0000945764--12-312021Q2false0.0010.00150,000,00050,000,000————0.0010.001250,000,000250,000,00050,017,49149,999,9991,1688,7292,25118,181518,153339,01119,36214,53213,9455,2111,0671,322192,195190,56316,31919,0092,5241,63741,34530,05813,8235,11147,43333,5092,78840,56375,831152,276288,407106,641—18,99414,377734,9815,36013,784538112,3222.911.2650,661494,75250,661494,7521,255—5,503——1,493—5,572—83,4954505752500009457642021-01-012021-06-30xbrli:shares00009457642021-07-31iso4217:USD00009457642021-06-3000009457642020-12-31iso4217:USDxbrli:shares0000945764us-gaap:OilAndGasMember2021-04-012021-06-300000945764us-gaap:OilAndGasMember2020-04-012020-06-300000945764us-gaap:OilAndGasMember2021-01-012021-06-300000945764us-gaap:OilAndGasMember2020-01-012020-06-300000945764den:CarbondioxideMember2021-04-012021-06-300000945764den:CarbondioxideMember2020-04-012020-06-300000945764den:CarbondioxideMember2021-01-012021-06-300000945764den:CarbondioxideMember2020-01-012020-06-300000945764us-gaap:OilAndGasPurchasedMember2021-04-012021-06-300000945764us-gaap:OilAndGasPurchasedMember2020-04-012020-06-300000945764us-gaap:OilAndGasPurchasedMember2021-01-012021-06-300000945764us-gaap:OilAndGasPurchasedMember2020-01-012020-06-300000945764us-gaap:OtherIncomeMember2021-04-012021-06-300000945764us-gaap:OtherIncomeMember2020-04-012020-06-300000945764us-gaap:OtherIncomeMember2021-01-012021-06-300000945764us-gaap:OtherIncomeMember2020-01-012020-06-3000009457642021-04-012021-06-3000009457642020-04-012020-06-3000009457642020-01-012020-06-300000945764us-gaap:OilAndGasRefiningAndMarketingMember2021-04-012021-06-300000945764us-gaap:OilAndGasRefiningAndMarketingMember2020-04-012020-06-300000945764us-gaap:OilAndGasRefiningAndMarketingMember2021-01-012021-06-300000945764us-gaap:OilAndGasRefiningAndMarketingMember2020-01-012020-06-3000009457642019-12-3100009457642020-06-300000945764us-gaap:CommonStockMember2020-12-310000945764us-gaap:AdditionalPaidInCapitalMember2020-12-310000945764us-gaap:RetainedEarningsMember2020-12-310000945764us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-3100009457642021-01-012021-03-310000945764us-gaap:CommonStockMember2021-01-012021-03-310000945764us-gaap:RetainedEarningsMember2021-01-012021-03-310000945764us-gaap:CommonStockMember2021-03-310000945764us-gaap:AdditionalPaidInCapitalMember2021-03-310000945764us-gaap:RetainedEarningsMember2021-03-3100009457642021-03-310000945764us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-300000945764us-gaap:CommonStockMember2021-04-012021-06-300000945764us-gaap:RetainedEarningsMember2021-04-012021-06-300000945764us-gaap:CommonStockMember2021-06-300000945764us-gaap:AdditionalPaidInCapitalMember2021-06-300000945764us-gaap:RetainedEarningsMember2021-06-300000945764us-gaap:CommonStockMember2019-12-310000945764us-gaap:AdditionalPaidInCapitalMember2019-12-310000945764us-gaap:RetainedEarningsMember2019-12-310000945764us-gaap:TreasuryStockMember2019-12-310000945764us-gaap:CommonStockMember2020-01-012020-03-310000945764us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-3100009457642020-01-012020-03-310000945764us-gaap:TreasuryStockMember2020-01-012020-03-310000945764us-gaap:RetainedEarningsMember2020-01-012020-03-310000945764us-gaap:CommonStockMember2020-03-310000945764us-gaap:AdditionalPaidInCapitalMember2020-03-310000945764us-gaap:RetainedEarningsMember2020-03-310000945764us-gaap:TreasuryStockMember2020-03-3100009457642020-03-310000945764us-gaap:CommonStockMember2020-04-012020-06-300000945764us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-300000945764us-gaap:RetainedEarningsMember2020-04-012020-06-300000945764us-gaap:CommonStockMember2020-06-300000945764us-gaap:AdditionalPaidInCapitalMember2020-06-300000945764us-gaap:RetainedEarningsMember2020-06-300000945764us-gaap:TreasuryStockMember2020-06-300000945764us-gaap:CommonStockMember2020-07-012020-09-180000945764us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-1800009457642020-07-012020-09-180000945764us-gaap:TreasuryStockMember2020-07-012020-09-180000945764us-gaap:RetainedEarningsMember2020-07-012020-09-180000945764us-gaap:CommonStockMember2020-09-180000945764us-gaap:AdditionalPaidInCapitalMember2020-09-1800009457642020-09-180000945764us-gaap:RetainedEarningsMember2020-09-192020-09-3000009457642020-09-192020-09-300000945764us-gaap:CommonStockMember2020-09-300000945764us-gaap:AdditionalPaidInCapitalMember2020-09-300000945764us-gaap:RetainedEarningsMember2020-09-3000009457642020-09-300000945764us-gaap:AdditionalPaidInCapitalMember2020-10-012020-12-3100009457642020-10-012020-12-310000945764us-gaap:RetainedEarningsMember2020-10-012020-12-310000945764den:NetIncomeScenarioMember2021-04-012021-06-300000945764den:NetIncomeScenarioMember2020-04-012020-06-300000945764den:NetIncomeScenarioMember2021-01-012021-06-300000945764den:NetIncomeScenarioMember2020-01-012020-06-300000945764us-gaap:PhantomShareUnitsPSUsMember2021-04-012021-06-300000945764us-gaap:PhantomShareUnitsPSUsMember2021-01-012021-06-300000945764us-gaap:RestrictedStockUnitsRSUMember2021-06-300000945764us-gaap:RestrictedStockUnitsRSUMember2020-06-300000945764us-gaap:WarrantMember2021-06-300000945764us-gaap:WarrantMember2020-06-300000945764us-gaap:StockAppreciationRightsSARSMember2021-06-300000945764us-gaap:StockAppreciationRightsSARSMember2020-06-300000945764us-gaap:RestrictedStockMember2021-06-300000945764us-gaap:RestrictedStockMember2020-06-300000945764us-gaap:ConvertibleDebtSecuritiesMember2021-06-302021-06-300000945764us-gaap:ConvertibleDebtSecuritiesMember2020-06-302020-06-300000945764den:SeriesAWarrantsMember2021-06-300000945764den:SeriesBWarrantsMember2021-06-30den:warrantsiso4217:USDden:Barrel0000945764srt:OilReservesMember2021-01-012021-03-31xbrli:pure00009457642021-03-032021-03-030000945764den:Year2021Memberden:WindRiverBasinPropertiesMember2021-06-300000945764den:Year2021Memberden:WindRiverBasinPropertiesMembersrt:MinimumMember2021-01-012021-06-3000009457642021-03-0300009457642021-03-032021-06-300000945764den:BigSandDrawAndBeaverCreekFieldsMember2021-03-032021-03-030000945764den:BigSandDrawAndBeaverCreekFieldsMember2021-03-0300009457642021-06-302021-06-300000945764den:Year2022Memberden:WindRiverBasinPropertiesMember2021-06-300000945764den:Year2022Memberden:WindRiverBasinPropertiesMembersrt:MinimumMember2021-01-012021-06-300000945764den:OilSalesMember2021-04-012021-06-300000945764den:OilSalesMember2020-04-012020-06-300000945764den:OilSalesMember2021-01-012021-06-300000945764den:OilSalesMember2020-01-012020-06-300000945764den:NaturalGasSalesMember2021-04-012021-06-300000945764den:NaturalGasSalesMember2020-04-012020-06-300000945764den:NaturalGasSalesMember2021-01-012021-06-300000945764den:NaturalGasSalesMember2020-01-012020-06-300000945764den:CO2SalesAndTransportationFeesMember2021-04-012021-06-300000945764den:CO2SalesAndTransportationFeesMember2020-04-012020-06-300000945764den:CO2SalesAndTransportationFeesMember2021-01-012021-06-300000945764den:CO2SalesAndTransportationFeesMember2020-01-012020-06-300000945764den:DividendorOtherRestrictedPaymentMembersrt:MaximumMember2021-01-012021-06-300000945764den:DividendorOtherRestrictedPaymentMembersrt:MinimumMember2021-06-300000945764srt:MaximumMember2021-01-012021-06-300000945764srt:MinimumMember2021-01-012021-06-300000945764den:NEJDPipelineMember2021-01-012021-06-300000945764den:NEJDPipelineMember2020-10-312020-10-310000945764us-gaap:SubsequentEventMemberden:NEJDPipelineMember2021-07-012021-07-310000945764us-gaap:SubsequentEventMemberden:NEJDPipelineMember2021-10-312021-10-31utr:Rateutr:bblden:d0000945764us-gaap:SwapMemberden:Q3Q42021Memberden:NYMEXMember2021-06-300000945764us-gaap:SwapMemberden:Q3Q42021Memberden:NYMEXMembersrt:MinimumMember2021-06-300000945764us-gaap:SwapMemberden:Q3Q42021Memberden:NYMEXMembersrt:MaximumMember2021-06-300000945764den:Q3Q42021Memberden:NYMEXMemberus-gaap:OptionMember2021-06-300000945764us-gaap:SwapMemberden:NYMEXMemberden:Q1Q22022Member2021-06-300000945764us-gaap:SwapMemberden:NYMEXMembersrt:MinimumMemberden:Q1Q22022Member2021-06-300000945764us-gaap:SwapMemberden:NYMEXMembersrt:MaximumMemberden:Q1Q22022Member2021-06-300000945764us-gaap:SwapMemberden:NYMEXMemberden:Q3Q42022Member2021-06-300000945764us-gaap:SwapMemberden:NYMEXMembersrt:MinimumMemberden:Q3Q42022Member2021-06-300000945764us-gaap:SwapMemberden:NYMEXMembersrt:MaximumMemberden:Q3Q42022Member2021-06-300000945764den:NYMEXMemberus-gaap:OptionMemberden:Q1Q22022Member2021-06-300000945764den:NYMEXMemberus-gaap:OptionMemberden:Q3Q42022Member2021-06-300000945764us-gaap:FairValueInputsLevel1Member2021-06-300000945764us-gaap:FairValueInputsLevel2Member2021-06-300000945764us-gaap:FairValueInputsLevel3Member2021-06-300000945764us-gaap:FairValueInputsLevel1Member2020-12-310000945764us-gaap:FairValueInputsLevel2Member2020-12-310000945764us-gaap:FairValueInputsLevel3Member2020-12-310000945764den:PowerAgreementsMember2021-06-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☑ Quarterly report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended June 30, 2021

OR

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the transition period from _______ to ________

Commission file number: 001-12935

DENBURY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 20-0467835 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | | | |

| 5851 Legacy Circle, | | |

| Plano, | TX | | | 75024 |

| (Address of principal executive offices) | | (Zip Code) |

| | | | | | | | | | | |

| Registrant’s telephone number, including area code: | | (972) | 673-2000 |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class: | Trading Symbol: | Name of Each Exchange on Which Registered: |

| Common Stock $.001 Par Value | DEN | New York Stock Exchange |

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☑ | Non-accelerated filer | ☐ | Smaller reporting company | ☑ | Emerging growth company | ☐ |

| | | | | (Do not check if a smaller reporting company) | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☑ No ☐

The number of shares outstanding of the registrant’s Common Stock, $.001 par value, as of July 31, 2021, was 50,109,950.

Table of Contents

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

Denbury Inc.

Unaudited Condensed Consolidated Balance Sheets

(In thousands, except par value and share data)

| | | | | | | | | | | | | | |

| | |

| | Successor |

| | June 30, 2021 | | December 31, 2020 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 13,565 | | | $ | 518 | |

| Restricted cash | | — | | | 1,000 | |

| Accrued production receivable | | 140,302 | | | 91,421 | |

| Trade and other receivables, net | | 24,740 | | | 19,682 | |

| Derivative assets | | — | | | 187 | |

| Prepaids | | 12,454 | | | 14,038 | |

| Total current assets | | 191,061 | | | 126,846 | |

| Property and equipment | | | | |

| Oil and natural gas properties (using full cost accounting) | | | | |

| Proved properties | | 949,128 | | | 851,208 | |

| Unevaluated properties | | 103,088 | | | 85,304 | |

CO2 properties | | 188,700 | | | 188,288 | |

| Pipelines | | 143,633 | | | 133,485 | |

| Other property and equipment | | 97,699 | | | 86,610 | |

| Less accumulated depletion, depreciation, amortization and impairment | | (120,073) | | | (41,095) | |

| Net property and equipment | | 1,362,175 | | | 1,303,800 | |

| Operating lease right-of-use assets | | 19,000 | | | 20,342 | |

| | | | |

| Intangible assets, net | | 92,814 | | | 97,362 | |

| Other assets | | 85,044 | | | 86,408 | |

| Total assets | | $ | 1,750,094 | | | $ | 1,634,758 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current liabilities | | | | |

| Accounts payable and accrued liabilities | | $ | 163,905 | | | $ | 112,671 | |

| Oil and gas production payable | | 69,390 | | | 49,165 | |

| Derivative liabilities | | 223,212 | | | 53,865 | |

| Current maturities of long-term debt | | 34,498 | | | 68,008 | |

| Operating lease liabilities | | 2,596 | | | 1,350 | |

| Total current liabilities | | 493,601 | | | 285,059 | |

| Long-term liabilities | | | | |

| Long-term debt, net of current portion | | 35,000 | | | 70,000 | |

| Asset retirement obligations | | 226,615 | | | 179,338 | |

| Derivative liabilities | | 22,164 | | | 5,087 | |

| Deferred tax liabilities, net | | 1,187 | | | 1,274 | |

| Operating lease liabilities | | 18,157 | | | 19,460 | |

| Other liabilities | | 26,172 | | | 20,872 | |

| Total long-term liabilities | | 329,295 | | | 296,031 | |

| Commitments and contingencies (Note 8) | | | | |

| Stockholders’ equity | | | | |

| Preferred stock, $.001 par value, 50,000,000 shares authorized, none issued and outstanding | | — | | | — | |

| Common stock, $.001 par value, 250,000,000 shares authorized; 50,017,491 and 49,999,999 shares issued, respectively | | 50 | | | 50 | |

| Paid-in capital in excess of par | | 1,125,143 | | | 1,104,276 | |

| Accumulated deficit | | (197,995) | | | (50,658) | |

Total stockholders’ equity | | 927,198 | | | 1,053,668 | |

| Total liabilities and stockholders’ equity | | $ | 1,750,094 | | | $ | 1,634,758 | |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Inc.

Unaudited Condensed Consolidated Statements of Operations

(In thousands, except per-share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Successor | | | | | Predecessor | | Successor | | | Predecessor |

| | Three Months Ended

June 30, 2021 | | | | | Three Months Ended

June 30, 2020 | | Six Months Ended

June 30, 2021 | | | Six Months Ended

June 30, 2020 |

| | | | | | | | | | | | |

| Revenues and other income | | | | | | | | | | | | |

| Oil, natural gas, and related product sales | | $ | 282,708 | | | | | | $ | 109,387 | | | $ | 518,153 | | | | $ | 339,011 | |

CO2 sales and transportation fees | | 10,134 | | | | | | 6,504 | | | 19,362 | | | | 14,532 | |

| Oil marketing revenues | | 7,819 | | | | | | 1,490 | | | 13,945 | | | | 5,211 | |

| Other income | | 707 | | | | | | 494 | | | 1,067 | | | | 1,322 | |

| Total revenues and other income | | 301,368 | | | | | | 117,875 | | | 552,527 | | | | 360,076 | |

| Expenses | | | | | | | | | | | | |

| Lease operating expenses | | 110,225 | | | | | | 81,293 | | | 192,195 | | | | 190,563 | |

| Transportation and marketing expenses | | 8,522 | | | | | | 9,388 | | | 16,319 | | | | 19,009 | |

CO2 operating and discovery expenses | | 1,531 | | | | | | 885 | | | 2,524 | | | | 1,637 | |

| Taxes other than income | | 22,382 | | | | | | 10,372 | | | 41,345 | | | | 30,058 | |

| Oil marketing expenses | | 7,738 | | | | | | 1,450 | | | 13,823 | | | | 5,111 | |

| General and administrative expenses | | 15,450 | | | | | | 23,776 | | | 47,433 | | | | 33,509 | |

| Interest, net of amounts capitalized of $1,168, $8,729, $2,251 and $18,181, respectively | | 1,252 | | | | | | 20,617 | | | 2,788 | | | | 40,563 | |

| Depletion, depreciation, and amortization | | 36,381 | | | | | | 55,414 | | | 75,831 | | | | 152,276 | |

| Commodity derivatives expense (income) | | 172,664 | | | | | | 40,130 | | | 288,407 | | | | (106,641) | |

| Gain on debt extinguishment | | — | | | | | | — | | | — | | | | (18,994) | |

| Write-down of oil and natural gas properties | | — | | | | | | 662,440 | | | 14,377 | | | | 734,981 | |

| | | | | | | | | | | | |

| Other expenses | | 3,214 | | | | | | 11,290 | | | 5,360 | | | | 13,784 | |

| Total expenses | | 379,359 | | | | | | 917,055 | | | 700,402 | | | | 1,095,856 | |

| Loss before income taxes | | (77,991) | | | | | | (799,180) | | | (147,875) | | | | (735,780) | |

| Income tax benefit | | (296) | | | | | | (101,706) | | | (538) | | | | (112,322) | |

| Net loss | | $ | (77,695) | | | | | | $ | (697,474) | | | $ | (147,337) | | | | $ | (623,458) | |

| | | | | | | | | | | | |

| Net loss per common share | | | | | | | | | | | | |

| Basic | | $ | (1.52) | | | | | | $ | (1.41) | | | $ | (2.91) | | | | $ | (1.26) | |

| Diluted | | $ | (1.52) | | | | | | $ | (1.41) | | | $ | (2.91) | | | | $ | (1.26) | |

| | | | | | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | | | | | |

| Basic | | 50,999 | | | | | | 495,245 | | | 50,661 | | | | 494,752 | |

| Diluted | | 50,999 | | | | | | 495,245 | | | 50,661 | | | | 494,752 | |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Inc.

Unaudited Condensed Consolidated Statements of Cash Flows

(In thousands)

| | | | | | | | | | | | | | | | | | | |

| | Successor | | | | | Predecessor |

| | Six Months Ended

June 30, 2021 | | | | | Six Months Ended

June 30, 2020 |

| | | | | | | |

| Cash flows from operating activities | | | | | | | |

| Net loss | | $ | (147,337) | | | | | | $ | (623,458) | |

| Adjustments to reconcile net loss to cash flows from operating activities | | | | | | | |

| | | | | | | |

| Depletion, depreciation, and amortization | | 75,831 | | | | | | 152,276 | |

| Write-down of oil and natural gas properties | | 14,377 | | | | | | 734,981 | |

| Deferred income taxes | | (87) | | | | | | (106,513) | |

| Stock-based compensation | | 20,232 | | | | | | 3,540 | |

| Commodity derivatives expense (income) | | 288,407 | | | | | | (106,641) | |

| Receipt (payment) on settlements of commodity derivatives | | (101,796) | | | | | | 70,267 | |

| Gain on debt extinguishment | | — | | | | | | (18,994) | |

| Debt issuance costs and discounts | | 1,370 | | | | | | 9,921 | |

| Other, net | | 744 | | | | | | (1,642) | |

| Changes in assets and liabilities, net of effects from acquisitions | | | | | | | |

| Accrued production receivable | | (48,881) | | | | | | 62,063 | |

| Trade and other receivables | | (5,578) | | | | | | (16,162) | |

| Other current and long-term assets | | 1,294 | | | | | | (4,552) | |

| Accounts payable and accrued liabilities | | 27,292 | | | | | | (60,295) | |

| Oil and natural gas production payable | | 20,224 | | | | | | (22,217) | |

| Other liabilities | | (2,554) | | | | | | 237 | |

| Net cash provided by operating activities | | 143,538 | | | | | | 72,811 | |

| | | | | | | |

| Cash flows from investing activities | | | | | | | |

| Oil and natural gas capital expenditures | | (53,411) | | | | | | (79,897) | |

| Acquisitions of oil and natural gas properties | | (10,811) | | | | | | — | |

| Pipelines and plants capital expenditures | | (4,851) | | | | | | (10,962) | |

| Net proceeds from sales of oil and natural gas properties and equipment | | 18,456 | | | | | | 40,971 | |

| Other | | (4,159) | | | | | | (105) | |

| Net cash used in investing activities | | (54,776) | | | | | | (49,993) | |

| | | | | | | |

| Cash flows from financing activities | | | | | | | |

| Bank repayments | | (485,000) | | | | | | (226,000) | |

| Bank borrowings | | 450,000 | | | | | | 491,000 | |

| Interest payments treated as a reduction of debt | | — | | | | | | (42,506) | |

| Cash paid in conjunction with debt repurchases | | — | | | | | | (14,171) | |

| | | | | | | |

| | | | | | | |

| Pipeline financing and capital lease debt repayments | | (33,510) | | | | | | (7,015) | |

| Other | | (2,735) | | | | | | (9,529) | |

| Net cash provided by (used in) financing activities | | (71,245) | | | | | | 191,779 | |

| Net increase in cash, cash equivalents, and restricted cash | | 17,517 | | | | | | 214,597 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 42,248 | | | | | | 33,045 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 59,765 | | | | | | $ | 247,642 | |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Inc.

Unaudited Condensed Consolidated Statements of Changes in Stockholders' Equity

(Dollar amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock

($.001 Par Value) | | Paid-In

Capital in

Excess of

Par | | Retained

Earnings (Accumulated Deficit) | | Treasury Stock

(at cost) | | |

| Shares | | Amount | Shares | | Amount | Total Equity |

| Balance – December 31, 2020 (Successor) | 49,999,999 | | | $ | 50 | | | $ | 1,104,276 | | | $ | (50,658) | | | — | | | $ | — | | | $ | 1,053,668 | |

| Stock-based compensation | — | | | — | | | 19,172 | | | — | | | — | | | — | | | 19,172 | |

| Tax withholding for stock compensation plans | — | | | — | | | (1,467) | | | — | | | — | | | — | | | (1,467) | |

| Issued pursuant to exercise of warrants | 5,620 | | | 0 | | | 195 | | | — | | | — | | | — | | | 195 | |

| Net loss | — | | | — | | | — | | | (69,642) | | | — | | | — | | | (69,642) | |

| Balance – March 31, 2021 (Successor) | 50,005,619 | | | 50 | | | 1,122,176 | | | (120,300) | | | — | | | — | | | 1,001,926 | |

| | | | | | | | | | | | | |

| Stock-based compensation | — | | | — | | | 2,682 | | | — | | | — | | | — | | | 2,682 | |

| Tax withholding for stock compensation plans | — | | | — | | | (7) | | | — | | | — | | | — | | | (7) | |

| Issued pursuant to exercise of warrants | 11,872 | | | 0 | | | 292 | | | — | | | — | | | — | | | 292 | |

| Net loss | — | | | — | | | — | | | (77,695) | | | — | | | — | | | (77,695) | |

| Balance – June 30, 2021 (Successor) | 50,017,491 | | | $ | 50 | | | $ | 1,125,143 | | | $ | (197,995) | | | — | | | $ | — | | | $ | 927,198 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Stock

($.001 Par Value) | | Paid-In

Capital in

Excess of

Par | | Retained

Earnings (Accumulated Deficit) | | Treasury Stock

(at cost) | | |

| Shares | | Amount | Shares | | Amount | Total Equity |

| Balance – December 31, 2019 (Predecessor) | 508,065,495 | | | $ | 508 | | | $ | 2,739,099 | | | $ | (1,321,314) | | | 1,652,771 | | | $ | (6,034) | | | $ | 1,412,259 | |

| Issued pursuant to stock compensation plans | 312,516 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Issued pursuant to directors’ compensation plan | 37,367 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation | — | | | — | | | 3,204 | | | — | | | — | | | — | | | 3,204 | |

| Tax withholding for stock compensation plans | — | | | — | | | — | | | — | | | 175,673 | | | (34) | | | (34) | |

| Net income | — | | | — | | | — | | | 74,016 | | | — | | | — | | | 74,016 | |

| Balance – March 31, 2020 (Predecessor) | 508,415,378 | | | 508 | | | 2,742,303 | | | (1,247,298) | | | 1,828,444 | | | (6,068) | | | 1,489,445 | |

| Canceled pursuant to stock compensation plans | (6,218,868) | | | (6) | | | 6 | | | — | | | — | | | — | | | — | |

| Issued pursuant to notes conversion | 7,357,450 | | | 8 | | | 11,453 | | | — | | | — | | | — | | | 11,461 | |

| Stock-based compensation | — | | | — | | | 987 | | | — | | | — | | | — | | | 987 | |

| Net loss | — | | | — | | | — | | | (697,474) | | | — | | | — | | | (697,474) | |

| Balance – June 30, 2020 (Predecessor) | 509,553,960 | | | 510 | | | 2,754,749 | | | (1,944,772) | | | 1,828,444 | | | (6,068) | | | 804,419 | |

| Canceled pursuant to stock compensation plans | (95,016) | | | — | | | — | | | — | | | — | | | — | | | — | |

| Issued pursuant to notes conversion | 14,800 | | | — | | | 40 | | | — | | | — | | | — | | | 40 | |

| Stock-based compensation | — | | | — | | | 10,126 | | | — | | | — | | | — | | | 10,126 | |

| Tax withholding for stock compensation plans | — | | | — | | | — | | | — | | | 567,189 | | | (134) | | | (134) | |

| Net loss | — | | | — | | | — | | | (809,120) | | | — | | | — | | | (809,120) | |

| Cancellation of Predecessor equity | (509,473,744) | | | (510) | | | (2,764,915) | | | 2,753,892 | | | (2,395,633) | | | 6,202 | | | (5,331) | |

| Issuance of Successor equity | 49,999,999 | | | 50 | | | 1,095,369 | | | — | | | — | | | — | | | 1,095,419 | |

| Balance – September 18, 2020 (Predecessor) | 49,999,999 | | | $ | 50 | | | $ | 1,095,369 | | | $ | — | | | — | | | $ | — | | | $ | 1,095,419 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance – September 19, 2020 (Successor) | 49,999,999 | | | $ | 50 | | | $ | 1,095,369 | | | $ | — | | | — | | | $ | — | | | $ | 1,095,419 | |

| Net income | — | | | — | | | — | | | 2,758 | | | — | | | — | | | 2,758 | |

| Balance – September 30, 2020 (Successor) | 49,999,999 | | | 50 | | | 1,095,369 | | | 2,758 | | | — | | | — | | | 1,098,177 | |

| Stock-based compensation | — | | | — | | | 8,907 | | | — | | | — | | | — | | | 8,907 | |

| Net loss | — | | | — | | | — | | | (53,416) | | | — | | | — | | | (53,416) | |

| Balance – December 31, 2020 (Successor) | 49,999,999 | | | $ | 50 | | | $ | 1,104,276 | | | $ | (50,658) | | | — | | | $ | — | | | $ | 1,053,668 | |

See accompanying Notes to Unaudited Condensed Consolidated Financial Statements.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 1. Basis of Presentation

Organization and Nature of Operations

Denbury Inc. (“Denbury,” “Company” or the “Successor”), a Delaware corporation, is an independent energy company with operations focused in the Gulf Coast and Rocky Mountain regions. The Company is differentiated by its focus on CO2 enhanced oil recovery (“EOR”) and the emerging carbon capture, use, and storage (“CCUS”) industry, supported by the Company’s CO2 EOR technical and operational expertise and its extensive CO2 pipeline infrastructure. The utilization of captured industrial-sourced CO2 in EOR significantly reduces the carbon footprint of the oil that Denbury produces, underpinning the Company’s goal to fully offset its Scope 1, 2, and 3 CO2 emissions within this decade, primarily through increasing the amount of captured industrial-sourced CO2 used in its operations.

Emergence from Voluntary Reorganization Under Chapter 11 of the Bankruptcy Code

On July 30, 2020, Denbury Resources Inc. (the “Predecessor”) and its subsidiaries filed petitions for reorganization in a “prepackaged” voluntary bankruptcy under chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the Southern District of Texas (the “Bankruptcy Court”) under the caption “In re Denbury Resources Inc., et al., Case No. 20-33801”. On September 2, 2020, the Bankruptcy Court entered an order (the “Confirmation Order”) confirming the prepackaged joint plan of reorganization (the “Plan”) and approving the Disclosure Statement, and on September 18, 2020 (the “Emergence Date”), the Plan became effective in accordance with its terms and the Company emerged from Chapter 11 as the successor reporting company of Denbury Resources Inc. On April 23, 2021, the Bankruptcy Court entered a final decree closing the Chapter 11 case captioned “In re Denbury Resources Inc., et al., Case No. 20-33801”, so all of the Chapter 11 cases have been closed.

Upon emergence from bankruptcy, we met the criteria and were required to adopt fresh start accounting in accordance with Financial Accounting Standards Board Codification (“FASC”) Topic 852, Reorganizations. Fresh start accounting requires that new fair values be established for the Company’s assets, liabilities and equity as of the Emergence Date, and therefore certain values and operational results of the condensed consolidated financial statements subsequent to September 18, 2020 are not comparable to those in the Company’s condensed consolidated financial statements prior to, and including September 18, 2020. The Emergence Date fair values of the Successor’s assets and liabilities differ materially from their recorded values as reflected on the historical balance sheets of the Predecessor contained in periodic reports previously filed with the Securities and Exchange Commission. References to “Successor” relate to the financial position and results of operations of the Company subsequent to September 18, 2020, and references to “Predecessor” relate to the financial position and results of operations of the Company prior to, and including, September 18, 2020.

Interim Financial Statements

The accompanying unaudited condensed consolidated financial statements of Denbury Inc. and its subsidiaries have been prepared in accordance with the rules and regulations of the Securities and Exchange Commission (“SEC”) and do not include all of the information and footnotes required by accounting principles generally accepted in the United States for complete financial statements. These financial statements and the notes thereto should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2020 (the “Form 10-K”). Unless indicated otherwise or the context requires, the terms “we,” “our,” “us,” “Company” or “Denbury,” refer to Denbury Inc. and its subsidiaries.

Accounting measurements at interim dates inherently involve greater reliance on estimates than at year end, and the results of operations for the interim periods shown in this report are not necessarily indicative of results to be expected for the year. In management’s opinion, the accompanying unaudited condensed consolidated financial statements include all adjustments of a normal recurring nature necessary for a fair presentation of our consolidated financial position as of June 30, 2021 (Successor); our consolidated results of operations for the three and six months ended June 30, 2021 (Successor) and June 30, 2020 (Predecessor); our consolidated cash flows for the six months ended June 30, 2021 (Successor) and June 30, 2020 (Predecessor); and our consolidated statements of changes in stockholders’ equity for the three and six months ended June 30, 2021 (Successor), for the period January 1, 2020 through September 18, 2020 (Predecessor), and for the period September 19, 2020 through December 31, 2020 (Successor). Upon the adoption of fresh start accounting, the Company’s assets and liabilities were recorded at their fair values as of the fresh start reporting date. As a result of the adoption of fresh start

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

accounting, certain values and operational results of the Company’s condensed consolidated financial statements subsequent to September 18, 2020 are not comparable to those in its condensed consolidated financial statements prior to, and including September 18, 2020.

Reclassifications

Certain prior period amounts have been reclassified to conform to the current year presentation. Such reclassifications had no impact on our reported net income (loss), current assets, total assets, current liabilities, total liabilities or stockholders’ equity.

Cash, Cash Equivalents, and Restricted Cash

The following table provides a reconciliation of cash, cash equivalents, and restricted cash as reported within the Unaudited Condensed Consolidated Balance Sheets to “Cash, cash equivalents, and restricted cash at end of period” as reported within the Unaudited Condensed Consolidated Statements of Cash Flows:

| | | | | | | | | | | | | | |

| | Successor |

| In thousands | | June 30, 2021 | | December 31, 2020 |

| Cash and cash equivalents | | $ | 13,565 | | | $ | 518 | |

| Restricted cash, current | | — | | | 1,000 | |

| Restricted cash included in other assets | | 46,200 | | | 40,730 | |

| Total cash, cash equivalents, and restricted cash shown in the Unaudited Condensed Consolidated Statements of Cash Flows | | $ | 59,765 | | | $ | 42,248 | |

Restricted cash included in other assets in the table above consists of escrow accounts that are legally restricted for certain of our asset retirement obligations, and are included in “Other assets” in the accompanying Unaudited Condensed Consolidated Balance Sheets.

Net Income (Loss) per Common Share

Basic net income (loss) per common share is computed by dividing the net income (loss) attributable to common stockholders by the weighted average number of shares of common stock outstanding during the period. Diluted net income per common share is calculated in the same manner but includes the impact of potentially dilutive securities. Potentially dilutive securities during the Successor periods consist of nonvested restricted stock units and outstanding series A and series B warrants, and during the Predecessor periods consisted of nonvested restricted stock, nonvested performance-based equity awards, and convertible senior notes. For the three and six months ended June 30, 2021 and 2020, there were no adjustments to net loss for purposes of calculating basic and diluted net loss per common share.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The following is a reconciliation of the weighted average shares used in the basic and diluted net loss per common share calculations for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Successor | | | | | Predecessor | | Successor | | | Predecessor |

| In thousands | | Three Months Ended

June 30, 2021 | | | | | Three Months Ended

June 30, 2020 | | Six Months Ended

June 30, 2021 | | | Six Months Ended

June 30, 2020 |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Weighted average common shares outstanding – basic | | 50,999 | | | | | | 495,245 | | | 50,661 | | | | 494,752 | |

| Effect of potentially dilutive securities | | | | | | | | | | | | |

| Restricted stock units | | — | | | | | | — | | | — | | | | |

| | | | | | | | | | | | |

| Warrants | | — | | | | | | — | | | — | | | | — | |

| Restricted stock and performance-based equity awards | | — | | | | | | — | | | — | | | | — | |

Convertible senior notes(1) | | — | | | | | | — | | | — | | | | — | |

Weighted average common shares outstanding – diluted(2) | | 50,999 | | | | | | 495,245 | | | 50,661 | | | | 494,752 | |

(1)In connection with the Company’s emergence from bankruptcy on September 18, 2020, all outstanding convertible senior notes were fully extinguished.

(2)If the Company had recognized net income, the weighted average diluted shares outstanding would have been 54.3 million and 587.1 million for the three months ended June 30, 2021 and 2020, respectively, and 52.7 million and 586.6 million for the six months ended June 30, 2021 and 2020, respectively.

Basic weighted average common shares during the Successor periods includes 987,987 and 563,416 performance stock units during the three and six months ended June 30, 2021, respectively, with vesting parameters tied to the Company’s common stock trading prices and which became fully vested on March 3, 2021. Although the performance measures for vesting of these awards have been achieved, the shares underlying these awards are not currently outstanding as actual delivery of the shares is not scheduled to occur until after the end of the performance period, December 4, 2023. Basic weighted average common shares during the Predecessor periods included time-vesting restricted stock that vested during the periods.

The following outstanding securities were excluded from the computation of diluted net loss per share, as their effect would have been antidilutive, as of the respective dates:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | Successor | | | | | Predecessor | | | | | |

| In thousands | | June 30, 2021 | | | | | June 30, 2020 | | | | | |

| Restricted stock units | | 1,255 | | | | | | — | | | | | | |

| Warrants | | 5,503 | | | | | | — | | | | | | |

| Stock appreciation rights | | — | | | | | | 1,493 | | | | | | |

| Nonvested time-based restricted stock and performance-based equity awards | | — | | | | | | 5,572 | | | | | | |

| Convertible senior notes | | — | | | | | | 83,495 | | | | | | |

For the Successor period, the Company’s restricted stock units and series A and series B warrants were antidilutive based on the Company’s net loss position for the period. At June 30, 2021, the Company had approximately 5.5 million warrants outstanding that can be exercised for shares of the Successor’s common stock, at an exercise price of $32.59 per share for the 2.6 million series A warrants and at an exercise price of $35.41 per share for the 2.9 million series B warrants. The series A warrants are exercisable until September 18, 2025, and the series B warrants are exercisable until September 18, 2023, at which time the warrants expire. The warrants were issued pursuant to the Plan to holders of the Predecessor’s convertible senior notes, senior subordinated notes, and equity. As of June 30, 2021, 2,315 series A warrants and 20,927 series B warrants had been exercised. The warrants may be exercised for cash or on a cashless basis. If warrants are exercised on a cashless basis, the amount of dilution will be less than 5.5 million shares.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Oil and Natural Gas Properties

Unevaluated Costs. Under full cost accounting, we exclude certain unevaluated costs from the amortization base and full cost ceiling test pending the determination of whether proved reserves can be assigned to such properties. These costs are transferred to the full cost amortization base as these properties are developed, tested and evaluated. At least annually, we test these assets for impairment based on an evaluation of management’s expectations of future pricing, evaluation of lease expiration terms, and planned development activities. In the first quarter of 2020 Predecessor period, given the significant declines in NYMEX oil prices in March and April 2020, we reassessed our development plans and transferred $244.9 million of our unevaluated costs to the full cost amortization base. Upon emergence from bankruptcy, the Company adopted fresh start accounting which resulted in our oil and natural gas properties, including unevaluated properties, being recorded at their fair values at the Emergence Date.

Write-Down of Oil and Natural Gas Properties. Under full cost accounting, the net capitalized costs of oil and natural gas properties are limited to the lower of unamortized cost or the cost center ceiling. The cost center ceiling is defined as (1) the present value of estimated future net revenues from proved oil and natural gas reserves before future abandonment costs (discounted at 10%), based on the average first-day-of-the-month oil and natural gas price for each month during a 12-month rolling period prior to the end of a particular reporting period; plus (2) the cost of properties not being amortized; plus (3) the lower of cost or estimated fair value of unproved properties included in the costs being amortized, if any; less (4) related income tax effects. Our future net revenues from proved oil and natural gas reserves are not reduced for development costs related to the cost of drilling for and developing CO2 reserves nor those related to the cost of constructing CO2 pipelines, as we do not have to incur additional CO2 capital costs to develop the proved oil and natural gas reserves. Therefore, we include in the ceiling test, as a reduction of future net revenues, that portion of our capitalized CO2 costs related to CO2 reserves and CO2 pipelines that we estimate will be consumed in the process of producing our proved oil and natural gas reserves. The fair value of our oil and natural gas derivative contracts is not included in the ceiling test, as we do not designate these contracts as hedge instruments for accounting purposes. The cost center ceiling test is prepared quarterly.

We recognized a full cost pool ceiling test write-down of $14.4 million during the three months ended March 31, 2021, with first-day-of-the-month NYMEX oil prices for the preceding 12 months averaging $36.40 per Bbl, after adjustments for market differentials and transportation expenses by field. The write-down was primarily a result of the recent acquisition (see Note 2 – Acquisition and Divestiture) which was recorded based on a valuation that utilized NYMEX strip oil prices at the acquisition date, which were significantly higher than the average first-day-of-the-month NYMEX oil prices used to value the cost ceiling. We also recognized full cost pool ceiling test write-downs of $662.4 million and $72.5 million during the Predecessor three months ended June 30, 2020 and March 31, 2020, respectively. We did not record a ceiling test write-down during the three months ended June 30, 2021.

Recent Accounting Pronouncements

Recently Adopted

Income Taxes. In December 2019, the Financial Accounting Standards Board (“FASB”) issued ASU 2019-12, Income Taxes (Topic 740) – Simplifying the Accounting for Income Taxes (“ASU 2019-12”). The objective of ASU 2019-12 is to simplify the accounting for income taxes by removing certain exceptions to the general principles in Topic 740 and to provide more consistent application to improve the comparability of financial statements. Effective January 1, 2021, we adopted ASU 2019-02. The implementation of this standard did not have a material impact on our consolidated financial statements and related footnote disclosures.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 2. Acquisition and Divestiture

Acquisition of Wyoming CO2 EOR Fields

On March 3, 2021, we acquired a nearly 100% working interest (approximately 83% net revenue interest) in the Big Sand Draw and Beaver Creek EOR fields located in Wyoming from a subsidiary of Devon Energy Corporation for $10.7 million cash (before final closing adjustments), including surface facilities and a 46-mile CO2 transportation pipeline to the acquired fields. The acquisition agreement provides for us to make two contingent cash payments, one in January 2022 and one in January 2023, of $4 million each, conditioned on NYMEX WTI oil prices averaging at least $50 per Bbl during 2021 and 2022, respectively. The fair value of the contingent consideration on the acquisition date was $5.3 million, and as of June 30, 2021, the fair value of the contingent consideration recorded on our unaudited condensed consolidated balance sheets was $7.0 million. The $1.7 million increase from the March 2021 acquisition date fair value was the result of higher NYMEX WTI oil prices and was recorded to “Other expenses” in our Unaudited Condensed Consolidated Statements of Operations.

The fair values allocated to our assets acquired and liabilities assumed for the acquisition were based on significant inputs not observable in the market and considered level 3 inputs. The following table presents a summary of the fair value of assets acquired and liabilities assumed in the acquisition:

| | | | | | | | |

| In thousands | | |

| Consideration: | | |

| Cash consideration | | $ | 10,657 | |

| | |

Less: Fair value of assets acquired and liabilities assumed:(1) | | |

| Proved oil and natural gas properties | | 59,852 | |

| Other property and equipment | | 1,685 | |

| Asset retirement obligations | | (39,794) | |

| Contingent consideration | | (5,320) | |

| Other liabilities | | (5,766) | |

| Fair value of net assets acquired | | $ | 10,657 | |

(1)Fair value of assets acquired and liabilities assumed is preliminary, pending final closing adjustments and further evaluation of reserves and liabilities assumed.

Divestiture of Hartzog Draw Deep Mineral Rights

On June 30, 2021, we closed the sale of undeveloped, unconventional deep mineral rights in Hartzog Draw Field in Wyoming. The cash proceeds of $18 million were recorded to “Proved properties” in our Unaudited Condensed Consolidated Balance Sheets. The proceeds reduced our full cost pool; therefore, no gain or loss was recorded on the transaction, and the sale had no impact on our production or reserves.

Note 3. Revenue Recognition

We record revenue in accordance with FASC Topic 606, Revenue from Contracts with Customers. The core principle of FASC Topic 606 is that an entity should recognize revenue for the transfer of goods or services equal to the amount of consideration that it expects to be entitled to receive for those goods or services. Once we have delivered the volume of commodity to the delivery point and the customer takes delivery and possession, we are entitled to payment and we invoice the customer for such delivered production. Payment under most oil and CO2 contracts is received within a month following product delivery and for natural gas and NGL contracts payment is generally received within two months following delivery. Timing of revenue recognition may differ from the timing of invoicing to customers; however, as the right to consideration after delivery is unconditional based on only the passage of time before payment of the consideration is due, upon delivery we record a receivable in “Accrued production receivable” in our Unaudited Condensed Consolidated Balance Sheets. From time to time,

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

the Company enters into marketing arrangements for the purchase and sale of crude oil for third parties. Revenues and expenses from these transactions are presented on a gross basis, as we act as a principal in the transaction by assuming control of the commodities purchased and responsibility to deliver the commodities sold. Revenue is recognized when control transfers to the purchaser at the delivery point based on the price received from the purchaser.

Disaggregation of Revenue

The following table summarizes our revenues by product type:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Successor | | | | | Predecessor | | Successor | | | Predecessor |

| | | | | | | | | | | | |

| In thousands | | Three Months Ended

June 30, 2021 | | | | | Three Months Ended

June 30, 2020 | | Six Months Ended

June 30, 2021 | | | Six Months Ended

June 30, 2020 |

| Oil sales | | $ | 280,577 | | | | | | $ | 108,538 | | | $ | 513,621 | | | | $ | 337,115 | |

| Natural gas sales | | 2,131 | | | | | | 849 | | | 4,532 | | | | 1,896 | |

CO2 sales and transportation fees | | 10,134 | | | | | | 6,504 | | | 19,362 | | | | 14,532 | |

| Oil marketing revenues | | 7,819 | | | | | | 1,490 | | | 13,945 | | | | 5,211 | |

| Total revenues | | $ | 300,661 | | | | | | $ | 117,381 | | | $ | 551,460 | | | | $ | 358,754 | |

Note 4. Long-Term Debt

The table below reflects long-term debt outstanding as of the dates indicated:

| | | | | | | | | | | | | | |

| | Successor |

| In thousands | | June 30, 2021 | | December 31, 2020 |

| Senior Secured Bank Credit Agreement | | $ | 35,000 | | | $ | 70,000 | |

| Pipeline financings | | 34,498 | | | 68,008 | |

| Total debt principal balance | | 69,498 | | | 138,008 | |

| Less: current maturities of long-term debt | | (34,498) | | | (68,008) | |

| Long-term debt | | $ | 35,000 | | | $ | 70,000 | |

Senior Secured Bank Credit Agreement

On the Emergence Date, we entered into a credit agreement with JPMorgan Chase Bank, N.A., as administrative agent, and other lenders party thereto (the “Bank Credit Agreement”). The Bank Credit Agreement is a senior secured revolving credit facility with an initial borrowing base and lender commitments of $575 million. Availability under the Bank Credit Agreement is subject to a borrowing base, which is redetermined semiannually on or around May 1 and November 1 of each year, with our next scheduled redetermination around November 1, 2021. The borrowing base is adjusted at the lenders’ discretion and is based, in part, upon external factors over which we have no control. If our outstanding debt under the Bank Credit Agreement exceeds the then-effective borrowing base, we would be required to repay the excess amount over a period not to exceed six months. The Bank Credit Agreement matures on January 30, 2024. The weighted average interest rate on borrowings outstanding as of June 30, 2021 under the Bank Credit Agreement was 4.0%. The undrawn portion of the aggregate lender commitments under the Bank Credit Agreement is subject to a commitment fee of 0.5% per annum.

The Bank Credit Agreement prohibits us from paying dividends on our common stock through September 17, 2021. Commencing on September 18, 2021, we may pay dividends on our common stock or make other restricted payments in an amount not to exceed “Distributable Free Cash Flow”, but only if (1) no event of default or borrowing base deficiency exists; (2) our total leverage ratio is 2 to 1 or lower; and (3) availability under the Bank Credit Agreement is at least 20%. The Bank Credit Agreement also limits our ability to, among other things, incur and repay other indebtedness; grant liens; engage in certain mergers, consolidations, liquidations and dissolutions; engage in sales of assets; make acquisitions and investments; make other restricted payments (including redeeming, repurchasing or retiring our common stock); and enter into commodity derivative agreements, in each case subject to customary exceptions.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

The Successor Bank Credit Agreement is secured by (1) our proved oil and natural gas properties, which are held through our restricted subsidiaries; (2) the pledge of equity interests of such subsidiaries; (3) a pledge of our commodity derivative agreements; (4) a pledge of deposit accounts, securities accounts and our commodity accounts; and (5) a security interest in substantially all other collateral that may be perfected by a Uniform Commercial Code filing, subject to certain exceptions.

The Bank Credit Agreement contains certain financial performance covenants including the following:

•A Consolidated Total Debt to Consolidated EBITDAX covenant (as defined in the Bank Credit Agreement), with such ratio not to exceed 3.5 times; and

•A requirement to maintain a current ratio (i.e., Consolidated Current Assets to Consolidated Current Liabilities) of 1.0 time.

For purposes of computing the current ratio per the Bank Credit Agreement, Consolidated Current Assets exclude the current portion of derivative assets but include available borrowing capacity under the Bank Credit Agreement, and Consolidated Current Liabilities exclude the current portion of derivative liabilities as well as the current portions of long-term indebtedness outstanding. As of June 30, 2021, we were in compliance with all debt covenants under the Bank Credit Agreement.

The above description of our Bank Credit Agreement is qualified by the express language and defined terms contained in the Bank Credit Agreement.

Pipeline Financing Transactions

During the first half of 2021, Denbury paid $35.0 million to Genesis Energy, L.P., half of the four quarterly installments totaling $70 million to be paid during 2021 in accordance with the October 2020 restructuring of the financing arrangements of our NEJD CO2 pipeline system. The third quarterly installment of $17.5 million was paid in July 2021, and the final quarterly payment of $17.5 million is payable on October 31, 2021.

Note 5. Income Taxes

We evaluate our estimated annual effective income tax rate based on current and forecasted business results and enacted tax laws on a quarterly basis and apply this tax rate to our ordinary income or loss to calculate our estimated tax liability or benefit. Our income taxes are based on an estimated combined federal and state statutory rate of approximately 25% in 2021 and 2020. Our effective tax rates for the three and six months ended June 30, 2021 (Successor) differed from our estimated statutory rate as the deferred tax benefit generated from our operating losses were offset by a valuation allowance applied to our underlying federal and state deferred tax assets.

Note 6. Commodity Derivative Contracts

We do not apply hedge accounting treatment to our oil and natural gas derivative contracts; therefore, the changes in the fair values of these instruments are recognized in income in the period of change. These fair value changes, along with the settlements of expired contracts, are shown under “Commodity derivatives expense (income)” in our Unaudited Condensed Consolidated Statements of Operations.

Historically, we have entered into various oil and natural gas derivative contracts to provide an economic hedge of our exposure to commodity price risk associated with anticipated future oil and natural gas production and to provide more certainty to our future cash flows. We do not hold or issue derivative financial instruments for trading purposes. Generally, these contracts have consisted of various combinations of price floors, collars, three-way collars, fixed-price swaps, fixed-price swaps enhanced with a sold put, and basis swaps. The production that we hedge has varied from year to year depending on our levels of debt, financial strength and expectation of future commodity prices. In addition, our new senior secured bank credit facility entered into on the Emergence Date required that, by December 31, 2020, we have certain minimum commodity hedge levels in place covering anticipated crude oil production through July 31, 2022. The requirement is non-recurring, and we were in compliance with the hedging requirements as of December 31, 2020.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

We manage and control market and counterparty credit risk through established internal control procedures that are reviewed on an ongoing basis. We attempt to minimize credit risk exposure to counterparties through formal credit policies, monitoring procedures and diversification, and all of our commodity derivative contracts are with parties that are lenders under our Bank Credit Agreement (or affiliates of such lenders). As of June 30, 2021, all of our outstanding derivative contracts were subject to enforceable master netting arrangements whereby payables on those contracts can be offset against receivables from separate derivative contracts with the same counterparty. It is our policy to classify derivative assets and liabilities on a gross basis on our balance sheets, even if the contracts are subject to enforceable master netting arrangements.

The following table summarizes our commodity derivative contracts as of June 30, 2021, none of which are classified as hedging instruments in accordance with the FASC Derivatives and Hedging topic:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Months | | Index Price | | Volume (Barrels per day) | | Contract Prices ($/Bbl) |

Range(1) | | Weighted Average Price |

| Swap | | Floor | | Ceiling |

| Oil Contracts: | | | | | | | | | | | | | |

| 2021 Fixed-Price Swaps | | | | | | | | | | | | | |

| July – Dec | | NYMEX | | 29,000 | | $ | 38.68 | | – | 56.00 | | | $ | 43.86 | | | $ | — | | | $ | — | |

| 2021 Collars | | | | | | | | | | | | | |

| July – Dec | | NYMEX | | 4,000 | | $ | 45.00 | | – | 59.30 | | | $ | — | | | $ | 46.25 | | | $ | 53.04 | |

| 2022 Fixed-Price Swaps | | | | | | | | | | | | | |

| Jan – June | | NYMEX | | 15,500 | | $ | 42.65 | | – | 58.15 | | | $ | 49.01 | | | $ | — | | | $ | — | |

| July – Dec | | NYMEX | | 9,000 | | | 50.13 | | – | 60.35 | | | 56.35 | | | — | | | — | |

| 2022 Collars | | | | | | | | | | | | | |

| Jan – June | | NYMEX | | 11,000 | | $ | 47.50 | | – | 70.75 | | | $ | — | | | $ | 49.77 | | | $ | 64.31 | |

| July – Dec | | NYMEX | | 10,000 | | | 47.50 | | – | 70.75 | | | — | | | 49.75 | | | 64.18 | |

(1)Ranges presented for fixed-price swaps represent the lowest and highest fixed prices of all open contracts for the period presented. For collars, ranges represent the lowest floor price and highest ceiling price for all open contracts for the period presented.

Note 7. Fair Value Measurements

The FASC Fair Value Measurement topic defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (often referred to as the “exit price”). We utilize market data or assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated or generally unobservable. We primarily apply the income approach for recurring fair value measurements and endeavor to utilize the best available information. Accordingly, we utilize valuation techniques that maximize the use of observable inputs and minimize the use of unobservable inputs. We are able to classify fair value balances based on the observability of those inputs. The FASC establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurement) and the lowest priority to unobservable inputs (Level 3 measurement). The three levels of the fair value hierarchy are as follows:

•Level 1 – Quoted prices in active markets for identical assets or liabilities as of the reporting date.

•Level 2 – Pricing inputs are other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reported date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies. Instruments in this category include non-exchange-traded oil derivatives that are based on NYMEX and regional pricing other than NYMEX (e.g., Light Louisiana Sweet). Our costless collars and the sold put features of our three-way collars are valued using the Black-Scholes model, an industry standard option valuation model that takes into account inputs such as contractual prices for the underlying instruments, maturity, quoted forward prices for commodities, interest rates, volatility factors and credit worthiness, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout the full term

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

of the instrument, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace.

•Level 3 – Pricing inputs include significant inputs that are generally less observable. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value.

We adjust the valuations from the valuation model for nonperformance risk, using our estimate of the counterparty’s credit quality for asset positions and our credit quality for liability positions. We use multiple sources of third-party credit data in determining counterparty nonperformance risk, including credit default swaps.

The following table sets forth, by level within the fair value hierarchy, our financial assets and liabilities that were accounted for at fair value on a recurring basis as of the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Fair Value Measurements Using: |

| In thousands | | Quoted Prices

in Active

Markets

(Level 1) | | Significant

Other

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| June 30, 2021 | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Oil derivative contracts – current | | $ | — | | | $ | (223,212) | | | $ | — | | | $ | (223,212) | |

| Oil derivative contracts – long-term | | — | | | (22,164) | | | — | | | (22,164) | |

| Total Liabilities | | $ | — | | | $ | (245,376) | | | $ | — | | | $ | (245,376) | |

| | | | | | | | |

| December 31, 2020 | | | | | | | | |

| Assets | | | | | | | | |

| Oil derivative contracts – current | | $ | — | | | $ | 187 | | | $ | — | | | $ | 187 | |

| Total Assets | | $ | — | | | $ | 187 | | | $ | — | | | $ | 187 | |

| | | | | | | | |

| Liabilities | | | | | | | | |

| Oil derivative contracts – current | | $ | — | | | $ | (53,865) | | | $ | — | | | $ | (53,865) | |

| Oil derivative contracts – long-term | | — | | | (5,087) | | | — | | | (5,087) | |

| Total Liabilities | | $ | — | | | $ | (58,952) | | | $ | — | | | $ | (58,952) | |

Since we do not apply hedge accounting for our commodity derivative contracts, any gains and losses on our assets and liabilities are included in “Commodity derivatives expense (income)” in the accompanying Unaudited Condensed Consolidated Statements of Operations.

Other Fair Value Measurements

The carrying value of our loans under our Bank Credit Agreement approximate fair value, as they are subject to short-term floating interest rates that approximate the rates available to us for those periods. The estimated fair value of the principal amount of our debt as of June 30, 2021 and December 31, 2020, excluding pipeline financing obligations, was $35.0 million and $70.0 million. We have other financial instruments consisting primarily of cash, cash equivalents, U.S. Treasury notes, short-term receivables and payables that approximate fair value due to the nature of the instrument and the relatively short maturities.

Denbury Inc.

Notes to Unaudited Condensed Consolidated Financial Statements

Note 8. Commitments and Contingencies

Chapter 11 Proceedings

On July 30, 2020, Denbury Resources Inc. and each of its wholly-owned subsidiaries filed for relief under chapter 11 of the Bankruptcy Code. The chapter 11 cases were administered jointly under the caption “In re Denbury Resources Inc., et al., Case No. 20-33801”. On September 2, 2020, the Bankruptcy Court entered the Confirmation Order and on the Emergence Date, all of the conditions of the Plan were satisfied or waived and the Plan became effective and was implemented in accordance with its terms. On September 30, 2020, the Bankruptcy Court closed the chapter 11 cases of each of Denbury Inc.’s wholly-owned subsidiaries. On April 23, 2021, the Bankruptcy Court entered a final decree closing the Chapter 11 case captioned “In re Denbury Resources Inc., et al., Case No. 20-33801”, so all of the Chapter 11 cases have been closed.

Litigation

We are involved in various lawsuits, claims and regulatory proceedings incidental to our businesses. We are also subject to audits for various taxes (income, sales and use, and severance) in the various states in which we operate, and from time to time receive assessments for potential taxes that we may owe. While we currently believe that the ultimate outcome of these proceedings, individually and in the aggregate, will not have a material adverse effect on our financial position, results of operations or cash flows, litigation is subject to inherent uncertainties. We accrue for losses from litigation and claims if we determine that a loss is probable and the amount can be reasonably estimated.

Note 9. Additional Balance Sheet Details

Trade and Other Receivables, Net

| | | | | | | | | | | | | | |

| | Successor |

| In thousands | | June 30, 2021 | | December 31, 2020 |

| Trade accounts receivable, net | | $ | 11,795 | | | $ | 11,691 | |

| Federal income tax receivable, net | | 597 | | | 597 | |

| Commodity derivative settlement receivables | | — | | | 5,716 | |

Other receivables(1) | | 12,348 | | | 1,678 | |

| Total | | $ | 24,740 | | | $ | 19,682 | |

(1)Primarily consists of a currently estimated $9.9 million benefit under the Company’s power agreements for reduced power usage during the winter storms in February 2021.

Accounts Payable and Accrued Liabilities

| | | | | | | | | | | | | | |

| | Successor |

| In thousands | | June 30, 2021 | | December 31, 2020 |

| Accounts payable | | $ | 27,166 | | | $ | 18,629 | |

| Accrued derivative settlements | | 26,121 | | | 3,908 | |

| Accrued lease operating expenses | | 24,802 | | | 21,294 | |

| Accrued compensation | | 21,428 | | | 7,512 | |

| Accrued exploration and development costs | | 12,361 | | | 1,861 | |

| Taxes payable | | 10,180 | | | 17,221 | |

| Accrued general and administrative expenses | | 4,432 | | | 21,825 | |

| Other | | 37,415 | | | 20,421 | |

| Total | | $ | 163,905 | | | $ | 112,671 | |

Denbury Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis should be read in conjunction with our Unaudited Condensed Consolidated Financial Statements and Notes thereto included herein and our Consolidated Financial Statements and Notes thereto included in our Annual Report on Form 10-K for the year ended December 31, 2020 (the “Form 10-K”), along with Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the Form 10-K. Any terms used but not defined herein have the same meaning given to them in the Form 10-K.

As a result of the Company’s emergence from bankruptcy and adoption of fresh start accounting on September 18, 2020 (the “Emergence Date”), certain values and operational results of the condensed consolidated financial statements subsequent to September 18, 2020 are not comparable to those in the Company’s condensed consolidated financial statements prior to, and including September 18, 2020. The Emergence Date fair values of the Successor’s assets and liabilities differ materially from their recorded values as reflected on the historical balance sheets of the Predecessor contained in periodic reports previously filed with the Securities and Exchange Commission. References to “Successor” relate to the financial position and results of operations of the Company subsequent to September 18, 2020, and references to “Predecessor” relate to the financial position and results of operations of the Company prior to, and including, September 18, 2020.

Our discussion and analysis includes forward-looking information that involves risks and uncertainties and should be read in conjunction with Risk Factors under Item 1A of this Form 10-Q as well as Item 1A of the Form 10-K, along with Forward-Looking Information at the end of this section for information on the risks and uncertainties that could cause our actual results to be materially different than our forward-looking statements.

OVERVIEW

Denbury is an independent energy company with operations focused in the Gulf Coast and Rocky Mountain regions. The Company is differentiated by its focus on CO2 enhanced oil recovery (“EOR”) and the emerging carbon capture, use, and storage (“CCUS”) industry, supported by the Company’s CO2 EOR technical and operational expertise and its extensive CO2 pipeline infrastructure. The utilization of captured industrial-sourced CO2 in EOR significantly reduces the carbon footprint of the oil that Denbury produces, underpinning the Company’s goal to fully offset its Scope 1, 2, and 3 CO2 emissions within this decade, primarily through increasing the amount of captured industrial-sourced CO2 used in its operations.

Oil Price Impact on Our Business. Our financial results are significantly impacted by changes in oil prices, as 97% of our sales is oil. Changes in oil prices impact all aspects of our business; most notably our cash flows from operations, revenues, capital allocation and budgeting decisions, and oil and natural gas reserves volumes. The table below outlines selected financial

Denbury Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

items and sales volumes, along with changes in our realized oil prices, before and after commodity derivative impacts, for our most recent comparative periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Successor | | | Predecessor | | | | |

| | Three Months Ended | | | Three Months Ended

June 30, 2020 | | |

| In thousands, except per-unit data | | June 30, 2021 | | March 31, 2021 | | December 31, 2020 | | | | |

| Oil, natural gas, and related product sales | | $ | 282,708 | | | $ | 235,445 | | | $ | 178,787 | | | | $ | 109,387 | | | | | |

| Receipt (payment) on settlements of commodity derivatives | | (63,343) | | | (38,453) | | | 14,429 | | | | 45,629 | | | | | |

| Oil, natural gas, and related product sales and commodity settlements, combined | | $ | 219,365 | | | $ | 196,992 | | | $ | 193,216 | | | | $ | 155,016 | | | | | |

| | | | | | | | | | | | | |

| Average daily sales (BOE/d) | | 49,133 | | | 47,357 | | | 48,805 | | | | 50,190 | | | | | |

| | | | | | | | | | | | | |

| Average net realized prices | | | | | | | | | | | | | |

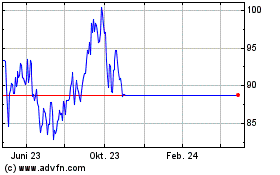

Oil price per Bbl - excluding impact of derivative settlements | | $ | 64.70 | | | $ | 56.28 | | | $ | 40.63 | | | | $ | 24.39 | | | | | |

Oil price per Bbl - including impact of derivative settlements | | 50.10 | | | 47.00 | | | 43.94 | | | | 34.64 | | | | | |

NYMEX WTI oil prices strengthened from the mid-$40s per Bbl range in December 2020 to an average of approximately $66 per Bbl during the second quarter of 2021, reaching highs of over $74 per Bbl in June 2021.

Second Quarter 2021 Financial Results and Highlights. We recognized a net loss of $77.7 million, or $1.52 per diluted common share, during the second quarter of 2021, compared to a net loss of $697.5 million, or $1.41 per diluted common share, during the second quarter of 2020. The principal determinant of our comparative second quarter results between 2020 and 2021 was the $662.4 million full cost pool ceiling test write-down in the prior-year period. Additional drivers of the comparative operating results include the following:

•Oil and natural gas revenues increased $173.3 million (158%), primarily due to an increase in commodity prices;

•Commodity derivatives expense increased by $132.5 million consisting of a $109.0 million decrease in cash receipts upon contract settlements ($63.3 million in payments during the second quarter of 2021 compared to $45.6 million in receipts upon settlements during the second quarter of 2020) and a $23.5 million increase in the loss on noncash fair value changes;

•A $28.9 million increase in lease operating expense, across nearly all expense categories, consisting of increases of $8.4 million in workovers, $4.4 million in CO2 expense, $3.7 million in power and fuel, and approximately $7.1 million due to the Wind River Basin acquisition in March 2021;

•A $19.4 million reduction in net interest expense resulting from the full extinguishment of senior secured second lien notes, convertible senior notes, and senior subordinated notes pursuant to the terms of the prepackaged joint plan of reorganization completed in September 2020;

•A reduction in depletion, depreciation, and amortization expense of $19.0 million as a result of lower depletable costs due to the step down in book value resulting from fresh start accounting on the Emergence Date; and

•An $8.3 million decrease in general and administrative expense in the second quarter of 2021, primarily due to higher expense in the prior-year period as a result of modifications in our compensation program during the second quarter of 2020 which resulted in adjustments to the bonus program for 2020, as well as certain severance-related costs recorded during the second quarter of 2020.

June 2021 Divestiture of Hartzog Draw Deep Mineral Rights. On June 30, 2021, we closed the sale of undeveloped, unconventional deep mineral rights in Hartzog Draw Field in Wyoming. The cash proceeds of $18 million were recorded to “Proved properties” in our Unaudited Condensed Consolidated Balance Sheets. The proceeds reduced our full cost pool; therefore, no gain or loss was recorded on the transaction, and the sale had no impact on our production or reserves.

Denbury Inc.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

March 2021 Acquisition of Wyoming CO2 EOR Fields. On March 3, 2021, we acquired a nearly 100% working interest (approximately 83% net revenue interest) in the Big Sand Draw and Beaver Creek EOR fields (collectively “Wind River Basin”) located in Wyoming from a subsidiary of Devon Energy Corporation for $10.7 million cash (before final closing adjustments), including surface facilities and a 46-mile CO2 transportation pipeline to the acquired fields. The acquisition agreement provides for us to make two contingent cash payments, one in January 2022 and one in January 2023, of $4 million each, conditioned on NYMEX WTI oil prices averaging at least $50 per Bbl during 2021 and 2022, respectively. As of June 30, 2021, the contingent consideration was recorded on our unaudited condensed consolidated balance sheets at its fair value of $7.0 million, a $1.7 million increase from the March 2021 acquisition date fair value. This $1.7 million increase was the result of higher NYMEX WTI oil prices and was recorded to “Other expenses” in our Unaudited Condensed Consolidated Statements of Operations. Wind River Basin sales averaged approximately 2,750 BOE/d during the second quarter of 2021 and utilize 100% industrial-sourced CO2.