SAS Gets $700 Million Bridge Financing From Apollo Global Management

15 August 2022 - 8:14AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Scandinavian airline SAS AB said Sunday that it has

entered into a $700 million bridge financing agreement with Apollo

Global Management Inc. as it continues working through the chapter

11 bankruptcy-protection process.

The so-called debtor-in-possession, or DIP, financing credit

agreement is a specialized type of bridge financing used by

businesses that are restructuring through a chapter 11 process. The

DIP financing, along with cash generated from the airline's ongoing

operations, enables SAS to continue meeting its obligations

throughout the chapter 11 process, it said.

SAS earlier this year launched a comprehensive restructuring

plan and last month filed for chapter 11 bankruptcy protection in

the U.S., as it seeks to push through the plan to cut costs and

raise capital.

SAS said it anticipates receiving court approval for its DIP

financing by mid-September.

The DIP facility matures nine months after the closing date, but

may be extended for an additional three-month period up to three

times, subject to the company paying an escalating extension

fee.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

August 15, 2022 01:59 ET (05:59 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

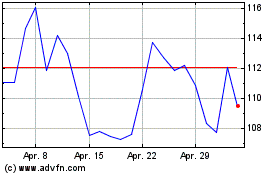

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Apollo Global Management (NYSE:APO)

Historical Stock Chart

Von Apr 2023 bis Apr 2024