0000719220false00007192202024-01-242024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

January 24, 2024

Date of Report (date of earliest event reported)

S&T BANCORP, INC

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Pennsylvania | 0-12508 | 25-1434426 | |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) | |

| |

800 Philadelphia Street | Indiana | PA | 15701 | |

(Address of Principal Executive Offices) | (Zip Code) | |

(800) 325-2265

Registrant's telephone number, including area code

(Not applicable)

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

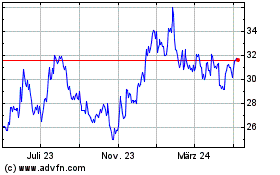

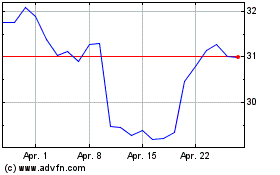

| Common Stock, $2.50 par value | STBA | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 25, 2024 S&T Bancorp, Inc. (S&T) announced by press release its earnings for the three and twelve months ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference in this Item 2.02. The information contained in this Item 2.02 of this Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Exchange Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. Item 7.01 Regulation FD Disclosure.

In connection with the issuance of its earnings for the three and twelve months ended December 31, 2023, S&T has also made available on its website materials that contain supplemental information about S&T’s financial results (“Supplemental Information”). A copy of the supplemental information is attached hereto as Exhibit 99.2 and Exhibit 99.3 and is incorporated by reference in this Item 7.01. The information contained in this Item 7.01 of this Report on Form 8-K, including Exhibit 99.2 and Exhibit 99.3, is being furnished and shall not be deemed "filed" for purposes of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. Item 8.01 Other Events.

The Board of Directors of S&T ("Board") approved a $0.33 per share cash dividend on January 24, 2024. A copy of the press release is attached hereto as Exhibit 99.4. This is an increase of $0.01, or 3.13 percent, compared to a cash dividend of $0.32 in the same period in the prior year. The annualized yield using the January 23, 2024 closing price of $33.97 is 3.89 percent. The dividend is payable February 22, 2024 to shareholders of record on February 8, 2024. The Board authorized a new $50 million share repurchase plan at its regular meeting held January 24, 2024. The new plan is set to expire May 30, 2025 and will replace the existing share repurchase plan effective immediately. This repurchase authorization permits S&T to repurchase shares of S&T's common stock from time to time through a combination of open market and privately negotiated repurchases up to the authorized $50 million aggregate value of S&T's common stock. The specific timing, price and quantity of repurchases will be at the discretion of S&T and will depend on a variety of factors, including general market conditions, the trading price of the common stock, legal and contractual requirements and S&T’s financial performance. The repurchase plan does not obligate S&T to repurchase any particular number of shares. S&T expects to fund any repurchases from cash on hand and internally generated funds. Any share repurchases will not begin until permissible under applicable laws.

The information in this Form 8-K and the exhibits attached to this Form 8-K contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements are based on current expectations and are subject to a number of factors that could cause actual events to differ materially from those anticipated, including without limitation fluctuations in the market price of the common stock, regulatory, legal and contractual requirements, other uses of capital, the company’s financial performance, market conditions generally or modification, extension or termination of the share repurchase authorization by the board of directors. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. You should consider the above uncertainties as well as the precautionary statements included in S&T’s filings with the SEC, including without limitation the “risk factors” section of its Form 10-K. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description of Exhibit |

| | Earnings Press Release |

| | 2023 Highlights |

| | Supplemental Information |

| | Dividend Press Release |

| 104 | | Cover Page Interactive Data File (embedded in the cover page formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed by the undersigned thereunto duly authorized.

| | | | | |

| S&T Bancorp, Inc. |

| /s/ Mark Kochvar |

| January 25, 2024 | Mark Kochvar

Senior Executive Vice President,

Chief Financial Officer |

| | | | | | | | |

INVESTOR CONTACT: Mark Kochvar S&T Bancorp, Inc. Chief Financial Officer 724.465.4826 mark.kochvar@stbank.com | | |

FOR IMMEDIATE RELEASE

S&T Bancorp, Inc. Announces Fourth Quarter and Full Year 2023 Results

INDIANA, Pa. - January 25, 2024 - S&T Bancorp, Inc. (S&T) (NASDAQ: STBA), the holding company for S&T Bank, announced fourth quarter and full year 2023 earnings. Net income of $37.0 million, or $0.96 per diluted share, for the fourth quarter of 2023 compared to net income of $33.5 million, or $0.87 per diluted share, for the third quarter of 2023 and net income of $40.3 million, or $1.03 per diluted share, for the fourth quarter of 2022.

Net income increased 6.83% to a record $144.8 million for 2023 compared to net income of $135.5 million for 2022. Earnings per diluted share, or EPS, increased 8.09% to a record $3.74 compared to $3.46 per diluted share in 2022.

Fourth Quarter of 2023 Highlights:

•Strong return metrics with return on average assets (ROA) of 1.55%, return on average equity (ROE) of 11.79% and return on average tangible equity (ROTE) (non-GAAP) of 17.00% compared to ROA of 1.42%, ROE of 10.84% and ROTE (non-GAAP) of 15.78% for the third quarter of 2023.

•Pre-provision net revenue to average assets (PPNR) (non-GAAP) was 1.97% compared to 1.99% for the third quarter of 2023.

•Net interest margin (NIM) (FTE) (non-GAAP) was solid at 3.92% compared to 4.09% in the third quarter of 2023.

•Total portfolio loans increased $137.4 million, or 7.25% annualized, compared to September 30, 2023.

•Total deposits increased $298.9 million with $98.2 million of growth in customer deposits and $200.7 million of brokered deposits compared to September 30, 2023.

•Net charge-offs of $3.6 million, or 0.19% of average loans (annualized), compared to net charge-offs of $3.7 million, or 0.20% of average loans (annualized), in the third quarter of 2023.

Full Year 2023 Highlights:

•Record EPS and net income for the second consecutive full year.

•Net income increased 6.83% to $144.8 million and EPS increased 8.09% to $3.74 per share compared to 2022.

•Strong return metrics with ROA of 1.56%, ROE of 11.80% and ROTE (non-GAAP) of 17.15% compared to ROA of 1.48%, ROE of 11.47% and ROTE (non-GAAP) of 17.02% for the prior year.

•PPNR (non-GAAP) was 2.12% compared to 1.93% in the prior year.

•Strong NIM (FTE) (non-GAAP) of 4.13% compared to 3.76% for the prior year.

•Net interest income increased $33.6 million, or 10.65%, compared to 2022.

•Total portfolio loans increased $469.4 million, or 6.53%, compared to December 31, 2022.

•Nonperforming assets remained low at $23.0 million, or 0.30% of total loans plus other real estate owned, or OREO compared to $22.1 million, or 0.31% at December 31, 2022.

•Net charge-offs of $13.2 million, or 0.18% of average loans, compared to net charge-offs of $2.6 million, or 0.04% of average loans, in the prior year.

“It was a great year for S&T with record net income and earnings per share for the second year in a row," said Chris McComish, chief executive officer. "Our highly engaged teams that go above and beyond every day to provide an award-winning customer experience are fundamental to our success. For the quarter, I am pleased that we achieved balanced loan and deposit growth, while delivering excellent returns and efficiency. Our people-forward purpose positions us well for continued growth."

Fourth Quarter of 2023 Results (three months ended December 31, 2023)

Net Interest Income

Net interest income was $85.1 million for the fourth quarter of 2023 compared to $87.4 million for the third quarter of 2023. The decrease of $2.3 million in net interest income was driven by higher funding costs, partially offset by higher yields on interest-earning assets. Net interest margin on a fully taxable equivalent basis (NIM) (FTE) (non-GAAP) was 3.92% compared to 4.09% in the prior quarter. The yield on total average loans increased 4 basis points to 6.19% compared to 6.15% in the third quarter of 2023. Average loan balances increased $151.4 million to $7.6 billion compared to $7.4 billion in the third quarter of 2023. Total interest-bearing deposit costs increased 49 basis points to 2.53% compared to 2.04% in the third quarter of 2023. Higher interest-bearing deposit costs primarily related to growth in higher costing deposit products combined with a continued shift in the mix of deposits. Average money market balances increased $247.4 million and average CD balances increased $150.7 million compared to the third quarter of 2023. Average borrowings decreased $151.5 million to $523.8 million compared to $675.3 million in the third quarter of 2023 due to increased deposits.

Asset Quality

The provision for credit losses was $0.9 million for the fourth quarter of 2023 compared to $5.5 million in the third quarter of 2023. The decrease in the provision for credit losses primarily related to a lower allowance for credit losses driven by improvement in loan risk ratings compared to the prior quarter. Net loan charge-offs were $3.6 million for the fourth quarter of 2023 compared to net loan charge-offs of $3.7 million in the third quarter of 2023. The allowance for credit losses was relatively stable at $108.0 million, or 1.41% of total portfolio loans, as of December 31, 2023 compared to $108.2 million, or 1.44%, at September 30, 2023. Nonperforming assets to total loans plus OREO remained low at 0.30% at December 31, 2023 compared to 0.22% at September 30, 2023.

Noninterest Income and Expense

Noninterest income increased $5.9 million to $18.1 million in the fourth quarter of 2023 compared to $12.2 million in the third quarter of 2023. The increase mainly related to higher other income from a gain on OREO of $3.3 million and from valuation adjustments on our commercial loan swaps and a nonqualified benefit plan of $2.2 million compared to the third quarter of 2023. Noninterest expense increased $3.4 million to $56.2 million compared to $52.8 million in the third quarter of 2023. The increase was primarily due to higher salaries and

employee benefits of $3.4 million mainly related to increases in medical, incentives and a valuation adjustment on a nonqualified benefit plan compared to the third quarter of 2023.

Financial Condition

Total assets were $9.6 billion at December 31, 2023 compared to $9.5 billion at September 30, 2023. Total portfolio loans increased $137.4 million, or 7.25% annualized, compared to September 30, 2023. The consumer loan portfolio increased $84.5 million with growth in residential mortgages of $77.0 million compared to September 30, 2023. The commercial loan portfolio increased $52.9 million with growth in commercial real estate of $71.3 million offset by a decrease in commercial construction of $25.2 million compared to September 30, 2023. Total deposits increased $298.9 million compared to September 30, 2023. CDs increased $93.8 million mainly due to growth from new and existing customers and a continued shift from other deposit types compared to September 30, 2023. Money Market increased $326.4 million mainly due to growth from new and existing customers, shifts from other deposit types and an increase in brokered money markets of $200.7 million compared to September 30, 2023. Total borrowings decreased $215.1 million to $503.6 million compared to $718.7 million at September 30, 2023 primarily related to deposit growth.

S&T continues to maintain a strong regulatory capital position with all capital ratios above the well-capitalized thresholds of federal bank regulatory agencies.

Full Year 2023 Results (twelve months ended December 31, 2023)

Net income increased 6.83% to a record $144.8 million compared to net income of $135.5 million for 2022. Earnings per diluted share, or EPS, increased 8.09% to a record $3.74 compared to $3.46 per diluted share in 2022.

Net interest income increased $33.6 million, or 10.65%, compared to 2022 primarily due to the impact of higher interest rates which drove an increase in yields on earning assets and higher costing liabilities. NIM (FTE) (non-GAAP) expanded 37 basis points to 4.13% compared to 3.76% for 2022. The yield on total average loans increased 154 basis points to 6.04% compared to 4.50% in 2022. Total interest-bearing deposit costs increased 152 basis points to 1.92% compared to 0.40% in 2022. Total borrowing cost increased 258 basis points to 5.59% compared to 3.01% in 2022.

Noninterest income decreased $0.6 million compared to the prior year. Mortgage banking income decreased $1.1 million due to a decline in loan sale activity caused by higher interest rates and a shift to holding originated mortgage loans on the balance sheet. Debit and credit card fees decreased $0.8 million and service charges on deposit accounts decreased $0.6 million due to decreased customer activity. Offsetting these decreases was an increase in other noninterest income of $2.5 million compared to the prior year primarily related to valuation adjustments on our commercial loan swaps and a nonqualified benefit plan. Noninterest expense increased $13.6 million compared to 2022. Salaries and employee benefits increased $8.2 million primarily due to higher salaries related to inflationary wage pressure, the acquisition of new talent and a change in valuation adjustment on a nonqualified benefit plan. The efficiency ratio (non-GAAP) for 2023 was 51.35% compared to 52.34% for 2022 due to higher revenue.

Nonperforming assets remained low at $23.0 million compared to $22.1 million in the prior year resulting in a nonperforming assets to total loans plus OREO ratio of 0.30% compared to 0.31% at December 31, 2022. The

provision for credit losses increased $9.5 million to $17.9 million for 2023 compared to $8.4 million for 2022 primarily due to higher net charge-offs. Net loan charge-offs were $13.2 million for 2023 compared to $2.6 million for 2022. The allowance for credit losses was 1.41% of total portfolio loans as of December 31, 2023 and December 31, 2022.

Dividend

S&T's Board of Directors approved a $0.33 per share cash dividend on January 24, 2024. This is an increase of $0.01, or 3.13%, compared to a $0.32 per share cash dividend declared in the same period in the prior year. The dividend is payable February 22, 2024 to shareholders of record on February 8, 2024. Dividends declared in 2023 increased $0.09, or 7.50%, to $1.29 compared to $1.20 for 2022.

Conference Call

S&T will host its fourth quarter 2023 earnings conference call live over the Internet at 1:00 p.m. ET on Thursday, January 25, 2024. To access the webcast, go to S&T Bancorp, Inc.’s Investor Relations webpage www.stbancorp.com. After the live presentation, the webcast will be archived at www.stbancorp.com for 12 months.

About S&T Bancorp, Inc. and S&T Bank

S&T Bancorp, Inc. is a $9.6 billion bank holding company that is headquartered in Indiana, Pennsylvania and trades on the NASDAQ Global Select Market under the symbol STBA. Its principal subsidiary, S&T Bank, was established in 1902 and operates in Pennsylvania and Ohio. S&T Bank was named by Forbes as a 2023 Best-in-State Bank. For more information visit stbancorp.com or stbank.com. Follow us on Facebook, Instagram and LinkedIn.

Forward-Looking Statements

This information contains or incorporates statements that we believe are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position and other matters regarding or affecting S&T and its future business and operations. Forward-looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve,” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: credit losses and the credit risk of our commercial and consumer loan products; changes in the level of charge-offs and changes in estimates of the adequacy of the allowance for credit losses, or ACL; cyber-security concerns; rapid technological developments and changes; operational risks or risk management failures by us or critical third parties, including fraud risk; our ability to manage our reputational risks; sensitivity to the interest rate environment, a rapid increase in interest rates or a change in the shape of the yield

curve; a change in spreads on interest-earning assets and interest-bearing liabilities; the transition from LIBOR as a reference rate; regulatory supervision and oversight, including changes in regulatory capital requirements and our ability to address those requirements; unanticipated changes in our liquidity position; unanticipated changes in regulatory and governmental policies impacting interest rates and financial markets; changes in accounting policies, practices or guidance; legislation affecting the financial services industry as a whole, and S&T, in particular; developments affecting the industry and the soundness of financial institutions and further disruption to the economy and U.S. banking system; the outcome of pending and future litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; an interruption or cessation of an important service by a third-party provider; our ability to attract and retain talented executives and employees; general economic or business conditions, including the strength of regional economic conditions in our market area; environmental, social and governance practices and disclosures, including climate change, hiring practices, the diversity of the work force, and racial and social justice issues; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an adjustment to its carrying value resulting in a non-cash charge to net income; the stability of our core deposit base and access to contingency funding; re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses.

Many of these factors, as well as other factors, are described in our Annual Report on Form 10-K for the year ended December 31, 2022, including Part I, Item 1A-"Risk Factors" and any of our subsequent filings with the SEC. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made.

Non-GAAP Financial Measures

In addition to traditional measures presented in accordance with GAAP, our management uses, and this information contains or references, certain non-GAAP financial measures, such as tangible book value, return on average tangible shareholder's equity, pre-provision net revenue to average assets, efficiency ratio, tangible common equity to tangible assets and net interest margin on an FTE basis. We believe these non-GAAP financial measures provide information useful to investors in understanding our underlying operational performance and our business and performance trends as they facilitate comparisons with the performance of other companies in the financial services industry. Although we believe that these non-GAAP financial measures enhance investors’ understanding of our business and performance, these non-GAAP financial measures should not be considered alternatives to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies. See Definitions and Reconciliation of GAAP to Non-GAAP Financial Measures for more information related to these financial measures.

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 7 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands, except per share data) | Quarter | | Quarter | | Quarter | |

| INTEREST AND DIVIDEND INCOME | | | | | | |

| Loans, including fees | $117,443 | | | $114,258 | | | $96,220 | | |

| Investment Securities: | | | | | | |

| Taxable | 8,491 | | | 7,857 | | | 6,507 | | |

| Tax-exempt | 210 | | | 213 | | | 233 | | |

| Dividends | 562 | | | 631 | | | 248 | | |

| Total Interest and Dividend Income | 126,706 | | | 122,959 | | | 103,208 | | |

| | | | | | |

| INTEREST EXPENSE | | | | | | |

| Deposits | 32,921 | | | 24,910 | | | 11,067 | | |

| Borrowings, junior subordinated debt securities and other | 8,676 | | | 10,662 | | | 3,083 | | |

| Total Interest Expense | 41,597 | | | 35,572 | | | 14,150 | | |

| | | | | | |

| NET INTEREST INCOME | 85,109 | | | 87,387 | | | 89,058 | | |

| Provision for credit losses | 943 | | | 5,498 | | | 3,176 | | |

| Net Interest Income After Provision for Credit Losses | 84,166 | | | 81,889 | | | 85,882 | | |

| | | | | | |

| NONINTEREST INCOME | | | | | | |

| | | | | | |

| Debit and credit card | 4,540 | | | 4,690 | | | 4,421 | | |

| Service charges on deposit accounts | 4,129 | | | 4,060 | | | 4,341 | | |

| Wealth management | 3,050 | | | 3,003 | | | 3,016 | | |

| Mortgage banking | 280 | | | 294 | | | 309 | | |

| Other | 6,062 | | | 131 | | | 3,556 | | |

| Total Noninterest Income | 18,061 | | | 12,178 | | | 15,643 | | |

| | | | | | |

| NONINTEREST EXPENSE | | | | | | |

| Salaries and employee benefits | 30,949 | | | 27,521 | | | 27,998 | | |

| Data processing and information technology | 4,523 | | | 4,479 | | | 4,159 | | |

| Furniture, equipment and software | 3,734 | | | 3,125 | | | 2,975 | | |

| Occupancy | 3,598 | | | 3,671 | | | 3,806 | | |

| Professional services and legal | 1,968 | | | 1,965 | | | 2,138 | | |

| Other taxes | 1,870 | | | 1,831 | | | 1,842 | | |

| Marketing | 1,435 | | | 1,741 | | | 1,348 | | |

| FDIC insurance | 1,049 | | | 1,029 | | | 437 | | |

| Other noninterest expense | 7,077 | | | 7,437 | | | 6,572 | | |

| Total Noninterest Expense | 56,203 | | | 52,799 | | | 51,275 | | |

| Income Before Taxes | 46,024 | | | 41,268 | | | 50,250 | | |

| Income tax expense | 8,977 | | | 7,800 | | | 9,980 | | |

| Net Income | $37,047 | | | $33,468 | | | $40,270 | | |

| | | | | | |

| Per Share Data | | | | | | |

| Shares outstanding at end of period | 38,232,806 | | | 38,244,309 | | | 38,999,733 | | |

| Average shares outstanding - diluted | 38,379,493 | | | 38,336,016 | | | 38,944,575 | | |

| Diluted earnings per share | $0.96 | | | $0.87 | | | $1.03 | | |

| Dividends declared per share | $0.33 | | | $0.32 | | | $0.31 | | |

| Dividend yield (annualized) | 3.95 | % | | 4.73 | % | | 3.63 | % | |

| Dividends paid to net income | 34.04 | % | | 36.55 | % | | 29.85 | % | |

| Book value | $33.57 | | | $31.99 | | | $30.38 | | |

Tangible book value (1) | $23.72 | | | $22.14 | | | $20.69 | | |

| Market value | $33.42 | | | $27.08 | | | $34.18 | | |

| | | | | | |

| Profitability Ratios (Annualized) | | | | | | |

| Return on average assets | 1.55 | % | | 1.42 | % | | 1.78 | % | |

| Return on average shareholders' equity | 11.79 | % | | 10.84 | % | | 13.68 | % | |

Return on average tangible shareholders' equity(2) | 17.00 | % | | 15.78 | % | | 20.36 | % | |

Pre-provision net revenue / average assets(3) | 1.97 | % | | 1.99 | % | | 2.36 | % | |

Efficiency ratio (FTE)(4) | 54.12 | % | | 52.67 | % | | 48.73 | % | |

| | | | | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 8 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (dollars in thousands, except per share data) | | | 2023 | | 2022 | |

| INTEREST AND DIVIDEND INCOME | | | | | | |

| Loans, including fees | | | $443,124 | | | $314,866 | | |

| Investment Securities: | | | | | | |

| Taxable | | | 31,611 | | | 23,743 | | |

| Tax-exempt | | | 852 | | | 1,579 | | |

| Dividends | | | 2,314 | | | 563 | | |

| Total Interest and Dividend Income | | | 477,901 | | | 340,751 | | |

| | | | | | |

| INTEREST EXPENSE | | | | | | |

| Deposits | | | 92,836 | | | 19,907 | | |

| Borrowings, junior subordinated debt securities and other | | | 35,655 | | | 5,061 | | |

| Total Interest Expense | | | 128,491 | | | 24,968 | | |

| | | | | | |

| NET INTEREST INCOME | | | 349,410 | | | 315,783 | | |

| Provision for credit losses | | | 17,892 | | | 8,366 | | |

| Net Interest Income After Provision for Credit Losses | | | 331,518 | | | 307,417 | | |

| | | | | | |

| NONINTEREST INCOME | | | | | | |

| Net gain on sale of securities | | | — | | | 198 | | |

| Debit and credit card | | | 18,248 | | | 19,008 | | |

| Service charges on deposit accounts | | | 16,193 | | | 16,829 | | |

| Wealth management | | | 12,186 | | | 12,717 | | |

| Mortgage banking | | | 1,164 | | | 2,215 | | |

| Other | | | 9,829 | | | 7,292 | | |

| Total Noninterest Income | | | 57,620 | | | 58,259 | | |

| | | | | | |

| NONINTEREST EXPENSE | | | | | | |

| Salaries and employee benefits | | | 111,462 | | | 103,221 | | |

| Data processing and information technology | | | 17,437 | | | 16,918 | | |

| Occupancy | | | 14,814 | | | 14,812 | | |

| Furniture, equipment and software | | | 12,912 | | | 11,606 | | |

| Professional services and legal | | | 7,823 | | | 8,318 | | |

| Other taxes | | | 6,813 | | | 6,620 | | |

| Marketing | | | 6,488 | | | 5,600 | | |

| FDIC insurance | | | 4,122 | | | 2,854 | | |

| Other noninterest expense | | | 28,463 | | | 26,797 | | |

| Total Noninterest Expense | | | 210,334 | | | 196,746 | | |

| Income Before Taxes | | | 178,804 | | | 168,930 | | |

| Income tax expense | | | 34,023 | | | 33,410 | | |

| | | | | | |

| Net Income | | | $144,781 | | | $135,520 | | |

| | | | | | |

| Per Share Data | | | | | | |

| Average shares outstanding - diluted | | | 38,655,405 | | | 39,030,934 | | |

| Diluted earnings per share | | | $3.74 | | | $3.46 | | |

| Dividends declared per share | | | $1.29 | | | $1.20 | | |

| Dividends paid to net income | | | 34.33 | % | | 34.64 | % | |

| | | | | | |

| Profitability Ratios (annualized) | | | | | | |

| Return on average assets | | | 1.56 | % | | 1.48 | % | |

| Return on average shareholders' equity | | | 11.80 | % | | 11.47 | % | |

Return on average tangible shareholders' equity(5) | | | 17.15 | % | | 17.02 | % | |

Pre-provision net revenue / average assets(6) | | | 2.12 | % | | 1.93 | % | |

Efficiency ratio (FTE)(7) | | | 51.35 | % | | 52.34 | % | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 9 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

| ASSETS | | | | | | |

| Cash and due from banks | $233,612 | | | $238,453 | | | $210,009 | | |

| Securities available for sale, at fair value | 970,391 | | | 955,262 | | | 1,002,778 | | |

| Loans held for sale | 153 | | | 257 | | | 16 | | |

| Commercial loans: | | | | | | |

| Commercial real estate | 3,357,603 | | | 3,286,272 | | | 3,128,187 | | |

| Commercial and industrial | 1,642,106 | | | 1,635,354 | | | 1,718,976 | | |

| Commercial construction | 363,284 | | | 388,470 | | | 399,371 | | |

| Total Commercial Loans | 5,362,993 | | | 5,310,096 | | | 5,246,534 | | |

| Consumer loans: | | | | | | |

| Residential mortgage | 1,461,097 | | | 1,384,133 | | | 1,116,528 | | |

| Home equity | 650,666 | | | 649,122 | | | 652,066 | | |

| Installment and other consumer | 114,897 | | | 115,379 | | | 124,896 | | |

| Consumer construction | 63,688 | | | 57,188 | | | 43,945 | | |

| Total Consumer Loans | 2,290,348 | | | 2,205,822 | | | 1,937,435 | | |

| Total Portfolio Loans | 7,653,341 | | | 7,515,918 | | | 7,183,969 | | |

| Allowance for credit losses | (107,966) | | | (108,206) | | | (101,340) | | |

| Total Portfolio Loans, Net | 7,545,375 | | | 7,407,712 | | | 7,082,629 | | |

| Federal Home Loan Bank and other restricted stock, at cost | 25,082 | | | 38,576 | | | 23,035 | | |

| Goodwill | 373,424 | | | 373,424 | | | 373,424 | | |

| Other assets | 403,489 | | | 452,393 | | | 418,676 | | |

| Total Assets | $9,551,526 | | | $9,466,077 | | | $9,110,567 | | |

| | | | | | |

| LIABILITIES | | | | | | |

| Deposits: | | | | | | |

| Noninterest-bearing demand | $2,221,942 | | | $2,276,009 | | | $2,588,692 | | |

| Interest-bearing demand | 825,787 | | | 868,624 | | | 846,653 | | |

| Money market | 1,941,842 | | | 1,615,445 | | | 1,731,521 | | |

| Savings | 950,546 | | | 974,940 | | | 1,118,511 | | |

| Certificates of deposit | 1,581,652 | | | 1,487,879 | | | 934,593 | | |

| Total Deposits | 7,521,769 | | | 7,222,897 | | | 7,219,970 | | |

| | | | | | |

| Borrowings: | | | | | | |

| | | | | | |

| Short-term borrowings | 415,000 | | | 630,000 | | | 370,000 | | |

| Long-term borrowings | 39,277 | | | 39,396 | | | 14,741 | | |

| Junior subordinated debt securities | 49,358 | | | 49,343 | | | 54,453 | | |

| Total Borrowings | 503,635 | | | 718,739 | | | 439,194 | | |

| Other liabilities | 242,677 | | | 300,909 | | | 266,744 | | |

| Total Liabilities | 8,268,081 | | | 8,242,545 | | | 7,925,908 | | |

| | | | | | |

| SHAREHOLDERS’ EQUITY | | | | | | |

| Total Shareholders’ Equity | 1,283,445 | | | 1,223,532 | | | 1,184,659 | | |

| Total Liabilities and Shareholders’ Equity | $9,551,526 | | | $9,466,077 | | | $9,110,567 | | |

| | | | | | |

| Capitalization Ratios | | | | | | |

| Shareholders' equity / assets | 13.44 | % | | 12.93 | % | | 13.00 | % | |

Tangible common equity / tangible assets(9) | 9.88 | % | | 9.31 | % | | 9.24 | % | |

| Tier 1 leverage ratio | 11.21 | % | | 11.12 | % | | 11.06 | % | |

| Common equity tier 1 capital | 13.37 | % | | 13.11 | % | | 12.81 | % | |

| Risk-based capital - tier 1 | 13.69 | % | | 13.43 | % | | 13.21 | % | |

| Risk-based capital - total | 15.27 | % | | 15.01 | % | | 14.73 | % | |

| | | | | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 10 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

| Net Interest Margin (FTE) (QTD Averages) | | | | | | |

| ASSETS | | | | | | |

| Interest-bearing deposits with banks | $149,985 | 5.92% | $144,303 | 4.93% | $79,881 | 4.04% |

| Securities, at fair value | 956,107 | 2.75% | 964,928 | 2.64% | 991,774 | 2.43% |

| Loans held for sale | 57 | 7.25% | 207 | 6.70% | 491 | 6.19% |

| Commercial real estate | 3,312,509 | 5.86% | 3,243,056 | 5.83% | 3,118,874 | 5.14% |

| Commercial and industrial | 1,621,091 | 7.29% | 1,646,572 | 7.22% | 1,724,480 | 6.15% |

| Commercial construction | 381,294 | 7.55% | 373,111 | 7.80% | 387,737 | 6.64% |

| Total Commercial Loans | 5,314,894 | 6.42% | 5,262,739 | 6.41% | 5,231,091 | 5.58% |

| Residential mortgage | 1,417,891 | 4.81% | 1,332,913 | 4.66% | 1,077,114 | 4.25% |

| Home equity | 650,721 | 6.94% | 645,949 | 6.80% | 648,340 | 5.44% |

| Installment and other consumer | 114,720 | 9.15% | 115,111 | 8.52% | 126,570 | 6.97% |

| Consumer construction | 62,850 | 5.22% | 52,783 | 4.89% | 41,385 | 3.81% |

| Total Consumer Loans | 2,246,182 | 5.66% | 2,146,756 | 5.52% | 1,893,409 | 4.83% |

| Total Portfolio Loans | 7,561,076 | 6.19% | 7,409,495 | 6.15% | 7,124,500 | 5.38% |

| Total Loans | 7,561,133 | 6.19% | 7,409,702 | 6.15% | 7,124,991 | 5.38% |

| Total other earning assets | 37,502 | 7.23% | 42,645 | 6.97% | 24,043 | 5.32% |

| Total Interest-earning Assets | 8,704,727 | 5.81% | 8,561,578 | 5.74% | 8,220,689 | 5.01% |

| Noninterest-earning assets | 768,942 | | 763,243 | | 763,927 | |

| Total Assets | $9,473,669 | | $9,324,821 | | $8,984,616 | |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | |

| Interest-bearing demand | $836,771 | 1.03% | $868,782 | 0.91% | $836,585 | 0.24% |

| Money market | 1,843,338 | 2.98% | 1,595,964 | 2.34% | 1,792,162 | 1.60% |

| Savings | 957,903 | 0.57% | 996,999 | 0.47% | 1,127,987 | 0.22% |

| Certificates of deposit | 1,533,266 | 4.02% | 1,382,532 | 3.54% | 941,774 | 1.14% |

| Total Interest-bearing Deposits | 5,171,278 | 2.53% | 4,844,277 | 2.04% | 4,698,508 | 0.93% |

| | | | | | |

| Short-term borrowings | 435,060 | 5.75% | 585,196 | 5.65% | 148,370 | 4.22% |

| Long-term borrowings | 39,341 | 4.53% | 39,458 | 4.47% | 14,801 | 2.55% |

| Junior subordinated debt securities | 49,350 | 8.25% | 50,649 | 8.16% | 54,443 | 6.21% |

| Total Borrowings | 523,751 | 5.90% | 675,303 | 5.77% | 217,614 | 4.60% |

| Total Other Interest-bearing Liabilities | 65,547 | | 5.40% | 62,584 | 5.33% | 60,156 | | 3.72% |

| Total Interest-bearing Liabilities | 5,760,576 | 2.86% | 5,582,164 | 2.53% | 4,976,278 | 1.13% |

| Noninterest-bearing liabilities | 2,466,063 | | 2,517,752 | | 2,840,315 | |

| Shareholders' equity | 1,247,030 | | 1,224,905 | | 1,168,023 | |

| Total Liabilities and Shareholders' Equity | $9,473,669 | | $9,324,821 | | $8,984,616 | |

| | | | | | |

Net Interest Margin(10) | | 3.92% | | 4.09% | | 4.33% |

| | | | | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 11 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (dollars in thousands) | | | 2023 | | 2022 | |

| Net Interest Margin (FTE) (YTD Averages) | | | | | | |

| ASSETS | | | | | | |

| Interest-bearing deposits with banks | | | $141,954 | 5.17% | $378,323 | 0.78% |

| Securities, at fair value | | | 976,095 | 2.61% | 1,017,471 | 2.25% |

| Loans held for sale | | | 121 | 6.71% | 1,115 | 4.38% |

| Commercial real estate | | | 3,216,593 | 5.70% | 3,182,821 | 4.39% |

| Commercial and industrial | | | 1,665,630 | 7.10% | 1,706,861 | 4.90% |

| Commercial construction | | | 381,838 | 7.55% | 401,780 | 4.68% |

| Total Commercial Loans | | | 5,264,061 | 6.27% | 5,291,462 | 4.57% |

| Residential mortgage | | | 1,282,078 | 4.62% | 980,134 | 4.10% |

| Home equity | | | 648,525 | 6.65% | 611,134 | 4.24% |

| Installment and other consumer | | | 117,807 | 8.43% | 119,703 | 6.00% |

| Consumer construction | | | 51,146 | 4.81% | 33,922 | 3.53% |

| Total Consumer Loans | | | 2,099,556 | 5.46% | 1,744,893 | 4.26% |

| Total Portfolio Loans | | | 7,363,617 | 6.04% | 7,036,355 | 4.50% |

| Total Loans | | | 7,363,738 | 6.04% | 7,037,470 | 4.50% |

| Total other earning assets | | | 37,988 | 7.04% | 12,694 | 4.54% |

| Total Interest-earning Assets | | | 8,519,775 | 5.64% | 8,445,958 | 4.06% |

| Noninterest-earning assets | | | 756,481 | | 721,080 | |

| Total Assets | | | $9,276,256 | | $9,167,038 | |

| | | | | | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | | | | |

| Interest-bearing demand | | | $844,588 | 0.72% | $918,222 | 0.11% |

| Money market | | | 1,677,584 | 2.33% | 1,909,208 | 0.63% |

| Savings | | | 1,020,314 | 0.43% | 1,121,818 | 0.10% |

| Certificates of deposit | | | 1,302,478 | 3.30% | 993,722 | 0.58% |

| Total Interest-bearing deposits | | | 4,844,964 | 1.92% | 4,942,970 | 0.40% |

| Securities sold under repurchase agreements | | | — | —% | 35,836 | 0.10% |

| Short-term borrowings | | | 500,421 | 5.44% | 40,013 | 4.15% |

| Long-term borrowings | | | 31,706 | 4.20% | 19,090 | 2.15% |

| Junior subordinated debt securities | | | 52,215 | 7.87% | 54,420 | 4.40% |

| Total Borrowings | | | 584,342 | 5.59% | 149,359 | 3.01% |

| Total Other Interest-bearing Liabilities | | | 58,135 | 5.12% | 15,163 | 3.69% |

| Total Interest-bearing Liabilities | | | 5,487,441 | 2.34% | 5,107,492 | 0.49% |

| Noninterest-bearing liabilities | | | 2,561,483 | | 2,877,758 | |

| Shareholders' equity | | | 1,227,332 | | 1,181,788 | |

| Total Liabilities and Shareholders' Equity | | | $9,276,256 | | $9,167,038 | |

| | | | | | |

Net Interest Margin(8) | | | | 4.13% | | 3.76% |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 12 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

| Nonaccrual Loans | | | | | | |

| Commercial loans: | | % Loans | | % Loans | | % Loans |

| Commercial real estate | $7,267 | | 0.22% | $1,735 | | 0.05% | $7,323 | | 0.23% |

| Commercial and industrial | 3,243 | | 0.20% | 3,468 | | 0.21% | 2,974 | | 0.17% |

| Commercial construction | 4,960 | | 1.37% | 384 | | 0.10% | 384 | | 0.10% |

| | | | | | |

| Total Nonaccrual Commercial Loans | 15,470 | | 0.29% | 5,587 | | 0.11% | 10,681 | | 0.20% |

| Consumer loans: | | | | | | |

| Residential mortgage | 4,579 | | 0.31% | 4,139 | | 0.30% | 6,063 | | 0.54% |

| Home equity | 2,567 | | 0.39% | 2,617 | | 0.40% | 2,031 | | 0.31% |

| Installment and other consumer | 330 | | 0.29% | 334 | | 0.29% | 277 | | 0.22% |

| | | | | | |

| Total Nonaccrual Consumer Loans | 7,476 | | 0.33% | 7,090 | | 0.32% | 8,371 | | 0.43% |

| Total Nonaccrual Loans | $22,946 | | 0.30% | $12,677 | | 0.17% | $19,052 | | 0.27% |

|

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

| Loan Charge-offs (Recoveries) | | | | | | |

| Charge-offs | $3,880 | | | $4,077 | | | $1,718 | | |

| Recoveries | (260) | | | (367) | | | (808) | | |

| Net Loan Charge-offs | $3,620 | | | $3,710 | | | $910 | | |

| | | | | | |

| Net Loan Charge-offs (Recoveries) | | | | | | |

| Commercial loans: | | | | | | |

| | | | | | |

| Commercial real estate | $1,690 | | | ($13) | | | $412 | | |

| Commercial and industrial | 949 | | | 3,389 | | | 150 | | |

| Commercial construction | 451 | | | — | | | — | | |

| Total Commercial Loan Charge-offs | 3,090 | | | 3,376 | | | 562 | | |

| Consumer loans: | | | | | | |

| Residential mortgage | (3) | | | (11) | | | 51 | | |

| Home equity | 148 | | | 71 | | | 136 | | |

| Installment and other consumer | 385 | | | 274 | | | 161 | | |

| | | | | | |

| Total Consumer Loan Charge-offs | 530 | | | 334 | | | 348 | | |

| Total Net Loan Charge-offs | $3,620 | | | $3,710 | | | $910 | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 13 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (dollars in thousands) | | | 2023 | | 2022 | |

| Loan Charge-offs (Recoveries) | | | | | | |

| Charge-offs | | | $24,638 | | | $11,617 | | |

| Recoveries | | | (11,456) | | | (9,022) | | |

| Net Loan Charge-offs | | | $13,182 | | $2,595 | |

| | | | | | |

| Net Loan Charge-offs (Recoveries) | | | | | | |

| Commercial loans: | | | | | | |

| Customer fraud | | | ($9,329) | | $— | |

| Commercial real estate | | | 622 | | 768 | |

| Commercial and industrial | | | 19,582 | | 435 | |

| Commercial construction | | | 449 | | | (1) | | |

| Total Commercial Loan Charge-offs | | | 11,324 | | 1,202 | |

| Consumer loans: | | | | | | |

| Residential mortgage | | | (6) | | 186 | |

| Home equity | | | 238 | | 232 | |

| Installment and other consumer | | | 1,626 | | 975 | |

| | | | | | |

| Total Consumer Loan Charge-offs | | | 1,858 | | 1,393 | |

| Total Net Loan Charge-offs | | | $13,182 | | $2,595 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

| Asset Quality Data | | | | | | |

| Nonaccrual loans | $22,947 | | | $12,677 | | | $19,052 | | |

| OREO | 75 | | | 3,715 | | | 3,065 | | |

| Total nonperforming assets | 23,022 | | | 16,392 | | | 22,117 | | |

| Troubled debt restructurings (nonaccruing)* | — | | | — | | | 2,894 | | |

| Troubled debt restructurings (accruing)* | — | | | — | | | 8,891 | | |

| Total troubled debt restructurings* | — | | | — | | | 11,785 | | |

| Nonaccrual loans / total loans | 0.30 | % | | 0.17 | % | | 0.27 | % | |

| Nonperforming assets / total loans plus OREO | 0.30 | % | | 0.22 | % | | 0.31 | % | |

| Allowance for credit losses / total portfolio loans | 1.41 | % | | 1.44 | % | | 1.41 | % | |

| | | | | | |

| Allowance for credit losses / nonaccrual loans | 471 | % | | 854 | % | | 532 | % | |

| Net loan charge-offs (recoveries) | $3,620 | | | $3,710 | | | $910 | | |

| Net loan charge-offs (recoveries) (annualized) / average loans | 0.19 | % | | 0.20 | % | | 0.05 | % | |

*TDR's were eliminated as of January 1, 2023 as part of implementing ASU 2022-02, Financial Instruments Credit Losses (Topic 326): Troubled Debt Restructurings and Vintage Disclosures. |

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (dollars in thousands) | | | 2023 | | 2022 | |

| Asset Quality Data | | | | | | |

| Net loan charge-offs | | | $13,182 | | | $2,595 | | |

| Net loan charge-offs / average loans | | | 0.18 | % | | 0.04 | % | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 14 |

|

|

Definitions and Reconciliation of GAAP to Non-GAAP Financial Measures:

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars and shares in thousands) | Quarter | | Quarter | | Quarter | |

(1) Tangible Book Value (non-GAAP) | | | | | | |

| Total shareholders' equity | $1,283,445 | | | $1,223,532 | | | $1,184,659 | | |

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,631) | | | (376,883) | | | (377,673) | | |

| Tangible common equity (non-GAAP) | $906,814 | | | $846,649 | | | $806,986 | | |

| Common shares outstanding | 38,233 | | | 38,244 | | | 39,000 | | |

| Tangible book value (non-GAAP) | $23.72 | | | $22.14 | | | $20.69 | | |

| Tangible book value is a preferred industry metric used to measure our company's value and commonly used by investors and analysts. |

| | | | | | |

(2) Return on Average Tangible Shareholders' Equity (non-GAAP) | | | | | | |

| Net income (annualized) | $146,980 | | | $132,779 | | | $159,765 | | |

| Plus: amortization of intangibles (annualized), net of tax | 1,003 | | | 1,034 | | | 1,144 | | |

| Net income before amortization of intangibles (annualized) | $147,983 | | | $133,813 | | | $160,909 | | |

| | | | | | |

| Average total shareholders' equity | $1,247,030 | | | $1,224,905 | | | $1,168,023 | | |

| Less: average goodwill and other intangible assets, net of deferred tax liability | (376,761) | | | (377,020) | | | (377,857) | | |

| Average tangible equity (non-GAAP) | $870,269 | | | $847,885 | | | $790,166 | | |

| Return on average tangible shareholders' equity (non-GAAP) | 17.00 | % | | 15.78 | % | | 20.36 | % | |

| Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. |

| | | | | | |

(3) Pre-provision Net Revenue / Average Assets (non-GAAP) | | | | | | |

| Income before taxes | $46,024 | | | $41,268 | | | $50,250 | | |

| Plus: Provision for credit losses | 943 | | | 5,498 | | | 3,176 | | |

| Total | $46,967 | | | $46,766 | | | $53,426 | | |

| Total (annualized) (non-GAAP) | $186,336 | | | $185,538 | | | $211,961 | | |

| Average assets | $9,473,669 | | | $9,324,821 | | | $8,984,616 | | |

| Pre-provision Net Revenue / Average Assets (non-GAAP) | 1.97 | % | | 1.99 | % | | 2.36 | % | |

| Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. |

| | | | | | |

(4) Efficiency Ratio (non-GAAP) | | | | | | |

| Noninterest expense | $56,203 | | | $52,799 | | | $51,275 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net interest income per consolidated statements of net income | $85,109 | | | $87,387 | | | $89,058 | | |

| Plus: taxable equivalent adjustment | 683 | | | 674 | | | 532 | | |

| Net interest income (FTE) (non-GAAP) | 85,792 | | | 88,061 | | | 89,590 | | |

| Noninterest income | 18,061 | | | 12,178 | | | 15,643 | | |

| | | | | | |

| Net interest income (FTE) (non-GAAP) plus noninterest income | $103,853 | | | $100,239 | | | $105,233 | | |

| Efficiency ratio (non-GAAP) | 54.12 | % | | 52.67 | % | | 48.73 | % | |

| The efficiency ratio is noninterest expense divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. |

| | | | | | |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 15 |

|

|

| | | | | | | | | | | | | | | | | | | | |

| | | Twelve Months Ended December 31, | |

| (dollars in thousands) | | | 2023 | | 2022 | |

(5) Return on Average Tangible Shareholders' Equity (non-GAAP) | | | | | | |

| Net income | | | $144,781 | | | $135,520 | | |

| Plus: amortization of intangibles, net of tax | | | 1,042 | | | 1,199 | | |

| Net income before amortization of intangibles | | | $145,823 | | | $136,719 | | |

| | | | | | |

| Average total shareholders' equity | | | $1,227,332 | | | $1,181,788 | | |

| Less: average goodwill and other intangible assets, net of deferred tax liability | | | (377,157) | | | (378,303) | | |

| Average tangible equity (non-GAAP) | | | $850,175 | | | $803,485 | | |

| Return on average tangible shareholders' equity (non-GAAP) | | | 17.15 | % | | 17.02 | % | |

| Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. |

| | | | | | |

(6) Pre-provision Net Revenue / Average Assets (non-GAAP) | | | | | | |

| Income before taxes | | | $178,804 | | | $168,930 | | |

| Plus: Provision for credit losses | | | 17,892 | | | 8,366 | | |

| Total | | | $196,696 | | | $177,296 | | |

| | | | | | |

| Average assets | | | $9,276,256 | | | $9,167,038 | | |

| Pre-provision Net Revenue / Average Assets (non-GAAP) | | | 2.12 | % | | 1.93 | % | |

| Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. |

| | | | | | |

(7) Efficiency Ratio (non-GAAP) | | | | | | |

| Noninterest expense | | | $210,334 | | | $196,746 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Net interest income per consolidated statements of net income | | | $349,410 | | | $315,783 | | |

| Plus: taxable equivalent adjustment | | | 2,550 | | | 2,052 | | |

| Net interest income (FTE) (non-GAAP) | | | 351,960 | | | 317,835 | | |

| Noninterest income | | | 57,620 | | | 58,259 | | |

| Less: net gains on sale of securities | | | — | | | (198) | | |

| Net interest income (FTE) (non-GAAP) plus noninterest income | | | $409,580 | | | $375,896 | | |

| Efficiency ratio (non-GAAP) | | | 51.35 | % | | 52.34 | % | |

| The efficiency ratio is noninterest expense divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. |

| | | | | | |

(8) Net Interest Margin Rate (FTE) (non-GAAP) | | | | | | |

| Interest income and dividend income | | | $477,901 | | | $340,751 | | |

| Less: interest expense | | | (128,491) | | | (24,968) | | |

| Net interest income per consolidated statements of net income | | | 349,410 | | | 315,783 | | |

| Plus: taxable equivalent adjustment | | | 2,550 | | | 2,052 | | |

| Net interest income (FTE) (non-GAAP) | | | $351,960 | | | $317,835 | | |

| | | | | | |

| Average interest-earning assets | | | $8,519,775 | | | $8,445,958 | | |

| Net interest margin - (FTE) (non-GAAP) | | | 4.13 | % | | 3.76 | % | |

| The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. |

| | | | | | | | | | | |

S&T Bancorp, Inc. Consolidated Selected Financial Data Unaudited | | S&T Earnings Release - | 16 |

|

|

Definitions and Reconciliation of GAAP to Non-GAAP Financial Measures:

| | | | | | | | | | | | | | | | | | | | |

| 2023 | | 2023 | | 2022 | |

| Fourth | | Third | | Fourth | |

| (dollars in thousands) | Quarter | | Quarter | | Quarter | |

(9) Tangible Common Equity / Tangible Assets (non-GAAP) | | | | | | |

| Total shareholders' equity | $1,283,445 | | | $1,223,532 | | | $1,184,659 | | |

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,631) | | | (376,883) | | | (377,673) | | |

| Tangible common equity (non-GAAP) | $906,814 | | | $846,649 | | | $806,986 | | |

| | | | | | |

| Total assets | $9,551,526 | | | $9,466,077 | | | $9,110,567 | | |

| Less: goodwill and other intangible assets, net of deferred tax liability | (376,631) | | | (376,883) | | | (377,673) | | |

| Tangible assets (non-GAAP) | $9,174,895 | | | $9,089,194 | | | $8,732,894 | | |

| Tangible common equity to tangible assets (non-GAAP) | 9.88 | % | | 9.31 | % | | 9.24 | % | |

| Tangible common equity to tangible assets is a preferred industry measurement to evaluate capital adequacy. |

| | | | | | |

(10) Net Interest Margin Rate (FTE) (non-GAAP) | | | | | | |

| Interest income and dividend income | $126,706 | | | $122,959 | | | $103,208 | | |

| Less: interest expense | (41,597) | | | (35,572) | | | (14,150) | | |

| Net interest income per consolidated statements of net income | 85,109 | | | 87,387 | | | 89,058 | | |

| Plus: taxable equivalent adjustment | 683 | | | 674 | | | 532 | | |

| Net interest income (FTE) (non-GAAP) | $85,792 | | | $88,061 | | | $89,590 | | |

| Net interest income (FTE) (annualized) | $340,370 | | | $349,373 | | | $355,438 | | |

| Average interest-earning assets | $8,704,727 | | | $8,561,578 | | | $8,220,689 | | |

| Net interest margin (FTE) (non-GAAP) | 3.92 | % | | 4.09 | % | | 4.33 | % | |

| The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. |

| | | | | | |

Asset Size $9.6 billion As of 12/31/23 Market Cap $1.3 billion As of 12/31/23 2023 Performance: 2023 Highlights “It was a great year for S&T with record net income and earnings per share for the second year in a row. Our highly engaged teams that go above and beyond every day to provide an award-winning customer experience are fundamental to our success. For the quarter, I am pleased that we achieved balanced loan and deposit growth, while delivering excellent returns and efficiency. Our people-forward purpose positions us well for continued growth.” – Chris McComish, Chief Executive Officer million Record Earnings Per Share $3.74 8% Record Net Income $144.8 7% 11.80% IN 2023 1.56% IN 2023 3.86% AS OF 12/31/23 DIVIDEND YIELD Recognition: Top Workplaces USA 2023 S&T Bank was recognized as a top workplace in the United States, issued by Energage. We were chosen based solely on employee feedback gathered through an anonymous, research-based employee engagement survey. Top Workplace for Work-Life Flexibility S&T was awarded the 2023 Top Workplaces Culture Excellence award for Work-Life Flexibility, issued by Energage. This national award recognizes organizations that provide options to their employees in how and where they work, as well as encouraging managers to acknowledge and care about employees’ concerns. America’s Best Mid-Size Employers S&T was honored as one of America’s Best Mid-Size Employers by Forbes and Statista in 2023. This recognition was obtained through results of an independent survey applied to a vast sample of approximately 45,000 American employees working for companies with more than 1,000 employees. Forbes Best-In-State Banks S&T Bank was named on the Forbes list of Best-In-State Banks 2023 for the second consecutive year. Consumers assessed banks regarding overall satisfaction, trust, terms and conditions, branch services, digital services, customer service and financial advice.

Fourth Quarter 2023 Earnings Supplement

Forward Looking Statements and Risk Factors This information contains or incorporates statements that we believe are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to our financial condition, results of operations, plans, objectives, outlook for earnings, revenues, expenses, capital and liquidity levels and ratios, asset levels, asset quality, financial position and other matters regarding or affecting S&T and its future business and operations. Forward-looking statements are typically identified by words or phrases such as “will likely result,” “expect,” “anticipate,” “estimate,” “forecast,” “project,” “intend,” “believe,” “assume,” “strategy,” “trend,” “plan,” “outlook,” “outcome,” “continue,” “remain,” “potential,” “opportunity,” “comfortable,” “current,” “position,” “maintain,” “sustain,” “seek,” “achieve,” and variations of such words and similar expressions, or future or conditional verbs such as will, would, should, could or may. Although we believe the assumptions upon which these forward-looking statements are based are reasonable, any of these assumptions could prove to be inaccurate and the forward-looking statements based on these assumptions could be incorrect. The matters discussed in these forward-looking statements are subject to various risks, uncertainties and other factors that could cause actual results and trends to differ materially from those made, projected, or implied in or by the forward-looking statements depending on a variety of uncertainties or other factors including, but not limited to: credit losses and the credit risk of our commercial and consumer loan products; changes in the level of charge-offs and changes in estimates of the adequacy of the allowance for credit losses, or ACL; cyber-security concerns; rapid technological developments and changes; operational risks or risk management failures by us or critical third parties, including fraud risk; our ability to manage our reputational risks; sensitivity to the interest rate environment, a rapid increase in interest rates or a change in the shape of the yield curve; a change in spreads on interest-earning assets and interest-bearing liabilities; the transition from LIBOR as a reference rate; regulatory supervision and oversight, including changes in regulatory capital requirements and our ability to address those requirements; unanticipated changes in our liquidity position; unanticipated changes in regulatory and governmental policies impacting interest rates and financial markets; changes in accounting policies, practices or guidance; legislation affecting the financial services industry as a whole, and S&T, in particular; developments affecting the industry and the soundness of financial institutions and further disruption to the economy and U.S. banking system; the outcome of pending and future litigation and governmental proceedings; increasing price and product/service competition; the ability to continue to introduce competitive new products and services on a timely, cost-effective basis; managing our internal growth and acquisitions; the possibility that the anticipated benefits from acquisitions cannot be fully realized in a timely manner or at all, or that integrating the acquired operations will be more difficult, disruptive or costly than anticipated; containing costs and expenses; reliance on significant customer relationships; an interruption or cessation of an important service by a third-party provider; our ability to attract and retain talented executives and employees; general economic or business conditions, including the strength of regional economic conditions in our market area; environmental, social and governance practices and disclosures, including climate change, hiring practices, the diversity of the work force, and racial and social justice issues; deterioration of the housing market and reduced demand for mortgages; deterioration in the overall macroeconomic conditions or the state of the banking industry that could warrant further analysis of the carrying value of goodwill and could result in an adjustment to its carrying value resulting in a non-cash charge to net income; the stability of our core deposit base and access to contingency funding; re-emergence of turbulence in significant portions of the global financial and real estate markets that could impact our performance, both directly, by affecting our revenues and the value of our assets and liabilities, and indirectly, by affecting the economy generally and access to capital in the amounts, at the times and on the terms required to support our future businesses. Many of these factors, as well as other factors, are described in our Annual Report on Form 10-K for the year ended December 31, 2022, including Part I, Item 1A-"Risk Factors" and any of our subsequent filings with the SEC. Forward-looking statements are based on beliefs and assumptions using information available at the time the statements are made. We caution you not to unduly rely on forward-looking statements because the assumptions, beliefs, expectations and projections about future events may, and often do, differ materially from actual results. Any forward-looking statement speaks only as to the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect developments occurring after the statement is made. Non-GAAP Financial Measures In addition to the traditional measures presented in accordance with Generally Accepted Accounting Principles (GAAP), S&T management uses and this presentation contains or references certain non-GAAP financial measures, such as net interest income on a fully taxable equivalent basis. S&T believes these non-GAAP financial measures provide information useful to investors in understanding our underlying business, operational performance and performance trends which facilitate comparisons with the performance of others in the financial services industry. Although S&T believes that these non-GAAP financial measures enhance investors’ understanding of S&T’s business and performance, these non-GAAP financial measures should not be considered an alternative to GAAP or considered to be more important than financial results determined in accordance with GAAP, nor are they necessarily comparable with non-GAAP measures which may be presented by other companies. The non-GAAP financial measures contained within this presentation should be read in conjunction with the audited financial statements and analysis as presented in the Annual Report on Form 10-K as well as the unaudited financial statements and analyses as presented in the respective Quarterly Reports in Exhibit 99.1 of Form 8-K for S&T Bancorp, Inc. and subsidiaries. 2

3 Full Year Overview RETURNS EARNINGS *Refer to appendix for reconciliation of non-GAAP financial measures EPS $3.74 Net Income $144.8 million ROA 1.56% ROE 11.80% ROTE* 17.15% PPNR* 2.12% HIGHLIGHTS • Record EPS and net income • Strong return metrics and EPS growth of 8.09% • Solid NIM of 4.13% compared to 3.76% for 2022 • Net interest income increased $33.6 million, or 10.65%, compared to 2022 • Net charge-offs of $13.2 million, or 0.18% of average loans • Efficiency ratio remains low at 51.35% NIM* 4.13% NCO 0.18% OTHER Efficiency Ratio* 51.35%

4 Fourth Quarter Overview RETURNS EARNINGS *Refer to appendix for reconciliation of non-GAAP financial measures EPS $0.96 Net Income $37.0 million ROA 1.55% ROE 11.79% ROTE* 17.00% PPNR* 1.97% HIGHLIGHTS • Strong earnings and return metrics • NIM remains solid at 3.92% • Net charge-offs of $3.6 million, or 0.19% of average loans (annualized) • Efficiency ratio of 54.12% NIM* 3.92% NCO 0.19% OTHER Efficiency Ratio* 54.12%

Balance Sheet • Loans increased $137.4 million, or 7.25% annualized, since September 30, 2023 • Customer deposit growth of $98.2 million in money market and CDs • Added $200.7 million of brokered money markets Dollars in millions 5 4Q23 3Q23 Var $234 $238 ($4) 970 955 15 7,653 7,516 137 7,522 7,223 299 Cash & Int Bear Bal Securities Loans Deposits ($50) $0 $50 $100 $150 $200 $250 $300 4Q23 vs 3Q23: 4Q23 vs 3Q23 DEPOSIT CHANGES DECREASES/INCREASES Brokered MMs

Asset Quality ACL Trend: Dollars in millions 6 ASSET QUALITY TRENDS • ACL relatively stable at 1.41% • Net charge-offs of $3.6 million, or 0.19% of average loans (annualized) • NPAs remain low at 0.30% of total loans plus OREO

• NIM was solid at 3.92% • NIM has increased 80 basis points through this interest rate cycle • Quarterly net interest income has improved $16.7 million, or 24.36%, since the fourth quarter of 2021 Net Interest Income Dollars in millions; *Refer to appendix for reconciliation of non-GAAP financial measures 7 CURRENT RATE CYCLE

4Q23 4Q23 vs 3Q23 4Q23 vs 4Q22 Debit and Credit Card $4.5 ($0.2) $0.1 Service Charges 4.1 — (0.2) Wealth 3.1 0.1 0.1 Mortgage 0.3 — — Other 6.1 6.0 2.5 Noninterest Income $18.1 $5.9 $2.5 Noninterest Income 8Dollars in millions • Increase in other related to a $3.3 million gain on OREO and valuation adjustments on our commercial loan swaps and a nonqualified benefit plan of $2.2 million compared to 3Q23

4Q23 4Q23 vs 3Q23 4Q23 vs 4Q22 Salaries & Benefits $31.0 $3.5 $3.0 Data Processing 4.5 — 0.3 FF&E 3.7 0.6 0.7 Occupancy 3.6 (0.1) (0.2) Professional Services 2.0 — (0.1) Other Taxes 1.9 — 0.1 Marketing 1.4 (0.3) — FDIC 1.0 — 0.6 Other 7.1 (0.3) 0.5 Noninterest Expense $56.2 $3.4 $4.9 Noninterest Expense 9Dollars in millions; *Refer to appendix for reconciliation of non-GAAP financial measures • Higher expenses mainly due to an increase in salaries and benefits due to higher medical, incentives and valuation adjustments on a nonqualified benefit plan

Capital Dollars in millions; *Refer to appendix for reconciliation of non-GAAP financial measures 10 TCE / TA* • We have strong capital levels and are well positioned for growth • TCE / TA improvement due to strong earnings and AOCI

4Q23 Return on Average Tangible Shareholders' Equity (ROTE) (non-GAAP) Net income (annualized) $146,980 Plus: amortization of intangibles (annualized), net of tax 1,003 Net income before amortization of intangibles (annualized) $147,983 Average total shareholders' equity $1,247,030 Less: average goodwill and other intangible assets, net of deferred tax liability (376,761) Average tangible equity (non-GAAP) $870,269 Return on average tangible shareholders' equity (non-GAAP) 17.00 % Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. Pre-provision Net Revenue (PPNR)/Average Assets (non-GAAP) Income before taxes $46,024 Plus: Provision for credit losses 943 Total $46,967 Total (annualized) (non-GAAP) $186,336 Average assets $9,473,669 PPNR/Average Assets (non-GAAP) 1.97 % Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. Appendix Definitions of GAAP to Non-GAAP Financial Measures 11

2023 Return on Average Tangible Shareholders' Equity (ROTE) (non-GAAP) Net income $144,781 Plus: amortization of intangibles, net of tax 1,042 Net income before amortization of intangibles $145,823 Average total shareholders' equity $1,227,332 Less: average goodwill and other intangible assets, net of deferred tax liability (377,157) Average tangible equity (non-GAAP) $850,175 Return on average tangible shareholders' equity (non-GAAP) 17.15 % Return on average tangible shareholders' equity is a key profitability metric used by management to measure financial performance. Pre-provision Net Revenue (PPNR)/Average Assets (non-GAAP) Income before taxes $178,804 Plus: Provision for credit losses 17,892 Total $196,696 Average assets $9,276,256 PPNR/Average Assets (non-GAAP) 2.12 % Pre-provision net revenue to average assets is income before taxes adjusted to exclude provision for credit losses. We believe this to be a preferred industry measurement to help evaluate our ability to fund credit losses or build capital. Appendix Definitions of GAAP to Non-GAAP Financial Measures 12

2023 Net Interest Margin Rate (FTE) (non-GAAP) Interest income and dividend income $477,901 Less: interest expense (128,491) Net interest income per consolidated statements of net income 349,410 Plus: taxable equivalent adjustment 2,550 Net interest income (FTE) (non-GAAP) $351,960 Average interest-earning assets $8,519,775 Net interest margin - (FTE) (non-GAAP) 4.13 % The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. Efficiency Ratio (non-GAAP) Noninterest expense $210,334 Net interest income per consolidated statements of net income $349,410 Plus: taxable equivalent adjustment 2,550 Net interest income (FTE) (non-GAAP) 351,960 Noninterest income 57,620 Net interest income (FTE) (non-GAAP) plus noninterest income $409,580 Efficiency ratio (non-GAAP) 51.35 % The efficiency ratio is noninterest divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax-exempt sources and is consistent with industry practice. Appendix Definitions of GAAP to Non-GAAP Financial Measures 13

4Q23 3Q23 2Q23 1Q23 4Q22 3Q22 2Q22 1Q22 4Q21 Tangible Common Equity (TCE)/Tangible Assets (non-GAAP) Total shareholders' equity $1,283,445 $1,223,532 $1,212,853 $1,227,795 $1,184,659 Less: goodwill and other intangible assets, net of deferred tax liability (376,631) (376,883) (377,144) (377,405) (377,673) Tangible common equity (non-GAAP) $906,814 $846,649 $835,709 $850,390 $806,986 Total assets $9,551,526 $9,466,077 $9,252,922 $9,193,442 $9,110,567 Less: goodwill and other intangible assets, net of deferred tax liability (376,631) (376,883) (377,144) (377,405) (377,673) Tangible assets (non-GAAP) $9,174,895 $9,089,194 $8,875,778 $8,816,037 $8,732,894 Tangible common equity to tangible assets (non-GAAP) 9.88 % 9.31 % 9.42 % 9.65 % 9.24 % Tangible common equity to tangible assets is a preferred industry measurement to evaluate capital adequacy. Efficiency Ratio (non-GAAP) Noninterest expense $56,203 $52,799 $49,633 $51,699 $51,275 Net interest income per consolidated statements of net income $85,109 $87,387 $88,123 $88,791 $89,058 Plus: taxable equivalent adjustment 683 674 639 555 532 Net interest income (FTE) (non-GAAP) 85,792 88,061 88,762 89,346 89,590 Noninterest income 18,061 12,178 14,191 13,190 15,643 Net interest income (FTE) (non-GAAP) plus noninterest income $103,853 $100,239 $102,953 $102,536 $105,233 Efficiency ratio (non-GAAP) 54.12 % 52.67 % 48.21 % 50.42 % 48.73 % The efficiency ratio is noninterest divided by noninterest income plus net interest income, on an FTE basis (non-GAAP), which ensures comparability of net interest income arising from both taxable and tax- exempt sources and is consistent with industry practice. Net Interest Margin Rate (NIM) (FTE) (non-GAAP) Interest income and dividend income $126,706 $122,959 $117,333 $110,903 $103,208 $89,835 $77,599 $70,109 $71,135 Less: interest expense (41,597) (35,572) (29,210) (22,112) (14,150) (6,037) (2,405) (2,376) (2,697) Net interest income per consolidated statements of net income 85,109 87,387 88,123 88,791 89,058 83,798 75,194 67,733 68,438 Plus: taxable equivalent adjustment 683 674 639 555 532 521 506 493 510 Net interest income (FTE) (non-GAAP) $85,792 $88,061 $88,762 $89,346 $89,590 $84,319 $75,700 $68,226 $68,948 Net interest income (FTE) (annualized) $340,370 $349,373 $356,022 $362,348 $355,438 $334,526 $303,633 $276,694 $273,537 Average interest-earning assets $8,704,727 $8,561,578 $8,436,490 $8,372,193 $8,220,689 $8,287,889 $8,535,384 $8,747,398 $8,768,329 Net interest margin (FTE) (non-GAAP) 3.92 % 4.09 % 4.22 % 4.32 % 4.33 % 4.04 % 3.56 % 3.16 % 3.12 % The interest income on interest-earning assets, net interest income and net interest margin are presented on an FTE basis (non-GAAP). The FTE basis (non-GAAP) adjusts for the tax benefit of income on certain tax-exempt loans and securities and the dividend-received deduction for equity securities using the federal statutory tax rate of 21 percent for each period. We believe this to be the preferred industry measurement of net interest income that provides a relevant comparison between taxable and non-taxable sources of interest income. Appendix Definitions of GAAP to Non-GAAP Financial Measures 14

Fourth Quarter 2023 Earnings Supplement

| | | | | | | | |

INVESTOR CONTACT: Mark Kochvar S&T Bancorp, Inc. Chief Financial Officer 724.465.4826 mark.kochvar@stbank.com

| | |

FOR IMMEDIATE RELEASE

S&T Bancorp, Inc. Declares Dividend