0001332551false0001332551us-gaap:CommonStockMember2023-08-022023-08-0200013325512023-08-022023-08-020001332551us-gaap:SeriesDPreferredStockMember2023-08-022023-08-020001332551us-gaap:SeriesCPreferredStockMember2023-08-022023-08-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 02, 2023 |

ACRES Commercial Realty Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Maryland |

1-32733 |

20-2287134 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

390 RXR Plaza |

|

Uniondale, New York |

|

11556 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 516 535-0015 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value per share |

|

ACR |

|

New York Stock Exchange |

8.625% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock |

|

ACRPrC |

|

New York Stock Exchange |

7.875% Series D Cumulative Redeemable Preferred Stock |

|

ACRPrD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 2, 2023, ACRES Commercial Realty Corp. (the “Company”) issued a press release and detailed presentation regarding its operating results for the quarter ended June 30, 2023. A copy of this press release is furnished with this report as Exhibit 99.1 and a copy of the earnings presentation is furnished with this report as Exhibit 99.2 as well as made available on the Company’s website at www.acresreit.com.

Item 7.01 Regulation FD Disclosure.

The information provided in Item 2.02 above is incorporated by reference into this Item 7.01.

The information in this Current Report, including the exhibit hereto, is to be considered “furnished” pursuant to Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ACRES COMMERCIAL REALTY CORP. |

|

|

|

|

Date: |

August 2, 2023 |

By: |

/s/ David J. Bryant |

|

|

|

David J. Bryant

Chief Financial Officer |

ACRES COMMERCIAL REALTY CORP.

REPORTS RESULTS FOR

SECOND QUARTER 2023

Uniondale, NY, August 2, 2023 – ACRES Commercial Realty Corp. (NYSE: ACR) (“ACR” or the “Company”), a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures, today reported results for the quarter ended June 30, 2023. ACR’s GAAP net income allocable to common shares was $817,000, or $0.10 per share-diluted, for the quarter ended June 30, 2023.

“The ACRES team has done an outstanding job proactively asset managing the investment portfolio to date,” said ACRES Commercial Realty Corp. President & CEO Mark Fogel. “Our commitment remains unwavering in seeking avenues for expansion while upholding our steadfast dedication to safeguarding shareholder value."

ACR issued a full, detailed presentation of its results for the quarter ended June 30, 2023 that can be viewed at www.acresreit.com.

Earnings Call Details

ACR will host a live conference call on August 3, 2023 at 11:00 a.m. Eastern Time to discuss its second quarter 2023 operating results. The conference call can be accessed by dialing 1-877-300-8521 (U.S. domestic) or 1-412-317-6026 (International) or from the investor relations section of the Company’s website at www.acresreit.com.

For those unable to listen to the live conference call, a replay will be available on the Company’s website and telephonically through August 17, 2023 by dialing 1-844-512-2921 (U.S. domestic) or 1-412-317-6671 (International), with the passcode 10179700.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate properties through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market commercial real estate lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such forward-looking statements can generally be identified by our use of forward-looking terminology such as “may,” “will,” “continue,” “expect,” “intend,” “anticipate,” “estimate,” “believe,” “look forward” or other similar words or terms. Because such statements include risks, uncertainties and contingencies, actual results may differ materially from the expectations, intentions, beliefs, plans or predictions of the future expressed or implied by such forward-looking statements. Factors that can affect future results are discussed in the documents filed by the Company from time to time with the Securities and Exchange Commission, including, without limitation, factors impacting whether we will be able to maintain our sources of liquidity and whether we will be able to identify sufficient suitable investments to increase our originations. The Company undertakes no obligation to update or revise any forward-looking statement to reflect new or changing information or events after the date hereof or to reflect the occurrence of unanticipated events, except as may be required by law.

Second Quarter 2023 Earnings Presentation August 2, 2023 Exhibit 99.2

Disclaimer Forward-Looking Statements This presentation contains forward-looking statements within the meaning of federal securities laws. These forward-looking statements are not historical facts but rather are based on ACRES Commercial Realty Corp.’s (“ACR’s” or the “Company’s”) current beliefs, assumptions and expectations. These beliefs, assumptions and expectations can change as a result of many possible events or factors, not all of which are known to ACR or are within its control. If a change occurs, its business, financial condition, liquidity and results of operations may vary materially from those expressed in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which reflect ACR’s view only as of the date of this presentation. ACR uses words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “seek,” “estimate,” “target,” and variations of these words and similar expressions to identify forward-looking statements. Forward-looking statements are subject to various risks and uncertainties that could cause actual results to vary from its forward-looking statements, including, but not limited to: ACRESREIT.COM changes in the industry, interest rates, the debt securities markets, real estate markets or the general economy; increased rates of default and/or decreased recovery rates on its investments; the performance and financial condition of its borrowers; the cost and availability of its financings, which depend in part on its asset quality, the nature of its relationships with its lenders and other capital providers, its business prospects and outlook and general market conditions; the availability and attractiveness of terms of additional debt repurchases; availability, terms and deployment of short-term and long-term capital; availability of, and ability to retain, qualified personnel; changes in its business strategy; availability of investment opportunities in commercial real estate-related and commercial finance assets; the degree and nature of its competition; the resolution of its non-performing and sub-performing assets; the outbreak of widespread contagious disease, such as the novel coronavirus, COVID-19; the Company’s ability to comply with financial covenants in its debt instruments; the adequacy of its cash reserves and working capital; the timing of cash flows, if any, from its investments; unanticipated increases in financial and other costs, including a rise in interest rates; our ability to maintain compliance with over-collateralization and interest coverage tests in our collateralized debt obligations (“CDOs”) and/or collateralized loan obligations (“CLOs”); its dependence on ACRES Capital, LLC, its “Manager”, and ability to find a suitable replacement in a timely manner, or at all, if its Manager or the Company were to terminate the management agreement; environmental and/or safety requirements; its ability to satisfy complex rules in order for ACR to qualify as a real estate investment trust (“REIT”), for federal income tax purposes and qualify for its exemption under the Investment Company Act of 1940, as amended, and its ability and the ability of its subsidiaries to operate effectively within the limitations imposed by these rules; legislative and regulatory changes (including changes to laws governing the taxation of REITs or the exemptions from registration as an investment company); and other factors discussed under Item IA. Risk Factors in its Annual Report on Form 10-K for the year ended December 31, 2022 and those factors that may be contained in any subsequent filing ACR makes with the Securities and Exchange Commission.

Disclaimer (continued) ACRESREIT.COM Forward-Looking Statements (continued) In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this presentation might not occur and actual results, performance or achievement could differ materially from those anticipated or implied in the forward-looking statements. The Company undertakes no obligation, and specifically disclaims any obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. Past Performance Past performance is not indicative of future results. There is no guarantee that any investment strategy referenced herein will work under all market conditions. Prior to making any investment decision, you should evaluate your ability to invest for the long-term, especially during periods of downturns in the market. You alone assume the responsibility of evaluating the merits and risks associated with any potential investment or investment strategy referenced herein. Notes on Presentation This presentation contains information regarding financial results that is calculated and presented on the basis of methodologies other than in accordance with accounting principles generally accepted in the United States (“GAAP”), which management believes is relevant to assessing ACR’s financial performance. Please refer to page 20 for the reconciliation of Net income (Loss), a GAAP financial measure, to Earnings Available for Distribution (“EAD”), a non-GAAP financial measure. Unless otherwise indicated, information included in this presentation is at or for the period ended June 30, 2023. Definitions Refer to page 25 for a description of certain terms not otherwise defined or footnoted, including EAD, Benchmark Rate, GAAP Book Value, and other key terms. No Offer or Sale of Securities This presentation is for informational purposes only and does not constitute an offer to sell or the solicitation of any offer to buy any securities of ACR or any other entity. Any offering of securities would be made pursuant to separate documentation and any such securities would not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

Highlights Manager is focused on delivering shareholder value through EAD (1) growth and share repurchases Earnings and capital gains can be retained through tax assets to increase book value ACRESREIT.COM 75% $0.10 / $0.60 $91.2M $10M $25.7M (1.30% of Loan Portfolio) Year over Year increase of $0.02 to $24.50 Refer to page 20 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure Book value is down $0.01 per share from the previous quarter Stability in Book Value (2) CECL Reserve at June 30, 2023 2Q Net CRE Loan Payoffs Per Share GAAP Net Income / EAD Total Liquidity at June 30, 2023 Percentage of Multifamily-focused CRE in Loan Portfolio

Second Quarter Results Financial Results GAAP net income per share for Q2 2023: $0.10, and includes: $(0.31) due to $2.7M provision for CECL reserves, primarily attributable to the expected negative impact of macroeconomic factors on the general economy, partially offset by improvements in general portfolio credit risk EAD (1) for Q2 2023: $0.60 Book Value GAAP book value: $24.50, down from $24.51 in the first quarter of 2023 and up from $24.48 in the second quarter of 2022 Annual increase of 12.9% since ACRES acquisition in Q3 2020 CRE Loan Activity & CRE Portfolio $2.0B CRE loan portfolio comprising 78 loans with a weighted average LTV of 74% $22.5M of CRE loan production and $47.3M of loan repayments 5% of CRE loan portfolio is rated 4 or 5 98% of the par value of the CRE loan portfolio is current on payments $161.9M of net investments in real estate and properties held for sale Capitalization & Liquidity Non-recourse, non-mark-to-market CLO financings comprised 80% of asset-specific borrowings Total liquidity of $91.2M at June 30, 2023 ACRESREIT.COM (1) Refer to page 20 for the reconciliation of Net Income (Loss), a GAAP financial measure, to EAD, a non-GAAP financial measure

Summary of Changes to GAAP Book Value per Share GAAP Book Value - Mar ‘23 GAAP Book Value - Jun ‘23 Other Comprehensive Income Stock Repurchases (2) GAAP Net Income (1) Equity Compensation and Vested Shares ACRESREIT.COM Per share adjustments are calculated based on the share count outstanding utilized in the calculation of book value at June 30, 2023 At June 30, 2023, $14.7 million, or 1.3 million shares, were repurchased under the board authorized plan

CRE Loan Portfolio Overview ACRESREIT.COM $ in Millions Sep. 30, 2022 Dec. 31, 2022 Mar. 31, 2023 Jun. 30, 2023 CRE whole loans, floating-rate $2,125.9 $2,052.9 $1,990.1 $1,959.1 CRE mezzanine loan (1) 4.7 4.7 4.7 4.7 Total loans held for investment amortized cost $2,130.6 $2,057.6 $1,994.8 $1,963.8 Allowance for credit losses (7.8) (18.8) (23.9) (25.7) Total loans held for investment carrying value $2,122.8 $2,038.8 $1,970.9 $1,938.1 Weighted Averages CRE whole loans, floating-rate (2) 1M BR + 3.76% 1M BR + 3.78% 1M BR + 3.89% 1M BR + 3.94% 1M BR Floor (2) 0.67% 0.68% 0.66% 0.68% Total CRE loan portfolio LTV 72% 73% 74% 74% Total number of CRE Loans 88 82 79 78 Fully reserved at December 31, 2022, March 31, 2023 and June 30, 2023 At June 30, 2023, all CRE whole loans are now indexed only to SOFR and the weighted average benchmark rate was 5.22% CRE Loan Summary

CRE Loan Portfolio Diversification ACRESREIT.COM Pacific �8.8% Mountain�14.2% West North �Central �3.3% Southwest 23.6% Southeast�21.2% East North�Central 5.5% Mid Atlantic 13.0% Northeast 10.4% Top State Concentration Metrics: Texas: 23.6% Florida: 15.1% Arizona: 8.9% New York: 8.1% South Carolina: 6.1% Property Type (2) Balance by Region (1)(2) Based on the regions identified by the National Council of Real Estate Investment Fiduciaries (NCREIF) Percentages based on total carrying value of the CRE loans

Second Quarter Portfolio Activity ACRESREIT.COM CRE Loan Production, at Par $ in Millions 3rd Quarter 2022 4th Quarter 2022 1st Quarter 2023 2nd Quarter 2023 12 Mos. Ended Jun. 30, 2023 New CRE floating-rate loan commitments $181.3 $18.0 $16.0 $22.5 $237.8 Sales, payoffs and paydowns (83.5) (114.6) (94.1) (47.3) (339.5) Future fundings 16.4 22.7 14.9 14.8 68.8 New unfunded loan commitments (44.3) (0.7) (1.2) 0.0 (46.2) Net CRE loan fundings (repayments) $69.9 $(74.6) $(64.4) $(10.0) ($79.1) New CRE loans: Weighted average LTV 61% 67% 60% 63% 61% Weighted average coupon 1M BR + 6.04% 1M BR + 4.80% 1M BR + 5.50% 1M BR + 6.25% 1M BR + 5.91% Weighted average BR floor 2.18% 4.32% 4.50% 3.00% 2.65%

CRE Loan Portfolio Maturity Profile ACRESREIT.COM Fully Extended Loan and Interest Rate Cap Maturities ($ in millions at par) Fully extended weighted average loan maturity of 3.2 years (1)(2) 95% of the par value of the portfolio has interest rate caps in place at June 30, 2023 (3)(4) Excludes loans in default at June 30, 2023 Fully-extended maturity basis assumes borrower elects and qualifies for all extensions Interest rate caps are contractually owned by the underlying borrower and supplement the property cash flows that collateralize the CRE loan portfolio Our current interest rate caps have maturities from July 2023 through February 2026

CRE Loan Portfolio LTV ACRESREIT.COM

CRE Loan Portfolio Risk Ratings ACRESREIT.COM Percentage of Principal at June 30, 2023 vs. March 31, 2023 0 53 59 20 15 2 1 3 4 Number of loans: 95% of ACR’s loans have a risk rating of 2 or 3 that are performing in line with or near underwritten expectations (1) All but three of ACR’s 78 loans are current on contractual payments through June 30, 2023 (1) See page 26 for additional information on the risk rating definitions

Investments in Real Estate Properties ACRESREIT.COM $161.9 million of net investments in real estate and properties held for sale (1)(2)(3) Office $14.6M (4) 99K SF Class A office / life science/ lab space Equity investment in the northeast region Lease up as life science / lab building Acquired in October 2021 Student Housing $13.0M (4) Existing structure and development of adjacent lot Equity investment in the southeast region Value add and development project Acquired in April 2022 Construction commenced in the first quarter of 2023 Investments in real estate comprise six properties, four of which are held at depreciated/amortized cost basis and two of which are held for sale at lower of cost or fair value Depreciation and amortization expense is $946,000 for the 2nd quarter of 2023 Images exclude the $20.9M property held for sale acquired via deed-in-lieu of foreclosure in June 2023 Represents value on date of acquisition Multifamily $14.2M (4) 12-acre parcel of land for multifamily development Equity investment in the northeast region Development of a multifamily complex Acquired in November 2021 Hotel $38.6M (4) 388-key hotel next to a convention center Equity investment in the east north central region Conversion to a Hilton hotel and stabilization Acquired in April 2022 Hotel $39.8M (4) 279-key hotel next to a convention center Equity via lending activities in the northeast region Acquired the deed in November 2020 Reclassified to held for sale as of September 30, 2022

Summary Capitalization $761.5 million of availability at June 30, 2023 ACRESREIT.COM $ in Millions Capitalization (1) Maximum Capacity Amount Availability W. Avg. Coupon Leverage Ratio Term warehouse financing facilities (2) $500.0 $251.3 $247.5 BR + 2.65% 0.6x Senior secured financing facility (2) 500.0 47.7 449.0 BR + 3.72% 0.1x Mortgage payable (2) 20.4 18.5 1.5 BR + 3.80% 0.1x Construction loans (3) 63.5 (1.9) 63.5 - % - Senior unsecured notes 150.0 147.8 - 5.75% 0.3x Trust preferred securities 51.5 51.5 - BR + 3.95% 0.1x Total recourse debt $1,285.4 $514.9 $761.5 1.2x Securitizations (2) (non-MTM) 1,234.3 1,234.3 - BR + 1.63% 2.7x Total leverage (4) $2,519.7 $1,749.2 $761.5 3.9x Preferred equity 226.5 8.26% Common equity (5) 217.5 Total capitalization $2,193.2 7.18% WACC For additional details, please refer to the Company’s Liquidity and Capital Resources discussion in its 10-K and subsequent public securities filings Asset-specific borrowings total $1.5 billion, of which securitizations are 80% Current balance represents capitalized deferred debt issuance costs on construction loans that can be drawn upon subsequent to June 30, 2023 Includes $16.7 million of unamortized deferred debt issuance costs and discounts on borrowings Includes $9.5 million of non-controlling interests

Historical Leverage Ratios Recourse Debt Leverage Ratio ACRESREIT.COM

Liquidity ($ in Millions) ACRESREIT.COM Includes the projected amount of proceeds available to the Company if the unfinanced loans were financed with the applicable facilities

Appendix

Consolidated Balance Sheets ACRESREIT.COM (in thousands, except share and per share data) Jun. 30, 2023 Dec. 31, 2022 Assets (unaudited) Cash and cash equivalents $ 57,112 $ 66,232 Restricted cash 15,251 38,579 Accrued interest receivable 12,615 11,969 CRE loans 1,963,740 2,057,590 Less: allowance for credit losses (25,651) (18,803) CRE loans, net 1,938,089 2,038,787 Loan receivable - related party 11,125 11,275 Investments in unconsolidated entities 1,548 1,548 Properties held for sale 61,565 53,769 Investments in real estate 137,363 120,968 Right of use assets 20,061 20,281 Intangible assets 8,376 8,880 Other assets 3,551 4,364 Total Assets $ 2,266,656 $ 2,376,652 Liabilities Accounts payable and other liabilities $ 15,597 $ 10,391 Management fee payable - related party 261 898 Accrued interest payable 7,181 6,921 Borrowings 1,749,199 1,867,033 Lease liabilities 43,988 43,695 Distributions payable 3,262 3,262 Accrued tax liability 142 113 Liabilities held for sale 3,025 3,025 Total Liabilities 1,822,655 1,935,338 Equity Series C Preferred stock, par value $0.001 5 5 Series D Preferred stock, par value $0.001 5 5 Common stock, par value $0.001 9 9 Additional paid-in capital 1,174,094 1,174,202 Accumulated other comprehensive loss (5,604) (6,394) Distributions in excess of earnings (733,958) (732,359) Total Stockholders’ Equity 434,551 435,468 Non-controlling interests 9,450 5,846 Total Equity 444,001 441,314 Total Liabilities and Equity $ 2,266,656 $ 2,376,652

Consolidated Statements of Operations ACRESREIT.COM (Unaudited, in thousands, except share and per share data) For the Three Months Ended For the Six Months Ended Jun. 30, 2023 Jun. 30, 2022 Jun. 30, 2023 Jun. 30, 2022 Revenues Interest income $ 47,148 $ 27,019 $ 92,477 $ 49,695 Interest expense 32,442 15,745 63,817 30,652 Net interest income 14,706 11,274 28,660 19,043 Real estate income 8,879 8,777 15,950 11,915 Other revenue 37 19 70 35 Total revenues 23,622 20,070 44,680 30,993 Operating Expenses General and administrative 2,348 2,353 5,327 5,810 Real estate expenses 10,492 9,162 19,352 13,956 Management fees - related party 1,890 1,672 3,663 3,354 Equity compensation - related party 719 991 1,613 1,735 Corporate depreciation and amortization 23 21 46 43 Provision for (reversal of) credit losses, net 2,700 524 7,796 (1,278) Total operating expenses 18,172 14,723 37,797 23,620 Other Income (Expense) Loss on extinguishment of debt — — — (460) Gain on sale of real estate — — 745 — Other income 242 175 352 973 Total other income 242 175 1,097 513 Income before Taxes 5,692 5,522 7,980 7,886 Income tax expense (134) — (129) (280) Net Income 5,558 5,522 7,851 7,606 Net income allocated to preferred shares (4,856) (4,856) (9,711) (9,711) Net loss allocable to non-controlling interest, net of taxes 115 24 261 24 Net Income (Loss) Allocable to Common Shares $ 817 $ 690 $ (1,599) $ (2,081) Net Income (Loss) per Common Share - Basic $ 0.10 $ 0.08 $ (0.19) $ (0.23) Net Income (Loss) per Common Share - Diluted $ 0.10 $ 0.08 $ (0.19) $ (0.23) Weighted Average Number of Common Shares Outstanding - Basic 8,451,973 8,888,461 8,476,059 8,992,142 Weighted Average Number of Common Shares Outstanding - Diluted 8,534,558 8,914,172 8,476,059 8,992,142

Earnings Available for Distribution ACRESREIT.COM The following table provides a reconciliation from GAAP net income (loss) allocable to common shares to Earnings Available for Distribution allocable to common shares, a non-GAAP measure, for the periods presented (1): See page 25 for additional information (unaudited, in thousands, except share and per share data) For the Three Months Ended For the Six Months Ended Jun. 30, 2023 Jun. 30, 2022 Jun. 30, 2023 Jun. 30, 2022 Net Income (Loss) Allocable to Common Shares - GAAP $ 817 $ 690 $ (1,599) $ (2,081) — Reconciling Items from Continuing Operations: Non-cash equity compensation expense 719 991 1,613 1,735 Non-cash provision for (reversal of) CRE credit losses 2,700 524 7,796 (1,278) Real estate depreciation and amortization 946 1,564 1,900 2,955 Non-cash amortization of discounts or premiums associated with borrowings — 280 — 1,126 Net income from non-core assets (26) (76) (52) (730) Reconciling Items from Legacy CRE Assets: Net interest income on legacy CRE assets — — — (29) EAD Allocable to common shares $ 5,156 $ 3,973 $ 9,658 $ 1,698 EAD per Common Share - Diluted $ 0.60 $ 0.45 $ 1.12 $ 0.19 Weighted Average Number of Common Shares Outstanding - Diluted on EAD Allocable to Common Shares 8,534,558 8,914,172 8,618,346 8,992,142

CECL Trend Analysis Chart ACRESREIT.COM ACR’s CECL reserve as a percentage of the total CRE loan portfolio declined from 2Q21 until 3Q22 as ACR (i) increased its percentage of multifamily loans and (ii) simultaneously reduced its portfolio percentage of loans originated prior to 4Q20. (“Pre-Covid Loans”)(1) During the trailing 12 months, volatility in the commercial real estate sector has increased the CECL reserves to 1.30% at 2Q23. Percentages based on total CRE loans at par, except for the multifamily percentage, which is based on total carrying value of the CRE loans

Benchmark Sensitivity Analysis Trend ACRESREIT.COM The recent increases to benchmark rates on net interest income have returned our match-financed investment portfolio to having a direct correlation to the rise or fall in interest rates Change to a positive correlation to net interest income assuming a 1.00% increase to BRs BR Change Quarterly Net Interest Income per Share Sensitivity to Changes in BRs at June 30, 2022 Decreased 1.00% No Change Increased 0.25% Increased 0.50% Increased 0.75% Increased 1.00% BR: 1.79% BR Change Quarterly Net Interest Income per Share Sensitivity to Changes in BRs at June 30, 2023 Decreased 1.00% No Change Increased 0.25% Increased 0.50% Increased 0.75% Increased 1.00% BR: 5.14%

Illustrative Earnings Potential ACRESREIT.COM Projected Maximum CRE Loan Portfolio Size & GAAP EPS & EAD per Share Projected maximum CRE loan portfolio size $2,100.0 $2,500.0 Target range of asset-specific leverage 3.7x 4.6x Illustrative return on net deployable capital 15.0% 17.0% CRE net interest income $72.5 $82.3 Less: general & administrative (10.6) (10.6) Less: base and incentive management fees (8.0) (9.8) Less: corporate interest expense (13.9) (13.9) Less: net REO and other GAAP activities (3.2) (10.7) Less: preferred dividends (19.4) (19.4) Illustrative GAAP earnings $17.4 $17.9 Add: other GAAP activities 5.7 13.2 Illustrative EAD $23.1 $31.1 Fully diluted share count 8.5 8.5 GAAP EPS $2.06 $2.12 EAD EPS $2.73 $3.67 (In millions, except percentages and per share data) ACR has presented this slide for illustrative purposes only. The illustrative earnings potential is based on current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to ACR's business, all of which are difficult to predict and many of which are beyond ACR’s control. As a result, there can be no assurance that any of the results will be realized or achieved. The illustration should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios. See page 27 for further details and assumptions. The chart below is meant to display the illustrative earnings potential of the Company. It is not meant to represent performance guidance for any period (1) (In millions, except per share data)

Projected Book Value Growth(1) ~$27.00 ACRESREIT.COM Impact of OPERATING loss carryforwards on BV Impact of CAPITAL loss carryforwards on BV Projected BV Growth Under Multiple Scenarios ACR’s strategy is to drive book value (“BV”) growth over the coming years, with a cumulative 35.4% increase in book value since ACRES acquisition in the 3rd quarter of 2020 Projected OPERATING loss carryforwards of $46.6M, expected to be fully utilized Projected CAPITAL loss carryforwards of $121.9M, expected to be partially utilized Projected operating loss carryforwards at Taxable REIT Subsidiaries (“TRSs”) of $61M, expected to be partially utilized ~$30.00 ~$33.00 ACR has presented this slide for illustrative purposes only. The projected book value growth is based on available projections and current market conditions and assumptions with respect to general business, economic, regulatory, and financial conditions and other future events, as well as matters specific to ACR's business, all of which are difficult to predict and many of which are beyond ACR’s control. As a result, there can be no assurance that any of the results will be realized or achieved. The illustration should not be relied upon as being necessarily indicative of future results, and you are cautioned not to place undue reliance on these scenarios. See page 27 for further details and assumptions.

Key Definitions Earnings Available for Distribution: Earnings Available for Distribution (“EAD”) is a non-GAAP financial measure that the Company uses to evaluate its operating performance. EAD excludes the effects of certain transactions and GAAP adjustments that it believes are not necessarily indicative of its current CRE loan portfolio and other CRE-related investments and operations. EAD excludes income (loss) from all non-core assets comprising of investments and securities owned by the Company at the initial measurement date of December 31, 2016 in commercial finance, middle market lending, residential mortgage lending, certain legacy CRE loans and other non-CRE assets designated as assets held for sale. EAD, for reporting purposes, is defined as GAAP net income (loss) allocable to common shares, excluding (i) non-cash equity compensation expense, (ii) unrealized gains and losses, (iii) non-cash provisions for loan losses, (iv) non-cash impairments on securities, (v) non-cash amortization of discounts or premiums associated with borrowings, (vi) net income or loss from a limited partnership interest owned at the initial measurement date, (vii) net income or loss from non-core assets, (viii) real estate depreciation and amortization, (ix) foreign currency gains or losses and (x) income or loss from discontinued operations. EAD may also be adjusted periodically to exclude certain one-time events pursuant to changes in GAAP and certain non-cash items. Although pursuant to the Fourth Amended and Restated Management Agreement the Company calculates the Manager’s incentive compensation using EAD excluding incentive fees payable to the Manager, the Company includes incentive fees payable to the Manager in EAD for reporting purposes. Benchmark Rate: Benchmark Rate (“BR”) refers to the collective one-month Term Secured Overnight Finance Rate (“SOFR”) rates that are used as benchmarks on the originated loans during the associated period. GAAP Book Value: GAAP book value is presented per common share, excluding unvested restricted stock and including warrants to purchase common stock. The measure refers to common stock book value, which is calculated as total stockholders’ equity less preferred stock equity. Leverage Ratio: Leverage ratio is calculated as the respective period ended borrowings over total equity. Asset-specific leverage ratio excludes corporate debt from the calculation. Weighted Average Cost of Capital: Weighted average cost of capital (“WACC”) calculation excludes the impact of common equity in the denominator. ACRESREIT.COM

Other Disclosures Commercial Real Estate Loans Risk Ratings CRE loans are collateralized by a diversified mix of real estate properties and are assessed for credit quality based on the collective evaluation of several factors, including but not limited to: collateral performance relative to underwritten plan, time since origination, current implied and/or reunderwritten loan-to-collateral value ratios, loan structure and exit plan. Depending on the loan’s performance against these various factors, loans are rated on a scale from 1 to 5, with loans rated 1 representing loans with the highest credit quality and loans rated 5 representing loans with the lowest credit quality. The factors evaluated provide general criteria to monitor credit migration in the Company’s loan portfolio; as such, a loan’s rating may improve or worsen, depending on new information received. The criteria set forth below should be used as general guidelines, and therefore not every loan will have all of the characteristics described in each category below. ACRESREIT.COM Rating 1: Property performance has surpassed underwritten expectations Occupancy is stabilized, the property has had a history of consistently high occupancy, and the property has a diverse and high-quality tenant mix Rating 2: Property performance is consistent with underwritten expectations and covenants and performance criteria are being met or exceeded Occupancy is stabilized, near stabilized or is on track with underwriting Rating 3: Property performance lags behind underwritten expectations Occupancy is not stabilized and the property has some tenancy rollover Rating 4: Property performance significantly lags behind underwritten expectations. Performance criteria and loan covenants have required occasional waivers Occupancy is not stabilized and the property has a large amount of tenancy rollover Rating 5: Property performance is significantly worse than underwritten expectations. The loan is not in compliance with loan covenants and performance criteria and may be in default. Expected sale proceeds would not be sufficient to pay off the loan at maturity The property has a material vacancy rate and significant rollover of remaining tenants An updated appraisal is required upon designation and updated on an as-needed basis

Key Assumptions Illustrative Earnings Potential – page 23 Net deployable capital is calculated as the total current corporate capital of $634.5 million, less total projected commitments for investments in real estate, excluding potential financing, of $110.7 million and a working capital reserve of $40.0 million for a total of $483.8 million. Assumes the rate at which the provision for credit losses is computed is constant for each scenario presented and is equal to the most recently reported allowance for credit losses on the Company’s balance sheet divided by the par value of the Company’s CRE loan portfolio for that same period. Real estate depreciation, provision for credit losses, equity compensation expense and certain non-cash amortization expenses are excluded from the calculation of Earnings Available for Distribution. See page 25 for additional information. Projected Book Value Growth – page 24 Operating loss carryforwards comprise qualified REIT subsidiary (“QRS”) net operating loss carryforwards, which have an unlimited useful life. Capital loss carryforwards comprise QRS net capital loss carryforwards, which have a useful life of five years. The “Min. Case” scenario assumes the partial utilization of the operating loss carryforwards. The “Base Case” scenario assumes the full utilization of existent operating loss carryforwards, plus a portion of the capital loss carryforwards. The “Max Case” scenario assumes the full utilization of existent operating loss carryforwards, plus a greater portion of the capital loss carryforwards than the “Base Case” Scenario. ACRESREIT.COM

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. Additional information is available at the Company’s website, www.acresreit.com. ACRESREIT.COM Contact Information: Headquarters: Investor Relations: New York Stock Exchange: 390 RXR Plaza ir@acresreit.com Common Stock Symbol: ACR Uniondale, NY 11556 516-862-2385 Pref. Stock Symbols: ACRPrC & ACRPrD

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesCPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

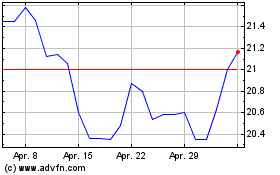

ACRES Commercial Realty (NYSE:ACR-D)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

ACRES Commercial Realty (NYSE:ACR-D)

Historical Stock Chart

Von Apr 2023 bis Apr 2024