Q1 Net Sales Increased 1.3% to $3.4 Billion;

Comparable Store Sales Decreased 0.4%

Operating Income of $90.0 Million; Operating

Income Margin of 2.6%

Advance Auto Parts, Inc. (NYSE: AAP), a leading automotive

aftermarket parts provider in North America, that serves both

professional installer and do-it-yourself customers, announced its

financial results for the first quarter ended April 22, 2023.

Tom Greco, president and chief executive officer, said, “I want

to thank our Advance team members and independent partners for

their continued hard work and focus on serving our customers. While

we anticipated the first quarter would be challenging, our results

were below our expectations. Net sales grew 1.3% in the quarter.

Our operating margin rate of 2.6% in the quarter was well below

expectations due to higher than planned investments to narrow

competitive price gaps in the professional sales channel as well as

unfavorable product mix.”

Mr. Greco continued, “We remain focused on improving inventory

availability while sustaining competitive price targets to improve

topline sales. We expect the competitive dynamics we faced in the

first quarter to continue, resulting in a shortfall to our 2023

expectations. We have reduced our full-year guidance and our board

of directors made the difficult decision to reduce our quarterly

dividend. In addition, in connection with my pending retirement,

our board’s independent chair, Gene Lee, has assumed an expanded

role as interim executive chair. Gene will be providing additional

operational oversight and support to our management team to enable

a seamless CEO transition. He has helped me immensely during my

time as CEO and I look forward to working with him to improve the

trajectory of our business in the months ahead.”

First Quarter 2023 Results (1)

First quarter of 2023 Net sales totaled $3.4 billion, a 1.3%

increase compared with the first quarter of the prior year,

primarily driven by new store openings. This was partially offset

by a decline of comparable store sales of 0.4%.

Gross profit decreased 2.4% to $1.5 billion. Gross profit margin

of 43.0% of Net sales decreased 162 basis points compared with the

first quarter of the prior year. This was primarily driven by

inflationary product costs that were not fully covered by pricing

actions. In addition, unfavorable product mix and supply chain

headwinds also contributed to gross margin deleverage in the

quarter.

SG&A expenses were $1.4 billion, which was 40.4% of Net

sales compared with 38.6% in the first quarter of 2022. This was

primarily driven by inflation in labor and benefit-related expenses

as well as costs associated with new store openings. This was

partially offset by a decrease in startup costs related to the

company's California expansion.

The company's Operating income was $90.0 million or 2.6% of Net

sales, compared with 6.0% in the first quarter of 2022.

The company's effective tax rate was 28.4%, compared with 23.7%

in the first quarter of 2022. The higher effective income tax rate

reflects the impact associated with share based compensation. The

company's Diluted EPS was $0.72, compared with $2.26 in the first

quarter of 2022.

Net cash used in operating activities was $378.9 million through

the first quarter of 2023 versus $54.9 million used in operating

activities in the same period of the prior year. The increase was

primarily driven by lower Net income and an increase in cash used

in working capital, primarily in accounts payable. Free cash flow

through the first quarter of 2023 was an outflow of $468.9 million

compared with an outflow of $169.8 million in the same period of

the prior year.

_______________________ (1) All comparisons are based on the

same time period in the prior year. Comparable store sales include

locations open for 13 complete accounting periods and excludes

sales to independently owned Carquest locations.

Capital Allocation

On May 30, 2023, the company declared a cash dividend of $0.25

per share to be paid on July 28, 2023 to all common stockholders of

record as of July 14, 2023.

Full Year 2023 Guidance

Jeff Shepherd, executive vice president and chief financial

officer, commented, “Given the shortfall experienced this quarter,

along with our revised outlook for the balance of the year, we are

reducing our full-year 2023 guidance. In addition, our board of

directors made the decision to reduce our quarterly cash dividend

to provide enhanced financial flexibility. We are committed to

improving our operational performance and driving increased

profitability."

Prior FY 2023 Outlook

Updated FY 2023

Outlook

As of February 28,

2023

As of May 31, 2023

($ in millions, except per share data)

Low

High

Low

High

Net sales

$

11,400

$

11,600

$

11,200

$

11,300

Comparable store sales (1)

1.0

%

3.0

%

(1.0

)%

0.0

%

Operating income margin

7.8

%

8.2

%

5.0

%

5.3

%

Income tax rate

24.0

%

25.0

%

24.0

%

25.0

%

Diluted EPS

$

10.20

$

11.20

$

6.00

$

6.50

Capital expenditures

$

300

$

350

$

250

$

300

Free cash flow (2)

Minimum $400

$

200

$

300

New store and branch openings

60

80

40

60

(1)

Comparable store sales include locations

open for 13 complete accounting periods and excludes sales to

independently owned Carquest locations.

(2)

Free cash flow is a non-GAAP measure. For

a better understanding of the company's non-GAAP adjustments, refer

to the reconciliation of non-GAAP financial measures in the

accompanying financial tables included herein.

Investor Conference Call

The company will detail its results for the first quarter ended

April 22, 2023 via a webcast scheduled to begin at 8 a.m. Eastern

Time on Wednesday, May 31, 2023. The webcast will be accessible via

the Investor Relations page of the company's website

(ir.AdvanceAutoParts.com).

To join by phone, please pre-register online for dial-in and

passcode information. Upon registering, participants will receive a

confirmation with call details and a registrant ID. While

registration is open through the live call, the company suggests

registering a day in advance or at minimum 10 minutes before the

start of the call. A replay of the conference call will be

available on the company's Investor Relations website for one

year.

About Advance Auto Parts

Advance Auto Parts, Inc. is a leading automotive aftermarket

parts provider that serves both professional installer and

do-it-yourself customers. As of April 22, 2023 Advance operated

4,778 stores and 318 Worldpac branches primarily within the United

States, with additional locations in Canada, Puerto Rico and the

U.S. Virgin Islands. The company also served 1,315 independently

owned Carquest branded stores across these locations in addition to

Mexico and various Caribbean islands. Additional information about

Advance, including employment opportunities, customer services, and

online shopping for parts, accessories and other offerings can be

found at www.AdvanceAutoParts.com.

Forward-Looking Statements

Certain statements herein are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. Forward-looking statements are usually identifiable by

words such as “anticipate,” “believe,” “could,” “estimate,”

“expect,” “forecast,” “guidance,” “intend,” “likely,” “may,”

“plan,” “position,” “possible,” “potential,” “probable,” “project,”

“should,” “strategy,” “will,” or similar language. All statements

other than statements of historical fact are forward-looking

statements, including, but not limited to, statements about our

strategic initiatives, operational plans and objectives,

expectations for economic conditions and recovery and future

business and financial performance, as well as statements regarding

underlying assumptions related thereto. Forward-looking statements

reflect our views based on historical results, current information

and assumptions related to future developments. Except as may be

required by law, we undertake no obligation to update any

forward-looking statements made herein. Forward-looking statements

are subject to a number of risks and uncertainties that could cause

actual results to differ materially from those projected or implied

by the forward-looking statements. They include, among others,

factors related to the company’s leadership transition, the timing

and implementation of strategic initiatives, including with respect

to labor shortages or disruptions and the impact on our ability to

complete store openings, deterioration of general macroeconomic

conditions, the highly competitive nature of our industry, demand

for our products and services, complexities in our inventory and

supply chain and challenges with transforming and growing our

business. Please refer to “Item 1A. Risk Factors” of our most

recent Annual Report on Form 10-K filed with the Securities and

Exchange Commission (“SEC”), as updated by our subsequent filings

with the SEC, for a description of these and other risks and

uncertainties that could cause actual results to differ materially

from those projected or implied by the forward-looking

statements.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated Balance

Sheets

(In thousands) (unaudited)

April 22, 2023(1)

December 31, 2022(2)

Assets

Current assets:

Cash and cash equivalents

$

226,499

$

269,282

Receivables, net

782,093

698,613

Inventories, net

5,015,973

4,915,262

Other current assets

177,127

163,695

Total current assets

6,201,692

6,046,852

Property and equipment, net

1,694,337

1,690,139

Operating lease right-of-use assets

2,628,899

2,607,690

Goodwill

990,573

990,471

Other intangible assets, net

612,104

620,901

Other assets

54,633

62,429

Total assets

$

12,182,238

$

12,018,482

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable

$

3,682,749

$

4,123,462

Accrued expenses

718,290

634,447

Current portion of long-term debt

116,000

185,000

Other current liabilities

466,416

427,480

Total current liabilities

4,983,455

5,370,389

Long-term debt

1,784,596

1,188,283

Noncurrent operating lease liabilities

2,269,280

2,278,318

Deferred income taxes

422,984

415,997

Other long-term liabilities

85,762

87,214

Total stockholders' equity

2,636,161

2,678,281

Total liabilities and stockholders’

equity

$

12,182,238

$

12,018,482

(1)

This preliminary condensed consolidated

balance sheet has been prepared on a basis consistent with the

company's previously prepared consolidated balance sheets filed

with the Securities and Exchange Commission (“SEC”), but does not

include the footnotes required by accounting principles generally

accepted in the United States of America (“GAAP”).

(2)

The balance sheet at December 31, 2022 has

been derived from the audited consolidated financial statements at

that date, but does not include the footnotes required by GAAP.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Operations

(In thousands, except per share

data) (unaudited)

Sixteen Weeks Ended

April 22, 2023(1)

April 23, 2022(1)

Net sales

$

3,417,594

$

3,374,210

Cost of sales, including purchasing and

warehousing costs

1,946,931

1,867,690

Gross profit

1,470,663

1,506,520

Selling, general and administrative

expenses (2)

1,380,664

1,303,250

Operating income

89,999

203,270

Other, net:

Interest expense

(29,718

)

(12,868

)

Loss on early redemptions of senior

unsecured notes

—

(7,408

)

Other (expense) income, net

(674

)

136

Total other, net

(30,392

)

(20,140

)

Income before provision for income

taxes

59,607

183,130

Provision for income taxes

16,956

43,339

Net income

$

42,651

$

139,791

Basic earnings per common share

$

0.72

$

2.28

Weighted-average common shares

outstanding

59,334

61,261

Diluted earnings per common share

$

0.72

$

2.26

Weighted-average common shares

outstanding

59,544

61,732

(1)

These preliminary condensed consolidated

statements of operations have been prepared on a basis consistent

with the company's previously prepared consolidated statements of

operations filed with the SEC, but do not include the footnotes

required by GAAP.

(2)

The sixteen weeks ended April 22, 2023

included an out-of-period charge of approximately $17 million

related to costs incurred in prior years but not expensed in the

corresponding periods. The company determined the cumulative impact

was not material to the current period or any previously issued

financial statements.

Advance Auto Parts, Inc. and

Subsidiaries

Condensed Consolidated

Statements of Cash Flows

(In thousands) (unaudited)

Sixteen Weeks Ended

April 22, 2023(1)

April 23, 2022(1)

Cash flows from operating

activities:

Net income

$

42,651

$

139,791

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation and amortization

92,554

85,581

Share-based compensation

16,524

16,978

Loss on property and equipment, net

90

1,237

Loss on early redemptions of senior

unsecured notes

—

7,408

Provision for deferred income taxes

6,899

9,681

Other, net

391

1,020

Net change in:

Receivables, net

(83,370

)

(174,895

)

Inventories, net

(100,178

)

(119,550

)

Accounts payable

(440,995

)

20,225

Accrued expenses

85,035

(98,978

)

Other assets and liabilities, net

1,534

56,562

Net cash used in operating activities

(378,865

)

(54,940

)

Cash flows from investing

activities:

Purchases of property and equipment

(89,996

)

(114,854

)

Proceeds from sales of property and

equipment

325

828

Net cash used in investing activities

(89,671

)

(114,026

)

Cash flows from financing

activities:

Borrowings under credit facilities

2,886,000

275,000

Payments on credit facilities

(2,955,000

)

(275,000

)

Borrowings on senior unsecured notes

599,571

348,618

Payments on senior unsecured notes

—

(201,081

)

Dividends paid

(89,487

)

(154,796

)

Repurchases of common stock

(12,605

)

(264,469

)

Other, net

(2,819

)

(2,007

)

Net cash provided by (used in) financing

activities

425,660

(273,735

)

Effect of exchange rate changes on

cash

93

(19,994

)

Net decrease in cash and cash

equivalents

(42,783

)

(462,695

)

Cash and cash equivalents,

beginning of period

269,282

601,428

Cash and cash equivalents, end of

period

$

226,499

$

138,733

(1)

These preliminary condensed consolidated

statements of cash flows have been prepared on a consistent basis

with the company's previously prepared statements of cash flows

filed with the SEC, but do not include the footnotes required by

GAAP.

Reconciliation of Non-GAAP Financial

Measure

The company's financial results include certain financial

measures not derived in accordance with accounting principles

generally accepted in the United States of America (“GAAP”).

Management uses Free cash flow as a measure of its liquidity and

believes it is a useful indicator to investors or potential

investors of the company's ability to implement growth strategies

and service debt. Free cash flow is a non-GAAP measure and should

be considered in addition to, but not as a substitute for,

information contained in the company's condensed consolidated

statement of cash flows as a measure of liquidity.

Reconciliation of Free Cash

Flow:

Sixteen Weeks Ended

(in thousands)

April 22, 2023

April 23, 2022

Cash flows used in operating

activities

$

(378,865

)

$

(54,940

)

Purchases of property and equipment

(89,996

)

(114,854

)

Free cash flow

$

(468,861

)

$

(169,794

)

Adjusted Debt to

EBITDAR: (1)

Four Quarters Ended

(In thousands, except adjusted debt to

EBITDAR ratio)

April 22, 2023

December 31, 2022

Total GAAP debt

$

1,900,596

$

1,373,283

Add: Operating lease liabilities

2,726,880

2,692,861

Adjusted debt

$

4,627,476

$

4,066,144

GAAP Net income

$

404,732

$

501,872

Depreciation and amortization

291,032

283,800

Provision for income taxes

120,432

146,815

Interest expense

67,910

51,060

Share-based compensation

50,524

50,978

Other expense, net

7,806

6,996

Rent expense

595,208

594,838

EBITDAR

$

1,537,644

$

1,636,359

Adjusted Debt to EBITDAR

3.0

2.5

(1)

Beginning in first quarter 2023, the

company no longer excludes transformation-related activities in

non-GAAP measures. Prior period has been recast to conform to

current year presentation.

NOTE: Management believes its Adjusted Debt to EBITDAR ratio

(“leverage ratio”) is a key financial metric for debt securities,

as reviewed by rating agencies, and believes its debt levels are

best analyzed using this measure. The company’s goal is to maintain

an investment grade rating. The company's credit rating directly

impacts the interest rates on borrowings under its existing credit

facility and could impact the company's ability to obtain

additional funding. If the company was unable to maintain its

investment grade rating this could negatively impact future

performance and limit growth opportunities. Similar measures are

utilized in the calculation of the financial covenants and ratios

contained in the company's financing arrangements. The leverage

ratio calculated by the company is a non-GAAP measure and should

not be considered a substitute for debt to net earnings, net

earnings or debt as determined in accordance with GAAP. The company

adjusts the calculation to remove rent expense and to add back the

company’s existing operating lease liabilities related to their

right-of-use assets to provide a more meaningful comparison with

the company’s peers and to account for differences in debt

structures and leasing arrangements. The company’s calculation of

its leverage ratio might not be calculated in the same manner as,

and thus might not be comparable to, similarly titled measures by

other companies.

Store Information

During the sixteen weeks ended April 22, 2023, 21 stores and

branches were opened and 11 were closed or consolidated, resulting

in a total of 5,096 stores and branches as of April 22, 2023,

compared with a total of 5,086 stores and branches as of December

31, 2022.

The below table summarizes the changes in the number of

company-operated store and branch locations during the sixteen

weeks ended April 22, 2023:

AAP

CARQUEST

WORLDPAC (1)

Total

December 31, 2022

4,440

330

316

5,086

New

19

—

2

21

Closed

(3

)

(8

)

—

(11

)

Consolidated

—

—

—

—

Converted

—

—

—

—

Relocated

—

—

—

—

April 22, 2023

4,456

322

318

5,096

(1)

Certain converted Autopart International

("AI") locations will remain branded as AI going forward.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230530005726/en/

Investor Relations Contact: Elisabeth Eisleben T: (919)

227-5466 E: invrelations@advanceautoparts.com

Media Contact: Darryl Carr T: (984) 389-7207 E:

AAPCommunications@advance-auto.com

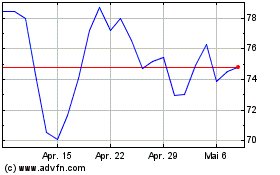

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Advance Auto Parts (NYSE:AAP)

Historical Stock Chart

Von Apr 2023 bis Apr 2024