UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-21842

First Trust Strategic High Income Fund II

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

Registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2012

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 100 F Street, NE,

Washington, DC 20549. The OMB has reviewed this collection of information under

the clearance requirements of 44 U.S.C. ss. 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

FIRST TRUST

STRATEGIC

HIGH INCOME

FUND II

SEMI-ANNUAL REPORT

FOR THE SIX MONTHS ENDED

APRIL 30, 2012

FIRST TRUST BROOKFIELD

TABLE OF CONTENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

SEMI-ANNUAL REPORT

APRIL 30, 2012

Shareholder Letter......................................................... 1

At A Glance................................................................ 2

Portfolio Commentary ...................................................... 3

Portfolio of Investments................................................... 6

Statement of Assets and Liabilities........................................ 14

Statement of Operations.................................................... 15

Statements of Changes in Net Assets........................................ 16

Statement of Cash Flows.................................................... 17

Financial Highlights....................................................... 18

Notes to Financial Statements.............................................. 19

Additional Information..................................................... 28

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

|

This report contains certain forward-looking statements within the meaning of

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934,

as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. ("First

Trust" or the "Advisor") and/or Brookfield Investment Management Inc.

("Brookfield" or the "Sub-Advisor") and their respective representatives, taking

into account the information currently available to them. Forward-looking

statements include all statements that do not relate solely to current or

historical fact. For example, forward-looking statements include the use of

words such as "anticipate," "estimate," "intend," "expect," "believe," "plan,"

"may," "should," "would" or other words that convey uncertainty of future events

or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or achievements of

First Trust Strategic High Income Fund II (the "Fund") to be materially

different from any future results, performance or achievements expressed or

implied by the forward-looking statements. When evaluating the information

included in this report, you are cautioned not to place undue reliance on these

forward-looking statements, which reflect the judgment of the Advisor and/or

Sub-Advisor and their respective representatives only as of the date hereof. We

undertake no obligation to publicly revise or update these forward-looking

statements to reflect events and circumstances that arise after the date hereof.

PERFORMANCE AND RISK DISCLOSURE

There is no assurance that the Fund will achieve its investment objectives. The

Fund is subject to market risk, which is the possibility that the market values

of securities owned by the Fund will decline and that the value of the Fund

shares may therefore be less than what you paid for them. Accordingly, you can

lose money by investing in the Fund. See "Risk Considerations" in the Notes to

Financial Statements for a discussion of certain other risks of investing in the

Fund.

Performance data quoted represents past performance, which is no guarantee of

future results, and current performance may be lower or higher than the figures

shown. For the most recent month-end performance figures, please visit

http://www.ftportfolios.com or speak with your financial advisor. Investment

returns, net asset value and common share price will fluctuate and Fund shares,

when sold, may be worth more or less than their original cost.

HOW TO READ THIS REPORT

This report contains information that may help you evaluate your investment. It

includes details about the Fund and presents data and analysis that provide

insight into the Fund's performance and investment approach.

By reading the portfolio commentary by the portfolio management team of the

Fund, you may obtain an understanding of how the market environment affected the

Fund's performance. The statistical information that follows may help you

understand the Fund's performance compared to that of relevant market

benchmarks.

It is important to keep in mind that the opinions expressed by personnel of

Brookfield are just that: informed opinions. They should not be considered to be

promises or advice. The opinions, like the statistics, cover the period through

the date on the cover of this report. The risks of investing in the Fund are

spelled out in the prospectus, the statement of additional information, this

report and other Fund regulatory filings.

SHAREHOLDER LETTER

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

SEMI-ANNUAL LETTER FROM THE CHAIRMAN AND CEO

APRIL 30, 2012

Dear Shareholders:

I am pleased to present you with the semi-annual report for your investment in

First Trust Strategic High Income Fund II (the "Fund").

The report you hold contains detailed information about your investment; a

portfolio commentary from the Fund's management team that provides a recap of

the period; a performance analysis and a market and Fund outlook. Additionally,

you will find the Fund's financial statements for the period this report covers.

I encourage you to read this document and discuss it with your financial

advisor. A successful investor is also typically a knowledgeable one, as we have

found to be the case at First Trust.

First Trust remains committed to being a long-term investor and investment

manager and to bringing you quality financial solutions regardless of market ups

and downs. We have always believed, as I have written previously, that there are

two ways to attain success in reaching your financial goals: staying invested in

quality products and having a long-term investment horizon. We are committed to

this approach in the products we manage or supervise and offer to investors.

As you know, First Trust offers a variety of products that we believe could fit

many financial plans to help investors seeking long-term investment success. We

encourage you to talk to your advisor about the other investments First Trust

offers that might also fit your financial goals and to discuss those goals with

your advisor regularly so that he or she can help keep you on track.

First Trust will continue to make available up-to-date information about your

investments so you and your financial advisor are current on any First Trust

investments you own. We value our relationship with you, and thank you for the

opportunity to assist you in achieving your financial goals. I look forward to

the remainder of 2012 and to the next edition of your Fund's report.

Sincerely,

/s/ James A. Bowen

James A. Bowen

Chairman of the Board of Trustees of First Trust Strategic High Income Fund II

and Chief Executive Officer of First Trust Advisors L.P.

|

Page 1

FIRST TRUST STRATEGIC HIGH INCOME FUND II

"AT A GLANCE"

AS OF APRIL 30, 2012 (UNAUDITED)

FUND STATISTICS

Symbol on New York Stock Exchange FHY

Common Share Price $17.34

Common Share Net Asset Value ("NAV") $16.69

Premium (Discount) to NAV 3.89%

Net Assets Applicable to Common Shares $135,437,434

Current Monthly Distribution per Common Share (1) $0.1300

Current Annualized Distribution per Common Share $1.5600

Current Distribution Rate on Closing Common Share Price (2) 9.00%

Current Distribution Rate on NAV (2) 9.35%

-------------------------------------------------------------------------

|

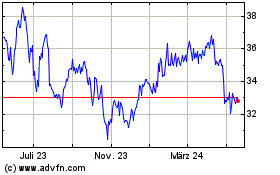

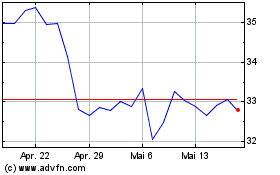

COMMON SHARE PRICE & NAV (WEEKLY CLOSING PRICE)(5)

Common Share Price NAV

4/11 15.48 17.16

15.15 17.16

15.69 17.22

15.66 17.34

5/11 15.87 17.28

15.63 17.10

15.54 16.95

15.12 16.80

6/11 15.60 16.77

15.45 16.80

15.60 16.98

15.39 16.95

15.54 17.04

7/11 15.27 17.01

14.40 16.47

14.10 15.78

14.10 15.99

8/11 14.22 15.78

14.52 15.99

14.22 15.96

14.43 15.90

14.10 15.48

9/11 13.83 15.09

13.12 14.84

13.46 15.29

13.75 15.65

14.53 16.18

10/11 14.51 16.17

14.22 16.03

14.44 15.88

14.35 15.73

11/11 14.23 15.48

14.44 15.68

14.57 15.81

14.50 15.81

15.12 15.91

12/11 15.28 16.00

15.08 16.02

15.15 16.14

15.71 16.28

1/12 16.20 16.51

16.63 16.49

16.89 16.42

16.60 16.53

2/12 17.66 16.64

17.48 16.62

17.41 16.52

17.06 16.56

17.15 16.56

3/12 17.31 16.62

17.07 16.49

17.09 16.45

17.36 16.54

17.35 16.67

4/12 17.34 16.69

|

-------------------------------------------------------------------------------------------------------------------

PERFORMANCE

-------------------------------------------------------------------------------------------------------------------

Average Annual Total Return

-------------------------------------

6 Months Ended 1 Year Ended 5 Years Ended Inception (3/28/2006)

4/30/2012 4/30/2012 4/30/2012 to 4/30/2012

FUND PERFORMANCE (3)

NAV 8.34% 8.89% -10.30% -6.28%

Market Value 25.44% 25.41% -10.36% -6.40%

INDEX PERFORMANCE

Barclays Capital Ba U.S. High Yield Index 6.46% 7.53% 9.03% 9.16%

-------------------------------------------------------------------------------------------------------------------

|

---------------------------------------------------------------------

% OF TOTAL

ASSET CLASSIFICATION INVESTMENTS

----------------------------------------------------------------------

Corporate Bonds and Notes 79.3%

Residential Mortgage-Backed Securities 8.8

Foreign Corporate Bonds and Notes 5.6

Manufactured Housing Loans 3.1

Commercial Mortgage-Backed Securities 2.9

Senior Floating-Rate Loan Interests 0.3

Collateralized Debt Obligations 0.0*

Equity 0.0*

U.S. Government Agency Mortgage-Backed Securities 0.0*

-------------------------------------------------------------------

Total 100.0%

======

|

* Amount is less than 0.1%.

---------------------------------------------------------

% OF TOTAL

FIXED-INCOME

CREDIT QUALITY (4) INVESTMENTS

--------------------------------------------------------

AAA 1.0%

A- 1.1

BBB- 4.0

BB+ 6.4

BB 9.7

BB- 13.4

B+ 14.6

B 14.1

B- 17.2

CCC+ 9.8

CCC 1.3

CCC- 0.4

CC 3.7

C 1.8

D 1.1

NR 0.4

------------------------------------------------------

Total 100.0%

======

|

(1) Most recent distribution paid or declared through 4/30/2012. Subject to

change in the future. The distribution was increased subsequent to

4/30/2012. See Note 10-Subsequent Events in the Notes to Financial

Statements.

(2) Distribution rates are calculated by annualizing the most recent

distribution paid or declared through the report date and then dividing by

Common Share price or NAV, as applicable, as of 4/30/2012. Subject to

change in the future.

(3) Total return is based on the combination of reinvested dividend, capital

gain and return of capital distributions, if any, at prices obtained by

the Dividend Reinvestment Plan and changes in NAV per share for net asset

value returns and changes in Common Share price for market value returns.

Total returns do not reflect sales load and are not annualized for periods

less than one year. Past performance is not indicative of future results.

(4) The credit quality and ratings information presented above reflects the

ratings assigned by one or more nationally recognized statistical rating

organizations (NRSROs), including Standard & Poor's Ratings Group, a

division of the McGraw Hill Companies, Inc., Moody's Investors Service,

Inc. or a comparably rated NRSRO. For situations in which a security is

rated by more than one NRSRO and the ratings are not equivalent, the

highest ratings are used. Sub-investment grade ratings are those rated

BB+/Ba1 or lower. Investment grade ratings are those rated BBB-/Baa3 or

higher.

(5) All Common Share prices and NAVs have been adjusted as a result of the

1-for-3 reverse share split on September 30, 2011.

NR Not rated.

Page 2

PORTFOLIO COMMENTARY

FIRST TRUST STRATEGIC HIGH INCOME FUND II (FHY)

SEMI-ANNUAL REPORT

APRIL 30, 2012

SUB-ADVISOR

BROOKFIELD INVESTMENT MANAGEMENT INC.

Brookfield Investment Management Inc. ("Brookfield") serves as the Fund's

Sub-Advisor. Brookfield is a wholly-owned subsidiary of Brookfield Asset

Management, a global alternative asset manager with approximately $150 billion

in assets under management as of March 31, 2012. Brookfield Asset Management has

over a 100-year history of owning and operating assets with a focus on property,

renewable power, infrastructure and private equity and also offers a range of

public and private investment products and services. On behalf of its clients,

Brookfield Asset Management is also an active investor in the public securities

markets.

The public market activities of Brookfield, an SEC-registered investment

advisor, complement the firm's core competencies as a direct investor. These

activities encompass global listed real estate and infrastructure equities,

corporate high-yield investments, opportunistic credit strategies and a

dedicated insurance asset management division. Headquartered in New York, NY,

Brookfield maintains offices and investment teams in Toronto, Chicago, Boston

and London.

PORTFOLIO MANAGEMENT TEAM

DANA E. ERIKSON, CFA

MANAGING DIRECTOR

Mr. Erikson, Senior Portfolio Manager and the Head of the Global High Yield

Team, is responsible for the firm's corporate high-yield exposures and the

establishment of portfolio objectives and strategies. Mr. Erikson joined

Brookfield in 2006 and has 25 years of investment experience. Prior to joining

the firm, he was with Evergreen Investments or one of its predecessor firms

since 1996. He was a senior portfolio manager and the Head of the High Yield

team. Prior to that, he was Head of High Yield Research. Mr. Erikson received a

Bachelor of Arts in Economics from Brown University and an MBA, with honors,

from Northeastern University. He is a member of the Boston Security Analysts

Society. He holds the Chartered Financial Analyst ("CFA") designation.

ANTHONY BREAKS, CFA

DIRECTOR

Mr. Breaks is a Portfolio Manager on the Securitized Products Investments team.

Mr. Breaks joined Brookfield in 2002 and is one of four team leaders in

mortgage-backed securities ("MBS") and asset-backed securities ("ABS") and is a

member of the team's securities analysis committee. In his role, Mr. Breaks is

one of the team's portfolio managers. Mr. Breaks also has managed securitized

product vehicles, such as structured investment vehicles ("SIVs"), asset-backed

commercial paper ("ABCP") and collateralized debt obligations ("CDOs") for

Brookfield and has experience in insurance company asset management. Mr. Breaks

earned a Bachelor of Science degree in Electrical Engineering from the

Massachusetts Institute of Technology. He holds the CFA designation.

COMMENTARY

FIRST TRUST STRATEGIC HIGH INCOME FUND II

The primary investment objective of the First Trust Strategic High Income Fund

II ("FHY" or the "Fund") is to seek a high level of current income. The Fund

seeks capital growth as a secondary objective. The Fund seeks to achieve its

investment objectives by investing in a diversified portfolio of

below-investment grade and investment grade debt securities and equity

securities that the Sub-Advisor believes offer attractive yield and/or capital

appreciation potential. There can be no assurance that the Fund will achieve its

investment objectives. The Fund may not be appropriate for all investors.

MARKET RECAP AND OUTLOOK

High Yield

Following a challenging summer, markets turned decidedly positive, producing

strong returns for the six-month period ended April 30, 2012. High-yield bonds

returned 6.5% as the spread narrowed from 707 basis points to 604 basis points.

In addition to spread narrowing, the yield on the benchmark 10-year U.S.

Treasury bond fell from 2.35% to 1.91%, which provided a tailwind for the

high-yield market. Equity returns, as measured by the Russell 2000 Index, were

positive at 11.03%. High-yield bonds tend to be positively correlated to the

Russell 2000 Index; therefore, we monitor the index closely.

In the fourth calendar quarter of 2011, markets recovered from a summer sell-off

which had been triggered by yet another bout of concern over the health of the

weaker European countries, particularly Greece. In the first calendar quarter of

2012, investors remained positive as fears of a double-dip recession in the U.S.

receded. At the end of the period, we saw a modest short-lived scare that the

Federal Reserve might not be able to keep interest rates low through 2014 as

promised. Despite this, the high-yield market turned in its strongest first

quarter performance since 2003.

Page 3

PORTFOLIO COMMENTARY - (CONTINUED)

The spread between high-yield bonds and the 10-year U.S. Treasury, which had

risen with recession fears in mid-2011, continued their recovery as confidence

in the U.S. economy returned. Current spreads of 604 basis points remain much

wider than the 400 - 500 basis points we would normally expect to see at this

point in the credit cycle. As such, we believe the market continues to represent

value to investors. Although, with the market as a whole now trading above par,

further price appreciation is likely to be limited. As is typical in a bull

market, the more volatile CCC-rated securities outperformed over the period,

returning 8.5%, compared with 5.9% from the more conservative BB-rated

securities.

Corporate credit has been sound for the past two years, and remained so, with

the default rate steady at 2.1%.(1) Note that this year's default rate of 2.1%

remains well below the market's 25-year average default rate of 4.2%.(2)

Credit ratings agencies confirmed the improving trend in corporate credit, by

upgrading 1.1 times as many high-yield companies as were downgraded in the past

12 months.(3) This means that credit is still improving, albeit at a slower rate

than before. We noted that companies reported generally good earnings through

the fourth quarter of 2011 (the latest reporting period); however, we saw some

decline in the rate of improvement, with more companies reporting pressure on

their costs.

Supply and demand was generally positive during the six-month reporting period

and high-yield mutual funds continued to experience strong inflows.(4) New issue

volume was strong as well, accelerating to an all-time quarterly record of $96.8

billion, up from $35.5 billion last quarter and above the previous record of

$81.8 billion posted in the second quarter of last year. Overall, with money

flooding into mutual funds, deals were oversubscribed and traded higher in the

aftermarket. Traders report that there seems to be ample cash available for

reasonably creditworthy names and report some challenges buying good quality

paper in the secondary market. The bulk of new issues are used to refinance debt

which has the effect of improving credit quality by eliminating near-term

maturities.

Brookfield has been positive on the high-yield market, noting the robust credit

quality, good corporate liquidity, and excellent progress on the part of

corporate treasurers in managing their debt structures. The high-yield market

agreed and returns were positive. As these fundamentals remain in place, we

continue to view the market favorably over the medium term, absent any changes

in the macro environment. Nonetheless, we also believe that significant further

potential upside appreciation is limited due to the decline in spreads and the

return of the average price of the market to above par. While we would typically

expect the spread to be 100 - 150 basis points narrower than current levels, we

note the unusually depressed level of the benchmark Treasury yields, which may

be artificially depressed due to actions by the Federal Reserve. With the market

trading at yield levels within 50 basis points of all-time lows, our enthusiasm

is somewhat tempered at this point.

Given our expectation of moderate economic growth, modestly increasing defaults,

although no general recession, we believe that high-yield investors are

adequately, although not generously compensated, at current yield spread levels.

We remain skeptical that the problems in Europe are permanently addressed, and

wonder if investors might not question the health of the United States' balance

sheet after the November election. With these risks outstanding, we expect

high-yield investors will continue to demand a premium to historical spreads, at

least for the next few quarters. For investors seeking to clip the current

coupon offered in the high-yield market, the investment landscape remains

attractive.

Securitized Products

Securitized Products performed well during the six-month period, with "Risk On"

being the dominant theme. Trading activity was brisk for the period as large

amounts of supply met strong demand from insurance companies and money managers.

Supply included the last of Maiden Lane II, the Fed's Special Purpose Vehicle

("SPV") that purchased AIG's structured assets during the 2008 crisis. Although

issuance of Residential Mortgage-Backed Securities ("RMBS") continued to be

light, there were three new issue deals announced in the first quarter, two with

new prime collateral and one with re-performing subprime collateral. Commercial

mortgage-backed securities ("CMBS") issuance continued its recovery with $4

billion in new deals this quarter.

Economic signs have been stronger in the U.S., especially as warm weather seems

to have pulled forward some of the consumption typically associated with a

second quarter spring thaw. Unemployment continues to fall and consumer

confidence is rising. Given the data and minutes from the Federal Open Market

Committee meeting, a third round of Fed bond buying, so called "QE3", now seems

unlikely. Government policy remains accommodative and the low-yield environment

is drawing investors toward higher yielding sectors such as RMBS and CMBS.

European news was generally mixed but the strong uptake of Long-Term Refinancing

Operations II ("LTRO") buoyed European markets and kept global investors feeling

bullish. This bullish sentiment has also caused yields to converge as the

premium for riskier assets has narrowed, which has increased our preference for

stability and income.

From a real estate fundamental perspective, our current projection for home

prices is a further decline of 6.2% for the 2012 year-end. This is a reduction

from our 9.2% decline projection at year-end. As we approach a nadir in the

national averages, we expect to see more regional real estate markets tighten

and for strategic default to look less appealing to underwater borrowers.

(1) JP Morgan, High Yield Default Monitor, May 1, 2012 p. 2.

(2) JP Morgan, High Yield Default Monitor, May 1, 2012 p. 2.

(3) JP Morgan, High Yield Default Monitor, May 1, 2012 p. 10.

(4) Credit Suisse "Leveraged Finance Strategy Update," April 2, 2012, p. 2.

Page 4

PORTFOLIO COMMENTARY - (CONTINUED)

More than 90% of new mortgages, including refinancing, are now guaranteed by

Fannie Mae, Freddie Mac or Ginnie Mae, so any changes to government programs

could be an important driver of performance. Based on the published score card

memo, we now believe that the Federal Housing Finance Agency will begin

attempting to combine Fannie Mae and Freddie Mac and to sell first loss

protection in some future RMBS transactions. We also expect continued increases

in Ginnie Mae's insurance premiums as this is the only source of funds to

replenish its dwindling reserve fund. These dynamics work against the White

House's policies expanding credit access. On the margin, this will most likely

result in a stalemate and a low chance of greatly expanded credit.

Last quarter, we posted positive returns in structured products on improving

forecasts for collateral performance and lower required yields from investors.

These dynamics are still intact as we enter the second quarter. With a

contraction in the premium for risk, we remain focused on stability and income.

We believe bonds with these characteristics will be the first choice for more

conventional investors dipping a toe back into this market. By contrast, more

volatile bonds tend to rally more with a "risk on" market; however, if their

fundamental risks remain unresolved, it will be difficult to harvest the paper

gain. For these reasons, we continue to emphasize senior Prime RMBS, CMBS and

seasoned Manufactured Housing.

PERFORMANCE ANALYSIS

For the six months ended April 30, 2012, the Fund had a total return(5) of

8.34% based on net asset value ("NAV"). For the period, the Fund traded from a

discount to NAV of -10.27% to a premium to NAV of 3.89%, resulting in a total

return5 of 25.44%, based on market price.

The total return for the Fund's benchmark, the Barclays Capital Ba U.S. High

Yield Index, was 6.46% for the six months ended April 30, 2012. While the

benchmark contains mostly corporate debt, it is important to note that the Fund

maintained exposure to structured finance and mortgage-related securities during

the period.

Contributors to the Fund's performance included USG Corp, Pulte Group and

American Reprographics. USG Corp, a building products company, and Pulte Group,

a homebuilder, both benefitted from an improved outlook for residential home

construction. American Reprographics, a printing company, recovered after

underperforming in the prior period. Within the Fund's securitized products

allocation, CMBS was a strong contributor, including the AJ class of Greenwich

Capital Commercial Fund Corp. Series 2007-GG11, a Vornado CMBS class D Note and

an RMBS bond, Residential Accredit Loans, Inc. Series 2007-QS6 A2, which has a

particularly high inverse floating coupon.

Detractors from performance included Niska Gas, a natural gas storage company,

whose bonds fell on weakness in natural gas prices. An additional detractor from

performance included BALL 2005-MIB L, a junior CMBS that has suffered as more

loans fell delinquent but which we feel will recover well.

An important factor impacting the return of the Fund relative to its benchmarks

was the Fund's use of financial leverage through the use of bank borrowings. The

Fund uses leverage because its managers believe that, over time, leverage

provides opportunities for additional income and total return for common

shareholders. However, the use of leverage can also expose common shareholders

to additional volatility. For example, as the prices of securities held by the

Fund decline, the negative impact of the evaluation changes on Common Share NAV

and Common shareholder total return is magnified by the use of leverage.

Conversely, leverage may enhance Common Share returns during periods when the

prices of securities held by the Fund generally are rising. Leverage had a

positive impact on the performance of the Fund over this reporting period.

DISCLOSURE

Fixed-income investing entails credit risks and interest rate risks. When

interest rates rise, bond prices generally fall, and the Fund's share prices can

fall. Investments in below-investment grade ("high-yield" or "junk") bonds are

more at risk of default and are subject to liquidity risk. Mortgage-backed

securities are subject to prepayment risk.

This management discussion contains certain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking

statements that are based on various assumptions (some of which are beyond our

control) may be identified by reference to a future period or periods or by the

use of forward-looking terminology, such as "may," "will," "believe," "expect,"

"anticipate," "continue," "should," "intend," or similar terms or variations on

those terms or the negative of those terms. Although we believe that the

expectations contained in any forward-looking statement are based on reasonable

assumptions, we can give no assurance that our expectations will be attained. We

do not undertake, and specifically disclaim any obligation, to publicly release

any update or supplement to any forward-looking statements to reflect the

occurrence of anticipated or unanticipated events or circumstances after the

date of such statements.

Opinions expressed herein are as of April 30, 2012 and subject to change.

(5) Total return is based on the combination of reinvested dividend,

capital gain and return of capital distributions, if any, at prices

obtained by the Dividend Reinvestment Plan and changes in NAV per share

for net asset value returns and changes in Common Share price for

market value returns. Total returns do not reflect sales load and are

not annualized for periods less than one year. Past performance is not

indicative of future results.

Page 5

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

CORPORATE BONDS AND NOTES - 107.2%

AUTOMOTIVE - 5.3%

$ 1,750,000 American Axle & Manufacturing, Inc. (a)...... 7.88% 03/01/17 $ 1,815,625

1,500,000 Ford Motor Co. (a)........................... 6.50% 08/01/18 1,695,000

1,950,000 Pittsburgh Glass Works LLC (a) (b)........... 8.50% 04/15/16 1,930,500

425,000 Tenneco, Inc. ............................... 6.88% 12/15/20 459,000

1,270,000 Visteon Corp. (a)............................ 6.75% 04/15/19 1,314,450

------------

7,214,575

------------

BASIC INDUSTRY - 18.5%

1,715,000 AK Steel Corp. (a)........................... 7.63% 05/15/20 1,654,975

1,675,000 Arch Coal, Inc. (a).......................... 8.75% 08/01/16 1,687,563

1,750,000 Associated Materials LLC (a)................. 9.13% 11/01/17 1,583,750

500,000 Building Materials Corp. of America (b)...... 6.75% 05/01/21 521,875

775,000 Consol Energy, Inc. (a)...................... 8.25% 04/01/20 817,625

1,160,000 Georgia-Pacific LLC (a)...................... 7.38% 12/01/25 1,459,413

415,000 Georgia-Pacific LLC (a)...................... 7.25% 06/01/28 498,588

1,750,000 Hexion U.S. Finance Corp./Hexion Nova

Scotia Finance ULC (a).................... 8.88% 02/01/18 1,841,875

1,100,000 Huntsman International LLC (a)............... 8.63% 03/15/21 1,260,875

1,750,000 Ply Gem Industries, Inc. (a)................. 8.25% 02/15/18 1,728,125

1,700,000 Polymer Group, Inc. (a)...................... 7.75% 02/01/19 1,823,250

1,600,000 Steel Dynamics, Inc. (a)..................... 7.63% 03/15/20 1,768,000

1,250,000 United States Steel Corp. (a)................ 7.00% 02/01/18 1,287,500

675,000 United States Steel Corp. (a)................ 7.38% 04/01/20 693,563

2,100,000 USG Corp. (a) (c)............................ 9.75% 01/15/18 2,157,750

1,225,000 Verso Paper Holdings LLC/Verso Paper,

Inc. (b).................................. 11.75% 01/15/19 1,318,406

1,725,000 Westlake Chemical Corp. (a).................. 6.63% 01/15/16 1,768,125

1,355,000 Xerium Technologies, Inc. (a)................ 8.88% 06/15/18 1,138,200

------------

25,009,458

------------

CAPITAL GOODS - 10.3%

1,750,000 Berry Plastics Corp. (a)..................... 9.50% 05/15/18 1,863,750

1,750,000 Coleman Cable, Inc. (a)...................... 9.00% 02/15/18 1,855,000

1,700,000 Crown Cork & Seal Co., Inc. (a).............. 7.38% 12/15/26 1,785,000

1,255,000 Mueller Water Products, Inc. (a)............. 7.38% 06/01/17 1,264,412

1,750,000 Owens-Illinois, Inc. (a)..................... 7.80% 05/15/18 1,986,250

2,100,000 Reynolds Group Issuer, Inc./Reynolds Group

Issuer LLC (a) (b)......................... 9.00% 04/15/19 2,121,000

1,100,000 Terex Corp. (a).............................. 8.00% 11/15/17 1,157,750

650,000 Terex Corp. ................................. 6.50% 04/01/20 669,500

1,125,000 Trimas Corp. (a)............................. 9.75% 12/15/17 1,254,375

------------

13,957,037

------------

CONSUMER CYCLICAL - 6.9%

1,100,000 ACCO Brands Corp. (a)........................ 10.63% 03/15/15 1,202,245

750,000 ACE Hardware Corp. (a) (b)................... 9.13% 06/01/16 789,383

1,750,000 Levi Strauss & Co. (a)....................... 7.63% 05/15/20 1,887,812

1,775,000 Limited Brands, Inc. (a)..................... 7.60% 07/15/37 1,801,625

560,000 Neiman Marcus Group, Inc. (a)................ 10.38% 10/15/15 589,406

|

Page 6 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

CORPORATE BONDS AND NOTES - (Continued)

CONSUMER CYCLICAL - (Continued)

$ 1,725,000 Pharmaceutical Product Development,

Inc. (b).................................. 9.50% 12/01/19 $ 1,897,500

550,000 Phillips-Van Heusen Corp. (a)................ 7.38% 05/15/20 610,500

550,000 Rite Aid Corp. (a)........................... 9.75% 06/12/16 614,625

------------

9,393,096

------------

CONSUMER NON-CYCLICAL - 3.4%

1,700,000 B&G Foods, Inc. (a).......................... 7.63% 01/15/18 1,836,000

1,069,000 C&S Group Enterprises LLC (b)................ 8.38% 05/01/17 1,138,485

425,000 Cott Beverages, Inc. (a)..................... 8.13% 09/01/18 462,187

1,000,000 Easton-Bell Sports, Inc. (a)................. 9.75% 12/01/16 1,111,250

------------

4,547,922

------------

ENERGY - 19.1%

1,700,000 Breitburn Energy Partners LP/Breitburn

Finance Corp. (a)......................... 8.63% 10/15/20 1,819,000

425,000 Calfrac Holdings LP (a) (b).................. 7.50% 12/01/20 418,625

1,475,000 Chaparral Energy, Inc. ...................... 8.88% 02/01/17 1,547,835

1,675,000 Crosstex Energy LP/Crosstex Energy

Finance Corp. (a)......................... 8.88% 02/15/18 1,804,812

2,060,000 EV Energy Partners LP/EV Energy

Finance Corp. ............................ 8.00% 04/15/19 2,111,500

787,000 GMX Resources, Inc. (a) (b).................. 11.00% 12/01/17 672,885

1,050,000 Hercules Offshore LLC (a) (b)................ 10.50% 10/15/17 1,102,500

1,700,000 Hilcorp Energy I LP/Hilcorp Finance

Co. (a) (b)............................... 8.00% 02/15/20 1,865,750

1,750,000 Key Energy Services, Inc. (a)................ 6.75% 03/01/21 1,811,250

800,000 Linn Energy LLC Linn Energy Finance

Corp. .................................... 7.75% 02/01/21 848,000

945,000 Linn Energy LLC/Linn Energy Finance

Corp. (a)................................ 8.63% 04/15/20 1,037,138

1,750,000 McJunkin Red Man Corp. (a)................... 9.50% 12/15/16 1,938,125

1,840,000 Niska Gas Storage US LLC/Niska Gas

Storage Canada ULC (a).................... 8.88% 03/15/18 1,743,400

1,275,000 Pioneer Natural Resources Co. (a)............ 6.65% 03/15/17 1,452,819

1,675,000 Plains Exploration & Production Co. (a)...... 7.63% 06/01/18 1,792,250

650,000 Quicksilver Resources, Inc. (a).............. 11.75% 01/01/16 687,375

600,000 Sesi LLC (a)................................. 6.88% 06/01/14 604,500

250,000 Vanguard Natural Resources LLC/VNR

Finance Corp. ............................ 7.88% 04/01/20 250,938

2,100,000 Venoco, Inc. (a)............................. 8.88% 02/15/19 1,979,250

415,000 W&T Offshore, Inc. .......................... 8.50% 06/15/19 439,900

------------

25,927,852

------------

FINANCIAL SERVICES - 1.1%

1,475,000 Level 3 Financing, Inc. (b).................. 8.63% 07/15/20 1,548,750

-------------

HEALTHCARE - 2.8%

1,750,000 HCA, Inc. (a)................................ 8.00% 10/01/18 1,953,437

900,000 Health Management Associates, Inc. (b)....... 7.38% 01/15/20 941,625

|

See Notes to Financial Statements Page 7

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

CORPORATE BONDS AND NOTES - (Continued)

HEALTHCARE - (Continued)

$ 1,045,000 Inventiv Health, Inc. (b).................... 10.00% 08/15/18 $ 943,113

------------

3,838,175

------------

MEDIA - 9.3%

1,700,000 American Reprographics Co. (a)............... 10.50% 12/15/16 1,721,250

1,700,000 Cablevision Systems Corp. (a)................ 8.63% 09/15/17 1,874,250

1,700,000 CCO Holdings LLC/CCO Holdings Capital

Corp. (a).................................. 8.13% 04/30/20 1,912,500

1,700,000 Clear Channel Communications, Inc. (a)....... 9.00% 03/01/21 1,547,000

1,700,000 Deluxe Corp. (a)............................. 7.38% 06/01/15 1,738,250

1,700,000 Lamar Media Corp. (a)........................ 7.88% 04/15/18 1,867,875

1,700,000 Mediacom LLC/Mediacom Capital Corp. (a)...... 9.13% 08/15/19 1,861,500

------------

12,522,625

------------

REAL ESTATE - 1.3%

1,750,000 Realogy Corp. (a) (b)........................ 7.88% 02/15/19 1,723,750

------------

SERVICES - 18.3%

1,650,000 AMC Entertainment, Inc. (a).................. 8.75% 06/01/19 1,767,562

1,750,000 Avis Budget Car Rental LLC/Avis Budget

Finance, Inc. (a)......................... 8.25% 01/15/19 1,841,875

850,000 Beazer Homes USA, Inc. (a)................... 9.13% 06/15/18 726,750

1,400,000 Caesars Entertainment Operating Co., Inc. (a). 11.25% 06/01/17 1,554,000

650,000 Caesars Entertainment Operating Co., Inc. (b). 8.50% 02/15/20 671,125

800,000 Cenveo Corp. ................................ 8.88% 02/01/18 740,000

1,750,000 Citycenter Holdings LLC/Citycenter

Finance Corp. (a)......................... 7.63% 01/15/16 1,863,750

600,000 FireKeepers Development Authority (a) (b).... 13.88% 05/01/15 663,000

1,650,000 Iron Mountain, Inc. (a)...................... 8.75% 07/15/18 1,722,188

1,700,000 Marina District Finance Co., Inc. (a)........ 9.88% 08/15/18 1,640,500

1,750,000 MGM Resorts International (a)................ 7.63% 01/15/17 1,824,375

525,000 MGM Resorts International (b)................ 8.63% 02/01/19 572,906

542,700 MTR Gaming Group, Inc. ...................... 11.50% 08/01/19 545,414

1,000,000 National Cinemedia LLC (b)................... 6.00% 04/15/22 1,022,500

1,700,000 Palace Entertainment Holdings LLC/Palace

Entertainment Holdings Corp. (a) (b)...... 8.88% 04/15/17 1,759,500

2,100,000 Pulte Group, Inc. (a)........................ 6.38% 05/15/33 1,758,750

875,000 RSC Equipment Rental, Inc./RSC

Holdings III LLC (a)...................... 10.25% 11/15/19 988,750

875,000 RSC Equipment Rental, Inc./RSC

Holdings LLC ............................. 8.25% 02/01/21 949,375

2,100,000 Standard Pacific Corp. (a)................... 8.38% 05/15/18 2,231,250

------------

24,843,570

------------

TECHNOLOGY & ELECTRONICS - 2.7%

88,000 First Data Corp. ............................ 9.88% 09/24/15 89,100

1,750,000 First Data Corp. (a) (b)..................... 8.25% 01/15/21 1,732,500

1,775,000 Freescale Semiconductor, Inc. (a)............ 8.05% 02/01/20 1,797,187

------------

3,618,787

------------

|

Page 8 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

CORPORATE BONDS AND NOTES - (Continued)

TELECOMMUNICATIONS - 6.4%

$ 860,000 Cincinnati Bell, Inc. (a).................... 8.25% 10/15/17 $ 894,400

900,000 Cincinnati Bell, Inc. (a).................... 8.75% 03/15/18 848,250

1,750,000 Frontier Communications (a).................. 7.13% 03/15/19 1,754,375

1,700,000 PAETEC Holding Corp. (a)..................... 9.88% 12/01/18 1,933,750

1,450,000 Qwest Corp. (a).............................. 6.88% 09/15/33 1,462,687

1,725,000 Windstream Corp. (a)......................... 7.00% 03/15/19 1,768,125

------------

8,661,587

------------

UTILITY - 1.8%

1,700,000 Calpine Corp. (a) (b)........................ 7.25% 10/15/17 1,823,250

875,000 Edison Mission Energy (a).................... 7.00% 05/15/17 551,250

------------

2,374,500

------------

TOTAL CORPORATE BONDS AND NOTES ......................................... 145,181,685

------------

(Cost $140,322,705)

MORTGAGE-BACKED SECURITIES - 12.3%

COLLATERALIZED MORTGAGE OBLIGATIONS - 9.9%

Banc of America Mortgage Securities

299,507 Series 2007-1, Class 1A26 ................. 6.00% 03/25/37 269,502

Citicorp Mortgage Securities, Inc.

2,520,358 Series 2007-2, Class 1A3 .................. 6.00% 02/25/37 2,449,383

Citigroup Mortgage Loan Trust, Inc.

846,481 Series 2006-AR6, Class 1A1 (d)............. 5.85% 08/25/36 744,398

885,401 Series 2007-AR4, Class 1A1A (d)............ 5.81% 03/25/37 773,578

Countrywide Alternative Loan Trust

292,679 Series 2006-41CB, Class 2A14 .............. 6.00% 01/25/37 192,774

Countrywide Home Loan Mortgage Pass

Through Trust

1,418,365 Series 2005-27, Class 2A1 ................. 5.50% 12/25/35 1,281,969

371,354 Series 2006-21, Class A8 .................. 5.75% 02/25/37 298,881

1,052,733 Series 2007-10, Class A5 .................. 6.00% 07/25/37 790,634

HarborView Mortgage Loan Trust

3,597,355 Series 2005-9, Class B10 (d) (e)........... 1.99% 06/20/35 176,006

MASTR Asset Securitization Trust

366,747 Series 2006-2, Class 1A10 (d).............. 6.00% 06/25/36 319,254

Residential Accredit Loans, Inc.

237,760 Series 2007-Q56, Class A2 (d).............. 53.60% 04/25/37 550,854

Residential Asset Securitization Trust

1,366,975 Series 2005-A8CB, Class A11 ............... 6.00% 07/25/35 1,151,381

Structured Asset Securities Corp.

186,808 Series 2003-10, Class A ................... 6.00% 04/25/33 196,099

|

See Notes to Financial Statements Page 9

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

MORTGAGE-BACKED SECURITIES - (Continued)

COLLATERALIZED MORTGAGE OBLIGATIONS - (Continued)

Wells Fargo Mortgage Backed Securities Trust

$ 1,392,007 Series 2006-8, Class A15 .................. 6.00% 07/25/36 $ 1,290,312

161,000 Series 2006-AR1, Class 2A5 (d)............. 5.37% 03/25/36 150,113

1,264,365 Series 2007-3, Class 1A10 ................. 5.50% 04/25/37 1,155,363

92,223 Series 2007-6, Class A6 ................... 6.00% 05/25/37 79,165

522,981 Series 2007-7, Class A38 .................. 6.00% 06/25/37 485,348

385,791 Series 2007-7, Class A6 ................... 6.00% 06/25/37 375,083

131,710 Series 2007-8, Class 1A16 ................. 6.00% 07/25/37 122,350

571,628 Series 2007-8, Class 2A2 .................. 6.00% 07/25/37 561,319

------------

13,413,766

------------

COMMERCIAL MORTGAGE-BACKED SECURITIES - 2.4%

Banc of America Large Loan, Inc.

3,000,000 Series 2005-MIB1, Class L (d) (f) (g)...... 3.24% 03/15/22 975,321

Countrywide Alternative Loan Trust

239,345 Series 2007-11T1, Class A37 (d)............ 38.59% 05/25/37 411,567

Greenwich Capital Commercial Funding Corp.

1,180,000 Series 2007-GG11, Class AJ (d)............. 6.00% 12/10/49 767,292

Vornado DP LLC

930,000 Series 2010-VNO, Class D (b)............... 6.36% 09/13/28 983,200

Washington Mutual Alternative Mortgage

Pass-Through Certificates

75,190 Series 2007-5, Class A11 (d)............... 38.05% 06/25/37 123,614

------------

3,260,994

------------

TOTAL MORTGAGE-BACKED SECURITIES ........................................ 16,674,760

------------

(Cost $17,671,456)

ASSET-BACKED SECURITIES - 7.8%

Ace Securities Corp.

1,220,000 Series 2003-MH1, Class A4 (b).............. 6.50% 08/15/30 1,301,051

BankAmerica Manufactured Housing Contract

Trust II

2,300,000 Series 1997-1, Class B1 (e)................ 6.94% 06/10/21 2,017,638

Bombardier Capital Mortgage Securitization

Corp.......................................

295,600 Series 1999-B, Class A1B .................. 6.61% 12/15/29 173,810

1,701,430 Series 1999-B, Class A3 ................... 7.18% 12/15/29 1,023,878

Citigroup Mortgage Loan Trust, Inc.

2,301,000 Series 2003-HE3, Class M4 (d).............. 3.24% 12/25/33 700,255

Conseco Finance Securitizations Corp.

2,258,312 Series 2000-6, Class M1 ................... 7.72% 09/01/31 564,105

1,363,233 Series 2001-3, Class M1 ................... 7.15% 05/01/33 783,133

Countrywide Asset-Backed Certificates

26,791 Series 2004-6, Class 2A5 (d)............... 0.63% 11/25/34 24,821

752,166 Series 2006-13, Class 3AV2 (d)............. 0.39% 01/25/37 518,902

Credit Suisse First Boston Mortgage

Securities Corp.

256,084 Series 2002-MH3, Class A .................. 6.70% 12/25/31 273,187

|

Page 10 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

ASSET-BACKED SECURITIES - (Continued)

Green Tree Financial Corp.

$ 1,191,582 Series 1996-6, Class B1 ................... 8.00% 09/15/27 $ 270,810

133,943 Series 1997-4, Class B1 ................... 7.23% 02/15/29 10,880

764,333 Series 1998-4, Class M1 ................... 6.83% 04/01/30 373,799

2,746,223 Series 1999-3, Class M1 ................... 6.96% 02/01/31 294,915

GSAMP Trust

2,871,671 Series 2006-S3, Class A2 (g)............... 6.27% 05/25/36 120,313

2,949,839 Series 2006-S5, Class A1 (d)............... 0.33% 09/25/36 53,068

IMC Home Equity Loan Trust

2,679,129 Series 1997-3, Class B .................... 7.87% 08/20/28 1,152,510

2,564,135 Series 1997-5, Class B .................... 7.59% 11/20/28 517,203

Independence III CDO, Ltd.

7,000,000 Series 3A, Class C1 (d) (f) (h)............ 2.97% 10/03/37 26,950

New Century Home Equity Loan Trust

198,000 Series 2005-A, Class A5 ................... 5.14% 08/25/35 108,319

Oakwood Mortgage Investors, Inc.

931,923 Series 1999-B, Class M1 ................... 7.18% 12/15/26 200,918

Park Place Securities, Inc.

212,569 Series 2004-WCW1, Class M8 (d)............. 3.74% 09/25/34 984

1,268,721 Series 2004-WCW2, Class M10 (d) (f)........ 2.99% 10/25/34 28,441

Summit CBO I, Ltd.

4,093,795 Series 1A, Class B (d) (f) (e)............. 1.71% 05/23/12 41

------------

TOTAL ASSET-BACKED SECURITIES ........................................... 10,539,931

(Cost $8,132,579) ------------

FOREIGN CORPORATE BONDS AND NOTES - 7.5%

AUTOMOTIVE - 1.0%

1,300,000 Jaguar Land Rover PLC (b).................... 8.13% 05/15/21 1,365,000

------------

BASIC INDUSTRY - 5.7%

1,540,000 Cascades, Inc. (a)........................... 7.88% 01/15/20 1,513,050

850,000 FMG Resources (August 2006) Pty Ltd. (b)..... 6.88% 04/01/22 864,875

1,750,000 Ineos Group Holdings Ltd. (a) (b)............ 8.50% 02/15/16 1,719,375

1,750,000 Masonite International Corp. (a) (b)......... 8.25% 04/15/21 1,828,750

1,725,000 Tembec Industries, Inc. (a).................. 11.25% 12/15/18 1,854,375

------------

7,780,425

------------

ENERGY - 0.8%

375,000 Petroleum Geo-Services Asa (b)............... 7.38% 12/15/18 390,000

645,000 Precision Drilling Corp. .................... 6.63% 11/15/20 675,638

------------

1,065,638

------------

TOTAL FOREIGN CORPORATE BONDS AND NOTES ................................. 10,211,063

(Cost $10,033,766) ------------

|

See Notes to Financial Statements Page 11

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

________________ _____________________________________________ _________ ____________ ____________

SENIOR FLOATING-RATE LOAN INTERESTS - 0.3%

UTILITY - 0.3%

$ 834,744 Texas Competitive Electric Holdings Co.,

LLC Tranche B2 (d)......................... 4.74% 10/10/17 $ 459,677

------------

TOTAL SENIOR FLOATING-RATE LOAN INTERESTS ............................... 459,677

------------

(Cost $782,870)

STRUCTURED NOTES - 0.0%

5,750,000 Preferred Term Securities XXV, Ltd. (f)...... (i) 06 22/37 575

2,500,000 Preferred Term Securities XXVI, Ltd.

Subordinated Note (f)...................... (i) 09/22/37 250

------------

TOTAL STRUCTURED NOTES .................................................. 825

------------

(Cost $0)

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES - 0.0%

COMMERCIAL MORTGAGE-BACKED SECURITIES - 0.0%

FannieMae-ACES

130,139 Series 1998-M7, Class N, IO (d)............ 0.32% 05/25/36 1

------------

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES ................. 1

(Cost $0) ------------

SHARES DESCRIPTION VALUE

________________ _________________________________________________________________________ ____________

PREFERRED SECURITIES - 0.1%

3,500 Independence III CDO, Ltd., Series 3A, Class PS (f) (i)................... 3,500

4,000 Soloso CDO, Ltd., Series 2005-1 (f) (i)................................... 40,000

9,000 White Marlin CDO, Ltd., Series AI (f) (h) (i)............................. 45,000

------------

TOTAL PREFERRED SECURITIES............................................... 88,500

(Cost $0) ------------

TOTAL INVESTMENTS - 135.2% .............................................. 183,156,442

(Cost $176,943,376) (j)

OUTSTANDING LOAN - (40.2%) .............................................. (54,400,000)

NET OTHER ASSETS AND LIABILITIES - 4.9% ................................. 6,680,992

------------

NET ASSETS - 100.0% ..................................................... $135,437,434

------------

_________________________

(a) All or a portion of this security is available to serve as

collateral on the outstanding loan.

(b) This security, sold within the terms of a private placement

memorandum, is exempt from registration upon resale under Rule 144A

under the Securities Act of 1933, as amended (the "1933 Act"), and

may be resold in transactions exempt from registration, normally to

qualified institutional buyers. Pursuant to procedures adopted by

the Fund's Board of Trustees, this security has been determined to

be liquid by Brookfield Investment Management Inc., the Fund's

sub-advisor. Although market instability can result in periods of

increased overall market illiquidity, liquidity for each security is

determined based on security specific factors and assumptions, which

require subjective judgment. At April 30, 2012, securities noted as

such amounted to $35,631,179 or 26.31% of net assets.

(c) Multi-Step Coupon Bond - Coupon steps up or down based upon ratings

changes by Standard & Poor's Ratings Group or Moody's Investors

Service, Inc. The interest rate shown reflects the rate in effect at

April 30, 2012.

(d) Floating rate security. The interest rate shown reflects the rate in

effect at April 30, 2012.

|

Page 12 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

PORTFOLIO OF INVESTMENTS - (CONTINUED)

APRIL 30, 2012 (UNAUDITED)

(e) Security missed one or more of its interest payments.

(f) This security, sold within the terms of a private placement

memorandum, is exempt from registration upon resale under Rule 144A

under the 1933 Act, and may be resold in transactions exempt from

registration, normally to qualified institutional buyers (see Note

2C - Restricted Securities in the Notes to Financial Statements).

(g) Security is receiving less than the stated coupon. (h) The issuer is

in default. Income is not being accrued.

(i) Zero coupon security.

(j) Aggregate cost for financial reporting purposes, which approximates

the aggregate cost for federal income tax purposes. As of April 30,

2012, the aggregate gross unrealized appreciation for all securities

in which there was an excess of value over tax cost was $10,184,980

and the aggregate gross unrealized depreciation for all securities

in which there was an excess of tax cost over value was $3,971,914.

ACES Alternative Credit Enhancement Securities

CBO Collateralized Bond Obligation

CDO Collateralized Debt Obligation

IO Interest-Only Security - Principal amount shown represents par value on

which interest payments are based.

|

VALUATION INPUTS

A summary of the inputs used to value the Fund's investments as of April 30,

2012 is as follows (see Note 2A - Portfolio Valuation in the Notes to Financial

Statements):

LEVEL 2 LEVEL 3

TOTAL LEVEL 1 SIGNIFICANT SIGNIFICANT

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

4/30/2012 PRICES INPUTS INPUTS

_____________ ___________ _____________ ___________

Corporate Bonds and Notes*......................... $ 145,181,685 $ -- $ 145,181,685 $ --

Mortgage-Backed Securities:

Collateralized Mortgage Obligations............ 13,413,766 -- 13,413,766 --

Commercial Mortgage-Backed Securities.......... 3,260,994 -- 3,260,994 --

Asset-Backed Securities............................ 10,539,931 -- 10,539,931 --

Foreign Corporate Bonds and Notes*................. 10,211,063 -- 10,211,063 --

Senior Floating-Rate Loan Interests*............... 459,677 -- 459,677 --

Structured Notes................................... 825 -- 825 --

U.S. Government Agency Mortgage-Backed

Securities..................................... 1 -- 1 --

Preferred Securities .............................. 88,500 -- -- 88,500

------------- ----------- ------------- -----------

TOTAL INVESTMENTS.................................. $ 183,156,442 $ -- $ 183,067,942 $ 88,500

============= =========== ============= ===========

|

* See the Portfolio of Investments for industry breakout.

The following table presents the activity of the Fund's investments measured at

fair value on a recurring basis using significant unobservable inputs (Level 3)

for the period presented.

CHANGE IN BALANCE

BALANCE AS OF TRANSFERS NET NET UNREALIZED NET AS OF

INVESTMENTS AT FAIR VALUE USING OCTOBER 31, IN (OUT) REALIZED APPRECIATION PURCHASES APRIL 30,

SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) 2011 OF LEVEL 3 GAINS (LOSSES) (DEPRECIATION) (SALES) 2012

____________________________________________________________________________________________________________________________________

Preferred Securities.................... $ 88,500 $ -- $ -- $ -- $ -- $ 88,500

|

There was no net change in unrealized appreciation (depreciation) from Level 3

investments held as of April 30, 2012.

See Notes to Financial Statements Page 13

FIRST TRUST STRATEGIC HIGH INCOME FUND II

STATEMENT OF ASSETS AND LIABILITIES

APRIL 30, 2012 (UNAUDITED)

ASSETS:

Investments, at value

(Cost $176,943,376)......................................................................... $183,156,442

Cash........................................................................................... 2,816,091

Prepaid expenses............................................................................... 21,523

Receivables:

Interest.................................................................................... 3,480,451

Investment securities sold.................................................................. 565,636

Other assets................................................................................... 10,112

------------

Total Assets............................................................................. 190,050,255

------------

LIABILITIES:

Outstanding loan............................................................................... 54,400,000

Payables:

Investment advisory fees.................................................................... 138,958

Audit and tax fees.......................................................................... 25,528

Custodian fees.............................................................................. 14,755

Administrative fees......................................................................... 13,834

Interest and fees on loan................................................................... 8,682

Transfer agent fees......................................................................... 5,697

Legal fees.................................................................................. 2,395

Trustees' fees and expenses................................................................. 2,201

Financial reporting fees.................................................................... 771

------------

Total Liabilities........................................................................ 54,612,821

------------

NET ASSETS..................................................................................... $135,437,434

============

NET ASSETS consist of:

Paid-in capital................................................................................ $206,594,007

Par value...................................................................................... 81,140

Accumulated net investment income (loss)....................................................... 2,412,479

Accumulated net realized gain (loss) on investments............................................ (79,863,258)

Net unrealized appreciation (depreciation) on investments...................................... 6,213,066

------------

NET ASSETS..................................................................................... $135,437,434

============

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share)........................... $ 16.69

============

Number of Common Shares outstanding (unlimited number of Common Shares has been authorized).... 8,113,968

============

|

Page 14 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED APRIL 30, 2012 (UNAUDITED)

INVESTMENT INCOME:

Interest...................................................................................... $ 8,354,631

------------

Total investment income..................................................................... 8,354,631

------------

EXPENSES:

Investment advisory fees....................................................................... 832,263

Interest and fees on loan...................................................................... 406,542

Legal fees..................................................................................... 115,382

Administrative fees............................................................................ 82,850

Audit and tax fees............................................................................. 34,311

Reorganization fees............................................................................ 31,983

Printing fees.................................................................................. 29,519

Transfer agent fees............................................................................ 23,414

Trustees' fees and expenses.................................................................... 14,163

Custodian fees................................................................................. 10,256

Financial reporting fees....................................................................... 4,625

Other.......................................................................................... 85,022

------------

Total expenses.............................................................................. 1,670,330

------------

NET INVESTMENT INCOME (LOSS)................................................................... 6,684,301

------------

NET REALIZED AND UNREALIZED GAIN (LOSS):

Net realized gain/loss on investments....................................................... (295,503)

Net change in unrealized appreciation (depreciation) on investments......................... 3,984,322

------------

NET REALIZED AND UNREALIZED GAIN (LOSS)........................................................ 3,688,819

------------

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS................................ $ 10,373,120

============

|

See Notes to Financial Statements Page 15

FIRST TRUST STRATEGIC HIGH INCOME FUND II

STATEMENTS OF CHANGES IN NET ASSETS

SIX MONTHS

ENDED YEAR

4/30/2012 ENDED

(UNAUDITED) 10/31/2011

______________ ______________

OPERATIONS:

Net investment income (loss)....................................................... $ 6,684,301 $ 5,613,623

Net realized gain (loss)........................................................... (295,503) 2,082,983

Net change in unrealized appreciation (depreciation)............................... 3,984,322 4,136,138

-------------- --------------

Net increase (decrease) in net assets resulting from operations.................... 10,373,120 11,832,744

-------------- --------------

DISTRIBUTIONS TO SHAREHOLDERS FROM:

Net investment income.............................................................. (6,162,152) (4,945,284)

Net realized gain.................................................................. -- --

Return of capital.................................................................. -- (651,423)

-------------- -------------

Total distributions to shareholders................................................ (6,162,152) (5,596,707)

-------------- -------------

CAPITAL TRANSACTIONS:

Proceeds from Common Shares acquired through reorganization........................ -- 74,405,197

Proceeds from Common Shares reinvested............................................. 117,020 --

-------------- -------------

Net increase (decrease) in net assets resulting from capital transactions.......... 117,020 74,405,197

-------------- -------------

Total increase (decrease) in net assets............................................ 4,327,988 80,641,234

NET ASSETS:

Beginning of period................................................................ 131,109,446 50,468,212

-------------- --------------

End of period...................................................................... $ 135,437,434 $ 131,109,446

-------------- --------------

Accumulated net investment income (loss) at end of period.......................... $ 2,412,479 $ 1,890,330

============== =============

CAPITAL TRANSACTIONS WERE AS FOLLOWS:

Common Shares at beginning of period............................................... 8,106,875 3,177,925

Common Shares issued through reorganization........................................ 7,093 4,928,950

Common Shares issued as reinvestment under the Dividend Reinvestment Plan.......... -- --

-------------- -------------

Common Shares at end of period..................................................... 8,113,968 8,106,875

============== =============

|

Page 16 See Notes to Financial Statements

FIRST TRUST STRATEGIC HIGH INCOME FUND II

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED APRIL 30, 2012 (UNAUDITED)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net increase (decrease) in net assets resulting from operations................. $ 10,373,120

Adjustments to reconcile net increase (decrease) in net assets resulting from

operations to net cash provided by operating activities:

Purchases of investments.................................................. (38,223,424)

Sales, maturities and paydowns of investments............................. 37,464,737

Net amortization/accretion of premiums/discounts on investments........... (426,690)

Net realized gain/loss on investments..................................... 295,503

Net change in unrealized appreciation/depreciation on investments......... (3,984,322)

CHANGES IN ASSETS AND LIABILITIES:

Increase in interest receivable........................................... (66,173)

Increase in prepaid expenses.............................................. (10,473)

Increase in other assets.................................................. (10,112)

Decrease in interest and fees on loan payable............................. (55,668)

Increase in investment advisory fees payable.............................. 2,476

Decrease in reorganization fees payable................................... (48,407)

Decrease in audit and tax fees payable.................................... (29,972)

Increase in legal fees payable............................................ 1,380

Decrease in printing fees payable......................................... (16,293)

Increase in administrative fees payable................................... 261

Increase in custodian fees payable........................................ 6,736

Increase in transfer agent fees payable................................... 246

Decrease in Trustees' fees and expenses payable........................... (1,311)

Decrease in other liabilities............................................. (3,112)

--------------

CASH PROVIDED BY OPERATING ACTIVITIES........................................... $ 5,268,502

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds of Common Shares reinvested...................................... 117,020

Distributions to Common Shareholders from net investment income........... (6,162,152)

--------------

CASH USED IN FINANCING ACTIVITIES............................................... (6,045,132)

-----------

Decrease in cash................................................................ (776,630)

Cash at beginning of period..................................................... 3,592,721

-----------

CASH AT END OF PERIOD........................................................... $ 2,816,091

===========

SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION:

Cash paid during the period for interest and fees............................... $ 462,210

===========

|

See Notes to Financial Statements Page 17

FIRST TRUST STRATEGIC HIGH INCOME FUND II

FINANCIAL HIGHLIGHTS

FOR A COMMON SHARE OUTSTANDING THROUGHOUT EACH PERIOD

ALL SHARE AMOUNTS, NET ASSET VALUES AND MARKET VALUES HAVE BEEN ADJUSTED AS A

RESULT OF THE 1-FOR-3 REVERSE SHARE SPLIT ON SEPTEMBER 30, 2011.

SIX MONTHS

ENDED YEAR YEAR YEAR YEAR YEAR

4/30/2012 ENDED ENDED ENDED ENDED ENDED

(UNAUDITED) 10/31/2011 10/31/2010 (a) 10/31/2009 (b) 10/31/2008 10/31/2007

__________ __________ ____________ ____________ __________ __________

Net asset value, beginning of period ....... $ 16.17 $ 15.87 $ 14.22 $ 25.56 $ 48.93 $ 60.54

--------- --------- --------- ----------- ---------- ---------

INCOME FROM INVESTMENT OPERATIONS:

Net investment income (loss) ............... 0.82 0.59 1.86 3.87 6.12 7.26

Net realized and unrealized gain (loss)..... 0.46 0.32 1.17 (11.31) (23.49) (12.87)

--------- --------- --------- ----------- ---------- ---------

Total from investment operations ........... 1.28 0.91 3.03 (7.44) (17.37) (5.61)

--------- --------- --------- ----------- ---------- ---------

Distributions paid to shareholders from:

Net investment income ...................... (0.76) (0.54) -- (0.27) (5.13) (5.85)

Net realized gain .......................... -- -- -- -- -- (0.15)

Return of capital .......................... -- (0.07) (1.38) (3.63) (0.87) --

--------- --------- --------- ----------- ---------- ---------

Total from distributions ................... (0.76) (0.61) (1.38) (3.90) (6.00) (6.00)

--------- --------- --------- ----------- ---------- ---------

Net asset value, end of period ............. $ 16.69 $ 16.17 $ 15.87 $ 14.22 $ 25.56 $ 48.93

========= ========= ========= =========== ========== =========

Market value, end of period ................ $ 17.34 $ 14.51 $ 14.49 $ 13.17 $ 21.45 $ 45.33

========= ========= ========= =========== ========== =========

Total return based on net asset value (c)... 8.34% 13.60% 23.46% (28.92)% (37.09)% (9.92)%

========= ========= ========= =========== ========== =========

Total return based on market value (c)...... 25.44% 11.64% 21.71% (22.00)% (42.84)% (19.21)%

========= ========= ========= =========== ========== =========

----------------------------------------------

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA:

Net assets, end of period (in 000's) ....... $ 135,437 $ 131,109 $ 50,468 $ 45,159 $ 80,740 $ 154,131

Ratio of net expenses to average net assets 2.55% (d) 2.35% 2.29% 1.77% 4.09% 4.19%

Ratio of total expenses to average net assets

excluding interest expense ............... 1.93% (d) 1.93% 2.21% 1.77% 2.45% 1.74%

Ratio of net investment income (loss) to

average net assets ....................... 10.10% (d) 9.65% 12.54% 22.79% 16.48% 12.64%

Portfolio turnover rate ..................... 21% 49% 332% (e) 147% (e) 4% 21%

INDEBTEDNESS:

Total loan outstanding (in 000's) ........... $ 54,400 $ 54,400 N/A N/A N/A $ 67,000

Asset coverage per $1,000 of indebtedness (f) $ 3,490 $ 3,410 N/A N/A N/A $ 3,300

----------------------------------------------

(a) On September 20, 2010, the Fund's Board of Trustees approved an interim

investment management agreement with First Trust Advisors L.P. and an

interim investment sub-advisory agreement with Brookfield Investment

Management Inc. (formerly known as Hyperion Brookfield Asset Management,

Inc.) ("Brookfield"), and on December 20, 2010, the Shareholders voted to

approve new such agreements.

(b) On June 29, 2009, the Fund's Board of Trustees approved an interim

sub-advisory agreement with Brookfield, and on October 14, 2009, the

Shareholders voted to approve a new sub-advisory agreement with

Brookfield.

(c) Total return is based on the combination of reinvested dividend, capital

gain and return of capital distributions, if any, at prices obtained by

the Dividend Reinvestment Plan, and changes in net asset value per share

for net asset value returns and changes in Common Share price for market

value returns. Total returns do not reflect sales load and are not

annualized for periods less than one year. Past performance is not

indicative of future results.

(d) Annualized.

(e) For the fiscal years ended October 31, 2010 and 2009, the Fund's portfolio

turnover rate reflected mortgage pool forward commitments as purchases and

sales. This caused the reported portfolio turnover rate to be higher than

in previous and subsequent fiscal years. The turnover rate may vary

greatly from year to year as well as within a year.

(f) Calculated by subtracting the Fund's total liabilities (not including the

loan outstanding) from the Fund's total assets, and dividing by the

outstanding loan balance in 000's.

N/A Not applicable.

|

Page 18 See Notes to Financial Statements

NOTES TO FINANCIAL STATEMENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND II

APRIL 30, 2012 (UNAUDITED)

1. FUND DESCRIPTION

First Trust Strategic High Income Fund II (the "Fund") is a diversified,

closed-end management investment company organized as a Massachusetts business

trust on January 18, 2006, and is registered with the Securities and Exchange

Commission ("SEC") under the Investment Company Act of 1940, as amended (the