SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of May, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS

BRASILEIRAS S.A. – ELETROBRAS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC

POWER COMPANY

(Translation of Registrant’s name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check mark whether the registrant by furnishing the information

contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange

Act of 1934.

Yes

¨ No

x

ELETROBRAS ANNOUNCES PUBLIC OFFERING OF ITS

SHARES

Centrais Elétricas Brasileiras S.A.

– Eletrobras (“Company” or “Eletrobras”) (B3: ELET3, ELET5

& ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O & XELT.B) informs its shareholders and the market that, on the date hereof, it

has launched a public offering of common shares of the Company (“Shares”), some of which may be represented by American Depositary

Shares (“ADS”), evidenced by American Depositary Receipts.

In connection with this public offering,

Eletrobras has filed on the date hereof a registration statement with the Brazilian Securities Commission (“CVM”) and

the U.S. Securities and Exchange Commission (“SEC”) in respect of a global offering that consists of an international

offering outside Brazil and a concurrent public offering in Brazil (the “Global Offering”). The international offering

includes a registered offering of ADSs in the United States with the SEC under the U.S. Securities Act of 1933, as amended (the

“International Offering”). The Shares are being offered directly and as ADS, each of which represents one common

share.

The primary offering will consist of the distribution

of new Shares, including in the form of ADSs, to be issued by the Company. The secondary offering will consist of the distribution

of Shares held by BNDES Participações

S.A. - BNDESPar (the “Selling Shareholder”), in the relative proportion indicated in the preliminary prospectus

of the offering.

The International Offering is being conducted pursuant to a registration

statement on Form F-3 filed on May 27, 2022 with the SEC, which automatically became effective upon filing, and a preliminary prospectus

supplement. The registration statement on Form F-3 and the preliminary prospectus supplement may be accessed through the SEC’s website

at www.sec.gov.

Banco BTG Pactual S.A. – Cayman Branch,

BofA Securities, Inc., Goldman Sachs & Co. LLC, Itau BBA USA Securities, Inc., XP Investimentos Corretora de Câmbio, Títulos

e Valores Mobiliários S.A., Bradesco Securities, Inc., Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, J.P.

Morgan Securities LLC and Morgan Stanley & Co. LLC are serving as international underwriters with respect to the International Offering

of the ADSs.

BTG Pactual US Capital, LLC, BofA Securities,

Inc., Goldman Sachs & Co. LLC, Itau BBA USA Securities, Inc., XP Investments US, LLC, Bradesco Securities, Inc., Citigroup Global

Markets Inc., Credit Suisse Securities (USA) LLC, J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC, Inc. and Safra Securities

LLC will collectively act as international placement agents with respect to the International Offering of Shares (not in the form of ADSs)

sold outside Brazil on behalf of the Brazilian underwriters (except for Caixa Econômica Federal).

Before you invest, you should read the

registration statement (including the preliminary prospectus supplement) and other documents filed with the SEC for more complete

information about the Company, the Selling Shareholder and the Global Offering. Please refer to our annual report on Form 20-F as of

and for the year ended December 31, 2021 filed with the SEC, as well as any further updates in our current reports on Form 6-K,

which may be amended, supplemented or superseded, from time to time, by other reports that we file with the SEC. You may access

these documents for free by visiting EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of the

registration statement (including the preliminary prospectus supplement) may be obtained by contacting (i) Banco BTG Pactual S.A.

– Cayman Branch, Address: Harbour Place, 5th Floor 103 South Church Street, PO Box 1353GT Grand Cayman, Cayman Islands

KYI-1108; Fax: (212) 293-4609; E-mail: ol-btgpactual-prospectusdepartment@btgpactual.com; (ii) BofA Securities, Inc., Attn: Prospectus Department; Address:

NC1-004-03-43 200 North College Street, 3rd floor Charlotte NC 28255-0001; Email: dg.prospectus_requests@bofa.com; (iii)

Goldman Sachs & Co. LLC, Attn: Prospectus Department, Address: 200 West Street, New York, New York 10282, Telephone:

1-866-471-2526, Facsimile: 212-902-9316, e-mail: prospectus-ny@ny.email.gs.com; (iv) Itau BBA USA Securities, Inc, Address:

540 Madison Avenue, 24th Floor, New York, New York 10022; and (v) XP Investments US, Address: 55 W 46th Street 30th Floor, New York,

New York 10036.

This report on Form 6-K is for informative

purposes only under the current applicable laws and regulations, and is neither an offer to sell nor a solicitation of an offer to buy

the securities described herein, nor shall there be any sale of these securities in any jurisdiction in which such an offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

The Company will inform its shareholders and the

market about any further developments with respect to the Global Offering in accordance with the applicable regulation.

Rio de Janeiro, May 27, 2022.

/s/ Elvira Cavalcanti Presta

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

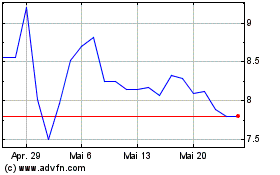

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

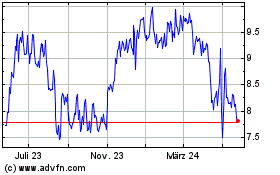

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024