As filed with the Securities and Exchange Commission

on October 10, 2023

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT

(Under Section 14(d)(1) or 13(e)(1) of the

Securities Exchange Act of 1934)

Templeton Global Income Fund

(Name of Issuer)

Templeton Global Income Fund

(Names of Filing Person(s) (Issuer))

Common Shares of Beneficial Interest, no

par value

(Title of Class of Securities)

800198106

(CUSIP Number of Class of Securities)

Garry Khasidy, Trustee and Chair of the

Special Committee

c/o Templeton Global Income Fund

300 S.E. 2nd Street

Fort Lauderdale, Florida 33301-1923

(954) 527-7500

(Name, Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing Person(s))

Copies to:

| |

David A. Curtiss, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000

|

|

| o |

Check box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes to designate any transactions to which

this statement relates:

| o |

third party tender offer subject to Rule 14d-1 |

| x |

issuer tender offer subject to Rule 13e-4 |

| o |

going-private transaction subject to Rule 13e-3 |

| o |

amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. o

If applicable, check the appropriate box(es) below to designate

the appropriate rule provision(s) relied upon:

| o |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| o |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

Introductory Statement

This Issuer Tender Offer

Statement on Schedule TO relates to an offer by Templeton Global Income Fund (the “Fund”), a Delaware statutory trust and

closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “Investment Company

Act”), to repurchase up to 45% of its issued and outstanding common shares, no par value (the “Shares”), in exchange

for cash at a price equal to 99% of the net asset value (“NAV”) per Share (the “Purchase Price”) determined as

of the close of the regular trading session of the New York Stock Exchange (the “NYSE”), the principal market on which the

Shares are traded, on the day the offer expires (the “Pricing Date”), upon the terms and subject to the conditions set forth

in the Offer to Purchase, dated October 10, 2023 (the “Offer to Purchase”), and in the related Letter of Transmittal

which are filed as exhibits to this Schedule TO.

This Issuer Tender Offer

Statement on Schedule TO is being filed in satisfaction of the reporting requirements of Rule 13e-4(c)(2) promulgated under the Securities

Exchange Act of 1934, as amended.

The information set forth

in the Offer to Purchase and the related Letter of Transmittal is incorporated herein by reference in answer to Items 1 through 11 of

Schedule TO.

| Item 1. | Summary Term Sheet |

The information set forth

under “Summary Term Sheet” in the Offer to Purchase is incorporated herein by reference.

| Item 2. | Subject Company Information |

(a) The

name of the issuer is Templeton Global Income Fund, a Delaware statutory trust and closed-end management investment company registered

under the Investment Company Act. The principal executive offices of the Fund are located at 300 S.E. 2nd Street, Fort Lauderdale, Florida

33301-1923. The telephone number of the Fund is (954) 527-7500.

(b) The

title of the securities being sought is common shares, no par value. As of September 15, 2023, there were 102,746,371 Shares issued and

outstanding.

(c) The

principal market in which the Shares are traded is the NYSE. The Fund began trading on the NYSE on March 17, 1988. For information on

the high and low closing (as of the close of ordinary trading on the NYSE on the last day of each of the Fund’s fiscal quarters)

market prices of the Shares in such principal market for each quarter for the past two calendar years, see Section 10, “Price

Range of Shares” of the Offer to Purchase, which is incorporated herein by reference.

| Item 3. | Identity and Background of Filing Person |

(a) The

Fund is the filing person. The information set forth in the Offer to Purchase under “Certain Information about the Fund” is

incorporated herein by reference.

| Item 4. | Terms of the Transaction |

(a) The

following sections of the Offer to Purchase contain a description of the material terms of the transaction and are incorporated herein

by reference:

| · | “Price; Number of Shares” |

| · | “Plans or Proposals of the Fund” |

| · | “Certain Conditions of the Offer” |

| · | “Procedures for Tendering Shares for Purchase” |

| · | “Source and Amount of Consideration” |

| · | “Effects of the Offer; Consequences of Participation” |

| · | “Interests of Trustees and Officers; Transactions and Arrangement Concerning the Shares” |

| · | “Certain Information about the Fund” |

| · | “Certain U.S. Federal Income Tax Consequences” |

| · | “Amendments; Extensions of Repurchase Period; Termination” |

(a) (2)

Not applicable.

(b) The

information set forth in the Offer to Purchase under “Interests of Trustees and Officers; Transactions and Arrangements Concerning

the Shares” is incorporated herein by reference.

| Item 5. | Past Contracts, Transactions, Negotiations and Agreements |

(e) The

information set forth in the Offer to Purchase under “Purpose of the Offer;” “Purpose of the Offer;” “Plans or Proposals of the Fund,”

“Interests of Trustees and Officers; Transactions and Arrangements Concerning the Shares” and “Certain Information About

the Fund” is incorporated herein by reference.

| Item 6. | Purposes of the Transaction and Plans or Proposals |

(a) The

information set forth in the Offer to Purchase under “Purpose of the Offer” and “Plans or Proposals of the Fund”

is incorporated herein by reference.

(b) The

information set forth in the Offer to Purchase under “Purpose of the Offer” is incorporated herein by reference.

(c) The information set forth in the Offer to Purchase under "Purpose

of the Offer and "Plans or Proposals of the Fund" is incorporated herein by reference.

| Item 7. | Source and Amount of Funds or Other Considerations |

(a) The

information set forth in the Offer to Purchase under “Source and Amount of Consideration” is incorporated herein by reference.

(b) The

information set forth in the Offer to Purchase under “Source and Amount of Consideration” is incorporated herein by reference.

(d) Not

applicable.

| Item 8. | Interests in Securities of the Subject Company |

(a) The

information set forth in the Offer to Purchase under “Interests of Trustees and Officers; Transactions and Arrangements Concerning

the Shares” is incorporated herein by reference.

(b) The

information set forth in the Offer to Purchase under “Interests of Trustees and Officers; Transactions and Arrangements Concerning

the Shares” is incorporated herein by reference.

| Item 9. | Persons/Assets Retained, Employed, Compensated or Used |

(a) No

persons have been directly or indirectly employed, retained, or are to be compensated by or on behalf of the Fund to make solicitations

or recommendations in connection with the Offer to Purchase.

| Item 10. | Financial Statements |

Not applicable.

| Item 11. | Additional Information |

(a)(1) The information

set forth in the Offer to Purchase under “Interests of Trustees and Officers; Transactions and Arrangements Concerning the Shares”

is incorporated herein by reference.

(a)(2) None.

(a)(3) Not applicable.

(a)(4) Not applicable.

(a)(5) None.

(c) Not

applicable.

| (a)(1)(i) |

Offer to Purchase, dated October 10, 2023.* |

| (a)(1)(ii) |

Form of Letter of Transmittal.* |

| (a)(1)(iii) |

Form of Letter to Brokers, Dealers, Commercial Banks, Fund Companies and Other Nominees.* |

| (a)(1)(iv) |

Form of Letter to Clients.* |

| (a)(2) |

None. |

| (a)(3) |

Not Applicable. |

| (a)(4) |

Not Applicable. |

| (a)(5)(i) |

Press release issued on October 10, 2023.* |

| (b) |

None. |

| (b)(1) |

None. |

| (g) |

None. |

| (h) |

None. |

| A |

Calculation of Filing Fees Table.* |

* Filed herewith.

| Item 13. | Information Required By Schedule 13E-3 |

Not Applicable.

SIGNATURE

After due inquiry and to

the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Templeton Global Income Fund |

| |

|

| |

By: |

/s/ Garry Khasidy |

| |

|

Name: Garry Khasidy |

| |

|

Title: Trustee and

Chair of the Special Committee |

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Dated: October 10, 2023 |

Exhibit Index

| |

|

| (a)(1)(i) |

Offer to Purchase, dated October 10, 2023. |

| |

|

| (a)(1)(ii) |

Form of Letter of Transmittal.

|

| (a)(1)(iii) |

Form of Letter to Brokers, Dealers, Commercial Banks, Trust Companies and

Other Nominees.

|

| (a)(1)(iv) |

Form of Letter to Clients. |

| |

|

| (a)(5)(i) |

Press release issued on October 10, 2023. |

| |

|

| A |

Calculation of Filing Fees Table. |

Exhibit (a)(1)(i)

Offer to Purchase

Up to 45% of the Issued and Outstanding Common Shares of Beneficial Interest

of

Templeton Global Income Fund

at

99% of Net Asset Value Per Share

by

Templeton Global Income Fund

in Exchange for Cash

THE OFFER TO PURCHASE WILL EXPIRE AT 5:00

P.M., EASTERN TIME,

ON NOVEMBER 9, 2023, UNLESS THE OFFER IS EXTENDED.

To the Shareholders of Templeton Global Income Fund:

Templeton Global Income Fund, a Delaware statutory trust and a closed-end

management investment company registered under the Investment Company Act of 1940, as amended (the “Fund”), is offering to

purchase up to 45% of its issued and outstanding common shares of beneficial interest, no par value (the “Shares”) (the “Offer

Amount”). The offer is to purchase Shares in exchange for cash at a price equal to 99% of the net asset value (“NAV”)

per Share (the “Purchase Price”) determined as of the close of the regular trading session of the New York Stock Exchange

(the “NYSE”), the principal market on which the Shares are traded, on the day the offer expires (the “Pricing Date”).

The offer is being made upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal

(which, together with any amendments or supplements thereto, collectively constitute the “Offer”).

In order to participate, the materials described in the Offer must

be delivered to Equiniti Trust Company, LLC (the “Depositary Agent”) by 5:00 p.m. Eastern time, November 9, 2023, or such

later date to which the Offer is extended (the “Expiration Date”). Should the Offer be extended beyond November 9, 2023, the

Pricing Date will be the close of ordinary trading on the NYSE on the newly designated Expiration Date. Shareholders who choose to participate

in the Offer can expect payments for Shares duly tendered and accepted to be mailed within approximately ten business days after the Expiration

Date.

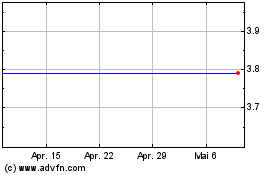

The Shares are traded on the NYSE under the symbol

“GIM.” As of October 5, 2023, there were 102,746,371 Shares issued and outstanding; its NAV per Share was $4.20 and its

market price per Share was $3.80, representing a discount of -9.52% to NAV per Share. The NAV per Share on the Pricing Date may be

higher or lower than the NAV per Share as of October 5, 2023, and the discount to NAV per Share at which the Shares trade may be

greater or lesser than the discount as of October 5, 2023. For the Fund’s most current NAV per Share and market price per

Share, you may view online at https://www.franklintempleton.com/investments/options/

closed-end-funds/products/146/SINGLCLASS/templeton-global-income-fund-inc/GIM. For additional questions or information during the

pendency of this Offer, you may contact Campaign Management LLC (the “Information Agent”) by calling 1-855-434-5243, between the hours of 9:00 a.m. and 11:00 p.m., Eastern time, Monday through Friday (except holidays),

and 12:00 p.m. and 6:00 p.m., Eastern time, on Saturday.

The Offer is subject to important terms and conditions, including

the conditions listed under Section 4, “Certain Conditions of the Offer.”

Neither the Securities and Exchange Commission (the “Commission”)

nor any state securities commission has approved or disapproved of the Offer, passed upon the fairness or merits of the Offer, or determined whether this Offer to Purchase is accurate

or complete. Any representation to the contrary is a crime.

If you are not interested in selling any of your Shares at this

time, you do not need to do anything. This Offer is not part of a plan to liquidate the Fund. Shareholders are not required to participate

in the Offer.

You should be aware that, if you tender Shares pursuant to the

Offer, duly tendered Shares will not be entitled to receive any Fund dividend or distribution with a record date on or after November

9, 2023.

Because this Offer is limited as to the number of Shares that

the Fund will purchase, not all Shares duly tendered for purchase by shareholders may be accepted for payment by the Fund. This may occur,

for example, if one or more large investors seek to tender a significant number of Shares or if a large number of investors tender Shares.

IMPORTANT INFORMATION

Shareholders who desire to participate in the Offer should either:

(a) properly complete and sign the Letter of Transmittal, provide thereon the original of any required signature guarantee(s) and mail

or deliver it together with the Shares, if any (in proper form), and all other documents required by the Letter of Transmittal; or (b)

request their broker, dealer, commercial bank or trust company (each, a “Nominee”) to effect the transaction on their behalf.

Shareholders whose Shares are registered in the name of a Nominee, such as a brokerage firm or other financial intermediary, must contact

that firm to instruct the firm to participate in the Offer on their behalf. Tendering shareholders may be charged a fee by their Nominee

or other financial intermediary for processing the documentation required to participate in the Offer on their behalf. Shareholders are

urged to consult their own investment and tax advisers and make their own decisions whether to tender Shares and, if so, how many Shares

to tender, or to refrain from tendering Shares in the Offer.

The Fund reserves the absolute right to reject Shares determined

not to be tendered in appropriate form.

Beneficial owners should be aware that their broker, dealer,

commercial bank, trust company or other nominee may establish its own earlier deadline for participation in the Offer. Accordingly, beneficial

owners wishing to participate in the Offer should contact their Nominee as soon as possible in order to determine the times by which such

owner must take action in order to participate in the Offer.

If you want to tender your Shares but your certificates for the

Shares are not immediately available or cannot be delivered to the Depositary Agent within the required time or you cannot comply with

the procedures for book-entry transfer, or your other required documents cannot be delivered to the Depositary Agent by the Expiration

Date of the Offer, you will not be able to tender your Shares.

None of the Fund, its Board of Trustees (the “Board of

Trustees” or the “Board”) or Franklin Advisers, Inc. (the “Investment Advisor”) makes any recommendation

to any shareholders as to whether to tender Shares for purchase or to refrain from tendering Shares in the Offer. No person has been

authorized to make any recommendation on behalf of the Fund, its Board or the Investment Advisor as to whether shareholders should tender

Shares for purchase pursuant to the Offer or to make any representation or to give any information in connection with the Offer other

than as contained herein. If made or given, any such recommendation, representation or information must not be relied upon as having

been authorized by the Fund, its Board or the Investment Advisor. Shareholders are urged to carefully evaluate all information in the

Offer, consult their own investment and tax advisers and make their own decisions whether to tender their Shares for purchase or refrain

from participating in the Offer.

The Fund has filed with the Commission a Tender Offer Statement

on Schedule TO under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), relating to the Offer.

The making of the Offer may, in some jurisdictions, be restricted

or prohibited by applicable law. The Offer is not being made, directly or indirectly, in or into, and may not accepted from within, any

jurisdiction in which the making of the Offer or the acceptance of the Offer would, absent prior registration, filing or qualification

under applicable laws, not be in compliance with the laws of that jurisdiction. Accordingly, shareholders are required to inform themselves

of and observe any such restrictions.

TABLE OF CONTENTS

Page

| SUMMARY TERM SHEET |

1 |

| 1. Price; Number of Shares. |

6 |

| 2. Purpose of the Offer. |

7 |

| 3. Plans or Proposals of the Fund. |

8 |

| 4. Certain Conditions of the Offer. |

8 |

| 5. Procedures for Tendering Shares for Purchase. |

10 |

| 6. Withdrawal Rights. |

13 |

| 7. Payment for Shares. |

14 |

| 8. Source and Amount of Consideration. |

15 |

| 9. Effects of the Offer; Consequences of Participation. |

15 |

| 10. Price Range of Shares. |

17 |

| 11. Interests of Trustees and Officers; Transactions and Arrangements Concerning the Shares |

17 |

| 12. Certain Information about the Fund. |

20 |

| 13. Additional Information. |

21 |

| 14. Certain U.S. Federal Income Tax Consequences. |

21 |

| 15. Certain Legal and Regulatory Matters. |

25 |

| 16. Amendments; Extensions of Purchase Period; Termination. |

25 |

| 17. Fees and Expenses. |

26 |

| 18. Miscellaneous. |

27 |

SUMMARY TERM SHEET

This Summary Term Sheet highlights certain information concerning

this Offer. To understand the Offer fully and for a more complete discussion of its terms and conditions, you should read carefully the

entire Offer to Purchase and the related Letter of Transmittal. We have included section references parenthetically to direct you to a

more complete description in the Offer of the topics in this Summary Term Sheet.

What is the Offer?

The Fund is offering to purchase up to 45% of its Shares.

The Fund will pay cash for Shares purchased pursuant to the Offer. The Fund will purchase Shares at a price equal to 99% of the NAV per

Share as of the close of regular trading session of the NYSE on the Pricing Date. If the number of Shares duly tendered and not timely

withdrawn prior to the date and time the Offer expires is less than or equal to the Offer Amount, the Fund will, upon the terms and subject

to the conditions of the Offer, purchase all Shares duly tendered. If shareholders duly tender (and do not timely withdraw) more than

the Offer Amount, the Fund will purchase duly tendered Shares from participating shareholders on a pro rata basis, based upon the number

of Shares each shareholder duly tenders for purchase and does not timely withdraw. The Fund does not intend to increase the number of

Shares that it is offering to purchase, even if shareholders duly tender more than the Offer Amount. Shareholders cannot be assured that

all of their duly tendered Shares will be purchased. (See Section 1, “Price; Number of Shares” and Section 7, “Payment

for Shares.”)

When will the Offer expire, and may the Offer be extended?

The Offer will expire at 5:00 p.m., Eastern time, on November

9, 2023, the Expiration Date, unless extended. The Fund may extend the offer period at any time. If it does, the Fund will determine the

Purchase Price as of the close of ordinary trading on the NYSE on the new Expiration Date. The Fund may extend the period of time the

Offer will be open by issuing a press release or making some other public announcement by no later than 9:00 a.m. Eastern time on the

next business day after the Offer otherwise would have expired. (See Section 1, “Price; Number of Shares.”)

What is the purpose of the Offer?

The Board approved a self-tender offer for cash up to

45% of the outstanding Shares of the Fund at a price equal to 99% of the NAV per Share determined as of the close of the regular

trading session of the NYSE on the Pricing Date to: provide enhanced liquidity to the Fund’s shareholders ahead of the

Fund’s potential transition to Saba Capital Management, L.P. (“Saba”) as its new investment adviser (which is

subject to approval by shareholders); provide potential accretion to the Fund’s NAV per share; and seek to help narrow

the NAV discount at which the Fund’s shares trade.

There can be no assurances as to the effect that the Offer

will have on the Fund’s NAV discounts. Common shares of closed-end investment companies often trade at a discount to their NAV

per Share, and the Fund’s Shares may also continue to trade at a discount to their NAV per Share, although it is possible that they

may trade or have traded at a premium above NAV per Share. The market price of the Fund’s Shares is determined by such factors as

relative demand for and supply of such common shares in the market, the Fund’s NAV per Share, general market and economic conditions

and other factors beyond the control of the Fund. Therefore, the Fund cannot predict whether its Shares will trade at, below or above

NAV per Share. (See Section 2, “Purpose of the Offer” and Section 3, “Plans or Proposals of the Fund.”)

Will I have to pay anything to participate in the Offer?

The Fund will not charge a separate service fee in

conjunction with the Offer. If your Shares are held through a financial intermediary, the financial intermediary may charge a

service fee for participation in the Offer. The Fund, however, will bear the costs of the tender, including postage and handling.

(See Section 1, “Price; Number of Shares,” Section 7, “Payment for Shares” and Section 17, “Fees and

Expenses.”)

What is the NAV per Share as of a recent date?

On October 5, 2023, there were 102,746,371 Shares issued

and outstanding, the NAV per Share was $4.20 and the last reported market price per Share on the NYSE on such date was $3.80,

representing a discount of -9.52% to NAV per Share. The NAV per Share on the Pricing Date may be higher or lower than the NAV per

Share as of October 5, 2023, and the discount to NAV at which the Shares trade may be greater or lesser than the discount as of

October 5, 2023. For the Fund’s most current NAV per Share and market price per Share, you may view online at

https://www.franklintempleton.com/

investments/options/closed-end-funds/products/146/SINGLCLASS/templeton-global-income-fund-inc/GIM. For additional questions or

information during the pendency of this Offer, you may contact the Information Agent by calling 1-855-434-5243, between the hours of

9:00 a.m. and 11:00 p.m., Eastern time, Monday through Friday (except holidays), and 12:00 p.m. and 6:00 p.m., Eastern time, on

Saturday. (See Section 10, “Price Range of Shares.”)

Will the Fund’s NAV per Share be higher or lower on the Pricing

Date?

No one can accurately predict what the Fund’s NAV per

Share will be at any future date. You should realize that the NAV per Share on the Pricing Date may be higher or lower than the NAV per

Share as of October 5, 2023 set forth above.

Does the Fund have the financial resources to pay me for my Shares?

Yes. If the Fund

purchases 46,235,867 Shares (assuming a fully subscribed Offer) at a price per share of $4.16, equal to 99% of the NAV per Share as

of October 5, 2023 ($4.20 per Share), the Fund’s total cost, not including fees and expenses incurred in connection with

the Offer, would be approximately $192,341,207. The Fund intends to first use cash on hand to pay for Shares tendered, and

then intends to sell portfolio securities to raise any additional cash needed for the purchase of Shares. (See Section 8,

“Source and Amount of Consideration.”)

Are there any recent developments at the Fund that I should be aware

of?

Yes. At an upcoming

special meeting of the shareholders of the Fund, to be held on October 25, 2023 (the “Special Meeting”), shareholders

will vote on whether to adopt a new investment management agreement between the Fund and Saba pursuant to which Saba would become

the investment advisor to the Fund. If such proposal is approved, in addition to replacing the Fund’s current investment

advisor, which is expected to happen on or about January 1, 2024, the name of the Fund will change from “Templeton Global

Income Fund” to “Saba Capital Income & Opportunities Fund II” and the Fund’s principal strategy is

proposed to be modified. For additional information about the Special Meeting, including the proposed changes for the Fund, see the

Fund’s Definitive Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on September 26, 2023 (the

“Special Meeting Proxy Statement”).

How do I participate in the Offer?

If your Shares are registered in the name of a Nominee, you

should contact that firm if you wish to tender your Shares.

All other shareholders wishing to participate in the Offer

must, prior to the date and time the Offer expires, deliver a completed and executed Letter of Transmittal, together with any

required signature guarantees, and any other documents required by the Letter of Transmittal, to the Depositary Agent at its address

set forth on the last page of this offer. If you hold certificates for Shares, you must also send the certificates to the Depositary

Agent at its address set forth on the last page of this offer prior to the date and time the Offer expires. If your Shares are held

in book-entry form, you must comply with the book-entry delivery procedure set forth in Section 5.C of this Offer. In all these

cases, the Depositary Agent must receive these materials prior to the date and time the Offer expires.

If any certificate representing Shares has been mutilated, lost,

stolen or destroyed, the shareholder should promptly call the Depositary Agent at 1-800-937-5449. The shareholder will then

be instructed by the Depositary Agent as to the steps that must be taken to replace the certificate. This Letter of Transmittal and related

documents cannot be processed until the procedures for replacing lost or destroyed certificates have been followed.

The Fund’s transfer agent holds Shares in uncertificated

form for certain shareholders pursuant to the Fund’s automatic dividend reinvestment plan.

Must I tender all of my Shares for purchase?

No. You may tender for purchase all or part of the

Shares you own. (See Section 1, “Price; Number of Shares.”)

May I withdraw my Shares after I have tendered them for purchase and,

if so, by when?

Yes, you may withdraw all, but not less than all, of

your duly tendered Shares at any time prior to 5:00 p.m., Eastern time, on November 9, 2023, which is the Expiration Date. In order

for your withdrawal to be effective, you must submit or direct your Nominee to submit a withdrawal request to the Depositary Agent

prior to 5:00 p.m., Eastern time on the Expiration Date. You may resubmit your withdrawn Shares to be tendered in the Offer by

following the purchase procedures before the Offer expires, including during any extension period. In addition, duly tendered Shares

that are not accepted by us for purchase by November 9, 2023 may thereafter be withdrawn by you until such time as the Shares are

accepted by us for purchase. (See Section 6, “Withdrawal Rights.”)

How do I withdraw previously tendered Shares?

You must submit or direct your Nominee to submit a request

for withdrawal of previously duly tendered Shares to the Depositary Agent. You may withdraw only all Shares previously tendered by you,

and not a portion thereof, and your request for withdrawal must state this. (See Section 6, “Withdrawal Rights.”)

May my Nominee place any conditions on my tender of Shares?

No.

May I place any conditions on my tender of Shares?

No.

Is my tender of Shares in the Offer a taxable transaction?

It is anticipated that the tender of Shares in exchange for

cash will generally be a taxable transaction for U.S. federal income tax purposes either in the form of a “sale or exchange”

or, under certain circumstances, a “dividend.” Please consult your tax adviser regarding your individual tax consequences,

including potential state, local and foreign tax consequences. (See Section 14, “Certain U.S. Federal Income Tax Consequences.”)

Is there any reason Shares duly tendered by me for purchase would

not be accepted?

In addition to those circumstances described under

“Certain Conditions of the Offer” in which the Fund is not required to purchase tendered Shares, the Fund has reserved

the right to reject any and all tendered Shares determined by the Fund not to have been tendered in the appropriate form. For

example, tenders will be rejected if the tender does not include the original signature(s) or the original of any required signature

guarantee(s). Moreover, as further described herein, if more than the Offer Amount is tendered and not withdrawn, any purchases will

be made on a pro rata basis.

What should I do if I decide not to tender my Shares for purchase?

Nothing. There are no actions that you need to take

if you determine not to participate in the Offer.

If I decide not to tender, how will the Offer affect my Shares?

If you do not tender your Shares (or if you own Shares

following completion of the Offer), you may be subject to any increased risks associated with the potential of greater volatility

due to a decreased asset base and proportionately higher expenses, as well as the possibility of receiving additional taxable

capital gains resulting from the sale of assets to pay for duly tendered Shares. The reduced assets of the Fund as a result of the

Offer may also result in less investment flexibility for the Fund and may have an adverse effect on the Fund’s investment

performance. In addition, participation in the Offer may reduce the number of shareholders in the Fund thereby potentially reducing

the number of Shares that might otherwise trade publicly. This could adversely affect the liquidity and market value of the

remaining Shares the public holds. (See Section 9, “Effects of the Offer; Consequences of Participation” and Section 17,

“Fees and Expenses.”)

Does the Fund’s management recommend that shareholders participate

in the Offer, and will management participate in the Offer?

None of the Fund, the Board, and the Investment Advisor

is making any recommendation to shareholders regarding whether to tender Shares for purchase or refrain from tendering Shares in the

Offer. The Fund has been advised that none of its Board, officers, the Investment Advisor intends to tender any Shares pursuant to

the Offer. Saba has informed us that all investment funds it manages are likely to subscribe to the Offer. (See Section 11,

“Interests of Trustees and Officers; Transactions and Arrangements Concerning the Shares.”)

Will there be additional opportunities to tender my Shares to the

Fund?

No other tender offers have been approved by the Board, but

the Board reserves the right to conduct tender offers in the future. (See Section 2, “Purpose of the Offer” and Section 3,

“Plans or Proposals of the Fund.”)

The Board has previously authorized the Fund to repurchase up to 10% of

the Fund’s outstanding Shares in open-market transactions, at the discretion of management (the “Share Repurchase Plan”).

Since the inception of the Share Repurchase Plan, the Fund has repurchased a total of 11,285,400 shares. The Fund will not make any purchases

of shares pursuant to the Share Repurchase Plan while the Offer is open. The Fund makes no assurance that it will repurchase any shares

in the future.

How do I obtain more information?

Questions and requests for assistance may be directed to your

financial advisor or other Nominee, or to the Information Agent toll free at 1-855-434-5243. Requests for additional

copies of this Offer to Purchase and the applicable Letter of Transmittal should also be directed to the Information Agent.

The Information Agent for the Offer

is:

Campaign Management LLC

15 West 38th Street, Suite #747

New York, NY 10018

1-855-434-5243 (Toll Free)

The Depositary Agent for the Offer is:

| |

|

|

| By Mail: |

|

By Overnight Courier: |

| Equiniti Trust Company, LLC |

|

Equiniti Trust Company, LLC |

| Operations Center |

|

Operations Center |

| Attn: Reorganization Department |

|

Attn: Reorganization Department |

| 6201 15th Avenue |

|

6201 15th Avenue |

| Brooklyn, New York 11219 |

|

Brooklyn, New York 11219 |

1.

Price; Number of Shares.

Upon the terms and subject to the conditions of the Offer

(including, if the Offer is extended or amended, the terms and conditions of any such extension or amendment), the Fund will accept

for purchase, and pay for, an aggregate amount of up to 46,235,867 Shares, which represents 45% of the 102,746,371 Shares

outstanding as of October 5, 2023, which are duly tendered and not timely withdrawn in accordance with Section 6 prior to the

Expiration Date. The term “Expiration Date” means 5:00 p.m., Eastern time, on November 9, 2023, unless the Fund, in its

sole discretion, extends the period during which the Offer is open, in which case “Expiration Date” shall mean the time

and date on which the Offer, as so extended by the Fund, shall expire. The Fund reserves the right in its sole discretion and for

any reason to amend, extend or terminate the Offer prior to the time the Offer expires. See Section 16, “Amendments;

Extensions of Purchase Period; Termination.” The Fund will not be obligated to purchase Shares pursuant to the Offer under

certain circumstances. See Section 4, “Certain Conditions of the Offer.”

The Purchase Price of the Shares will be 99% of the NAV per Share

determined as of the close of the regular trading session of the NYSE on the Pricing Date. On October 5, 2023, the NAV per Share was

$4.20 and the last reported market price per Share on the NYSE on such date was $3.80, representing a discount of -9.52% to NAV per Share.

The NAV per Share on the Pricing Date may be higher or lower than the NAV per Share as of October 5, 2023, and the discount to NAV

per Share at which the Shares trade may be greater or lesser than the discount as of -9.52%. For the Fund’s most current NAV per

Share and market price per Share, you may view online at https://www.franklintempleton.com/investments/options/closed-end-funds/products/146/

SINGLCLASS/templeton-global-income-fund-inc/GIM.

For additional questions or information during the pendency of this Offer, you may contact the Information Agent by calling 1-855-434-5243, between the hours of 9:00 a.m. and 11:00 p.m., Eastern time, Monday through Friday (except holidays), and 12:00 p.m. and

6:00 p.m., Eastern time, on Saturday. Shareholders tendering Shares shall be entitled to receive all dividends with a record date

on or before the Expiration Date provided that they own Shares as of the record date for such dividend. Shareholders should be aware that,

if they tender Shares pursuant to the Offer, tendered Shares will not be entitled to receive any Fund dividend or distribution with a

record date on or after November 9, 2023.

The Offer is being made to all shareholders and is not conditioned

upon shareholders tendering for purchase in the aggregate any minimum number of Shares. If the number of Shares duly tendered and not

withdrawn prior to the date and time the Offer expires is less than or equal to the Offer Amount, the Fund will, upon the terms and subject

to the conditions of the Offer, purchase all Shares duly tendered and not timely withdrawn. If more than the Offer Amount is duly tendered

for purchase pursuant to the Offer (and not timely withdrawn as provided in Section 6), the Fund, subject to the conditions listed in

Section 3, will purchase Shares from participating shareholders in accordance with the terms and conditions specified in the Offer on

a pro rata basis based upon the number of Shares duly tendered (and not timely withdrawn) by or on behalf of each shareholder. The Fund

does not intend to increase the number of Shares offered for purchase, even if more than the Offer Amount is duly tendered.

Shares will be purchased at 99% of the Fund’s NAV per Share

on the Pricing Date, which may help defray certain costs of the tender, including the processing of tender forms, effecting payment, postage

and handling. The Fund will not charge a separate service fee in conjunction with the Offer. If your Shares are held through a financial

intermediary, the financial intermediary may charge a service fee for participation in the Offer. Tendering shareholders will not be obligated

to pay transfer taxes on the purchase of Shares by the Fund, except in the circumstances set forth in Section 7, “Payment for Shares.”

As of September 27, 2023, there were 102,746,371 Shares issued and outstanding,

and as of September 27, 2023, there were approximately 1,140 holders of record of Shares. One of these record holders is a nominee for

brokers, dealers, commercial banks, trust companies and other institutions that held legal title to Shares in “street name”

on behalf of multiple beneficial owners. Based upon information provided or available to the Fund, no trustee or officer intends to tender

any Shares in the tender offer. Saba has informed us that all investment funds it manages are likely to subscribe to the Offer.

The Fund reserves the right, in its sole discretion, at any time

or from time to time, to extend the period of time during which the Offer is open by giving notice of such extension to the Depositary

Agent and making a public announcement thereof. See Section 16, “Amendments; Extensions of Purchase Period; Termination.”

The Fund makes no assurance that it will extend the Offer. During any extension, all Shares previously duly tendered and not withdrawn

will remain subject to the Offer, subject to the right of a tendering shareholder to withdraw his or her Shares.

2.

Purpose of the Offer.

The Board approved the Offer to: provide enhanced liquidity to the Fund’s

shareholders ahead of the Fund’s potential transition to Saba as its new investment adviser (which is subject to approval by shareholders);

provide potential accretion to the Fund’s NAV per share; and seek to help narrow the NAV discount at which the Fund’s shares

trade.

There can be no assurances as to the effect that the Offer will

have on the Fund’s NAV discounts. Common shares of closed-end investment companies often trade at a discount to their NAV per

Share, and the Fund’s Shares may also trade at a discount to their NAV per Share, although it is possible that they may trade at

NAV per Share or at a premium above NAV per Share. The market price of the Fund’s Shares is determined by such factors as relative

demand for and supply of such common stock in the market, the Fund’s NAV per Share, general market and economic conditions and other

factors beyond the control of the Fund. Therefore, the Fund cannot predict whether its Shares will trade at, below or above NAV per Share.

Any Shares purchased by the Fund pursuant to the Offer will be available

for issuance by the Fund without further shareholder action (except as required by applicable law or the rules of the NYSE on which the

Shares are listed).

None of the Fund, the Board or the Investment Advisor makes any

recommendation to any shareholder as to whether to tender Shares for purchase or to refrain from tendering Shares in the Offer. No person

has been authorized to make any recommendation on behalf of the Fund, the Board or the Investment Advisor as to whether shareholders

should tender Shares for purchase pursuant to the Offer or to make any representation or to give any information in connection with the

Offer other than as contained herein. If made or given, any such recommendation, representation or information must not be relied upon

as having been authorized by the Fund, the Board or the Investment Advisor. Shareholders are urged to evaluate carefully all information

in the Offer, consult their own investment and tax advisers and make their own decisions whether to tender their Shares for purchase

or refrain from participating in the Offer.

3.

Plans or Proposals of the Fund.

Except to the extent described herein, in the Special Meeting

Proxy Statement and in connection with the Fund’s dividend reinvestment plan, the Fund does not have any present plans or

proposals and is not engaged in any negotiations that relate to or would result in:

(a)

any extraordinary transaction, such as a merger, reorganization or liquidation, involving the Fund or any of its subsidiaries;

(b)

other than in connection with transactions in the ordinary course of the Fund’s operations and for purposes of funding the

Offer, any purchase, sale or transfer of a material amount of assets of the Fund or any of its subsidiaries;

(c)

any material change in the Fund’s present dividend policy, or indebtedness or capitalization of the Fund;

(d)

changes to the present Board or management of the Fund, including changes to the number or the term of members of the Board, the

filling of any existing vacancies on the Board or changes to any material term of the employment contract of any executive officer;

(e)

any other material change in the Fund’s corporate structure or business, including any plans or proposals to make any changes

in the Fund’s investment policy for which a vote would be required by Section 13 of the 1940 Act;

(f)

any class of equity securities of the Fund being delisted from a national securities exchange or ceasing to be authorized to be

quoted in an automated quotations system operated by a national securities association;

(g)

any class of equity securities of the Fund becoming eligible for termination of registration pursuant to Section 12(g)(4) of the

Exchange Act;

(h)

the suspension of the Fund’s obligation to file reports pursuant to Section 15(d) of the Exchange Act;

(i)

the acquisition by any person of additional securities of the Fund, or the disposition of securities of the Fund, other than the

Share Repurchase Plan; or

(j)

any changes in the Fund’s Declaration of Trust, By-Laws or other governing instruments or other actions that could impede

the acquisition of control of the Fund.

4.

Certain Conditions of the Offer.

Notwithstanding any other provision of the Offer, and in addition

to (and not in limitation of) the Fund’s right to extend, amend or terminate the Offer at any time in its sole discretion, the Fund

shall not be required to accept for purchase or, subject to the applicable rules and regulations of the Commission, including Rule 14e-1(c)

under the Exchange Act, pay for, and may delay the acceptance of or payment for any tendered Shares, if:

(a)

such transactions, if consummated, would:

(i)

result in delisting of the Fund’s Shares from the NYSE (the NYSE Listed Company Manual provides that the NYSE would promptly

initiate suspension and delisting procedures with respect to closed-end funds if the total market value of publicly held shares and net

assets of the Fund over 60 consecutive calendar days are each below $5,000,000);

(ii) in

the Fund’s reasonable judgment, be likely to cause the common shares to be eligible for deregistration under the Exchange Act

or the suspension of reporting obligations under Section 12 of the Exchange Act; or

(iii) impair the Fund’s status as a regulated

investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”) (which would make

the Fund subject to U.S. federal income taxes on all of its income and gains in addition to the taxation of shareholders who receive distributions

from the Fund);

(b)

there shall be instituted, pending or threatened before any governmental entity or court any action, proceeding, application or

claim, or there shall be any judgment, order or injunction sought or any other action taken by any person or entity, which restrains,

prohibits or materially delays the making or consummation of the Offer, challenges the acquisition by the Fund of any Shares pursuant

to the Offer or the Board’s fulfillment of its fiduciary obligations in connection with the Offer, seeks to obtain any material

amount of damages in connection with the Offer, or otherwise directly or indirectly adversely affects the Offer or the Fund;

(c)

there shall have occurred (i) any general suspension of trading in or limitation on prices for securities on the NYSE or any other

exchange on which the Shares are traded; (ii) any declaration of a banking moratorium or similar action materially adverse to the Fund

by U.S. federal or state authorities or any foreign jurisdiction, or any suspension of payment material to the Fund by banks in the United

States, the State of New York, or any other jurisdiction; (iii) any limitation having a material adverse effect on the Fund that is imposed

by U.S. federal or state authorities, or by any governmental authority of any foreign jurisdiction, with respect to the extension of credit

by lending institutions or the convertibility of foreign currencies; (iv) the commencement of war, armed hostilities, or any other international

or national calamity directly involving the United States other than any such event which is currently occurring; or (v) any other event

or condition which, in the judgment of the Board, would have a material adverse effect on the Fund if the Offer were consummated; or

(d)

the Board determines that effecting the Offer would be inconsistent with applicable legal requirements or would constitute a breach

of the Board’s fiduciary duties owed to the Fund or its shareholders.

The foregoing conditions are for the Fund’s sole benefit and

may be asserted by the Fund regardless of the circumstances giving rise to any such condition (including any action or inaction of the

Fund), and any such condition may be waived by the Fund, in whole or in part, at any time and from time to time in its reasonable judgment.

The Fund’s failure at any time to exercise any of the foregoing rights shall not be deemed a waiver of any such right; the waiver

of any such right with respect to particular facts and circumstances shall not be deemed a waiver with respect to any other facts or circumstances;

and each such right shall be deemed an ongoing right which may be asserted at any time and from time to time. Any determination by the

Fund concerning the events described in this Section 4 shall be final and binding.

The Fund reserves the right, at any time during the pendency of

the Offer, to terminate, extend or amend the Offer in any respect. If the Fund determines to terminate or amend the Offer or to postpone

the acceptance for payment of or payment for Shares duly tendered, it will, to the extent necessary, extend the period of time during which the Offer is open as provided in Section

16, “Amendments; Extensions of Purchase Period; Termination.” In the event any of the foregoing conditions are modified or

waived in whole or in part at any time, the Fund will promptly make a public announcement of such waiver and may, depending on the materiality

of the modification or waiver, extend the Offer period as provided in Section 16, “Amendments; Extensions of Purchase Period; Termination.”

5.

Procedures for Tendering Shares for Purchase.

A. Proper Tender of Shares.

Shareholders who desire to tender Shares registered in the name

of a Nominee must contact their Nominee to effect a tender on their behalf.

For Shares to be duly tendered pursuant to the Offer, a shareholder

must cause a properly completed and duly executed Letter of Transmittal bearing original signature(s) and the original of any required

signature guarantee(s), and all other documents required by the Letter of Transmittal, to be received by the Depositary Agent at one of

its addresses set forth on the back cover of this Offer to Purchase, and must cause certificates for tendered Shares to be received by

the Depositary Agent at such address or cause such Shares to be delivered pursuant to the procedures for book-entry delivery set forth

below (and confirmation of receipt of such delivery to be received by the Depositary Agent), in each case before the Expiration Date.

Mutilated, Lost, Stolen or Destroyed Certificates. If

any certificate representing Shares has been mutilated, lost, stolen or destroyed, the shareholder should promptly call the Depositary

Agent at 1-800-937-5449. The shareholder will then be instructed by the Depositary Agent as to the steps that must be taken

to replace the certificate. The Letter of Transmittal and related documents cannot be processed until the procedures for replacing lost

or destroyed certificates have been followed.

Letters of Transmittal and certificates representing tendered

Shares should not be sent or delivered to the Fund.

The Fund’s transfer agent holds Shares in uncertificated form

for certain shareholders pursuant to the Fund’s automatic dividend reinvestment plan. When a shareholder duly tenders certificated

Shares, the Depositary Agent will accept any of the shareholder’s uncertificated Shares for tender first, and accept the balance

of tendered Shares from the shareholder’s certificated Shares, and any remaining Shares will be issued in book-entry and will be

electronically held in your account in lieu of a certificate.

Section 14(e) of the Exchange Act and Rule 14e-4 promulgated thereunder

make it unlawful for any person, acting alone or in concert with others, directly or indirectly, to request a purchase of Shares pursuant

to the Offer unless at the time of the request, and at the time the Shares are accepted for payment, the person requesting the purchase

has a net long position equal to or greater than the amount requested for purchase in either: (a) Shares, and will deliver or cause to

be delivered such Shares for the purpose of purchase to the Fund within the period specified in the Offer, or (b) an equivalent security

and, upon the acceptance of his or her request to purchase, will acquire Shares by conversion, exchange, or exercise of such equivalent

security to the extent required by the terms of the Offer, and will deliver or cause to be delivered the Shares so acquired for the purpose

of requesting the purchase to the Fund prior to or on the Expiration Date. Section 14(e) and Rule 14e-4 provide a similar restriction

applicable to the request to purchase or guarantee of a request to tender on behalf of another person.

The acceptance of Shares by the Fund for purchase will

constitute a binding agreement between the participating shareholder and the Fund upon the terms and subject to the conditions of

the Offer, including the participating shareholder’s representation that

the shareholder has a net long position in the Shares being tendered for purchase within the meaning of Rule 14e-4 and that the request

to tender such Shares complies with Rule 14e-4.

By submitting the Letter of Transmittal, a tendering shareholder

shall, subject to and effective upon acceptance for payment of the Shares duly tendered, be deemed in consideration of such acceptance

to sell, assign and transfer to, or upon the order of, the Fund all right, title and interest in and to all the Shares that are being

tendered (and any and all dividends, distributions, other Shares or other securities or rights declared or issuable in respect of such

Shares after the Expiration Date) and irrevocably constitute and appoint the Fund the true and lawful attorney-in-fact of the tendering

shareholder with respect to such Shares (and any such dividends, distributions, other Shares or securities or rights), with full power

of substitution (such power of attorney being deemed to be an irrevocable power coupled with an interest) to (a) deliver certificates

for such Shares (and any such other dividends, distributions, other Shares or securities or rights) or transfer ownership of such Shares

(and any such other dividends, distributions, other Shares or securities or rights), together, in either such case, with all accompanying

evidences of transfer and authenticity to or upon the order of the Fund, upon receipt by the Depositary Agent of the Purchase Price, (b)

present such Shares (and any such other dividends, distributions, other Shares or securities or rights) for transfer on the books of the

Fund, and (c) receive all benefits and otherwise exercise all rights of beneficial ownership of such Shares (and any such other dividends,

distributions, other Shares or securities or rights), all in accordance with the terms of the Offer. Upon such acceptance for payment,

all prior powers of attorney given by the tendering shareholder with respect to such Shares (and any such dividends, distributions, other

shares or securities or rights) will, without further action, be revoked and no subsequent powers of attorney may be given by the tendering

shareholder with respect to the tendered Shares (and, if given, will be null and void.)

By submitting a Letter of Transmittal, and in accordance with the

terms and conditions of the Offer, a tendering shareholder shall be deemed to represent and warrant that: (a) the tendering shareholder

has full power and authority to tender, sell, assign and transfer the tendered Shares (and any and all dividends, distributions, other

Shares or other securities or rights declared or issuable in respect of such Shares after the Expiration Date); (b) when and to the extent

the Fund accepts the Shares for purchase, the Fund will acquire good, marketable and unencumbered title thereto, free and clear of all

liens, restrictions, charges, proxies, encumbrances or other obligations relating to their sale or transfer, and not subject to any adverse

claim; (c) on request, the tendering shareholder will execute and deliver any additional documents deemed by the Depositary Agent or the

Fund to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares (and any and all dividends, distributions,

other common shares or securities or rights declared or issuable in respect of such Shares after the Expiration Date); and (d) the tendering

shareholder has read and agreed to all of the terms of the Offer, including this Offer to Purchase and the Letter of Transmittal.

B. Signature Guarantees and Method of Delivery. All signatures

on the Letter of Transmittal must be guaranteed by an Eligible Institution. (See Instruction 2 of the Letter of Transmittal.) An “Eligible

Institution” is a firm which is a broker, dealer, commercial bank, credit union, savings association or other entity and which is

a member in good standing of a stock transfer association’s approved medallion program (such as STAMP, SEMP or MSP).

If the Letter of Transmittal is signed by the registered holder(s)

of the Shares duly tendered for purchase thereby, the signature(s) must correspond with the name(s) as written on the face of the certificate(s)

for the Shares duly tendered for purchase without any alteration, enlargement or any change whatsoever.

If any of the Shares duly tendered for purchase thereby are owned

of record by two or more joint owners, all such owners must sign the Letter of Transmittal.

If any of the Shares duly tendered for purchase are registered in

different names, it is necessary to complete, sign and submit as many separate Letters of Transmittal as there are different registrations.

If the Letter of Transmittal or any certificates for Shares duly

tendered for purchase or stock powers relating to Shares duly tendered for purchase are signed by trustees, executors, administrators,

guardians, attorneys-in-fact, officers of corporations or others acting in a fiduciary or representative capacity, such persons should

so indicate when signing, and proper evidence satisfactory to the Fund of their authority so to act must be submitted together with the

Letter of Transmittal.

If the Letter of Transmittal is signed by the registered holder(s)

of the Shares duly tendered for purchase, no endorsements of certificates or separate stock powers with respect to such Shares are required

unless payment is to be made to, or certificates for Shares not purchased are to be issued in the name of, a person other than the registered

holder(s). Signatures on such certificates or stock powers must be guaranteed by an Eligible Institution.

If the Letter of Transmittal is signed by a person other than the

registered holder(s) of the certificate(s) listed thereon, the certificate(s) must be endorsed or accompanied by appropriate stock powers,

in either case signed exactly as the name(s) of the registered holder(s) appear(s) on the certificate(s) for the Shares involved. Signatures

on such certificates or stock powers must be guaranteed by an Eligible Institution.

THE METHOD OF DELIVERY OF ANY DOCUMENTS, INCLUDING CERTIFICATES

FOR SHARES, IS AT THE ELECTION AND RISK OF THE PARTY TENDERING SHARES. IF DOCUMENTS ARE SENT BY MAIL, IT IS RECOMMENDED THAT THEY BE SENT

BY REGISTERED MAIL, PROPERLY INSURED, WITH RETURN RECEIPT REQUESTED.

C. Book-Entry Delivery. Any financial institution that is

a participant in the DTC system may make book-entry delivery of tendered Shares in accordance with DTC’s procedures. However, although

delivery of Shares may be effected through book-entry transfer at DTC, a Letter of Transmittal properly completed and bearing original

signature(s) and the original of any required signature guarantee(s) or an Agent’s Message (as defined below) in connection with

a book-entry transfer and any other documents required by the Letter of Transmittal, must be received by the Depositary Agent prior to

the Expiration Date at one of its addresses set forth on the back cover page of this Offer to Purchase.

The term “Agent’s Message” means a message from

DTC transmitted to, and received by, the Depositary Agent forming a part of a timely confirmation of a book-entry transfer of Shares (a

“Book-Entry Confirmation”) which states that (a) DTC has received an express acknowledgment from the DTC participant tendering

the Shares for purchase that are the subject of the Book-Entry Confirmation, (b) the DTC participant has received and agrees to be bound

by the terms of the Letter of Transmittal, and (c) the Fund may enforce such agreement against the DTC participant. Delivery of documents

to DTC in accordance with DTC’s procedures does not constitute delivery to the Depositary Agent.

D. Determinations of Validity. All questions as to the validity,

form, eligibility (including time of receipt) and acceptance of tenders will be determined by the Fund, in its sole discretion, which

determination shall be final and binding. The Fund reserves the absolute right to reject any or all tenders determined not to be in appropriate

form or to refuse to accept for payment or purchase, or pay for, any Shares if, in the opinion of the Fund’s counsel, accepting,

purchasing or paying for such Shares would be unlawful. The Fund also reserves the absolute right to the extent permitted by law to waive

any of the conditions of the Offer or any defect in any tender, whether generally or with respect to any particular Share(s) or shareholder(s).

The Fund’s interpretations of the terms and conditions of the Offer (including the Letter of Transmittal and the instructions thereto)

shall be final and binding.

None of the Fund, the Board, the Investment Advisor, the Information

Agent, the Depositary Agent nor any other person is or will be obligated to give any notice of any defect or irregularity in any tender,

and none of the foregoing persons will incur any liability for failure to give any such notice.

E. U.S. Federal Income Tax Withholding. Under the U.S. federal

income tax backup withholding rules, the Depositary Agent would generally be required to withhold 24% of the gross payments made pursuant

to the Offer to any U.S. Shareholder (as defined below) unless such U.S. Shareholder has completed and submitted to the Depositary Agent

an IRS Form W-9. In order to avoid the possibility of backup withholding, all participating U.S. Shareholders are required to provide

the Depositary Agent with a properly completed and signed IRS Form W-9. A “U.S. Shareholder” is a shareholder that is a “U.S.

person” within the meaning of the Code. In general, a U.S. Shareholder is a shareholder that is (a) an individual who is a citizen

or resident of the United States; (b) a corporation or partnership, or other entity taxed as a corporation or partnership, created or

organized in the United States or under the law of the United States or of any State thereof; (c) an estate the income of which is subject

to U.S. federal income taxation regardless of the source of such income; or (d) a trust if a court within the United States is able to

exercise primary supervision over the administration of the trust and one or more U.S. persons have the authority to control all substantial

decisions of the trust.

In order to avoid backup withholding, participating Non-U.S. Shareholders

(as defined below) must provide the Depositary Agent with a completed IRS Form W-8BEN or W-8BEN-E, or another type of Form W-8 appropriate

to the particular Non-U.S. Shareholder. For purposes of this Offer to Purchase, a “Non-U.S. Shareholder” is generally any

shareholder that is not a “U.S. person” within the meaning of the Code. Copies of Form W-8BEN or W-8BEN-E are provided with

the Letter of Transmittal for Non-U.S. Shareholders. Other types of Form W-8 can be found on the IRS website at www.irs.gov/formspubs/index.html.

Tendering Non-U.S. Shareholders may be subject to U.S. federal withholding

tax, even if they submit an appropriate IRS Form W-8 in order to claim an exemption from backup withholding. For an additional discussion

of U.S. federal income tax withholding as well as a discussion of certain other U.S. federal income tax consequences to tendering shareholders,

see Section 14, “Certain U.S. Federal Income Tax Consequences.”

6.

Withdrawal Rights.

At any time prior to the Expiration Date any shareholder may withdraw

all, but not less than all, of the Shares that the shareholder has tendered. In addition, Shareholders will also have the right to withdraw

the tender of Shares at any time after 5:00 p.m. on November 9, 2023, to the extent the Shares have not yet been accepted for payment

as of that date.

To be effective, a written notice of withdrawal of Shares duly tendered

for purchase must be timely received by the Depositary Agent at one of its addresses set forth on the back cover of this Offer to Purchase.

Shareholders may also send a facsimile transmission notice of withdrawal, which must be timely received by the Depositary Agent prior

to the Expiration Date, and the original notice of withdrawal must be delivered to the Depositary Agent by overnight courier the next

day. Any notice of withdrawal must specify the name(s) of the person who tendered the Shares to be withdrawn, the number of Shares to

be withdrawn (which may not be less than all of the Shares duly tendered by the shareholder) and, if one or more certificates representing

such Shares have been delivered or otherwise identified to the Depositary Agent, the name(s) of the registered owner(s) of such Shares

as set forth in such certificate(s) if different from the name(s) of the person tendering the Shares. If one or more certificates have

been delivered to the Depositary Agent, then, prior to the release of such certificate(s), the certificate number(s) shown on the particular certificate(s) evidencing such Shares must

also be submitted and the signature on the notice of withdrawal must be guaranteed by an Eligible Institution.

All questions as to the validity, form and eligibility (including

time of receipt) of notices of withdrawal will be determined by the Fund in its sole discretion, which determination shall be final and

binding. Shares duly withdrawn will not thereafter be deemed to be tendered for purposes of the Offer. Withdrawn Shares, however, may

be re-tendered for purchase by following the procedures described in Section 5 prior to the Expiration Date. Except as otherwise provided

in this Section 6, tenders of Shares made pursuant to the Offer will be irrevocable.

None of the Fund, the Board of Trustees, the Investment Advisor,

the Information Agent, the Depositary Agent nor any other person is or will be obligated to give any notice of any defect or irregularity

in any notice of withdrawal, nor shall any of them incur any liability for failure to give any such notice.

7.

Payment for Shares.

For purposes of the Offer, the Fund will be deemed to have accepted

for payment and purchased Shares that are tendered for purchase (and not timely withdrawn in accordance with Section 6) when, as and if

the Fund gives oral or written notice to the Depositary Agent of its acceptance of such Shares for purchase pursuant to the Offer. Under

the Exchange Act, the Fund is obligated to pay for or return Shares duly tendered for purchase promptly after the termination, expiration

or withdrawal of the Offer. Unless otherwise indicated on the Letter of Transmittal, duly tendered Shares that are not purchased because

of proration will be returned at the Fund’s expense to you or to other persons at your direction.

Payment for Shares accepted for payment pursuant to the Offer will

be made by the Depositary Agent out of funds made available to it by the Fund. The Depositary Agent will act as agent for the Fund for

the purpose of effecting payment to the tendering shareholder. In all cases, payment for Shares purchased pursuant to the Offer will be

made only after timely receipt by the Depositary Agent of:

(a)

a Letter of Transmittal (or a copy thereof) properly completed and duly executed with any required signature guarantee(s), or an

Agent’s Message in connection with a book-entry transfer;

(b)

a certificate evidencing Shares or timely confirmation of a book-entry transfer of such Shares into the Depositary Agent’s

account at DTC pursuant to the procedure set forth in Section 5; and

(c)

all other documents required by the Letter of Transmittal.

Accordingly, payment may not be made to all tendering shareholders

at the same time and will depend upon when Share certificates are received by the Depositary Agent or Book-Entry Confirmations of duly

tendered Shares are received in the Depositary Agent’s account at DTC.

If any tendered Shares are not accepted for payment or are not paid

because they were not duly tendered, if certificates are submitted for more Shares than are tendered, or if a shareholder withdraws duly

tendered Shares, (i) the Shares will be issued in book-entry form and will be electronically held in your account for such unpurchased

Shares, as soon as practicable following the expiration, termination or withdrawal of the Offer, (ii) Shares delivered pursuant to the

book-entry delivery procedures will be credited to the account from which they were delivered, and (iii) uncertificated Shares held by

the Fund’s transfer agent pursuant to the Fund’s dividend reinvestment plan will be returned to the automatic dividend reinvestment

plan account maintained by the transfer agent.

The Fund will pay all transfer taxes, if any, payable on the transfer

to it of Shares purchased pursuant to the Offer. If, however, payment of the Purchase Price is to be made to, or if unpurchased Shares

were registered in the name of, any person other than the tendering holder, or if any tendered certificates are registered or the Shares

duly tendered are held in the name of any person other than the person signing the Letter of Transmittal, the amount of any transfer taxes

(whether imposed on the registered holder or such other person) payable on account of such transfer will be deducted from the Purchase

Price unless satisfactory evidence of the payment of such taxes, or exemption therefrom, is submitted. In addition, if certain events

occur, the Fund may not be obligated to purchase Shares pursuant to the Offer. See Section 4, “Certain Conditions of the Offer.”

Any tendering shareholder or other payee who fails to complete fully

and sign the Substitute IRS Form W-9, if one is included with the Letter of Transmittal, may be subject to U.S. federal income tax withholding

of 24% of the gross proceeds paid to such shareholder or other payee pursuant to the Offer. Non-U.S. Shareholders should provide the Depositary

Agent with a completed IRS Form W-8 in order to avoid 24% backup withholding. A copy of IRS Form W-8 will be provided upon request from

the Depositary Agent. See Section 5, “Procedures for Tendering Shares for Purchase—U.S. Federal Income Tax Withholding.”

8.

Source and Amount of Consideration.

The actual cost of the Offer to the Fund cannot be determined

at this time because the number of Shares to be purchased will depend on the number of Shares duly tendered for purchase, and the

price will be based on the NAV per Share on the Pricing Date. If shareholders tendered all Shares offered for purchase pursuant to

the Offer, and the Fund purchased such Shares at a price per share of $4.16, equal to 99% of the NAV as of October 5, 2023 ($4.20 per

Share), payments by the Fund to the participating shareholders would be approximately $192,341,207. See Section 9, “Effects of

the Offer; Consequences of Participation.”

The money to be used by the Fund to purchase Shares pursuant to the Offer

will be first obtained from any cash on hand and then from the proceeds of sales of securities in the Fund’s investment portfolio.

The percentage of assets expected to be sold will be determined by the final Offer amount as the Fund will assume full participation by

eligible shareholders. The Board of Trustees believes that the Fund has sufficient liquidity to purchase the Shares that may be tendered

pursuant to the Offer. However, if, in the judgment of the Board of Trustees, there is not sufficient liquidity of the assets of the Fund

to pay for tendered Shares, the Fund may terminate the Offer. See Section 4, “Certain Conditions of the Offer.”

9.

Effects of the Offer; Consequences of Participation.

The Offer may have certain adverse consequences for tendering and

non-tendering shareholders.

A. Effects on NAV and Consideration Received by Tendering Shareholders.

To pay the aggregate Purchase Price of Shares accepted for payment pursuant

to the Offer, the Fund anticipates that funds will be first derived from any cash on hand and then from the proceeds from the sale of

portfolio securities held by the Fund, as the assets of the Fund are generally liquid. If the Fund is required to sell a substantial amount

of assets to raise cash to finance the Offer, such dispositions of assets could cause market prices of the Fund’s asset holdings,

and hence the Fund’s NAV per Share, to decline. Such disposition of assets (1) may be made at a time that may not maximize the value

of such assets, (2) may be sold lower than the NAV per share of such assets, and (3) may contribute to a decline in the Fund’s NAV

per share. If such a decline in the Fund’s NAV per share occurs, the Fund cannot predict what its magnitude might be or whether

such a decline would be temporary or continue to or beyond the Expiration Date. Because the price per Share to be paid in the Offer will

be dependent upon the NAV per Share as determined as of the close of ordinary trading on the NYSE on the Pricing Date, if such a decline

continued to the Pricing Date, the consideration received by tendering shareholders would be less than it otherwise might be. In addition,

a sale of assets will cause increased brokerage and related transaction expenses, and thus the Fund may receive proceeds from the sale

of assets that are less than the valuations of such assets by the Fund. Accordingly, because of the Offer, the Fund’s NAV per Share

may decline more than it otherwise might, thereby reducing the amount of proceeds received by tendering shareholders, and also reducing

the NAV per Share for non-tendering shareholders.

The Fund expects to sell assets to raise cash for the purchase of

Shares. Thus, it is possible that during the pendency of the Offer, and possibly for a short time thereafter, the Fund may hold a greater

than normal percentage of its net assets in cash and cash equivalents. This larger cash position may interfere with the Fund’s ability

to meet its investment objectives. The Fund is required by law to pay for duly tendered Shares it accepts for payment promptly after the

Expiration Date of this Offer. If on or prior to the Expiration Date the Fund does not have, or believes it is unlikely to have, sufficient

cash to pay for all Shares duly tendered, it may extend the Offer to allow additional time to sell additional assets and make additional

assets to raise sufficient cash.

B. Recognition of Capital Gains. As noted, the Fund may be required

to sell assets pursuant to the Offer. If the Fund’s tax basis for the assets sold is less than the sale proceeds, the Fund will

recognize capital gains. The Fund would expect to distribute any such gains to shareholders of record (reduced by net capital losses

realized during the fiscal year, if any, and available capital loss carry-forwards) during, or following the end of, the Fund’s

fiscal year. It is impossible to predict what the amount of unrealized gains or losses would be in the Fund’s portfolio at the

time that the Fund is required to sell assets (and hence the amount of capital gains or losses that would be realized and recognized).

As of August 31, 2023, the Fund had net unrealized capital depreciation of approximately $22,100,000. As of August 31, 2023, the Fund

had capital loss carryforwards of approximately $87,200,000, all of which is non-expiring.

In addition, some distributed gains may be realized on assets held

for one year or less, which would generate income taxable to the shareholders at ordinary income rates. This could adversely affect the

Fund’s after-tax performance.

C. Tax Consequences of Purchases to Shareholders. The Fund’s

purchase of duly tendered Shares pursuant to the Offer will have tax consequences for tendering shareholders. See Section 14, “Certain