HP Can't Shake Growth Problems -- Ahead of the Tape

23 Februar 2016 - 10:06PM

Dow Jones News

By Steven Russolillo

The new HP Inc. is still facing the same old problems.

The printer and personal-computer company is set to report its

first earnings report without the storage and enterprise-computing

business on its books, after the company split in two last

year.

Unfortunately, results for HP will likely show many of the same

growth problems that have hurt it for years. Those aren't likely to

go away anytime soon.

Analysts polled by FactSet expect fiscal first-quarter earnings

of 36 cents a share, at the midpoint of the company's previously

projected range of 33 cents to 38 cents. Revenue for the period

ending in January is expected to fall slightly to approximately $12

billion.

The bad news doesn't stop there: In the combined company's prior

quarterly earnings report, printing revenue fell 14%, commercial

printer sales dropped 23%, and revenue for printer supplies

declined 10%. Those downbeat trends will probably continue.

Meanwhile, the personal-computer market isn't faring much

better. Smartphone and tablet competition continues to take a toll

on PC sales, which slumped last year to their lowest since 2007,

according to International Data Corp. Not coincidentally, that was

the year that Apple Inc. launched the iPhone.

The bull case for HP centers on historically strong cash flow.

But even that took a hit in fiscal 2015 due to split-related costs,

falling to its lowest since 2004. And in November, HP predicted

free cash flow of $2.4 billion to $2.7 billion in fiscal 2016,

below the prior year's level.

HP has fallen 15% since the Nov. 1 split. And that is despite a

surprise rally in the three weeks following the split. The overall

performance is worse than Hewlett Packard Enterprise's 11% decline

over the same time. Both stocks have also trailed the

technology-heavy Nasdaq Composite and the broad S&P 500.

HP shares appear cheap, fetching about 6.5 times forward

earnings over the next 12 months. That is far lower than other tech

behemoths such as Apple, Microsoft Corp. and International Business

Machines Corp.

But HP is cheap for a reason. This print has paper jam written

all over it.

(END) Dow Jones Newswires

February 23, 2016 15:51 ET (20:51 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

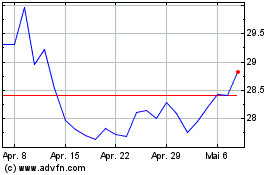

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

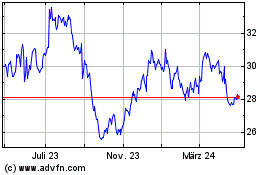

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024