false

0001604821

0001604821

2024-02-28

2024-02-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 28, 2024

Natera, Inc.

(Exact name of registrant as specified

in its charter)

| Delaware |

|

001-37478 |

|

01-0894487 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

13011 McCallen Pass

Building A Suite 100

Austin, TX 78753

(Address of principal executive offices,

including zip code)

(650)

980 9190

(Registrant’s telephone number,

including area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the

Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share |

|

NTRA |

|

Nasdaq Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 2.02. |

Results of Operations and Financial Condition. |

On February 28, 2024, Natera, Inc. issued a press release

announcing the results for its fourth quarter and year ended December 31, 2023 and provided a related investor presentation. A copy

of the press release and a copy of the investor presentation are furnished herewith as Exhibit 99.1 and Exhibit 99.2, respectively,

to this Current Report on Form 8-K and are incorporated herein by reference.

The information in this Current Report on Form 8-K and the accompanying

Exhibit 99.1 and Exhibit 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation

language in such filing, unless expressly incorporated by reference in such filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

Natera, Inc. |

| |

|

| |

By: |

/s/ Michael Brophy |

| |

|

Michael Brophy |

| |

|

Chief Financial Officer (Principal Financial and

Accounting Officer) |

| Dated: February 28, 2024 |

|

Exhibit 99.1

Natera Reports Fourth Quarter and Full Year 2023 Financial Results

AUSTIN, Texas, February 28, 2024 /PRNewswire/ — Natera, Inc.

(NASDAQ: NTRA), a global leader in cell-free DNA testing, today reported its financial

results for the fourth quarter and year ended December 31, 2023.

Recent Strategic and Financial Highlights

| ● | Generated total revenues of $311.1 million in the fourth quarter of 2023, compared to $217.3 million in

the fourth quarter of 2022, an increase of 43.2%. Product revenues grew 44.3% over the same period. |

| ● | Generated total revenues of $1,082.6 million in the full year 2023 compared to $820.2 million in 2022,

an increase of 32.0%. Product revenues grew 34.0% over the same period. |

| | ● | Generated gross margins of 51.4% in the fourth quarter of 2023, compared to gross margins of 41.4% in the fourth quarter of 2022. |

| ● | Processed approximately 2,496,100 tests in the full year 2023, compared to approximately 2,066,500 tests

in 2022, an increase of 20.8%. |

| ● | Performed approximately 97,500 oncology tests in the fourth quarter of 2023, compared to approximately

64,000 in the fourth quarter of 2022, an increase of 52.3%. |

| ● | Performed approximately 340,700 oncology tests in the full year 2023, compared to approximately 196,400

in 2022, an increase of 73.5%. |

| ● | Guiding 2024 total revenue of $1.32 billion-$1.35 billion, gross margin of 50% to 53%, and reiterating

expectations to achieve a cash flow breakeven quarter in 2024. |

| ● | Acquired Invitae’s reproductive health assets. |

| ● | Received Medicare Coverage for Signatera in two new indications, ovarian cancer and neoadjuvant breast

cancer. |

“We are really pleased with our performance

in the quarter and with the continued positive impact we make on patient care,” said Steve Chapman, chief executive officer of Natera.

“We believe we are in an excellent position to continue this momentum into 2024.”

Fourth Quarter and Year Ended December 31, 2023 Financial Results

Total revenues were $311.1 million in the fourth

quarter of 2023 compared to $217.3 million in the fourth quarter of 2022, an increase of 43.2%. The increase in total revenues was driven

primarily by a 44.3% increase in product revenues, which were $307.3 million in the fourth quarter of 2023 compared to $212.9 million

in the fourth quarter of 2022. The increase in product revenues was driven by average selling price improvements as well as an increase

in test volumes. Natera processed approximately 626,800 tests in the fourth quarter of 2023, including approximately 610,100 tests accessioned

in its laboratory, compared to approximately 559,700 tests processed, including approximately 543,900 tests accessioned in its laboratory,

in the fourth quarter of 2022.

In the fourth quarter of 2023, Natera recognized

revenue on approximately 619,800 tests for which results were reported to customers in the period (tests reported), including approximately

604,200 tests reported from its laboratory, compared to approximately 519,200 tests reported, including approximately 504,500 tests reported

from its laboratory, in the fourth quarter of 2022, an overall increase of 19.4% from the prior period.

Total revenues in 2023 were approximately $1,082.6

million compared to $820.2 million in 2022, which represents an increase of 32.0%. The increase in total revenues was driven primarily

by a 34.0% increase in product revenues, which were $1,068.5 million in the full year 2023 compared to $797.3 million in 2022. The increase

in product revenues was driven by an increase in test volumes as well as average selling price improvements compared to 2022. For the

full year 2023, Natera processed approximately 2,496,100 tests, including approximately 2,426,500 tests accessioned in its laboratory,

compared to approximately 2,066,500 tests processed in 2022, including approximately 2,004,000 tests accessioned in its laboratory.

For the full year 2023, Natera recognized revenue

on approximately 2,388,200 tests reported, including approximately 2,323,400 tests reported from its laboratory, compared to approximately

1,919,600 tests reported, including approximately 1,861,000 tests reported from its laboratory, in 2022, an overall increase of 24.4%.

Gross profit* for the three months ended December 31,

2023 and 2022 was $159.9 million and $90.0 million, respectively, representing a gross margin of 51.4% and 41.4%, respectively. Gross

profit for the year ended December 31, 2023 and 2022 was $492.7 million and $364.0 million, respectively, representing a gross margin

of 45.5% and 44.4%, respectively. Natera had higher gross margin in the fourth quarter of 2023 and for the full year 2023 primarily as

a result of higher revenues and continuous progress in reducing cost of goods sold associated with tests processed. Total operating expenses,

representing research and development expenses and selling, general and administrative expenses, for the fourth quarter of 2023 were $244.4

million, compared to $231.7 million in the same period of the prior year, an increase of 5.5%. Total operating expenses for the full year

2023 were $939.0 million, compared to $905.0 million in 2022, an increase of 3.8%. The increases for both periods were primarily driven

by headcount growth to support new product offerings.

Loss from operations for the fourth quarter of

2023 was $84.5 million compared to $141.8 million for the same period of the prior year. Loss from operations for the full year 2023 was

$446.2 million compared to $541.0 million in 2022.

Natera reported a net loss for the fourth quarter

of 2023 of $78.0 million, or ($0.65) per diluted share, compared to a net loss of $142.6 million, or ($1.37) per diluted share, for the

same period in 2022. Weighted average shares outstanding were approximately 119.3 million in the fourth quarter of 2023 compared to 104.3

million in the fourth quarter of the prior year. Natera’s net loss for the full year 2023 was $434.8 million, or ($3.78) per diluted

share, compared to a net loss of $547.8 million, or ($5.57) per diluted share, in 2022. Weighted average shares outstanding were 115.0

million in 2023 compared to 98.4 million in 2022.

At December 31, 2023, Natera held approximately

$879.0 million in cash, cash equivalents, short-term investments and restricted cash, compared to $898.4 million as of December 31,

2022. As of December 31, 2023, Natera had a total outstanding debt balance of $363.3 million, comprised of $80.4 million including

accrued interest under its line of credit with UBS at a variable interest rate of 30-day SOFR plus 50 bps and a net carrying amount of

$282.9 million under its seven-year convertible senior notes issued in April 2020. The gross principal balance outstanding for the

convertible senior notes was $287.5 million as of December 31, 2023.

Financial Outlook

Natera anticipates 2024 total revenue of $1.32

billion to $1.35 billion; 2024 gross margin to be approximately 50% to 53% of revenues; selling, general and administrative costs to be

approximately $630 million to $650 million; research and development costs to be $325 million to $345 million, and net cash consumption

to be $50 million to $75 million**.

* Gross profit is calculated as GAAP total revenues

less GAAP cost of revenues. Gross margin is calculated as gross profit divided by GAAP total revenues.

** Cash consumption is calculated as the sum of

GAAP net cash used by operating activities (estimated for 2024 to be up to $25 million) and GAAP net purchases of property and equipment

(estimated for 2024 to be up to $50 million).

Test Volume Summary

| Unit | |

Q4 2023 | | |

Q4 2022 | | |

FY 2023 | | |

FY 2022 | | |

Definition |

| Tests processed | |

| 626,800 | | |

| 559,700 | | |

| 2,496,100 | | |

| 2,066,500 | | |

Tests accessioned in our laboratory plus units processed outside of our laboratory |

| Tests accessioned | |

| 610,100 | | |

| 543,900 | | |

| 2,426,500 | | |

| 2,004,000 | | |

Test accessioned in our laboratory |

| Tests reported in our laboratory | |

| 604,200 | | |

| 504,500 | | |

| 2,323,400 | | |

| 1,861,000 | | |

Total tests reported in our laboratory less units reported outside of our laboratory |

| Tests reported | |

| 619,800 | | |

| 519,200 | | |

| 2,388,200 | | |

| 1,919,600 | | |

Total tests reported |

About Natera

Natera™

is a global leader in cell-free DNA testing, dedicated to oncology, women’s health, and organ health. We aim to make personalized

genetic testing and diagnostics part of the standard of care to protect health and enable earlier, more targeted interventions that help

lead to longer, healthier lives. Natera’s tests are validated by more than 150 peer-reviewed publications that demonstrate high

accuracy. Natera operates ISO 13485-certified and CAP-accredited laboratories certified under the Clinical Laboratory Improvement Amendments

(CLIA) in Austin, Texas and San Carlos, California. For more information, visit www.natera.com.

Conference Call Information

| Event: |

Natera's Fourth Quarter and Full Year 2023 Financial Results Conference

Call |

| Date: |

Wednesday, February 28, 2024 |

| Time: |

1:30 p.m. PT (4:30 p.m. ET) |

| Live Dial-In: |

(888) 770-7321, Domestic |

| |

(929) 201-7107, International |

| Conference ID: |

7684785 |

| |

|

| Webcast Link: |

https://events.q4inc.com/attendee/656023681 |

Forward-Looking Statements

This press release contains forward-looking statements

under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts, including

the company’s financial guidance for fiscal 2024, its market opportunity, anticipated products and launch schedules, reimbursement

coverage and product costs, commercial and strategic partnerships and acquisitions, user experience, clinical trials and studies, and

its strategies, goals and general business and market conditions, are forward-looking statements. Any forward-looking statements contained

in this press release are based upon Natera’s current plans, estimates, and expectations, as of the date of this release, and are

not a representation that such plans, estimates, or expectations will be achieved.

These forward-looking statements are subject to

known and unknown risks and uncertainties that may cause actual results to differ materially, including: we face numerous uncertainties

and challenges in achieving our financial projections and goals; we may be unable to further increase the use and adoption of our products

through our direct sales efforts or through our laboratory partners; we have incurred losses since our inception and we anticipate that

we will continue to incur losses for the foreseeable future; our quarterly results may fluctuate from period to period; our estimates

of market opportunity and forecasts of market growth may prove to be inaccurate; we may be unable to compete successfully with existing

or future products or services offered by our competitors; we may engage in acquisitions, dispositions or other strategic transactions

that may not achieve our anticipated benefits and could otherwise disrupt our business, cause dilution to our stockholders or reduce our

financial resources; we may not be successful in commercializing our cloud-based distribution model; our products may not perform as expected;

the results of our clinical studies, including our SNP-based Microdeletion and Aneuploidy Registry, or SMART, Study, may not be compelling

to professional societies or payors as supporting the use of our tests, particularly for microdeletions screening, or may not be able

to be replicated in later studies required for regulatory approvals or clearances; if either of our primary CLIA-certified laboratories

becomes inoperable, we will be unable to perform our tests and our business will be harmed; we rely on a limited number of suppliers or,

in some cases, single suppliers, for some of our laboratory instruments and materials and may not be able to find replacements or immediately

transition to alternative suppliers; if we are unable to successfully scale our operations, our business could suffer; the marketing,

sale, and use of Panorama and our other products could result in substantial damages arising from product liability or professional liability

claims that exceed our resources; we may be unable to expand, obtain or maintain third-party payer coverage and reimbursement for our

tests, and we may be required to refund reimbursements already received; third-party payers may withdraw coverage or provide lower levels

of reimbursement due to changing policies, billing complexities or other factors; if the FDA were to begin actively regulating our tests,

we could incur substantial costs and delays associated with trying to obtain premarket clearance or approval and incur costs associated

with complying with post-market controls; litigation or other proceedings, resulting from either third party claims of intellectual property

infringement or third party infringement of our technology, is costly, time- consuming and could limit our ability to commercialize our

products or services; any inability to effectively protect our proprietary technology could harm our competitive position or our brand;

and we cannot guarantee that we will be able to service and comply with our outstanding debt obligations or achieve our expectations regarding

the conversion of our outstanding convertible notes.

Additional risks and uncertainties that could

affect our financial results are included under the captions, "Risk Factors" and "Management’s Discussion and Analysis

of Financial Condition and Results of Operations" in our most recent filings on Forms 10-K and 10-Q and in other filings that we

make with the SEC from time to time. These documents are available on our website at www.natera.com under the Investor Relations section

and on the SEC’s website at www.sec.gov.

In light of the significant uncertainties in these

forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will

achieve our objectives and plans in any specified time frame, or at all. Natera assumes no obligation to, and does not currently intend

to, update any such forward-looking statements after the date of this release.

Contacts

Natera, Inc.

Investor

Relations

Mike Brophy, CFO, Natera, Inc., 510-826-2350

Media

Lesley Bogdanow, VP of Corporate Communications, Natera, Inc., pr@natera.com

Natera, Inc.

Consolidated Balance

Sheets

(Unaudited)

(in thousands,

except shares)

| | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | |

| | |

| | |

(1) | |

| Assets | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash,

cash equivalents and restricted cash | |

$ | 642,095 | | |

$ | 466,091 | |

| Short-term

investments | |

| 236,882 | | |

| 432,301 | |

| Accounts

receivable, net of allowance of $6,481 in 2023 and $3,830 in 2022 | |

| 278,289 | | |

| 244,385 | |

| Inventory | |

| 40,759 | | |

| 35,406 | |

| Prepaid expenses and other current assets,

net | |

| 60,524 | | |

| 33,634 | |

| Total current

assets | |

| 1,258,549 | | |

| 1,211,817 | |

| Property and equipment, net | |

| 111,210 | | |

| 92,453 | |

| Operating lease right-of-use

assets | |

| 56,537 | | |

| 71,874 | |

| Other assets | |

| 15,403 | | |

| 18,330 | |

| Total

assets | |

$ | 1,441,699 | | |

$ | 1,394,474 | |

| | |

| | | |

| | |

| Liabilities and Stockholders’

Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 14,998 | | |

$ | 31,148 | |

| Accrued

compensation | |

| 45,857 | | |

| 44,010 | |

| Other accrued

liabilities | |

| 149,405 | | |

| 144,214 | |

| Deferred

revenue, current portion | |

| 16,612 | | |

| 10,777 | |

| Short-term

debt financing | |

| 80,402 | | |

| 80,350 | |

| Total current

liabilities | |

| 307,274 | | |

| 310,499 | |

| Long-term

debt financing | |

| 282,945 | | |

| 281,653 | |

| Deferred

revenue, long-term portion | |

| 19,128 | | |

| 20,001 | |

| Operating

lease liabilities, long-term portion | |

| 67,025 | | |

| 76,577 | |

| Total liabilities | |

| 676,372 | | |

| 688,730 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Common

stock (2) | |

| 11 | | |

| 11 | |

| Additional paid in capital | |

| 3,145,837 | | |

| 2,664,730 | |

| Accumulated deficit | |

| (2,377,436 | ) | |

| (1,942,635 | ) |

| Accumulated other comprehensive loss | |

| (3,085 | ) | |

| (16,362 | ) |

| Total stockholders’ equity | |

| 765,327 | | |

| 705,744 | |

| Total

liabilities and stockholders’ equity | |

$ | 1,441,699 | | |

$ | 1,394,474 | |

| (1) | The consolidated

balance sheet at December 31, 2022 has been derived from the audited consolidated financial

statements at that date included in the Company’s Annual Report on Form 10-K for

the year ended December 31, 2022. |

| (2) | As of December 31,

2023 and 2022, there were approximately 119,581,000 and 111,255,000 shares of common stock

issued and outstanding, respectively. |

Natera, Inc.

Consolidated Statements

of Operations and Comprehensive Loss

(Unaudited)

(in thousands,

except per share data)

| | |

Year ended

December 31, | |

| | |

2023 | | |

2022 | | |

2021 | |

| Revenues | |

| | | |

| | | |

| | |

| Product

revenues | |

$ | 1,068,522 | | |

$ | 797,307 | | |

$ | 580,080 | |

| Licensing

and other revenues | |

| 14,049 | | |

| 22,915 | | |

| 45,406 | |

| Total revenues | |

| 1,082,571 | | |

| 820,222 | | |

| 625,486 | |

| Cost and expenses | |

| | | |

| | | |

| | |

| Cost of product

revenues | |

| 588,564 | | |

| 453,632 | | |

| 315,195 | |

| Cost of licensing

and other revenues | |

| 1,267 | | |

| 2,624 | | |

| 3,223 | |

| Research

and development | |

| 320,678 | | |

| 316,415 | | |

| 264,208 | |

| Selling,

general and administrative | |

| 618,307 | | |

| 588,591 | | |

| 511,034 | |

| Total

cost and expenses | |

| 1,528,816 | | |

| 1,361,262 | | |

| 1,093,660 | |

| Loss from operations | |

| (446,245 | ) | |

| (541,040 | ) | |

| (468,174 | ) |

| Interest expense | |

| (12,638 | ) | |

| (9,319 | ) | |

| (8,305 | ) |

| Interest

and other income, net | |

| 24,353 | | |

| 3,538 | | |

| 5,381 | |

| Loss before income taxes | |

| (434,530 | ) | |

| (546,821 | ) | |

| (471,098 | ) |

| Income tax

expense | |

| (271 | ) | |

| (978 | ) | |

| (618 | ) |

| Net

loss | |

$ | (434,801 | ) | |

$ | (547,799 | ) | |

$ | (471,716 | ) |

| Unrealized

gain (loss) on available-for-sale securities, net of tax | |

| 13,277 | | |

| (14,075 | ) | |

| (6,546 | ) |

| Comprehensive

loss | |

$ | (421,524 | ) | |

$ | (561,874 | ) | |

$ | (478,262 | ) |

| | |

| | | |

| | | |

| | |

| Net loss per share: | |

| | | |

| | | |

| | |

| Basic

and diluted | |

$ | (3.78 | ) | |

$ | (5.57 | ) | |

$ | (5.21 | ) |

| | |

| | | |

| | | |

| | |

| Weighted-average number of shares

used in computing basic and diluted net loss per share: | |

| | | |

| | | |

| | |

| Basic

and diluted | |

| 114,997 | | |

| 98,408 | | |

| 90,558 | |

Exhibit 99.2

Natera, Inc. Investor presentation Q4 and Full Year 2023 Earnings Call February 28, 2024

Not for reproduction or further distribution. This presentation contains forward - looking statements under the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this presentation, including statements regarding our market opportunity, our anticipated products and launch schedules, our reimb urs ement coverage and our product costs, our commercial and strategic partnerships and potential acquisitions, our user experience, our clinical trials and studies, and our strategies, goals and gen eral business and market conditions are forward - looking statements. These forward - looking statements are subject to known and unknown risks and uncertainties that may cause actual results to diffe r materially, including: we face numerous uncertainties and challenges in achieving our financial projections and goals; we may be unable to further increase the use and adoption of our products thro ugh our direct sales efforts or through our laboratory partners; we have incurred losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future; our quarterly res ults may fluctuate from period to period; our estimates of market opportunity and forecasts of market growth may prove to be inaccurate; we may be unable to compete successfully with existing or future produ cts or services offered by our competitors; we may engage in acquisitions, dispositions or other strategic transactions that may not achieve our anticipated benefits and could otherwise disrupt our bu sin ess, cause dilution to our stockholders or reduce our financial resources; we may not be successful in commercializing our cloud - based distribution model; our products may not perform as expected; the results o f our clinical studies, including our SNP - based Microdeletion and Aneuploidy Registry, or SMART, Study, may not be compelling to professional societies or payors as supporting the use of our tests, part icu larly for microdeletions screening, or may not be able to be replicated in later studies required for regulatory approvals or clearances; if either of our primary CLIA - certified laboratories becomes inoperable , we will be unable to perform our tests and our business will be harmed; we rely on a limited number of suppliers or, in some cases, single suppliers, for some of our laboratory instruments and materials and m ay not be able to find replacements or immediately transition to alternative suppliers; if we are unable to successfully scale our operations, our business could suffer; the marketing, sale, and use of Panorama an d o ur other products could result in substantial damages arising from product liability or professional liability claims that exceed our resources; we may be unable to expand, obtain or maintain third - party payer covera ge and reimbursement for our tests, and we may be required to refund reimbursements already received; third - party payers may withdraw coverage or provide lower levels of reimbursement due to changi ng policies, billing complexities or other factors; if the FDA were to begin actively regulating our tests, we could incur substantial costs and delays associated with trying to obtain premarket clearan ce or approval and incur costs associated with complying with post - market controls; litigation or other proceedings, resulting from either third party claims of intellectual property infringement or third part y i nfringement of our technology, is costly, time - consuming and could limit our ability to commercialize our products or services; any inability to effectively protect our proprietary technology could harm our compet iti ve position or our brand; and we cannot guarantee that we will be able to service and comply with our outstanding debt obligations or achieve our expectations regarding the conversion of our outstanding conv ert ible notes. We discuss these and other risks and uncertainties in greater detail in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operatio ns” in our periodic reports on Forms 10 - K and 10 - Q and in other filings we make with the SEC from time to time. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from ti me to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause a ctu al results to differ materially from those contained in any forward - looking statement. In light of these risks, uncertainties and assumptions, the forward - looking events and circumstances discussed in thi s presentation may not occur and our actual results could differ materially and adversely from those anticipated or implied. As a result, you should not place undue reliance on our forward - looking statements. Except as required by law, we undertake no obligation to update publicly any forward - looking statements for any reason after the date of this presentation to conform these statements to actual results or t o changes in our expectations. We file reports, proxy statements, and other information with the SEC. Such reports, proxy statements, and other information concerning us is available at http://www.sec. gov . Requests for copies of such documents should be directed to our Investor Relations department at Natera , Inc., 13011 McCallen Pass, Building A Suite 100, Austin, TX 78753. Our telephone number is (650) 980 - 9190. 2 Safe harbor statement

Not for reproduction or further distribution. 3 FY 2023 and recent strategic highlights Strong financial performance Strategic highlights & key updates • Acquisition of Invitae’s reproductive health assets; expansion of offering in broad panel screening. • Continued progress in organ health, including completion of enrollment of major clinical trials. • Expanded Medicare coverage of Signatera TM to ovarian cancer and neoadjuvant breast cancer. • New Signatera data/trials in colorectal cancer, breast cancer, bladder cancer and other indications. • Significant legal wins demonstrate strength and breadth of Natera’s IP. • Q4 2023 total revenue of $311M vs $300M preannouncement, representing 43% year - over - year growth. Full - year 2023 total revenue of $1.08B. • 2.496M total tests processed in 2023, ~6K more than preannouncement. • Performed ~341K oncology tests in 2023, representing 73.5% year - over - year growth. Q4 23 oncology units were 98K, up ~9K over Q3 2023. • Q4 2023 gross margin of 51.4%, compared to 39.9% in Q1 2023. 2023 full year gross margin of 45.5%; ahead of prior estimates. • Reduced cash burn by ~$193M in 2023 vs. 2022. • 2024 guidance: ─ Total revenue of $1.32B to $1.35B ─ Gross margin of 50% to 53% ─ Cash burn of $50M to $75M; breakeven quarter by Q3 2024 or sooner

Not for reproduction or further distribution. $67M $83M $112M $173M $217M ~ $311M Q4'18 Q4'19 Q4'20 Q4'21 Q4'22 Q4'23 4 Q4 revenues ~$11M above Jan. preannouncement Total revenues: year on year trend ($ in millions) • Strong growth across all business units • Signatera continues to ramp • Significant ASP momentum

Not for reproduction or further distribution. 5 Continued volume momentum in FY2023 ~6k units ahead of Jan. preannouncement • Robust volume growth across all business areas • Strong momentum heading into 2024 • Focus on sustainable growth in Women’s Health driving ASPs, gross margins 668K 804K 1,027K 1,570K 2,066K 2,496K K 500K 1,000K 1,500K 2,000K 2,500K 3,000K 2018 2019 2020 2021 2022 2023 Tests processed: year - on - year trend

Not for reproduction or further distribution. 6 Signatera continues to ramp • 9K+ clinical unit growth in Q4 2023 over Q3 2023 • ~40% of US oncologists ordered Signatera in the quarter with continued increases in new accounts • Surpassed ~$1,000+ ASP in Q4 3K 6K 28K 64K 98K K 20K 40K 60K 80K 100K 120K Q4'19 Q4'20 Q4'21 Q4'22 Q4'23 Total oncology unit volumes

Not for reproduction or further distribution. 41% 39% 45% 45% 51% Q4 '22 Q1'23 Q2'23 Q3'23 Q4'23 7 • Significant sequential step up in Signatera ASPs • Cash collections accelerating • Continued momentum in COGS projects ASPs and COGS execution driving organic gross margin gains Volume - based initiatives impacting margin Organic: ASP, COGS trends ahead of plan One - time benefits lifting margin Gross margins quarterly trend 49% organic margin : ASP growth, continued COGS improvements ~2% one - time benefit

Not for reproduction or further distribution. 8 1. Non - GAAP cash burn included $13.4 million change in unrealized loss and amortization or accretion on investments during the firs t quarter 2022. Cash burn included $3.8 million change in unrealized gain and amortization or accretion on investments during th e first quarter 2023. 2. The fourth quarter 2023 cash burn of approximately $61 million includes approximately $27 million of accelerated payments whi ch were made for significant discounts and relate to both short - term and long - term assets. 3. Non - GAAP cash burn for the quarter ended December. 31, 2023, is derived from the GAAP Statement of Cash Flows as follows: net c ash used in operating activities of $58.1 million, cash used in investing activities for purchases of property and equipment of $9.5 million, offset by cash provided in financing activities of $6.8 million. Reduced annual cash burn by ~$200M in 2023 • Executing the strategy: cash burn reduction driven by continued revenue growth, improving gross margins, and stable operating expenses • Q4 cash burn of approximately $61 million includes approximately $27 million of 2024 lab equipment and related expenditures that were prepaid in exchange for discounts • On track for a cash flow breakeven quarter in 2024 Quarterly cash burn trend ($ in millions) $162 $110 $113 $88 $86 $78 $38 $61 1Q23 2Q23 3Q22 4Q22 1Q23 2Q23 3Q23 4Q23 Includes 2 ~$27M of prepaid lab equipment and related expenditures 3 1 1 1Q22 2Q22

Not for reproduction or further distribution. 9 IP litigation update INVITAE NEOGENOMICS RAVGEN CAREDX Dec. 2023 Dec. 2023 Jan. 2024 Jan. 2024 Permanent injunction Preliminary injunction Jury verdict Jury verdict E njoining Invitae from using its personalized cancer monitoring (PCM) product with limited exceptions E njoining NeoGenomics from using its RaDaR assay with limited exceptions I n favor of Ravgen ; jury determined no willful infringement by Natera and awarded $57M in damages, far less than the $410M Ravgen was seeking I n favor of Natera ; awarded $96.3M in damages for lost profits and past royalties; seeking royalty for all ongoing and future AlloSure tests

Not for reproduction or further distribution. 10 Acquisition of NIPT & carrier screening assets from Invitae Key transaction terms: • $10 million upfront payment made to Invitae in January 2024. • Up to $42.5 million in potential milestone payments including cash and litigation - related credits. Account transitions to Panorama TM and Horizon TM progressing well. Additional catalysts for Women’s Health include potential society guideline changes and cutting - edge, product launches.

Not for reproduction or further distribution. 11 1. Dar P, Jacobsson B, Clifton R, et al. Cell - free DNA screening for prenatal detection of 22q11.2 deletion syndrome. Am J Obstet Gynecol. 2022;227(1):79.e1 - 79.e11. doi:10.1016/j.ajog.2022.01.002 Panorama screening for 22q is highly differentiated SMART trial enrolled >20,000 pregnant women, of which 87.6% had confirmed outcomes 1 Natera Test performance for 22q11.2 del • Sensitivity 83.3% (10/12), with incidence of ~1/1,500 in average risk population • The only test with validated clinical sensitivity based upon diagnostic confirmation • PPV 52.6% overall (10/19) • PPV 100% in cases w/ultrasound findings (4/4) • Targeted SNP method enables > 25X more sequence reads than MPSS in this tiny region <0.1% of the genome • Identifies nested deletions <2.5MB 1 • MPSS tests suffer from low detection rates

Not for reproduction or further distribution. 12 No. 1 ordered NGS - based carrier screen 1 with new broad panel screening options Key advantages for Horizon • Includes all ACMG - recommended genes, incl. technically challenging genes such as RPGR, AFF2, F8 and FXN • ~99% detection rate for most genes • >50 genetic counselors to support clinical interpretation • Leading UX features: − Pre & post test educational tools − EMR integration − Patient portal − Mobile phlebotomy New launches Horizon 613 Pan - ethnic comprehensive , including all 113 ACMG genes Customized panels up to 613 genes Horizon Custom 1. Internal market research and claims data analysis using Definitive Healthcare data set. Dec. 2023

Not for reproduction or further distribution. 13 Ongoing growth in organ health data generation Cumulative published/accepted papers 39 peer - reviewed papers since 2019 0 5 10 15 20 25 30 35 40 2019-2020 2021 2022 2023 JAN-FEB 2024 Total number of publications Kidney Heart Lung Renasight 4 11 24 34 39

Not for reproduction or further distribution. 14 1. Kim PJ, Olymbios M, Siu A, et al. A novel donor - derived cell - free DNA assay for the detection of acute rejection in heart transplantation. J. He art Lung Transplant. April 2022. doi:10.1016/j.healun.2022.04.002. 2. Deshpande et al. Accepted for publication in Pediatric Transplantation 2024 3. Halloran et al. Accepted for publication in Transplantation 2024 Clinical data pipeline – Prospera Ρ Heart DEDUCE 1 DTRT - 2 2 TRIFECTA Heart 3 Study Description Prospective Validation External, Prospective Longitudinal Prospective biopsy matched Patients 223 160 70 AR Reference Standard Histopathology Histopathology MMDx Overall AUC 0.86 0.8 2 0. 90 • The first randomized - controlled trial comparing standard of care endomyocardial biopsy surveillance vs. non - invasive surveillance using Prospera • Aims to show non - inferiority of the non - invasive approach with Prospera • Reducing surveillance biopsies will spare patients from an invasive and costly procedure that some centers perform up to 16x in the first year after surgery ACES (Ongoing RCT)

Not for reproduction or further distribution. 15 Clinical data pipeline – Prospera Ρ Kidney ProActive Pedal MOTR • 1,613 patients | 54 participating centers | 18 months follow up • Largest, multi - site prospective dd - cfDNA registry in kidney • 1 st paper accepted for publication, shows Prospera is a leading indicator of rejection, with up to 4 months lead time ahead of biopsy confirmation • Prospective, multi - site study • Completed enrollment of trial examining how dd - cfDNA can be leveraged to manage treatment of rejection • >500 patients enrolled from 28 sites • Prospective, multi - site study • Completed enrollment of large - scale trial to evaluate dd - cfDNA in patients with multiple transplanted organs • Kidney - heart, kidney - pancreas and kidney - liver patients

Not for reproduction or further distribution. 16 Significant first mover advantages Innovation & Intellectual Property Clinical data Market access & reimbursement Laboratory & customer experience • Cutting - edge test performance • Strong patent portfolio scoring two injunctions • New MRD products launching 2024 - 2025 • 70 peer - reviewed publications to date, in top journals • Multiple randomized trials underway to generate definitive, predictive data • Broad Medicare coverage with colorectal, bladder, breast, ovarian and pan - cancer IO • Unique ADLT status • Fast TAT, mobile phleb , portals, EMR, tissue acq • Scaled labs and processes for a complex personalized assay with multiple specimens over time

Not for reproduction or further distribution. 17 Extending data leadership in CRC BESPOKE - CRC ALTAIR INTERCEPT Patient reported outcomes MDACC prospective study Upcoming readout • 73% reported Signatera results reduced anxiety • 92% would continue using Signatera • Curative - intent treatment in 40% of recurrences • 1,140 patients observational study • 5.6 mos median DFS • 13 patients MRD - pos after chemo, received TAS - 102 • 9 .4 mos median DFS • 54% clearance at 3 mos • March 2023: l ast patient randomized • Q3 2024: expected topline results • If positive could lead to inclusion into NCCN guidelines and expanded commercial coverage Phase II TAS - 102 substudy

Not for reproduction or further distribution. 18 Bladder cancer: two large scale phase 3 studies now underway ~1,000 patient MODERN study now open, IMvigor011 readout anticipated Q12025 ahead of schedule MODERN Study Schema COHORT A Signatera (+) cohort COHORT B Signatera ( - ) cohort ARM 1 Nivolumab ARM 2 Nivolumab + Relatlimab ARM 3 Nivolumab ARM 4 Surveillance with ctDNA testing Randomization Randomization • Largest study of its kind in MIBC with both escalation and de - escalation arms • IMvigor011 ahead of schedule, ctDNA negative arm to be presented in oral session at EAU24 • If positive after readout, plan for Signatera FDA CDx submission in 2025 IMvigor011 Trial

Not for reproduction or further distribution. 19 1. American Cancer Society. Key Statistics for Ovarian Cancer. https:// www.cancer.org /cancer/types/ovarian - cancer/about/key - statistics.html 2. Hou JY, Chapman JS, Kalashnikova E, et al. Circulating tumor DNA monitoring for early recurrence detection in epithelial ovarian cancer. Gynecol Oncol. 2022;167:334 - 341. ( doi : 10.1016/j.ygyno.2022.09.004). 3. Riedel F, Hoffmann AS, Moderow M, et al. Time trends of neoadjuvant chemotherapy for early breast cancer. Int J Cancer. 2020;147(11):3049 – 3058. 4. Magbanua MJM, Swigart LB, Ahmed Z, et al. Clinical significance and biology of circulating tumor DNA in high - risk early - stage HER2 - negative breast ca ncer receiving neoadjuvant chemotherapy. Cancer Cell. 2023;41:1 - 12. New Medicare coverage in ovarian and neoadjuvant breast cancer Ovarian cancer (stage II - IV) adjuvant and surveillance Breast cancer (stage II - IV) neoadjuvant therapy monitoring • Up to 50% of newly diagnosed breast cancer patients receive neoadjuvant therapy 3 • Signatera can improve therapy response assessment, which is recommended but difficult with current tools • Validated in 283 patients (1024 time points) from the ISPY - 2 trial, showing early ctDNA clearance was highly predictive of therapy response, while ctDNA persistence was predictive of non - response and poor DRFS 4 • ~20K new diagnoses per year 1 • Signatera to help inform intensity and duration of adjuvant treatment, and detect recurrence early • Validated in 69 patients (163 time points); reported 100% longitudinal sensitivity and specificity in detecting recurrence, with avg lead time 10 months 2

Not for reproduction or further distribution. FY23 Q4 financial overview 20 1. Cash and investments also include cash equivalents and restricted cash. 2. This balance reflects net carrying value for the Convertible Senior Notes under ASC 470 - 20 while the gross principal amounts out standing is $287.5 million as of December 31, 2023. ($ in millions, except for per share data) Balance sheet Dec 31, 2023 Dec 31, 2022 Change Y/Y Cash & investments 1 $879.0 $898.4 ($19.4) UBS line of credit $80.4 $80.4 $ — Convertible senior notes 2 $282.9 $281.7 $1.2 P&L FY23 Q4 FY22 Q4 Change Y/Y Product revenues $307.3 $212.9 $94.4 Licensing and other revenues $3.8 $4.4 ($0.6) Total revenues $311.1 $217.3 $93.8 Gross margin% 51.4% 41.4% 998 bps R&D $83.0 $87.9 ($4.9) SG&A $161.4 $143.8 $17.6 Net loss per diluted share ($0.65) ($1.37) $0.72

Not for reproduction or further distribution. Guide $ (millions except gross margins) Key drivers Revenue $ 1,320 – $ 1,350 Continued volume growth across all business units, conservative women’s health ASPs, strong oncology contribution Gross margin % revenue 50 % – 53 % Conservative ASP assumptions, strong Oncology growth, completing key COGS improvement projects in 2024 for future leverage SG&A $ 630 – $ 650 Targeted investments in sales channels to capitalize on leadership position R&D $3 25 – $3 45 Stable v. 2023: continued focused investments in future COGS reduction projects, product launches, clinical trials intended to drive guideline adoption Cash burn $ 50 – $75 ~$205M reduction vs. 2023 cash burn, breakeven quarter in 2024 2024 annual guidance 21

Not for reproduction or further distribution. Upside potential with future catalysts in 2024 22 Potential Catalysts Continued execution on ASPs, COGS, volumes Guideline inclusion of Women’s Health products ALTAIR top - line results in Q3 Additional MolDx coverage for Signatera Potential uplift from biomarker states Product launches in Women’s Health and Oncology

©202 4 Natera, Inc. All Rights Reserved. Not for reproduction or further distribution. ®

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity File Number |

001-37478

|

| Entity Registrant Name |

Natera, Inc.

|

| Entity Central Index Key |

0001604821

|

| Entity Tax Identification Number |

01-0894487

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

13011 McCallen Pass

|

| Entity Address, Address Line Two |

Building A Suite 100

|

| Entity Address, City or Town |

Austin

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78753

|

| City Area Code |

650

|

| Local Phone Number |

980 9190

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

NTRA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

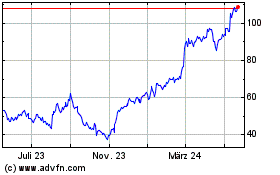

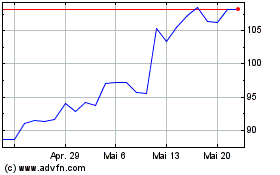

Natera (NASDAQ:NTRA)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Natera (NASDAQ:NTRA)

Historical Stock Chart

Von Apr 2023 bis Apr 2024