false000182014400018201442023-11-132023-11-130001820144us-gaap:CommonStockMember2023-11-132023-11-130001820144us-gaap:WarrantMember2023-11-132023-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 13, 2023

________________________

Grindr Inc.

(Exact name of registrant as specified in its charter)

________________________

Commission file number 001-39714

________________________

| | | | | | | | |

| Delaware | | 92-1079067 |

(State or other jurisdiction of incorporation) | | (IRS Employer Identification No.) |

| | |

PO Box 69176, 750 N. San Vicente Blvd., Suite RE 1400 West Hollywood, California | | 90069 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(310) 776-6680

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | GRND | New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share | GRND.WS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On November 13, 2023, Grindr Inc. (the “Company”) issued a press release and posted a shareholder letter to its website announcing its financial results for the third fiscal quarter ended September 30, 2023. A copy of the Company’s press release dated November 13, 2023 and the shareholder letter dated November 13, 2023 are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference.

The information contained herein and the accompanying Exhibit 99.1 and Exhibit 99.2 are being furnished under “Item 2.02 Results of Operations and Financial Condition” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended, nor shall it be deemed incorporated by reference in any filing with the Securities and Exchange Commission made by us, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release dated November 13, 2023 |

| | Shareholder Letter dated November 13, 2023 |

| 104 | | Cover Page Interactive Data File, formatted in inline XBRL (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 13, 2023

| | | | | | | | |

| | | GRINDR INC. |

| | | |

| | | By: |

| | | |

| | | /s/ Vandana Mehta-Krantz |

| | | Vandana Mehta-Krantz |

| | | Chief Financial Officer |

Exhibit 99.1

Grindr Inc. Reports Third Quarter 2023 Revenue Growth of 39%, Raises Guidance

Third Quarter Revenue was $70.3 Million

Net Loss of $0.4 Million, Net Loss Margin of 1%

Operating Income of $16.6 Million, Adjusted EBITDA of $32.6 million and Adjusted EBITDA Margin of 46%

Raising FY 2023 Guidance to 31% or Greater Revenue Growth and 41%+ Adjusted EBITDA Margin

LOS ANGELES, CA – November 13, 2023 – Grindr Inc. (NYSE: GRND), the world’s largest social network for the LGBTQ community, today posted its financial results for the third quarter ended September 30, 2023 in a Letter to Shareholders. The Letter to Shareholders can be accessed on Grindr’s Investor Relations website.

“We delivered another strong quarter as more users are engaging with our new paid offerings,” said George Arison, Chief Executive Officer of Grindr. “Based on continued solid business trends we are again raising our financial outlook for 2023. Looking into next year and beyond we are focused on building a high-performance team across the organization to drive our product roadmap and we are very excited about the many long-term opportunities to deliver more to our community.”

Earnings Webcast Information

Grindr will host a live webcast today at 2:00 p.m. Pacific Time to discuss the Company’s third quarter financial results. The webcast of the conference call can be accessed as follows:

Event: Grindr Third Quarter 2023 Earnings Conference Call

Date: Monday, November 13, 2023

Time: 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time)

Live Webcast Site: https://investors.grindr.com/

An archived webcast of the conference call will also be accessible on Grindr’s Investor Relations page, https://investors.grindr.com/.

Forward Looking Statements

This press release contains “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 regarding Grindr’s current views with respect to our industry, operations and future business plans and performance. These forward-looking statements can generally be identified by the use of forward-looking terminology, such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “will” or the negative version of these words or other comparable words or phrases, but the absence of these words does not mean that a statement is not forward-looking.

These forward-looking statements include, among others, statements about our growth opportunities, expectations regarding new product launches and their expected effect on full year 2023 guidance, including the expected continued success of Weeklies, our 2023 strategic priorities, our plan to generate sustainable double-digit revenue growth and strong profitability and our full year 2023 guidance. Forward-looking statements, including guidance related to revenue growth and adjusted EBITDA margin, are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from our expectations discussed in the forward-looking statements. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to:

•our reliance on historical data, which may be of limited reliability, in providing revenue guidance;

•our success in retaining or recruiting our directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles;

•the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy and data protection laws and regulations;

•our ability to respond to general economic conditions;

•factors relating to the business, operations and financial performance of Grindr and our subsidiaries, including:

◦competition in the dating and social networking products and services industry;

◦the ability to maintain and attract users;

◦fluctuation in quarterly and yearly results;

◦our ability to adapt to changes in technology and user preferences in a timely and cost-effective manner;

◦our ability to protect systems and infrastructures from cyber-attacks and prevent unauthorized data access;

◦our dependence on the integrity of third-party systems and infrastructure; and

◦our ability to protect our intellectual property rights from unauthorized use by third parties.

•whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters;

•the effects macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters and wars or other regional conflicts;

•the ability to maintain the listing of our common stock and public warrants on the New York Stock Exchange (“NYSE”); and

•the increasingly competitive environment in which we operate.

The foregoing list of factors is not exhaustive. Further information on these and additional risks, uncertainties and other factors that could cause actual outcomes and results to differ materially from those included in or contemplated by the forward-looking statements contained in this press release are included in the section titled “Risk Factors” included under Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2022 and updates in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

About Non-GAAP Measures

Grindr uses Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of Grindr’s financial performance and should not be considered as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We define Adjusted EBITDA as net loss excluding income tax provision, interest expense, net, depreciation and amortization, stock-based compensation expense, severance, transaction-related costs, litigation-related costs for matters unrelated to the Company's ongoing business, including those matters incurred as part of the Business Combination, Legacy Grindr management fees, change in fair value of warrant liability and other expense. Our management uses this measure internally to evaluate the performance of our business and this measure is one of the primary metrics by which our internal budgets are based and by which management is compensated. We exclude the above items as some are non-cash in nature, and others are non-recurring that they may not be representative of normal operating results. Adjusted EBITDA adjusts for the impact of items that we do not consider indicative of the operational performance of our business. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period. While we believe that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP.

The following table presents the reconciliation of net loss to Adjusted EBITDA for the three and nine months ended September 30, 2023 and 2022.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| ($ in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Reconciliation of net loss to Adjusted EBITDA | | | | | | | |

Net loss | $ | (437) | | | $ | (4,657) | | | $ | (11,005) | | | $ | (4,458) | |

| Interest expense, net | 11,985 | | | 4,786 | | | 35,695 | | | 10,998 | |

Income tax provision | 1,272 | | | 3,474 | | | 2,724 | | | 3,727 | |

| Depreciation and amortization | 5,753 | | | 9,097 | | | 21,845 | | | 27,215 | |

Transaction-related costs (1) | — | | | 1,033 | | | — | | | 2,211 | |

Litigation-related costs (2) | 414 | | | 439 | | | 1,913 | | | 1,521 | |

| Stock-based compensation expense | 3,648 | | | 9,686 | | | 10,594 | | | 23,353 | |

Severance expenses (3) | 6,744 | | | — | | | 8,077 | | | 552 | |

Management fees (4) | (97) | | | 181 | | | (97) | | | 544 | |

Change in fair value of warrant liability (5) | 3,362 | | | — | | | 11,581 | | | — | |

Others (6) | (43) | | | — | | | 157 | | | — | |

| Adjusted EBITDA | $ | 32,601 | | | $ | 24,039 | | | $ | 81,484 | | | $ | 65,663 | |

| Revenue | $ | 70,258 | | | $ | 50,402 | | | $ | 187,605 | | | $ | 140,487 | |

Net loss margin | (0.6) | % | | (9.2) | % | | (5.9) | % | | (3.2) | % |

| Adjusted EBITDA Margin | 46.4 | % | | 47.7 | % | | 43.4 | % | | 46.7 | % |

_________________

(1)Transaction-related costs consist of legal, tax, accounting, consulting, and other professional fees related to a transaction entered into on May 9, 2022, whereby Grindr Group LLC (“Grindr Group”) and its subsidiaries (“Legacy Grindr”) entered into an Agreement and Plan of Merger (as amended on October 5, 2022) with Tiga Acquisition Corp. (“Tiga”), in which Grindr Group became a wholly owned subsidiary of Tiga (the “Business Combination”) and other potential acquisitions that are non-recurring in nature.

(2)Litigation-related costs primarily represent external legal fees associated with the outstanding litigation or regulatory matters incurred in connection with the Business Combination, related to a potential fine that may be imposed by the Norwegian Data Protection Authority, the CFIUS review of the Business Combination, as well as legal fees related to employee unionization, which are unrelated to Grindr’s core ongoing business operations.

(3)Severance expenses related to severance incurred for employees who elected not to relocate or participate in our multi-phase return-to-office plan announced in August 2023 and other one-off severance.

(4)Management fees represent administrative costs associated with San Vicente Holdings LLC's administrative role in managing financial relationships and providing directive on strategic and operational decisions, which ceased to continue after the Business Combination. In September 2023, certain management fees previously accrued were forgiven.

(5)Change in fair value of warrant liability relates to our warrants that were remeasured as of September 30, 2023.

(6)Others represent other costs that are unrelated to Grindr's core ongoing business operations.

About Grindr Inc.

With more than 13 million monthly active users globally, Grindr has grown to become a fundamental part of the LGBTQ community since its launch in 2009. The company continues to expand its ecosystem to enable LGBTQ people to connect, express themselves, and discover the world around them. Grindr is headquartered in West Hollywood, California. The Grindr app is available on the App Store and Google Play, as well as on the web.

Investors:

IR@grindr.com

Media:

Press@grindr.com

Shareholder Letter Third Quarter 2023 November 13, 2023

2Q3 2023 Letter To Shareholders I am very proud of our exceptional results in Q3’23. As we’ve shared these past several quarters, our focus has been on improving the user experience and driving monetization through greater conversion with new paid offerings. We will continue to deliver on both fronts while setting up a successful 2024. Both our revenue growth and Adjusted EBITDA margin in Q3’23 were ahead of our full-year guidance. This outperformance is due to the successful execution of new product monetization initiatives, and also reflects the impact of Monkeypox virus in Q3 of 2022, which was a headwind to Direct Revenue in the prior-year quarter. Due to our outperformance to date, we are raising our revenue guidance for the full year. We now expect 2023 revenue growth of 31% or greater, and Adjusted EBITDA margin of 41% or greater. The anticipated higher revenue growth rate contemplates strong year-over-year growth and a stabilization in our sequential growth rate. Grindr achieved strong business performance and growth while concurrently driving positive and ongoing workplace culture change. In order to serve our users, create value for them and for our shareholders, as well as attracting top talent, it is important for us to have a performance-driven culture that seeks out audacious goals and strives to achieve them through operational excellence and accountability. Over the last year, a big focus for the executive team has been to facilitate our transition to an environment where our employees can continually learn, execute successfully, and unleash their full potential. Dear Shareholders, $70.3mm revenue +39% YoY growth $32.6mm adj. EBITDA 46% of revenue Q3 2023

3Q3 2023 Letter To Shareholders Returning to the office on a hybrid basis was crucial to this change. I wrote recently about the significant benefits that can be achieved when a team works together in person. In Q2 our leadership team decided Grindr would move to a hybrid work model, involving a return to in-office work, and in August, we announced the adoption of a multi-phase return-to-office (“RTO”) plan. This plan is designed to capture the benefits of in-office work while preserving the flexibility that so many of us have come to value. With this evolution of our company culture, a portion of our team chose to depart. This possibility was modeled into our forecasting, and we supported these transitions with generous severance. At the end of September Grindr headcount stood at 111, down 45% from its peak at year-end 2022. This is the result of both natural and planned attrition in H1, and voluntary RTO-related departures. We do not expect RTO-related departures to impact our performance in the near- term – as is clear from our raised guidance for 2023 – nor do we expect it will impact our ability to achieve strong results in 2024. That said, as our team is expanding we will have to prioritize our focus within our longer-term product development pipeline. We have also continued to add strong leaders across departments who will help us attract more excellent talent. In Q3, Zac Katz, a former Chief of Staff at the FCC, joined as General Counsel and Head of Global Affairs; Tristan Pineiro joined as VP of Brand and Communications after impressive tenures at King, Bumble/Badoo, and Netflix; Tolu Adeofe joined as Director of Investor Relations with over a decade of finance and technology experience at Google, Goldman Sachs, and Lyft; and Solmaz Shariat Torbaghan, a computer scientist who has spent the last decade building cutting-edge AI models, joined as Director of Artificial Intelligence and Machine Learning. We believe AI technology in particular will be transformative to the dating industry in general and Grindr in particular. I’m personally excited about AI’s potential to help us provide users with unique insight about one another and to better match users based on their behavior patterns. We are working on several significant AI features and look forward to telling you more about them in the coming quarters. Thank you, George Arison, CEO

4Q3 2023 Letter To Shareholders Q3 Accomplishments + Strategic Progress In Q3’23 Grindr delivered strong progress on each of its 2023 strategic priorities, particularly driving monetization and planning for future growth. Please see updates below. The Grindr app continues to improve as we invest in a great user experience. This quarter, we made enhancements to our popular Boost feature designed to help users make more high- quality connections regardless of whether they are in a high or low density area. We also introduced new measures, such as Optical Character Recognition, to reduce spam. We have a lot more on tap in the coming months. Q3 marked the first full quarter with our Weekly subscription rolled out to 100% of our users, and the results continue to be very strong as indicated in our financial performance and key metrics. We also successfully tested trial offers for first-time subscribers and improved our in-app marketing, both endeavors that we will continue to iterate on in order to engage new subscribers, re-engage lapsed ones, and help all our users to more easily find the feature sets they find most compelling. Improving the User Experience Driving Monetization Through Greater Conversion + New Offerings

5Q3 2023 Letter To Shareholders Grindr’s innovative combination of social networking with geolocation offers significant untapped upside in product development, and we have spent the past several quarters developing new ideas to help our users connect across the world. One such new feature we have tested and expect to roll out in the coming quarters is Teleport, an expansion of our Explore feature that enables users to show up in locations to which they plan to travel so they can make more active connections ahead of their trips. We’re excited about the potential for this new paid feature, as well as several others we are actively testing. This quarter, our Grindr for Equality (“G4E”) team was active in a number of regions across the world. In Asia and Europe – particularly Thailand, India and Czechia – we completed a series of grants to LGBTQ advocacy organizations specifically working towards marriage equality. We also continued to provide financial support to our longtime grantees in the Middle East-North Africa region. In Latin America, G4E pursued two programs, with The Trevor Project and the Pan-American Health Organization (PAHO), each helping connect our users there to mental and sexual health resources they would not otherwise be able to easily access. Here in the U.S., we worked with the Maui AIDS Foundation to ensure that Grindr users in Maui had access to testing and other emergency services after the fires there changed their lives dramatically. Serving the LGBTQ Community Planning for Future Growth

6Q3 2023 Letter To Shareholders We had a remarkable quarter financially and in key user metric trends, driven by continued momentum in our subscription offerings, especially our Weekly subscription, and our enhanced Boost a la carte offering. Average Paying Users for the quarter increased 18% year-over-year from 815 thousand to 962 thousand. Average Monthly Active Users (“MAU”) for the quarter was up 8% year-over- year and up 3% compared to the second quarter. Average Direct Revenue per Paying User (“ARPPU”) increased by 21% year-over-year to $21.33 from $17.67 in Q3 2022 and from $19.08 in Q2 2023, driven by the favorable impact of Xtra weekly subscriptions and our unlimited product offering. Q3 Financial + Operating Performance 962k avg. paying users +18% YoY growth 13.5mm avg. MAU +8% YoY growth $21.33 ARPPU +21% YoY growth Q3 2023 Highlights

7Q3 2023 Letter To Shareholders Revenue Q3 revenue of $70.3 million was up 39% year-over-year from $50.4 million, driven by strong sales of our subscription and a la carte products. Direct Revenue increased by 43% year-over- year to $61.6 million. Indirect Revenue was up 21% year-over-year to $8.7 million. Operating Expenses Operating expenses, excluding cost of revenue, were $35.4 million in Q3 2023, up 5% year- over-year. Our operating expenses reflect higher people costs, with severance costs and higher costs from legal and other professional services offset by lower salary and benefit expenses in the later weeks of the quarter following implementation of our return-to-office initiative. Operating Income Operating Income for Q3 was $16.6 million, or 24% of revenue, versus operating income in Q3 2022 of $3.9 million, or 8% of revenue. Net Loss Net Loss for Q3 was $0.4 million, an improvement from a loss of $4.7 million in Q3 2022. Net loss margin for Q3 was 1% compared to 9% in Q3 2022. Adjusted EBITDA Adjusted EBITDA for Q3 was $32.6 million, or 46% of total revenue, primarily reflecting our strong revenue growth as more Grindr users adopt our expanded subscription and a la carte offerings. Adjusted EBITDA also benefited from the add-back of severance costs related to implementation of our hybrid work model. Outlook We have updated our 2023 outlook based on our performance year-to-date. We now expect revenue growth in 2023 to be at or above 31% and expect our Adjusted EBITDA margin to remain at 41% or better. This outlook reflects our strong performance year-to-date and implies Q4 year-over-year revenue growth of more than 25%.

8Q3 2023 Letter To Shareholders Performance Metrics Q3 2023 Average Paying Users 962k Average Paying User Penetration 7.1% Average MAU 13.5m ARPPU $21.33 Conference Call Grindr will host a conference call to discuss these results at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time), November 13, 2023. To access the conference call, participants should dial (+1) 888 259 6580 and enter the conference ID number 36791446. The live audio webcast along with the press release will be accessible at https://investors.grindr.com/. A recording of the webcast will also be available on our website following the conference call. Guidance 2023 Full Year 31%+ revenue growth up from 28%+ 41%+ adjusted EBITDA margin

9Q3 2023 Letter To Shareholders Condensed Consolidated Balance Sheets (unaudited) Table of Contents 1 Grindr Inc. and subsidiaries Condensed Consolidated Balance Sheets (unaudited) (in thousands, except share data) September 30, December 31, 2023 2022 Assets Current Assets Cash and cash equivalents.................................................................................................... $ 29,948 $ 8,725 Accounts receivable, net of allowance of $876 and $336, respectively ............................ 32,311 22,435 Prepaid expenses .................................................................................................................. 5,942 7,622 Deferred charges .................................................................................................................. 3,711 3,652 Other current assets .............................................................................................................. 212 750 Total current assets ................................................................................................................. 72,124 43,184 Restricted cash ..................................................................................................................... 1,392 1,392 Property and equipment, net ................................................................................................ 1,516 2,021 Capitalized software development costs, net ....................................................................... 7,718 7,385 Intangible assets, net ............................................................................................................ 86,549 104,544 Goodwill............................................................................................................................... 275,703 275,703 Right-of-use assets ............................................................................................................... 3,668 4,535 Other assets .......................................................................................................................... 239 64 Total assets............................................................................................................................. $ 448,909 $ 438,828 Liabilities and Stockholders’ Equity Current liabilities Accounts payable ................................................................................................................. $ 1,356 $ 5,435 Accrued expenses and other current liabilities .................................................................... 22,223 15,681 Current maturities of long-term debt, net............................................................................. 24,341 22,152 Deferred revenue .................................................................................................................. 19,147 18,586 Total current liabilities ............................................................................................................ 67,067 61,854 Long-term debt, net .............................................................................................................. 319,036 338,476 Warrant liability ................................................................................................................... 29,514 17,933 Lease liability ....................................................................................................................... 2,615 3,658 Deferred tax liability ............................................................................................................ 5,455 12,528 Other non-current liabilities ................................................................................................. 1,078 327 Total liabilities ....................................................................................................................... 424,765 434,776 Commitments and Contingencies (Note 14) Stockholders’ Equity Preferred stock, par value $0.0001; 100,000,000 shares authorized; none issued and outstanding at September 30, 2023 and December 31, 2022, respectively ...................... — — Common stock, par value $0.0001; 1,000,000,000 shares authorized; 174,206,564 and 173,524,360 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively ............................................................................................................. 17 17 Additional paid-in capital..................................................................................................... 40,175 9,078 Accumulated deficit ............................................................................................................. (16,048) (5,043) Total stockholders’ equity .................................................................................................... 24,144 4,052 Total liabilities and stockholders’ equity ............................................................................ $ 448,909 $ 438,828 (i t , xcept share data)

10Q3 2023 Letter To Shareholders Consolidated Statements of Operations and Comprehensive (Loss) Income (unaudited) Table of Contents 2 Grindr Inc. and Subsidiaries Consolidated Statements of Operations and Comprehensive Loss (unaudited) (in thousands, except per share and share data) Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Revenue .......................................................................... $ 70,258 $ 50,402 $ 187,605 $ 140,487 Operating costs and expenses Cost of revenue (exclusive of depreciation and amortization shown separately below) ........................ 18,243 12,955 49,168 36,758 Selling, general and administrative expense ................... 16,420 20,325 52,523 53,937 Product development expense ......................................... 13,270 4,159 24,976 11,981 Depreciation and amortization ........................................ 5,753 9,097 21,845 27,215 Total operating expenses ............................................... 53,686 46,536 148,512 129,891 Income from operations ................................................ 16,572 3,866 39,093 10,596 Other income (expense) Interest expense, net ........................................................ (11,985) (4,786) (35,695) (10,998) Other expense, net ........................................................... (390) (263) (98) (329) Change in fair value of warrant liability.......................... (3,362) — (11,581) — Total other income (expense), net ................................. (15,737) (5,049) (47,374) (11,327) Net income (loss) before income tax............................. 835 (1,183) (8,281) (731) Income tax provision ..................................................... 1,272 3,474 2,724 3,727 Net loss and comprehensive loss ................................... $ (437) $ (4,657) $ (11,005) $ (4,458) Net loss per share: Basic .............................................................................. $ 0.00 $ (0.03) $ (0.06) $ (0.03) Diluted ........................................................................... $ 0.00 $ (0.03) $ (0.06) $ (0.03) Weighted-average shares outstanding: Basic .............................................................................. 174,113,605 155,863,725 173,871,888 155,705,031 Diluted ........................................................................... 174,113,605 155,863,725 173,871,888 155,705,031 (in thousands, except per share data)

11Q3 2023 Letter To Shareholders Table of Contents 3 Grindr Inc. and subsidiaries Condensed Consolidated Statements of Cash Flows (unaudited) (in thousands) Nine Months Ended September 30, 2023 2022 Operating activities Net loss ................................................................................................................................. $ (11,005) $ (4,458) Adjustments to reconcile net loss to net cash provided by operating activities: .................. Stock-based compensation ................................................................................................... 10,594 23,353 Change in fair value of warrant liability............................................................................... 11,581 — Amortization of debt issuance costs ..................................................................................... 1,452 759 Interest income on promissory note from member............................................................... (282) (2,232) Depreciation and amortization ............................................................................................. 21,845 27,215 Provision for expected credit losses/doubtful accounts........................................................ 540 27 Deferred income taxes .......................................................................................................... (7,221) (3,595) Non-cash lease expense ........................................................................................................ 867 777 Changes in operating assets and liabilities: .......................................................................... Accounts receivable ...................................................................................................... (10,416) (575) Prepaid expenses and deferred charges ......................................................................... 1,621 (1,030) Other current assets ....................................................................................................... 538 (4,779) Other assets ................................................................................................................... (175) (677) Accounts payable .......................................................................................................... (2,883) (524) Accrued expenses and other current liabilities .............................................................. 6,542 5,545 Deferred revenue ........................................................................................................... 561 (1,345) Lease liability ................................................................................................................ (1,043) (1,667) Net cash provided by operating activities ........................................................................ 23,116 36,794 Investing activities Purchase of property and equipment ............................................................................. (241) (339) Additions to capitalized software .................................................................................. (3,248) (3,434) Net cash used in investing activities .................................................................................. (3,489) (3,773) Financing activities Transaction costs paid in connection with the Business Combination ......................... (1,196) — Proceeds from the repayment of promissory note to a member including interest ....... 19,353 — Proceeds from exercise of stock options ....................................................................... 2,142 1,136 Distributions paid .......................................................................................................... — (79,524) Proceeds of issuance of debt ......................................................................................... — 60,000 Principal payment on debt ............................................................................................. (18,703) (2,220) Payment of debt issuance costs ..................................................................................... — (955) Net cash provided by (used in) financing activities ......................................................... 1,596 (21,563) Net increase in cash, cash equivalents and restricted cash ............................................. 21,223 11,458 Cash, cash equivalents and restricted cash, beginning of the period ............................ 10,117 17,170 Cash, cash equivalents and restricted cash, end of the period ....................................... $ 31,340 $ 28,628 Reconciliation of cash, cash equivalents and restricted cash Cash and cash equivalents ............................................................................................. $ 29,948 $ 27,236 Restricted cash............................................................................................................... 1,392 1,392 Cash, cash equivalents and restricted cash .................................................................... $ 31,340 $ 28,628 Supplemental disclosure of cash flow information: Cash interest paid .......................................................................................................... $ 34,973 $ 12,591 Income taxes paid .......................................................................................................... $ 5,494 $ 2,207 Consolidated Statements of Cash Flows (unaudited) (in thousands)

12Q3 2023 Letter To Shareholders Reconciliation of Net Income to Adjusted EBITDA (unaudited) Table of Contents 4 Grindr Inc. and subsidiaries Reconciliation of net loss to adjusted EBITDA (unaudited) (in thousands) Three Months Ended September 30, Nine Months Ended September 30, ($ in thousands) 2023 2022 2023 2022 Reconciliation of net loss to Adjusted EBITDA Net loss……………………………………………………... $ (437) $ (4,657) $ (11,005) $ (4,458) Interest expense, net ................................................................ 11,985 4,786 35,695 10,998 Income tax provision……………………………………….. 1,272 3,474 2,724 3,727 Depreciation and amortization ................................................ 5,753 9,097 21,845 27,215 Transaction-related costs (1) ..................................................... — 1,033 — 2,211 Litigation-related costs (2) ........................................................ 414 439 1,913 1,521 Stock-based compensation expense ........................................ 3,648 9,686 10,594 23,353 Severance expenses (3) ............................................................. 6,744 — 8,077 552 Management fees (4) ................................................................. (97) 181 (97) 544 Change in fair value of warrant liability (5) ............................. 3,362 — 11,581 — Others (6) .................................................................................. (43) — 157 — Adjusted EBITDA .................................................................. $ 32,601 $ 24,039 $ 81,484 $ 65,663 Revenue ................................................................................... $ 70,258 $ 50,402 $ 187,605 $ 140,487 Net loss margin ........................................................................ (0.6)% (9.2)% (5.9)% (3.2)% Adjusted EBITDA Margin ...................................................... 46.4 % 47.7 % 43.4 % 46.7 % _________________ (1) Transaction-related costs consist of legal, tax, accounting, consulting, and other professional fees related to the Business Combination and other potential acquisitions that are non-recurring in nature. (2) Litigation-related costs primarily represent external legal fees associated with the outstanding litigation or regulatory matters incurred in connection with the Business Combination, related to the potential NDPA fine, the CFIUS review of the Business Combination, as well as legal fees related to employee unionization, which are unrelated to Grindr’s core ongoing business operations. (3) Severance expenses related to severance incurred for employees who elected not to relocate or participate in our RTO Plan and other one-off severance. (4) Management fees represent administrative costs associated with San Vicente Holdings LLC's ("SVE") administrative role in managing financial relationships and providing directive on strategic and operational decisions, which ceased to continue after the Business Combination. In September 2023, certain management fees previously accrued were forgiven. (5) Change in fair value of warrant liability relates to our warrants that were remeasured as of September 30, 2023. (6) Others represent other costs that are unrelated to Grindr's core ongoing business operations.

13Q3 2023 Letter To Shareholders Forward Looking Statements This letter contains “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 regarding Grindr’s current views with respect to our industry, operations and future business plans and performance. These forward-looking statements can generally be identified by the use of forward-looking terminology, such as “anticipates,” “approximately,” “believes,” “continues,” “could,” “estimates,” “expects,” “intends,” “may,” “outlook,” “plans,” “potential,” “predicts,” “seeks,” “should,” “will” or the negative version of these words or other comparable words or phrases, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, among others, statements about our growth opportunities, expectations regarding new product launches and their expected effect on full year 2023 guidance, including the expected continued success of Weeklies, our 2023 strategic priorities, our plan to generate sustainable double-digit revenue growth and strong profitability and our full year 2023 guidance. Forward-looking statements, including guidance related to revenue growth and adjusted EBITDA margin, are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are not guarantees of future performance and are subject to risks and uncertainties that may cause actual results to differ materially from our expectations discussed in the forward-looking statements. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our reliance on historical data, which may be of limited reliability, in providing revenue guidance; (ii) our success in retaining or recruiting our directors, officers, key employees, or other key personnel, and our success in managing any changes in such roles; (iii) the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy and data protection laws and regulations; (iv) our ability to respond to general economic conditions; (v) factors relating to the business, operations and financial performance of Grindr and our subsidiaries, including: (a) competition in the dating and social networking products and services industry; (b) the ability to maintain and attract users; and (c) fluctuation in quarterly and yearly results; (d) our ability to adapt to changes in technology and user preferences in a timely and cost- effective manner; (e) our ability to protect systems and infrastructures from cyber-attacks and prevent unauthorized data access; (f) our dependence on the integrity of third-party systems and infrastructure; and (g) our ability to protect our intellectual property rights from unauthorized use by third parties; (vi) whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters; (vii) the effects macroeconomic and geopolitical events on our business, such as health epidemics, pandemics, natural disasters and wars or other regional conflicts; (viii) the ability to maintain the listing of our common stock and public warrants on the New York Stock Exchange (“NYSE”); (ix) and the increasingly competitive environment in which we operate. The foregoing list of factors is not exhaustive. Further information on these and additional risks, uncertainties and other factors that could cause actual outcomes and results to differ materially from those included in or contemplated by the forward-looking statements contained in this press release are included in the section titled “Risk Factors’’ included under Part I, Item 1A in our Annual Report on Form 10-K for the year ended December 31, 2022, and updates in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2023. Any forward-looking statement speaks only as of the date on which it is made, and you should not place undue reliance on forward-looking statements, and Grindr assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise.

14Q3 2023 Letter To Shareholders About Non-GAAP Grindr uses Adjusted EBITDA and Adjusted EBITDA margin, which are non-GAAP measures, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may differ from similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of Grindr’s financial performance and should not be considered as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. Grindr define Adjusted EBITDA as net loss excluding income tax provision, interest expense, net, depreciation and amortization, stock-based compensation expense, severance, transaction-related costs, litigation- related costs for matters unrelated to the Company’s ongoing business, including those matters incurred as part of the Business Combination, Legacy Grindr management fees, change in fair value of warrant liability and other expense. Grindr’s management uses this measure internally to evaluate the performance of our business and this measure is one of the primary metrics by which our internal budgets are based and by which management is compensated. Grindr excludes the above items as some are non-cash in nature, and others are non-recurring that they may not be representative of normal operating results. Adjusted EBITDA adjusts for the impact of items that Grindr do not consider indicative of the operational performance of our business. Adjusted EBITDA Margin is calculated by dividing Adjusted EBITDA for a period by revenue for the same period. While Grindr believes that Adjusted EBITDA and Adjusted EBITDA Margin are useful in evaluating our business, this information should be considered as supplemental in nature and is not meant as a substitute for the related financial information prepared and presented in accordance with GAAP. About Grindr With more than 13 million monthly active users globally, Grindr has grown to become a fundamental part of the LGBTQ community since its launch in 2009. The company continues to expand its ecosystem to enable LGBTQ people to connect, express themselves, and discover the world around them. Grindr is headquartered in West Hollywood, California. The Grindr app is available on the App Store and Google Play, as well as on the web.

v3.23.3

Cover

|

Nov. 13, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Entity File Number |

001-39714

|

| Document Period End Date |

Nov. 13, 2023

|

| Entity Registrant Name |

Grindr Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

92-1079067

|

| Entity Address, Postal Zip Code |

90069

|

| Entity Address, Address Line One |

PO Box 69176

|

| Entity Address, Address Line Two |

750 N. San Vicente Blvd.

|

| Entity Address, Address Line Three |

Suite RE 1400

|

| Entity Address, State or Province |

CA

|

| Entity Address, City or Town |

West Hollywood

|

| City Area Code |

310

|

| Local Phone Number |

776-6680

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001820144

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

GRND

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

GRND.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

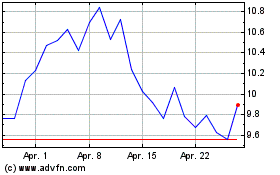

Grindr (NYSE:GRND)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Grindr (NYSE:GRND)

Historical Stock Chart

Von Jul 2023 bis Jul 2024