Fifth Third Receives $50M Federal New Markets Tax Credits Allocation

26 September 2024 - 2:00PM

Business Wire

Fifth Third New Markets Development Company one

of 104 entities to receive an award

The Fifth Third New Markets Development Company has received a

$50 million allocation in New Markets Tax Credits from the U.S.

Department of the Treasury’s Community Development Financial

Institutions Fund.

An affiliate of the Fifth Third Community Development Company,

LLC (CDC), the Fifth Third New Markets Development Company is one

of 104 community development entities across the U.S. to receive an

award in the $5 billion Treasury fund allocation announced on Sept.

19.

“One of the primary missions of the Fifth Third CDC is to

support low-income communities across our footprint that have

experienced a legacy of disinvestment, wealth extraction and income

disparities,” said Kala Gibson, chief corporate responsibility

officer for Fifth Third. “Through initiatives like our place-based

neighborhood investment program, we have delivered capital to

low-income communities to help build existing community assets and

address barriers to economic mobility. This allocation will enable

our Community Development Banking team and the Fifth Third CDC to

bring exponentially more impact to the communities we serve.”

The New Markets Tax Credit Program helps economically distressed

communities attract private investment capital. The federal tax

credit helps to fill project financing gaps by enabling investors

to make larger investments than would otherwise be possible.

Communities benefit from the jobs associated with investments in

manufacturing, retail and technology, as well as from greater

access to housing and public facilities such as health, education

and childcare.

The Fifth Third CDC invests in real estate developments across

the Bank’s 11-state footprint to help communities thrive. These

investments can include affordable housing, small business spaces

or community facilities. Often, the projects enable access to

essential services for residents, including financial education,

social programming and greenspaces for recreation.

"This allocation demonstrates that Fifth Third’s innovative,

place-based approach to working in neighborhoods and working at a

neighborhood scale is being recognized nationally. And for

neighborhoods across our footprint in which we are engaged, Fifth

Third now has yet another tool we can use to drive capital into

communities in partnership with them,” said Susan E. Thomas,

president of the Fifth Third CDC.

“Of the various federal tax credits, New Markets Tax Credits are

the most impactful for driving neighborhood transformation,” Thomas

said. “As we have become increasingly active in place-based

development and lending, we realized that not having these tax

credits as part of our toolkit was hampering our ability to show up

for our communities with all of the tools at our disposal.”

The Fifth Third CDC is an experienced NMTC participant as an

equity investor and leverage lender in this locally managed federal

program. Fifth Third works with a network of Community Development

Entities – intermediaries serving low-income communities – to

provide funding for qualified projects. Recent Fifth Third CDC

investments include CityLink Center in Cincinnati, mHUB in Chicago,

and AVW Equipment in Maywood, Illinois.

Community economic development is a cornerstone of Fifth Third’s

Neighborhood Program, which creates and implements innovative

place-based strategies to effect positive change in nine

historically disinvested neighborhoods across the Bank’s

footprint.

Launched in 2021, Fifth Third’s Neighborhood Program is

pioneering a new way to do community development by partnering with

local organizations to build ecosystems that drive real change

through both financial and social investments. This collective

ecosystem approach is focused on identifying solutions to key

challenges in partnership with the community, with the goal of

creating lasting, transformative change.

In December 2023, Fifth Third announced that its $180 million,

three-year commitment to the Neighborhood Program had been met and

exceeded early, reaching $187 million in just two years. Fifth

Third has extended technical assistance for the program through

2025 to ensure continued, sustained impact and progress.

About Fifth Third

Fifth Third is a bank that’s as long on innovation as it is on

history. Since 1858, we’ve been helping individuals, families,

businesses and communities grow through smart financial services

that improve lives. Our list of firsts is extensive, and it’s one

that continues to expand as we explore the intersection of

tech-driven innovation, dedicated people and focused community

impact. Fifth Third is one of the few U.S.-based banks to have been

named among Ethisphere’s World’s Most Ethical Companies® for

several years. With a commitment to taking care of our customers,

employees, communities and shareholders, our goal is not only to be

the nation’s highest performing regional bank, but to be the bank

people most value and trust.

Fifth Third Bank, National Association is a federally chartered

institution. Fifth Third Bancorp is the indirect parent company of

Fifth Third Bank and its common stock is traded on the NASDAQ®

Global Select Market under the symbol "FITB." Investor information

and press releases can be viewed at www.53.com. Deposit and credit

products provided by Fifth Third Bank, National Association. Member

FDIC.

About the New Markets Tax Credit Program

The New Markets Tax Credit Program, established by Congress in

December 2000, permits individual and corporate taxpayers to

receive a non-refundable tax credit against federal income taxes

for making equity investments in financial intermediaries known as

Community Development Entities (CDEs). CDEs that receive the tax

credit allocation authority under the program are domestic

corporations or partnerships that provide loans, investments, or

financial counseling in low-income urban and rural communities. The

tax credit provided to the investor totals 39% of the cost of the

investment and is claimed over a seven-year period. The CDEs in

turn use the capital raised to make investments in low-income

communities. CDEs must apply annually to the CDFI Fund to compete

for New Markets Tax Credit Program allocation authority. Since the

inception of the NMTC Program, the CDFI Fund has completed 20

allocation rounds and has made 1,667 awards totaling $81 billion in

tax allocation authority. This includes $3 billion in Recovery Act

Awards and $1 billion of special allocation authority used for the

recovery and redevelopment of the Gulf Opportunity Zone.

To learn more about the New Markets Tax Credit Program, please

visit www.cdfifund.gov/nmtc.

Category: Other

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240926223035/en/

Amanda Nageleisen (Media Relations) amanda.nageleisen@53.com

Matt Curoe (Investor Relations) matthew.curoe@53.com |

513-534-2345

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

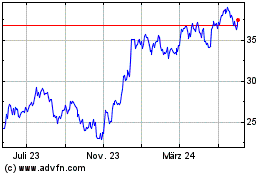

Fifth Third Bancorp (NASDAQ:FITB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025