Goldman Sachs Asset Management Closed-End Fund Announces Results of Annual Shareholder Meeting

23 März 2023 - 11:45PM

Business Wire

Goldman Sachs Asset Management, investment adviser for the

Goldman Sachs MLP and Energy Renaissance Fund (GER) (the “Fund”),

announced the results from the Fund’s annual shareholder meeting

held today.

Election of Trustees

Shareholders of the Fund elected two Class II Trustees, Linda A.

Lang and James A. McNamara.

For additional information, please visit the Fund’s website at

www.gsamfunds.com/cef.

Goldman Sachs MLP and Energy Renaissance Fund

Goldman Sachs MLP and Energy Renaissance Fund is a

non-diversified, closed-end management investment company managed

by Goldman Sachs Asset Management’s Energy & Infrastructure

Team, which is among the industry’s largest master limited

partnerships (“MLPs”) investment groups.

The Fund began trading on the NYSE on September 26, 2014. The

Fund seeks a high level of total return with an emphasis on current

distributions to shareholders. The Fund invests primarily in “MLPs”

and other energy investments. The Fund currently expects to

concentrate its investments in the energy sector, with an emphasis

on midstream MLP investments. The Fund invests across the energy

value chain, including upstream, midstream and downstream

investments.

About Goldman Sachs Asset Management, L.P.

Bringing together traditional and alternative investments,

Goldman Sachs Asset Management provides clients around the world

with a dedicated partnership and focus on long-term performance. As

the primary investing area within Goldman Sachs (NYSE: GS), we

deliver investment and advisory services for the world’s leading

institutions, financial advisors and individuals, drawing from our

deeply connected global network and tailored expert insights,

across every region and market – overseeing more than $2 trillion

in assets under supervision worldwide as of December 31, 20221.

Driven by a passion for our clients’ performance, we seek to build

long-term relationships based on conviction, sustainable outcomes,

and shared success over time. Follow us on LinkedIn.

Disclosures

Shares of closed-end investment companies frequently trade at a

discount from their net asset value (“NAV”), which may increase

investors’ risk of loss. At the time of sale, an investor’s shares

may have a market price that is above or below NAV, and may be

worth more or less than the original investment. There is no

assurance that the Fund will meet its investment objective. Past

performance does not guarantee future results. Investments in

securities of MLPs involve risks that differ from investments in

common stock, including among others risks related to limited

control and limited rights to vote on matters affecting MLPs,

potential conflicts of interest risk, cash flow risks, dilution

risks and trading risks.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any security. The Fund has

completed its initial public offering. Investors should consider

their investment goals, time horizons and risk tolerance before

investing in the Fund. An investment in the Fund is not appropriate

for all investors, and the Fund is not intended to be a complete

investment program. Investors should carefully review and consider

the Fund’s investment objective, risks, charges and expenses before

investing.

For additional information, please visit the Fund’s website

at www.GSAMFUNDS.com/cef.

© 2023 Goldman Sachs. All rights reserved. Compliance code:

312252. OTU Date of first use: 3/23/2023

1 Assets Under Supervision (AUS) includes assets under

management and other client assets for which Goldman Sachs does not

have full discretion. AUS figure as of December 31, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230323005531/en/

Media: Avery Reed Tel: 212-357-0125

Investor: Charles Sturges Tel: 212-902-7996

Goldman Sachs MLP Energy... (NYSE:GER)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

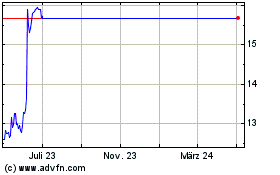

Goldman Sachs MLP Energy... (NYSE:GER)

Historical Stock Chart

Von Nov 2023 bis Nov 2024