Intercontinental Exchange, Inc. (NYSE: ICE), a leading global

provider of data, technology, and market infrastructure, and Black

Knight, Inc. (NYSE: BKI), a software, data and analytics company

that serves the housing finance continuum, including real estate

data, mortgage lending and servicing, as well as the secondary

markets, today announced that ICE has completed its acquisition of

Black Knight.

The Black Knight acquisition follows ICE’s 2020 acquisition of

Ellie Mae, its 2019 acquisition of Simplifile, and its 2018

acquisition of Mortgage Electronic Registrations Systems (MERS),

which together created the foundation of its ICE Mortgage

Technology business segment. ICE Mortgage Technology combines data

and expertise to help automate the mortgage process, from consumer

engagement through loan registration, and every step in

between.

“Since our founding over twenty years ago, ICE has steadfastly

adhered to our founding principle, demonstrated throughout our

history, that applying technological innovation and digitization to

traditionally analog businesses can make markets more efficient and

transparent for all participants,” said Jeffrey C. Sprecher, ICE’s

Founder, Chair and Chief Executive Officer. “Our team is

well-positioned and ready to apply our proven playbook across the

U.S. mortgage ecosystem to help improve the homeownership

experience for millions of American families.”

As previously announced, subject to the proration procedures

specified in the Agreement and Plan of Merger entered into by ICE

and Black Knight on May 4, 2022 and amended on March 7, 2023 (the

“Merger Agreement”), Black Knight stockholders were entitled to

elect to receive, in exchange for each issued and outstanding share

of Black Knight common stock they owned:

- an amount in cash (the “Per Share Cash Consideration”) equal to

the sum, rounded to the nearest one tenth of a cent, of (x) $68.00

plus (y) the product, rounded to the nearest one tenth of a cent,

of 0.0682 multiplied by the average of the volume weighted averages

of the trading prices of ICE common stock on the New York Stock

Exchange on each of the ten consecutive trading days ended on (and

including) the trading day that was three trading days prior to the

date on which the effective time of the acquisition occurred (the

“Closing 10-Day Average ICE VWAP”); or

- a number of validly issued, fully paid and nonassessable shares

of ICE common stock (the “Per Share Stock Consideration”) as is

equal to the quotient, rounded to the nearest one ten thousandth,

of (x) the Per Share Cash Consideration divided by (y) the Closing

10-Day Average ICE VWAP.

Based on the Closing 10-Day Average ICE VWAP for the ten

consecutive trading days ended on (and including) August 30, 2023,

which was $115.355, the Per Share Cash Consideration is $75.867,

the Per Share Stock Consideration is 0.6577 shares of ICE common

stock, and the aggregate value of the consideration to be received

by Black Knight stockholders (including rollover equity awards) is

approximately $11.9 billion.

The elections of Black Knight stockholders are subject to

proration in accordance with the terms of the Merger Agreement,

which is applicable in the event one form of merger consideration

is undersubscribed or oversubscribed. The Merger Agreement provides

that the aggregate amount of cash consideration will equal

$10,505,000,000 (the “Cash Component”). The total number of shares

of Black Knight common stock that will convert into the right to

receive the Per Share Cash Consideration will equal the quotient,

rounded down to the nearest whole share, of (i) the Cash Component

divided by (ii) the Per Share Cash Consideration. All the remaining

shares of Black Knight common stock not receiving the Per Share

Cash Consideration will be converted into the right to receive the

Per Share Stock Consideration.

As previously announced, the deadline for Black Knight

stockholders to have made an election as to the form of

consideration they wished to receive in connection with the

acquisition was 5:00 p.m., Eastern Time, on September 1, 2023.

Based on the information available as of the election deadline, the

preliminary results for the election of merger consideration were

as follows:

- holders of 61,205,562 shares of Black Knight common stock

(which includes 13,982,224 shares that remain subject to guaranteed

delivery procedures), or approximately 39% of the shares deemed

outstanding for purposes of the election, elected to receive the

Per Share Cash Consideration;

- holders of 52,660,646 shares of Black Knight common stock

(which includes 27,329,938 shares that remain subject to guaranteed

delivery procedures), or approximately 34% of the shares deemed

outstanding for purposes of the election, elected to receive the

Per Share Stock Consideration; and

- holders of 41,161,297 shares of Black Knight common stock, or

approximately 27% of the shares deemed outstanding for purposes of

the election, did not submit valid elections.

The foregoing results are preliminary only and subject to a

notice of guaranteed delivery procedure. The final election results

may therefore differ materially from the preliminary election

results. Based on the preliminary results, the Per Share Stock

Consideration is oversubscribed, Black Knight stockholders who

elected to receive the Per Share Stock Consideration will be

subject to proration and their shares are expected to be converted

into the right to receive approximately 68% of the merger

consideration payable to them in cash and approximately 32% in the

form of ICE common stock. Black Knight stockholders who made valid

elections to receive the Per Share Cash Consideration and any

shares with respect to which an election was not made prior to the

election deadline will be converted into the right to receive the

Per Share Cash Consideration. After the final election results are

determined, the final allocation and proration of merger

consideration to Black Knight stockholders who elected to receive

Per Share Stock Consideration will be calculated in accordance with

the procedures specified in the Merger Agreement.

As previously announced, in connection with efforts to secure

regulatory clearance from the Federal Trade Commission for ICE’s

acquisition of Black Knight, ICE has agreed to divest Black

Knight’s Optimal Blue and Empower loan origination system (LOS)

businesses to subsidiaries of Constellation Software Inc. (TSX:

CSU). The divestitures are expected to be completed within the next

20 days.

Following the divestitures, ICE plans to hold a conference call

with investors to discuss the acquisition on September 28 at 8:30

a.m. ET. A live audio webcast of the conference call will be

available on the company’s website at www.ice.com in the investor

relations section. Participants may also listen via telephone by

dialing 833-470-1428 from the United States or 929-526-1599 from

outside of the United States. Telephone participants are required

to provide the participant entry number 800389 and are recommended

to call 10 minutes prior to the start of the call. The call will be

archived on the company’s website for replay.

About Intercontinental Exchange

Intercontinental Exchange, Inc. (NYSE: ICE) is a Fortune 500

company that designs, builds and operates digital networks to

connect people to opportunity. We provide financial technology and

data services across major asset classes that offer our customers

access to mission-critical workflow tools that increase

transparency and operational efficiencies. We operate exchanges,

including the New York Stock Exchange, and clearing houses that

help people invest, raise capital and manage risk across multiple

asset classes. Our comprehensive fixed income data services and

execution capabilities provide information, analytics and platforms

that help our customers capitalize on opportunities and operate

more efficiently. At ICE Mortgage Technology, we are transforming

and digitizing the U.S. residential mortgage process, from consumer

engagement through loan registration. Together, we transform,

streamline and automate industries to connect our customers to

opportunity.

Trademarks of ICE and/or its affiliates include Intercontinental

Exchange, ICE, ICE block design, NYSE and New York Stock Exchange.

Information regarding additional trademarks and intellectual

property rights of Intercontinental Exchange, Inc. and/or its

affiliates is located here. Key Information Documents for certain

products covered by the EU Packaged Retail and Insurance-based

Investment Products Regulation can be accessed on the relevant

exchange website under the heading “Key Information Documents

(KIDS).”

About Black Knight

Black Knight, Inc. (NYSE: BKI) is an award-winning software,

data and analytics company that drives innovation in the mortgage

lending and servicing and real estate industries, as well as the

capital and secondary markets. Businesses leverage its robust,

integrated solutions across the entire homeownership life cycle to

help retain existing customers, gain new customers, mitigate risk

and operate more effectively.

FORWARD-LOOKING STATEMENTS

This communication contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Rule 175 promulgated thereunder, and Section 21E of

the Securities Exchange Act of 1934, as amended, and Rule 3b-6

promulgated thereunder, which involve inherent risks and

uncertainties. Any statements about ICE’s or Black Knight’s plans,

objectives, expectations, strategies, beliefs, or future

performance or events constitute forward-looking statements. Such

statements are identified as those that include words or phrases

such as “believes,” “expects,” “anticipates,” “plans,” “trend,”

“objective,” “continue,” or similar expressions or future or

conditional verbs such as “will,” “would,” “should,” “could,”

“might,” “may,” or similar expressions. Forward-looking statements

involve known and unknown risks, uncertainties, assumptions,

estimates, and other important factors that change over time and

could cause actual results to differ materially from any results,

performance, or events expressed or implied by such forward-looking

statements. Such forward-looking statements include but are not

limited to statements about the benefits of the acquisition of

Black Knight by ICE (the “Transaction”), including future financial

and operating results, Black Knight’s or ICE’s plans, objectives,

expectations and intentions, and other statements that are not

historical facts.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. In addition to factors previously disclosed

in Black Knight’s and ICE’s reports filed with the U.S. Securities

and Exchange Commission (the “SEC”) and those identified elsewhere

in this communication, the following factors, among others, could

cause actual results to differ materially from forward-looking

statements or historical performance: the outcome of any legal

proceedings that may be instituted against Black Knight or ICE; the

possibility that the proposed divestitures of Black Knight’s

Optimal Blue business and its Empower loan origination system (LOS)

do not close when expected or at all because conditions to closing

are not satisfied on a timely basis or at all; the risk that the

benefits from the Transaction may not be fully realized or may take

longer to realize than expected, including as a result of changes

in, or problems arising from, general economic, political and

market conditions, interest and exchange rates, laws and

regulations and their enforcement, and the degree of competition in

the geographic and business areas in which Black Knight and ICE

operate; the ability to promptly and effectively integrate the

businesses of Black Knight with those of ICE; reputational risk and

potential adverse reactions of Black Knight’s or ICE’s customers,

employees or other business partners, including those resulting

from the announcement or completion of the Transaction; the

diversion of management’s attention and time from ongoing business

operations and opportunities on merger-related matters; and the

impact of the global COVID-19 pandemic on Black Knight’s or ICE’s

businesses or any of the other foregoing risks.

These factors are not necessarily all of the factors that could

cause Black Knight’s or ICE’s actual results, performance, or

achievements to differ materially from those expressed in or

implied by any of the forward-looking statements. Other unknown or

unpredictable factors also could harm Black Knight’s or ICE’s

results.

All forward-looking statements attributable to ICE or Black

Knight, or persons acting on ICE’s or Black Knight’s behalf, are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date they are made and ICE and Black Knight do not undertake or

assume any obligation to update publicly any of these statements to

reflect actual results, new information or future events, changes

in assumptions, or changes in other factors affecting

forward-looking statements, except to the extent required by

applicable law. If ICE or Black Knight update one or more

forward-looking statements, no inference should be drawn that ICE

or Black Knight will make additional updates with respect to those

or other forward-looking statements. Further information regarding

Black Knight, ICE and factors which could affect the

forward-looking statements contained herein can be found in Black

Knight’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 and its other filings with the SEC, and in ICE’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022 and its other filings with the SEC.

Category: Mortgage Technology

SOURCE: Intercontinental Exchange

ICE-CORP

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230905668146/en/

ICE Media Contact: Josh King josh.king@ice.com (212)

656-2490 Damon Leavell damon.leavell@ice.com (212) 323-8587

media@ice.com ICE Investor Contact: Katia Gonzalez

katia.gonzalez@ice.com (678) 981-3882 investors@ice.com Black

Knight Media Contact: Michelle Kersch michelle.kersch@bkfs.com

(904) 854-5043 Black Knight Investor Contact: Steve Eagerton

steven.eagerton@bkfs.com (904) 854-3683

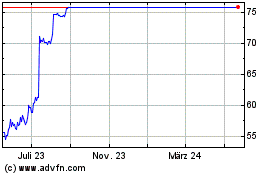

Black Knight (NYSE:BKI)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

Black Knight (NYSE:BKI)

Historical Stock Chart

Von Feb 2024 bis Feb 2025