FALSE000179620900017962092023-11-272023-11-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

11/27/2023

Date of Report (date of earliest event reported)

___________________________________

APi Group Corporation

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | | | | |

| Delaware (State or other jurisdiction of incorporation or organization) | 001-39275 (Commission File Number) | 98-1510303 (I.R.S. Employer Identification Number) |

| 1100 Old Highway 8 NW New Brighton, MN 55112 |

| (Address of principal executive offices and zip code) |

| (651) 636-4320 |

| (Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | APG | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 - Regulation FD Disclosure

On November 27, 2023, APi Group Corporation (the “Company”) provided an update on the strategic initiatives announced at the November 2022 investor day. A copy of the press release is furnished as Exhibit 99.1.

The information furnished under Item 7.01 of this Current Report on Form 8-K is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 - Financial Statements and Exhibits

(d): The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| APi Group Corporation |

| | |

| Date: November 27, 2023 | By: | /s/ Kevin S. Krumm |

| Name: | Kevin S. Krumm |

| Title: | Chief Financial Officer |

APi Group Provides Update on Chubb Value Capture Progress

-Run-rate Value Capture Target Increased 25% from $100 million to $125 million-

New Brighton, Minnesota – November 27, 2023 – APi Group Corporation (NYSE: APG) (“APi” or the “Company”), a global, market-leading business services provider of life safety, security and specialty services, today provided an update on the strategic initiatives relating to the Chubb business announced one year ago at the Company’s Investor Day meeting in New York City.

Russ Becker, APi’s President and Chief Executive Officer, stated, “The leaders in our international business continue to deliver organic growth and margin expansion while executing on our Chubb value capture plan. I’m pleased that we are now in a position to increase the Chubb value capture target by 25% to $125 million. We expect that we will continue our 1:1, or better, cost-benefit ratio and spend up to $125 million in total to capture these savings. We expect to conclude these value capture efforts by year-end 2025. The team has also driven a substantial reduction in our loss-making branches in the international business through operational improvements—supported by footprint optimization—and a continued focus on addressing low-value contracts through increased pricing and pruning. It is gratifying to know that the evolution in our international business is inclusive of our culture as well, with over 7,500 leaders participating in our online introductory “I am a Leader” development program.

As I look across our global operation, I am confident in our leaders’ ability to continue to deliver double-digit core inspection organic growth and continued margin expansion across the business as we drive towards our 2025 target of 13% (or more) Adjusted EBITDA margin. As we look to 2024 and beyond, we have great confidence in the business, our ability to deliver consistent organic growth globally, while simultaneously increasing our discipline on project selection and pruning low margin revenue opportunities.

Our backlog is strong and our balance sheet is in an advantageous position. We expect to end 2023 below our targeted 2.5x debt to Adjusted EBITDA ratio, which gives us many strategic options for capital deployment in the coming years. We expect to continue to evolve APi into an even lower capex, asset light business focused on high-margin, statutorily mandated services. I look forward to updating you early in the new year on our continued progress, our year end 2023 results, and our 2024 guidance.”

About APi:

APi is a global, market-leading business services provider of life safety, security and specialty services with a substantial recurring revenue base and over 500 locations worldwide. APi provides statutorily mandated and other contracted services to a strong base of long-standing customers across industries. We have a winning leadership culture driven by entrepreneurial business leaders to deliver innovative solutions for our customers. More information can be found at www.apigroupcorp.com.

Investor Relations & Media Inquiries:

Adam Fee

Vice President of Investor Relations

Tel:+1 651-240-7252

Email: investorrelations@apigroupinc.us

Forward-Looking Statements and Disclaimers

Certain statements in this press release and related comments made by management may be considered forward-looking statements within the meaning of the U.S federal securities laws. Forward-looking statements are any statements other than statements of historical fact and represent our current judgment about possible future events. In some cases, you can identify forward-looking statements by terms including “expect”, “anticipate”, “project”, “will”, “should”, “believe”, “intend”, “plan”, “estimate”, “potential”, “target”, “would”, and similar expressions, although not all forward-looking statements contain these identifying terms, including expectations regarding: (i) the Company’s outlook and ability to execute on long-term goals, and (ii) the timing and expected benefits of the acquisition of the Chubb fire and security business.. While we believe these statements are reasonable, they are not guarantees of future performance and are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, including (i) economic conditions, competition, inflation, or currency impacts, (ii) the Company’s financial targets, including leverage ratio and the impact on the Company’s capital allocation, (iii) the ability to recognize the anticipated benefits of the Company’s acquisitions, (iv) failure to fully execute the Company’s inspection first strategy or to realize the expected service revenue from such inspections, (v) risks associated with the Company’s contract portfolio; and (vi) those risks and uncertainties discussed in the “Risk Factors” section of our Form 10-K filings, and any updates to the risk factors in our Form 10-Q and 8-K filings with the U.S. Securities and Exchange Commission. Given these risks and uncertainties, investors are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date of such statements and, except as required by applicable law, the Company does not undertake any obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

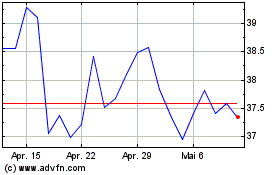

APi (NYSE:APG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

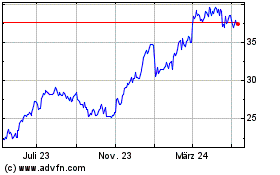

APi (NYSE:APG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024