AstraZeneca Raises Core EPS Guidance Despite Profit Miss -- Update

09 November 2023 - 9:03AM

Dow Jones News

By Ian Walker

AstraZeneca raised its full-year guidance for core earnings per

share and total revenue excluding Covid-19 medicines despite a

lower third-quarter profit that missed forecasts after booking a

tax charge compared with a credit for the comparable period.

The Anglo-Swedish pharmaceutical giant said Thursday that it

expects core earnings per share to increase by a low double-digit

percentage compared with previous guidance of a high single-digit

to low double-digit percentage increase.

Total revenue excluding Covid-19 medicines is now expected to

increase by a low-teens percentage at constant-exchange rates

compared with previous expectations of low double-digit percentage

growth.

Total revenue is expected to increase by a mid single-digit

percentage compared with previous guidance of low-to-mid

single-digit, it said.

Net profit attributable to shareholders for the quarter was

$1.37 billion compared with $1.64 billion and a FactSet consensus

of $1.58 billion, based on four analysts forecasts. It booked a tax

charge of $274 million compared with a credit of $720 million.

Core earnings per share rose to $1.73 compared with $1.67, a

rise of 9% at constant-exchange rates.

Revenue rose to $11.49 billion from $10.98 billion, up 6% at

constant-exchange rates.

Revenue consensus was $11.55 billion, while core EPS consensus

was $1.69.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

November 09, 2023 02:48 ET (07:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

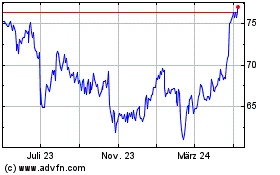

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

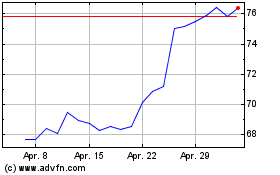

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

Von Jul 2023 bis Jul 2024