Caterpillar Lowers 2020 Expectations -- WSJ

01 Februar 2020 - 9:02AM

Dow Jones News

By Austen Hufford

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (February 1, 2020).

Caterpillar Inc. said it expects demand for its machinery to

fall this year, widening a performance gap between some

manufacturers and an otherwise robust U.S. economy.

The maker of equipment for mining companies and builders around

the world said Friday that global economic uncertainty crimped

sales in the latest quarter as companies held off on big purchases.

Revenue in 2019 was 1.7% lower than a year earlier, and Caterpillar

said it expected another decline in 2020.

"A lot of people have been deferring making capital decisions,"

Andrew Bonfield, Caterpillar's financial chief, said in an

interview.

The company's shares closed Friday nearly 3% lower at

$131.35.

Cost reductions helped offset lower demand in Caterpillar's

latest quarter. Adjusted profit per share rose 3.1% as the company

reduced production and hired fewer temporary workers.

Caterpillar joined a chorus of manufacturers saying they expect

sluggish conditions to carry into 2020. Lingering trade tensions,

Boeing Co.'s idled 737 MAX production lines and the coronavirus

outbreak in China all threaten to extend a rough patch for U.S.

factories.

"The industrial economy in the United States is very weak,"

Stanley Black & Decker Inc. Chief Executive James Loree said in

an interview last week. He said suppliers and producers were

experiencing an inventory mismatch that he expects to dissipate in

time. The company has said it expects slowdowns in automobile

production and domestic oil-and-gas drilling to continue in the

first half of this year.

3M Co. Chief Executive Mike Roman said this week that he expects

the conglomerate's sales to other manufacturers to lag sales to

consumers this year. The maker of an array of products from

electrical tape to molar crowns is planning a second round of

layoffs in less than a year as part of a global restructuring.

"The industrial-production-related businesses are a little lower

growth, " Mr. Roman said in an interview.

DuPont de Nemours Inc., which makes nylon and other materials,

and paint company PPG Industries Inc. both said lower industrial

demand would weigh on business this year as well. Conglomerate

Honeywell International Inc. on Friday reported lower-than-expected

sales for the fourth quarter.

The U.S. manufacturing sector contracted for five straight

months through December, according to the Institute for Supply

Management. New orders for so-called core capital goods, which

excludes aircraft and defense orders, were largely flat in 2019,

according to the Commerce Department.

"Customers are being cautious due to global economic

conditions," Caterpillar Chief Executive Jim Umpleby said on a call

with analysts.

Still, manufacturing drives just about a tenth of the economy,

and other sectors are performing better. Consumer confidence is

strong, unemployment is at the lowest level in half a century and

incomes are rising. Gross domestic product grew 2.3% last year, the

Commerce Department said Thursday.

Caterpillar, which sells its construction and mining machines to

customers in 193 countries, is widely viewed as a barometer for

global industrial vigor. The company, which makes its sales through

a network of independent dealers, said it expects revenue to

decline this year as demand from companies that buy its machines

falls by between 4% and 9%. In North America, Caterpillar said it

expects construction activity to decline and demand from

oil-and-gas customers to remain weak.

The Deerfield, Ill.-based company said machinery sales fell 14%

in North America, 16% in Latin America and 6% in its Europe, Africa

and Middle East region for the fourth quarter from a year earlier.

Sales in Asia were flat for the quarter.

The coronavirus outbreak in China poses a new threat to

businesses operating in the country. Many factories have extended

closures planned over the Lunar New Year holiday as people avoid

travel.

Caterpillar said it is delaying opening some facilities in China

by up to a week, and that its factories in China aren't in parts of

the country most affected by the outbreak.

Caterpillar said total revenue, which includes financial

services, declined 8.4% for the quarter to $13.14 billion as net

income rose 4.8% to $1.1 billion. Adjusted profit per share rose

3.1% to $2.63 in the fourth quarter.

Amber Burton

contributed to this article.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

February 01, 2020 02:47 ET (07:47 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

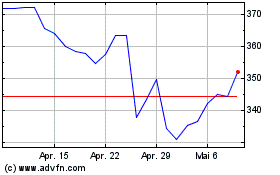

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

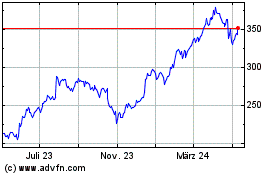

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024