United-Guardian Reports 1st Quarter Increase in Sales

13 Mai 2020 - 3:00PM

United-Guardian, Inc. (NASDAQ:UG) reported today that net sales for

the first quarter of 2020 increased by 4% over the same quarter

last year, increasing from $3,180,318 in 2019 to $3,322,914 this

year. Net income decreased from $1,222,694 ($0.27 per share) in

2019 to $790,307 ($0.17 per share) this year, which was primarily

due to the decrease in value of the company’s marketable

securities.

Ken Globus, President of United-Guardian,

stated, “Despite the severe impact on the economy of the

coronavirus, our first quarter sales remained strong, and continued

to be so in April. As an “essential business” we have remained in

operation during this coronavirus pandemic, albeit on a reduced and

staggered schedule, and we have been able to maintain production

and continue to fill orders. The decline in net income was due to

the decreased market value of our investments, which resulted from

the substantial stock market decline that occurred during the first

quarter of 2020. As a result of a change in accounting rules in

2018, companies are now required to include in net income any

fluctuations in the market value of their marketable securities,

even though no actual gains or losses are experienced. Had it not

been for that accounting change, our earnings would have been

significantly higher, since our income from operations actually

increased from $1,246,352 to $1,310,576. While it is likely that in

the coming months we could see a decline in sales of our cosmetic

ingredients as the global impact of the coronavirus continues, we

are hopeful that sales of our pharmaceutical and medical products

will remain strong.”

United-Guardian is a manufacturer of cosmetic

ingredients, personal and health care products, pharmaceuticals,

and specialty industrial products.

Contact: Ken Globus(631) 273-0900

NOTE: This press release contains

both historical and "forward-looking statements” within the meaning

of the Private Securities Litigation Reform Act of 1995.

These statements about the company’s expectations or beliefs

concerning future events, such as financial performance, business

prospects, and similar matters, are being made in reliance upon the

“safe harbor” provisions of that Act. Such statements are subject

to a variety of factors that could cause our actual results or

performance to differ materially from the anticipated results or

performance expressed or implied by such forward-looking

statements. For further information about the risks and

uncertainties that may affect the company’s business please refer

to the company's reports and filings with the Securities and

Exchange Commission.

RESULTS FOR THE QUARTERS ENDED MARCH 31,

2020 and MARCH 31, 2019*

STATEMENTS OF INCOME

(UNAUDITED)

| |

|

THREE MONTHS

ENDED MARCH 31, |

|

| |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

| |

Net

Sales |

$ |

3,322,914 |

|

$ |

3,180,318 |

|

| |

|

|

|

|

|

|

|

| |

Costs and

expenses: |

|

|

|

|

|

|

| |

Cost of sales |

|

1,389,331 |

|

|

1,288,345 |

|

| |

Operating expenses |

|

515,275 |

|

|

546,962 |

|

| |

Research and development |

|

107,732 |

|

|

98,659 |

|

| |

Total costs and expenses |

|

2,012,338 |

|

|

1,933,966 |

|

| |

Income from operations |

|

1,310,576 |

|

|

1,246,352 |

|

| |

|

|

|

|

|

|

|

| |

Other (expense) income: |

|

|

|

|

|

|

| |

Investment income |

|

44,067 |

|

|

44,167 |

|

| |

Net (loss) gain on marketable securities |

|

(356,595 |

) |

|

257,194 |

|

| |

Total other (expense) income |

|

(312,528 |

) |

|

301,361 |

|

| |

Income before provision for income taxes |

|

998,048 |

|

|

1,547,713 |

|

| |

|

|

|

|

|

|

|

| |

Provision

for income taxes |

|

207,741 |

|

|

325,019 |

|

| |

|

|

|

|

|

|

|

| |

Net income |

$ |

790,307 |

|

$ |

1,222,694 |

|

| |

|

|

|

|

|

|

|

| |

Earnings

per common share (basic and

diluted) |

$ |

0.17 |

|

$ |

0.27 |

|

| |

|

|

|

|

|

|

|

| |

Weighted average

shares – basic and diluted |

|

4,594,319 |

|

|

4,594,319 |

|

* Additional financial information can be found

at the company’s web site at www.u-g.com.

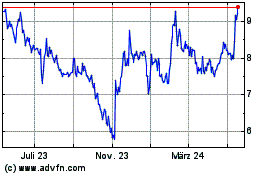

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

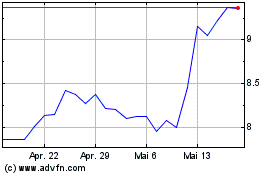

United Guardian (NASDAQ:UG)

Historical Stock Chart

Von Jul 2023 bis Jul 2024