false000152986400015298642024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 30, 2024 |

ENOVA INTERNATIONAL, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

1-35503 |

45-3190813 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

175 West Jackson Boulevard |

|

Chicago, Illinois |

|

60604 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 312 568-4200 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $.00001 par value per share |

|

ENVA |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2024, Enova International, Inc. (the “Company”) issued a press release to announce its consolidated financial results for the three months ended December 31, 2023. A copy of the Company’s press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information included or incorporated by reference in this Current Report on Form 8-K under this Item 2.02 is being furnished and shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibits are furnished as part of this Report on Form 8-K:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Enova International, Inc. |

|

|

|

|

Date: |

January 30, 2024 |

By: |

/s/ Sean Rahilly |

|

|

|

Sean Rahilly

General Counsel & Secretary |

Exhibit 99.1

Enova Reports Fourth Quarter and Full Year 2023 Results

•Total revenue increased 20% from the fourth quarter of 2022 to $584 million

•Diluted earnings per share totaled $1.13 and adjusted earnings per share totaled $1.83

•Total company combined loans and finance receivables increased 16% from the end of fourth quarter of 2022 to $3.3 billion as total company originations reached a quarterly record of $1.4 billion

•Continued solid credit performance and outlook with a fourth quarter net revenue margin of 56% and a sequential increase in the fair value of the consolidated portfolio as a percentage of principal to 115% at December 31

•Liquidity, including cash and marketable securities and available capacity on facilities, totaled $870 million at December 31

•Repurchased $66 million of common stock under the company’s share repurchase program

CHICAGO, January 30, 2024 /PRNewswire/ -- Enova International (NYSE: ENVA), a leading financial technology company powered by machine learning and world-class analytics, today announced financial results for the fourth quarter and full year ended December 31, 2023.

“We are pleased to end the year on a positive note with another strong quarter of solid revenue and profitable growth,” said David Fisher, Enova’s CEO. “Our performance in 2023 was made possible by the world class team we have built at Enova, along with our flexible online-only business model, nimble machine learning powered credit risk management capabilities, diversified product offerings and solid balance sheet. We delivered a record quarter of originations, driven by strong demand, especially in our SMB business and solid credit performance across our entire portfolio. Looking ahead, we feel like we are in a strong position heading into 2024 with an improving macroeconomic environment and good momentum across our entire product range.”

Fourth Quarter 2023 Summary

•Total revenue of $584 million in the fourth quarter of 2023 increased 20% from $486 million in the fourth quarter of 2022.

•Net revenue margin of 56% in the fourth quarter of 2023 compared to 60% in the fourth quarter of 2022.

•Net income of $35 million, or $1.13 per diluted share, in the fourth quarter of 2023 compared to $51 million, or $1.56 per diluted share, in the fourth quarter of 2022.

•Fourth quarter 2023 adjusted EBITDA, a non-GAAP measure, of $130 million compared to $120 million in the fourth quarter of 2022.

•Adjusted earnings of $57 million, or $1.83 per diluted share, both non-GAAP measures, in the fourth quarter of 2023 compared to adjusted earnings of $57 million, or $1.76 per diluted share, in the fourth quarter of 2022.

Full Year 2023 Summary

•Total revenue of $2.1 billion in 2023 increased 22% from $1.7 billion in 2022.

•Net revenue margin of 58% in 2023 compared to 64% in 2022.

•Net income from continuing operations of $175 million, or $5.49 per diluted share, in 2023, compared to $207 million, or $6.19 per diluted share, in 2022.

•Full year 2023 adjusted EBITDA, a non-GAAP measure, of $503 million compared to $443 million in 2022.

•Adjusted earnings of $219 million, or $6.85 per diluted share, both non-GAAP measures, in 2023, compared to adjusted earnings of $228 million, or $6.81 per diluted share, in 2022.

“We ended 2023 with positive momentum as strong growth in originations, receivables and revenue along with solid credit and operating efficiency drove another quarter of solid financial results,” said Steve Cunningham, CFO of Enova. “We continued to successfully access multiple funding markets during the fourth quarter and our ample liquidity and strong balance sheet enabled record originations this quarter while returning significant capital to shareholders through share repurchases. Our strong financial position as we begin 2024 has us well positioned to drive profitable growth and deliver on our commitment to generating long-term shareholder value.”

For information regarding the non-GAAP financial measures discussed in this release, please see "Non-GAAP Financial Measures" and "Reconciliation of GAAP to Non-GAAP Financial Measures" below.

Conference Call

Enova will host a conference call to discuss its fourth quarter and full year 2023 results at 4 p.m. Central Time / 5 p.m. Eastern Time today, January 30th. The live webcast of the call can be accessed at the Enova Investor Relations website at http://ir.enova.com, along with the company's earnings press release and supplemental financial information. The U.S. dial-in for the call is 1-855-560-2575 (1-412-542-4161 for non-U.S. callers). Please ask to join the Enova International call. A replay of the conference call will be available until February 6, 2024, at 10:59 p.m. Central Time / 11:59 p.m. Eastern Time, while an archived version of the webcast will be available on the Enova International Investor Relations website for 90 days. The U.S. dial-in for the conference call replay is 1-877-344-7529 (1-412-317-0088). The replay access code is 9204889.

About Enova

Enova International (NYSE: ENVA) is a leading financial services company with powerful online lending that serves small businesses and consumers who are underserved by traditional banks. Through its world-class analytics and machine learning algorithms, Enova has provided more than 9.5 million customers with over $53 billion in loans and financing. You can learn more about the company and its portfolio of businesses at www.enova.com.

SOURCE Enova International, Inc.

For further information:

Public Relations Contact:

Erin Yeager

Email: media@enova.com

Investor Relations Contact:

Lindsay Savarese

Office: (212) 331-8417

Email: IR@enova.com

Cassidy Fuller

Office: (415) 217-4168

Email: IR@enova.com

Non-GAAP Financial Measures

In addition to the financial information prepared in conformity with generally accepted accounting principles, or GAAP, Enova provides historical non-GAAP financial information. Management believes that presentation of non-GAAP financial information is meaningful and useful in understanding the activities and business metrics of Enova's operations. Management believes that these non-GAAP financial measures reflect an additional way of viewing aspects of Enova's business that, when viewed with its GAAP results, provide a more complete understanding of factors and trends affecting its business.

Management provides non-GAAP financial information for informational purposes and to enhance understanding of Enova's GAAP consolidated financial statements. Readers should consider the information in addition to, but not instead of or superior to, Enova's financial statements prepared in accordance with GAAP. This non-GAAP financial information may be determined or calculated differently by other companies, limiting the usefulness of those measures for comparative purposes.

Combined Loans and Finance Receivables

The combined loans and finance receivables measures are non-GAAP measures that include loans and finance receivables that Enova owns or has purchased and loans that Enova guarantees. Management believes these non-GAAP measures provide investors with important information needed to evaluate the magnitude of potential receivable losses and the opportunity for revenue performance of the loans and finance receivable portfolio on an aggregate basis. Management also believes that the comparison of the aggregate amounts from period to period is more meaningful than comparing only the amounts reflected on Enova's consolidated balance sheet since revenue is impacted by the aggregate amount of receivables owned by Enova and those guaranteed by Enova as reflected in its consolidated financial statements.

Adjusted Earnings Measures

In addition to reporting financial results in accordance with GAAP, Enova has provided adjusted earnings and adjusted earnings per share, or, collectively, the Adjusted Earnings Measures, which are non-GAAP measures. Management believes that the presentation of these measures provides investors with greater transparency and facilitates comparison of operating results across a broad spectrum of companies with varying capital structures, compensation strategies, derivative instruments and amortization methods, which provides a more complete understanding of Enova's financial performance, competitive position and prospects for the future. Management also believes that investors regularly rely on non-GAAP financial measures, such as the Adjusted

Earnings Measures, to assess operating performance and that such measures may highlight trends in Enova's business that may not otherwise be apparent when relying on financial measures calculated in accordance with GAAP. In addition, management believes that the adjustments shown below are useful to investors in order to allow them to compare Enova's financial results during the periods shown without the effect of each of these expense items.

Adjusted EBITDA Measures

In addition to reporting financial results in accordance with GAAP, Enova has provided Adjusted EBITDA and Adjusted EBITDA margin, or, collectively, the Adjusted EBITDA measures, which are non-GAAP measures. Adjusted EBITDA is a non-GAAP measure that Enova defines as earnings excluding depreciation, amortization, interest, foreign currency transaction gains or losses, taxes and stock-based compensation. In addition, management believes that the adjustments for other nonoperating expenses, equity method investment income or loss, certain transaction-related costs and a discrete regulatory settlement shown below are useful to investors in order to allow them to compare our financial results during the periods shown without the effect of the expense items. Adjusted EBITDA margin is a non-GAAP measure that Enova defines as Adjusted EBITDA as a percentage of total revenue. Management believes Adjusted EBITDA Measures are used by investors to analyze operating performance and evaluate Enova's ability to incur and service debt and Enova's capacity for making capital expenditures. Adjusted EBITDA Measures are also useful to investors to help assess Enova's estimated enterprise value.

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(dollars in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

54,357 |

|

|

$ |

100,165 |

|

Restricted cash |

|

|

323,082 |

|

|

|

78,235 |

|

Loans and finance receivables at fair value |

|

|

3,629,167 |

|

|

|

3,018,528 |

|

Income taxes receivable |

|

|

44,129 |

|

|

|

43,741 |

|

Other receivables and prepaid expenses |

|

|

71,982 |

|

|

|

66,267 |

|

Property and equipment, net |

|

|

108,705 |

|

|

|

93,228 |

|

Operating lease right-of-use asset |

|

|

14,251 |

|

|

|

19,347 |

|

Goodwill |

|

|

279,275 |

|

|

|

279,275 |

|

Intangible assets, net |

|

|

19,005 |

|

|

|

27,390 |

|

Other assets |

|

|

41,583 |

|

|

|

54,713 |

|

Total assets |

|

$ |

4,585,536 |

|

|

$ |

3,780,889 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

261,156 |

|

|

$ |

198,320 |

|

Operating lease liability |

|

|

27,042 |

|

|

|

33,595 |

|

Deferred tax liabilities, net |

|

|

113,350 |

|

|

|

104,169 |

|

Long-term debt |

|

|

2,943,805 |

|

|

|

2,258,660 |

|

Total liabilities |

|

|

3,345,353 |

|

|

|

2,594,744 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

|

|

Common stock, $0.00001 par value, 250,000,000 shares authorized, 45,339,814 and 44,326,999 shares issued and 29,089,258 and 31,220,928 outstanding as of December 31, 2023 and 2022, respectively |

|

|

— |

|

|

|

— |

|

Preferred stock, $0.00001 par value, 25,000,000 shares authorized, no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

Additional paid in capital |

|

|

284,256 |

|

|

|

251,878 |

|

Retained earnings |

|

|

1,488,306 |

|

|

|

1,313,185 |

|

Accumulated other comprehensive loss |

|

|

(6,264 |

) |

|

|

(5,990 |

) |

Treasury stock, at cost (16,250,556 and 13,106,071 shares as of December 31, 2023 and 2022, respectively) |

|

|

(526,115 |

) |

|

|

(372,928 |

) |

Total stockholders' equity |

|

|

1,240,183 |

|

|

|

1,186,145 |

|

Total liabilities and stockholders' equity |

|

$ |

4,585,536 |

|

|

$ |

3,780,889 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(in thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

583,592 |

|

|

$ |

486,164 |

|

|

$ |

2,117,639 |

|

|

$ |

1,736,085 |

|

Change in Fair Value |

|

|

(258,556 |

) |

|

|

(196,056 |

) |

|

|

(887,717 |

) |

|

|

(618,521 |

) |

Net Revenue |

|

|

325,036 |

|

|

|

290,108 |

|

|

|

1,229,922 |

|

|

|

1,117,564 |

|

Operating Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marketing |

|

|

122,226 |

|

|

|

96,573 |

|

|

|

414,460 |

|

|

|

382,573 |

|

Operations and technology |

|

|

47,089 |

|

|

|

44,723 |

|

|

|

194,905 |

|

|

|

173,668 |

|

General and administrative |

|

|

49,148 |

|

|

|

35,064 |

|

|

|

160,265 |

|

|

|

140,464 |

|

Depreciation and amortization |

|

|

9,034 |

|

|

|

8,499 |

|

|

|

38,157 |

|

|

|

36,867 |

|

Total Operating Expenses |

|

|

227,497 |

|

|

|

184,859 |

|

|

|

807,787 |

|

|

|

733,572 |

|

Income from Operations |

|

|

97,539 |

|

|

|

105,249 |

|

|

|

422,135 |

|

|

|

383,992 |

|

Interest expense, net |

|

|

(57,208 |

) |

|

|

(37,530 |

) |

|

|

(194,779 |

) |

|

|

(115,887 |

) |

Foreign currency transaction gain (loss), net |

|

|

49 |

|

|

|

(715 |

) |

|

|

57 |

|

|

|

(645 |

) |

Equity method investment income (loss) |

|

|

1,251 |

|

|

|

(87 |

) |

|

|

116 |

|

|

|

6,435 |

|

Other nonoperating expenses |

|

|

(3 |

) |

|

|

— |

|

|

|

(282 |

) |

|

|

(1,321 |

) |

Income before Income Taxes |

|

|

41,628 |

|

|

|

66,917 |

|

|

|

227,247 |

|

|

|

272,574 |

|

Provision for income taxes |

|

|

6,860 |

|

|

|

16,045 |

|

|

|

52,126 |

|

|

|

65,150 |

|

Net income |

|

$ |

34,768 |

|

|

$ |

50,872 |

|

|

$ |

175,121 |

|

|

$ |

207,424 |

|

Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.17 |

|

|

$ |

1.62 |

|

|

$ |

5.71 |

|

|

$ |

6.42 |

|

Diluted |

|

$ |

1.13 |

|

|

$ |

1.56 |

|

|

$ |

5.49 |

|

|

$ |

6.19 |

|

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

29,687 |

|

|

|

31,401 |

|

|

|

30,673 |

|

|

|

32,290 |

|

Diluted |

|

|

30,887 |

|

|

|

32,627 |

|

|

|

31,921 |

|

|

|

33,483 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(dollars in thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows provided by operating activities |

|

$ |

1,166,869 |

|

|

$ |

893,998 |

|

Cash flows from investing activities |

|

|

|

|

|

|

|

|

Loans and finance receivables |

|

|

(1,449,417 |

) |

|

|

(1,631,354 |

) |

Capitalization of software development costs and purchases of fixed assets |

|

|

(45,241 |

) |

|

|

(43,629 |

) |

Sale of subsidiary |

|

|

— |

|

|

|

8,713 |

|

Total cash flows used in investing activities |

|

|

(1,494,658 |

) |

|

|

(1,666,270 |

) |

Cash flows provided by financing activities |

|

|

526,541 |

|

|

|

724,866 |

|

Effect of exchange rates on cash |

|

|

287 |

|

|

|

(77 |

) |

Net change in cash and cash equivalents and restricted cash |

|

|

199,039 |

|

|

|

(47,483 |

) |

Cash, cash equivalents and restricted cash at beginning of year |

|

|

178,400 |

|

|

|

225,883 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

377,439 |

|

|

$ |

178,400 |

|

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

LOANS AND FINANCE RECEIVABLES FINANCIAL AND OPERATING DATA

(dollars in thousands)

The following table includes financial information for loans and finance receivables, which is based on loan and finance receivable balances for the three months ended December 31, 2023 and 2022.

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31 |

|

2023 |

|

|

2022 |

|

|

Change |

|

Ending combined loan and finance receivable principal balance: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

3,154,735 |

|

|

$ |

2,739,164 |

|

|

$ |

415,571 |

|

Guaranteed by the Company(a) |

|

|

13,537 |

|

|

|

12,937 |

|

|

|

600 |

|

Total combined loan and finance receivable principal balance(b) |

|

$ |

3,168,272 |

|

|

$ |

2,752,101 |

|

|

$ |

416,171 |

|

Ending combined loan and finance receivable fair value balance: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

3,629,167 |

|

|

$ |

3,018,528 |

|

|

$ |

610,639 |

|

Guaranteed by the Company(a) |

|

|

18,534 |

|

|

|

16,257 |

|

|

|

2,277 |

|

Ending combined loan and finance receivable fair value balance(b) |

|

$ |

3,647,701 |

|

|

$ |

3,034,785 |

|

|

$ |

612,916 |

|

Fair value as a % of principal(c) |

|

|

115.1 |

% |

|

|

110.3 |

% |

|

|

4.8 |

% |

Ending combined loan and finance receivable balance, including principal and accrued fees/interest outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned |

|

$ |

3,297,082 |

|

|

$ |

2,837,799 |

|

|

$ |

459,283 |

|

Guaranteed by the Company(a) |

|

|

16,351 |

|

|

|

15,644 |

|

|

|

707 |

|

Ending combined loan and finance receivable balance(b) |

|

$ |

3,313,433 |

|

|

$ |

2,853,443 |

|

|

$ |

459,990 |

|

Average combined loan and finance receivable balance, including principal and accrued fees/interest outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Company owned(d) |

|

$ |

3,141,479 |

|

|

$ |

2,723,006 |

|

|

$ |

418,473 |

|

Guaranteed by the Company(a)(d) |

|

|

16,341 |

|

|

|

15,050 |

|

|

|

1,291 |

|

Average combined loan and finance receivable balance(a)(d) |

|

$ |

3,157,820 |

|

|

$ |

2,738,056 |

|

|

$ |

419,764 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

574,721 |

|

|

$ |

478,945 |

|

|

$ |

95,776 |

|

Change in fair value |

|

|

(256,412 |

) |

|

|

(194,375 |

) |

|

|

(62,037 |

) |

Net revenue |

|

|

318,309 |

|

|

|

284,570 |

|

|

|

33,739 |

|

Net revenue margin |

|

|

55.4 |

% |

|

|

59.4 |

% |

|

|

(4.0 |

)% |

Change in fair value as a % of average loan and finance receivable balance(d) |

|

|

8.1 |

% |

|

|

7.1 |

% |

|

|

1.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Delinquencies: |

|

|

|

|

|

|

|

|

|

|

|

|

>30 days delinquent |

|

$ |

263,524 |

|

|

$ |

190,119 |

|

|

$ |

73,405 |

|

>30 days delinquent as a % of loan and finance receivable balance(c) |

|

|

8.0 |

% |

|

|

6.7 |

% |

|

|

1.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Charge-offs: |

|

|

|

|

|

|

|

|

|

|

|

|

Charge-offs (net of recoveries) |

|

$ |

305,436 |

|

|

$ |

240,531 |

|

|

$ |

64,905 |

|

Charge-offs (net of recoveries) as a % of average loan and finance receivable balance(d) |

|

|

9.7 |

% |

|

|

8.8 |

% |

|

|

0.9 |

% |

(a) Represents loans originated by third-party lenders through the CSO programs, which are not included in our consolidated balance sheets.

(b) Non-GAAP measure.

(c) Determined using period-end balances.

(d) The average combined loan and finance receivable balance is the average of the month-end balances during the period.

ENOVA INTERNATIONAL, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(dollars in thousands, except per share data)

Adjusted Earnings Measures

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income |

|

$ |

34,768 |

|

|

$ |

50,872 |

|

|

$ |

175,121 |

|

|

$ |

207,424 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction-related costs(a) |

|

|

755 |

|

|

|

— |

|

|

|

755 |

|

|

|

— |

|

Lease termination and cease use costs(b) |

|

|

— |

|

|

|

— |

|

|

|

1,698 |

|

|

|

— |

|

Equity method investment (income) loss(c) |

|

|

(1,251 |

) |

|

|

87 |

|

|

|

(116 |

) |

|

|

(6,107 |

) |

Other nonoperating expenses(d) |

|

|

3 |

|

|

|

— |

|

|

|

282 |

|

|

|

1,321 |

|

Intangible asset amortization |

|

|

2,014 |

|

|

|

2,014 |

|

|

|

8,385 |

|

|

|

8,055 |

|

Stock-based compensation expense |

|

|

7,458 |

|

|

|

5,993 |

|

|

|

26,738 |

|

|

|

21,950 |

|

Foreign currency transaction (gain) loss, net |

|

|

(49 |

) |

|

|

715 |

|

|

|

(57 |

) |

|

|

645 |

|

Cumulative tax effect of adjustments |

|

|

(2,293 |

) |

|

|

(2,191 |

) |

|

|

(9,456 |

) |

|

|

(5,365 |

) |

Regulatory settlement(e) |

|

|

15,201 |

|

|

|

— |

|

|

|

15,201 |

|

|

|

— |

|

Adjusted earnings |

|

$ |

56,606 |

|

|

$ |

57,490 |

|

|

$ |

218,551 |

|

|

$ |

227,923 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted earnings per share |

|

$ |

1.13 |

|

|

$ |

1.56 |

|

|

$ |

5.49 |

|

|

$ |

6.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted earnings per share |

|

$ |

1.83 |

|

|

$ |

1.76 |

|

|

$ |

6.85 |

|

|

$ |

6.81 |

|

Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Year Ended |

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Net income |

|

$ |

34,768 |

|

|

$ |

50,872 |

|

|

$ |

175,121 |

|

|

$ |

207,424 |

|

Depreciation and amortization expenses |

|

|

9,034 |

|

|

|

8,499 |

|

|

|

38,157 |

|

|

|

36,867 |

|

Interest expense, net |

|

|

57,208 |

|

|

|

37,530 |

|

|

|

194,779 |

|

|

|

115,887 |

|

Foreign currency transaction (gain) loss, net |

|

|

(49 |

) |

|

|

715 |

|

|

|

(57 |

) |

|

|

645 |

|

Provision for income taxes |

|

|

6,860 |

|

|

|

16,045 |

|

|

|

52,126 |

|

|

|

65,150 |

|

Stock-based compensation expense |

|

|

7,458 |

|

|

|

5,993 |

|

|

|

26,738 |

|

|

|

21,950 |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Transaction-related costs(a) |

|

|

755 |

|

|

|

— |

|

|

|

755 |

|

|

|

— |

|

Equity method investment (income) loss(c) |

|

|

(1,251 |

) |

|

|

87 |

|

|

|

(116 |

) |

|

|

(6,435 |

) |

Regulatory settlement(e) |

|

|

15,201 |

|

|

|

— |

|

|

|

15,201 |

|

|

|

— |

|

Other nonoperating expenses(d) |

|

|

3 |

|

|

|

— |

|

|

|

282 |

|

|

|

1,321 |

|

Adjusted EBITDA |

|

$ |

129,987 |

|

|

$ |

119,741 |

|

|

$ |

502,986 |

|

|

$ |

442,809 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA margin calculated as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

|

$ |

583,592 |

|

|

$ |

891,761 |

|

|

$ |

2,117,639 |

|

|

$ |

1,736,085 |

|

Adjusted EBITDA |

|

|

129,987 |

|

|

|

119,741 |

|

|

|

502,986 |

|

|

|

442,809 |

|

Adjusted EBITDA as a percentage of total revenue |

|

|

22.3 |

% |

|

|

13.4 |

% |

|

|

23.8 |

% |

|

|

25.5 |

% |

(a)In the fourth quarter of 2023, the Company recorded $0.8 million ($0.6 million net of tax) of costs related to a consent solicitation for the Senior Notes due 2025.

(b)In the first quarter of 2023, the Company recorded a loss of $1.7 million ($1.3 million net of tax) related to the exit of leased office space.

(c)In the second quarter of 2022, the Company recorded equity method investment income of $6.3 million ($3.6 million net of tax) that was comprised primarily of a gain of $11.0 million on an equity method investment, partially offset by a $4.4 million loss on the sale of another equity method investment.

(d)In the second and third quarters of 2022, the Company recorded other nonoperating expenses totaling $1.3 million ($1.0 million net of tax) related to incomplete transactions.

(e)In the fourth quarter of 2023, the Company reached an agreement with the Consumer Financial Protection Bureau, or the CFPB, pursuant to which it agreed to pay a civil money penalty of $15.0 million, which is nondeductible for tax purposes.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

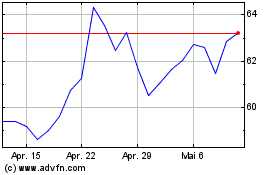

Enova (NYSE:ENVA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Enova (NYSE:ENVA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024