Caterpillar, Industrial Shares Slump as Investors Weigh Rising Costs -- 3rd Update

24 April 2018 - 11:00PM

Dow Jones News

By Andrew Tangel

Caterpillar Inc. executives said a strong first quarter could be

a "high-water mark" for the year, a suggestion that pushed down

shares in the machinery giant and the broader stock market.

Caterpillar's shares dropped 6% Tuesday as the Dow Jones

Industrial Average declined about 2%. Shares in 3M Co. fell nearly

7% after the maker of myriad products including tapes and adhesives

narrowed its revenue and profit forecast for this year.

Deerfield, Ill.-based Caterpillar said sales of its bulldozers,

mining trucks and other equipment jumped 31% in the first quarter

thanks to strong global construction and mining activity. Revenue,

$12.9 billion in the quarter, also benefited from a stronger euro

and Chinese yuan.

"The strength in the global economy as well as favorable pricing

for most commodities is benefiting many of our end-markets," said

Chief Financial Officer Brad Halverson.

But some of those gains were offset by higher manufacturing

costs, executives said. U.S. manufacturers said their steel costs

have risen since the Trump administration moved in recent weeks to

place duties on imports from many foreign countries.

3M Chief Financial Officer Nicholas Gangestad said the St. Paul,

Minn., manufacturer also has been facing higher transportation and

material costs as oil prices have risen. "We are seeing some

increases in raw material prices, in fact, more than what we

originally estimated," he said.

Executives at both 3M and Caterpillar said they would raise

prices to offset the hit to profits.

Caterpillar also warned that trade tensions that reach far

beyond the steel industry could darken the outlook for the rest of

the year. Officials in both China and the U.S. are threatening each

other with additional trade barriers.

"We remain optimistic that government leaders can work towards a

positive outcome," Amy Campbell, Caterpillar's director of investor

relations, said in an interview.

Caterpillar's suggestion about headwinds for the rest of the

year spooked investors. "It got everybody spooked," Stifel analyst

Stanley Elliott said.

Still, Caterpillar boosted its profit outlook for the year by $2

above the upper end of its previous forecast, saying it could earn

as much as $10.75 a share in 2018. "It certainly wasn't our intent

to express a concern," Chief Executive Jim Umpleby told analysts

after one noted the sharp share drop.

Executives declined to detail the company's plans for potential

future acquisitions or share repurchases.

Sales growth in North America was Caterpillar's biggest driver

in the quarter. Dealers boosted inventories as demand for

construction equipment increased, primarily due to public works and

energy infrastructure such as pipelines.

Increased building construction and spending on infrastructure

in China drove sales in its Asia/Pacific region. Ms. Campbell told

analysts that demand in China for 10-ton excavators would rise 30%

this year, versus earlier predictions of 8%. "We do at this point

continue to expect China to be very strong for the rest of the

year," she said.

Mining companies increasingly replaced equipment and expanded

their fleets as commodity prices remained strong.

Overall for the first quarter the company reported a profit of

$1.67 billion, or $2.74 a share, up from $192 million, or 32 cents

a share, a year earlier. On an adjusted basis, earnings more than

doubled to $2.82 a share.

The year-prior results were dented by $723 million in

restructuring costs primarily related to a facility closure.

Restructuring costs in the most recent quarter were $69

million.

Analysts polled by Thomson Reuters had forecast earnings of

$2.13 a share on $12.07 billion in sales.

The company's domestic workforce stood at 51,500 employees at

the end of March, up from 46,500 a year ago.

Imani Moise and Bob Tita contributed to this article.

Write to Andrew Tangel at Andrew.Tangel@wsj.com

(END) Dow Jones Newswires

April 24, 2018 16:45 ET (20:45 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

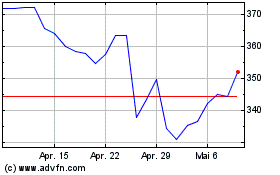

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

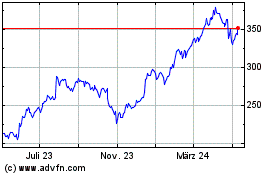

Caterpillar (NYSE:CAT)

Historical Stock Chart

Von Jul 2023 bis Jul 2024