Current Report Filing (8-k)

19 April 2022 - 12:05PM

Edgar (US Regulatory)

0001232582

false

0001232582

2022-04-14

2022-04-14

0001232582

us-gaap:CommonStockMember

2022-04-14

2022-04-14

0001232582

us-gaap:SeriesDPreferredStockMember

2022-04-14

2022-04-14

0001232582

us-gaap:SeriesFPreferredStockMember

2022-04-14

2022-04-14

0001232582

us-gaap:SeriesGPreferredStockMember

2022-04-14

2022-04-14

0001232582

us-gaap:SeriesHPreferredStockMember

2022-04-14

2022-04-14

0001232582

aht:PreferredStockSeriesIMember

2022-04-14

2022-04-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of

earliest event reported): April 14,

2022

ASHFORD HOSPITALITY TRUST, INC.

(Exact name of registrant

as specified in its charter)

| Maryland |

|

001-31775 |

|

86-1062192 |

(State or other

jurisdiction of incorporation or

organization) |

|

(Commission File Number) |

|

(IRS employer identification number) |

| |

|

|

|

|

| 14185

Dallas Parkway, Suite

1200 |

|

|

|

|

| Dallas,

Texas |

|

|

|

75254 |

| (Address of principal executive offices) |

|

|

|

(Zip code) |

Registrant’s telephone

number, including area code: (972) 490-9600

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of

this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Securities registered pursuant to Section

12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

AHT |

|

New

York Stock Exchange |

| Preferred

Stock, Series D |

|

AHT-PD |

|

New

York Stock Exchange |

| Preferred

Stock, Series F |

|

AHT-PF |

|

New

York Stock Exchange |

| Preferred

Stock, Series G |

|

AHT-PG |

|

New

York Stock Exchange |

| Preferred

Stock, Series H |

|

AHT-PH |

|

New

York Stock Exchange |

| Preferred

Stock, Series I |

|

AHT-PI |

|

New

York Stock Exchange |

ITEM 5.02 DEPARTURE OF DIRECTORS OR CERTAIN

OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS.

On April 15, 2022, Ashford

Inc. (the “Advisor”) and Ashford Hospitality Services, LLC, a subsidiary of the Advisor (“Ashford

Services”), agreed with Jeremy Welter, the Chief Operating Officer of the Advisor, that, effective July 15, 2022 (the

“Resignation Date”), Mr. Welter would terminate employment with and service to the Advisor, Ashford Services and

their affiliates. Mr. Welter is also the Chief Operating Officer of Ashford Hospitality Trust, Inc. (the

“Company”) and Braemar Hotels & Resorts Inc. (“Braemar”) and accordingly his service as Chief

Operating Officer of each of the Company and Braemar will also end effective as of the Resignation Date.

Ashford Services and Mr. Welter

have entered into a Release and Waiver Agreement (the “Release”) in connection with his departure. Pursuant to the Release,

Mr. Welter will continue to receive his base salary and be eligible for employee benefits through the Resignation Date and, in consideration of and subject to a release of claims

by Mr. Welter and his continuing compliance with certain post-employment obligations, the parties agreed among other things that,

effective as of the Resignation Date:

| · | Mr. Welter will receive a lump-sum payment of $750,000 and, commencing in August 2022, payment

of $6,397,067 in 24 equal monthly installments; |

| · | Mr. Welter and his eligible dependents will generally remain eligible to participate in, and receive

reimbursement for the employee cost of, health, life and long-term disability plans for up to 24 months following the Resignation Date,

and he or they would be eligible thereafter for up to 12 months of COBRA cost reimbursement, if applicable; and |

| · | All outstanding equity incentive awards granted to Mr. Welter, including those issued by the Company

and Braemar, will be treated as if Mr. Welter’s employment termination was by the employer without “Cause” as contemplated

by the underlying award agreements. |

Mr. Welter remains bound

by the restrictive covenants set forth in his Employment Agreement with the Advisor and Ashford Services dated as of December 20,

2019 (generally relating to confidentiality, noncompetition and nonsolicitation), with certain modifications to the employee nonsolicitation

obligations as provided in the Release. Pursuant to the Release, Mr. Welter also agrees to certain limitations during the 24-month

cash payment period described above on his ability to acquire stock of the Advisor, the Company and Braemar and their affiliates and to

engage in certain corporate transactions involving such entities, and Mr. Welter is provided a release of claims.

The foregoing summary of

the Release does not purport to be complete and is qualified in its entirety by the full text of the Release, which is attached to this

Current Report on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ASHFORD HOSPITALITY

TRUST, INC. |

| |

|

| |

|

| |

By: |

/s/ Alex Rose |

| |

|

Alex Rose |

| |

|

Executive Vice President, General Counsel & Secretary |

Date: April 19, 2022

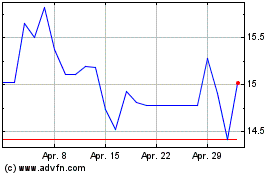

Ashford Hospitality (NYSE:AHT-G)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Ashford Hospitality (NYSE:AHT-G)

Historical Stock Chart

Von Apr 2023 bis Apr 2024

Echtzeit-Nachrichten über Ashford Hospitality Trust Inc (New York Börse): 0 Nachrichtenartikel

Weitere Ashford Hospitality Trust Inc News-Artikel