UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO/A

(Amendment No. 2)

Tender Offer Statement Under Section 14(d)(1)

or 13(e)(1)

of the Securities Exchange Act of 1934

Aenza S.A.A.

(Name of Subject Company (issuer))

IG4 Capital Infrastructure Investments LP

IG4 Capital Private Equity Investments II-A

LP

IG4 Capital Private Equity Investments II-B

LP

IG4 Capital Private Equity Investments II-C

LP

(Name of Filing Persons (Offerors))

Common Shares, par value S/ 1.00 per share

(Title of Class of Securities)

PEP736581005*

(CUSIP Number of Class of Securities)

*The Common Shares are listed on the Lima Stock

Exchange and the CINS Identifier is PEP736581005.

American Depositary Shares, each representing five

Common Shares

(Title of Class of Securities)

00776D 103**

(CUSIP Number of American Depositary Shares)

**CUSIP number

of the American Depositary Shares (“ADSs”) listed on the New York Stock Exchange.

Andrew Cunningham

Director

IG4 Capital Infrastructure GP Limited

50 La Colomberie, St. Helier, Jersey, JE2 4QB

+44.1534.844234

(Name,

Address and Telephone Number of Person Authorized

to Receive Notices and Communications on Behalf of Filing

Persons)

With a copy to:

George Karafotias

Derrick Lott

Shearman & Sterling LLP

599 Lexington Avenue

New York, NY 10022-6069

+1.212.848.4000

Calculation of Filing Fee

|

Transaction Valuation(1)

|

Amount of Filing Fee(2)

|

|

$45,006,671

|

$4,910.23

|

|

|

(1)

|

Estimated for purposes of calculating the amount of the filing fee only, in accordance with Rule 0-11(d) under the Securities Exchange

Act of 1934, as amended (the “Exchange Act”). Calculated as follows: (a) the difference of (i) 871,917,855 common shares

par value S/ 1.00 per share (collectively, the “Common Shares”), of Aenza S.A.A. (formerly Graña y Montero S.A.A.),

a publicly-held corporation (sociedad anónima abierta) organized under the laws of Peru (the “Company”),

including Common Shares represented by American Depositary Shares (each of which represents five (5) Common Shares) (collectively, the

“ADSs”) outstanding as of March 31, 2021 minus (ii) 204,830,579 Common Shares owned by GH Holding Group Corp.,

Bamas International Investment Corp., Bethel Enterprises Inc., Hernando Alejandro Constancio Graña Acuña, Mario Germán

Óscar Alvarado Pflucker, Francisco Javier Dulanto Swayne, Hugo Rangel Zavala, Alfonso Galvez Rubio, Ruth Alvarado Pflucker, Elisa

Alvarado Pflucker, Gonzalo Alvarado Pflucker and Claudia Gutierrez Benavides (collectively, the “Sellers”), being 667,087,276

Common Shares, including Common Shares represented by ADSs, which can be tendered in the tender offer launched in the United States (the

“U.S. Offer”) simultaneously with a tender offer launched in Peru (the “Peru Offer” and together

with the U.S. Offer, the “Offers”); (b) the sum of (i) 667,087,276 Common Shares, including Common Shares represented

by ADSs, and (ii) 93,962,525 Common Shares to be tendered by the Sellers in the Peru Offer pursuant to a tender offer support agreement

between IG4 Capital Infrastructure Investments LP (“Purchaser”) and the Sellers, dated as of August 24, 2020, as amended

on June 3, 2021, being 761,049,801 Common Shares, including Common Shares represented by ADSs, that can be tendered across the Offers;

(c) the quotient of (i) 667,087,276 divided by (ii) 761,049,801, yielding a proration factor of 0.87654; (d) the product of (i)

107,198,601, being the Common Shares, including Common Shares represented by ADSs, sought in the Offers and (ii) 0.87654, being 93,963,395

(the maximum number of Common Shares, including Common Shares represented by ADSs, which can be acquired by Purchaser in the U.S. Offer

(the “Subject Securities”); and (e) the product of (i) the Subject Securities and (ii) the offer price of S/ 1.88 per

Common Share, being S/ 176,651,182, as converted into U.S. dollars based on the average Peruvian Sol/U.S. dollar interbank exchange rate

(tipo de cambio interbancario promedio) for transactions carried out between 9:00 a.m. and 1:30 p.m., Lima time, as reported by

the Central Reserve Bank of Peru on its official website at https://www.bcrp.gob.pe/en at 2:00 p.m., Lima time, on June 7, 2021, being

U.S. $45,006,671 (the “Transaction Valuation”).

|

|

|

(2)

|

The filing fee was calculated in accordance with Rule 0-11 of the Exchange Act by multiplying the Transaction Valuation by .0001091.

|

|

|

x

|

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee

was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and date of its filing.

|

|

|

Amount Previously Paid: $4,910.23

|

Filing Party: IG4 Capital Infrastructure Investments LP

|

|

|

Form or Registration No.: Schedule TO

|

Date Filed: June 16, 2021

|

|

|

o

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate any transactions to

which the statement relates:

|

|

x

|

third-party tender offer subject to Rule 14d-1.

|

|

|

o

|

issuer tender offer subject to Rule 13e-4.

|

|

|

o

|

going-private transaction subject to Rule 13e-3.

|

|

|

o

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing

is a final amendment reporting the results of the tender offer: o

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

|

|

o

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

x

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

|

|

________________________________________________

|

|

This Amendment No. 2 filed with the Securities

and Exchange Commission (the “SEC”) on July 7, 2021 (this “Amendment”), amends and supplements the

Tender Offer Statement on Schedule TO filed with the SEC on June 16, 2021, as amended on June 22, 2021 (together with any subsequent amendments

and supplements thereto, the “Schedule TO”) by IG4 Capital Infrastructure Investments LP, a limited partnership organized

under the laws of Scotland (“Purchaser”), which is jointly owned by IG4 Capital Private Equity Investments II-A LP,

IG4 Capital Private Equity Investments II-B LP, IG4 Capital Private Equity Investments II-C LP and IG4 Capital Infrastructure Co-Investments

A LP, each a limited partnership organized under the laws of England and Wales (collectively, “IG4”). This Schedule

TO relates to the offer by Purchaser to purchase 107,198,601 common shares, par value S/ 1.00 per share (each, a “Common Share,”

and collectively, the “Common Shares”), of Aenza S.A.A. (formerly Graña y Montero S.A.A.), a publicly-held corporation

(sociedad anónima abierta) organized under the laws of Peru (the “Company”), including Common Shares

represented by American Depositary Shares (each of which represents five (5) Common Shares) (each, an “ADS,” and collectively,

the “ADSs”), which represent in the aggregate approximately 12.29% of the outstanding Common Shares, including Common

Shares represented by ADSs, through concurrent tender offers in Peru and in the United States, for S/ 1.88 per Common Share and S/ 9.40

per ADS, in each case, payable to the seller in cash, without interest, less any withholding taxes that may be applicable, upon the terms

and subject to the conditions set forth in the Offer to Purchase, dated June 16, 2021 (together with any amendments or supplements thereto,

the “Offer to Purchase”) and in the accompanying American Depositary Share Letter of Transmittal (together with any

amendments or supplements thereto, the “ADS Letter of Transmittal” and, together with the Offer to Purchase and other

related materials, as each may be amended or supplemented from time to time, the “U.S. Offer”).

This Amendment is being filed on behalf of Purchaser

and IG4. All capitalized terms used in this Amendment and not otherwise defined have the respective meanings ascribed to them in the Schedule

TO. Except as otherwise set forth in this Amendment, the information set forth in the Schedule TO remains unchanged and is incorporated

herein by reference to the extent relevant to the items in this Amendment. This Amendment should be read together with the Schedule TO.

This Amendment is being filed for the purpose

of disclosing the following matters:

(a) On

June 25, 2021, Purchaser became aware that the 10,077,855 Common Shares owned by Mr. Alvarado Pflucker, representing approximately 1.16%

of the outstanding Common Shares, including Common Shares represented by ADSs (the “MA Shares”), were subject to a

precautionary measure of seizure (embargo e inhibición) in the form of registration on the Common Shares owned by Mr. Alvarado

Pflucker by the Peruvian Public Prosecutor (Fiscalía) and the Peruvian Attorney General (Procuraduria) (the “MA

Embargo”), thereby preventing Mr. Alvarado Pflucker from being able to tender the MA Shares into the Peru Offer.

As a consequence of the foregoing, on July 2,

2021:

|

|

(i)

|

Purchaser and Mr. Alvarado Pflucker entered into a Supplementary Agreement (as more fully described below), pursuant to which Mr.

Alvarado Pflucker agreed, among other things, that the MA Shares will be transferred to the Trust, subject to the release of the MA Shares

from the MA Embargo and the registration of such release in Cavali;

|

|

|

(ii)

|

Purchaser and Mr. Alvarado Pflucker entered into a Syndication Agreement (as more fully described below), pursuant to which Mr. Alvarado

Pflucker agreed, among other things, to vote the MA Shares during the term of the Syndication Agreement at each general meeting of the

shareholders of the Company in the same manner as Purchaser;

|

|

|

(iii)

|

Purchaser and the Grantors entered into an amendment agreement amending the Trust Agreement (as more fully described below), pursuant

to which Purchaser and the Grantors agreed, among other things, that the 9,000,000 Common Shares transferred to the Trust by Ms. Benavides

(the spouse of Mr. Alvarado Pflucker) in accordance with the Trust Agreement, will be returned to Ms. Benavides, thereby terminating the

Trust Agreement in relation to Mr. Benavides; and

|

|

|

(iv)

|

Purchaser and the Sellers entered into a second amendment agreement amending the Tender Offer Support Agreement (as more fully described

below), pursuant to which, among other things, Ms. Benavides agreed to tender her 9,000,000 Common Shares, representing approximately

1.03% of the outstanding Common Shares, including Common Shares represented by ADSs, into the Peru Offer.

|

As a further consequence of the foregoing, the

number of Common Shares that the Sellers have agreed to tender into the Peru Offer pursuant to the terms of the Tender Offer Support Agreement

(as amended by the second amendment agreement) is 92,884,670 Common Shares, representing approximately 10.65% of the outstanding Common

Shares, including Common Shares represented by ADSs.

The number of Common Shares, including Common

Shares represented by ADSs, that Purchaser is seeking to purchase pursuant to the Offers remains unchanged.

(b) On

July 2, 2021, Purchaser and the Sellers agreed to waive the condition to the effectiveness of the voting arrangements made by Purchaser

and the Sellers pursuant to the GH Supplementary Agreement, the HG Supplementary Agreement and the Trust Agreement and, as a consequence

of the foregoing:

|

|

(i)

|

Purchaser and GH Holding Group entered into an amendment agreement amending the GH Supplementary Agreement and an amendment agreement

amending the GH Syndication Agreement (each as more fully described below);

|

|

|

(ii)

|

Purchaser and Mr. Graña Acuña entered into an amendment agreement amending the HG Supplementary Agreement and an amendment

agreement amending the HG Syndication Agreement (each as more fully described below); and

|

|

|

(iii)

|

Purchaser and the Grantors entered into an amendment agreement amending the Trust Agreement (as more fully described below).

|

As a result of the waiver of the condition to

the effectiveness of the voting arrangements made by Purchaser and the Sellers pursuant to the Tender Offer Support Agreement, Purchaser,

IG4 and their controlling persons identified in Schedule 1 to the Offer to Purchase may be deemed to beneficially own 111,945,909 Common

Shares in the aggregate, representing approximately 12.84% of the outstanding Common Shares, including Common Shares represented by ADSs,

pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, as amended.

(c) In

connection with the arrangements made by Purchaser with each of Mr. Alvarado Pflucker, GH Holding Group and Mr. Graña Acuña

relating to the transfer to the Trust of Common Shares that are subject to a precautionary measure of seizure (embargo e inhibición)

or confiscation (incautación) by the Peruvian Public Prosecutor (Fiscalía) and the Peruvian Attorney General

(Procuraduria) following the release of such Common Shares from seizure and the registration of such release in Cavali, Purchaser

has agreed to make such arrangements available to all shareholders of the Company on the same terms and conditions and in accordance with

the applicable laws of Peru and the United States.

The items of the Schedule TO set forth below

are hereby amended and supplemented as follows:

|

|

Item 1.

|

Summary Term Sheet.

|

Item 1 of the Schedule TO is hereby amended

and supplemented by amending and supplementing the information set forth in the Summary Term Sheet of the Offer to Purchase as follows:

The following paragraph replaces, in the Summary Term Sheet,

the definition of “Tender Offer Support Agreement” on page 3:

On August 24, 2020, Purchaser entered into a

tender offer support agreement with GH Holding Group Corp. (“GH Holding Group”), Bamas International Investment Corp.,

Bethel Enterprises Inc., Hernando Alejandro Constancio Graña Acuña (“Mr. Graña Acuña”),

Mario Germán Óscar Alvarado Pflucker, Francisco Javier Dulanto Swayne, Hugo Rangel Zavala, Alfonso Galvez Rubio, Ruth Alvarado

Pflucker, Elisa Alvarado Pflucker, Gonzalo Alvarado Pflucker and Claudia Gutierrez Benavides (collectively, the “Sellers”),

as amended by Purchaser and the Sellers on June 3, 2021, and as further amended on July 2, 2021 (together, the “Tender Offer

Support Agreement”), pursuant to which the Sellers have agreed to, among other things, tender into the Peru Offer in the aggregate

92,884,670 Common Shares, representing approximately 10.65% of the outstanding Common Shares, including Common Shares represented by ADSs,

on the terms and subject to the conditions set forth in the Tender Offer Support Agreement (see “The U.S. Offer—Tender Offer

Support Agreement and Related Agreements”).

The following paragraph replaces, in the Summary Term Sheet,

the third paragraph of the answer to the question “If the number of Common Shares and ADSs tendered exceeds the maximum number of

Common Shares and ADSs that Purchaser is offering to purchase, what happens?” on page 6:

On August 24, 2020, Purchaser entered into the

Tender Offer Support Agreement with the Sellers (as amended on June 3, 2021 and as further amended on July 2, 2021), pursuant to which

the Sellers have agreed to, among other things, tender into the Peru Offer in the aggregate 92,884,670 Common Shares, representing approximately

10.65% of the outstanding Common Shares, including Common Shares represented by ADSs, on the terms and subject to the conditions set forth

in the Tender Offer Support Agreement (see “The U.S. Offer—Tender Offer Support Agreement and Related Agreements”).

The following paragraph replaces, in the Summary Term Sheet,

the third paragraph of the answer to the question “If I decide not to tender, how will the U.S. Offer affect my Common Shares or

ADSs?” on page 8:

As a result of the Offers and the arrangements

that we have made pursuant to the Tender Offer Support Agreement, immediately following consummation of the Offers, we expect to either

own or have the ability to direct the voting of 219,144,510 Common Shares representing, in the aggregate, approximately 25.13% of the

outstanding Common Shares, including Common Shares represented by ADSs (see “The U.S. Offer—Tender Offer Support Agreement

and Related Agreements”).

The following paragraphs replace, in the Summary Term Sheet,

the answer to the question “Does the Tender Offer Support Agreement govern the Offers in any way?” on page 14 in its entirety:

Yes. Subject to the terms and conditions of

the Tender Offer Support Agreement (as amended), Purchaser has agreed, among other things:

|

|

·

|

to make an offer to all holders of Common Shares to acquire not less than 92,884,670 Common Shares and no more than 107,198,601 Common

Shares, representing between approximately 10.65% and 12.29% of the outstanding Common Shares, including Common Shares represented by

ADSs;

|

|

|

·

|

to acquire from the Sellers pursuant to the Peru Offer and subject to proration, if applicable, 92,884,670 Common Shares in the aggregate,

representing approximately 10.65% of the outstanding Common Shares, including Common Shares represented by ADSs;

|

|

|

·

|

following completion of the Offers, to acquire from GH Holding Group directly, for the Common Share Offer Price per Common Share,

2,585,597 Common Shares, representing approximately 0.30% of the outstanding Common Shares, including Common Shares represented by ADSs,

subject to the release of such Common Shares from seizure (embargo e inhibición) by the Peruvian Public Prosecutor (Fiscalía)

and the Peruvian Attorney General (Procuraduria) and the registration of such release in Cavali, and to make the arrangements agreed

upon with GH Holding Group with respect to such shares available to all shareholders of the Company on the same terms and conditions and

in accordance with the applicable laws of Peru and the United States;

|

|

|

·

|

following completion of the Offers, to acquire from Mr. Graña Acuña, for the Common Share Offer Price, 7,765,604 Common

Shares, representing approximately 0.89% of the outstanding Common Shares, including Common Shares represented by ADSs, subject to the

release of such Common Shares from seizure (embargo e inhibición) and confiscation (incautación) by the Peruvian

Public Prosecutor (Fiscalía) and the Peruvian Attorney General (Procuraduria) and the registration of such release

in Cavali, and to make the arrangements agreed upon with Mr. Graña Acuña with respect to such shares available to all shareholders

of the Company on the same terms and conditions and in accordance with the applicable laws of Peru and the United States; and

|

|

|

·

|

to enter into arrangements with certain of such Sellers in respect of the voting of 111,945,909 Common Shares in the aggregate, representing

approximately 12.84% of the outstanding Common Shares, including Common Shares represented by ADSs.

|

See “The U.S. Offer—Tender Offer Support Agreement

and Related Agreements.”

|

|

Item 4.

|

Terms of the Transaction

|

Item 4 of the Schedule TO is hereby amended

and supplemented by amending and supplementing the information set forth in Section 1 (“Terms of the U.S. Offer”) of the Offer

to Purchase as follows:

The following paragraph replaces, in Section

1, the first paragraph under the caption “Transaction Background” on page 20:

Purchaser is interested in acquiring a “participación

significativa” (as defined in Reglamento de Oferta Pública de Adquisicion y de Compra de Valores por Exclusión

approved by CONASEV Resolution No. 009-2006-EF to mean a direct or indirect ownership, or the ability to direct the voting, of 25% or

more of the shares of a Peruvian company listed on the LSE) of no less than 219,144,510 Common Shares, representing approximately 25.13%

of the outstanding Common Shares, including Common Shares represented by ADSs.

The following paragraph replaces, in Section

1, the second paragraph under the caption “Transaction Background” on page 20:

On August 24, 2020, Purchaser entered into the

Tender Offer Support Agreement with the Sellers (as amended on June 3, 2021 and as further amended on July 2, 2021), pursuant to which,

among other things:

|

|

(i)

|

the Sellers have agreed to tender 92,884,670 Common Shares in the aggregate, representing approximately 10.65% of the outstanding

Common Shares, including Common Shares represented by ADSs, into the Peru Offer;

|

|

|

(ii)

|

(A) GH Holding Group has agreed to sell 2,585,597 Common Shares, representing approximately 0.30% of the outstanding Common Shares,

including Common Shares represented by ADSs, following completion of the Offers directly to Purchaser for the Common Share Offer Price

per Common Share subject to the release of such Common Shares from seizure (embargo e inhibición) by the Peruvian Public

Prosecutor (Fiscalía) and the Peruvian Attorney General (Procuraduria) (the “GH Embargo”) and

the registration of such release in Cavali S.A. ICLV (“Cavali”), and (B) Purchaser has agreed to make the arrangements

agreed upon with GH Holding Group with respect to such shares available to all shareholders of the Company on the same terms and conditions

and in accordance with the applicable laws of Peru and the United States;

|

|

|

(iii)

|

(A) Mr. Graña Acuña has agreed to sell 7,765,604 Common Shares, representing approximately 0.89% of the outstanding

Common Shares, including Common Shares represented by ADSs, following completion of the Offers directly to Purchaser for the Common Share

Offer Price per Common Share, subject to the release of such Common Shares from seizure (embargo e inhibición) and confiscation

(incautación) by the Peruvian Public Prosecutor (Fiscalía) and the Peruvian Attorney General (Procuraduria)

(the “HG Embargo”) and the registration of such release in Cavali, and (B) Purchaser has agreed to make the arrangements

agreed upon with Mr. Graña Acuña with respect to such shares available to all shareholders of the Company on the same terms

and conditions and in accordance with the applicable laws of Peru and the United States; and

|

|

|

(iv)

|

certain Sellers have agreed to enter into arrangements with Purchaser in respect of the voting of 111,945,909 Common Shares in the

aggregate, representing approximately 12.84% of the outstanding Common Shares, including Common Shares represented by ADSs,

|

in each case, on the terms and subject to the conditions set forth

in the Tender Offer Support Agreement (see “The U.S. Offer—Tender Offer Support Agreement and Related Agreements”).

The following paragraph replaces, in Section

1, the third paragraph under the caption “Transaction Background” on page 20:

As a result of the Offers and the arrangements

that we have made pursuant to the Tender Offer Support Agreement, immediately following consummation of the Offers, Purchaser expects

to either own or have the ability to direct the voting of 219,144,510 Common Shares representing, in the aggregate, approximately 25.13%

of the outstanding Common Shares, including Common Shares represented by ADSs.

|

|

Item 5.

|

Past Contacts, Transactions, Negotiations and Agreements.

|

Item 5 of the Schedule TO is hereby amended

and supplemented by amending and supplementing the information set forth in Section 10 (“Background of the Offers; Past Contacts

or Negotiations with the Company”) of the Offer to Purchase as follows:

The following paragraph replaces, in Section 10, the last paragraph

on page 44:

On June 3, 2021, Purchaser and the Sellers entered

into an amendment agreement amending the Tender Offer Support Agreement (the “First Amendment Agreement”), pursuant

to which Purchaser and the Sellers agreed, among other things, that their termination rights under Section 7.1(b) of the Tender Offer

Support Agreement, which allows either Purchaser or the Sellers to terminate the Tender Offer Support Agreement if the commencement date

of the Offers has not occurred within twelve (12) business days of the later of (a) the date of the release of the Clear GH Shares (as

defined below) from the GH Embargo and the registration of such release in Cavali, or (b) the date of receipt of the Jersey Approval (as

defined below) (the “Outside Date”), shall be waived and that the Outside Date shall be fifteen (15) business days

of the later to occur of the abovementioned conditions.

The following paragraphs are added at the end of Section 10:

By means of Official Letter No. 2571-2021-SMV/11.1,

dated June 24, 2021, through which the SMV forwarded Official Letter No. 428-2020-JUS/PPAH-ODEBRECHT issued by Ms. Silvana A. Carrión

Ordinola, Ad Hoc Public Prosecutor for the Case of Odebrecht and Others to the Peru Tender Agent, on June 25, 2021, Purchaser became aware

that the 10,077,855 Common Shares owned by Mr. Alvarado Pflucker, representing approximately 1.16% of the outstanding Common Shares, including

Common Shares represented by ADSs (the “MA Shares”), were subject to a precautionary measure of seizure (embargo

e inhibición) in the form of registration on the Common Shares owned by Mr. Alvarado Pflucker (the “MA Embargo”)

by the Peruvian Public Prosecutor (Fiscalía) and the Peruvian Attorney General (Procuraduria), thereby preventing

Mr. Alvarado Pflucker from being able to tender the MA Shares into the Peru Offer.

On July 2, 2021, Purchaser and the Sellers entered

into a second amendment agreement amending the Tender Offer Support Agreement (the “Second Amendment Agreement” and

together with the First Amendment Agreement, the “Amendment Agreements”), pursuant to which Purchaser and the Sellers

agreed, among other things, that:

|

|

(i)

|

the Sellers will tender 92,884,670 Common Shares in the aggregate, representing approximately 10.65% of the outstanding Common Shares,

including Common Shares represented by ADSs, into the Peru Offer; and

|

|

|

(ii)

|

Purchaser and Mr. Alvarado Pflucker will enter into: (x) a supplementary agreement in respect of the MA Shares (the “MA Supplementary

Agreement”) and (y) a syndication agreement (the “MA Syndication Agreement”), pursuant to which Mr. Alvarado

Pflucker will agree, among other things, effective from the date of the MA Syndication Agreement, to vote the MA Shares at each general

meeting of the shareholders of the Company in the same manner as Purchaser.

|

As a consequence of the foregoing, on July

2, 2021:

|

|

(i)

|

Purchaser and Mr. Alvarado Pflucker entered into:

|

|

|

(A)

|

the MA Supplementary Agreement, pursuant to which (x) Mr. Alvarado Pflucker agreed, among other things, that the MA Shares will be

transferred to the Trust (as defined below), subject to the release of the MA Shares from the MA Embargo and the registration of such

release in Cavali, and (y) Purchaser agreed to make the arrangements agreed upon with Mr. Alvarado Pflucker with respect to such shares

available to all shareholders of the Company on the same terms and conditions and in accordance with the applicable laws of Peru and the

United States; and

|

|

|

(B)

|

the MA Syndication Agreement; and

|

|

|

(ii)

|

Purchaser and the Grantors (as defined below) entered into an amendment agreement amending the Trust Agreement (as defined below)

(the “Trust Amendment Agreement”), pursuant to which Purchaser and the Grantors agreed, among other things, that:

|

|

|

(A)

|

the 9,000,000 Common Shares transferred to the Trust by Ms. Benavides, Mr. Alvarado Pflucker’s spouse, in accordance with the

Trust Agreement, will be returned to Ms. Benavides, thereby terminating the Trust Agreement in relation to Mr. Benavides; and

|

|

|

(B)

|

the political rights associated with the Trust Shares (as defined below) will become exercisable by Purchaser on the date of the Trust

Amendment Agreement.

|

On July 2, 2021:

(i) Purchaser

and GH Holding Group entered into:

|

|

(A)

|

an amendment agreement amending the supplementary agreement between Purchaser and GH Holding Group, dated as of June 3, 2021

(the “GH Supplementary Agreement”), in respect of 117,527,103 Common Shares, representing approximately 13.48% of

the outstanding Common Shares, including Common Shares represented by ADSs (the “Amended GH Supplementary

Agreement”), pursuant to which Purchaser and GH Holding Group agreed, among other things, that (x) GH Holding Group will

sell 2,585,597 Common Shares, representing approximately 0.30% of the outstanding Common Shares, including Common Shares represented

by ADSs, following completion of the Offers directly to Purchaser for the Common Share Offer Price per Common Share subject to the

release of such Common Shares from the GH Embargo and the registration of such release in Cavali, and (y) Purchaser will make the

arrangements agreed upon with GH Holding Group with respect to such shares available to all shareholders of the Company on the same

terms and conditions and in accordance with the applicable laws of Peru and the United States; and

|

|

|

(B)

|

an amendment agreement amending the syndication agreement between Purchaser and GH Holding Group dated as of June 3, 2021 (the “Amended

GH Syndication Agreement” and the “GH Syndication Agreement”, respectively), pursuant to which GH Holding

Group agreed, among other things, from the execution date of the Amended GH Syndication Agreement and during the term of the GH Syndication

Agreement (as amended) to exercise the voting rights in relation to the 61,349,148 Common Shares owned by GH Holding Group, representing

approximately 7.04% of the outstanding Common Shares, including Common Shares represented by ADSs, at each general meeting of the shareholders

of the Company in the same manner as Purchaser;

|

(ii) Purchaser

and Mr. Graña Acuña entered into:

|

|

(A)

|

an amendment agreement amending the supplementary agreement between Purchaser and Mr. Graña Acuña dated as of June

3, 2021 (the “HG Supplementary Agreement”) in respect of 15,531,208 Common Shares (the “HG

Shares”), representing approximately 1.78% of the outstanding Common Shares, including Common Shares represented by ADSs

(the “Amended HG Supplementary Agreement”), pursuant to which Purchaser and Mr. Graña Acuña agreed,

among other things, that (x) Mr. Graña Acuña will sell 7,765,604 Common Shares, representing approximately 0.89% of

the outstanding Common Shares, including Common Shares represented by ADSs, following completion of the Offers directly to Purchaser

for the Common Share Offer Price per Common Share, subject to the release of such Common Shares from the HG Embargo and the

registration of such release in Cavali, and (y) Purchaser will make the arrangements agreed upon with Mr. Graña Acuña with respect to such shares available to all shareholders

of the Company on the same terms and conditions and in accordance with the applicable laws of Peru and the United States; and

|

|

|

(B)

|

an amendment agreement amending the syndication agreement between Purchaser and Mr. Graña Acuña dated as of June 3,

2021 (the “Amended HG Syndication Agreement” and the “HG Syndication Agreement”, respectively),

pursuant to which Mr. Graña Acuña agreed, among other things, from the date of the HG Syndication Agreement (as amended)

to exercise the voting rights in relation to the 15,531,208 Common Shares owned by Mr. Graña Acuña, representing approximately

1.78% of the outstanding Common Shares, including Common Shares represented by ADSs, at each general meeting of the shareholders of the

Company in the same manner as Purchaser.

|

|

|

Item 6.

|

Purposes of the Transaction and Plans or Proposals.

|

Item 6 of the Schedule TO is hereby amended

and supplemented by amending and supplementing the information set forth in Section 7 (“Possible Effects of the U.S. Offer on the

Market for Common Shares and ADSs”) of the Offer to Purchase as follows:

The following paragraph replaces, in Section 7, the first paragraph

on page 37:

As a result of the Offers and the arrangements

that we have made pursuant to the Tender Offer Support Agreement, immediately following consummation of the Offers, we expect to either

own or have the ability to direct the voting of 219,144,510 Common Shares representing, in the aggregate, approximately 25.13% of the

outstanding Common Shares, including Common Shares represented by ADSs (see “The U.S. Offer—Tender Offer Support Agreement

and Related Agreements”).

Item 6 of the Schedule TO is hereby further

amended and supplemented by amending and supplementing the information set forth in Section 11 (“Purpose of the Offers; Plans for

the Company”) of the Offer to Purchase as follows:

The following paragraph replaces, in Section 11, the first paragraph

under the caption “Purpose of the Offers” on page 44:

IG4 believes in the long term prospects of the

Company and is interested in acquiring a “participación significativa” (as defined in Reglamento de Oferta

Pública de Adquisicion y de Compra de Valores por Exclusión approved by CONASEV Resolution No. 009-2006-EF to mean the

direct or indirect ownership, or the ability to direct the voting, of 25% or more of the shares of a Peruvian company listed on the LSE)

of no less than 219,144,510 Common Shares, representing approximately 25.13% of the outstanding Common Shares, including Common Shares

represented by ADSs.

The following paragraph replaces, in Section 11, the third paragraph

under the caption “Purpose of the Offers” on page 45:

As a result of the arrangements contemplated

by the Tender Offer Support Agreement, Purchaser has commenced on the date of the publication of this Offer to Purchase, a tender offer

to purchase 107,198,601 Common Shares, including Common Shares represented by ADSs. The purpose of the Offers is for IG4, through Purchaser,

to acquire approximately 12.29% of the outstanding Common Shares, including Common Shares represented by ADSs, and, together with the

additional Common Shares and the voting rights in respect of Common Shares that IG4 will acquire pursuant to the terms of the Tender Offer

Support Agreement and related agreements, for Purchaser to either own or have the ability to direct the voting of 219,144,510 Common Shares

representing, in the aggregate, approximately 25.13% of the outstanding Common Shares, including Common Shares represented by ADSs, to

enable IG4 to exert a level of influence over the Company that, together with the support of the Other Shareholders, will allow IG4 to

promote and execute measures that IG4 determines will enhance the value of the Company.

The following paragraph replaces the last paragraph of Item

6 of the amendment to the Schedule TO filed on June 22, 2021:

If IG4 achieves a “participación

significativa” representing no less than 219,144,510 Common Shares, representing approximately 25.13% of the outstanding Common

Shares, including Common Shares represented by ADSs, then according to the Peru Tender Offer Regulations, IG4 is not permitted to acquire

an additional significant interest in the Company, including Common Shares and Common Shares represented by ADSs, if such acquisition

would result in IG4’s percentage ownership of the voting interests in the Company being equal to or exceeding 50% of the outstanding

capital stock of the Company, other than by means of a mandatory tender offer.

|

|

Item 8.

|

Interest in Securities of the Subject Company.

|

Item 8 of the Schedule TO is hereby amended

and supplemented by amending and supplementing the information set forth in Section 12 (“Tender Offer Support Agreement and Related

Agreements”) of the Offer to Purchase as follows:

The following paragraph is added in Section

12 before the last paragraph on page 56:

As a consequence of the entry by Purchaser into:

|

|

(i)

|

the MA Syndication Agreement with Mr. Alvarado Pflucker in connection with the 10,077,855 Common Shares owned by Mr. Alvarado Pflucker;

|

|

|

(ii)

|

the Amended GH Syndication Agreement with GH Holding Group in connection with the 61,349,148 Common Shares owned by GH Holding Group;

|

|

|

(iii)

|

the Amended HG Syndication Agreement with Mr. Graña Acuña in connection with the 15,531,208 Common Shares owned by Mr.

Graña Acuña; and

|

|

|

(iv)

|

the Trust Amendment Agreement with the Grantors in connection with the 24,987,698 Common Shares collectively owned by the Grantors,

|

as of July 2, 2021, Purchaser, IG4 Capital Infrastructure

GP, the manager of Purchaser, and IG4 Capital Partners Holding Investments LP, the sole shareholder of IG4 Capital Infrastructure GP,

may be deemed to beneficially own 111,945,909 Common Shares in the aggregate, representing approximately 12.84% of the outstanding Common

Shares, including Common Shares represented by ADSs pursuant to Rule 13d-3 under the Securities Exchange Act of 1934, as amended.

In accordance with the Tender Offer Support

Agreement, Purchaser shall pay the Political Rights Consideration to the Grantors for each Common Share transferred to the Trust upon

completion of the Offers.

|

|

Item 11.

|

Additional Information.

|

Item 11 of the Schedule TO is hereby amended and supplemented

by amending and supplementing the information set forth on the cover page of the Offer to Purchase as follows:

The following paragraph replaces the fourth paragraph on the second

cover page:

On August 24, 2020, Purchaser entered into a tender

offer support agreement with GH Holding Group Corp., Bamas International Investment Corp., Bethel Enterprises Inc., Hernando Alejandro

Constancio Graña Acuña, Mario Germán Óscar Alvarado Pflucker, Francisco Javier Dulanto Swayne, Hugo Rangel

Zavala, Alfonso Galvez Rubio, Ruth Alvarado Pflucker, Elisa Alvarado Pflucker, Gonzalo Alvarado Pflucker and Claudia Gutierrez Benavides

(collectively, the “Sellers”), as amended by Purchaser and the Sellers on June 3, 2021, and as further amended on July

2, 2021 (together, the “Tender Offer Support Agreement”), pursuant to which the Sellers have agreed to, among other

things, tender into the Peru Offer in the aggregate 92,884,670 Common Shares, representing approximately 10.65% of the outstanding Common

Shares, including Common Shares represented by ADSs, on the terms and subject to the conditions set forth in the Tender Offer Support

Agreement (see “The U.S. Offer—Tender Offer Support Agreement and Related Agreements”).

Item 11 of the Schedule TO is hereby further amended

and supplemented by amending and supplementing the information set forth in the Introduction of the Offer to Purchase as follows:

The following paragraph replaces the fifth paragraph of the Introduction

on page 18:

On August 24, 2020, Purchaser entered into a tender

offer support agreement with GH Holding Group Corp. (“GH Holding Group”), Bamas International Investment Corp. (“Bamas”),

Bethel Enterprises Inc. (“Bethel”), Hernando Alejandro Constancio Graña Acuña (“Mr. Graña

Acuña”), Mario Germán Óscar Alvarado Pflucker (“Mr. Alvarado Pflucker”), Francisco Javier

Dulanto Swayne (“Mr. Dulanto Swayne”), Hugo Rangel Zavala (“Mr. Zavala”), Alfonso Galvez Rubio (“Mr.

Rubio”), Ruth Alvarado Pflucker, Elisa Alvarado Pflucker, Gonzalo Alvarado Pflucker and Claudia Gutierrez Benavides (“Ms.

Benavides,” and collectively, the “Sellers”), as amended by Purchaser and the Sellers on June 3, 2021, and

as further amended on July 2, 2021 (together, the “Tender Offer Support Agreement”), pursuant to which the Sellers

have agreed to, among other things, tender into the Peru Offer in the aggregate 92,884,670 Common Shares, representing approximately 10.65%

of the outstanding Common Shares, including Common Shares represented by ADSs, on the terms and subject to the conditions set forth in

the Tender Offer Support Agreement (see “The U.S. Offer—Tender Offer Support Agreement and Related Agreements”).

Item 11 of the Schedule TO is hereby amended and supplemented

by amending and supplementing the information set forth in Section 12 (“Tender Offer Support Agreement and Related Agreements”)

of the Offer to Purchase as follows:

The following paragraph replaces, in Section 12, the first paragraph

on page 47:

The following is a summary of certain provisions

of the Tender Offer Support Agreement, including as amended by the Amendment Agreements, and the agreements attached as exhibits to the

Tender Offer Support Agreement and the Schedule TO. This summary does not purport to be complete and is qualified in its entirety

by reference to the Tender Offer Support Agreement itself, including the exhibits thereto, and the Amendment Agreements which have been

filed as exhibits to the Schedule TO. Copies of the Tender Offer Support Agreement, including the exhibits thereto, the Amendment

Agreements and the Schedule TO, and any other filings that IG4 or Purchaser makes with the SEC with respect to the Offers, may be

obtained in the manner set forth in “The U.S. Offer—Certain Information Concerning Purchaser, IG4 and IG4 Capital.”

All shareholders of the Company (including ADS holders) and other interested parties should read the Tender Offer Support Agreement, including

the exhibits thereto, and the Amendment Agreements in their entirety for a more complete description of the provisions summarized below.

The following paragraph replaces, in Section 12, the first paragraph

on page 47:

On August 24, 2020, Purchaser entered into the

Tender Offer Support Agreement with the Sellers (as amended pursuant to the Amendment Agreements), pursuant to which the Sellers have

agreed to, among other things, tender into the Peru Offer in the aggregate 92,884,670 Common Shares, representing approximately 10.65%

of the outstanding Common Shares, including Common Shares represented by ADSs, on the terms and subject to the conditions set forth in

the Tender Offer Support Agreement.

The following paragraph replaces, in Section 12, the fourth paragraph

on page 48:

In connection with the plea bargain processes that

are currently underway with Mr. Graña, Mr. Graña Acuña and Mr. Alvarado Pflucker, (i) the 117,527,103 Common Shares

owned by GH Holding Group became subject to GH Embargo, (ii) the 15,531,208 Common Shares owned by Mr. Graña Acuña became

subject to the HG Embargo and (iii) the 10,077,855 Common Shares owned by Mr. Alvarado Pflucker became subject to the MA Embargo, respectively,

pursuant to which the rights of GH Holding Group, Mr. Graña Acuña and Mr. Alvarado Pflucker to transfer ownership of their

Common Shares is restricted. On June 18, 2020, 56,177,955 Common Shares owned by GH Holding Group (out of the 117,527,103 Common Shares

owned by GH Holding Group) were released from the GH Embargo and such release was registered in Cavali on December 16, 2020 (the “Clear

GH Shares”). The other 61,349,148 Common Shares owned by GH Holding Group (the “Encumbered GH Shares”), the

HG Shares and the MA Shares remain subject to GH Embargo, the HG Embargo and the MA Embargo, respectively.

The following paragraph replaces, in Section 12, the lead-in language

to the third paragraph on page 48:

The Sellers agreed, within five (5) business days of

the commencement date of the Offers, to grant an irrevocable power of attorney to attorneys-in-fact Carlos Arata Delgado and Wilfredo

Cáceres Ghisilieri that authorizes each attorney-in-fact to tender into the Peru Offer in the aggregate 93,962,525 Common Shares,

representing approximately 10.78% of the outstanding Common Shares, including Common Shares represented by ADSs (which Purchaser and the

Sellers agreed to amend pursuant to the Second Amendment Agreement, so that the Sellers will tender into the Peru Offer in the aggregate

92,884,670 Common Shares, representing approximately 10.65% of the outstanding Common Shares, including Common Shares represented by ADSs).

Following the issuance of the report by the Company Board, as required by article 15 of the Peru Tender Offer Regulations, indicating

the advantages and disadvantages of accepting the Peru Offer, the Sellers have agreed to deliver, or to instruct their attorneys-in-fact

to deliver, their acceptance letters in respect of the Peru Offer to BTG Pactual Perú Sociedad Agente de Bolsa (the “Sellers’

Dealer”), to be held in escrow until the Sellers instruct in writing their attorneys-in-fact to instruct the Sellers’

Dealer to release the acceptance letters; provided that their attorneys-in-fact will not instruct the Sellers’ Dealer to release

the acceptance letters prior to notification by Purchaser that the following conditions have been satisfied (or waived by Purchaser in

writing):

The following paragraph replaces, in Section 12, the second bullet point

on page 49:

|

|

·

|

Purchaser having been able to secure a “participación significativa” (pursuant to the definition contained

in Reglamento de Oferta Pública de Adquisicion y de Compra de Valores por Exclusión approved by CONASEV Resolution

No. 009-2006-EF) of no less than 262,756,145 Common Shares, representing approximately 30.14% of the outstanding Common Shares, including

Common Shares represented by ADSs (which Purchaser and the Sellers agreed to amend (i) verbally so that the “participación

significativa” that Purchaser needs to secure is no less than 219,144,510 Common Shares, representing approximately 25.13% of

the outstanding Common Shares, including Common Shares represented by ADSs, which requirement, for the avoidance of doubt, Purchaser has

the right to waive in accordance with the terms of the Tender Offer Support Agreement and (ii) pursuant to the Second Amendment Agreement

to include entry into the MA Supplementary Agreement), comprising:

|

|

|

(1)

|

the committed tender into the Peru Offer in the aggregate of 92,884,670 Common Shares by the Sellers;

|

|

|

(2)

|

the entry into the Trust Agreement (as amended pursuant to the Trust Amendment Agreement) with the Grantors in respect of 24,987,698

Common Shares, representing approximately 2.87% of the outstanding Common Shares, including Common Shares represented by ADSs;

|

|

|

(3)

|

the entry into the Amended GH Supplementary Agreement in respect of 117,527,103 Common Shares, representing approximately 13.48% of

the outstanding Common Shares, including Common Shares represented by ADSs (of which 117,527,103 Common Shares, 56,177,955 will be tendered

into the Peru Offer and the remaining 61,349,148 are the subject of the GH Syndication Agreement (as amended));

|

|

|

(4)

|

the entry into the Amended HG Supplementary Agreement in respect of 15,531,208 Common Shares, representing approximately 1.78% of

the outstanding Common Shares, including Common Shares represented by ADSs;

|

|

|

(5)

|

the entry into the MA Supplementary Agreement in respect of 10,077,855 Common Shares, representing approximately 1.16% of the outstanding

Common Shares, including Common Shares represented by ADSs; and

|

|

|

(6)

|

the tender into the Offers by shareholders other than the Sellers,

|

(“Participación Significativa”);

The following paragraph replaces, in Section 12, the last paragraph

on page 49:

Pursuant to the Tender Offer Support Agreement (as

amended pursuant to the Second Amendment Agreement), Purchaser has agreed to purchase 92,884,670 Common Shares from the Sellers. If more

than 107,198,601 Common Shares, including Common Shares represented by ADSs, are validly tendered (and not properly withdrawn) in the

Offers and, as a result of proration, fewer than 92,884,670 Common Shares tendered by the Sellers into the Peru Offer are accepted for

payment, within five (5) LSE trading days after the settlement date of the Peru Offer, the Sellers have agreed to transfer the beneficial

ownership of the Common Shares not accepted for payment by Purchaser to the Trust (the “Additional Shares”).

The following paragraph replaces, in Section 12, the second last paragraph

under the caption “Amendment Agreement” on page 50:

First Amendment Agreement

On June 3, 2021, Purchaser and the Sellers entered

into the First Amendment Agreement, pursuant to which Purchaser and the Sellers agreed, among other things, that their termination rights

under Section 7.1(b) of the Tender Offer Support Agreement shall be waived and that the Outside Date shall be fifteen (15) business days

of the later of (a) the date of the release of the Clear GH Shares from the GH Embargo and the registration of such release in Cavali,

or (b) the date of receipt of the Jersey Approval.

The following paragraph is added after the second last paragraph

under the caption “First Amendment Agreement” on page 50:

Second Amendment Agreement

On July 2, 2021, Purchaser and the Sellers entered

into the Second Amendment Agreement, pursuant to which Purchaser and the Sellers agreed, among other things, that (a) the Sellers will

tender 92,884,670 Common Shares in the aggregate, representing approximately 10.65% of the outstanding Common Shares, including Common

Shares represented by ADSs, into the Peru Offer and (b) Purchaser and Mr. Alvarado Pflucker will enter into: (x) the MA Supplementary

Agreement and (y) the MA Syndication Agreement.

The following paragraph replaces, in Section 12, the second paragraph

under the caption “GH Supplementary Agreement” on page 51:

Pursuant to the GH Supplementary Agreement,

GH Holding Group has agreed to:

|

|

•

|

tender into the Peru Offer the Clear GH Shares following the release of the Clear GH Shares from the GH Embargo and the registration

of such release in Cavali, provided that if the release has not been registered in Cavali before the Expiration Date, GH Holding Group

has agreed to vote such Clear GH Shares on the terms of the GH Syndication Agreement until the release is registered in Cavali, following

which such Clear GH Shares will be automatically transferred to Purchaser at the Common Share Offer Price – the Clear GH Shares

were released from the GH Embargo on June 18, 2020 and such release was registered in Cavali on December 16, 2020;

|

|

|

•

|

enter into the GH Syndication Agreement with Purchaser in respect of the Encumbered GH Shares, representing approximately 7.04% of

the outstanding Common Shares, including Common Shares represented by ADSs, that remain subject to the GH Embargo;

|

|

|

•

|

sell to Purchaser 2,585,597 Common Shares of the Encumbered GH Shares at the Common Share Offer Price, subject to the release of the

Encumbered GH Shares from the GH Embargo and the registration of such release in Cavali, and Purchaser has agreed to make the arrangements

agreed upon with GH Holding Group with respect to such shares available to all shareholders of the Company on the same terms and conditions

and in accordance with the applicable laws of Peru and the United States; and

|

|

|

•

|

transfer to the Trust 58,763,551 Common Shares, subject to the release of the Encumbered GH Shares from the GH Embargo and the registration

of such release in Cavali, and Purchaser has agreed to make the arrangements agreed upon with GH Holding Group with respect to such shares

available to all shareholders of the Company on the same terms and conditions and in accordance with the applicable laws of Peru and the

United States.

|

The following paragraph is inserted as a new paragraph after

the second paragraph under the caption “GH Supplementary Agreement” on page 51:

If GH Holding Group is not capable of transferring

all of its 2,585,597 Common Shares of the Encumbered GH Shares to Purchaser following the release of the Encumbered GH Shares and the

registration of such release in Cavali as described above, GH Holding Group will transfer its remaining Encumbered GH Shares to the Trust

(and such Encumbered GH Shares will be treated as Additional Shares).

The following paragraph replaces, in Section 12, the first paragraph

under the caption “GH Syndication Agreement” on page 51:

Pursuant to the GH Syndication Agreement, GH

Holding Group has agreed to vote the Encumbered GH Shares (and, if applicable, the Clear GH Shares) at each general meeting of the shareholders

of the Company in the same manner as Purchaser. The GH Syndication Agreement was entered into on June 3, 2021 and the voting arrangements

contemplated by the GH Syndication Agreement became effective on July 2, 2021 in accordance with the terms of the Amended GH Syndication

Agreement.

The following paragraph replaces, in Section 12, the second bullet

point in the second paragraph under the caption “GH Syndication Agreement” on page 51:

|

|

•

|

the successful conclusion of the transfer process described in the GH Supplementary Agreement; and

|

The following paragraph replaces, in Section 12, the second paragraph

under the caption “HG Supplementary Agreement” on page 51:

Pursuant to the HG Supplementary Agreement (as

amended pursuant to the Amended HG Supplementary Agreement), Mr. Graña Acuña has agreed, on the same date as the execution

of the Trust Agreement, to enter into the HG Syndication Agreement, pursuant to which Mr. Graña Acuña has agreed to vote

the HG Shares at each general meeting of the shareholders of the Company in the same manner as Purchaser. The HG Syndication Agreement

was entered into on June 3, 2021 and the voting arrangements contemplated by the HG Syndication Agreement became effective on July 2,

2021 in accordance with the terms of the Amended HG Syndication Agreement.

The following paragraph replaces, in Section 12, the sixth paragraph

under the caption “HG Supplementary Agreement” on page 52:

Upon the release of the Common Shares from the

HG Embargo, Mr. Graña Acuña has agreed to transfer:

|

|

•

|

7,765,604 Common Shares to the Trust and Purchaser has agreed to pay Mr. Graña Acuña for each Common Share the Political

Rights Consideration; and

|

|

|

•

|

7,765,604 Common Shares to Purchaser and Purchaser has agreed to pay to Mr. Graña Acuña for each Common Share the Common

Share Offer Price,

|

and in each case, Purchaser has agreed to make the arrangements

agreed upon with Mr. Graña Acuña with respect to such shares available to all shareholders of the Company on the same terms

and conditions and in accordance with the applicable laws of Peru and the United States.

The following paragraph replaces, in Section 12, the seventh

paragraph under the caption “HG Supplementary Agreement” on page 52:

If less than all of the Common Shares are released

from the HG Embargo, then 50% of any Common Shares released will be transferred to the Trust and 50% of the Common Shares released will

be transferred to Purchaser as described above, and in each case Purchaser has agreed to make the arrangements agreed upon with Mr. Graña

Acuña with respect to such released shares available to all shareholders of the Company on the same terms and conditions and in

accordance with the applicable laws of Peru and the United States.

The following paragraph is inserted as a new paragraph after

the seventh paragraph under the caption “HG Supplementary Agreement” on page 52:

If Mr. Graña Acuña is not capable

of transferring all of his 7,765,604 Common Shares released from the HG Embargo to Purchaser as described above, Mr. Graña Acuña

will transfer his remaining released Common Shares to the Trust (and such released Common Shares will be treated as Additional Shares).

The following paragraph replaces, in Section 12, the second bullet

point in the last paragraph under the caption “HG Supplementary Agreement” on page 52:

|

|

•

|

the successful conclusion of the transfer process described in the HG Supplementary Agreement; and

|

The following paragraphs are inserted as new paragraphs after

the last paragraph under the caption “HG Supplementary Agreement” on page 52:

MA Supplementary Agreement

The MA Supplementary Agreement was entered into

on July 2, 2021. Pursuant to the MA Supplementary Agreement, Mr. Alvarado Pflucker has agreed to:

|

|

•

|

enter into the MA Syndication Agreement, pursuant to which Mr. Alvarado Pflucker has agreed, with effect from the date of the MA Syndication

Agreement, to vote the MA Shares at each general meeting of the shareholders of the Company in the same manner as Purchaser – the

MA Syndication Agreement was entered into on July 2, 2021; and

|

|

|

•

|

transfer to the Trust, the MA Shares, subject to the release of the MA Shares from the MA Embargo and the registration of such release

in Cavali, and Purchaser has agreed to make the arrangements agreed upon with Mr. Alvarado Pflucker with respect to such released shares

available to all shareholders of the Company on the same terms and conditions and in accordance with the applicable laws of Peru and the

United States.

|

The MA Supplementary Agreement and the MA Syndication

Agreement will terminate automatically if Purchaser has not been able to achieve Participación Significativa following completion

of the Offers.

The MA Syndication agreement will also terminate

upon the first to occur of, among other things:

|

|

·

|

the termination of the Trust Agreement or the MA Supplementary Agreement, whichever occurs first;

|

|

|

·

|

the successful conclusion of the transfer process described in the MA Supplementary Agreement; and

|

|

|

·

|

the notification of an order from the Peruvian Public Prosecutor (Fiscalía), the Peruvian Attorney General (Procuraduria)

or any other governmental entity mandating the termination of the MA Syndication Agreement.

|

The following paragraph replaces, in Section 12, the second paragraph

under the caption “Trust Agreement” on page 52:

Pursuant to the Trust Agreement (as amended

by the Trust Amendment Agreement), the Grantors have agreed to transfer the beneficial ownership of 24,987,698 Common Shares, representing

approximately 2.87% of the outstanding Common Shares, including Common Shares represented by ADSs (the “Trust Shares”),

to an irrevocable trust established pursuant to the Trust Agreement (the “Trust”). For as long as the Trust Shares

remain in the Trust, Purchaser will exercise, in its sole discretion, all political rights associated with the Trust Shares, including,

among other things, attending shareholder meetings of the Company and executing corporate documents requiring the participating of the

Trust. During the term of the Trust Agreement, the Grantors will retain the economic rights associated with the Trust Shares. The Trustee

will have full rights to manage the proceeds of such economic rights, including all collection rights and cash flows arising from the

sale of the Trust Shares by the Grantors. Purchaser acquired the political rights associated with the Trust Shares on July 2, 2021 in

accordance with the Trust Amendment Agreement.

The fourth paragraph in Section 12 under the caption “Trust

Agreement” on page 53 is deleted in its entirety:

The exercise of the political rights by Purchaser

in accordance with the Trust Agreement is conditional upon Purchaser having achieved Participación Significativa following completion

of the Offers.

The second last and last paragraphs in Section 12 on pages 56

and 57 are deleted in their entirety and replaced as follows:

A summary of the foregoing arrangements contemplated

by the Tender Offer Support Agreement and the related agreements (as amended pursuant to the Amendment Agreements) attached as exhibits

thereto is set forth in the table below.

|

Shareholder

|

Number of Common Shares subject to the Tender Offer Support Agreement

|

Common Shares tendered in the Peru Offer

|

Common Shares transferred pursuant to the Trust Agreement

|

Syndication Agreements

|

|

GH Holding Group Corp.

|

117,527,103

|

56,177,955

|

0

|

61,349,148

|

|

Bamas International Investment Corp.

|

1,802,001

|

1,802,001

|

0

|

0

|

|

Bethel Enterprises Inc.

|

33,785,285

|

16,892,643

|

16,892,642

|

0

|

|

Hernando Alejandro Constancio Graña Acuña

|

15,531,208

|

0

|

0

|

15,531,208

|

|

Mario Germán Óscar Alvarado Pflucker

|

10,077,855

|

0

|

0

|

10,077,855

|

|

Francisco Javier Dulanto Swayne

|

8,450,000

|

4,225,000

|

4,225,000

|

0

|

|

Hugo Rangel Zavala

|

6,055,126

|

2,422,050

|

3,633,076

|

0

|

|

Alfonso Galvez Rubio

|

394,966

|

157,986

|

236,980

|

0

|

|

Ruth Alvarado Pflucker

|

402,345

|

402,345

|

0

|

0

|

|

Elisa Alvarado Pflucker

|

402,345

|

402,345

|

0

|

0

|

|

Gonzalo Alvarado Pflucker

|

402,345

|

402,345

|

0

|

0

|

|

Claudia Gutierrez Benavides

|

10,000,000

|

10,000,000

|

0

|

0

|

|

Total

|

204,830,579

|

92,884,670

|

24,987,698

|

86,958,211

|

As of the date hereof, the Common Shares subject

to the foregoing arrangements represent with respect to the outstanding Common Shares of the Company:

|

Outstanding Common Shares

|

Common Shares to be tendered in the Peru Offer

|

Common Shares to be transferred pursuant to the Trust Agreement

|

|

871,917,855

|

Approximately 10.65%

|

Approximately 2.87%

|

Item 12 of the Schedule TO is hereby amended and

supplemented by adding the following exhibits:

|

|

(a)(5)(I)

|

Second Amendment Agreement amending the Tender Offer Support Agreement, dated July 2, 2021, between Purchaser and the Sellers.*

|

|

|

(a)(5)(J)

|

Amended GH Supplementary Agreement amending the GH Supplementary Agreement, dated July 2, 2021, between Purchaser and GH Holding Group.*

|

|

|

(a)(5)(K)

|

Amended GH Syndication Agreement amending the GH Syndication Agreement, dated July 2, 2021, between Purchaser and GH Holding Group.*

|

|

|

(a)(5)(L)

|

Amended HG Supplementary Agreement amending the HG Supplementary Agreement, dated July 2, 2021, between Purchaser and Mr. Graña

Acuña.*

|

|

|

(a)(5)(M)

|

Amended HG Syndication Agreement amending the HG Syndication Agreement, dated July 2, 2021, between Purchaser and Mr. Graña

Acuña.*

|

|

|

(a)(5)(N)

|

Supplementary Agreement, dated July 2, 2021, between Purchaser and Mr. Alvarado Pflucker.*

|

|

|

(a)(5)(O)

|

Syndication Agreement, dated July 2, 2021, between Purchaser and Mr. Alvarado Pflucker.*

|

|

|

(a)(5)(P)

|

Trust Amendment Agreement amending the Trust Agreement, dated July 2, 2021, between Purchaser and the Grantors.*

|

* Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated: July 7, 2021

|

|

IG4 CAPITAL INFRASTRUCTURE INVESTMENTS LP

|

|

|

By: IG4 Capital Infrastructure GP Limited, its general partner

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

|

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

|

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

IG4 CAPITAL PRIVATE EQUITY INVESTMENTS II-A LP

|

|

|

By: IG4 Capital General Partner II Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

|

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

|

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

IG4 CAPITAL PRIVATE EQUITY INVESTMENTS II-B LP

|

|

|

By: IG4 Capital General Partner II Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

|

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

|

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

|

|

[Signature Page – Schedule TO/A]

|

|

|

|

|

|

IG4 CAPITAL PRIVATE EQUITY INVESTMENTS II-C LP

|

|

|

By: IG4 Capital General Partner II Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

|

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

|

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

IG4 CAPITAL INFRASTRUCTURE CO-INVESTMENTS A LP

|

|

|

By: IG4 Capital General Partner II Limited, its general partner

|

|

|

|

|

|

|

By:

|

/s/ Mark Cleary

|

|

|

|

|

|

|

Name:

|

Mark Cleary

|

|

|

Title:

|

Director

|

|

|

|

|

|

|

By:

|

/s/ Andrew Cunningham

|

|

|

|

|

|

|

Name:

|

Andrew Cunningham

|

|

|

Title:

|

Director

|

[Signature Page – Schedule TO/A]

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

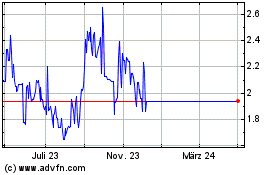

Aenza SAA (NYSE:AENZ)

Historical Stock Chart

Von Apr 2023 bis Apr 2024