UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-41563

Brookfield Asset Management Ltd.

(Translation of registrant's name into English)

Brookfield Place, Suite 100, 181 Bay Street, P.O. Box 762 Toronto, Ontario, Canada M5J 2T3

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [ X ] Form 40-F [ ]

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | Brookfield Asset Management Ltd. |

| | | (Registrant) |

| | | |

| | | |

| Date: December 21, 2023 | | /s/ Bahir Manios |

| | | Bahir Manios |

| | | Chief Financial Officer

(Principal Financial and Accounting Officer) |

| | | |

EXHIBIT 99.1

Canada Growth Fund Announces Strategic Investment in Entropy Inc. and Carbon Credit Offtake Commitment

BROOKFIELD, NEWS, Dec. 21, 2023 (GLOBE NEWSWIRE) -- Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) and Canada Growth Fund Inc. ("CGF") and Advantage Energy Ltd. (TSX: AAV) ("Advantage") today announce that CGF has entered into a strategic investment agreement with Entropy Inc. ("Entropy" or the "Company"), a Calgary-based developer of technologically-advanced carbon capture and sequestration ("CCS") projects with the potential to significantly reduce emissions in Canada and worldwide.

CGF has agreed to a $200 million investment in Entropy coupled with a fixed-price carbon credit purchase agreement ("Carbon Credit Offtake Commitment" or "CCO") of up to one million tonnes per annum ("tpa"). This strategic growth partnership represents an important new investment in Canadian carbon markets. The features of the CCO—notably its large scale and its long-term fixed-price—represent a global first in compliance markets. This financeable structure helps to de-risk and accelerate private CCS investment by establishing carbon price certainty for Canadian projects.

"With its abundance of natural resources, access to high-quality geological storage, and sophisticated engineering know-how, Canada is the best place in the world to build a CCS industry," said Patrick Charbonneau, President and CEO of Canada Growth Fund Investment Management Inc. ("CGF Investment Management"). "The CGF Investment Management team is pleased to deliver this inaugural transaction in Alberta's carbon market, and we look forward to putting additional capital to work across Canada in the months ahead."

One pillar of CGF's mandate is to invest in projects and technologies, including CCS, that hold significant potential to reduce emissions across the Canadian economy. A second pillar is to scale promising Canadian clean technology champions that can help create value for Canadians.

"I am very proud of the investment, technical, and execution expertise that the Canada Growth Fund Investment Management team is bringing to the CGF mandate," said Deborah K. Orida, President and CEO of Public Sector Pension Investment Board ("PSP Investments"). "CGF is able to deliver complex transactions such as this thanks to PSP Investments' rigorous and established processes and arm's length governance model."

Entropy aligns well with both aspects of CGF's mandate: it is a Canadian-based CCS company with an innovative technology solution and a skilled team of Canadian experts focused on expanding the use of CCS technology in Canada and globally. Entropy's modular CCS technology is relevant across Canada's hard-to-abate industries, which represent an important challenge and opportunity for Canada to tackle as it works towards its emissions objectives.

"Entropy is excited to partner with CGF in re-establishing Canada as a world-leading CCS market," said Mike Belenkie, President and CEO of Entropy. "By creating a large-scale CCO to guarantee long-term carbon pricing and adding $200 million to our existing Brookfield funding for third-party projects, Entropy has a clear path to accelerating growth and reducing emissions, right here at home. While we will remain a global CCS developer, we believe our projects are likely to advance much more quickly in Canada than any other country in the world."

In March 2022, Entropy announced a strategic $300 million investment agreement with Brookfield, via the Brookfield Global Transition Fund, to scale up the deployment of Entropy's CCS technology globally. Today's announcement builds on this strong foundation and provides greater revenue certainty to accelerate Entropy's major investments in Canada.

"Carbon capture and sequestration is a vital technology for reducing emissions in carbon intensive sectors" said Jehangir Vevaina, Managing Partner and Chief Investment Officer for Renewable Power & Transition at Brookfield. "Our investment agreement with Entropy was designed to accelerate the deployment of this important technology in Canada and worldwide. We welcome the additional capital and revenue certainty that the Canada Growth Fund is providing to enable Entropy's success."

Transaction Highlights

Definitive agreements between Entropy and CGF to accelerate the decarbonization of hard-to-abate industries in Canada;

CGF to invest $200 million in Entropy for the development of Canadian CCS projects and for corporate purposes which, once fully drawn, could result in CGF owning approximately 20% of Entropy;

Brookfield will continue to invest the balance of its existing $300 million hybrid security into the business, by which point it would be the largest shareholder and control Entropy;

CGF to provide the first ever large-scale, long-term, fixed-price CCO in a compliance carbon market, committing to purchase up to one million tpa of carbon credits for 15 years;

The initial allocation of CCO commitment will allow Entropy to proceed with its Glacier Phase 2 project, targeting the sale of up to 185,000 tpa of Alberta TIER carbon credits at an initial price of $86.50 per tonne for a term of 15 years;

The balance of the remaining CCO will be available for Entropy to underwrite additional third-party projects on similar terms in Canada;

Post-investment, Entropy will have approximately $460 million of capital available which, together with investment tax credits, carbon capture incentives and project financing, establishes a path to execute over $1 billion of CCS projects and abate more than 1 million metric tonnes per annum ("MMTPA") of emissions, with a focus on the Canadian market.

Deal Structure Overview

CGF's investment in Entropy is via a hybrid security similar to the prior investment from Brookfield (please see Entropy news release dated March 28, 2022), though at a valuation that reflects the numerous advancements of the business in the last two years. The flexible structure ensures access to capital for Entropy and retains flexible liquidity options for all major investors including Brookfield, CGF and Advantage (the Company's controlling shareholder). Funding draws from Brookfield and CGF for Canadian projects and corporate purposes will proceed in tandem.

Coupled with the CGF investment, Entropy and CGF have entered into a CCO agreement whereby CGF has committed to purchase up to 9 million tonnes (up to 600,000 tpa over a 15-year term) of TIER or equivalent carbon credits from Entropy projects. The initial project to benefit from the CCO is intended to be Advantage Glacier Phase 2, drawing up to 185,000 tpa at an initial price of $86.50 per tonne, for a total of approximately 2.8 million tonnes over the 15-year term. With this CCO agreement in place, CGF has absorbed the carbon pricing risk for the project. Entropy is therefore pleased to announce provisional final investment decision of Glacier Phase 2.

Beyond Glacier Phase 2, CGF and Entropy intend to enter into separate CCO agreements for other Canadian projects, on terms that are expected to provide similar investment returns. Upon successful deployment of the initial 600,000 tpa of CCO, CGF may make available a further 400,000 tpa of CCOs for additional Entropy Canadian CCS projects.

CGF will nominate one member to the Entropy Board of Directors and is pleased to participate in the growth and evolution of this Canadian clean technology leader. Advantage and Brookfield will retain their existing Entropy board representation.

About Entropy Inc

Entropy was founded by Advantage and Allardyce Bower Consulting Inc. in 2020 with the goal of developing world-leading technology for post-combustion carbon capture. After partnering with University of Regina to acquire breakthrough technology and developing further advancements, Entropy designed and constructed the world's first commercial natural-gas-fired CCS project (Glacier Phase 1), which began capturing and storing carbon about 18 months ago. Entropy's team has industry-leading capabilities in all aspects of the CCS chain, including capture, compression, transportation, subsurface storage, carbon finance, regulatory, carbon markets and commercial structuring. This full-cycle approach allows Entropy to help third parties that would otherwise not have the capacity to take on these complex emissions-reduction investments. For further information, please visit www.entropyinc.com.

About Canada Growth Fund

CGF is a $15 billion arm's length public investment vehicle that will help attract private capital to build Canada's clean economy by using investment instruments that absorb certain risks in order to encourage private investment in low carbon projects, technologies, businesses, and supply chains.

CGF will make strategic investments to help Canada to meet the following national economic and climate policy goals:

a) reduce emissions and achieve Canada's climate targets;

b) accelerate the deployment of key technologies, such as low-carbon hydrogen and carbon capture, utilization, and storage (CCUS);

c) scale-up companies that will create jobs, drive productivity and clean growth across new and traditional sectors of Canada's industrial base;

d) encourage the retention of intellectual property in Canada; and

e) capitalize on Canada's abundance of natural resources and strengthen critical supply chains to secure Canada's future economic and environmental well-being.

Further information on CGF's mandate, strategic objectives, investment selection criteria, scope of investment activities, and range of investment instruments can be found in the technical backgrounder published by Finance Canada. You may also visit www.cgf-fcc.ca.

About CGF Investment Management

In Budget 2023, the Government of Canada announced that PSP Investments, through a wholly owned subsidiary, would act as investment manager for CGF. CGF Investment Management has been incorporated to act as the independent and exclusive investment manager of CGF.

Note: PSP Investments has a passive limited partner interest in the Brookfield Global Transition Fund I, and ownership of Advantage's publicly traded common stock through index replication and externally managed funds. The foregoing is being disclosed in accordance with PSP Investments' Conflicts of Interest Policy. For more information, see the disclosure made under PSP Investments' Conflict of Interest Policy below.

About Brookfield Asset Management

Brookfield Asset Management Ltd. (NYSE: BAM, TSX: BAM) is a leading global alternative asset manager with over $850 billion of assets under management across renewable power and transition, infrastructure, private equity, real estate, and credit. We invest client capital for the long-term with a focus on real assets and essential service businesses that form the backbone of the global economy. We offer a range of alternative investment products to investors around the world — including public and private pension plans, endowments and foundations, sovereign wealth funds, financial institutions, insurance companies and private wealth investors. We draw on Brookfield’s heritage as an owner and operator to invest for value and generate strong returns for our clients, across economic cycles.

About Brookfield Renewable

Brookfield operates Brookfield Renewable Partners (NYSE: BEP, BEPC; TSX: BEP.UN, BEPC), one of the world's largest publicly traded, pure-play renewable power platforms, with approximately 31,800 megawatts of installed renewable energy capacity and a development pipeline of approximately 143,400 megawatts of renewable power assets, 14 MMTPA of carbon capture and storage, 2 million tons of recycled material and 4 million metric million British thermal units of renewable natural gas production annually.

For more information, please visit our website at https://bam.brookfield.com or contact:

Communications & Media:

Kerrie McHugh Hayes

Tel: (212) 618-3469

Email: kerrie.mchugh@brookfield.com | | Investor Relations:

Jason Fooks

Tel: (212) 417-2442

Email: jason.fooks@brookfield.com

|

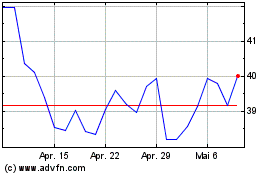

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Brookfield Asset Managem... (NYSE:BAM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024