0001910851falseR1 RCM Inc. /DE00019108512023-11-152023-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________

FORM 8-K

________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 15, 2023

____________

R1 RCM Inc.

(Exact Name of Registrant as Specified in Charter)

____________

| | | | | | | | |

| Delaware | 001-41428 | 87-4340782 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

| | | | | |

| 433 W. Ascension Way | 84123 |

| Suite 200 |

| Murray |

| Utah |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.01 per share | RCM | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing

As anticipated, on November 15, 2023, R1 RCM Inc. (the “Company”) received a letter from Nasdaq’s Listing Qualifications Department indicating that, as a result of the Company’s delay in filing its Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2023 (the “Form 10-Q”), the Company no longer complies with the continued listing requirements under Nasdaq Listing Rule 5250(c)(1), which requires Nasdaq-listed companies to timely file all periodic reports with the Securities and Exchange Commission (the “Commission”).

On November 13, 2023, the Company filed with the Commission a Notification of Late Filing on Form 12b-25 with respect to the Form 10-Q as a result of its determination to restate certain of its previously issued financial statements.

The Nasdaq notice has no immediate effect on the listing of the Company’s common stock. The Nasdaq notice states that the Company is required to submit a plan to regain compliance with Nasdaq’s filing requirements for continued listing within 60 calendar days of the date of the notice. Upon acceptance of the Company’s compliance plan, Nasdaq is permitted to grant an extension of up to 180 days from the Form 10-Q’s filing due date for the Company to regain compliance with Nasdaq’s filing requirements for continued listing.

The Company intends to file the Form 10-Q with the Commission as soon as practicable.

Item 7.01 Regulation FD Disclosure

On November 17, 2023, the Company issued a press release disclosing receipt of the Nasdaq notice. A copy of the press release is furnished herewith as Exhibit 99.1.

The information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Forward-Looking Statements

This Current Report on Form 8-K and Exhibit 99.1 contain “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended and Section 21E of the Exchange Act. Forward-looking statements generally relate to future events, including among other things statements regarding the Company’s intent to restate its prior consolidated financial statements for the applicable non-reliance periods, the estimated impact of adjustments to the financial statements for the applicable non-reliance periods, the impact of the Company’s material weakness in internal control over financial reporting and the Company’s disclosure controls and procedures on its financial statements and other public disclosures, the anticipated timing for filing the Company’s restated reports and the Form 10-Q for the third quarter of 2023 and related matters. These statements are often identified by the use of words such as “anticipate,” “believe,” “contemplate,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “see,” “seek,” “target,” “would” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this Current Report on Form 8-K, and on the current expectations of the Company’s management and are not predictions of actual performance. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks and changes in circumstances, including but not limited to risk and uncertainties related to: (i) the Company’s failure to promptly restate the financial statements for the applicable non-reliance periods and file the required reports with the Commission, (ii) the impact of the restatements of the financial statements for the applicable non-reliance periods, and the notice from Nasdaq, on the price of the Company’s common stock, the Company’s reputation, the Company’s relationships with its investors, suppliers, customers, employees and other parties and (iii) the Company’s ability to regain compliance with Nasdaq’s timely filing requirements for continued listing within the applicable cure period. Additional risks and uncertainties that could cause actual outcomes and results to differ

materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 31, 2022 and any other periodic reports that the Company may file with the Commission. Subsequent events and developments, including actual results or changes in the Company’s assumptions, may cause the Company’s views to change. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | |

| (d) | Exhibit Number | Description |

| | |

| 104 | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | R1 RCM INC. |

| | | |

| Date: November 17, 2023 | | |

| | | |

| | By: /s/ Jennifer Williams |

| | Name: Jennifer Williams |

| | Title: Chief Financial Officer |

R1 RCM Receives Notice of Filing Delinquency from Nasdaq

MURRAY, UT – November 17, 2023 -- R1 RCM Inc. (NASDAQ: RCM), a leading provider of technology-driven solutions that transform the patient experience and financial performance of healthcare providers, today announced that, as anticipated, it received a letter from Nasdaq’s Listing Qualifications Department indicating that, as a result of the Company’s delay in filing its Quarterly Report on Form 10-Q for the three and nine months ended September 30, 2023 (the “Form 10-Q”), the Company no longer complies with the continued listing requirements under Nasdaq Listing Rule 5250(c)(1), which requires Nasdaq-listed companies to timely file all periodic reports with the Securities and Exchange Commission (the “Commission”). On November 13, 2023, the Company filed with the Commission a Notification of Late Filing on Form 12b-25 with respect to the Form 10-Q as a result of its determination to restate certain of its previously issued financial statements.

The Nasdaq notice has no immediate effect on the listing of the Company’s common stock. The Nasdaq notice states that the Company is required to submit a plan to regain compliance with Nasdaq’s filing requirements for continued listing within 60 calendar days of the date of the notice. Upon acceptance of the Company’s compliance plan, Nasdaq is permitted to grant an extension of up to 180 days from the Form 10-Q’s filing due date for the Company to regain compliance with Nasdaq’s filing requirements for continued listing.

The Company intends to file the Form 10-Q with the Commission as soon as practicable.

Forward-Looking Statements

This press release contains “forward-looking statements” made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended and Section 21E of the Exchange Act. Forward-looking statements generally relate to future events, including among other things statements regarding the Company’s intent to restate its prior consolidated financial statements for the applicable non-reliance periods, the estimated impact of adjustments to the financial statements for the applicable non-reliance periods, the impact of the Company’s material weakness in internal control over financial reporting and the Company’s disclosure controls and procedures on its financial statements and other public disclosures, the anticipated timing for filing the Company’s restated reports and the Form 10-Q for the third quarter of 2023 and related matters. These statements are often identified by the use of words such as “anticipate,” “believe,” “contemplate,” “designed,” “estimate,” “expect,” “forecast,” “goal,” “intend,” “may,” “outlook,” “plan,” “predict,” “project,” “see,” “seek,” “target,” “would” and similar expressions or variations or negatives of these words, although not all forward-looking statements contain these identifying words. These statements are based on various assumptions, whether or not identified in this press release, and on the current expectations of the Company’s management and are not predictions of actual performance. Actual outcomes and results may differ materially from those contemplated by these forward-looking statements as a result of uncertainties, risks and changes in circumstances, including but not limited to risk and uncertainties related to: (i) the Company’s failure to promptly restate the financial statements for the applicable non-reliance periods and file the required reports with the Commission, (ii) the impact of the restatements of the financial statements for the applicable non-reliance periods, and the notice from Nasdaq, on the price of the Company’s common stock, the Company’s reputation, the Company’s relationships with its investors, suppliers, customers, employees and other parties and (iii) the Company’s ability to regain compliance with Nasdaq’s timely filing requirements for continued listing within the applicable cure period. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the heading “Risk Factors” in the Company’s annual report on Form 10-K for the year ended December 31, 2022 and any other periodic reports that the Company may file with the Commission. Subsequent events and developments, including actual results or changes in the Company’s assumptions, may cause the Company’s views to

change. The Company assumes no obligation and does not intend to update these forward-looking statements, except as required by law. You are cautioned not to place undue reliance on such forward-looking statements.

About R1 RCM

R1 is a leading provider of technology-driven solutions that transform the patient experience and financial performance of hospitals, health systems, and medical groups. R1’s proven and scalable operating models seamlessly complement a healthcare organization’s infrastructure, quickly driving sustainable improvements to net patient revenue and cash flows while reducing operating costs and enhancing the patient experience. To learn more, visit: r1rcm.com.

Contact:

R1 RCM Inc.

Investor Relations:

Evan Smith, CFA

516.743.5184

investorrelations@r1rcm.com

Media Relations:

Allison + Partners

Amanda Critelli

R1PR@allisonpr.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

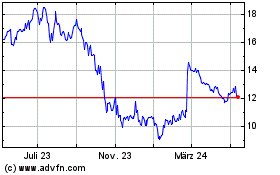

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

Von Apr 2023 bis Apr 2024