Current Report Filing (8-k)

29 Juli 2022 - 8:46PM

Edgar (US Regulatory)

false000004661900000466192022-07-262022-07-260000046619hei:HeicoCommonStockMember2022-07-262022-07-260000046619us-gaap:CommonClassAMember2022-07-262022-07-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event Reported): July 26, 2022

HEICO CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Florida | 001-04604 | 65-0341002 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification Number) |

| | |

3000 Taft Street, Hollywood, Florida 33021 |

| (Address of Principal Executive Offices) (Zip Code) |

| | |

(954) 987-4000 |

| (Registrant's telephone number, including area code) |

(Former name or former address, if changed since last report)

| | | | | | | | |

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| Common Stock, $.01 par value per share | | HEI | | New York Stock Exchange |

| Class A Common Stock, $.01 par value per share | | HEI.A | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On July 26, 2022, HEICO Corporation (the “Company”), through its wholly owned Electronic Technologies Group subsidiary (the “Purchaser”), entered into a Put Option Agreement with IK Partners and certain other parties thereto (collectively, the “Sellers”). Pursuant to the Put Option Agreement and a Stock Purchase Agreement attached to the Put Option Agreement (the “Purchase Agreement” and, together with the Put Option Agreement, the “Acquisition Agreements”), the Purchaser has committed to acquire Exxelia International ("Exxelia") from an affiliate of IK Partners and the Sellers for €453 million in cash to be paid at closing plus the assumption of approximately €14 million of liabilities pursuant to the terms, and subject to the conditions, set forth in the Acquisition Agreements. Exxelia's management and team members are expected to continue to own a minority interest of around 5% of the business.

Exxelia is a global leader in the design, manufacture and sale of high-reliability (“Hi-Rel”), complex, passive electronic components and rotary joint assemblies for mostly aerospace and defense applications, in addition to other high-end applications, such as medical and energy uses, including emerging “clean energy” and electrification applications.

The parties’ entry into the Purchase Agreement is subject to the completion of a works council consultation process required under French law, following which the Sellers will have the right, pursuant to and subject to the terms of the Put Option Agreement, to require the Purchaser and the Company to enter into the Purchase Agreement. The closing of the transaction is subject to customary closing conditions, including, among others, obtaining required foreign antitrust clearances and foreign investment authorizations.

The foregoing description of the Acquisition Agreements does not purport to be complete and is qualified in its entirety by reference to the full text of the Acquisition Agreements. A copy of the Put Option Agreement (including the Stock Purchase Agreement, which is attached to the Put Option Agreement as an exhibit thereto) is attached hereto as Exhibit 10.1, and is incorporated herein by reference.

On July 28, 2022, the Company issued a press release announcing HEICO Electronics Technologies Group’s entry into the Put Option Agreement. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| | |

| 10.1 | | |

| | |

| 99.1 | | |

| | |

| 101.SCH | | Inline XBRL Taxonomy Extension Schema Document. |

| | |

| | |

| | |

| 101.DEF | | Inline XBRL Taxonomy Extension Definition Linkbase Document. |

| | |

| 101.LAB | | Inline XBRL Taxonomy Extension Labels Linkbase Document. |

| | |

| 101.PRE | | Inline XBRL Taxonomy Extension Presentation Linkbase Document. |

| | |

| 104 | | Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit 101). |

| |

* The Company has omitted schedules and other similar attachments to such agreement pursuant to Item 601 of Regulation S-K. The Company will furnish a copy of such omitted schedule or attachment to the SEC upon request.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | HEICO CORPORATION |

| | | |

| Date: | July 29, 2022 | By: | /s/ CARLOS L. MACAU, JR. |

| | | Carlos L. Macau, Jr.

Executive Vice President -

Chief Financial Officer and Treasurer |

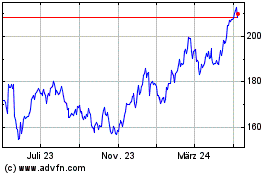

HEICO (NYSE:HEI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

HEICO (NYSE:HEI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024