Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

21 August 2024 - 10:15PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13D/A

Under the Securities Exchange Act of 1934

(Amendment No. 3)*

Gildan

Activewear Inc.

(Name of Issuer)

Common Shares

(Title of

Class of Securities)

375916103

(CUSIP Number)

Christopher Shackelton/Adam Gray

105 Rowayton Avenue

Rowayton, CT 06853

(Name,

Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 19, 2024

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §240.13d-1(e),

§240.13d-1(f) or §240.13d-1(g), check the following box. ☐

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

| CUSIP No. 375916103 |

|

Page

2

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Coliseum Capital Management, LLC |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) AF |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

7,852,118 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

7,852,118 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

7,852,118 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 4.8% |

| 14. |

|

Type of reporting person (see

instructions) IA |

|

|

|

| CUSIP No. 375916103 |

|

Page

3

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Coliseum Capital, LLC |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) AF |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

6,493,956 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

6,493,956 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

6,493,956 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 4.0% |

| 14. |

|

Type of reporting person (see

instructions) OO |

|

|

|

| CUSIP No. 375916103 |

|

Page

4

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Coliseum Capital Partners, L.P. |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

5,448,593 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

5,448,593 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

5,448,593 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 3.4% |

| 14. |

|

Type of reporting person (see

instructions) PN |

|

|

|

| CUSIP No. 375916103 |

|

Page

5

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Coliseum Capital Co-Invest III, L.P. |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) WC |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization

Delaware |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

1,045,363 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

1,045,363 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

1,045,363 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 0.6% |

| 14. |

|

Type of reporting person (see

instructions) PN |

|

|

|

| CUSIP No. 375916103 |

|

Page

6

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Adam Gray |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) AF |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization United

States |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

7,852,118 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

7,852,118 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

7,852,118 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 4.8% |

| 14. |

|

Type of reporting person (see

instructions) IN |

|

|

|

| CUSIP No. 375916103 |

|

Page

7

of 9 |

|

|

|

|

|

|

|

| 1. |

|

Names of reporting persons.

Christopher Shackelton |

| 2. |

|

Check the appropriate box if a

member of a group (see instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC use only

|

| 4. |

|

Source of funds (see

instructions) AF |

| 5. |

|

Check if disclosure of legal

proceedings is required pursuant to Items 2(d) or 2(e) ☐ |

| 6. |

|

Citizenship or place of

organization United

States |

|

|

|

|

|

|

|

| Number of

shares beneficially

owned by each

reporting person

with |

|

7. |

|

Sole voting power

0 |

| |

8. |

|

Shared voting power

7,852,118 |

| |

9. |

|

Sole dispositive power

0 |

| |

10. |

|

Shared dispositive power

7,852,118 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate amount beneficially owned by each reporting person

7,852,118 |

| 12. |

|

Check if the aggregate amount

in Row (11) excludes certain shares (see instructions) ☐ |

| 13. |

|

Percent of class represented by

amount in Row (11) 4.8% |

| 14. |

|

Type of reporting person (see

instructions) IN |

|

|

|

| CUSIP No. 375916103 |

|

Page

8

of 9 |

EXPLANATORY NOTE

This Amendment No. 3 (this “Amendment No. 3”) amends and supplements the statement on Schedule 13D filed by the

Reporting Persons (as defined below) with the U.S. Securities and Exchange Commission (the “SEC”) on December 27, 2023 (the “Original Schedule 13D”), as amended and supplemented by Amendment No. 1 to the

Original Schedule 13D filed on April 23, 2024 (the “Amendment No. 1”) and Amendment No. 2 to the Original Schedule 13D filed on June 4, 2024 (the “Amendment

No. 2”), relating to the common shares (the “Common Shares”) of Gildan Activewear Inc. (the “Issuer”). As used in this Amendment No. 3, the term “Reporting Persons”

collectively refers to:

| |

• |

|

Coliseum Capital Management, LLC, a Delaware limited liability company (“CCM”);

|

| |

• |

|

Coliseum Capital, LLC, a Delaware limited liability company (“CC”); |

| |

• |

|

Coliseum Capital Partners, L.P., a Delaware limited partnership (“CCP”); |

| |

• |

|

Coliseum Capital Co-Invest III, L.P., a Delaware limited partnership

(“CCC III”); |

| |

• |

|

Adam Gray (“Mr. Gray”); and |

| |

• |

|

Christopher Shackelton (“Mr. Shackelton”). |

As a result of the transactions described herein, on August 20, 2024, each of the Reporting Persons ceased to be the beneficial owner of more than 5% of

the Issuer’s Common Shares. The filing of this Amendment No. 3 represents the final amendment to this Schedule 13D and constitutes an exit filing for the Reporting Persons.

Item 5. Interest in Securities of the Issuer.

Item

5(a)-(c) of the of the Original Schedule 13D, as amended and supplemented by Amendment No. 1 and Amendment No. 2, is hereby amended and supplemented as follows:

(a) – (b) The information relating to the beneficial ownership of the Common Shares by each of the Reporting Persons set forth in Rows 7 through 13 of the

cover pages hereto is incorporated by reference herein. The percentages set forth in Row 13 for all cover pages filed herewith are calculated based upon 162,610,386 Common Shares outstanding as of July 26, 2024, as reported in the Issuer’s

Current Report on Form 6-K filed with the SEC on August 1, 2024.

(c) The Reporting Persons and a separate

account investment advisory client of CCM (the “Separate Account”) effected the following transactions in the Common Shares on the dates indicated, and such transactions are the only transactions in the Common Shares by the

Reporting Persons in the sixty days preceding the filing of this Amendment No. 3, or since the most recent filing of Schedule 13D by the Reporting Persons, whichever is less. The Reporting Persons undertake to provide to the staff of SEC, upon

request, full information regarding the number of Common Shares purchased at each separate price within each range of prices set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Purchase or Sale |

|

Date |

|

Number

of

Shares |

|

|

Weighted

Average

Price Per

Share |

|

|

Range of Prices |

|

| CCP |

|

Sale |

|

August 20, 2024 |

|

|

239,364 |

|

|

$ |

58.13 |

|

|

$ |

58.38-$57.90 |

|

| Separate Account |

|

Sale |

|

August 20, 2024 |

|

|

60,636 |

|

|

$ |

58.13 |

|

|

$ |

58.38-$57.90 |

|

| CCP |

|

Sale |

|

August 19, 2024 |

|

|

16,914 |

|

|

$ |

58.06 |

|

|

$ |

58.13-$58.00 |

|

| Separate Account |

|

Sale |

|

August 19, 2024 |

|

|

4,286 |

|

|

$ |

58.06 |

|

|

$ |

58.13-$58.00 |

|

| CCP |

|

Sale |

|

August 13, 2024 |

|

|

19,318 |

|

|

$ |

57.35 |

|

|

$ |

57.67-$57.25 |

|

| Separate Account |

|

Sale |

|

August 13, 2024 |

|

|

4,862 |

|

|

$ |

57.35 |

|

|

$ |

57.67-$57.25 |

|

| CCP |

|

Sale |

|

August 12, 2024 |

|

|

7,173 |

|

|

$ |

57.59 |

|

|

$ |

57.72-$57.05 |

|

|

|

|

| CUSIP No. 375916103 |

|

Page

9

of 9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Separate Account |

|

Sale |

|

August 12, 2024 |

|

|

1,827 |

|

|

$ |

57.59 |

|

|

$ |

57.72-$57.05 |

|

| CCP |

|

Sale |

|

August 8, 2024 |

|

|

27,930 |

|

|

$ |

57.04 |

|

|

$ |

57.04-$57.04 |

|

| Separate Account |

|

Sale |

|

August 8, 2024 |

|

|

7,070 |

|

|

$ |

57.04 |

|

|

$ |

57.04-$57.04 |

|

| CCP |

|

Sale |

|

August 8, 2024 |

|

|

259,355 |

|

|

$ |

56.54 |

|

|

$ |

56.92-$56.00 |

|

| Separate Account |

|

Sale |

|

August 8, 2024 |

|

|

65,645 |

|

|

$ |

56.54 |

|

|

$ |

56.92-$56.00 |

|

| CCP |

|

Sale |

|

August 7, 2024 |

|

|

95,697 |

|

|

$ |

55.79 |

|

|

$ |

56.06-$55.57 |

|

| Separate Account |

|

Sale |

|

August 7, 2024 |

|

|

24,303 |

|

|

$ |

55.79 |

|

|

$ |

56.06-$55.57 |

|

| CCP |

|

Sale |

|

August 6, 2024 |

|

|

60,533 |

|

|

$ |

55.98 |

|

|

$ |

56.08-$55.72 |

|

| Separate Account |

|

Sale |

|

August 6, 2024 |

|

|

15,367 |

|

|

$ |

55.98 |

|

|

$ |

56.08-$55.72 |

|

| CCP |

|

Sale |

|

August 1, 2024 |

|

|

160 |

|

|

$ |

57.40 |

|

|

$ |

57.40-$57.40 |

|

| Separate Account |

|

Sale |

|

August 1, 2024 |

|

|

40 |

|

|

$ |

57.40 |

|

|

$ |

57.40-$57.40 |

|

| CCP |

|

Sale |

|

July 31, 2024 |

|

|

23,457 |

|

|

$ |

56.52 |

|

|

$ |

56.87-$56.30 |

|

| Separate Account |

|

Sale |

|

July 31, 2024 |

|

|

5,943 |

|

|

$ |

56.52 |

|

|

$ |

56.87-$56.30 |

|

| CCP |

|

Sale |

|

July 30, 2024 |

|

|

31,917 |

|

|

$ |

55.64 |

|

|

$ |

56.00-$55.50 |

|

| Separate Account |

|

Sale |

|

July 30, 2024 |

|

|

8,083 |

|

|

$ |

55.64 |

|

|

$ |

56.00-$55.50 |

|

| CCP |

|

Sale |

|

July 29, 2024 |

|

|

18,912 |

|

|

$ |

55.31 |

|

|

$ |

55.50-$55.25 |

|

| Separate Account |

|

Sale |

|

July 29, 2024 |

|

|

4,788 |

|

|

$ |

55.31 |

|

|

$ |

55.50-$55.25 |

|

| CCP |

|

Sale |

|

July 26, 2024 |

|

|

99,799 |

|

|

$ |

55.31 |

|

|

$ |

55.59-$55.06 |

|

| Separate Account |

|

Sale |

|

July 26, 2024 |

|

|

25,201 |

|

|

$ |

55.31 |

|

|

$ |

55.59-$55.06 |

|

| CCP |

|

Sale |

|

July 25, 2024 |

|

|

73,852 |

|

|

$ |

54.19 |

|

|

$ |

54.37-$54.05 |

|

| Separate Account |

|

Sale |

|

July 25, 2024 |

|

|

18,648 |

|

|

$ |

54.19 |

|

|

$ |

54.37-$54.05 |

|

| CCP |

|

Sale |

|

July 24, 2024 |

|

|

16,435 |

|

|

$ |

54.56 |

|

|

$ |

54.61-$54.25 |

|

| Separate Account |

|

Sale |

|

July 24, 2024 |

|

|

4,165 |

|

|

$ |

54.56 |

|

|

$ |

54.61-$54.25 |

|

| CCP |

|

Sale |

|

July 23, 2024 |

|

|

35,931 |

|

|

$ |

54.36 |

|

|

$ |

54.62-$54.22 |

|

| Separate Account |

|

Sale |

|

July 23, 2024 |

|

|

9,069 |

|

|

$ |

54.36 |

|

|

$ |

54.62-$54.22 |

|

| CCP |

|

Sale |

|

July 22, 2024 |

|

|

119,813 |

|

|

$ |

54.18 |

|

|

$ |

54.42-$54.10 |

|

| Separate Account |

|

Sale |

|

July 22, 2024 |

|

|

30,187 |

|

|

$ |

54.18 |

|

|

$ |

54.42-$54.10 |

|

| CCP |

|

Sale |

|

July 19, 2024 |

|

|

30,578 |

|

|

$ |

54.16 |

|

|

$ |

54.40-$54.10 |

|

| Separate Account |

|

Sale |

|

July 19, 2024 |

|

|

7,722 |

|

|

$ |

54.16 |

|

|

$ |

54.40-$54.10 |

|

| CCP |

|

Sale |

|

July 18, 2024 |

|

|

43,922 |

|

|

$ |

54.21 |

|

|

$ |

54.61-$53.86 |

|

| Separate Account |

|

Sale |

|

July 18, 2024 |

|

|

11,078 |

|

|

$ |

54.21 |

|

|

$ |

54.61-$53.86 |

|

| CCP |

|

Sale |

|

July 17, 2024 |

|

|

82,022 |

|

|

$ |

54.10 |

|

|

$ |

54.31-$53.95 |

|

| Separate Account |

|

Sale |

|

July 17, 2024 |

|

|

20,678 |

|

|

$ |

54.10 |

|

|

$ |

54.31-$53.95 |

|

| CCP |

|

Sale |

|

July 16, 2024 |

|

|

51,626 |

|

|

$ |

54.28 |

|

|

$ |

54.57-$54.12 |

|

| Separate Account |

|

Sale |

|

July 16, 2024 |

|

|

12,974 |

|

|

$ |

54.28 |

|

|

$ |

54.57-$54.12 |

|

| CCP |

|

Sale |

|

July 15, 2024 |

|

|

53,158 |

|

|

$ |

54.11 |

|

|

$ |

54.37-$53.77 |

|

| Separate Account |

|

Sale |

|

July 15, 2024 |

|

|

13,342 |

|

|

$ |

54.11 |

|

|

$ |

54.37-$53.77 |

|

| CCP |

|

Sale |

|

July 12, 2024 |

|

|

48,421 |

|

|

$ |

54.39 |

|

|

$ |

54.51-$54.20 |

|

| Separate Account |

|

Sale |

|

July 12, 2024 |

|

|

12,179 |

|

|

$ |

54.39 |

|

|

$ |

54.51-$54.20 |

|

| CCP |

|

Sale |

|

July 11, 2024 |

|

|

95,973 |

|

|

$ |

53.51 |

|

|

$ |

53.64-$53.29 |

|

| Separate Account |

|

Sale |

|

July 11, 2024 |

|

|

24,027 |

|

|

$ |

53.51 |

|

|

$ |

53.64-$53.29 |

|

| CCP |

|

Sale |

|

July 10, 2024 |

|

|

83,818 |

|

|

$ |

53.07 |

|

|

$ |

53.25-$52.80 |

|

| Separate Account |

|

Sale |

|

July 10, 2024 |

|

|

21,182 |

|

|

$ |

53.07 |

|

|

$ |

53.25-$52.80 |

|

| CCP |

|

Sale |

|

July 9, 2024 |

|

|

47,894 |

|

|

$ |

53.11 |

|

|

$ |

53.34-$52.85 |

|

| Separate Account |

|

Sale |

|

July 9, 2024 |

|

|

12,106 |

|

|

$ |

53.11 |

|

|

$ |

53.34-$52.85 |

|

| CCP |

|

Sale |

|

July 8, 2024 |

|

|

95,792 |

|

|

$ |

52.83 |

|

|

$ |

53.04-$52.72 |

|

| Separate Account |

|

Sale |

|

July 8, 2024 |

|

|

24,208 |

|

|

$ |

52.83 |

|

|

$ |

53.04-$52.72 |

|

| CCP |

|

Sale |

|

July 5, 2024 |

|

|

18,999 |

|

|

$ |

52.66 |

|

|

$ |

53.01-$52.40 |

|

| Separate Account |

|

Sale |

|

July 5, 2024 |

|

|

4,801 |

|

|

$ |

52.66 |

|

|

$ |

53.01-$52.40 |

|

| CCP |

|

Sale |

|

July 3, 2024 |

|

|

42,863 |

|

|

$ |

52.56 |

|

|

$ |

52.67-$52.51 |

|

| Separate Account |

|

Sale |

|

July 3, 2024 |

|

|

10,837 |

|

|

$ |

52.56 |

|

|

$ |

52.67-$52.51 |

|

(e) As a result of the transactions described herein, on August 20, 2024, the Reporting Persons ceased to be the

beneficial owners of more than five percent of the Issuer’s Common Shares.

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: August 21, 2024

|

|

|

|

|

|

|

|

|

| COLISEUM CAPITAL MANAGEMENT, LLC |

|

|

|

COLISEUM CAPITAL, LLC |

|

|

|

|

|

| By: |

|

/s/ Adam Cina |

|

|

|

By: |

|

/s/ Adam Cina |

|

|

Adam Cina,

Attorney-in-fact |

|

|

|

|

|

Adam Cina,

Attorney-in-fact |

|

|

|

| COLISEUM CAPITAL PARTNERS, L.P. |

|

|

|

COLISEUM CAPITAL CO-INVEST III, L.P. |

|

|

|

|

|

| By: |

|

Coliseum Capital, LLC, General Partner |

|

|

|

By: |

|

Coliseum Capital, LLC, General Partner |

|

|

|

|

|

| By: |

|

/s/ Adam Cina |

|

|

|

By: |

|

/s/ Adam Cina |

|

|

Adam Cina,

Attorney-in-fact |

|

|

|

|

|

Adam Cina,

Attorney-in-fact |

|

|

|

| CHRISTOPHER SHACKELTON |

|

|

|

ADAM GRAY |

|

|

|

|

|

| By: |

|

/s/ Adam Cina |

|

|

|

By: |

|

/s/ Adam Cina |

|

|

Adam Cina,

Attorney-in-fact |

|

|

|

|

|

Adam Cina,

Attorney-in-fact |

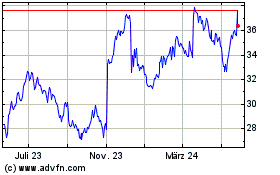

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

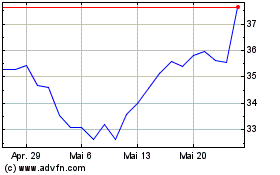

Gildan Activewear (NYSE:GIL)

Historical Stock Chart

Von Dez 2023 bis Dez 2024