Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

18 September 2023 - 7:11PM

Edgar (US Regulatory)

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM INVESTMENTS - 98% |

|

|

|

|

|

|

|

|

|

|

|

Alaska - 0.3% |

|

|

|

|

| |

$290 |

|

|

Anchorage Elec. Util. Rev., |

|

|

|

|

|

|

|

|

5.00%, 12/01/36 |

|

|

|

|

|

|

|

|

Prerefunded 12/01/24 @ $100 (b) |

|

|

$296,474 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Arizona - 5% |

|

|

|

|

| |

1,350 |

|

|

Arizona Brd. of Regents Rev., |

|

|

|

|

|

|

|

|

Arizona St. Univ., |

|

|

|

|

|

|

|

|

5.00%, 7/01/37 |

|

|

1,398,336 |

|

| |

650 |

|

|

Arizona St. Hlth. Fac. Auth. Rev., |

|

|

|

|

|

|

|

|

HonorHealth Hosp. Proj., |

|

|

|

|

|

|

|

|

5.00%, 12/01/42 |

|

|

651,704 |

|

| |

1,000 |

|

|

Maricopa Cnty. Indl. Dev. Auth. Rev., |

|

|

|

|

|

|

|

|

Banner Hlth., |

|

|

|

|

|

|

|

|

4.00%, 1/01/34 |

|

|

1,009,744 |

|

| |

310 |

|

|

Northern Arizona Univ. Rev., |

|

|

|

|

|

|

|

|

5.00%, 6/01/40 |

|

|

311,622 |

|

| |

1,000 |

|

|

Northern Arizona Univ. SPEED Rev., |

|

|

|

|

|

|

|

|

(Stimulus Plan for Econ. and Edl. Dev.), |

|

|

|

|

|

|

|

|

5.00%, 8/01/38 |

|

|

|

|

|

|

|

|

Prerefunded 8/01/23 @ $100 (b) |

|

|

1,000,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4,371,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

California - 13.2% |

|

|

|

|

| |

330 |

|

|

California St. Hlth. Facs. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Providence St. Joseph Hlth., |

|

|

|

|

|

|

|

|

4.00%, 10/01/36 |

|

|

331,822 |

|

| |

1,660 |

|

|

California St. Hlth. Facs. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Sutter Hlth., |

|

|

|

|

|

|

|

|

5.00%, 11/15/46 |

|

|

|

|

|

|

|

|

Prerefunded 11/15/25 @ $100 (b) |

|

|

1,736,089 |

|

| |

1,000 |

|

|

California St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00% 10/01/28 |

|

|

1,021,053 |

|

| |

1,000 |

|

|

California St. Pub. Wks. Brd. Lease Rev., |

|

|

|

|

|

|

|

|

Dept. of Corrections and Rehab., |

|

|

|

|

|

|

|

|

5.25%, 9/01/29 |

|

|

1,001,407 |

|

| |

1,000 |

|

|

Garden Grove Successor Agy. to Agy. |

|

|

|

|

|

|

|

|

Cmty. Dev., Tax Allocation, |

|

|

|

|

|

|

|

|

5.00%, 10/01/31, BAM |

|

|

1,056,513 |

|

| |

2,000 |

|

|

Gilroy Unified Sch. Dist. Gen. Oblig., |

|

|

|

|

|

|

|

|

4.00%, 8/01/41 |

|

|

2,006,044 |

|

The accompanying note is

an integral part of this financial statement.

1

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

$1,215 |

|

|

San Marcos Successor Agy. to Redev. |

|

|

|

|

|

|

|

|

Agy., Tax Allocation, |

|

|

|

|

|

|

|

|

5.00%, 10/01/32 |

|

|

$1,261,658 |

|

| |

2,000 |

|

|

San Mateo Successor Agy. to Redev. |

|

|

|

|

|

|

|

|

Agy., Tax Allocation, |

|

|

|

|

|

|

|

|

5.00%, 8/01/30 |

|

|

2,074,759 |

|

| |

1,000 |

|

|

Temple City Unified Sch. Dist. Gen. Oblig., |

|

|

|

|

|

|

|

|

4.00%, 8/01/43 |

|

|

995,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,484,881 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Colorado - 4% |

|

|

|

|

| |

1,000 |

|

|

Denver City and Cnty. Arpt. Rev., |

|

|

|

|

|

|

|

|

5.50%, 11/15/30 |

|

|

1,141,083 |

|

| |

2,150 |

|

|

Public Auth. for Colorado Energy, |

|

|

|

|

|

|

|

|

Natural Gas Purch. Rev., |

|

|

|

|

|

|

|

|

6.25%, 11/15/28 |

|

|

2,301,907 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,442,990 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Connecticut - 6.3% |

|

|

|

|

| |

935 |

|

|

Connecticut St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00%, 9/15/35 |

|

|

1,020,033 |

|

| |

730 |

|

|

Connecticut St. Gen. Oblig., |

|

|

|

|

|

|

|

|

4.00%, 4/15/38 |

|

|

735,333 |

|

| |

1,265 |

|

|

Connecticut St. Hlth. & Edl. Facs. Auth. |

|

|

|

|

|

|

|

|

Rev., Yale Univ., |

|

|

|

|

|

|

|

|

5.00%, 7/01/40 |

|

|

1,384,377 |

|

| |

550 |

|

|

Connecticut St. Hlth. & Edl. Facs. Auth. |

|

|

|

|

|

|

|

|

Rev., Yale-New Haven Hosp., |

|

|

|

|

|

|

|

|

5.00%, 7/01/48 |

|

|

546,278 |

|

| |

390 |

|

|

Connecticut St. Hsg. Auth. Rev., |

|

|

|

|

|

|

|

|

3.00%, 5/15/33 |

|

|

363,410 |

|

| |

1,250 |

|

|

Hartford Cnty. Met. Dist. Clean Wtr. Proj. Rev., |

|

|

|

|

|

|

|

|

5.00%, 2/01/33 |

|

|

1,440,207 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,489,638 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida - 16% |

|

|

|

|

| |

780 |

|

|

Brevard Cnty. Sch. Brd. Ref. COP, |

|

|

|

|

|

|

|

|

5.00%, 7/01/32 |

|

|

840,609 |

|

| |

1,000 |

|

|

Central Florida Expwy. Auth. Rev., |

|

|

|

|

|

|

|

|

4.00%, 7/01/36 |

|

|

1,005,288 |

|

| |

1,000 |

|

|

Hillsborough Cnty. Aviation Auth. Rev., |

|

|

|

|

|

|

|

|

Tampa Int’l. Arpt., |

|

|

|

|

|

|

|

|

5.00%, 10/01/44 |

|

|

|

|

|

|

|

|

Prerefunded 10/01/24 @ $100 (b) |

|

|

1,015,313 |

|

The accompanying note is

an integral part of this financial statement.

2

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

$1,080 |

|

|

Miami Beach Hlth. Facs. Auth. Rev., |

|

|

|

|

|

|

|

|

Mt. Sinai Med. Ctr., |

|

|

|

|

|

|

|

|

5.00%, 11/15/39 |

|

|

$1,085,843 |

|

| |

500 |

|

|

Miami Beach Redev. Agy. Rev., |

|

|

|

|

|

|

|

|

5.00%, 2/01/40, AGM |

|

|

501,876 |

|

| |

1,250 |

|

|

Miami-Dade Cnty. Ed. Facs. Auth. Rev., |

|

|

|

|

|

|

|

|

Univ. of Miami, |

|

|

|

|

|

|

|

|

5.00%, 4/01/45 |

|

|

1,267,204 |

|

| |

2,220 |

|

|

Miami-Dade Cnty. Sch. Brd. Ref. COP, |

|

|

|

|

|

|

|

|

5.00%, 2/01/34 |

|

|

2,292,525 |

|

| |

2,035 |

|

|

Seminole Cnty. Sales Tax Rev., |

|

|

|

|

|

|

|

|

5.25%, 10/01/31, NRE |

|

|

2,338,220 |

|

| |

2,190 |

|

|

Seminole Cnty. Sch. Brd. COP, |

|

|

|

|

|

|

|

|

5.00%, 7/01/33 |

|

|

2,280,094 |

|

| |

830 |

|

|

S. Florida Wtr. Mgmt. Dist. COP, |

|

|

|

|

|

|

|

|

5.00%, 10/01/35 |

|

|

859,385 |

|

| |

470 |

|

|

Tallahassee Hlth. Facs. Rev., |

|

|

|

|

|

|

|

|

Tallahassee Memorial Hlthcare., |

|

|

|

|

|

|

|

|

5.00%, 12/01/41 |

|

|

467,623 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13,953,980 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia - 0.6% |

|

|

|

|

| |

500 |

|

|

Atlanta Arpt. Passenger Fac. Charge Gen. Rev., |

|

|

|

|

|

|

|

|

5.00%, 1/01/32 |

|

|

503,324 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Illinois - 13.3% |

|

|

|

|

| |

500 |

|

|

Chicago Multi-Family Hsg. Rev., |

|

|

|

|

|

|

|

|

Paul G. Stewart (Phases I and II), |

|

|

|

|

|

|

|

|

4.90%, 3/20/44, FHA |

|

|

500,160 |

|

| |

1,000 |

|

|

Chicago O’Hare Intl. Arpt. Rev., |

|

|

|

|

|

|

|

|

Customer Fac. Charge, |

|

|

|

|

|

|

|

|

5.125%, 1/01/30, AGM |

|

|

1,003,187 |

|

| |

250 |

|

|

Chicago Sales Tax Rev., |

|

|

|

|

|

|

|

|

5.00%, 1/01/30 |

|

|

|

|

|

|

|

|

Prerefunded 1/01/25 @ $100 (b) |

|

|

255,721 |

|

| |

250 |

|

|

Chicago Wtrwks. Rev., |

|

|

|

|

|

|

|

|

5.00%, 11/01/30 |

|

|

261,600 |

|

| |

665 |

|

|

Chicago Wtrwks. Rev., |

|

|

|

|

|

|

|

|

5.25%, 11/01/32, AGM |

|

|

718,185 |

|

| |

250 |

|

|

Chicago Wtrwks. Rev., |

|

|

|

|

|

|

|

|

5.00%, 11/01/36, AGM |

|

|

262,725 |

|

| |

865 |

|

|

Chicago Wtrwks. Rev., |

|

|

|

|

|

|

|

|

5.00%, 11/01/44 |

|

|

871,489 |

|

The accompanying note is

an integral part of this financial statement.

3

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

$1,000 |

|

|

Cook Cnty. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00%, 11/15/24 |

|

|

$1,018,351 |

|

| |

170 |

|

|

Illinois St. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Advocate Hlth. Care Network, |

|

|

|

|

|

|

|

|

5.00%, 5/01/45 |

|

|

|

|

|

|

|

|

Prerefunded 5/01/25 @ $100 (b) |

|

|

174,322 |

|

| |

1,055 |

|

|

Illinois St. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Advocate Hlth. Care Network, |

|

|

|

|

|

|

|

|

5.00%, 5/01/45 |

|

|

|

|

|

|

|

|

Prerefunded 5/01/25 @ $100 (b) |

|

|

1,083,626 |

|

| |

525 |

|

|

Illinois St. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Northwestern Memorial Hlthcare., |

|

|

|

|

|

|

|

|

5.00%, 9/01/42 |

|

|

|

|

|

|

|

|

Prerefunded 9/01/24 @ $100 (b) |

|

|

534,099 |

|

| |

1,000 |

|

|

Illinois St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00%, 2/01/27 |

|

|

1,051,538 |

|

| |

2,020 |

|

|

Illinois St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.50%, 1/01/29 |

|

|

2,238,443 |

|

| |

600 |

|

|

Illinois St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00%, 2/01/29 |

|

|

631,978 |

|

| |

1,000 |

|

|

Univ. of Illinois Aux. Facs. Sys. Rev., |

|

|

|

|

|

|

|

|

5.00%, 4/01/34 |

|

|

1,003,650 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11,609,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Indiana - 0.3% |

|

|

|

|

| |

240 |

|

|

Indiana St. Fin. Auth. Hosp. Rev., |

|

|

|

|

|

|

|

|

Indiana Univ. Hlth., |

|

|

|

|

|

|

|

|

5.00%, 12/01/28 |

|

|

245,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Louisiana - 1.8% |

|

|

|

|

| |

1,250 |

|

|

Louisiana St. Tran. Auth. Rev., |

|

|

|

|

|

|

|

|

5.00%, 8/15/38 |

|

|

|

|

|

|

|

|

Prerefunded 8/15/23 @ $100 (b) |

|

|

1,250,717 |

|

| |

300 |

|

|

New Orleans Swr. Svc. Rev., |

|

|

|

|

|

|

|

|

5.00%, 6/01/44 |

|

|

|

|

|

|

|

|

Prerefunded 6/01/24 @ $100 (b) |

|

|

304,170 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,554,887 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maine - 1% |

|

|

|

|

| |

905 |

|

|

Maine St. Hlth. & Hgr. Edl. Facs. Auth. Rev., |

|

|

|

|

|

|

|

|

5.00%, 7/01/33 |

|

|

905,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maryland - 1.2% |

|

|

|

|

| |

1,000 |

|

|

Maryland St. Hlth. & Hgr. Edl. Facs. Auth. Rev., |

|

|

|

|

|

|

|

|

Luminis Hlth., |

|

|

|

|

|

|

|

|

5.00%, 7/01/39 |

|

|

|

|

|

|

|

|

Prerefunded 7/01/24 @ $100 (b) |

|

|

1,014,945 |

|

|

|

|

|

|

|

|

|

|

The accompanying note is

an integral part of this financial statement.

4

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Massachusetts - 2.6% |

|

|

|

|

| |

$1,945 |

|

|

Massachusetts St. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.50%, 8/01/30, AMBAC |

|

|

$2,262,446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michigan - 3.5% |

|

|

|

|

| |

1,630 |

|

|

Great Lakes Wtr. Auth., Sewage Disposal |

|

|

|

|

|

|

|

|

Sys. Rev., |

|

|

|

|

|

|

|

|

5.00%, 7/01/33 |

|

|

1,699,230 |

|

| |

550 |

|

|

Michigan St. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Corewell Hlth., |

|

|

|

|

|

|

|

|

5.00%, 11/01/44 |

|

|

558,012 |

|

| |

540 |

|

|

Michigan St. Bldg. Auth. Rev., |

|

|

|

|

|

|

|

|

4.00%, 10/15/36 |

|

|

548,235 |

|

| |

225 |

|

|

Royal Oak Hosp. Fin. Auth. Rev., |

|

|

|

|

|

|

|

|

Corewell Hlth., |

|

|

|

|

|

|

|

|

5.00%, 9/01/39 |

|

|

|

|

|

|

|

|

Prerefunded 3/01/24 @ $100 (b) |

|

|

226,958 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,032,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Minnesota - 0.2% |

|

|

|

|

| |

200 |

|

|

Minnesota St. Hsg. Fin. Agy., |

|

|

|

|

|

|

|

|

2.70%, 7/01/44 |

|

|

158,323 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nebraska - 2.4% |

|

|

|

|

| |

1,925 |

|

|

Omaha Gen. Oblig., |

|

|

|

|

|

|

|

|

5.25%, 4/01/27 |

|

|

2,085,148 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Jersey - 2.2% |

|

|

|

|

| |

400 |

|

|

Camden Cnty. Impvt. Auth. Hlthcare. |

|

|

|

|

|

|

|

|

Redev. Rev., Cooper Hlth. Sys., |

|

|

|

|

|

|

|

|

5.00%, 2/15/33 |

|

|

401,796 |

|

| |

295 |

|

|

New Jersey St. COVID-19 Gen. Oblig. |

|

|

|

|

|

|

|

|

Emergency Bonds, |

|

|

|

|

|

|

|

|

4.00%, 6/01/31 |

|

|

314,534 |

|

| |

1,125 |

|

|

New Jersey St. Tpk. Auth. Rev., |

|

|

|

|

|

|

|

|

5.00%, 1/01/34 |

|

|

1,191,732 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,908,062 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New York - 3.4% |

|

|

|

|

| |

2,035 |

|

|

New York St. Dorm. Auth., |

|

|

|

|

|

|

|

|

Personal Inc. Tax Rev., |

|

|

|

|

|

|

|

|

5.00%, 03/15/31 |

|

|

2,091,615 |

|

| |

900 |

|

|

Port Auth. of New York and New Jersey Rev., |

|

|

|

|

|

|

|

|

5.00%, 6/01/33 |

|

|

904,590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,996,205 |

|

|

|

|

|

|

|

|

|

|

The accompanying note is

an integral part of this financial statement.

5

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Oregon - 1.9% |

|

|

|

|

| |

$570 |

|

|

Port of Portland Intl. Arpt. Rev., |

|

|

|

|

|

|

|

|

5.00%, 7/01/32 |

|

|

$575,631 |

|

| |

1,000 |

|

|

Washington Cnty. Sch. Dist. 48J |

|

|

|

|

|

|

|

|

(Beaverton), Gen. Oblig. |

|

|

|

|

|

|

|

|

5.00%, 6/15/36 |

|

|

1,060,684 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,636,315 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pennsylvania - 2.3% |

|

|

|

|

| |

2,000 |

|

|

Delaware River Port Auth. Rev., |

|

|

|

|

|

|

|

|

5.00%, 1/01/34 |

|

|

|

|

|

|

|

|

Prerefunded 1/01/24 @ $100 (b) |

|

|

2,014,262 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rhode Island - 1.3% |

|

|

|

|

| |

1,070 |

|

|

Rhode Island St. Clean Wtr. Fin. Agy., |

|

|

|

|

|

|

|

|

Wtr. Poll. Control Rev., |

|

|

|

|

|

|

|

|

5.00%, 10/01/32 |

|

|

|

|

|

|

|

|

Prerefunded 10/01/24 @ $100 (b) |

|

|

1,091,295 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South Carolina - 2.1% |

|

|

|

|

| |

1,500 |

|

|

Charleston Edl. Excellence Fin. Corp. Rev., |

|

|

|

|

|

|

|

|

Charleston Cnty. Sch. Dist., |

|

|

|

|

|

|

|

|

5.00%, 12/01/24 |

|

|

1,531,395 |

|

| |

290 |

|

|

SCAGO Edl. Facs. Corp. Rev., |

|

|

|

|

|

|

|

|

Pickens Cnty. Sch. Dist., |

|

|

|

|

|

|

|

|

5.00%, 12/01/24 |

|

|

295,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,826,957 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tennessee - 2.7% |

|

|

|

|

| |

250 |

|

|

Chattanooga-Hamilton Cnty. Hosp. Auth. Rev., |

|

|

|

|

|

|

|

|

Erlanger Hlth. Sys., |

|

|

|

|

|

|

|

|

5.00%, 10/01/34 |

|

|

252,751 |

|

| |

2,000 |

|

|

Tennessee St. Sch. Bond Auth. Rev., |

|

|

|

|

|

|

|

|

5.00%, 11/01/42 |

|

|

2,109,333 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,362,084 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas - 6.4% |

|

|

|

|

| |

600 |

|

|

Bexar Cnty. Hosp. Dist. Gen. Oblig., |

|

|

|

|

|

|

|

|

5.00%, 2/15/25 |

|

|

615,010 |

|

| |

670 |

|

|

Dallas Area Rapid Transit Rev., |

|

|

|

|

|

|

|

|

5.00%, 12/01/41 |

|

|

|

|

|

|

|

|

Prerefunded 12/01/25 @ $100 (b) |

|

|

698,423 |

|

| |

1,410 |

|

|

Houston Util. Sys. Rev., |

|

|

|

|

|

|

|

|

5.00%, 11/15/32 |

|

|

|

|

|

|

|

|

Prerefunded 11/15/23 @ $100 (b) |

|

|

1,416,604 |

|

The accompanying note is

an integral part of this financial statement.

6

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

|

|

|

|

|

|

|

|

|

|

Principal

Amount

(000) |

|

|

Description (a) |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

$1,505 |

|

|

North Texas Twy. Auth. Rev., |

|

|

|

|

|

|

|

|

Convertible CAB, |

|

|

|

|

|

|

|

|

0.00%, 9/01/43 |

|

|

|

|

|

|

|

|

Prerefunded 9/01/31 @ $100 (b) |

|

|

$1,894,653 |

|

| |

1,000 |

|

|

Texas St. Wtr. Development Brd. Rev., |

|

|

|

|

|

|

|

|

St. Wtr. Implementation Fund, |

|

|

|

|

|

|

|

|

4.00%, 10/15/47 |

|

|

972,792 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,597,482 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vermont - 0.6% |

|

|

|

|

| |

500 |

|

|

Vermont St. Edl. and Hlth. Bldg. Fin. Agy. Rev., |

|

|

|

|

|

|

|

|

Univ. of Vermont Med. Center, |

|

|

|

|

|

|

|

|

5.00%, 12/01/35 |

|

|

518,441 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington - 1.5% |

|

|

|

|

| |

1,260 |

|

|

Port of Seattle Rev., |

|

|

|

|

|

|

|

|

5.00%, 5/01/32 |

|

|

1,323,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wisconsin - 1.9% |

|

|

|

|

| |

1,400 |

|

|

Wisconsin St. Pub. Fin. Auth. Hosp. Rev., |

|

|

|

|

|

|

|

|

Renown Reg. Med. Ctr., |

|

|

|

|

|

|

|

|

5.00%, 6/01/40 |

|

|

1,418,168 |

|

| |

250 |

|

|

Wisconsin St. Pub. Fin. Auth., |

|

|

|

|

|

|

|

|

Solid Waste Disp. Rev., |

|

|

|

|

|

|

|

|

2.875%, 5/01/27 |

|

|

233,419 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,651,587 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Long-Term Investments |

|

|

|

|

|

|

|

|

(Cost $85,648,776) |

|

|

85,337,661 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS - 98% |

|

|

|

|

|

|

|

|

(Cost $85,648,776) |

|

|

$85,337,661 |

|

|

|

|

|

Other assets less liabilities - 2% |

|

|

1,759,595 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS - 100% |

|

|

$87,097,256 |

|

|

|

|

|

|

|

|

|

|

The accompanying note is

an integral part of this financial statement.

7

DTF TAX-FREE INCOME 2028 TERM FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2023

(Unaudited)

(a) The following abbreviations are used in the portfolio descriptions:

AGM - Assured Guaranty Municipal Corp.*

AMBAC - Ambac Assurance Corporation*

BAM - Build America Mutual Assurance Company*

CAB - Capital Appreciation Bond

COP - Certificate of Participation

FHA - Federal Housing Authority*

NRE - National Public Finance Guarantee Corporation*

* Indicates an obligation of credit support, in whole or in part.

(b) Prerefunded issues are secured by escrowed cash, U.S. government obligations, or other securities.

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common stock of the Fund.

Note 1. Investment Valuation

The Fund’s

investments are carried at fair value which is defined as the price that the Fund might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the

investment.

The three-tier hierarchy of inputs established to classify fair value measurements for disclosure purposes is summarized in the three broad

levels listed below.

Level 1 – quoted prices in active markets for identical securities

Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.)

Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. For more

information about the Fund’s policy regarding the valuation of investments and other significant accounting policies, please refer to the Fund’s most recent financial statements contained in its semi-annual report. The following is a

summary of the inputs used to value each of the Fund’s investments at July 31, 2023:

|

|

|

|

|

| |

|

Level 2 |

|

| Municipal bonds |

|

$ |

85,337,661 |

|

| |

|

| |

|

There were no Level 1 or Level 3 priced securities held and there were no transfers into or out of Level 3.

Other information regarding the Fund is available on the Fund’s website at www.dpimc.com/dtf or the Securities and Exchange Commission’s website at

www.sec.gov.

8

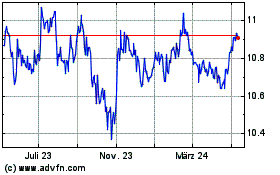

DTF Tax free Income 2028... (NYSE:DTF)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

DTF Tax free Income 2028... (NYSE:DTF)

Historical Stock Chart

Von Apr 2023 bis Apr 2024