0001428205falseDecember 3100014282052023-10-022023-10-020001428205arr:PreferredClassCMember2023-10-022023-10-020001428205us-gaap:CommonStockMember2023-10-022023-10-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________

FORM 8-K

______________

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported) October 2, 2023 (September 29, 2023)

ARMOUR Residential REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Maryland | 001-34766 | 26-1908763 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 3001 Ocean Drive, Suite 201 | | |

| Vero Beach, | Florida | | 32963 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(772) 617-4340

(Registrant’s Telephone Number, Including Area Code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| Title of Each Class | | Trading symbols | | Name of Exchange on which registered |

| Preferred Stock, 7.00% Series C Cumulative Redeemable | | ARR-PRC | | New York Stock Exchange |

| Common Stock, $0.001 par value | | ARR | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by a check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

| | | | | |

| Item 3.03. | Material Modification to the Rights of Security Holders. |

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated by reference herein.

| | | | | |

| Item 5.03. | Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

ARMOUR Residential REIT, Inc. (“ARMOUR” or the “Company”) filed two amendments to its Articles of Amendment and Restatement of Articles of Incorporation (the “Amendments”) with the Secretary of State of the State of Maryland, which effected the Company's previously announced one-for-five reverse stock split of its common stock (the “Reverse Stock Split”). The first Amendment, effective as of 5:01 p.m. ET on September 29, 2023, converted every five shares of ARMOUR's issued and outstanding common stock $0.001 par value per share, into one share of ARMOUR's common stock, $0.005 per share. Pursuant to the first Amendment, any fraction of a share of common stock that would otherwise have resulted from the Reverse Stock Split shall be settled by cash payment, calculated according to the average per share closing price of the Company’s common stock for the three consecutive trading days ending on September 29, 2023. The second Amendment, effective as of 5:02 p.m. ET on September 29, 2023, reduced the par value of ARMOUR's issued and outstanding common stock from $0.005 per share to $0.001 per share and reduced the number of ARMOUR's authorized shares of common stock, on a one-for-five basis, from 450,000,000 shares to 90,000,000 shares. The number of shares of ARMOUR’s 7.00% Series C Cumulative Preferred Stock outstanding and their preference amount and dividend rate are not affected by the Reverse Stock Split.

The above description of the Amendments is qualified in its entirety by reference to the full text of the Amendments, copies of which are attached hereto as Exhibits 3.1 and 3.2.

The full text of ARMOUR's press release issued in connection with the foregoing matter is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Trading in ARMOUR’s common stock on a split-adjusted basis is expected to begin at the market open on October 2, 2023. ARMOUR’s common stock will continue trading on the New York Stock Exchange under the symbol “ARR” but will be assigned the new CUSIP number of 042315 705.

Second Amended and Restated 2009 Stock Incentive Plan

In connection with the Reverse Stock Split, the number of shares of common stock issuable from unvested awards under ARMOUR's Second Amended and Restated 2009 Stock Incentive Plan (the “Plan”) was proportionately adjusted to reflect the Reverse Stock Split. Additionally, the total number of authorized shares of common stock that may be issued under the Plan (including shares already issued pursuant to awards) was proportionately adjusted from 867,123 shares to 173,424 shares to reflect the Reverse Stock Split. Any other affected terms of the Plan and any awards thereunder were adjusted to the extent necessary to reflect proportionately the Reverse Stock Split.

Common Stock At-the-Market Offering Program

As previously disclosed on July 26, 2023, the Company has an ongoing at-the-market (“ATM”) offering of shares of its common stock, pursuant to an Equity Sales Agreement dated July 26, 2023 (the “Sales Agreement") with BUCKLER Securities LLC (“BUCKLER”), JonesTrading Institutional Services LLC (“JonesTrading”), JMP Securities LLC (“JMP Securities”), Ladenburg Thalmann & Co. Inc. (“Ladenburg Thalmann”), and B. Riley Securities, Inc. (“B. Riley Securities,” and together with BUCKLER, JonesTrading, JMP Securities and Ladenburg Thalmann, the “Agents”). Under the terms of the Sales Agreement, the Company may offer and sell, from time to time, through the Agents, as the Company's agents, or to the Agents for resale, up to 75,000,000 pre-split shares of the Company's common stock. At the time of effectiveness of the Reverse Stock Split, the Company had sold 16,643,715 pre-split shares of its common stock under the Sales Agreement and 58,356,285 pre-split shares of common stock remained unsold under the Sales Agreement. As a result of the Reverse Stock Split, an aggregate of 11,671,257 post-split shares of the Company's common stock remain unsold under the Sales Agreement (the “Post-Split Unsold ATM Common Stock”).

The offering of the Post-Split Unsold ATM Common Stock will be made pursuant to (a) the Company's automatic shelf registration statement on Form S-3 (No. 333-253311) (the “Registration Statement”), (b) the prospectus, dated February 19, 2021, filed as a portion of the Registration Statement (the “Prospectus”), and (c) the prospectus supplement, dated July 26, 2023, which forms a part of, and supplements, the Registration Statement. The offering will continue to be governed by the terms of the Sales Agreement.

The Sales Agreement, as described in the Company's Quarterly Report on Form 10-Q filed with the Commission on July 26, 2023, does not purport to be complete and is qualified in its entirety by reference to the Sales Agreement filed as an exhibit to such Quarterly Report on Form 10-Q.

Dividend Reinvestment and Stock Purchase Plans

As previously disclosed, the Company adopted (i) the 2012 Dividend Reinvestment and Stock Purchase Plan (the “2012 Plan”) relating to the offer and sale of up to 1,650,256 pre-split shares of the Company's common stock pursuant to the terms of the 2012 Plan (13,202,045 shares prior to the Company's one-for-eight reverse stock split of the Company's common stock effective July 31, 2015 (the "2015 Reverse Stock Split"), representing the unsold shares of the Company's 20,000,000 pre-2015 Reverse Stock Split shares of common stock under the 2012 Plan at the time of the 2015 Reverse Stock Split), and (ii) the 2013 Dividend Reinvestment and Stock Purchase Plan (the “2013 Plan”) relating to an additional offer and sale of up to 3,750,000 pre-split shares of the Company's common stock pursuant to the terms of the 2013 Plan (30,000,000 shares prior to the 2015 Reverse Stock Split), which 2013 Plan is essentially identical by its terms to the 2012 Plan. The 2012 Plan and 2013 Plan each permit the Company's stockholders to automatically reinvest all or a portion of their cash dividends on their shares of the Company's common stock and to purchase additional shares of the Company's common stock. Immediately prior to the Reverse Stock Split, an aggregate of 181,982 shares of the Company’s common stock were authorized for issuance under the 2012 Plan, and the Company had sold 1,468,274 shares pursuant to the 2012 Plan, and an aggregate of 3,750,000 shares of the Company’s common stock were authorized for issuance under the 2013 Plan, and the Company had not sold any shares pursuant to the 2013 Plan. As a result of the Reverse Stock Split, an aggregate of 36,396 post-Reverse Stock Split shares remain available for sale pursuant to the 2012 Plan (the "Post-Split Unsold 2012 DRIP Common Stock") and an aggregate of 750,000 post-Reverse Stock Split shares remain available for sale pursuant to the 2013 Plan (the "Post-Split Unsold 2013 DRIP Common Stock").

The offering of the Post-Split Unsold 2012 DRIP Common Stock will be made pursuant to (a) the Registration Statement, (b) the Prospectus, and (c) the prospectus supplement, dated March 12, 2021, regarding the 2012 Plan, which forms a part of, and supplements, the Registration Statement, and will continue to be governed by the terms of the 2012 Plan. The offering of the Post-Split Unsold 2013 DRIP Common Stock will be made pursuant to (a) the Registration Statement, (b) the Prospectus, and (c) the prospectus supplement, dated March 12, 2021, regarding the 2013 Plan, which forms a part of, and supplements, the Registration Statement, and will continue to be governed by the terms of the 2013 Plan.

Common Stock Repurchase Program

The Company’s common stock repurchase program (the "Repurchase Program") allows for the repurchase of shares of the Company’s common stock from time to time in the open market, including block trades, through privately negotiated transactions, or pursuant to a trading plan separately adopted in the future. Immediately prior to the Reverse Stock Split, an aggregate of 9,000,000 shares of the Company’s common stock were authorized for repurchase pursuant to the Repurchase Program, of which a total of 3,535,627 pre-split shares had been repurchased and 5,464,373 pre-split shares remained available for repurchase. As a result of the Reverse Stock Split, an aggregate of 1,092,874 post-split shares remain available for repurchase pursuant to the Repurchase Program.

This Current Report on Form 8-K does not constitute offers to sell or the solicitation of offers to buy nor shall there be any sales of the Company's Common Stock in any state in which such offers, solicitations or sales would be unlawful prior to registration or qualification under the securities laws of any such state.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

| Exhibit No. | Description | |

| | |

| 3.1 | | |

| 3.2 | | |

| 99.1 | | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: October 2, 2023

| | | | | | | | | | | |

| | ARMOUR RESIDENTIAL REIT, INC. |

| | | | |

| | By: | /s/ Gordon M. Harper | |

| | Name: | Gordon M. Harper | |

| | Title: | VP Finance, Controller and Treasurer | |

ARMOUR RESIDENTIAL REIT, INC.

ARTICLES OF AMENDMENT

ARMOUR Residential REIT, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Charter of the Corporation is hereby amended to provide that, at the Effective Time (as defined below), every five shares of common stock, $0.001 par value per share, of the Corporation, which were issued and outstanding immediately prior to the Effective Time, shall be changed into one issued and outstanding share of common stock, $0.005 par value per share. Any fraction of a share of common stock that would otherwise have resulted from the foregoing combination shall be settled by cash payment, calculated according to the average per share closing price of the Corporation’s common stock for the three consecutive trading days ending on September 29, 2023.

SECOND: The amendment to the Charter of the Corporation as set forth above has been duly approved by at least a majority of the entire Board of Directors of the Corporation as required by the Maryland General Corporation Law (the “MGCL”). Pursuant to Section 2-309(e) of the MGCL, no stockholder approval was required.

THIRD: There has been no increase in the authorized stock of the Corporation effected by the amendment to the Charter of the Corporation as set forth above.

FOURTH: These Articles of Amendment shall be effective at 5:01 p.m. EST on September 29, 2023 (the “Effective Time”).

FIFTH: The undersigned officer of the Corporation acknowledges these Articles of Amendment to be the corporate act of the Corporation and as to all matters or facts required to be verified under oath, the undersigned officer acknowledges that, to the best of his knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made under the penalties for perjury.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be executed in its name and on its behalf by its Co-Chief Executive Officer and attested to by its Chief Financial Officer on this 28th day of September, 2023.

ATTEST: ARMOUR RESIDENTIAL REIT, INC.

| | | | | | | | |

| By: /s/ James R. Mountain | | By: /s/ Jeffrey J. Zimmer |

| Name: James R. Mountain | | Name: Jeffrey J. Zimmer |

| Title: Chief Financial Officer | | Title: Co-Chief Executive Officer |

ARMOUR RESIDENTIAL REIT, INC.

ARTICLES OF AMENDMENT

ARMOUR Residential REIT, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The Charter of the Corporation is hereby amended, as of the Effective Time (as defined below), to decrease the par value of the shares of common stock of the Corporation issued and outstanding immediately prior to the Effective Time from $0.005 per share to $0.001 per share.

SECOND: The Charter of the Corporation is hereby further amended to reflect a decrease in authorized common stock, by deleting the existing Section 6.1 in its entirety and adding a new Section 6.1 to read as follows:

“6.1 Authorized Shares. The Corporation has authority to issue 140,000,000 shares of stock, consisting of 90,000,000 shares of Common Stock, $0.001 par value per share (“Common Stock”), and 50,000,000 shares of Preferred Stock, $0.001 par value per share (“Preferred Stock”). The aggregate par value of all authorized shares of stock having par value is $140,000. If shares of one class of stock are classified or reclassified into shares of another class of stock pursuant to this Article VI, the number of authorized shares of the former class shall be automatically decreased and the number of shares of the latter class shall be automatically increased, in each case by the number of shares so classified or reclassified, so that the aggregate number of shares of stock of all classes that the Corporation has authority to issue shall not be more than the total number of shares of stock set forth in the first sentence of this paragraph. The Board of Directors, without any action by the stockholders of the Corporation, may amend the Charter from time to time to increase or decrease the aggregate number of shares of stock or the number of shares of stock of any class or series that the Corporation has authority to issue.”

THIRD: The amendments to the Charter of the Corporation as set forth above have been duly approved by a majority of the entire Board of Directors of the Corporation as required by the Maryland General Corporation Law (the “MGCL”). The amendments set forth herein are limited to changes expressly authorized to be made without action by the stockholders of the Corporation by, as applicable, (a) Section 2-105(a)(13) of the MGCL and the Charter of the Corporation; or (b) Section 2-605(a)(2) of the MGCL.

FOURTH: These Articles of Amendment shall be effective at 5:02 p.m. EST on September 29, 2023 (the “Effective Time”).

FIFTH: The undersigned officer of the Corporation acknowledges these Articles of Amendment to be the corporate act of the Corporation and as to all matters or facts required to be verified under oath, the undersigned officer acknowledges that to the best of his knowledge, information and belief, these matters and facts are true in all material respects and that this statement is made under the penalties for perjury.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be executed in its name and on its behalf by its Co-Chief Executive Officer and attested to by its Chief Financial Officer on this 28th day of September, 2023.

ATTEST: ARMOUR RESIDENTIAL REIT, INC.

| | | | | | | | |

| By: /s/ James R. Mountain | | By: /s/ Jeffrey J. Zimmer |

| Name: James R. Mountain | | Name: Jeffrey J. Zimmer |

| Title: Chief Financial Officer | | Title: Co-Chief Executive Officer |

ARMOUR RESIDENTIAL REIT, INC. ANNOUNCES

EFFECTIVENESS OF ONE-FOR-FIVE REVERSE STOCK SPLIT

VERO BEACH, Florida – October 2, 2023 – ARMOUR Residential REIT, Inc. (NYSE: ARR and ARR-PRC) (“ARMOUR” or the “Company”) today announced the effectiveness of its previously announced one-for-five reverse stock split. Beginning with the opening of trading on Monday, October 2, 2023, the Company's common stock will trade on the NYSE on a reverse split-adjusted basis under the same symbol "ARR," but with a new CUSIP of 042315 705 As a result of the reverse stock split, the number of outstanding shares of ARMOUR's common stock was reduced from approximately 245,031,959 to approximately 49,006,392. Concurrently, the authorized number of shares of common stock was reduced from 450,000,000 to 90,000,000. After the reverse stock split, approximately 40,993,608 shares of common stock remain available for future issuances. The par value of ARMOUR's common stock remains at $0.001 per share after the reverse stock split. The number of shares of ARMOUR's 7.00% Series C Cumulative Preferred Stock outstanding and their preference amount and dividend rate are not affected by this reverse stock split.

No fractional shares will be issued in connection with the reverse stock split. Instead, each stockholder holding fractional shares will be entitled to receive, in lieu of such fractional shares, cash in an amount determined based on the average closing price of ARMOUR's common stock on the NYSE for the three consecutive trading days ending on September 29, 2023. The reverse stock split applies to all of ARMOUR's authorized and outstanding shares of common stock. Stockholders of record will be receiving information from Continental Stock Transfer & Trust Company, ARMOUR's transfer agent, regarding their stock ownership following the reverse stock split and cash in lieu of fractional share payments, if applicable. Stockholders who hold their shares in brokerage accounts or "street name" are not required to take any action in connection with the reverse stock split.

About ARMOUR Residential REIT, Inc.

ARMOUR invests primarily in fixed rate residential, adjustable rate and hybrid adjustable rate residential mortgage-backed securities issued or guaranteed by U.S. Government-sponsored enterprises or guaranteed by the Government National Mortgage Association. ARMOUR is externally managed and advised by ARMOUR Capital Management LP, an investment advisor registered with the Securities and Exchange Commission (“SEC”).

Safe Harbor

This press release includes “forward-looking statements” within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Actual results may differ from expectations, estimates and projections and, consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. The Company disclaims any obligation to release publicly any updates or revisions to any forward-looking statement to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

ARMOUR Announces Effectiveness of One-For-Five Reverse Stock Split

Page 2

October 2, 2023

Additional Information and Where to Find It

Investors, security holders and other interested persons may find additional information regarding the Company at the SEC’s internet site at www.sec.gov, or the Company website at www.armourreit.com, or by directing requests to: ARMOUR Residential REIT, Inc., 3001 Ocean Drive, Suite 201, Vero Beach, Florida 32963, Attention: Investor Relations.

Investor Contact:

James R. Mountain

Chief Financial Officer

ARMOUR Residential REIT, Inc.

(772) 617-4340

v3.23.3

Cover Document

|

Oct. 02, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 02, 2023

|

| Entity Registrant Name |

ARMOUR Residential REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34766

|

| Entity Tax Identification Number |

26-1908763

|

| Entity Address, Address Line One |

3001 Ocean Drive, Suite 201

|

| Entity Address, City or Town |

Vero Beach,

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32963

|

| City Area Code |

772

|

| Local Phone Number |

617-4340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001428205

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Preferred Class C [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock, 7.00% Series C Cumulative Redeemable

|

| Trading Symbol |

ARR-PRC

|

| Security Exchange Name |

NYSE

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.001 par value

|

| Trading Symbol |

ARR

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=arr_PreferredClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

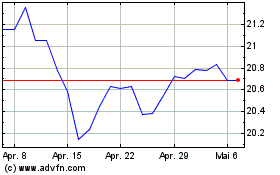

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

ARMOUR Residential REIT (NYSE:ARR-C)

Historical Stock Chart

Von Mai 2023 bis Mai 2024