Current Report Filing (8-k)

18 Juni 2020 - 10:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event

reported): June 16, 2020

________________________________________________________________

IDEAL POWER INC.

(Exact name of registrant as specified in

Charter)

|

Delaware

|

|

001-36216

|

|

14-1999058

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File No.)

|

|

(IRS Employee Identification No.)

|

4120 Freidrich Lane, Suite 100

Austin, Texas, 78744

(Address of Principal Executive Offices)

512-264-1542

(Issuer Telephone number)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction

A.2 below).

|

|

¨

|

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR240.14a-12)

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

|

|

|

¨

|

Pre-commencement communications

pursuant to Rule 13e-(c) under the Exchange Act (17 CFR 240.13(e)-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

Trading

Symbol

|

Name of

each exchange on which registered

|

|

Common Stock

|

IPWR

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

|

On June 16, 2020, Ideal Power Inc. (the

“Company”) held its 2020 Annual Meeting of Stockholders (the “Annual Meeting”) at which the

Company’s stockholders approved the Ideal Power Inc. Amended & Restated 2013 Equity Incentive Plan (the “2013

Plan”). The 2013 Plan was amended primarily to (1) increase the number of authorized shares under the 2013 Plan by

350,000 shares and (2) to extend the term of the 2013 Plan to June 16, 2030. The 2013 Plan became effective immediately upon

stockholder approval at the Annual Meeting.

A summary of the material terms of the 2013 Plan are set forth

in the Company’s definitive proxy statement for the Annual Meeting filed with the Securities and Exchange Commission on April

29, 2020 (the “Proxy Statement”). The summaries of the 2013 Plan set forth above and in the Proxy Statement are qualified

in their entirety by reference to the full text of the 2013 Plan, a copy of which is filed as Exhibit 10.1 to this Current Report

on Form 8-K, and incorporated herein by reference.

|

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders.

|

On June 16, 2020, the Company held the Annual Meeting as a virtual

meeting online via live audio webcast. The Company’s stockholders voted on, and approved, the following proposals at the

Annual Meeting:

Proposal 1 — Election of four directors to serve until

the 2021 annual meeting of stockholders and until their respective successors are elected and qualified.

|

Nominee:

|

|

For

|

|

Withheld

|

|

Broker Non-Votes

|

|

R. Daniel Brdar

|

|

587,166

|

|

6,967

|

|

605,875

|

|

David B. Eisenhaure

|

|

581,515

|

|

12,618

|

|

605,875

|

|

Ted Lesster

|

|

577,610

|

|

16,523

|

|

605,875

|

|

Michael C. Turmelle

|

|

581,487

|

|

12,646

|

|

605,875

|

Proposal 2 — Ratification of the appointment of Gumbiner

Savett Inc. as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2020.

|

For

|

|

Against

|

|

Abstain

|

|

1,191,469

|

|

7,570

|

|

969

|

Proposal 3 — Advisory vote to approve the compensation

of the Company’s named executive officers.

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

562,302

|

|

29,177

|

|

2,654

|

|

605,875

|

Proposal 4 — Approval of the amended Ideal Power Inc.

2013 Equity Incentive Plan.

|

For

|

|

Against

|

|

Abstain

|

|

Broker Non-Votes

|

|

524,295

|

|

66,228

|

|

3,610

|

|

605,875

|

|

|

item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this Current Report to be signed on its behalf by the undersigned hereunto

duly authorized.

|

Dated: June 18, 2020

|

IDEAL POWER INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Timothy Burns

|

|

|

|

|

Timothy Burns

|

|

|

|

|

Chief Financial Officer

|

|

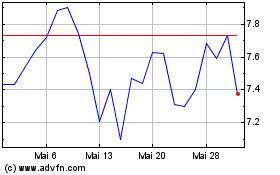

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Ideal Power (NASDAQ:IPWR)

Historical Stock Chart

Von Jul 2023 bis Jul 2024