3 Stocks to Buy Before Earnings Season - Investment Ideas

02 Juli 2013 - 12:15AM

Zacks

In the world of investing, past performance is certainly no

guarantee of future performance. A stock that has been going up for

years, may suddenly stop rising and start declining. Ditto for a

stock that has been sinking. In the blink of an eye it starts

rising.

The same is true during earnings season. Just

because a company beat the estimate the prior quarter doesn't mean

it will beat again this quarter.

But what if that company has put together a hot

streak of earnings beats?

What if a company has beaten not just two or three

quarters in a row but 20 quarters in a row- or 5 years- without a

miss?

Apple had put together just such an impressive

earnings surprise streak until it finally missed in late 2011. In

the 6 quarters since the miss, it has missed another 3 times. Share

price, however, peaked in between the second and third miss.

But during its earnings surprise streak, investors

were handsomely rewarded.

Perfection Isn't Easy

Even with all of the unknowns in investing, I'd

rather buy a company that is on an earnings hot streak, than one

that is dead cold.

Companies with a perfect earnings track record for

the last 5 years are a small select group. It's incredibly

difficult to keep beating for 5 years through all the ups and downs

in the economy. Management has to manage expectations very, very

well. There's little room for error. That takes skill (and maybe

some luck.)

These three companies haven't missed in 5 years. I

featured two of these companies last quarter and they came through

with another earnings beat.

Of course, an earnings beat doesn't necessarily

mean a stock will rise afterwards. Being light on guidance or an

earnings/sales warning, for instance, could put the damper on an

earnings beat. But I still like my chances with an earnings beat

versus an earnings miss.

Will their streaks continue this earnings

season?

3 Companies With Perfect Earnings Surprise Track

Records

1. Wyndham Worldwide

2. Jarden

3. Herbalife

1. Wyndham Worldwide (WYN)

Wyndham is one of the largest hospitality companies

in the world. It operates about 630,000 hotel rooms worldwide and

operates vacation rentals and exchanges with over 106,000 vacation

properties in 100 countries. It also operates a network of 190

timeshare properties with about 915,000 owners.

Forward P/E = 15.4

Expected 2013 earnings growth = 15%

Zacks Rank #3 (Hold)

Reporting second quarter results on July 24

2. Jarden Corporation (JAH)

Jarden owns over 100 of the most famous consumer

brands in the world including Rawlings, Crock-Pot, Mr. Coffee,

Sunbeam, Seal-a-Meal, and First Alert.

Forward P/E = 13.4

Expected 2013 earnings growth = 17.7%

Zacks Rank #3 (Hold)

Expected to report second quarter results on July 23

3. Herbalife Limited (HLF)

Herbalife makes a whole host of nutrition products

including protein shakes and snacks, energy and fitness drinks,

vitamins and nutritional supplements. It sells its products through

independent distributors in 85 countries.

The company has been in the news recently due to a

change in auditors resulting from the resignation of a partner with

its former auditor. It did not have to restate any financial

statements.

Forward P/E = 9.4

Expected 2013 earnings growth = 18.7%

Zacks Rank #2 (Buy)

Expected to report second quarter results on Aug 5

Want More of Our Best Recommendations?

Zacks' Executive VP, Steve Reitmeister, knows when key trades

are about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

Tracey Ryniec is the Value Stock Strategist for Zacks.com.

She is also the Editor of the Turnaround Trader and Value Investor

services. You can follow her on twitter at @TraceyRyniec.

APPLE INC (AAPL): Free Stock Analysis Report

HERBALIFE LTD (HLF): Free Stock Analysis Report

JARDEN CORP (JAH): Free Stock Analysis Report

WYNDHAM WORLDWD (WYN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

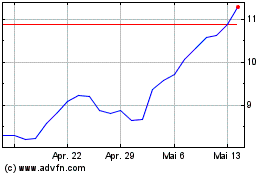

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Herbalife (NYSE:HLF)

Historical Stock Chart

Von Jul 2023 bis Jul 2024