Energy Transfer LP (NYSE:ET) (“Energy Transfer” or the

“Partnership”) today reported financial results for the quarter and

year ended December 31, 2023.

Energy Transfer reported net income attributable to partners for

the three months ended December 31, 2023 of $1.33 billion, an

increase of $172 million compared to the same period last year. For

the three months ended December 31, 2023, net income per common

unit (basic) was $0.37.

Adjusted EBITDA for the three months ended December 31, 2023 was

$3.60 billion compared to $3.44 billion for the same period last

year, an increase of $165 million.

Distributable Cash Flow attributable to partners, as adjusted,

for the three months ended December 31, 2023 was $2.03 billion

compared to $1.91 billion for the same period last year.

Growth capital expenditures in 2023 were $1.59 billion while

maintenance capital expenditures were $762 million.

2024 Outlook

- Energy Transfer expects its 2024 Adjusted EBITDA to range

between $14.5 billion and $14.8 billion.

- The midpoint of this range represents a 7% increase from 2023

Adjusted EBITDA of $13.7 billion, which was $100 million above the

high end of Energy Transfer 2023 estimates.

- For 2024, the Partnership expects its growth capital

expenditures to range from $2.4 billion to $2.6 billion, including

approximately $300 million of spending that was deferred from

Energy Transfer's previous 2023 growth capital guidance.

Maintenance capital expenditures for 2024 are expected to be

between $835 million and $865 million.

Fourth Quarter 2023 Operational Highlights

- With the addition of new growth projects and acquisitions,

Energy Transfer’s assets continued to reach new milestones during

the fourth quarter of 2023.

- NGL fractionation volumes were up 16%, setting a new

Partnership record.

- NGL transportation volumes were up 10%, setting a new

Partnership record.

- NGL exports were up more than 13%.

- Interstate natural gas transportation volumes were up 5%.

- Midstream gathered volumes increased 5%.

- Crude oil transportation and terminal volumes were up 39% and

16%, respectively.

Fourth Quarter 2023 Strategic Highlights

- In November 2023, Energy Transfer completed its previously

announced merger with Crestwood Equity Partners LP (“Crestwood”)

and integration of the combined operations is ongoing. The merger

is now expected to generate $80 million of annual cost synergies by

2026 with $65 million in 2024, before additional anticipated

benefits from financial and commercial synergies.

- In November 2023, Energy Transfer announced its entry into a

non-binding Heads of Agreement (“HOA”) with TotalEnergies related

to term crude oil offtake from its proposed Blue Marlin Offshore

Port for four million barrels per month.

Financial Highlights

- In January 2024, Energy Transfer announced a quarterly cash

distribution of $0.3150 per common unit ($1.26 annualized) for the

quarter ended December 31, 2023, which is an increase of 3.3%

compared to the fourth quarter of 2022.

- In January 2024, the Partnership issued $1.25 billion aggregate

principal amount of 5.55% senior notes due 2034, $1.75 billion

aggregate principal amount of 5.95% senior notes due 2054 and $800

million aggregate principal amount of 8.00% fixed-to-fixed reset

rate junior subordinated notes due 2054. The Partnership used the

net proceeds to refinance existing indebtedness, to redeem certain

of its outstanding preferred units (as detailed below) and for

general partnership purposes.

- In February 2024, the Partnership redeemed all of its

outstanding Series C preferred units and Series D preferred units.

The Partnership also intends to redeem all of its outstanding

Series E preferred units in May 2024.

- As of December 31, 2023, the Partnership’s revolving credit

facility had an aggregate $3.56 billion of available borrowing

capacity.

- For the three months ended December 31, 2023, the Partnership

invested approximately $379 million on growth capital

expenditures.

Energy Transfer benefits from a portfolio of assets with

exceptional product and geographic diversity. The Partnership’s

multiple segments generate high-quality, balanced earnings with no

single segment contributing more than one-third of the

Partnership’s consolidated Adjusted EBITDA for the three months or

full year ended December 31, 2023. The vast majority of the

Partnership’s segment margins are fee-based and therefore have

limited commodity price sensitivity.

Conference call information:

The Partnership has scheduled a conference call for 3:30 p.m.

Central Time/4:30 p.m. Eastern Time on Wednesday, February 14, 2024

to discuss its fourth quarter 2023 results and provide an update on

the Partnership, including its outlook for 2024. The conference

call will be broadcast live via an internet webcast, which can be

accessed through www.energytransfer.com and will also be available

for replay on the Partnership’s website for a limited time.

Energy Transfer LP (NYSE: ET) owns and operates one of

the largest and most diversified portfolios of energy assets in the

United States, with more than 125,000 miles of pipeline and

associated energy infrastructure. Energy Transfer’s strategic

network spans 44 states with assets in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (“NGL”) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

approximately 34% of the outstanding common units of Sunoco LP

(NYSE: SUN), and the general partner interests and approximately

45% of the outstanding common units of USA Compression Partners, LP

(NYSE: USAC). For more information, visit the Energy Transfer LP

website at www.energytransfer.com.

Sunoco LP (NYSE: SUN) is a master limited partnership

with core operations that include the distribution of motor fuel to

approximately 10,000 convenience stores, independent dealers,

commercial customers and distributors located in more than 40 U.S.

states and territories as well as refined product transportation

and terminalling assets. For more information, visit the Sunoco LP

website at www.sunocolp.com.

USA Compression Partners, LP (NYSE: USAC) is one of the

nation’s largest independent providers of natural gas compression

services in terms of total compression fleet horsepower. USAC

partners with a broad customer base composed of producers,

processors, gatherers, and transporters of natural gas and crude

oil. USAC focuses on providing midstream natural gas compression

services to infrastructure applications primarily in high-volume

gathering systems, processing facilities, and transportation

applications. For more information, visit the USAC website at

www.usacompression.com.

Forward-Looking Statements

This news release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results, including future distribution levels and leverage

ratio, are discussed in the Partnership’s Annual Report on Form

10-K and other documents filed from time to time with the

Securities and Exchange Commission. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

The information contained in this press release is available on

our website at www.energytransfer.com.

ENERGY

TRANSFER LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions)

(unaudited)

December 31, 2023

December 31, 2022

ASSETS

Current assets

$

12,433

$

12,081

Property, plant and equipment, net

85,351

80,311

Investments in unconsolidated

affiliates

3,097

2,893

Lease right-of-use assets, net

826

819

Other non-current assets, net

1,733

1,558

Intangible assets, net

6,239

5,415

Goodwill

4,019

2,566

Total assets

$

113,698

$

105,643

LIABILITIES AND EQUITY

Current liabilities (1)

$

11,277

$

10,368

Long-term debt, less current

maturities

51,380

48,260

Non-current derivative liabilities

4

23

Non-current operating lease

liabilities

778

798

Deferred income taxes

3,931

3,701

Other non-current liabilities

1,611

1,341

Commitments and contingencies

Redeemable noncontrolling interests

778

493

Equity:

Limited Partners:

Preferred Unitholders

6,459

6,051

Common Unitholders

30,197

26,960

General Partner

(2

)

(2

)

Accumulated other comprehensive income

28

16

Total partners’ capital

36,682

33,025

Noncontrolling interests

7,257

7,634

Total equity

43,939

40,659

Total liabilities and equity

$

113,698

$

105,643

(1)

As of December 31, 2023, current

liabilities includes $1.00 billion of senior notes issued by the

Bakken Pipeline entities, which mature in April 2024. The

Partnership’s proportional ownership in the Bakken Pipeline

entities is 36.4%.

ENERGY

TRANSFER LP AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except per unit

data)

(unaudited)

Three Months Ended December

31,

Year Ended December 31,

2023

2022

2023

2022

REVENUES

$

20,532

$

20,501

$

78,586

$

89,876

COSTS AND EXPENSES:

Cost of products sold

15,780

16,063

60,541

72,232

Operating expenses

1,144

1,356

4,368

4,338

Depreciation, depletion and

amortization

1,158

1,060

4,385

4,164

Selling, general and administrative

285

216

985

1,018

Impairment losses and other

—

—

12

386

Total costs and expenses

18,367

18,695

70,291

82,138

OPERATING INCOME

2,165

1,806

8,295

7,738

OTHER INCOME (EXPENSE):

Interest expense, net of interest

capitalized

(686

)

(592

)

(2,578

)

(2,306

)

Equity in earnings of unconsolidated

affiliates

97

71

383

257

Gains on extinguishments of debt

2

—

2

—

Gains (losses) on interest rate

derivatives

(11

)

(10

)

36

293

Non-operating litigation related loss

(2

)

—

(627

)

—

Other, net

49

207

86

90

INCOME BEFORE INCOME TAX EXPENSE

1,614

1,482

5,597

6,072

Income tax expense

47

45

303

204

NET INCOME

1,567

1,437

5,294

5,868

Less: Net income attributable to

noncontrolling interest

219

268

1,299

1,061

Less: Net income attributable to

redeemable noncontrolling interests

21

14

60

51

NET INCOME ATTRIBUTABLE TO PARTNERS

1,327

1,155

3,935

4,756

General Partner’s interest in net

income

1

1

3

4

Preferred Unitholders’ interest in net

income

123

105

463

422

Common Unitholders’ interest in net

income

$

1,203

$

1,049

$

3,469

$

4,330

NET INCOME PER COMMON UNIT:

Basic

$

0.37

$

0.34

$

1.10

$

1.40

Diluted

$

0.37

$

0.34

$

1.09

$

1.40

WEIGHTED AVERAGE NUMBER OF UNITS

OUTSTANDING:

Basic

3,278.6

3,090.3

3,161.7

3,086.8

Diluted

3,295.3

3,103.2

3,177.2

3,097.0

ENERGY

TRANSFER LP AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION

(Dollars and units in

millions)

(unaudited)

Three Months Ended December

31,

Year Ended December 31,

2023

2022

2023

2022

Reconciliation of net income to

Adjusted EBITDA and Distributable Cash Flow (a):

Net income

$

1,567

$

1,437

$

5,294

$

5,868

Interest expense, net of interest

capitalized

686

592

2,578

2,306

Impairment losses and other

—

—

12

386

Income tax expense

47

45

303

204

Depreciation, depletion and

amortization

1,158

1,060

4,385

4,164

Non-cash compensation expense

31

27

130

115

(Gains) losses on interest rate

derivatives

11

10

(36

)

(293

)

Unrealized (gains) losses on commodity

risk management activities

(185

)

88

(3

)

(42

)

Gains on extinguishments of debt

(2

)

—

(2

)

—

Inventory valuation adjustments (Sunoco

LP)

227

76

114

(5

)

Equity in earnings of unconsolidated

affiliates

(97

)

(71

)

(383

)

(257

)

Adjusted EBITDA related to unconsolidated

affiliates

177

156

691

565

Non-operating litigation related loss

2

—

627

—

Other, net

(20

)

17

(12

)

82

Adjusted EBITDA (consolidated)

3,602

3,437

13,698

13,093

Adjusted EBITDA related to unconsolidated

affiliates

(177

)

(156

)

(691

)

(565

)

Distributable Cash Flow from

unconsolidated affiliates

121

89

485

359

Interest expense, net of interest

capitalized

(686

)

(592

)

(2,578

)

(2,306

)

Preferred unitholders’ distributions

(135

)

(118

)

(511

)

(471

)

Current income tax expense

(31

)

(17

)

(100

)

(18

)

Transaction-related income taxes

—

—

—

(42

)

Maintenance capital expenditures

(259

)

(294

)

(860

)

(821

)

Other, net

20

3

41

20

Distributable Cash Flow (consolidated)

2,455

2,352

9,484

9,249

Distributable Cash Flow attributable to

Sunoco LP (100%)

(145

)

(152

)

(659

)

(648

)

Distributions from Sunoco LP

43

42

173

166

Distributable Cash Flow attributable to

USAC (100%)

(80

)

(60

)

(281

)

(221

)

Distributions from USAC

24

24

97

97

Distributable Cash Flow attributable to

noncontrolling interests in other non-wholly owned consolidated

subsidiaries

(369

)

(314

)

(1,352

)

(1,240

)

Distributable Cash Flow attributable to

the partners of Energy Transfer

1,928

1,892

7,462

7,403

Transaction-related adjustments (b)

102

18

116

44

Distributable Cash Flow attributable to

the partners of Energy Transfer, as adjusted

$

2,030

$

1,910

$

7,578

$

7,447

Distributions to partners:

Limited Partners

$

1,061

$

944

$

3,984

$

3,089

General Partner

1

1

3

3

Total distributions to be paid to

partners

$

1,062

$

945

$

3,987

$

3,092

Common Units outstanding – end of

period

3,367.5

3,094.4

3,367.5

3,094.4

(a)

Adjusted EBITDA and Distributable Cash

Flow are non-GAAP financial measures used by industry analysts,

investors, lenders and rating agencies to assess the financial

performance and the operating results of Energy Transfer’s

fundamental business activities and should not be considered in

isolation or as a substitute for net income, income from

operations, cash flows from operating activities or other GAAP

measures.

There are material limitations to

using measures such as Adjusted EBITDA and Distributable Cash Flow,

including the difficulty associated with using any such measure as

the sole measure to compare the results of one company to another,

and the inability to analyze certain significant items that

directly affect a company’s net income or loss or cash flows. In

addition, our calculations of Adjusted EBITDA and Distributable

Cash Flow may not be consistent with similarly titled measures of

other companies and should be viewed in conjunction with measures

that are computed in accordance with GAAP, such as operating

income, net income and cash flows from operating activities.

Definition of Adjusted EBITDA

We define Adjusted EBITDA as

total partnership earnings before interest, taxes, depreciation,

depletion, amortization and other non-cash items, such as non-cash

compensation expense, gains and losses on disposals of assets, the

allowance for equity funds used during construction, unrealized

gains and losses on commodity risk management activities, inventory

valuation adjustments, non-cash impairment charges, losses on

extinguishments of debt and other non-operating income or expense

items. Inventory adjustments that are excluded from the calculation

of Adjusted EBITDA represent only the changes in lower of cost or

market reserves on inventory that is carried at last-in, first-out

(“LIFO”). These amounts are unrealized valuation adjustments

applied to Sunoco LP’s fuel volumes remaining in inventory at the

end of the period.

Adjusted EBITDA reflects amounts

for unconsolidated affiliates based on the same recognition and

measurement methods used to record equity in earnings of

unconsolidated affiliates. Adjusted EBITDA related to

unconsolidated affiliates excludes the same items with respect to

the unconsolidated affiliate as those excluded from the calculation

of Adjusted EBITDA, such as interest, taxes, depreciation,

depletion, amortization and other non-cash items. Although these

amounts are excluded from Adjusted EBITDA related to unconsolidated

affiliates, such exclusion should not be understood to imply that

we have control over the operations and resulting revenues and

expenses of such affiliates. We do not control our unconsolidated

affiliates; therefore, we do not control the earnings or cash flows

of such affiliates. The use of Adjusted EBITDA or Adjusted EBITDA

related to unconsolidated affiliates as an analytical tool should

be limited accordingly.

Adjusted EBITDA is used by

management to determine our operating performance and, along with

other financial and volumetric data, as internal measures for

setting annual operating budgets, assessing financial performance

of our numerous business locations, as a measure for evaluating

targeted businesses for acquisition and as a measurement component

of incentive compensation.

Definition of Distributable Cash

Flow

We define Distributable Cash Flow

as net income, adjusted for certain non-cash items, less

distributions to preferred unitholders and maintenance capital

expenditures. Non-cash items include depreciation, depletion and

amortization, non-cash compensation expense, amortization included

in interest expense, gains and losses on disposals of assets, the

allowance for equity funds used during construction, unrealized

gains and losses on commodity risk management activities, inventory

valuation adjustments, non-cash impairment charges, losses on

extinguishments of debt and deferred income taxes. For

unconsolidated affiliates, Distributable Cash Flow reflects the

Partnership’s proportionate share of the investees’ distributable

cash flow.

Distributable Cash Flow is used

by management to evaluate our overall performance. Our partnership

agreement requires us to distribute all available cash, and

Distributable Cash Flow is calculated to evaluate our ability to

fund distributions through cash generated by our operations.

On a consolidated basis,

Distributable Cash Flow includes 100% of the Distributable Cash

Flow of Energy Transfer’s consolidated subsidiaries. However, to

the extent that noncontrolling interests exist among our

subsidiaries, the Distributable Cash Flow generated by our

subsidiaries may not be available to be distributed to our

partners. In order to reflect the cash flows available for

distributions to our partners, we have reported Distributable Cash

Flow attributable to partners, which is calculated by adjusting

Distributable Cash Flow (consolidated), as follows:

- For subsidiaries with publicly traded equity interests,

Distributable Cash Flow (consolidated) includes 100% of

Distributable Cash Flow attributable to such subsidiary, and

Distributable Cash Flow attributable to our partners includes

distributions to be received by the parent company with respect to

the periods presented.

- For consolidated joint ventures or similar entities, where the

noncontrolling interest is not publicly traded, Distributable Cash

Flow (consolidated) includes 100% of Distributable Cash Flow

attributable to such subsidiaries, but Distributable Cash Flow

attributable to partners reflects only the amount of Distributable

Cash Flow of such subsidiaries that is attributable to our

ownership interest.

For Distributable Cash Flow attributable

to partners, as adjusted, certain transaction-related adjustments

and non-recurring expenses that are included in net income are

excluded.

(b)

For the three months and year ended

December 31, 2023, transaction-related adjustments includes $49

million of Distributable Cash Flow attributable to the operations

of Crestwood for October 1, 2023 through the acquisition date,

which represents amounts distributable to Energy Transfer’s common

unitholders (including the holders of the common units issued in

the Crestwood acquisition) with respect to the fourth quarter 2023

distribution.

ENERGY

TRANSFER LP AND SUBSIDIARIES

SUMMARY

ANALYSIS OF QUARTERLY RESULTS BY SEGMENT

(Tabular dollar amounts in

millions)

(unaudited)

Three Months Ended December

31,

2023

2022

Segment Adjusted EBITDA:

Intrastate transportation and storage

$

242

$

433

Interstate transportation and storage

541

494

Midstream

674

632

NGL and refined products transportation

and services

1,042

928

Crude oil transportation and services

775

571

Investment in Sunoco LP

236

238

Investment in USAC

139

113

All other

(47

)

28

Adjusted EBITDA (consolidated)

$

3,602

$

3,437

The following analysis of segment operating results, includes a

measure of segment margin. Segment margin is a non-GAAP financial

measure and is presented herein to assist in the analysis of

segment operating results and particularly to facilitate an

understanding of the impacts that changes in sales revenues have on

the segment performance measure of Segment Adjusted EBITDA. Segment

margin is similar to the GAAP measure of gross margin, except that

segment margin excludes charges for depreciation, depletion and

amortization. Among the GAAP measures reported by the Partnership,

the most directly comparable measure to segment margin is Segment

Adjusted EBITDA; a reconciliation of segment margin to Segment

Adjusted EBITDA is included in the following tables for each

segment where segment margin is presented.

Intrastate Transportation and

Storage

Three Months Ended December

31,

2023

2022

Natural gas transported (BBtu/d)

14,229

14,295

Withdrawals from storage natural gas

inventory (BBtu)

6,440

5,425

Revenues

$

892

$

1,600

Cost of products sold

497

992

Segment margin

395

608

Unrealized gains on commodity risk

management activities

(78

)

(84

)

Operating expenses, excluding non-cash

compensation expense

(72

)

(83

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(13

)

(16

)

Adjusted EBITDA related to unconsolidated

affiliates

6

8

Other

4

—

Segment Adjusted EBITDA

$

242

$

433

Transported volumes decreased primarily due to decreased

production from our Haynesville assets.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our intrastate transportation and storage segment

decreased due to the net impacts of the following:

- a decrease of $134 million in realized natural gas sales and

other primarily due to lower pipeline optimization from both

physical sales and settled derivatives;

- a decrease of $53 million in storage margin primarily due to

lower storage optimization from hedged inventory activity; and

- a decrease of $20 million in retained fuel revenues related to

lower natural gas prices; partially offset by

- a decrease of $11 million in operating expenses related to a

decrease in cost of fuel consumption from lower natural gas

prices.

Interstate Transportation and

Storage

Three Months Ended December

31,

2023

2022

Natural gas transported (BBtu/d)

16,651

15,821

Natural gas sold (BBtu/d)

31

26

Revenues

$

620

$

606

Cost of products sold

1

1

Segment margin

619

605

Operating expenses, excluding non-cash

compensation, amortization, accretion and other non-cash

expenses

(179

)

(201

)

Selling, general and administrative

expenses, excluding non-cash compensation, amortization and

accretion expenses

(26

)

(31

)

Adjusted EBITDA related to unconsolidated

affiliates

122

115

Other

5

6

Segment Adjusted EBITDA

$

541

$

494

Transported volumes increased primarily due to our Gulf Run

system going in service in December 2022, as well as more capacity

sold and higher utilization on our Transwestern, Rover and

Trunkline systems.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our interstate transportation and storage segment

increased due to the net impacts of the following:

- an increase of $14 million in segment margin primarily due to a

$44 million increase resulting from our Gulf Run system being

placed in service in December 2022, an $8 million increase in

transportation revenue from several of our interstate pipeline

systems due to higher contracted volumes and higher rates, and a $6

million increase due to higher parking and storage. These increases

were partially offset by a $34 million decrease due to lower

operational gas sales resulting from lower prices and a $6 million

decrease due to lower rates on our Panhandle system resulting from

a FERC rate case;

- a decrease of $22 million in operating expenses primarily due

to a $15 million decrease from the revaluation of system gas and an

aggregate $11 million decrease in various other operating costs.

These decreases were partially offset by $4 million of incremental

expenses from our Gulf Run system being placed in service in

December 2022;

- a decrease of $5 million in selling, general and administrative

expenses primarily due to lower M&A costs; and

- an increase of $7 million in Adjusted EBITDA related to

unconsolidated affiliates primarily due to a $4 million increase

from our Citrus joint venture as a result of revenue from new

projects and lower operating expenses and a $3 million increase

from our Southeast Supply Header joint venture due to increased

capacity sold at higher rates.

Midstream

Three Months Ended December

31,

2023

2022

Gathered volumes (BBtu/d)

20,322

19,434

NGLs produced (MBbls/d)

976

813

Equity NGLs (MBbls/d)

49

43

Revenues

$

2,407

$

3,255

Cost of products sold

1,379

2,264

Segment margin

1,028

991

Operating expenses, excluding non-cash

compensation expense

(314

)

(319

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(47

)

(46

)

Adjusted EBITDA related to unconsolidated

affiliates

6

5

Other

1

1

Segment Adjusted EBITDA

$

674

$

632

Gathered volumes and NGL production increased primarily due to

newly acquired assets and higher volumes from existing

customers.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our midstream segment increased due to the net impacts

of the following:

- an increase of $95 million due to newly acquired assets and

increased processing volumes in the Permian, South Texas and

Midcontinent/Panhandle regions; and

- a decrease of $5 million in operating expenses primarily due to

a $12 million decrease in environmental reserve adjustments and a

$14 million decrease due to lower maintenance project costs,

partially offset by a $21 million increase due to newly acquired

assets; partially offset by

- a decrease of $58 million due to lower natural gas prices of

$45 million and lower NGL prices of $13 million.

NGL and Refined Products Transportation and Services

Three Months Ended December

31,

2023

2022

NGL transportation volumes (MBbls/d)

2,162

1,970

Refined products transportation volumes

(MBbls/d)

552

520

NGL and refined products terminal volumes

(MBbls/d)

1,446

1,316

NGL fractionation volumes (MBbls/d)

1,137

982

Revenues

$

6,039

$

5,748

Cost of products sold

4,684

4,735

Segment margin

1,355

1,013

Unrealized (gains) losses on commodity

risk management activities

(72

)

174

Operating expenses, excluding non-cash

compensation expense

(225

)

(254

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(51

)

(31

)

Adjusted EBITDA related to unconsolidated

affiliates

34

26

Other

1

—

Segment Adjusted EBITDA

$

1,042

$

928

NGL transportation and terminal volumes increased primarily due

to higher volumes from the Permian region, on our Mariner East

pipeline system and on our Gulf Coast export pipelines. The

increase in transportation volumes and the commissioning of our

eighth fractionator in August 2023 also led to higher fractionated

volumes at our Mont Belvieu, Texas fractionation facility.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our NGL and refined products transportation and services

segment increased due to the net impacts of the following:

- an increase of $50 million in terminal services margin

primarily due to a $31 million increase from our Marcus Hook

Terminal due to contractual rate escalations and higher throughput,

an increase of $17 million from higher export volumes loaded at our

Nederland Terminal and a $2 million increase due to increased tank

leases and throughput at our Eagle Point Terminal;

- an increase of $47 million in transportation margin primarily

due to a $25 million increase resulting from higher throughput and

contractual rate escalations on our Mariner East pipeline system, a

$19 million increase resulting from higher throughput and

contractual rate escalations on our Texas y-grade pipeline system,

an $11 million increase from higher throughput and contractual rate

escalations on our refined product pipelines and an $8 million

increase from higher exported volumes feeding into our Nederland

Terminal. These increases were partially offset by intrasegment

charges of $10 million and $5 million which were fully offset

within our marketing and fractionation margins, respectively;

- a decrease of $29 million in operating expenses primarily due

to a $17 million decrease in gas and power utility costs, a $3

million decrease in office expenses and decreases totaling $7

million from various other operating expenses;

- an increase of $18 million in fractionators and refinery

services margin primarily due to a $10 million increase resulting

from higher volumes, $5 million in intrasegment margin which was

fully offset within our transportation margin and a $3 million

increase from a more favorable pricing environment impacting our

refinery services business;

- an increase of $13 million in storage margin primarily due to a

$7 million increase in fees generated from export related activity,

a $4 million increase in throughput fees and a $2 million increase

in blending activity; and

- an increase of $8 million in adjusted EBITDA related to

unconsolidated affiliates due to higher volumes on certain joint

venture pipelines; partially offset by

- a decrease of $32 million in marketing margin (excluding

unrealized gains and losses on commodity risk management

activities) primarily due to a $42 million decrease in gains from

the optimization of hedged NGL and refined product inventories.

This decrease was partially offset by intrasegment margin of $10

million which was fully offset within our transportation margin;

and

- an increase of $20 million in selling, general and

administrative expenses primarily due to a $13 million increase

resulting from a one-time charge related to regulatory expenses, a

$3 million increase in insurance costs and a $2 million increase in

overhead expenses.

Crude Oil Transportation and

Services

Three Months Ended December

31,

2023

2022

Crude oil transportation volumes

(MBbls/d)

5,949

4,272

Crude oil terminal volumes (MBbls/d)

3,430

2,954

Revenues

$

7,214

$

6,340

Cost of products sold

6,213

5,570

Segment margin

1,001

770

Unrealized gains on commodity risk

management activities

(13

)

(10

)

Operating expenses, excluding non-cash

compensation expense

(191

)

(178

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(30

)

(12

)

Adjusted EBITDA related to unconsolidated

affiliates

7

1

Other

1

—

Segment Adjusted EBITDA

$

775

$

571

Crude oil transportation volumes were higher on our Texas

pipeline system due to higher Permian crude oil production, higher

gathered volumes and contributions from assets acquired in 2023.

Bakken Pipeline volumes were also higher. Volumes on our Bayou

Bridge Pipeline were higher due to continuing strong Gulf Coast

refinery demand. Midcontinent systems were higher, driven by

contributions from assets acquired in 2023. We also realized higher

Bakken gathering volumes. Crude terminal volumes were higher due to

growth in Permian and Bakken volumes, stronger Gulf Coast refinery

utilization and contributions from assets acquired in 2023.

Adjusted EBITDA. For the three months ended December 31, 2023

compared to the same period last year, Segment Adjusted EBITDA

related to our crude oil transportation and services segment

increased due to the net impacts of the following:

- an increase of $228 million in segment margin (excluding

unrealized gains and losses on commodity risk management

activities) primarily due to a $144 million increase from recently

acquired assets, a $72 million increase from higher volumes on our

Bakken Pipeline, a $25 million increase from higher throughput and

exports at our Gulf Coast terminals as well as the recognition of a

customer deficiency, a $12 million increase from higher volumes on

our Midcontinent gathering systems, a $5 million increase from

higher volumes on our Texas crude pipeline system and a $3 million

increase from our Bayou Bridge Pipeline, partially offset by a $35

million decrease from our crude oil acquisition and marketing

business primarily due to less favorable pricing and higher

affiliate fees from higher volumes; and

- an increase of $6 million in Adjusted EBITDA related to

unconsolidated affiliates due to assets acquired and higher volumes

on our White Cliffs crude pipeline; partially offset by

- an increase of $18 million in selling, general and

administrative expenses primarily due to a settlement related to a

legal matter in the prior period; and

- an increase of $13 million in operating expenses primarily due

to a $30 million increase from assets acquired, partially offset by

a $5 million decrease in volume-driven expenses and an $11 million

decrease in maintenance project expenses.

Investment in Sunoco LP

Three Months Ended December

31,

2023

2022

Revenues

$

5,641

$

5,918

Cost of products sold

5,492

5,647

Segment margin

149

271

Unrealized (gains) losses on commodity

risk management activities

(10

)

18

Operating expenses, excluding non-cash

compensation expense

(110

)

(103

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(30

)

(33

)

Adjusted EBITDA related to unconsolidated

affiliates

2

3

Inventory fair value adjustments

227

76

Other, net

8

6

Segment Adjusted EBITDA

$

236

$

238

The Investment in Sunoco LP segment reflects the consolidated

results of Sunoco LP.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our investment in Sunoco LP decreased primarily due to

an increase in operating expenses.

In January 2024, Sunoco LP announced a definitive agreement to

acquire NuStar Energy L.P. in an all-equity unit-for-unit exchange.

The transaction is expected to close in the second quarter of 2024,

subject to customary closing conditions.

Investment in USAC

Three Months Ended December

31,

2023

2022

Revenues

$

225

$

191

Cost of products sold

33

33

Segment margin

192

158

Operating expenses, excluding non-cash

compensation expense

(40

)

(33

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(14

)

(12

)

Other, net

1

—

Segment Adjusted EBITDA

$

139

$

113

The Investment in USAC segment reflects the consolidated results

of USAC.

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our investment in USAC increased primarily due to higher

revenue-generating horsepower as a result of increased demand for

compression services, higher market-based rates on newly deployed

and redeployed compression units and higher average rates on

existing customer contracts.

All Other

Three Months Ended December

31,

2023

2022

Revenues

$

411

$

813

Cost of products sold

386

780

Segment margin

25

33

Unrealized gains on commodity risk

management activities

(11

)

(10

)

Operating expenses, excluding non-cash

compensation expense

(22

)

(5

)

Selling, general and administrative

expenses, excluding non-cash compensation expense

(52

)

(16

)

Adjusted EBITDA related to unconsolidated

affiliates

1

1

Other and eliminations

12

25

Segment Adjusted EBITDA

$

(47

)

$

28

Segment Adjusted EBITDA. For the three months ended December 31,

2023 compared to the same period last year, Segment Adjusted EBITDA

related to our all other segment decreased primarily due to:

- a decrease of $40 million due to higher M&A related

expenses;

- a decrease of $12 million in storage gains;

- a decrease of $6 million from our dual drive compression

business due to lower gas prices and increased electricity costs;

and

- a decrease of $5 million from our power trading business;

partially offset by

- an increase of $7 million due to increased sales in our

compressor business.

ENERGY

TRANSFER LP AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION ON LIQUIDITY

(In millions)

(unaudited)

The table below provides information on

our revolving credit facility. We also have consolidated

subsidiaries with revolving credit facilities which are not

included in this table.

Facility Size

Funds Available at December 31,

2023

Maturity Date

Five-Year Revolving Credit Facility

$

5,000

$

3,559

April 11, 2027

ENERGY

TRANSFER LP AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION ON UNCONSOLIDATED

AFFILIATES

(In millions)

(unaudited)

The table below provides information on an

aggregated basis for our unconsolidated affiliates, which are

accounted for as equity method investments in the Partnership’s

financial statements for the periods presented.

Three Months Ended December

31,

2023

2022

Equity in earnings (losses) of

unconsolidated affiliates:

Citrus

$

36

$

32

MEP

19

17

White Cliffs

5

(9

)

Explorer

10

8

Other

27

23

Total equity in earnings of unconsolidated

affiliates

$

97

$

71

Adjusted EBITDA related to

unconsolidated affiliates:

Citrus

$

85

$

81

MEP

27

26

White Cliffs

10

5

Explorer

15

13

Other

40

31

Total Adjusted EBITDA related to

unconsolidated affiliates

$

177

$

156

Distributions received from

unconsolidated affiliates:

Citrus

$

12

$

—

MEP

26

13

White Cliffs

7

4

Explorer

9

7

Other

31

22

Total distributions received from

unconsolidated affiliates

$

85

$

46

ENERGY

TRANSFER LP AND SUBSIDIARIES

SUPPLEMENTAL INFORMATION ON NON-WHOLLY OWNED JOINT

VENTURE SUBSIDIARIES

(In millions)

(unaudited)

The table below provides information on an

aggregated basis for our non-wholly owned joint venture

subsidiaries, which are reflected on a consolidated basis in our

financial statements. The table below excludes Sunoco LP and USAC,

which are non-wholly owned subsidiaries that are publicly

traded.

Three Months Ended December

31,

2023

2022

Adjusted EBITDA of non-wholly owned

subsidiaries (100%) (a)

$

709

$

613

Our proportionate share of Adjusted EBITDA

of non-wholly owned subsidiaries (b)

334

294

Distributable Cash Flow of non-wholly

owned subsidiaries (100%) (c)

$

682

$

593

Our proportionate share of Distributable

Cash Flow of non-wholly owned subsidiaries (d)

313

279

Below is our ownership percentage of

certain non-wholly owned subsidiaries:

Non-wholly owned subsidiary:

Energy Transfer Percentage

Ownership (e)

Bakken Pipeline

36.4 %

Bayou Bridge

60.0 %

Maurepas

51.0 %

Ohio River System

75.0 %

Permian Express Partners

87.7 %

Red Bluff Express

70.0 %

Rover

32.6 %

Others

various

(a)

Adjusted EBITDA of non-wholly owned

subsidiaries reflects the total Adjusted EBITDA of our non-wholly

owned subsidiaries on an aggregated basis. This is the amount

included in our consolidated non-GAAP measure of Adjusted

EBITDA.

(b)

Our proportionate share of Adjusted EBITDA

of non-wholly owned subsidiaries reflects the amount of Adjusted

EBITDA of such subsidiaries (on an aggregated basis) that is

attributable to our ownership interest.

(c)

Distributable Cash Flow of non-wholly

owned subsidiaries reflects the total Distributable Cash Flow of

our non-wholly owned subsidiaries on an aggregated basis.

(d)

Our proportionate share of Distributable

Cash Flow of non-wholly owned subsidiaries reflects the amount of

Distributable Cash Flow of such subsidiaries (on an aggregated

basis) that is attributable to our ownership interest. This is the

amount included in our consolidated non-GAAP measure of

Distributable Cash Flow attributable to the partners of Energy

Transfer.

(e)

Our ownership reflects the total economic

interest held by us and our subsidiaries. In some cases, this

percentage comprises ownership interests held in (or by) multiple

entities. In addition to the ownership reflected in the table

above, the Partnership also owned a 51% interest in Energy Transfer

Canada until August 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240214068077/en/

Investor Relations: Bill Baerg, Brent Ratliff, Lyndsay

Hannah, 214-981-0795 Media Relations: Vicki Granado,

214-840-5820

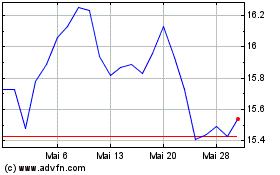

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Jan 2024 bis Jan 2025