Current Report Filing (8-k)

10 März 2015 - 9:07PM

Edgar (US Regulatory)

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

March 10, 2015

Date of Report (Date of Earliest Event Reported)

|

|

HEWLETT-PACKARD COMPANY

|

|

(Exact name of registrant as specified in its charter)

|

|

DELAWARE

|

1-4423

|

94-1081436

|

|

(State or other jurisdiction

of incorporation)

|

(Commission File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

3000 HANOVER STREET, PALO ALTO, CA

|

|

94304

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

|

|

|

|

|

|

|

|

|

|

(650) 857-1501

|

|

|

(Registrant’s telephone number, including area code)

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01.

|

Other Events.

|

|

|

|

|

|

|

On February 23, 2015, Hewlett-Packard Company (“HP”) and the plaintiffs and co-defendants in two consolidated shareholder derivative actions, In re Hewlett-Packard Company Shareholder Derivative Litigation, United States District Court, Central District of California, Master File No. 8:11-cv-01454- AG, and In re Hewlett-Packard Company Derivative Litigation, State of California, Orange County Superior Court, Lead Case No. No. 30-2011-00511941-CU-BT-CJC (collectively, the “Actions”), filed Joint Stipulations for Voluntary Dismissal of the Actions.

Pursuant to the terms of the Joint Stipulations for Voluntary Dismissal of the Actions, the respective courts ordered the parties to give notice of the proposed voluntary dismissals. Accordingly, HP has filed a Notice of Proposed Voluntary Dismissal of Derivative Actions (the “Notice”) as Exhibit 99.1 to this Current Report on Form 8-K, and has published the Notice on the “Investor Relations” portion of the HP website.

|

|

|

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

|

|

|

Exhibit 99.1

|

Notice of Proposed Voluntary Dismissal of Derivative Actions (filed herewith).

|

|

|

|

SIGNATURE

|

|

|

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

HEWLETT-PACKARD COMPANY

|

|

|

|

|

|

|

|

|

|

DATE: March 10, 2015

|

By:

|

/s/ Rishi Varma

|

|

|

|

Name:

|

Rishi Varma

|

|

|

Title:

|

Senior Vice President,

Deputy General Counsel

and Assistant Secretary

|

|

EXHIBIT INDEX

|

|

|

|

|

|

|

|

Exhibit Number

|

Description

|

|

|

|

|

Exhibit 99.1

|

Notice of Proposed Voluntary Dismissal of Derivative Actions (filed herewith).

|

|

|

|

Exhibit 99.1

Notice of Proposed Voluntary Dismissal of Derivative Actions

On September 21, 2011, two purported shareholder derivative actions were filed in the United States District Court for the Central District of California, Case No. 8:11-cv-01454- AG (filed by plaintiff Ernesto Espinoza) and Case No. 8:11-cv-01456- AG (filed by plaintiff Larry Salat). On November 21, 2011, these two actions were consolidated into a single action referred to as In re Hewlett-Packard Company Shareholder Derivative Litigation, Master File No. 8:11-cv-01454- AG (the “Federal Derivative Action”). The Federal Derivative Action seeks recovery on behalf of Hewlett-Packard Company (“Hewlett-Packard” or “the Company”), which is named as a “nominal defendant,” against certain current and former officers and directors of the Company. The Federal Derivative Action purports to assert causes of actions for alleged violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, breach of fiduciary duty, waste of corporate assets, and unjust enrichment, in connection with statements allegedly made regarding the development of new devices using the webOS operating system following the Company’s acquisition of Palm, Inc.

On September 29, 2011, plaintiff Luis Gonzales filed a purported shareholder derivative action in Orange County Superior Court, in the State of California, Case No. No. 30-2011-00511941. On October 5, 2011, plaintiff Richard Tyner filed a purported shareholder derivative action in Orange County Superior Court, in the State of California, Case No. No. 30-2011-00513236. On December 1, 2011, these two actions were consolidated into a single action hereinafter referred to as the “State Derivative Action.” The State Derivative Action asserts substantially similar claims against many of the same defendants as the Federal Derivative Action. On November 1, 2012, the Court stayed the State Derivative Action in favor of the Federal Derivative Action.

On November 21, 2014, defendants in the Federal Derivative Action filed motions to dismiss the action in its entirety. While the motions to dismiss were pending, plaintiffs proposed a voluntary dismissal of the action without any payment or other consideration from defendants. Plaintiffs in the State Derivative Action agreed to a voluntary dismissal on the same terms.

On February 23, 2015, the parties to the Federal Derivative Action and the State Derivative Action (collectively, the “Derivative Actions”) filed Joint Stipulations for Voluntarily Dismissal of the Derivative Actions (“Joint Stipulations”). As set forth in the Joint Stipulations, there has been no settlement or compromise of the Derivative Actions, there has been no collusion among the parties, and neither plaintiffs nor their counsel has received or will receive directly or indirectly any consideration from defendants for the dismissals.

Pursuant to the Joint Stipulations, the Courts in the Derivative Actions ordered the following:

|

·

|

Notice of the Joint Stipulations for Voluntary Dismissal and Orders thereon shall be: (i) included in a Form 8-K filed with the U.S. Securities and Exchange Commission; and (ii) posted on the “Investor Relations” page of the Company’s website for a period of at least two weeks.

|

|

·

|

In the event no shareholder seeks to intervene within thirty (30) days of issuance of this notice, the Derivative Actions shall be dismissed on the terms provided for in the Joint Stipulations, with prejudice as to plaintiffs but otherwise without prejudice as to Hewlett-Packard and/or any other Hewlett-Packard shareholders.

|

|

·

|

The Parties shall bear their own fees and costs in connection with the Derivative Actions.

|

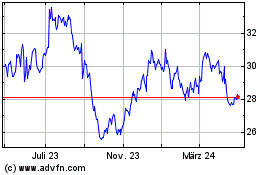

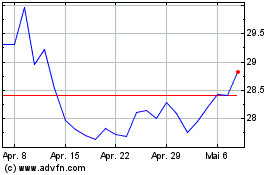

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2024 bis Aug 2024

HP (NYSE:HPQ)

Historical Stock Chart

Von Aug 2023 bis Aug 2024