UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For

the month of November 2024

Commission

File No. 001-41010

MAINZ

BIOMED N.V.

(Translation

of registrant’s name into English)

Robert

Koch Strasse 50

55129 Mainz

Germany

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F

Form

20-F ☒ Form 40-F ☐

Other

Events

Results

of Extraordinary General Meeting of Shareholders

On

November 13, 2024, Mainz Biomed N.V. (the “Company”) held an Extraordinary General Meeting of Shareholders (the “Extraordinary

General Meeting”). All proposals brought before the holders of the Company’s ordinary shares at such meeting were approved.

Minutes announcing the results of the Extraordinary General Meeting are attached hereto as Exhibit 99.1.The final results of

each of the agenda items submitted to a vote by the shareholders are as follows:

At

the Extraordinary General Meeting, a total of 9,803,128 shares (or 16.83%) of the Company’s issued and outstanding shares of record

held as of October 16, 2024, the record date for the Extraordinary General Meeting, were present either in person or by proxy. At the

Extraordinary General Meeting, the following proposals were voted on and approved:

| 1. | To

authorize the amendment to the articles of association of the Company to effect a reverse stock split: |

| Votes For |

|

Votes Against |

|

Abstentions |

| 8,262,897 |

|

1,507,091 |

|

33,140 |

This

current report on Form 6-K and the exhibit hereto are hereby incorporated by reference into our registration statement on Form F-3 (no.

333-269091) as well as our registration statement on Form S-8 (no. 333-273203).

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Date: November 15, 2024 |

By: |

/s/

William J. Caragol |

| |

Name: |

William J. Caragol |

| |

Title |

Chief Financial Officer |

2

Exhibit 99.1

MINUTES of

the proceedings at the extraordinary general meeting of Mainz Biomed N.V., a public company under Dutch law, registered with

the Dutch trade register under number 82122571, held at the offices of CMS Derks Star Busman N.V., Atrium, Parnassusweg 737, 1077

DG Amsterdam, the Netherlands, on 13 November 2024 at 14.00 hours CET.

CHAIRMAN AND SECRETARY

Hans Hekland,

non-executive director of the Company, present at the meeting in person, is appointed chairman of the meeting and Hans Hekland, as chairman

of the meeting, designates Martijn van der Bie, civil law notary with CMS Derks Star Busman N.V., Dutch counsel to the Company, present

at the meeting, as secretary of the meeting, all in accordance with article 27 of the articles of association of the Company.

OPENING

The chairman

opens the meeting and records that the meeting is held in one of the places referred to in article 26.1 of the articles of association

of the company and that the meeting was otherwise convened with due observance of the applicable provisions of the articles of association

of the Company and Dutch law.

Furthermore, the chairman records that:

| (a) | the

notice of the meeting, including the agenda with explanatory notes, and all relevant ancillary

documents were made available on the website of the Company as of 15 October

2024 and filed with the US Securities and Exchange Commission on SEC Form 6-K on 15

October 2024; |

| (b) | a total of 58,140,483 ordinary shares were issued and outstanding on 16 October

2024, being the record date for the meeting; |

| (c) | 9,803,128 ordinary shares are represented at the meeting by Hans Hekland, as proxy

authorised in writing, representing 16.86% of the issued and outstanding shares; |

| (d) | each share confers the right to cast one vote at the meeting. |

Finally, the chairman records

that no persons with meeting rights have requested discussion of any matters at the meeting or submitted any resolutions for adoption

at the meeting in accordance with article 26.6 of the articles of association of the Company.

DISCUSSION OF THE AGENDA

The chairman discussed the agenda of the meeting

and records that none of the attendees has any questions or comments in respect of the items included in the agenda.

PROPOSALS AND VOTING

The chairman puts each of the voting items included

in the agenda of the meeting to the vote and records that each voting item is adopted with the requisite majority.

CLOSE

There being no further business, the chairman closes the

meeting.

ATTACHMENTS

The following documents will be attached to these minutes:

| (a) | the notice of the meeting; |

| (b) | the agenda of the meeting with explanatory notes; |

| (c) | the list of attendants of the meeting; and |

| (d) | the tabulation report of Broadridge relating to the meeting. |

SIGNED AS FOLLOWS

(signature pages follow)

(signature page to minutes)

Chairperson

(signature page to minutes)

Secretary

NOTICE OF EXTRAORDINARY

GENERAL MEETING OF MAINZ BIOMED N.V.

Notice

is given that an extraordinary general meeting of Mainz Biomed N.V., a public company under Dutch law, registered with the Dutch

trade register under number 82122571 (the “Company”), will be held at the offices of CMS Netherlands, Atrium, Parnassusweg

737, 1077 DG Amsterdam, the Netherlands, on 13 November 2024 at 14.00 hours Central European Time (the “EGM”).

Agenda

The agenda for the EGM and related

documents and further information regarding the EGM can be found on the Company’s website at https://www.mainzbiomed.com/investors. They

are also available for inspection and can be obtained free of charge at the offices of the Company.

Record Date

The Record Date for the EGM is 16

October 2024. Each share outstanding on the Record Date entitles the holder to cast one vote on each voting item at the EGM.

Shareholders of Record

Shareholders of Record are those

who are shareholders of the Company, or otherwise have voting rights or meeting rights in respect of shares in the capital of the Company,

at the Record Date and who are recorded as such in the part of the register of shareholders of the Company, including all records and

other data carriers relating thereto, kept by Transhare Corporation, the Company’s transfer agent, irrespective of any changes to the

entitlement to their shares or to their voting rights or meeting rights after the Record Date.

Beneficial Owners

Beneficial Owners are those who beneficially own shares in

the capital of the Company through a bank, broker or other nominee on the Record Date.

Attendance

A Shareholder of Record or Beneficial

Owner who wishes to attend the EGM, in person or by a proxy, must notify the Company of its intention to do so by e-mail at ir@mainzbiomed.com

no later than 18.00 hours Central European Time on 11 November 2024. The notice must contain the name and the number of shares the Shareholder

of Record or Beneficial Owner will represent at the EGM. In addition, a Shareholder of Record or Beneficial Owner who wishes to attend

the EGM by a proxy must enclose its signed proxy. A proxy can be downloaded from the website of the Company at https://www.mainzbiomed.com/investors.

A Beneficial Owner must also enclose:

| (a) | proof of its beneficial ownership of the relevant shares,

for instance a recent account statement; and |

| (b) | a signed proxy from the bank, broker or other nominee registered

in the part of the register of shareholders of the Company, including all records and other data carriers relating thereto, kept by Transhare

Corporation as the holder of the relevant shares on the Record Date, confirming that the Beneficial Owner is authorised to attend and

vote at the EGM. |

Beneficial

Owners should contact their bank, broker or other nominee to obtain such a proxy from them.

Any notice of attendance, proof

of beneficial ownership or signed proxy received after 18.00 hours Central European Time on 11 November 2024 will be disregarded. Shareholders

of Record, Beneficial Owners and proxyholders who have not complied with the procedures described above may be refused entry to the EGM.

All attendees must be prepared to show

a valid proof of identity for admittance.

To avoid misunderstandings, the

procedures outlined above do not apply with respect to proxy cards solicited through Broadridge, the Company’s proxy solicitor. Shareholders

of Record using such a proxy card should follow the instructions and observe the deadlines specified on the proxy card they receive.

How to vote

Shareholders of Record and Beneficial

Owners may vote in person or by proxy at the EGM in accordance with the procedures described above.

Beneficial Owners may also have

their shares voted by following the procedures specified on their broker’s voting instruction form. Shortly before the EGM, the brokers

will tabulate the votes they have received and submit one or more proxy cards to the Company reflecting the aggregate votes of the Beneficial

Owners.

Contact details

For further information please

contact the Company’s Investor Relations Department by e-mail at ir@mainzbiomed.com.

AGENDA OF THE EXTRAORDINARY GENERAL MEETING

OF MAINZ BIOMED N.V.

Agenda of the extraordinary general meeting of

Mainz Biomed N.V., a public company under Dutch law, registered with the Dutch trade register under number 82122571 (the “Company”),

to be held at the offices of CMS, Atrium, Parnassusweg 737, 1077 DG Amsterdam, the Netherlands, on 13 November 2024 at 14.00 hours Central

European Time (the “EGM”).

| 1. |

Opening |

|

| |

|

|

| 2. |

Reverse stock split, amendment of articles of association and authorisation execution of deed of amendment of articles of association |

Voting item |

| |

|

|

| 3. |

Other matters for discussion |

|

| |

|

|

| 4. |

Close |

|

EXPLANATORY NOTES TO

THE AGENDA OF THE EXTRAORDINARY GENERAL

MEETING OF MAINZ BIOMED N.V.

| 2. | Reverse stock split, amendment of articles of association

and authorisation execution deed of amendment of articles of association |

Reverse stock split

It is proposed to authorise the board of directors

of the Company (the “Board”), in its discretion, to effect a reverse stock split within a range between 2:1 and 100:1.

The primary purpose for effecting the reverse

stock split would be to increase the per-share trading price of the Company’s ordinary shares to maintain their listing on the Nasdaq

Stock Market. The Nasdaq Listing Rules require that listed shares maintain a minimum bid price of USD 1.00 per share (the “Minimum

Bid Price Requirement”). As previously reported, on 28 May 2024, the Company received a deficiency letter from the Nasdaq Listing

Qualifications Department notifying the Company that, for the last 30 consecutive business days, the Company did not meet the Minimum

Bid Price Requirement. The Company has been provided an initial period of 180 calendar days, or until 25 November 2024 (the “Compliance

Date”), to regain compliance with the Minimum Bid Price Requirement.

If at any time during this 180-day period the

closing bid price of the Company’s ordinary shares is at least USD 1.00 per share for a minimum of ten consecutive business

days, the Nasdaq Listing Qualifications Department will provide the Company written confirmation that it complies with the Minimum Bid

Price Requirement and the ordinary shares will continue to be eligible for listing on The Nasdaq Capital Market.

In the event the Company does not regain compliance

with the Minimum Bid Price Requirement by the Compliance Date, the Company may be eligible for additional time. To qualify, the Company

will be required to meet the continued listing requirement and all other initial listing standards for The Nasdaq Capital Market, with

the exception of the Minimum Bid Price Requirement, and will need to provide written notice of its intention to cure the deficiency during

the second compliance period, by effecting a reverse stock split, if necessary. If the Company meets these requirements, the Nasdaq Listing

Qualifications Department will inform the Company that it has been granted an additional 180 calendar days.

By granting the Company the flexibility to effect

a reverse stock split, the Company will have a contingency plan to increase the share price of the ordinary shares above USD 1.00 in the

event that it does not regain compliance with the Minimum Bid Price Requirement prior to the Compliance Date or, if secured, within a

second period of 180 days. For the 30 trading days during the period 22 August 2024 to 3 October 2024 prior to the publication of these

explanatory notes, the closing bid price of the Company’s ordinary shares has ranged from USD 0.43 to USD 0.20, with an average

closing bid price of USD 0.30.

The Board has considered the potential harm to

the Company and its shareholders should Nasdaq delist the Company’s ordinary shares. Delisting could adversely affect the liquidity

of the Company’s ordinary shares since alternatives are generally considered to be less liquid markets. An investor likely would

find it less convenient to sell, or to obtain accurate quotations in seeking to buy, the Company’s ordinary shares on an over-the-counter

market. Further, many investors likely would not buy or sell the Company’s ordinary shares due to difficulty in accessing over-the-counter

markets, policies preventing them from trading in securities not listed on a national exchange or for other reasons.

If and when the Board determines to implement

the reverse stock split, the reverse stock split ratio will be set within a range between 2:1 and 100:1 (the “Split Ratio Range”)

subject to the proviso that the reverse stock split will be implemented in such a way that it does not entail a capital reduction. The

Board is authorised to do whatever is necessary to avoid a capital reduction. If the reverse stock split is implemented, the reverse stock

split ratio as set by the Board will be announced in accordance with applicable laws.

If the EGM authorises the Board to effect a reverse

stock split, the Board will have the sole authority to elect, at any time prior to the annual general meeting of the Company to be held

in 2025, whether or not to effect a reverse stock split. The Board will have the flexibility to decide whether or not a reverse stock

split, and at what ratio within the Split Ratio Range, is in the Company’s best interests.

Upon effectiveness of the reverse stock split,

each shareholder will own a reduced number of ordinary shares. However, the Company expects that the market price of the ordinary shares

immediately after the reverse stock split will increase above the market price of the ordinary shares immediately prior to the reverse

stock split, which is designed to help the Company to regain and maintain compliance with the Minimum Bid Price Requirement. The proposed

reverse stock split will be effected simultaneously for all of the ordinary shares and the ratio for the reverse stock split, once determined,

will be the same for all of the ordinary shares. Ïhe reverse stock split will affect all shareholders uniformly and will not affect

any shareholder’s percentage ownership interest in the Company, except to the extent that the reverse stock split would result in

any of the shareholders owning a fractional interest as described below. Likewise, the reverse stock split will affect all holders of

outstanding equity awards under the Company’s equity incentive plans substantially the same, except to the extent that the reverse

stock split would result in a fractional interest as described below. Proportionate voting rights and other rights of the holders of ordinary

shares will not be affected by the proposed reverse stock split, except to the extent that the reverse stock split would result in any

shareholders owning a fractional interest as described below.

The nominal value per ordinary share would be

adjusted from EUR 0.01 per share before the reverse stock split to a proportionately increased nominal value per share after the reverse

stock split, based on the final reverse stock split ratio, as described below.

The ordinary shares are currently registered under

section 12(b) of the U.S. Securities and Exchange Act of 1934 (the “Exchange Act”), and the Company is subject to the

periodic reporting and other requirements of the Exchange Act. The reverse stock split will not affect the registration of the ordinary

shares under the Exchange Act.

Shares that are held in registered form will be

consolidated and converted into shares based on the new nominal value to be determined in accordance with the final reverse stock split

ratio. Fractional shares created as a result of the consolidation and conversion will be subject to the rights specified in article 4.5,

29.2 and 31.1 of the articles of association of the Company contained in the draft of the deed of amendment of articles of association

referred to below.

Shares that are held through the facilities of

Cede & Co. as nominee for the Depositary Trust Company will be consolidated and converted into a rounded down number of whole shares

and the holders will receive a cash-in-lieu of fractional shares payment from their bank or intermediary.

Amendment articles of association

Furthermore, for the purpose of effecting the

reverse stock split, it is proposed to approve the amendment of the Company’s articles of association in accordance with the draft

of the deed of amendment of articles of association drawn up by CMS Derks Star Busmann N.V. in connection with the EGM and published on

the Company’s website.

The amount of the authorised capital will be derived

from the reverse stock split ratio as set by the Board subject to the proviso that it will not be more than five times the issued capital,

as prescribed by Dutch law. The authorised share capital will be divided nine-tenths into ordinary shares and one-tenth into preferred

shares. Ordinary shares and preferred shares will have the same nominal value. There are no preferred shares outstanding at the moment.

The proposed amendment to the articles of association

will not change the terms of the ordinary shares. After the reverse stock split, the ordinary shares will have the same voting rights

and rights to dividends and distributions and will be identical in all other respects to the ordinary shares now authorised. The ordinary

shares issued pursuant to the reverse stock split will remain fully paid and nonassessable. Following the reverse stock split, the Company

will continue to be subject to the periodic reporting requirements of the Exchange Act.

Authorisation for execution of deed of amendment

of articles of association

Finally, it is proposed that each director of

the Company and each civil law notary, assigned civil law notary, candidate civil law notary, notarial assistant and notarial secretary

working with CMS Derks Star Busmann N.V. be authorised to have the deed of amendment of articles of association executed and to perform

all other legal acts which the authorised person deems necessary in connection therewith.

| 3. | Other matters for discussion |

ATTENDANCE LIST EXTRAORDINARY

GENERAL MEETING 13 NOVEMBER 2024

MAINZ BIOMED N.V.

| No. |

|

Name |

|

Capacity |

|

Representation |

|

Signature |

| |

|

|

|

|

|

|

|

|

| 1. |

|

Hans Hekland |

|

Non-executive director and chairman of the general meeting and holder of proxies submitted by several shareholders |

|

Several shareholders pursuant to proxies received through Broadridge |

|

/s/

Hans Hekland |

| |

|

|

|

|

|

|

|

|

| 2. |

|

Martijn van der Bie |

|

Civil law notary and secretary of the general meeting |

|

N/a |

|

/s/ Martijn van der Bie |

|

Broadridge

51 Mercedes Way

Edgewood, NY 11717 |

|

| |

|

MAINZ BIOMED N.V.

SPECIAL MEETING 11/13/2024

AS REQUESTED, WE HAVE TABULATED THE VOTES

CAST FOR THE ABOVE MEETING. THE RESULTS OF THIS TABULATION ARE AS FOLLOWS:

IN ACCORDANCE WITH OUR CUSTOMARY PROCEDURES,

WE HAVE EXAMINED THE PROXIES RECEIVED, BUT DO NOT GUARANTEE THE GENUINENESS OF THE SIGNATURES THEREOF, OR ASSUME ANY RESPONSIBILITY FOR

THE LEGALITY OF ANY PROXY.

| SINCERELY, |

|

| |

|

| /s/ Anthony Lapoma |

|

| ANTHONY LAPOMA |

|

| DIRECTOR |

|

| VOTING SERVICES |

|

|

Broadridge

51 Mercedes Way

Edgewood, NY 11717 |

|

| |

|

PROPOSAL #001 AUTHORISATION FOR AMENDMENT OF

ARTICLES OF ASSOCIATION

| *** |

FOR |

AGAINST |

ABS/WHD |

BROKER NON-VOTES |

| BENEFICIAL |

4,729,984 |

1,507,091 |

33,140 |

|

| REGISTERED |

3,532,913 |

0 |

0 |

|

| TOTAL SHARES VOTED |

8,262,897 |

1,507,091 |

33,140 |

|

| % OF VOTED |

84.57% |

15.42% |

|

|

| % OF OUTSTANDING |

14.21% |

2.59% |

|

|

| % OF VOTED W/ABS/WHD |

84.28% |

15.37% |

0.33% |

|

| % OF OUTSTNDG W/ABS/WHD |

14.21% |

2.59% |

0.05% |

|

Page 2 of 2

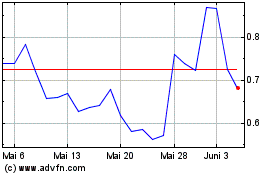

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Mainz BioMed NV (NASDAQ:MYNZ)

Historical Stock Chart

Von Dez 2023 bis Dez 2024