SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of September, 2021

Commission File Number: 1-16269

AMÉRICA MÓVIL, S.A.B. DE C.V.

(Exact name of registrant as specified in its charter)

America Mobile

(Translation of Registrant´s name into English)

Lago Zurich 245

Plaza Carso / Edificio Telcel

Colonia Ampliación Granada

Delegación Miguel Hidalgo,

11529, Mexico City, Mexico

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports

under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(1):

Yes _______ No ___X____

Indicate by check mark if the Registrant is submitting this Form 6-K in paper as

permitted by Regulation S-T Rule 101(b)(7):

Yes _______ No ___X____

Indicate by check mark whether the registrant by furnishing the information contained in this Form 6-K is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No ___X____

“América

Móvil and Liberty Latin America to combine

their Chilean

operations”

Denver, USA and Mexico City, Mexico –

September 29, 2021: Liberty Latin America Ltd. (“Liberty Latin America” or “LLA”) (NASDAQ:

LILA and LILAK, OTC Link: LILAB) and América Móvil S.A.B. de C.V. (“América Móvil”

or “AMX”) (BMV: AMX, NYSE: AMX and AMOV) announced an agreement to combine their respective Chilean operations,

VTR and Claro Chile, to form a 50:50 joint venture (the “JV”).

Strategic Rationale & Value Creation

The proposed transaction combines the complementary

operations of VTR, a leading provider of high-speed consumer fixed products, such as broadband and Pay TV services, where it connects

close to 3 million subscribers nationwide, and Claro Chile, one of Chile’s leading telecommunications service providers with over

6.5 million mobile customers, to create a business with greater scale, product diversification, and a capital structure that will enable

significant investment for fixed fiber footprint expansion and to be at the forefront of 5G mobile delivery. By 2025, the JV anticipates

passing 6 million homes through its fixed network and the majority will have access to FTTH infrastructure.

The parties expect the JV will generate significant

operating benefits and associated value creation, with estimated run-rate synergies of over $180 million, 80% of which are expected to

be achieved within three years post completion. Most of these benefits relate to cost savings, driven by network and operating efficiencies

resulting from the combination. In addition, parties expect the JV to develop additional revenue streams through cross-selling opportunities

and scale.

LLA and AMX bring significant experience in the integration

and execution of identified synergies in the context of in-country consolidations and convergence transactions in the region.

Transaction Structure & Governance

Each of LLA and AMX made a commitment to contribute

businesses with net debt of CLP 1,095 billion ($1.5 billion) and CLP 259 billion ($0.4 billion), respectively. In addition, LLA will make

a balancing payment to AMX of CLP 73 billion ($0.1 billion).

Neither LLA nor AMX will consolidate the JV after the

closing. The formation of the JV will not result in a change of control event for existing debtholders of VTR. The JV, as a whole, through

organic growth and synergy realization will target a long-term net leverage ratio of 2.8x to 3.5x EBITDA.

Executive leadership of the JV will be agreed prior

to the closing. The board will consist of eight persons, with four representatives from each of LLA and AMX. The role of Chairperson will

rotate between the shareholders. Certain actions of the JV will be subject to the consent of both parties.

The transaction excludes all telecommunication towers

owned indirectly by AMX in Chile.

Conditions to Completion and Indicative Timetable

Completion of the transaction is subject to certain

customary closing conditions, including regulatory approvals, and is expected to close in the second half of 2022. The transaction is

not subject to LLA or AMX shareholder approvals.

Claro Chile owns a DTH business which VTR would be

unable to operate according to restrictions imposed by the Chilean Antitrust Court’s, following its acquisition of Metrópolis

in 2005. If these restrictions remain in place at the time of completion, both parties have agreed to take every necessary step to comply

with such restrictions.

About Liberty Latin America

Visit: www.lla.com

About América Móvil

Visit: www.americamovil.com

For more information contact:

|

Liberty Latin America Investor Relations

Kunal Patel

ir@lla.com

|

América Móvil Investor Relations

Daniela Lecuona

daniela.lecuona@americamovil.com

|

|

Liberty Latin America Media Relations

Claudia Restrepo

llacommunications@lla.com

|

América Móvil Media Relations

Paula García

paula.garcia@americamovil.com

|

Forward Looking Statements

This press release contains forward-looking statements

within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the timing

and benefits of the transaction, including synergy benefits; the expected impact of the transaction and expansion targets, and other information

and statements that are not historical fact. These forward-looking statements involve certain risks and uncertainties that could cause

actual results to differ materially from those expressed or implied by these statements. These risks and uncertainties include, but are

not limited to, events that are outside of the control of the parties, such as natural disasters and pandemics (including COVID-19), their

ability to obtain regulatory consents for the transaction as well as other conditions to closing; the parties’ ability to continue

financial and operational performance at historic levels, continued use by subscribers of their services, their ability to achieve expected

operational efficiencies, synergies and economies of scale, as well as other factors detailed from time to time in their respective filings

with the Securities and Exchange Commission. These forward-looking statements speak only as of the date of this press release. Both parties

expressly disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein

to reflect any change in their expectations with regard thereto or any change in events, conditions or circumstances on which any such

statement is based.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 29, 2021

|

AMÉRICA MÓVIL, S.A.B. DE C.V.

|

|

|

|

|

|

|

By:

|

/S/ Alejandro

Cantú Jiménez

|

|

|

Name:

Title:

|

Alejandro

Cantú Jiménez

Attorney-in-fact

|

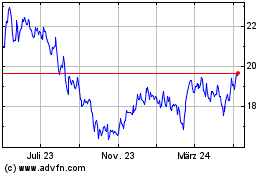

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

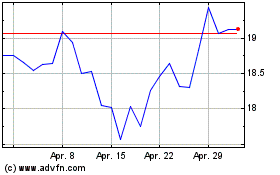

America Movil SAB de CV (NYSE:AMX)

Historical Stock Chart

Von Feb 2024 bis Feb 2025