Form DEFA14A - Additional definitive proxy soliciting materials and Rule 14(a)(12) material

08 März 2024 - 11:21PM

Edgar (US Regulatory)

As filed with the Securities and Exchange

Commission on March 8, 2024

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant

to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

First Trust/abrdn Global

Opportunity Income Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act

Rules 14a-6(i)(1) and 0-11. |

For Broker

Use Only

First Trust requests your help in assisting shareholders to vote in our

upcoming shareholder meeting on April 18, 2024. Attached are talking points that you can use to discuss the proposed merger with shareholders

as of the October 20, 2023 record date.

Proxy Solicitation to Merge First Trust Closed-end Funds into abrdn

Closed-end Fund

| Acquired Fund |

Acquiring Fund |

| First Trust High Income Long/Short Fund (“FSD”) Cusip: 33738E109 |

abrdn Income Credit Strategies Fund (“ACP”) Cusip: 003057106 |

| First Trust/abrdn Global Opportunity Income Fund (“FAM”) Cusip: 337319107 |

- ISS recommends shareholders vote FOR the reorganization.

- ACP has a history of trading at a narrow discount to NAV. As of

3/7/24, FSD trades at a -7.29% discount, FAM at a -5.99% discount, while ACP was trading at a -3.53% discount.

- ACP has higher distribution

as of March 7, 2024 and historically over the one-year period ended March 7, 2024 relative to FSD and FAM. Additionally, as of October

2023, both First Trust funds have historically over the past five-years had higher return of capital as a percentage of the total distribution.

- ACP would be bigger and more visible based on size than

FSD/FAM currently.

Below are voting instructions to assist shareholders:

There are 4 voting options:

- Online

- By phone

- By mail

- In-person

If you received your proxy material by mail, the quickest

way to vote is:

- Vote online at www.proxyvote.com

- Please enter the 16-digit control number that’s

listed on your WHITE Vote Instruction Form. The control number can be located in a box under the phrase: “Make your vote count.”

- Vote by touchtone phone at 800-454-8683

- Once connected, please enter the same 16-digit control

number found on your WHITE Vote Instruction Form, and follow the voice prompts.

- Please fill out your voting instruction by checking the

appropriate box next to Proposal 1. You have the option to vote FOR, AGAINST, or ABSTAIN.

- Please also SIGN and DATE the Vote Instruction Form.

Please note the Vote Instruction Form will not be processed if it is not signed.

- Please return the completed WHITE Vote Instruction Form

in the Business Return Envelope that’s included in the proxy material you’ve received. No postage is necessary.

- You can vote by attending the meeting.

- Please ask your broker for a LEGAL PROXY, and bring it

with you, along with a government issued ID to the meeting.

- The meeting will be held at the offices of First Trust Advisors L.P.,

located at 120 East Liberty Drive, Suite 400, Wheaton, Illinois 60187 on April 18, 2024 at 12:30 pm CT.

If you received your proxy material by e-mail, please

vote by following the link that’s included in your email. To log in, please refer to the control number that’s included

in your email.

For

Broker Use Only

First Trust High Income Long/Short Fund

First Trust/abrdn Global Opportunity Income Fund

First Trust Advisors L.P. (“First Trust”)

has announced the following reorganizations, which must be approved by shareholders of the respective fund in order to occur:

| Acquired Fund |

Acquiring Fund |

| First Trust High Income Long/Short Fund (“FSD”) Cusip: 33738E109 |

abrdn Income Credit Strategies Fund (“ACP”) Cusip: 003057106 |

| First Trust/abrdn Global Opportunity Income Fund (“FAM”) Cusip: 337319107 |

What is happening?

| • | On October 23, 2023, the board of trustees of each of FSD and FAM (the “Board”) approved a

Agreement and Plan of Reorganization with respect to each of FSD and FAM, which provide for the reorganization of FSD with and into ACP

as well as FAM with and into ACP (each a “Reorganization” and collectively, the “Reorganizations”). |

| o | With respect to FSD, its agreement provides for the transfer of all of the assets of FSD to ACP in exchange

solely for newly issued common shares of beneficial interest of ACP (although cash may be distributed in lieu of fractional shares of

ACP) and the assumption by ACP of all of the liabilities of FSD. |

| o | With respect to FAM, its agreement provides for the transfer of all of the assets of FAM to ACP in exchange

solely for newly issued common shares of beneficial interest of ACP (although cash may be distributed in lieu of fractional shares of

ACP) and the assumption by ACP of all of the liabilities of FAM. |

| • | On April 18, 2024, a special meeting of shareholders will take place at First Trust’s offices to

vote on the approval of the proposed Agreement and Plan of Reorganization for each of FSD and FAM. At a separate meeting, shareholders

of ACP will be asked to approve the issuance of additional common shares of beneficial interest of ACP that would be issued to FSD and/or

FAM shareholders in connection with the Reorganizations. |

| • | Institutional Shareholder Services, the leading independent proxy advisory firm, has recommended that

shareholders vote FOR the approval of each Reorganization. |

| • | Each Reorganization is not contingent on the approval or consummation of the other Reorganization. |

What are the potential benefits of the Reorganizations?

| • | With respect to the Reorganization of FSD with and into ACP: |

| o | Higher Distribution Rate: ACP has a higher distribution rate than FSD. ACP pays a monthly

distribution of $0.10 per share, which based on the market value and net asset value (“NAV”) as of February 29, 2024, represents

an annualized distribution rate of 17.7% and 17.0%, respectively. FSD pays a monthly distribution of $0.105 per share, which based on

market prices and NAV as of February 29, 2024, is an annualized distribution rate of 10.64% and 9.91%, respectively. The Reorganization,

therefore, would represent a 66% increase in distribution rate for FSD shareholders. |

| o | Narrower Trading Discount: As of February 29, 2024, ACP has a history of trading at a narrow

trading discount to NAV, and even to a premium to NAV, over the last three years, while FSD has traded at a more persistent discount.

As of February 29, 2024, FSD was trading at a -6.81% discount to NAV whereas ACP was trading at a -3.55% discount to NAV. If these trading

discount differences persist, the Reorganization would result in positive total return for existing shareholders on the Reorganization

date. |

| o | Trading: Shares of ACP trade at high volumes and at a tighter bid/ask spread percentage

than those of FSD. After the Reorganization, shareholders of FSD should be provided better liquidity to add to or exit their investment

on a moving forward basis. |

| • | With respect to the Reorganization of FAM with and into ACP: |

| o | Higher Distribution Rate: ACP has a higher distribution rate than FSD. ACP pays a monthly

distribution of $0.10 per share, which based on the market value and NAV as of February 29, 2024, represents an annualized distribution

rate of 17.7% and 17.0%, respectively. FAM pays a monthly distribution of $0.06 per share, which based on market prices and NAV as of

February 29, 2024, is an annualized distribution rate of 11.23% and 10.60%, respectively. The Reorganization, therefore, would represent

a 57% increase in distribution rate for FAM shareholders. |

| o | Narrower Trading Discount: As of February 29, 2024, ACP has a history of trading at a narrow

trading discount to NAV, and even to a premium to NAV, over the last three years, while FAM has traded at a more persistent discount,

especially over the last 12 months. As of February 29, 2024, FAM was trading at a -5.60% discount to NAV whereas ACP was trading at a

-3.55% discount to NAV. If these trading discount differences persist, the Reorganization would result in positive total return for existing

shareholders on the merger date. |

| o | Performance: While ACP and FAM utilize different investment strategies, ACP has outperformed

FAM on a NAV basis over the 1-, 3-, and 5-year period as of February 29, 2024. |

How different are FSD and ACP?

| • | FSD and ACP have some substantial differences. FSD’s primary investment objective is to provide

current income, with a secondary objective of capital appreciation. ACP’s primary investment objective is to seek a high level of

current income with a secondary objective of capital appreciation. FSD and ACP’s investment strategies are similar in that they

invest in high-yield fixed income securities, however there are some substantial differences in the investment strategies implemented

to achieve their respective investment objectives and accompanying risks. FSD seeks to achieve its investment objectives by investing,

under normal market conditions, a majority of its assets in a diversified portfolio of U.S. and foreign high-yield corporate fixed-income

securities of varying maturities that are rated below investment grade at the time of purchase. Additionally, FSD maintains both long

and short positions in securities under normal market conditions as part of its investment strategy. ACP is a high-yield debt fund that

is permitted to invest in a variety of US and foreign-issued debt instruments and may utilize derivatives and hedging techniques to achieve

its investment objectives. ACP may invest in lower rated bonds in the high yield sector as compared to FSD. Each of FSD and ACP may utilize

leverage. ACP offers preferred shares while FSD does not. |

How different are FAM and ACP?

| • | FAM and ACP have some substantial differences, however the investment objectives of each fund are materially

the same. Each of FAM and ACP’s primary investment objective is to seek a high level of current income with a secondary objective

of capital appreciation. FAM and ACP’s investment strategies are similar in that they invest in high-yield fixed income securities,

however there are some substantial differences in the investment strategies implemented to achieve their respective investment objectives,

and accompanying risks. FAM seeks to achieve its investment objectives by investing, under normal circumstances, substantially all of

its Managed Assets in a diversified portfolio of fixed-income securities, including government and corporate bonds, of U.S. and non-U.S.

issuers, and invests primarily in emerging markets. ACP is a high-yield debt fund that is permitted to invest in a variety of US and foreign-issued

debt instruments and may utilize derivatives and hedging techniques to achieve its investment objectives. ACP may invest in in high-yield

securities without limitation while FAM may only invest up to 60% of its managed assets in such securities. While FAM invests in high-yield

fixed income securities, its current weighted average is in investment grade bonds, and ACP invests more of its assets in lower rated

bonds in the high yield sector. Each of FAM and ACP may utilize leverage. ACP offers preferred shares while FAM does not. |

What are the tax implications of the Reorganizations?

| • | It is expected that shareholders of each of FSD and FAM will not recognize any gain or loss for federal

income tax purposes as a result of the exchange of their respective shares for shares of ACP (except with respect to cash received in

lieu of fractional shares of ACP). The portfolio re-positioning and de-levering associated with the Reorganizations may result in capital

gains or losses, which may have federal income tax consequences. No sales of portfolio securities are anticipated after the Reorganization

as it relates to FSD. |

Not for inspection by, distribution or

quotation to, the general public. The foregoing is for broker use only and not for retail distribution.

The foregoing is not an offer to sell,

nor a solicitation of an offer to buy, shares of any fund, nor is it a solicitation of any proxy.

To receive a free copy of a Proxy

Statement/Prospectus relating to the proposed Reorganization of FSD with and into ACP and FAM with and into ACP, please call the following

at First Trust: Jeff Margolin (630) 517-7643, Daniel Lindquist (630) 765-8692, and Chris Fallow (630) 517-7628. The foregoing is qualified

in its entirety by reference to the Proxy Statement/Prospectus. The Proxy Statement/Prospectus contains important information about fund

objectives, strategies, fees, expenses and risk considerations, and therefore you are advised to read it. The Proxy Statement/Prospectus

and shareholder reports and other information are or will also be available for free on the SEC's website (www.sec.gov). Please read any

Proxy Statement/Prospectus carefully before making any decision to invest or to approve the Reorganization.

Contents of this communication may

contain information regarding past performance, market opinions, competitor data, projections, forecasts and other forward-looking statements.

While the information presented has been obtained from sources First Trust deems to be reliable, this data is subject to unintentional

errors, omissions and changes prior to distribution without notice.

Your clients should consider the investment objectives, risks, charges

and expenses of FSD and FAM, as applicable, and ACP carefully before voting, which are contained in the Proxy Statement/Prospectus. Please

instruct your clients to read the Proxy Statement/Prospectus carefully before voting.

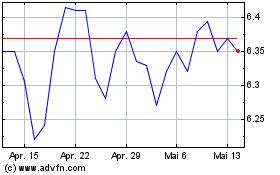

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

First Trust abrdn Global... (NYSE:FAM)

Historical Stock Chart

Von Mai 2023 bis Mai 2024