.73 |

| |

g) |

Current

tax |

3,366.19 |

3,246.52 |

2,601.91 |

9,750.08 |

7,446.26 |

10,254.48 |

| |

h) |

Deferred

tax |

36.52 |

139.12 |

100.02 |

236.75 |

(6.24) |

270.25 |

| 13. |

NET

PROFIT FROM ORDINARY ACTIVITIES AFTER TAX (11)–(12) |

10,271.54 |

10,261.00 |

8,311.85 |

30,180.74 |

22,774.63 |

31,896.50 |

| 14. |

Extraordinary

items (net of tax expense) |

.. |

.. |

.. |

.. |

.. |

.. |

| 15. |

NET

PROFIT FOR THE PERIOD (13)–(14) |

10,271.54 |

10,261.00 |

8,311.85 |

30,180.74 |

22,774.63 |

31,896.50 |

| 16. |

Paid-up

equity share capital (face value Rs. 2 each) |

1,403.18 |

1,400.83 |

1,395.62 |

1,403.18 |

1,395.62 |

1,396.78 |

| 17. |

Reserves

excluding revaluation reserves |

221,129.31 |

210,508.56 |

186,042.33 |

221,129.31 |

186,042.33 |

195,495.25 |

| 18. |

Analytical

ratios |

|

|

|

|

|

|

| |

i) |

Percentage

of shares held by Government of India |

0.22% |

0.21% |

0.20% |

0.22% |

0.20% |

0.20% |

| |

ii) |

Capital

adequacy ratio (Basel III) |

14.61% |

16.07% |

16.26% |

14.61% |

16.26% |

18.34% |

| |

iii) |

Earnings

per share (EPS) |

|

|

|

|

|

|

| |

|

a) |

Basic

EPS before and after extraordinary items, net of tax expense (not annualised) (in Rs.) |

14.65 |

14.66 |

11.92 |

43.12 |

32.71 |

45.79 |

| |

|

b) |

Diluted

EPS before and after extraordinary items, net of tax expense (not annualised) (in Rs.) |

14.40 |

14.40 |

11.68 |

42.34 |

32.07 |

44.89 |

| 19. |

NPA

Ratio1 |

|

|

|

|

|

|

| |

i) |

Gross

non-performing customer assets (net of write-off) |

28,774.63 |

29,836.94 |

32,528.24 |

28,774.63 |

32,528.24 |

31,183.70 |

| |

ii) |

Net

non-performing customer assets |

5,378.48 |

5,046.47 |

5,651.22 |

5,378.48 |

5,651.22 |

5,155.07 |

| |

iii) |

%

of gross non-performing customer assets (net of write-off) to gross customer assets |

2.30% |

2.48% |

3.07% |

2.30% |

3.07% |

2.81% |

| |

iv) |

%

of net non-performing customer assets to net customer assets |

0.44% |

0.43% |

0.55% |

0.44% |

0.55% |

0.48% |

| 20. |

Return

on assets (annualised) |

2.32% |

2.41% |

2.20% |

2.38% |

2.08% |

2.16% |

| 21. |

Net

worth2 |

215,432.30 |

204,617.01 |

179,246.33 |

215,432.30 |

179,246.33 |

189,125.63 |

| 22. |

Outstanding

redeemable preference shares |

.. |

.. |

.. |

.. |

.. |

.. |

| 23. |

Capital

redemption reserve |

350.00 |

350.00 |

350.00 |

350.00 |

350.00 |

350.00 |

| 24. |

Debt-equity

ratio3 |

0.32 |

0.30 |

0.38 |

0.32 |

0.38 |

0.37 |

| 25. |

Total

debts to total assets4 |

7.11% |

6.79% |

8.58% |

7.11% |

8.58% |

7.53% |

| 1. |

At December 31, 2023, the percentage of gross non-performing

advances (net of write-off) to gross advances was 2.37% (September 30, 2023: 2.55%, March 31, 2023: 2.87%, December 31, 2022: 3.13%)

and net non-performing advances to net advances was 0.47% (September 30, 2023: 0.45%, March 31, 2023: 0.51%, December 31, 2022: 0.58%). |

| 2. |

Net worth is computed as per RBI Master Circular No. RBI/2015-16/70

DBR.No.Dir.BC.12/13.03.00/2015-16 on Exposure Norms dated July 1, 2015. |

| 3. |

Debt represents borrowings with residual maturity of more

than one year. |

| 4. |

Total debts represents total borrowings of the Bank. |

SUMMARISED

STANDALONE BALANCE SHEET

(Rs. in crore)

| Particulars |

At |

December

31, 2023 |

September

30, 2023 |

March

31, 2023 |

December

31, 2022 |

| (Unaudited) |

(Unaudited) |

(Audited) |

(Unaudited) |

| Capital

and Liabilities |

|

|

|

|

|

| Capital |

|

1,403.18 |

1,400.83 |

1,396.78 |

1,395.62 |

| Employees

stock options outstanding |

|

1,242.55 |

1,078.01 |

760.89 |

635.49 |

| Reserves

and surplus |

|

224,190.83 |

213,570.08 |

198,557.72 |

189,237.43 |

| Deposits |

|

1,332,314.54 |

1,294,741.72 |

1,180,840.69 |

1,122,049.48 |

| Borrowings

(includes subordinated debt) |

|

126,871.26 |

116,758.02 |

119,325.49 |

130,550.00 |

| Other

liabilities and provisions |

|

97,199.72 |

93,230.90 |

83,325.08 |

77,880.09 |

| Total

Capital and Liabilities |

|

1,783,222.08 |

1,720,779.56 |

1,584,206.65 |

1,521,748.11 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

| Cash

and balances with Reserve Bank of India |

|

64,869.20 |

66,221.19 |

68,526.17 |

62,281.19 |

| Balances

with banks and money at call and short notice |

|

34,458.91 |

43,240.51 |

50,912.10 |

60,189.63 |

| Investments |

|

436,649.75 |

413,253.09 |

362,329.73 |

337,050.56 |

| Advances |

|

1,153,771.02 |

1,110,542.14 |

1,019,638.31 |

974,047.50 |

| Fixed

assets |

10,353.96 |

10,165.93 |

9,599.84 |

9,574.52 |

| Other

assets |

|

83,119.24 |

77,356.70 |

73,200.50 |

78,604.71 |

| Total

Assets |

|

1,783,222.08 |

1,720,779.56 |

1,584,206.65 |

1,521,748.11 |

2

| STANDALONE SEGMENTAL RESULTS |

| (Rs. in crore) |

| Sr.

no. |

Particulars |

Three

months ended |

Nine

months ended |

Year

ended |

December

31, 2023

(Q3-2024) |

September

30, 2023

(Q2-2024) |

December

31, 2022

(Q3-2023) |

December

31, 2023

(9M-2024) |

December

31, 2022

(9M-2023) |

March

31, 2023

(FY2023) |

| (Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

| 1. |

Segment

revenue |

|

|

| a |

Retail

Banking |

34,000.52 |

33,080.02 |

26,325.77 |

98,137.75 |

75,036.00 |

103,775.34 |

| b |

Wholesale

Banking |

19,454.81 |

17,383.77 |

13,593.64 |

52,907.71 |

36,018.21 |

50,614.85 |

| c |

Treasury |

29,473.80 |

27,859.08 |

22,253.30 |

83,637.99 |

60,762.04 |

84,770.74 |

| d |

Other

Banking |

949.56 |

727.96 |

684.37 |

2,521.71 |

1,669.72 |

2,383.06 |

| |

Total

segment revenue |

83,878.69 |

79,050.83 |

62,857.08 |

237,205.16 |

173,485.97 |

241,543.99 |

| |

Less:

Inter segment revenue |

41,087.05 |

38,353.76 |

29,327.82 |

114,953.59 |

80,532.06 |

112,481.20 |

| |

Income

from operations |

42,791.64 |

40,697.07 |

33,529.26 |

122,251.57 |

92,953.91 |

129,062.79 |

| 2. |

Segmental

results (i.e. Profit before tax) |

|

|

| a |

Retail

Banking |

4,288.46 |

4,895.97 |

4,288.56 |

13,363.06 |

12,631.04 |

17,533.68 |

| b |

Wholesale

Banking |

5,746.05 |

4,670.00 |

3,876.69 |

14,495.75 |

11,282.19 |

15,785.78 |

| c |

Treasury |

3,327.70 |

3,966.92 |

4,257.14 |

11,656.75 |

10,036.32 |

14,271.55 |

| d |

Other

Banking |

312.04 |

113.75 |

91.39 |

652.01 |

315.10 |

480.22 |

| e |

Unallocated

expenses |

.. |

.. |

(1,500.00) |

.. |

(4,050.00) |

(5,650.00) |

| |

Total

segment results |

13,674.25 |

13,646.64 |

11,013.78 |

40,167.57 |

30,214.65 |

42,421.23 |

| 3. |

Segment

assets |

|

| a |

Retail

Banking |

690,053.22 |

668,057.40 |

564,925.73 |

690,053.22 |

564,925.73 |

603,959.37 |

| b |

Wholesale

Banking |

476,924.80 |

463,638.43 |

407,505.95 |

476,924.80 |

407,505.95 |

432,874.35 |

| c |

Treasury |

575,869.22 |

550,912.76 |

510,710.02 |

575,869.22 |

510,710.02 |

508,469.75 |

| d |

Other

Banking |

33,024.20 |

30,867.69 |

28,646.13 |

33,024.20 |

28,646.13 |

29,791.54 |

| e |

Unallocated |

7,350.64 |

7,303.28 |

9,960.28 |

7,350.64 |

9,960.28 |

9,111.64 |

| |

Total

segment assets |

1,783,222.08 |

1,720,779.56 |

1,521,748.11 |

1,783,222.08 |

1,521,748.11 |

1,584,206.65 |

| 4. |

Segment

liabilities |

|

|

| a |

Retail

Banking |

977,391.31 |

940,334.15 |

851,158.87 |

977,391.31 |

851,158.87 |

891,354.54 |

| b |

Wholesale

Banking |

419,641.39 |

416,050.16 |

327,091.38 |

419,641.39 |

327,091.38 |

347,276.49 |

| c |

Treasury |

140,077.86 |

129,456.51 |

138,455.45 |

140,077.86 |

138,455.45 |

129,240.96 |

| d |

Other

Banking |

6,174.96 |

5,126.69 |

2,273.87 |

6,174.96 |

2,273.87 |

2,519.27 |

| e |

Unallocated |

13,100.00 |

13,763.13 |

11,500.00 |

13,100.00 |

11,500.00 |

13,100.00 |

| |

Total

segment liabilities |

1,556,385.52 |

1,504,730.64 |

1,330,479.57 |

1,556,385.52 |

1,330,479.57 |

1,383,491.26 |

| 5. |

Capital

employed |

226,836.56 |

216,048.92 |

191,268.54 |

226,836.56 |

191,268.54 |

200,715.39 |

| 6. |

Total

(4)+(5) |

1,783,222.08 |

1,720,779.56 |

1,521,748.11 |

1,783,222.08 |

1,521,748.11 |

1,584,206.65 |

|

Notes

on segmental results: |

|

|

|

|

|

|

| 1. |

The disclosure on segmental reporting has been prepared

in accordance with Securities and Exchange Board of India (SEBI) circular no. CIR/CFD/FAC/62/2016 dated July 5, 2016 on Revised Formats

for Financial Results and Implementation of Ind-AS by Listed Entities. |

| 2. |

"Retail Banking" includes exposures of the Bank

which satisfy the four criteria of orientation, product, granularity and low value of individual exposures for retail exposures laid

down in Basel Committee on Banking Supervision document 'International Convergence of Capital Measurement and Capital Standards:

A Revised Framework'. This segment also includes income from credit cards, debit cards, third party product distribution and the

associated costs. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

RBI’s Master Direction on Financial Statements –

Presentation and Disclosures, requires to sub-divide ‘Retail banking’ into (a) Digital Banking (as defined in RBI circular

on Establishment of Digital Banking Units dated April 7, 2022) and (b) Other Retail Banking segment. Accordingly, the segmental results

for retail banking segment is subdivided as below: |

3

(Rs. in crore)

| |

Sr. no. |

Particulars |

Segment

revenue |

Segment Results |

Segment

assets |

Segment

liabilities |

| |

Q3-2024 |

|

|

|

|

| |

|

Retail

Banking |

34,000.52 |

4,288.46 |

690,053.22 |

977,391.31 |

| |

(i) |

Digital

Banking |

8,308.75 |

1,031.74 |

111,841.19 |

174,210.51 |

| |

(ii) |

Other

Retail Banking |

25,691.77 |

3,256.72 |

578,212.03 |

803,180.80 |

| |

Q2-2024 |

|

|

|

|

| |

|

Retail

Banking |

33,080.02 |

4,895.97 |

668,057.40 |

940,334.15 |

| |

(i) |

Digital

Banking |

7,644.09 |

1,162.52 |

99,513.41 |

161,717.18 |

| |

(ii) |

Other

Retail Banking |

25,435.93 |

3,733.45 |

568,543.99 |

778,616.97 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. |

"Wholesale Banking" includes all advances to

trusts, partnership firms, companies and statutory bodies, by the Bank which are not included under Retail Banking. |

| 4. |

"Treasury" primarily includes the entire investment

and derivative portfolio of the Bank. |

| 5. |

"Other Banking" includes leasing operations

and other items not attributable to any particular business segment of the Bank. |

| 6. |

"Unallocated" includes items such as tax paid

in advance net of provision, deferred tax and provisions to the extent reckoned at the entity level. |

4

| CONSOLIDATED FINANCIAL RESULTS |

| (Rs. in crore) |

| Sr.

no. |

Particulars |

Three

months ended |

Nine

months ended |

Year

ended |

December

31, 2023

(Q3-2024) |

September

30, 2023

(Q2-2024) |

December

31, 2022

(Q3-2023) |

December

31, 2023

(9M-2024) |

December

31, 2022

(9M-2023) |

March

31, 2023

(FY2023) |

| (Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

| 1. |

Interest

earned (a)+(b)+(c)+(d) |

40,865.23 |

38,938.08 |

31,618.81 |

116,909.20 |

86,627.90 |

121,066.81 |

| |

a) |

Interest/discount

on advances/bills |

30,030.69 |

28,501.06 |

23,259.99 |

85,619.44 |

62,575.56 |

87,929.24 |

| |

b) |

Income

on investments |

9,523.04 |

9,279.96 |

7,136.29 |

27,634.05 |

20,077.16 |

27,905.03 |

| |

c) |

Interest

on balances with Reserve Bank of India and other inter-bank funds |

680.86 |

699.56 |

595.39 |

1,962.63 |

1,598.32 |

2,305.46 |

| |

d) |

Others |

630.64 |

457.50 |

627.14 |

1,693.08 |

2,376.86 |

2,927.08 |

| 2. |

Other

income |

18,614.53 |

18,354.18 |

16,240.69 |

51,946.82 |

45,628.15 |

65,111.99 |

| 3. |

TOTAL

INCOME (1)+(2) |

59,479.76 |

57,292.26 |

47,859.50 |

168,856.02 |

132,256.05 |

186,178.80 |

| 4. |

Interest

expended |

19,408.76 |

17,908.01 |

12,977.89 |

53,684.43 |

36,063.92 |

50,543.39 |

| 5. |

Operating

expenses (e)+(f) |

23,908.69 |

23,911.01 |

20,511.90 |

67,876.37 |

58,201.93 |

82,439.02 |

| |

e) |

Employee

cost |

4,749.19 |

4,662.23 |

3,723.10 |

14,222.75 |

10,986.17 |

15,234.17 |

| |

f) |

Other

operating expenses |

19,159.50 |

19,248.78 |

16,788.80 |

53,653.62 |

47,215.76 |

67,204.85 |

| 6. |

TOTAL

EXPENDITURE (4)+(5) |

43,317.45 |

41,819.02 |

33,489.79 |

121,560.80 |

94,265.85 |

132,982.41 |

| |

(excluding

provisions and contingencies) |

| 7. |

OPERATING

PROFIT (3)–(6) |

16,162.31 |

15,473.24 |

14,369.71 |

47,295.22 |

37,990.20 |

53,196.39 |

| |

(Profit

before provisions and contingencies) |

| 8. |

Provisions

(other than tax) and contingencies (refer note no. 3 and 4) |

1,020.45 |

649.01 |

2,434.12 |

3,014.50 |

5,217.88 |

6,939.93 |

| 9. |

PROFIT

FROM ORDINARY ACTIVITIES BEFORE EXCEPTIONAL ITEMS AND TAX (7)–(8) |

15,141.86 |

14,824.23 |

11,935.59 |

44,280.72 |

32,772.32 |

46,256.46 |

| 10. |

Exceptional

items |

.. |

.. |

.. |

.. |

.. |

.. |

| 11. |

Add:

Share of profit in associates |

259.96 |

335.45 |

229.44 |

846.45 |

747.22 |

998.29 |

| 12. |

PROFIT

FROM ORDINARY ACTIVITIES BEFORE TAX AND MINORITY INTEREST (9)–(10)+(11) |

15,401.82 |

15,159.68 |

12,165.03 |

45,127.17 |

33,519.54 |

47,254.75 |

| 13. |

Tax

expense (g)+(h) |

3,886.67 |

3,808.82 |

2,999.41 |

11,246.71 |

8,294.52 |

11,793.44 |

| |

g) |

Current

tax |

3,810.46 |

3,638.50 |

2,905.98 |

10,956.53 |

8,278.38 |

11,456.44 |

| |

h) |

Deferred

tax |

76.21 |

170.32 |

93.43 |

290.18 |

16.14 |

337.00 |

| 14. |

Less:

Share of profit/(loss) of minority shareholders |

462.55 |

454.73 |

373.20 |

1,295.61 |

1,041.08 |

1,424.67 |

| 15. |

NET

PROFIT FROM ORDINARY ACTIVITIES AFTER TAX (12)–(13)–(14) |

11,052.60 |

10,896.13 |

8,792.42 |

32,584.85 |

24,183.94 |

34,036.64 |

| 16. |

Extraordinary

items (net of tax expense) |

.. |

.. |

.. |

.. |

.. |

.. |

| 17. |

NET

PROFIT FOR THE PERIOD (15)-(16) |

11,052.60 |

10,896.13 |

8,792.42 |

32,584.85 |

24,183.94 |

34,036.64 |

| 18. |

Paid-up

equity share capital (face value Rs. 2/- each) |

1,403.18 |

1,400.83 |

1,395.62 |

1,403.18 |

1,395.62 |

1,396.78 |

| 19. |

Reserves

excluding revaluation reserves |

238,096.82 |

226,314.47 |

199,333.21 |

238,096.82 |

199,333.21 |

209,248.29 |

| 20. |

Earnings

per share (EPS) |

|

|

|

|

|

|

| |

Basic

EPS before and after extraordinary items, net of tax expense (not annualised) (in Rs.) |

15.77 |

15.57 |

12.61 |

46.55 |

34.74 |

48.86 |

| |

Diluted

EPS before and after extraordinary items, net of tax expense (not annualised) (in Rs.) |

15.47 |

15.27 |

12.35 |

45.65 |

34.01 |

47.84 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SUMMARISED CONSOLIDATED BALANCE SHEET |

| (Rs. in crore) |

| Particulars |

At |

December

31, 2023 |

September

30, 2023 |

March

31, 2023 |

December

31, 2022 |

| (Unaudited) |

(Unaudited) |

(Audited) |

(Unaudited) |

| Capital

and Liabilities |

|

|

|

|

| Capital |

1,403.18 |

1,400.83 |

1,396.78 |

1,395.62 |

| Employees

stock options outstanding |

1,242.55 |

1,078.01 |

760.89 |

636.11 |

| Reserves

and surplus |

241,184.80 |

229,405.37 |

212,340.13 |

202,561.15 |

| Minority

interest |

7,431.64 |

7,203.63 |

6,686.75 |

6,573.21 |

| Deposits |

1,366,842.09 |

1,325,252.62 |

1,210,832.15 |

1,152,325.13 |

| Borrowings

(includes subordinated debt) |

200,966.94 |

189,709.79 |

189,061.81 |

192,496.93 |

| Liabilities

on policies in force |

273,564.40 |

259,349.87 |

238,867.36 |

239,975.30 |

| Other liabilities

and provisions |

115,382.83 |

111,449.63 |

98,544.63 |

91,245.56 |

| Total

Capital and Liabilities |

2,208,018.43 |

2,124,849.75 |

1,958,490.50 |

1,887,209.01 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Cash and

balances with Reserve Bank of India |

64,935.13 |

66,269.76 |

68,648.94 |

62,323.30 |

| Balances

with banks and money at call and short notice |

56,514.16 |

62,832.19 |

67,807.55 |

77,556.73 |

| Investments |

754,864.94 |

715,263.84 |

639,551.97 |

612,557.65 |

| Advances |

1,229,198.02 |

1,182,108.54 |

1,083,866.32 |

1,038,091.18 |

| Fixed assets |

11,913.77 |

11,657.62 |

10,969.00 |

10,858.87 |

| Other assets |

90,491.08 |

86,616.47 |

87,545.39 |

85,719.95 |

| Goodwill

on consolidation |

101.33 |

101.33 |

101.33 |

101.33 |

| Total

Assets |

2,208,018.43 |

2,124,849.75 |

1,958,490.50 |

1,887,209.01 |

| CONSOLIDATED SEGMENTAL RESULTS |

| (Rs.

in crore) |

| Sr.

no. |

Particulars |

Three

months ended |

Nine

months ended |

Year

ended |

December

31, 2023

(Q3-2024) |

September

30, 2023

(Q2-2024) |

December

31, 2022

(Q3-2023) |

December

31, 2023

(9M-2024) |

December

31, 2022

(9M-2023) |

March

31, 2023

(FY2023) |

| (Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Unaudited) |

(Audited) |

| 1. |

Segment

revenue |

|

|

|

|

|

|

| a |

Retail

Banking |

34,000.52 |

33,080.02 |

26,325.77 |

98,137.75 |

75,036.00 |

103,775.34 |

| b |

Wholesale

Banking |

19,454.81 |

17,383.77 |

13,593.64 |

52,907.71 |

36,018.21 |

50,614.85 |

| c |

Treasury |

29,356.10 |

27,718.83 |

22,147.29 |

83,380.45 |

60,527.61 |

84,536.92 |

| d |

Other

Banking |

1,747.71 |

1,497.57 |

1,273.30 |

4,811.91 |

3,084.90 |

4,464.00 |

| e |

Life

Insurance |

13,150.14 |

13,413.14 |

11,923.16 |

36,500.97 |

32,975.10 |

47,930.17 |

| f |

Others |

3,607.65 |

3,287.17 |

2,526.81 |

10,024.60 |

7,027.49 |

9,725.98 |

| |

Total

segment revenue |

101,316.93 |

96,380.50 |

77,789.97 |

285,763.39 |

214,669.31 |

301,047.26 |

| |

Less:

Inter segment revenue |

41,837.17 |

39,088.24 |

29,930.47 |

116,907.37 |

82,413.26 |

114,868.46 |

| |

Income

from operations |

59,479.76 |

57,292.26 |

47,859.50 |

168,856.02 |

132,256.05 |

186,178.80 |

| 2. |

Segmental

results (i.e. Profit before tax and minority interest) |

|

| a |

Retail

Banking |

4,288.46 |

4,895.97 |

4,288.56 |

13,363.06 |

12,631.04 |

17,533.68 |

| b |

Wholesale

Banking |

5,746.05 |

4,670.00 |

3,876.69 |

14,495.75 |

11,282.19 |

15,785.78 |

| c |

Treasury |

3,209.97 |

3,826.64 |

4,151.08 |

11,399.12 |

9,801.78 |

14,037.21 |

| d |

Other

Banking |

521.95 |

323.65 |

219.41 |

1,277.26 |

659.17 |

1,001.45 |

| e |

Life

Insurance |

232.10 |

248.31 |

224.92 |

688.89 |

580.09 |

896.89 |

| f |

Others |

1,674.77 |

1,367.63 |

1,086.25 |

4,386.80 |

3,146.84 |

4,202.37 |

| g |

Unallocated

expenses |

.. |

.. |

(1,500.00) |

.. |

(4,050.00) |

(5,650.00) |

| |

Total

segment results |

15,673.30 |

15,332.20 |

12,346.91 |

45,610.88 |

34,051.11 |

47,807.38 |

| |

Less:

Inter segment adjustment |

531.44 |

507.97 |

411.32 |

1,330.16 |

1,278.79 |

1,550.92 |

| |

Add:

Share of profit in associates |

259.96 |

335.45 |

229.44 |

846.45 |

747.22 |

998.29 |

| |

Profit

before tax and minority interest |

15,401.82 |

15,159.68 |

12,165.03 |

45,127.17 |

33,519.54 |

47,254.75 |

| 3. |

Segment

assets |

|

| a |

Retail

Banking |

690,053.22 |

668,057.40 |

564,925.73 |

690,053.22 |

564,925.73 |

603,959.37 |

| b |

Wholesale

Banking |

476,924.80 |

463,638.43 |

407,505.95 |

476,924.80 |

407,505.95 |

432,874.35 |

| c |

Treasury |

581,439.71 |

556,107.71 |

515,090.22 |

581,439.71 |

515,090.22 |

512,940.50 |

| d |

Other

Banking |

90,976.81 |

85,485.62 |

83,428.58 |

90,976.81 |

83,428.58 |

83,696.05 |

| e |

Life

Insurance |

290,291.18 |

276,072.97 |

255,466.24 |

290,291.18 |

255,466.24 |

255,689.90 |

| f |

Others |

81,565.42 |

79,509.73 |

60,930.70 |

81,565.42 |

60,930.70 |

71,134.84 |

| g |

Unallocated |

7,891.62 |

7,409.61 |

10,661.65 |

7,891.62 |

10,661.65 |

9,656.72 |

| |

Total |

2,219,142.76 |

2,136,281.47 |

1,898,009.07 |

2,219,142.76 |

1,898,009.07 |

1,969,951.73 |

| |

Less:

Inter segment adjustment |

11,124.33 |

11,431.72 |

10,800.06 |

11,124.33 |

10,800.06 |

11,461.23 |

| |

Total

segment assets |

2,208,018.43 |

2,124,849.75 |

1,887,209.01 |

2,208,018.43 |

1,887,209.01 |

1,958,490.50 |

| 4. |

Segment

liabilities |

|

| a |

Retail

Banking |

977,391.31 |

940,334.15 |

851,158.87 |

977,391.31 |

851,158.87 |

891,354.54 |

| b |

Wholesale

Banking |

419,641.39 |

416,050.16 |

327,091.38 |

419,641.39 |

327,091.38 |

347,276.49 |

| c |

Treasury |

155,996.16 |

145,118.41 |

153,461.88 |

155,996.16 |

153,461.88 |

144,338.32 |

| d |

Other

Banking |

58,540.17 |

54,431.14 |

52,081.33 |

58,540.17 |

52,081.33 |

51,378.80 |

| e |

Life

Insurance |

279,465.00 |

265,576.06 |

245,592.15 |

279,465.00 |

245,592.15 |

245,755.62 |

| f |

Others |

71,178.20 |

69,541.69 |

52,530.58 |

71,178.20 |

52,530.58 |

62,250.16 |

| g |

Unallocated |

13,100.00 |

13,345.66 |

11,500.00 |

13,100.00 |

11,500.00 |

13,100.00 |

| |

Total |

1,975,312.23 |

1,904,397.27 |

1,693,416.19 |

1,975,312.23 |

1,693,416.19 |

1,755,453.93 |

| |

Less:

Inter segment adjustment |

11,124.33 |

11,431.72 |

10,800.06 |

11,124.33 |

10,800.06 |

11,461.23 |

| |

Total

segment liabilities |

1,964,187.90 |

1,892,965.55 |

1,682,616.13 |

1,964,187.90 |

1,682,616.13 |

1,743,992.70 |

| 5. |

Capital

employed |

243,830.53 |

231,884.20 |

204,592.88 |

243,830.53 |

204,592.88 |

214,497.80 |

| 6. |

Total

(4)+(5) |

2,208,018.43 |

2,124,849.75 |

1,887,209.01 |

2,208,018.43 |

1,887,209.01 |

1,958,490.50 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Notes on segmental results: |

|

|

|

|

|

|

| 1. |

The disclosure on segmental reporting has been prepared

in accordance with Securities and Exchange Board of India (SEBI) circular no. CIR/CFD/FAC/62/2016 dated July 5, 2016 on Revised Formats

for Financial Results and Implementation of Ind AS by Listed Entities. |

| 2. |

'Retail Banking' includes exposures of the Bank which satisfy

the four criteria of orientation, product, granularity and low value of individual exposures for retail exposures laid down in Basel

Committee on Banking Supervision document 'International Convergence of Capital Measurement and Capital Standards: A Revised Framework'.

This segment also includes income from credit cards, debit cards, third party product distribution and the associated costs. |

| 3. |

'Wholesale Banking' includes all advances to trusts, partnership

firms, companies and statutory bodies, by the Bank which are not included under Retail Banking. |

| 4. |

'Treasury' primarily includes the entire investment and

derivative portfolio of the Bank. |

| 5. |

'Other Banking' includes leasing operations and other items

not attributable to any particular business segment of the Bank. Further, it includes the Bank’s banking subsidiaries i.e.

ICICI Bank UK PLC and ICICI Bank Canada. |

| 6. |

'Life Insurance' represents ICICI Prudential Life Insurance

Company Limited. |

| 7. |

'Others' comprises the consolidated entities of the Bank,

not covered in any of the segments above. |

| 8. |

'Unallocated' includes items such as tax paid in advance

net of provision, deferred tax and provisions to the extent reckoned at the entity level. |

| Notes: |

|

|

|

|

|

|

| 1. |

The above standalone and consolidated financial results

have been approved by the Board of Directors at its meeting held on January 20, 2024. The joint statutory auditors have conducted

limited review and issued an unmodified report on the standalone and consolidated financial results for Q3-2024 and 9M-2024. |

| 2. |

The financial results have been prepared in accordance

with the recognition and measurement principles given in Accounting Standard (AS) 25 on 'Interim Financial Reporting' as prescribed

under the Companies Act, 2013. |

| 3. |

At December 31, 2023, the Bank holds contingency provision

of Rs. 13,100.00 crore (September 30, 2023 and March 31, 2023: Rs. 13,100.00 crore; December 31, 2022: Rs. 11,500.00 crore). |

| 4. |

During Q3-2024, the Bank has made a provision of Rs. 627.03

crore against its investments in Alternate Investment Funds (AIFs) as per RBI circular dated December 19, 2023. |

| 5. |

During Q3-2024, the Bank has allotted 11,738,550 equity

shares of Rs. 2 each pursuant to exercise of employee stock options. |

| 6. |

In accordance with RBI guidelines, consolidated Pillar

3 disclosure (unaudited), leverage ratio, liquidity coverage ratio, net stable funding ratio and details of loans transferred/acquired

under the RBI Master Direction on Transfer of Loan Exposures dated September 24, 2021 is available at https://www.icicibank.com/regulatory-disclosure.page. |

| 7. |

Previous period/year figures have been re-grouped/re-classified

where necessary to conform to current period classification. |

| 8. |

The above standalone and consolidated financial results

have been reviewed/audited by the joint statutory auditors, M S K A & Associates, Chartered Accountants and KKC & Associates

LLP, Chartered Accountants. |

| 9. |

Rs. 1.00 crore = Rs. 10.0 million. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For and

on behalf of the Board of Directors |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rakesh Jha |

|

| Mumbai |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Executive Director |

|

| January 20, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

DIN-00042075 |

|

7

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| 602 Floor 6, Raheja Titanium, |

Level-19, Sunshine Tower, |

| Western Express Highway, |

Senapati Bapat Marg, |

| Geetanjali, Railway Colony, |

Elphinstone Road. |

| Ram Nagar, Goregaon (E), |

Mumbai 400 013 |

| Mumbai 400 063 |

|

Independent

Auditors’ Review Report on unaudited standalone financial results for the quarter and nine months ended 31 December 2023 of ICICI

Bank Limited pursuant to Regulation 33 and Regulation 52(4) read with Regulation 63 of the Securities and Exchange Board of India (Listing

Obligations and Disclosure Requirements) Regulations, 2015, as amended.

To

The Board of Directors

of

ICICI Bank Limited

| 1. | We have reviewed

the accompanying statement of unaudited standalone financial results of ICICI Bank Limited

(‘the Bank’) for the quarter and nine months ended 31 December 2023 (‘the

Statement’), being submitted by the Bank pursuant to the requirements of Regulation

33 and Regulation 52(4) read with Regulation 63 of the Securities and Exchange Board of India

(Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (‘the

Listing Regulations’), except for the disclosures relating to Pillar 3 disclosures

as at 31 December 2023, including leverage ratio, liquidity coverage ratio and net stable

funding ratio under Basel III Capital Regulations as have been disclosed on the Bank’s

website and in respect of which a link has been provided in the Note 06 to the Statement

and have not been reviewed by us. |

| 2. | This Statement,

which is the responsibility of the Bank's Management and approved by the Board of Directors

of the Bank, has been prepared in accordance with the recognition and measurement principles

laid down in the Accounting Standard 25 ‘Interim Financial Reporting’(‘AS

25’), prescribed under section 133 of the Companies Act, 2013, read with relevant rules

issued thereunder, in so far as they apply to Banks, the relevant provisions of the Banking

Regulation Act, 1949, the circulars, guidelines and directions issued by the Reserve Bank

of India (the ‘RBI’) from time to time (the ‘RBI Guidelines’) and

other accounting principles generally accepted in India, and in compliance with Regulation

33 and Regulation 52(4) read with Regulation 63 of the Listing Regulations. Our responsibility

is to express a conclusion on the Statement based on our review. |

| 3. | We conducted

our review in accordance with the Standard on Review Engagements (‘SRE’) 2410,

“Review of Interim Financial Information Performed by the Independent Auditor of the

Entity” issued by the Institute of Chartered Accountants of India. This standard requires

that we plan and perform the review to obtain moderate assurance as to whether the Statement

is free of material misstatement. A review is limited primarily to inquiries of the Bank’s

personnel and analytical procedures applied to financial data and thus provides less assurance

than an audit. We have not performed an audit and accordingly, we do not express an audit

opinion. |

1

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| 4. | Based on our

review conducted as stated in paragraph 3 above, nothing has come to our attention that causes

us to believe that the accompanying Statement, prepared in accordance with the recognition

and measurement principles laid down in AS 25 prescribed under Section 133 of the Companies

Act, 2013, read with relevant rules thereunder, the RBI Guidelines and other accounting principles

generally accepted in India, has not disclosed the information required to be disclosed in

terms of Regulation 33 and Regulation 52(4) read with Regulation 63 of the Listing Regulations,

including the manner in which it is to be disclosed, or that it contains any material misstatement

or that it has not been prepared in accordance with the relevant prudential norms issued

by the RBI in respect of income recognition, asset classification, provisioning and other

related matters, except for the disclosures relating to Pillar 3 disclosures as at 31 December

2023, including leverage ratio, liquidity coverage ratio and net stable funding ratio under

Basel III Capital Regulations, as have been disclosed on the Bank’s website and in

respect of which a link has been provided in the Note 06 to the Statement and have not been

reviewed by us. |

| For M S K A & Associates |

For KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| ICAI Firm Registration No. 105047W |

ICAI Firm Registration No. 105146W/W100621 |

| |

|

| |

|

| /s/ Tushar Kurani |

/s/ Vinit Jain |

| Tushar Kurani |

Vinit Jain |

| Partner |

Partner |

| ICAI Membership No.: 118580 |

ICAI Membership No.: 145911 |

| |

|

| UDIN : 24118580BKFLW05606 |

UDIN : 24145911BKFXL03983 |

| |

|

| Place: Mumbai |

Place: Mumbai |

| Date: 20 January 2024 |

Date: 20 January 2024 |

2

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| 602 Floor 6, Raheja Titanium, |

Level-19, Sunshine Tower, |

| Western Express Highway, |

Senapati Bapat Marg, |

| Geetanjali, Railway Colony, |

Elphinstone Road. |

| Ram Nagar, Goregaon (E), |

Mumbai 400 013 |

| Mumbai 400 063 |

|

Independent Auditors’ Review Report on

unaudited consolidated financial results for the quarter and nine months ended 31 December 2023 of ICICI Bank Limited pursuant to the

Regulation 33 of the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended.

To

The Board of Directors of

ICICI Bank Limited

| 1. | We have reviewed the accompanying statement of unaudited consolidated financial results of ICICI Bank

Limited (‘the Parent Bank’ or ‘the Bank’), its subsidiaries (the Parent Bank and its subsidiaries together referred

to as ‘the Group’) and its share of the net profit / (loss) after tax of its associates for the quarter and nine months ended

31 December 2023 (the ‘Statement’), being submitted by the Bank pursuant to the requirements of Regulation 33 of the Securities

and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended (the ‘Listing Regulations’),

except for the disclosures relating to consolidated Pillar 3 disclosures as at 31 December 2023, including leverage ratio, liquidity coverage

ratio and net stable funding ratio under Basel III Capital Regulations as have been disclosed on the Bank’s website and in respect

of which a link has been provided in the Note 06 of the Statement and have not been reviewed by us. |

| 2. | This Statement, which is the responsibility of the Bank’s Management and has been approved by the

Bank’s Board of Directors, has been prepared in accordance with the recognition and measurement principles laid down in the Accounting

Standard (‘AS’) 25 ‘Interim Financial Reporting’ (‘AS 25’), prescribed under section 133 of the Companies

Act, 2013, read with relevant rules thereunder, the relevant provisions of the Banking Regulation Act, 1949, the circulars, guidelines

and directions issued by the Reserve Bank of India (the ‘RBI’) from time to time (the ‘RBI Guidelines’) and other

accounting principles generally accepted in India, and in compliance with Regulation 33 of the Listing Regulations. Our responsibility

is to express a conclusion on the Statement based on our review. |

| 3. | We conducted our review of the Statement in accordance with the Standard on Review Engagements (‘SRE’)

2410, “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”, issued by the Institute

of Chartered Accountants of India. A review of interim financial information consists of making inquiries, primarily of persons responsible

for financial and accounting matters, and applying analytical and other review procedures. A review is substantially less in scope than

an audit conducted in accordance with the Standards on Auditing and consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in an audit. Accordingly, we do not express an audit opinion. |

We also performed procedures in accordance

with the circular issued by the Securities and Exchange Board of India under Regulation 33(8) of the Listing Regulations, as amended,

to the extent applicable.

| 4. | The Statement includes the results/information of the entities referred in Annexure 1. |

| 5. | Based on our review conducted and procedures performed as stated in paragraph 3 above and based on the

consideration of the review/audit reports of other auditors, referred to in paragraph 8 & 9 below, nothing has come to our attention

that causes us to believe that the accompanying Statement, prepared in accordance with the recognition and measurement principles laid

down in AS 25, prescribed under Section 133 of the Companies Act, 2013, read with relevant rules thereunder, the RBI Guidelines, and other

accounting principles generally accepted in India, has not disclosed the information required to be disclosed in accordance with the requirements

of Regulation 33 of the Listing Regulations including the manner in which it is to be disclosed, or that it contains any material misstatement,

except for the disclosures relating to consolidated Pillar 3 disclosures as at 31 December 2023, including leverage ratio, liquidity coverage

ratio and net stable funding ratio under Basel III Capital Regulations, as have been disclosed on the Bank’s website and in respect

of which a link has been provided in Note 06 to the Statement and have not been reviewed by us. |

1

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| 6. | The joint statutory auditors of ICICI Prudential Life Insurance Company Limited (‘ICICI Life’),

vide their audit report dated 17 January 2024 have expressed an unmodified opinion and have reported in the 'Other Matter' section that

'The actuarial valuation of liabilities for life policies in force and for policies in respect of which premium has been discontinued

but liability exists as at 31 December 2023 is the responsibility of the Company's Panel Actuary (the ‘Appointed Actuary’).

The actuarial valuation of these liabilities for life policies in force and for policies in respect of which premium has been discontinued

but liability exists as at 31 December 2023 has been duly certified by the Appointed Actuary and in his opinion, the assumptions for such

valuation are in accordance with the guidelines and norms issued by the Insurance Regulatory and Development Authority of India (‘IRDAI')

and the Institute of Actuaries of India in concurrence with the Authority. The joint auditors have relied upon the Appointed Actuary's

certificate in this regard for forming their opinion on the valuation of liabilities for life policies in force and for policies in respect

of which premium has been discontinued but liability exists, as contained in the condensed standalone interim financial statements of

the Company’. Our conclusion on the Statement is not modified in respect of this matter based on the opinion expressed by the joint

statutory auditors of ICICI Life. |

| 7. | The joint statutory auditors of ICICI Lombard General Insurance Company Limited (‘ICICI General’),

vide their audit report dated 16 January 2024, have expressed an unmodified opinion and have reported in the 'Other Matter' section that,

'The actuarial valuation of liabilities in respect of Claims Incurred But Not Reported (‘IBNR'), Claims Incurred But Not Enough

Reported ('IBNER') and the Premium Deficiency Reserve ('PDR') is the responsibility of the Company's Appointed Actuary (the 'Appointed

Actuary'). The actuarial valuation of these liabilities, which are estimated using statistical methods as at 31 December 2023 has been

duly certified by the Appointed Actuary and in his opinion, the assumptions considered by him for such valuation are in accordance with

the guidelines and norms issued by the IRDAI and the Institute of Actuaries of India in concurrence with IRDAI. The joint auditors have

relied upon the Appointed Actuary's certificate in this regard for forming their opinion on the valuation of liabilities for outstanding

claims reserves and the PDR contained in the financial results of the Company’. Our conclusion on the Statement is not modified

in respect of this matter based on the opinion expressed by the joint statutory auditors of ICICI General. |

| 8. | We did not review / audit the interim financial statements / financial results of ten subsidiaries, included

in the Statement, whose interim financial statements / financial results reflects total assets of Rs. 4,29,925.38 crore (before consolidation

adjustments) as at 31 December 2023 and total revenues of Rs. 17,528.07 crore and Rs. 48,733.85 crore (before consolidation adjustments)

and total net profit after tax of Rs. 1,631.34 crore and Rs. 4,446.34 crore (before consolidation adjustments) for the quarter and nine

months ended 31 December 2023 respectively as considered in the Statement. These interim financial statements/ financial results have

been reviewed/audited by other auditors whose review/ audit reports have been furnished to us by the management, and our conclusion on

the Statement in so far as it relates to the amounts and disclosures included in respect of these subsidiaries is based solely on the

review reports of such other auditors, and the procedures performed by us as stated in paragraph 3 above. Further, of these subsidiaries,

three subsidiaries are located outside India whose interim financial statements / information have been prepared in accordance with accounting

principles generally accepted in their respective countries and which have been reviewed/audited by their respective auditors under generally

accepted auditing standards applicable in their respective countries. Our review report in so far as it relates to the balances and affairs

of such subsidiaries located outside India, is based on the reports of other auditors. According to the information and explanations given

to us by the management, the interim financial statements/information of these three subsidiaries are not material to the Group. Our conclusion

on the statement is not modified in respect of the above matter. |

| 9. | The Statement also includes the Group's share of net profit after tax of Rs. 205.86 crore and Rs. 670.28

crore for the quarter and nine months ended 31 December 2023 respectively, as considered in the Statement, in respect of an associate,

whose interim financial information / financial result have not been reviewed by us. This interim financial statements/information have

been audited/reviewed by other auditors whose reports have been furnished to us by the Management and our conclusion on the Statement,

in so far as it relates to the amounts and disclosures included in respect of this associate, is based solely on the reports of the other

auditors and the procedures performed by us as stated in paragraph 3 above. Our conclusion on the Statement is not modified in respect

of the above matter. |

2

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| 10. | The Statement includes the interim financial statements / information of six subsidiaries which have not

been reviewed / audited by their auditors, whose interim financial statements / financial results reflect total assets of Rs. 441.41 crore

(before consolidation adjustments) as at 31 December 2023, total revenues of Rs. 32.48 crore and Rs. 96.89 crore (before consolidation

adjustments) and total net (loss) after tax of Rs. 1.18 crore and Rs. 3.96 crore (before consolidation adjustments) for the quarter and

nine months ended 31 December 2023 respectively as considered in the Statement. The Statement also includes the Group's share of net profit

after tax of Rs. 54.10 crore and Rs. 176.16 crore for the quarter and nine months ended 31 December 2023 respectively, as considered in

the Statement, in respect of seven associates based on their interim financial statements / financial results which have not been reviewed/audited

by their auditors. According to the information and explanations given to us by the Management, these interim financial statements / financial

results are not material to the Group. Our conclusion on the Statement is not modified in respect of the above matter. |

| For M S K A & Associates |

For KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

| ICAI Firm Registration No. 105047W |

ICAI Firm Registration No. 105146W/W100621 |

| |

|

| |

|

| /s/ Tushar Kurani |

/s/ Vinit Jain |

| Tushar Kurani |

Vinit Jain |

| Partner |

Partner |

| ICAI Membership No.: 118580 |

ICAI Membership No.: 145911 |

| |

|

| UDIN: 24118580BKFLW05606 |

UDIN: 24145911BKFXL03983 |

| |

|

| Place: Mumbai |

Place: Mumbai |

| Date: 20 January 2024 |

Date: 20 January 2024 |

3

| M S K A & Associates |

KKC & Associates LLP |

| Chartered Accountants |

Chartered Accountants |

| |

(formerly Khimji Kunverji & Co LLP) |

Annexure 1

List of entities included in the Statement.

Parent Bank

Subsidiaries

| 4. | ICICI International Limited |

| 5. | ICICI Prudential Life Insurance Company Limited |

| 6. | ICICI Prudential Pension Funds Management Company Limited |

| 7. | ICICI Securities Primary Dealership Limited |

| 8. | ICICI Home Finance Company Limited |

| 9. | ICICI Investment Management Company Limited |

| 10. | ICICI Securities Limited |

| 11. | ICICI Securities Holdings Inc. |

| 13. | ICICI Venture Funds Management Company Limited |

| 14. | ICICI Trusteeship Services Limited |

| 15. | ICICI Prudential Asset Management Company Limited |

| 16. | ICICI Prudential Trust Limited |

| 17. | ICICI Strategic Investments Limited |

Associates

| 18. | ICICI Lombard General Insurance Company Limited |

| 19. | I-Process Services (India) Private Limited |

| 20. | NIIT Institute of Finance Banking and Insurance Trading Limited |

| 21. | ICICI Merchant Services Private Limited |

| 22. | Arteria Technologies Private Limited |

| 23. | India Infradebt Limited |

| 24. | India Advantage Fund III |

| 25. | India Advantage Fund IV |

4

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra

Kurla Complex

Mumbai

400 051

|

| News

Release |

January

20, 2024 |

Performance

Review: Quarter ended December 31, 2023

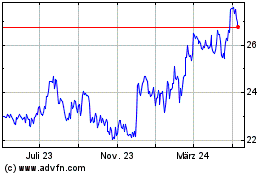

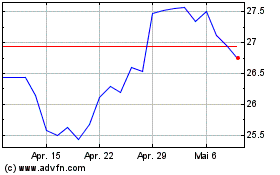

| · | Profit

before tax excluding treasury grew by 23.4% year-on-year to ₹ 13,551 crore (US$ 1.6 billion)

in the quarter ended December 31, 2023 (Q3-2024) |

| · | Core

operating profit grew by 10.3% year-on-year to ₹ 14,601 crore (US$ 1.8 billion) in Q3-2024 |

| · | Profit

after tax grew by 23.6% year-on-year to ₹ 10,272 crore (US$ 1.2 billion) in Q3-2024 |

| · | Total

period-end deposits grew by 18.7% year-on-year to ₹ 13,32,315 crore (US$ 160.1 billion) at

December 31, 2023 |

| · | Average

current account and savings account (CASA) ratio was 39.4% in Q3-2024 |

| · | Domestic

loan portfolio grew by 18.8% year-on-year to ₹ 11,14,820 crore (US$ 134.0 billion) at December

31, 2023 |

| · | Net

NPA ratio was 0.44% at December 31, 2023 compared to 0.43% at September 30, 2023 |

| · | Provisioning

coverage ratio on non-performing assets was 80.7% at December 31, 2023 |

| · | Including

profits for the nine months ended December 31, 2023 (9M-2024), total capital adequacy ratio

was 16.70% and CET-1 ratio was 16.03%, on a standalone basis, at December 31, 2023 |

The

Board of Directors of ICICI Bank Limited (NSE: ICICIBANK, BSE: 532174, NYSE: IBN) at its meeting held at Mumbai today, approved the standalone

and consolidated accounts of the Bank for the quarter ended December 31, 2023 (Q3-2024). The statutory auditors have conducted a limited

review and have issued an unmodified report on the standalone and consolidated financial statements for the quarter ended December 31,

2023.

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra

Kurla Complex

Mumbai

400 051

|

Profit

& loss account

| · | Profit

before tax excluding treasury grew by 23.4% year-on-year to ₹ 13,551 crore (US$ 1.6 billion)

in Q3-2024 from ₹ 10,978 crore (US$ 1.3 billion) in the quarter ended December 31, 2022 (Q3-2023) |

| · | The

core operating profit grew by 10.3% year-on-year to ₹ 14,601 crore (US$ 1.8 billion) in Q3-2024

from ₹ 13,235 crore (US$ 1.6 billion) in Q3-2023; excluding dividend income from subsidiaries/associates,

core operating profit grew by 9.7% year-on-year in Q3-2024 |

| · | Net

interest income (NII) increased by 13.4% year-on-year to ₹ 18,678 crore (US$ 2.2 billion)

in Q3-2024 from ₹ 16,465 crore (US$ 2.0 billion) in Q3-2023 |

| · | The

net interest margin was 4.43% in Q3-2024 compared to 4.53% in Q2-2024 and 4.65% in Q3-2023.

The net interest margin was 4.57% in 9M-2023 |

| · | Non-interest

income, excluding treasury, increased by 19.8% year-on-year to ₹ 5,975 crore (US$ 718 million)

in Q3-2024 from ₹ 4,987 crore (US$ 599 million) in Q3-2023 |

| · | Fee

income grew by 19.4% year-on-year to ₹ 5,313 crore (US$ 638 million) in Q3-2024 from ₹ 4,448

crore (US$ 535 million) in Q3-2023. Fees from retail, rural, business banking and SME customers

constituted about 79% of total fees in Q3-2024 |

| · | There

was a treasury gain of ₹ 123 crore (US$ 15 million) in Q3-2024 compared to ₹ 36 crore (US$

4 million) in Q3-2023 |

| · | Provisions

(excluding provision for tax) were ₹ 1,050 crore (US$ 126 million) in Q3-2024 compared to

₹ 2,257 crore (US$ 271 million) in Q3-2023 |

| · | In

Q3-2024, provisions included ₹ 627 crore (US$ 75 million) on investments in Alternate Investment

Funds as per RBI circular dated December 19, 2023 |

| · | The

profit before tax grew by 24.2% year-on-year to ₹ 13,674 crore (US$ 1.6 billion) in Q3-2024

from ₹ 11,014 crore (US$ 1.3 billion) in Q3-2023 |

| · | The

profit after tax grew by 23.6% year-on-year to ₹ 10,272 crore (US$ 1.2 billion) in Q3-2024

from ₹ 8,312 crore (US$ 999 million) in Q3-2023 |

2

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra

Kurla Complex

Mumbai

400 051

|

Growth

in digital and payments platforms

There

have been more than one crore activations from non-ICICI Bank account holders on the Bank’s mobile banking app, iMobile Pay as

of end-December 2023.

ICICI

Bank’s Merchant STACK offers an array of banking and value-added services to retailers, online businesses and large e-commerce

firms such as digital current account opening, instant overdraft facilities based on point-of-sale transactions, connected banking services

and digital store management, among others. The value of the Bank’s merchant acquiring transactions through UPI grew by 85.0% year-on-year

and 20.7% sequentially in Q3-2024. The Bank had a market share of about 28.8% by value in electronic toll collections through FASTag

in Q3-2024, with a 11.9% year-on-year growth in collections in Q3-2024.

The Bank

has created more than 20 industry specific STACKs which provide bespoke and purpose-based digital solutions to corporate clients and

their ecosystems. The Bank’s Trade Online and Trade Emerge platforms allow customers to perform most of their trade finance and

foreign exchange transactions digitally. The Bank’s digital solutions integrate the import transaction lifecycle with bespoke solutions

providing frictionless experience to our clients and simplify customer journeys. About 72% of trade transactions were done digitally

in Q3-2024. The volume of transactions done through Trade Online platform in Q3-2024 grew by 26.2% year-on-year.

The Bank

has further simplified cross-border remittance journeys with new enhancements. SmartIRM is a multi-party cross-border inward remittance

solution with virtual account architecture, enhanced security features and remittances reconciliation with payer identification. SmartORM

enables pre-vetting of outward remittance transactions to ensure error-free submission before booking foreign exchange deals.

iLens,

the retail lending platform currently enable for the mortgage, is being upgraded on an ongoing basis with new features such as integration

with account aggregators, opening of instant paperless saving bank account for newly on-boarded mortgage customers and instant property

valuation reports for select developers to provide enhanced customer experience and serve the customer’s 360° needs digitally.

3

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra

Kurla Complex

Mumbai

400 051

|

Credit

growth

The net

domestic advances grew by 18.8% year-on-year and 3.8% sequentially at December 31, 2023. The retail loan portfolio grew by 21.4%

year-on-year and 4.5% sequentially, and comprised 54.3% of the total loan portfolio at December 31, 2023. Including non-fund

outstanding, the retail portfolio was 46.4% of the total portfolio at December 31, 2023. The business banking portfolio grew by

31.9% year-on-year and 6.5% sequentially at December 31, 2023. The SME business, comprising borrowers with a turnover of less than

₹ 250 crore (US$ 30 million), grew by 27.5% year-on-year and 6.7% sequentially at December 31, 2023. The rural portfolio grew

by 18.2% year-on-year and 4.6% sequentially at December 31, 2023. The domestic corporate portfolio grew by 13.3% year-on-year and

2.9% sequentially at December 31, 2023. Total advances increased by 18.5% year-on-year and 3.9% sequentially to ₹ 11,53,771

crore (US$ 138.7 billion) at December 31, 2023.

Deposit

growth

Total

period-end deposits increased by 18.7% year-on-year and 2.9% sequentially to ₹ 13,32,315 crore (US$ 160.1 billion) at December 31, 2023.

Period-end term deposits increased by 31.2% year-on-year and 4.9% sequentially to ₹ 8,04,320 crore (US$ 96.7 billion) at December 31,

2023. Average current account deposits increased by 11.6% year-on-year in Q3-2024. Average savings account deposits increased by 2.8%

year-on-year in Q3-2024.

With

the addition of 471 branches in 9M-2024, the Bank had a network of 6,371 branches and 17,037 ATMs and cash recycling machines at December

31, 2023.

Asset

quality

The

gross NPA ratio declined to 2.30% at December 31, 2023 from 2.48% at September 30, 2023. The net NPA ratio was 0.44% at December 31,

2023 compared to 0.43% at September 30, 2023 and 0.55% at December 31, 2022. The net additions to gross NPAs, excluding write-offs and

sale, were ₹ 363 crore (US$ 44 million) in Q3-2024 compared to ₹ 116 crore (US$ 14 million) in Q2-2024. The gross NPA additions were

₹ 5,714 crore (US$ 687 million) in Q3-2024 compared to ₹ 4,687 crore (US$ 563 million) in Q2-2024. Recoveries and upgrades of NPAs, excluding

write-offs and sale, were ₹ 5,351 crore (US$ 643 million) in Q3-2024 compared to ₹ 4,571 crore (US$ 549 million) in Q2-2024. The Bank

has written off gross NPAs amounting to ₹ 1,389 crore (US$ 167 million) in Q3-2024. The provisioning coverage ratio on NPAs was 80.7%

at December 31, 2023.

Excluding

NPAs, the total fund based outstanding to all borrowers under resolution as per the various extant regulations/guidelines declined

to ₹ 3,318 crore (US$ 399 million) or 0.3% of total advances at December 31, 2023 from ₹ 3,536 crore (US$ 425 million) at

September 30, 2023. The Bank holds provisions amounting to ₹ 1,032 crore (US$ 124 million) against these borrowers under

resolution, as of December 31, 2023. In addition, the Bank continues to hold contingency provisions of ₹ 13,100 crore (US$ 1.6

billion) at December 31, 2023. The loan and non-fund based outstanding to performing corporate and SME borrowers rated BB and below

was ₹ 5,853 crore (US$ 703 million) at December 31, 2023 compared to ₹ 4,789 crore (US$ 576 million) at September 30,

2023. The loan and non-fund based outstanding of ₹ 5,853 crore (US$ 703 million) at December 31, 2023 includes ₹ 661

crore (US$ 79 million) to borrowers under resolution.

4

|

ICICI

Bank Limited

ICICI

Bank Towers

Bandra

Kurla Complex

Mumbai

400 051

|

Capital

adequacy

Including

profits for the nine months ended December 31, 2023, the Bank’s total capital adequacy ratio at December 31, 2023 was 16.70% and

CET-1 ratio was 16.03% compared to the minimum regulatory requirements of 11.70% and 8.20% respectively.

Consolidated

results

The consolidated

profit after tax increased by 25.7% year-on-year to ₹ 11,053 crore (US$ 1.3 billion) in Q3-2024 from ₹ 8,792 crore (US$ 1.1 billion)

in Q3-2023.

Consolidated

assets grew by 17.0% year-on-year to ₹ 22,08,018 crore (US$ 265.3 billion) at December 31, 2023 from ₹ 18,87,209 crore (US$ 226.8 billion)

at December 31, 2022.

Key

subsidiaries and associates

The annualised

premium equivalent increased by 1.7% year-on-year to ₹ 5,430 crore (US$ 653 million) in 9M-2024 compared to ₹ 5,341 crore (US$ 642 million)

in 9M-2023. The VNB margin was 26.7% in 9M-2024 compared to 32.0% in FY2023 and 32.0% in 9M-2023. Value of New Business (VNB) of ICICI

Prudential Life Insurance (ICICI Life) was ₹ 1,451 crore (US$ 174 million) in 9M-2024 compared to 1,710 crore (US$ 205 million) in 9M-2023.

The profit after tax was ₹ 679 crore (US$ 82 million) in 9M-2024 compared to ₹ 576 crore (US$ 69 million) in 9M-2023 and ₹ 227 crore

(US$ 27 million) in Q3-2024 compared to ₹ 221 crore (US$ 27 million) in Q3-2023.

The Gross

Direct Premium Income (GDPI) of ICICI Lombard General Insurance Company (ICICI General) grew by 13.4% year-on-year to ₹ 6,230 crore (US$

749 million) in Q3-2024 from ₹ 5,493 crore (US$ 660 million) in Q3-2023. The combined ratio stood at 103.6% in Q3-2024 compared to 104.4%

in Q3-2023. Excluding the impact of CAT losses, the combined ratio was 102.3% in Q3-2024. The profit after tax of ICICI General grew

by 22.1% to ₹ 431 crore (US$ 52 million) in Q3-2024 from ₹ 353 crore (US$ 42 million) in Q3-2023.

The profit

after tax of ICICI Prudential Asset Management Company, as per Ind AS, grew by 30.0% year-on-year to ₹ 546 crore (US$ 66 million) in

Q3-2024 from ₹ 420 crore (US$ 50 million) in Q3-2023.

The profit