Filed Pursuant to Rule 424(b)(3)

Registration No. 333-282707

PROSPECTUS

Up

to 13,617,521 Shares of Common Stock

This

prospectus relates to the resale of up to 13,617,521 shares of common stock, par value $0.001 per share (the “Common Stock”),

of Applied Digital Corporation (the “Company,” “we,” “our” or “us”) by the selling stockholders

listed in this prospectus or their permitted transferees (each, a “Selling Stockholder” and collectively,

the “Selling Stockholders”). The shares of Common Stock registered for resale pursuant to this prospectus consist

of (i) 13,088,980 shares of Common Stock (the “Series F Shares”) issuable upon conversion of the 53,191

shares of Series F Convertible Preferred Stock of the Company, par value $0.001 per share (the “Series F Preferred

Stock”), including 3,191 shares of Series F Preferred Stock representing an original issue discount of 6%, issued to YA

II PN, LTD (“YA Fund”) pursuant to and in accordance with the terms and conditions of that certain securities purchase agreement,

dated August 29, 2024 (the “Series F Purchase Agreement”), between the Company and YA Fund, and (ii) 528,541 shares of Common

Stock (the “Northland Shares” and collectively with the Series F Shares, the “Shares”) issued to Northland Securities,

Inc. (“Northland”) as placement agent compensation in connection with that certain Standby Equity Purchase Agreement, dated

August 28, 2024, as amended on August 29, 2024, between the Company and YA Fund (the “SEPA”).

The

Shares were issued to their respective Selling Stockholders in private placement offerings, as described herein

(the “Private Placements”). For additional information about the Private Placements, see “Private

Placements” on page 12 of this prospectus.

We

will not receive any proceeds from the resale or other disposition of the Shares by the Selling Stockholders. See “Use

of Proceeds” beginning on page 18 and “Plan of Distribution” beginning on page 19 of this prospectus for

more information. Although we have been advised by the Selling Stockholders that the Selling Stockholders are purchasing

the Shares for their own account, for investment purpose in which they take investment risk (including, without limitation,

the risk of loss), and without any view or intention to distribute such Shares in violation of the Securities Act of 1933, as amended

(the “Securities Act”), or any other applicable securities laws, the Securities and Exchange Commission (the “SEC”)

may take the position that the Selling Stockholders are deemed “underwriters” within the meaning of Section

2(a)(11) of the Securities Act and any profits on the sales of the Shares by the Selling Stockholders and any discounts, commissions

or concessions received by the Selling Stockholders are deemed to be underwriting discounts and commissions under the Securities

Act.

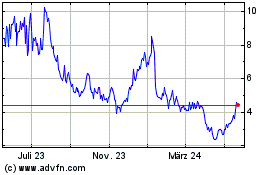

Our

Common Stock is listed on The Nasdaq Global Select Market, or Nasdaq, under the symbol “APLD.” On November 20, 2024,

the last reported sale price of our Common Stock as reported on Nasdaq was $8.76.

You

should read this prospectus carefully, together with additional information described under the headings “Incorporation of Certain

Information by Reference” and “Where You Can Find More Information,” before you invest in any of our securities.

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described in our Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed with

the SEC on August 30, 2024, and in our Current Reports on Form 8-K filed with the SEC on August 30, 2024 and November 5, 2024, and

the other filings we make with the SEC from time to time, which are incorporated by reference herein in their entirety, together

with other information in this prospectus and the information incorporated by reference herein.

Neither

the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is November 27, 2024.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus forms part of a registration statement that we filed with the SEC, and that includes exhibits that provide more detail with

respect to the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC,

together with the additional information described under the headings “Where You Can Find More Information” and “Incorporation

of Certain Information by Reference” before making your investment decision.

You

should rely only on the information provided in this prospectus or in a prospectus supplement or any free writing prospectuses or amendments

thereto. Neither we, nor the Selling Stockholders, have authorized anyone else to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely on it. You should assume that the information in this prospectus

is accurate only as of the date hereof. Our business, financial condition, results of operations and prospects may have changed since

that date.

Neither

we, nor the Selling Stockholders, are offering to sell or seeking offers to purchase these securities in any jurisdiction where

the offer or sale is not permitted. We have not done anything that would permit this offering or possession or distribution of this prospectus

in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who

come into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

as to distribution of the prospectus outside of the United States.

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary

does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire

prospectus carefully, including the section entitled “Risk Factors” beginning on page 14, our consolidated financial

statements and the related notes and the other information incorporated by reference into this prospectus before making an investment

decision.

Our

Business

We

are a United States (“U.S.”) designer, developer, and operator of next-generation digital infrastructure across North America.

We provide digital infrastructure solutions and cloud services to the rapidly growing industries of High-Performance Computing (“HPC”)

and Artificial Intelligence (“AI”). We operate in three distinct business segments, including, Blockchain data center hosting

(the “Data Center Hosting Business”), cloud services through a wholly owned subsidiary (the “Cloud Services Business”)

and HPC data center hosting (the “HPC Hosting Business”), as further discussed below.

We

completed our initial public offering in April 2022 and our Common Stock began trading on Nasdaq on April 13, 2022. In November 2022,

we changed our name from Applied Blockchain, Inc. to Applied Digital Corporation.

Data

Center Hosting Business

Our

Data Center Hosting Business provides energized infrastructure services to crypto mining customers. Our custom-designed data centers

allow customers to rent space based on their power requirements. We currently serve seven crypto mining customers, all of which have

entered into contracts with us ranging from three to five years. This business segment accounts for the majority of the revenue we generate

from our operations (approximately 83% for the fiscal year ended May 31, 2024).

We

currently operate sites in Jamestown and Ellendale, North Dakota, with a total hosting capacity of approximately 286 MW:

| ● | Jamestown,

North Dakota: 106 MW facility. |

| ● | Ellendale,

North Dakota: 180 MW facility. |

In

March 2021, we executed a strategy planning and portfolio advisory services agreement (the “Services Agreement”) with GMR

Limited, a British Virgin Island limited liability company (“GMR”), Xsquared Holding Limited, a British Virgin Island limited

liability company (“SparkPool”) and Valuefinder, a British Virgin Islands limited liability company (“Valuefinder”

and, together with GMR and SparkPool, the “Service Provider(s)”). Under the Services Agreement, the Service Providers agreed

to provide crypto asset mining management and analysis and assist us in securing difficult-to-obtain mining equipment. Under the terms

of the Services Agreement, we issued 7,440,148 shares of our Common Stock to each of GMR and SparkPool and 3,156,426 shares of our Common

Stock to Valuefinder. In June 2022, SparkPool ceased all operations and forfeited 4,965,432 shares of our Common Stock back to us.

In

March 2022, we decided to terminate our crypto mining operations, shifting our focus and our business strategy to developing the HPC

Hosting Business and our other two business segments (including the Data Center Hosting Business). Each Service Provider advised us concerning

the design and buildout of our hosting operations. We continue to partner with GMR, and other providers as they remain our strategic

equity investors. Our partners have strong relationships across the cryptocurrency ecosystem, which we may leverage to identify leads

for the expansion of our operations and business segments.

Compared

to our previous mining operations, co-hosting revenues are less subject to volatility related to the underlying crypto-asset markets.

We have a contractual ceiling for our energy costs through our Amended and Restated Electric Service Agreement, entered into in September

2023 with a utility in the upper Midwest (the “Electric Service Agreement”). One of the main benefits of the Electric Service

Agreement is the low cost of power for mining. Even before the recently imposed crypto mining restrictions in China, power capacity available

for Bitcoin mining was scarce, especially at scalable sites with over 100 MW of potential capacity. This scarcity of mining power allows

us to realize attractive hosting rates in the current market. The Electric Service Agreement has also enabled us to launch our hosting

business with long-term customer contracts.

In

March 2024, we announced that we entered into a definitive agreement to sell our 200 MW campus in Garden City, TX, to Mara Garden City

LLC, a Delaware limited liability company and subsidiary of Marathon Digital Holdings (Nasdaq: MARA). We completed the sale transaction

on April 1, 2024.

Cloud

Services Business

We

officially launched our Cloud Services Business in May 2023. We operate our Cloud Services Business through our wholly owned subsidiary,

Applied Digital Cloud Corporation (“Applied Digital Cloud”), which provides cloud services to customers, such as AI and machine

learning developers. Our Cloud Services Business specializes in providing GPU computing solutions to empower customers in executing critical

workloads related to AI, machine learning (“ML”), rendering, and other HPC tasks. Our managed hosting cloud service allows

customers to sign service contracts, utilizing our Company-provided equipment for seamless and cost-effective operations.

We

are rolling out multiple GPU clusters, each comprising 1,024 GPUs, which are available for lease by our customers. Additionally, we have

secured contracts with colocation service providers to ensure secure space and energy for our hosting services. Our strategy is to utilize

a blend of third-party colocation and our own HPC data centers to deliver cloud services to our customers.

We

currently rely on a few major suppliers for our products in this business segment: NVIDIA Corp. (“NVIDIA”), Super Micro Computer

Inc. (“Super Micro”), Hewlett Packard Enterprise (“HPE”) and Dell Technologies Inc. (“Dell”). In

May 2023, we partnered with Super Micro, a renowned provider of Application-Optimized Total IT Solutions. Together, we aim to deliver

our cloud services to our customers. Super Micro’s high-performance server and storage solutions are designed to address

a wide range of computational-intensive workloads. Their next-generation GPU servers are incredibly power-efficient, which is vital for

data centers as the power requirements for large-scale AI models continue to increase. Optimizing the Total Cost of Ownership (“TCO”)

and Total Cost to Environment (“TCE”) is critical for data center operators to ensure sustainable operations.

In

June 2023, we announced a partnership with HPE, a global company specializing in edge-to-cloud technology. As part of this collaboration,

HPE will provide its powerful and energy-efficient supercomputers to support large-scale AI through our cloud service. HPE has been supportive

in core design considerations and engineering of Company-owned facilities which will support Applied Digital Cloud’s infrastructure.

In addition, we have supply agreements with Dell for delivery of AI and GPU servers.

By

May 31, 2024, we had received and deployed a total of 6,144 GPUs; 4,096 GPUs were actively recognizing revenue and 2,048 GPUs

were pending customer acceptance to start revenue recognition. The Cloud Services Business currently serves two customers and accounted

for approximately 17% of our revenue in fiscal year 2024. As we ramp up operations in this business segment, we expect to acquire and

deploy additional GPUs, increase revenue from the Cloud Services Business and increase the percentage of our revenue produced by our

Cloud Services Business.

HPC

Hosting Business

Our

HPC Hosting Business specializes in designing, constructing, and managing data centers tailored to support HPC applications, including

AI.

We

are currently building two HPC focused data centers.

The first facility, which is nearing completion, is a 7.5 MW facility in Jamestown, ND location adjacent to our 106 MW Data center

hosting facility. We also broke ground on a 100 MW HPC data center project in Ellendale, ND (the “HPC Ellendale Facility”),

on land located adjacent to its existing 180 MW Data center hosting facility. These separate and unique buildings, designed and purpose-built

for GPUs, will sit separate from our current buildings and host more traditional HPC applications, such as natural language processing,

machine learning, and additional HPC developments.

We

anticipate that this business segment will begin generating meaningful revenues once the HPC Ellendale Facility becomes operational,

which is expected in calendar year 2025.

Recent

Developments

2024

Annual Meeting of Stockholders

On

November 20, 2024, we held our 2024 Annual Meeting of Stockholders. We received stockholder approval for all proposals set forth in

our definitive proxy statement filed with the SEC on October 23, 2024, as supplemented, including for the proposal to approve, for

the purpose of complying with the applicable provisions of The Nasdaq Stock Market LLC Listing Rule 5635, the potential issuance of

shares of our Common Stock issuable upon conversion of the Series F Preferred Stock.

Charter

Amendment

On

November 20, 2024, we filed an amendment to our Second Amended and Restated Articles of Incorporation (as amended, the “Articles

of Incorporation”), increasing the number of shares of (i) Common Stock authorized for issuance thereunder to 400,000,000 shares,

each share of Common Stock having a par value of $0.001 and (ii) preferred stock authorized for issuance thereunder to 10,000,000 shares.

Series

E-1 Preferred Stock

On

September 23, 2024, we entered into a Dealer Manager Agreement with Preferred Capital Securities, LLC (the “Dealer Manager”),

pursuant to which the Dealer Manager agreed to serve as our agent and dealer manager for an offering (the “Series E-1 Offering”)

of up to 62,500 shares of the Company’s Series E-1 Redeemable Preferred Stock, par value $0.001 (the “Series E-1 Preferred

Stock”). In connection with the issuance of the Series E-1 Preferred Stock, we filed a registration statement on Form S-1 (File

No. 333-282293) with the SEC under the Securities Act to register the offer and sale of the shares of Series E-1 Preferred Stock, which

was declared effective by the SEC on November 4, 2024.

On

November 8, 2024, we filed a Certificate of Designations of the Powers, Preferences and Relative, Participating, Optional and other Restrictions

of Series E-1 Preferred Stock of the Company (the “Series E-1 Certificate of Designations”) with the Secretary of State of

the State of Nevada to establish the rights, privileges, preferences, and restrictions of the Series E-1 Preferred Stock. As set forth

in the Series E-1 Certificate of Designations, we designated 62,500 shares of preferred stock as Series E-1 Preferred Stock. The Series

E-1 Certificate of Designations was filed in connection with the initial settlement under the Series E-1 Offering. As of the date of

this prospectus, we have issued and sold 6,359 shares of Series E-1 Preferred Stock and the Series E-1 Offering remains ongoing.

Convertible

Notes Offering and Indenture

On

November 4, 2024, we completed a private offering (the “Convertible Notes Offering”) of 2.75% Convertible Senior Notes due

2030 (the “Convertible Notes”). The Convertible Notes were sold under a purchase agreement, dated as of October 30, 2024,

entered into by and among the Company and Goldman Sachs & Co. LLC, Cantor Fitzgerald & Co. and J.P. Morgan Securities LLC, as

representatives of the several initial purchasers named therein (the “Initial Purchasers”), for resale to persons reasonably

believed to be qualified institutional buyers pursuant to Rule 144A under the Securities Act. The aggregate principal amount of Convertible

Notes sold in the Convertible Notes Offering was $450.0 million, which includes $75.0 million aggregate principal amount of Convertible

Notes issued pursuant to an option to purchase additional Convertible Notes granted to the Initial Purchasers under the purchase agreement,

which the Initial Purchasers exercised in full on October 31, 2024 and which additional purchase was completed on November 4, 2024. The

net proceeds from the sale of the Convertible Notes was approximately $434.5 million after deducting the Initial Purchasers’ discounts

and commissions and estimated offering expenses payable by us. We intend to use approximately $84 million of the net proceeds from the

Convertible Notes Offering to fund share repurchases of Common Stock in connection with the Convertible Notes Offering including (i)

$52.7 million to fund the cost of entering into prepaid forward repurchase (as described below) and (ii) $31.3 million to repurchase

shares of Common Stock, approximately $51.8 million of the net proceeds from the Convertible Notes Offering to pay the cost of the capped

call transactions (as described below) and the remainder for general corporate purposes.

Also

on November 4, 2024, we entered into an indenture with respect to the Convertible Notes (the “Indenture”) with Wilmington

Trust, National Association, as trustee. The Convertible Notes are senior unsecured obligations of the Company and bear interest at a

rate of 2.75% per year payable semiannually in arrears on June 1 and December 1 of each year, beginning on June 1, 2025. The Convertible

Notes will mature on June 1, 2030, unless earlier converted, redeemed or repurchased in accordance with their terms.

Prepaid

Forward Repurchase Transaction

On

October 30, 2024, in connection with the pricing of the Convertible Notes Offering, we entered into a privately negotiated prepaid forward

repurchase transaction (the “Prepaid Forward Repurchase”) with one of the Initial Purchasers (the “Forward Counterparty”).

The initial aggregate number of shares of Common Stock underlying the Prepaid Forward Repurchase was approximately 7.2 million shares

of Common Stock. In the event that we pay any cash dividends on our Common Stock, the Forward Counterparty will pay an equivalent amount

to us. The cost of the Prepaid Forward Repurchase was approximately $52.7 million.

Capped

Call Transaction

On

October 30, 2024, in connection with the pricing of the Convertible Notes Offering, we entered into privately negotiated capped call

transactions (the “Base Capped Call Transactions”) with certain financial institutions (the “Option Counterparties”).

In addition, on October 31, 2024, in connection with the Initial Purchasers’ exercise of their option to purchase additional Convertible

Notes, we entered into additional capped call transactions (the “Additional Capped Call Transactions,” and, together with

the Base Capped Call Transactions, the “Capped Call Transactions”) with each of the Option Counterparties. The Capped Call

Transactions cover, subject to customary anti-dilution adjustments, the aggregate number of shares of Common Stock that initially underlie

the Convertible Notes, and are expected generally to reduce potential dilution to the Common Stock upon any conversion of the Convertible

Notes and/or offset any cash payments we are required to make in excess of the principal amount of converted Convertible Notes, as the

case may be, with such reduction and/or offset subject to a cap, based on the cap price of the Capped Call Transactions. The cap price

of the Capped Call Transactions is approximately $14.72, which represents a premium of 100% over the last reported sale price of the

Common Stock on October 30, 2024. The cost of the Capped Call Transactions was approximately $51.8 million.

Yorkville

Agreements

As

previously disclosed, on March 27, 2024 and May 24, 2024, respectively, we entered into Prepaid Advance Agreements (as amended, the “March

PPA” and “May PPA,” respectively, and collectively, the “Prepaid Advance Agreements”) and related promissory

notes (the promissory note issued in March 2024 under the March PPA, the “March Note,” the promissory note issued in April

2024 under the March PPA, the “April Note,” and the promissory note issued in May 2024, the “May Note,” and collectively,

the “YA Notes”) with YA Fund. As of the date of this prospectus, approximately $85.9 million outstanding under the YA Notes

has been converted into shares of our Common Stock and $6.9 million remains outstanding across all the YA Notes with only the March Note

left outstanding, which amount is anticipated to be repaid in cash, unless we receive stockholder approval to issue shares of Common

Stock in lieu of repayment in cash, in compliance with Nasdaq rules and regulations (which approval we do not intend to seek at this

time).

On

October 29, 2024, we entered into certain amendments to the March PPA and the March Note. The amendments (i) provided consent to the

Convertible Notes Offering and share repurchase transactions and (ii) removed certain prior restrictions on redemption of the March Note

before January 1, 2025.

Termination

of Designations

We

previously designated (i) 70,000 shares of preferred stock as Series A Convertible Preferred Stock (the “Series A Preferred Stock”),

(ii) 50,000 shares of preferred stock as Series B Convertible Preferred Stock (the “Series B Preferred Stock”), and (iii)

1,380,000 shares of preferred stock as Series D Convertible Redeemable Preferred Stock (the “Series D Preferred Stock”).

On

October 21, 2024, we filed Withdrawals of Designation relating to the Series A Preferred Stock, the Series B Preferred

Stock and the Series D Preferred Stock (collectively, the “Withdrawals of Designation”) with the Secretary of State

of the State of Nevada and terminated the designations of the Series A Preferred Stock, Series B Preferred Stock and Series D Preferred

Stock. At the time of the filing of the Withdrawals of Designation, no shares of the Series A Preferred Stock, Series B Preferred

Stock or Series D Preferred Stock were outstanding. The Withdrawals of Designation were effective upon filing and eliminated from

our Articles of Incorporation all matters set forth in the previously filed Certificates of Designations with respect to the previously

designated Series A Preferred Stock, Series B Preferred Stock, and Series D Preferred Stock.

Management

Update

Effective

October 15, 2024, Saidal Mohmand transitioned from his prior role of Executive Vice President of Finance to become the Chief Financial

Officer of the Company, succeeding David Rench, who served as the Company’s Chief Financial Officer from March 2021 and who will

continue with the Company in his new capacity as Chief Administrative Officer.

PIPE

On

September 5, 2024, we entered into a securities purchase agreement (the “PIPE Purchase Agreement”) with the purchasers named

therein (the “PIPE Purchasers”), for the private placement of 49,382,720 shares of Common Stock (the “PIPE Shares”),

at a purchase price of $3.24 per share, representing the last closing price of the Common Stock on Nasdaq on September 4, 2024. The

private placement closed on September 9, 2024, with aggregate gross proceeds to us of approximately $160 million, before deducting

offering expenses.

We

and the PIPE Purchasers also entered into a registration

rights agreement (the “PIPE Registration Rights Agreement”), pursuant to which we agreed to prepare and file with the SEC

a Registration Statement on Form S-1, registering the resale of the PIPE Shares, within 30 days of signing the PIPE Registration Rights

Agreement (subject to certain exceptions). On October 4, 2024, we filed a registration statement on Form S-1 (File No. 333-282518) with

the SEC for the resale under the Securities Act by the PIPE Purchasers of the PIPE Shares, which was declared effective by the

SEC on October 15, 2024.

SEPA

On

August 28, 2024, we entered into the SEPA. Under the SEPA, we agreed to issue and sell to YA Fund, from time to time,

and YA Fund agreed to purchase from us, up to $250 million of our Common Stock, subject to certain obligations and

limitations (the “SEPA Aggregate Commitment”). In connection with the execution of the SEPA, we agreed to pay a structuring

fee (in cash) to YA Fund in the amount of $25,000. Additionally, we agreed to pay a commitment fee of $2,125,000 to YA Fund (the “Commitment

Fee”), payable on the effective date of the SEPA, in the form of the issuance of 456,287 shares of Common Stock. We have

subsequently agreed with YA Fund to satisfy our obligations with respect to the Commitment Fee in cash by increasing the

principal amount due under the March Note in an equivalent amount. As a result, as of the date of this prospectus, the principal amount

outstanding under the March Note is approximately $6.9 million (inclusive of the $2,125,000 Commitment Fee).

As

described elsewhere in this prospectus, in connection with the

SEPA, Northland acted as placement agent and received a fee equal to 1% of the SEPA Aggregate Commitment (the “SEPA Placement

Agent Fee”). We have agreed to pay the SEPA Placement Agent Fee in shares of Common Stock at a price per share

of $4.73 per share, the Nasdaq official closing price of the Common Stock on August 27, 2024, for a total of 528,541

shares of Common Stock. For additional information, see “Private Placements” on page 12 of this prospectus.

Corporate

Information

Our

executive office is located at 3811 Turtle Creek Blvd., Suite 2100, Dallas, Texas 75219, and our phone number is (214) 427-1704. Our

principal website address is www.applieddigital.com.

We

make available free of charge through the Investor Relations link on our website access to press releases and investor presentations,

as well as all materials that we file electronically with the SEC, including our annual report on Form 10-K, quarterly reports on Form

10-Q, current reports on Form 8-K and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities

Exchange Act of 1934 (the “Exchange Act”) as soon as reasonably practicable after electronically filing such materials with,

or furnishing them to, the SEC. In addition, the SEC maintains an Internet website, www.sec.gov, that contains reports, proxy and information

statements and other information that we file electronically with the SEC. Information contained in, or accessible through, our website

does not constitute part of this prospectus or the registration statement of which it forms a part and inclusions of our website address

in this prospectus or the registration statement are inactive textual references only. You should not rely on any such information in

making your decision whether to purchase our securities.

We

are a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act and may rely on exemptions from certain disclosure

requirements that are available to smaller reporting companies under the Exchange Act.

THE

OFFERING

| Shares

of Common Stock offered by the Selling Stockholders |

|

Up to 13,617,521 shares of Common Stock consisting of:

|

| |

|

|

● |

Up to 13,088,980 shares of Common Stock issuable upon conversion of the shares of Series F Preferred Stock issued to YA Fund in

a private placement offering (the “Series F Private Placement”) pursuant to the Series F Purchase Agreement; and |

| |

|

|

|

|

| |

|

|

● |

528,541 shares of Common Stock issued to Northland in a private placement offering in connection with the SEPA. |

| Common

Stock outstanding before this offering |

|

211,245,607

shares of Common Stock. |

| |

|

|

| Common

Stock to be outstanding immediately after this offering |

|

224,334,587

shares of Common Stock, assuming all 53,191

shares of Series F Preferred Stock are converted into Common Stock. |

| |

|

|

| Use

of Proceeds |

|

The

Common Stock to be offered and sold using this prospectus will be offered and sold by the Selling Stockholders named in this prospectus.

Accordingly, we will not receive any proceeds from any sale of shares of our Common Stock in this offering. However, we received

total proceeds of $50.0 million, prior to fees paid to Northland for their role as placement agent in an amount equal to 3.5% of

the total proceeds, from our issuance of the shares of Series F Preferred Stock to YA Fund. We intend to use the net proceeds from

our issuance of the shares of Series F Preferred Stock for working capital and general corporate purposes. Subject to the terms and

conditions of the Series F Purchase Agreement applicable to the use of proceeds from the issuance of such shares, our management

has broad discretion over the allocation of the net proceeds from the issuance of such shares. Please see the section entitled “Use

of Proceeds” on page 18 of this prospectus. |

| |

|

|

| National

Securities Exchange Listing |

|

Our

Common Stock is currently listed on Nasdaq under the symbol “APLD.” |

| |

|

|

| Risk

Factors |

|

An investment in our securities involves a high degree of risk. Please

see the section entitled “Risk Factors” beginning on page 14 of this prospectus. In addition before deciding whether

to invest in our securities, you should consider carefully the risks and uncertainties described in the section captioned “Risk

Factors” contained in our Annual Report on Form 10-K for the fiscal year ended May 31, 2024, filed with the SEC on August 30,

2024, and in our Current Reports on Form 8-K filed with the SEC on August 30, 2024 and November 5, 2024, and other filings we make with

the SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus

and the information incorporated by reference herein. |

PRIVATE

PLACEMENTS

Series

F Private Placement

On

August 29, 2024, we entered into the Series F Purchase Agreement with YA Fund for the issuance and sale of 53,191 shares of Series F

Preferred Stock, including 3,191 shares representing an original issue discount of 6% in the Series F Private Placement, pursuant to

an exemption from registration under Section 4(a)(2) of the Securities Act and/or Rule 506 of Regulation D promulgated thereunder. Northland

acted as the placement agent in connection with the Series F Private Placement. The Series F Private Placement closed on August 30, 2024,

with total proceeds to us of $50.0 million, prior to fees paid to Northland for its role as placement agent in an amount equal to 3.5%

of the total proceeds.

In

addition, on August 29, 2024, we entered into a registration rights agreement with YA Fund (the “Series F Registration Rights Agreement”),

pursuant to which we agreed to prepare and file with the SEC a Registration Statement on Form S-1, registering the resale of the shares

of Common Stock issuable upon the conversion of the shares of Series F Preferred Stock within 45 days of signing the Series F Registration

Rights Agreement (subject to certain exceptions).

The

Series F Preferred Stock will initially be non-convertible and will only become convertible upon, and subject to, the receipt by us of

the approval of our stockholders (the “Nasdaq Stockholder Approval”). Pursuant to the Series F Purchase Agreement, we have

agreed to seek such Nasdaq Stockholder Approval to enable the Series F Preferred Stock to become convertible into shares of our Common

Stock under the Nasdaq Listing Rules. Under the Series F Purchase Agreement, if Nasdaq Stockholder Approval is obtained, the Series F

Preferred Stock will not be subject to the limitations set forth in Nasdaq Listing Rule 5635 for purposes of conversion but will remain

subject to a cap for purposes of calculating its voting power in any stockholder vote with our Common Stock on an as-converted basis,

and if Nasdaq Stockholder Approval is not obtained for any reason, the Series F Preferred Stock will remain non-convertible and will

not vote on an as-converted basis with our Common Stock. We received the Nasdaq Stockholder Approval at our annual meeting of stockholders

held on November 20, 2024.

The

initial conversion price for the Series F Preferred Stock will be $7.00 per share (the “Initial Conversion Price”). If the

Initial Conversion Price is greater than the arithmetic average of the VWAP of the Common Stock for the three trading days immediately

prior to the trading day following the meeting of stockholders of the Company at which the Nasdaq Stockholder Approval is obtained (if

obtained), then on the trading day following such meeting (the “Initial Reset Date”), the conversion price will be reset

to such arithmetic average, subject to Nasdaq Stock Market rules and regulations. The conversion price may thereafter be subject to further

reset, on each of the 60th and 120th days after Nasdaq Stockholder Approval is obtained, if on each such date, the then effective conversion

price is greater than the arithmetic average of the VWAP of the Common Stock for the three trading days immediately prior to each such

date. The conversion price cannot be reset below an amount prohibited by the rules and regulations of the Nasdaq Stock Market (the “Floor

Conversion Price”), irrespective of the receipt of Nasdaq Stockholder Approval. The Floor Conversion Price of the Series F Preferred

Stock is $0.764. Based on its initial stated value of $1,000 per share (the “Stated Value”) and the Initial Conversion Price,

the Series F Preferred Stock would be convertible into an aggregate of 7,598,714 shares of our Common Stock. Additionally, as set forth

in the Certificate of the Designations, Powers, Preferences and Rights of Series F Convertible Preferred Stock (the “Series F Certificate

of Designation”), the conversion price of the Series F Preferred Stock for purposes of voting shall never be below $4.0638 (the

“Minimum Price”), as calculated in accordance with the Nasdaq Listing Rules (irrespective of our receipt of Nasdaq Stockholder

Approval). Based on the Minimum Price, the Series F Preferred Stock would be convertible into an aggregate of 13,088,980 shares of our

Common Stock, the number of shares of our Common Stock registered for resale hereunder issuable upon the conversion of the Series F Preferred

Stock if the conversion price is equal to the Minimum Price. The actual number of shares of our Common Stock issued will vary depending

on the conversion price at the time of conversion, which may range from the Initial Conversion Price to the Floor Conversion Price. If

converted at the Floor Conversion Price of $0.764, a maximum of 69,621,727 shares of Common Stock would be issuable upon conversion of

the shares of Series F Preferred Stock, which exceeds the number of shares of Common Stock registered for resale hereunder. No reset

of the Initial Conversion Price occurred on the Initial Reset Date as the conditions for such reset had not been met.

Pursuant

to the Series F Certificate of Designation, the Series F Preferred Stock is subject to redemption by the holder in certain circumstances,

as well as during the period beginning on December 31, 2024 and ending on January 10, 2025, at the option and sole discretion of the

holder (the “Time-Based Redemption Right”). If YA Fund notifies us of its intention to exercise its Time-Based Redemption

Right in accordance with the provisions of the Series F Certificate of Designation, we would be obligated to redeem its shares of Series

F Preferred Stock in cash by wire transfer of immediately available funds at a price per share equal to the Stated Value. If YA Fund

does not exercise its Time-Based Redemption Right between December 31, 2024 and January 10, 2025, such right shall be null and void and

of no further force and effect.

Pursuant

to the Series F Purchase Agreement, YA Fund executed an Irrevocable Proxy, dated August 30, 2024, appointing us as proxy to vote in all

matters submitted to the stockholders of the Company for a vote of all shares of the Series F Preferred Stock beneficially owned, directly

or indirectly, by YA Fund in accordance with the recommendation of our board of directors (the “Proxy”). The

Proxy became effective upon the receipt of Nasdaq Stockholder Approval.

Northland

Private Placement

On

August 28, 2024, we entered into the SEPA with YA Fund. Pursuant to the SEPA, subject to certain conditions

and limitations, we have the option, but not the obligation, to sell to YA Fund, and YA Fund must subscribe for the SEPA Aggregate

Commitment, at our request any time during the commitment period commencing on September 30, 2024, and terminating on the first day of

the month next following the 36-month anniversary of September 30, 2024.

In

connection with the SEPA, Northland acted as placement agent and received the SEPA Placement Agent Fee. We have agreed to pay the SEPA

Placement Agent Fee in shares of Common Stock at a price per share of $4.73 per share, the Nasdaq official closing price of the Common

Stock on August 27, 2024, for a total of 528,541 shares of Common Stock issued to Northland. The Northland Shares were issued without

registration under the Securities Act, pursuant to an exemption from the registration requirements of the Securities Act afforded by

Section 4(a)(2) thereof.

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on

Form 10-K for the fiscal year ended May 31, 2024, filed with the SEC on August 30, 2024, and in our Current Reports on Form 8-K filed

with the SEC on August 30, 2024 and November 5, 2024, and our other filings we make with the SEC from time to time, which are incorporated

by reference herein in their entirety, together with other information in this prospectus and the information incorporated by reference

herein. If any of these risks occur, our business, financial condition, results of operations or cash flow could suffer materially.

In such an event, the trading price of our shares of Common Stock could decline, and you might lose all or part of your investment.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Except

for historical information, this prospectus contains forward-looking statements made pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995 under Section 27A of the Securities Act and Section 21E of the Exchange Act. Forward-looking

statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates,

intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control,

and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements

expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that

could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,”

“can,” “anticipate,” “assume,” “should,” “indicate,” “would,”

“believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,”

“plan,” “point to,” “project,” “predict,” “could,” “intend,”

“target,” “potential” and other similar words and expressions of the future.

There

are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking

statement made by us. These factors include, but are not limited to:

| |

● |

our ability to complete construction of the HPC Ellendale Facility; |

| |

● |

availability

of financing to continue to grow our business; |

| |

● |

labor

and other workforce shortages and challenges; |

| |

● |

power

or other supply disruptions and equipment failures; |

| |

● |

our

dependence on principal customers; |

| |

● |

the

addition or loss of significant customers or material changes to our relationships with these customers; |

| |

● |

our

sensitivity to general economic conditions including changes in disposable income levels and consumer spending trends; |

| |

● |

our

ability to timely and successfully build new hosting facilities with the appropriate contractual margins and efficiencies; |

| |

● |

our

ability to continue to grow sales in our hosting business; |

| |

● |

volatility

of cryptoasset prices; |

| |

● |

uncertainties

of cryptoasset regulation policy; and |

| |

● |

equipment

failures, power or other supply disruptions. |

The

foregoing does not represent an exhaustive list of matters that may be covered by the forward-looking statements contained herein or

risk factors that we are faced with that may cause our actual results to differ from those anticipated in such forward-looking statements.

The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ

materially from those projected in the forward-looking statements. You should review the factors and risks and other information we describe

in our most recent Annual Report on Form 10-K, as well as any amendments thereto reflected in subsequent reports we will file from time

to time with the SEC.

All

forward-looking statements are expressly qualified in their entirety by this cautionary note. You are cautioned to not place undue reliance

on any forward-looking statements, which speak only as of the date of this prospectus or the date of the document incorporated by reference

herein. You should read this prospectus and the documents that we incorporate by reference and have filed as exhibits to the registration

statement, of which this prospectus is a part, completely and with the understanding that our actual future results may be materially

different from what we expect. In light of the significant uncertainties in these forward-looking statements, you should not regard these

statements as a representation or warranty by us or any other person that will achieve our objectives and plans in any specified time

frame, or at all. We have no obligation, and expressly disclaims any obligation, to update, revise or correct any of the forward-looking

statements, whether as a result of new information, future events or otherwise. We have expressed our expectations, beliefs and projections

in good faith and believe they have a reasonable basis. However, we cannot assure you that our expectations, beliefs or projections will

result or be achieved or accomplished.

SELLING

STOCKHOLDERS

This

prospectus covers the resale of:

| |

●

|

Up

to 13,088,980 shares of Common Stock issuable upon conversion of the shares of Series F Preferred Stock issued to YA Fund in the

Series F Private Placement pursuant to the Series F Purchase Agreement; and |

| |

|

|

| |

●

|

528,541

shares of Common Stock issued to Northland in a private placement offering in connection with the SEPA. |

For

additional information regarding the shares of Common

Stock included in this prospectus, see the section titled “Private Placements.” We are registering the shares

of Common Stock included in this prospectus in order to permit the Selling Stockholders to offer such shares for resale from

time to time. The term “Selling Stockholders” includes the stockholders listed in the table below and their permitted transferees.

The

table below sets forth, as of November 20, 2024, the following information regarding the Selling Stockholders:

| |

● |

the

names of the Selling Stockholders; |

| |

● |

the

number of shares of Common Stock owned by the Selling Stockholders prior to this offering; |

| |

● |

the

number of shares of Common Stock to be offered by the Selling Stockholders in this offering; |

| |

● |

the

number of shares of Common Stock to be owned by the Selling Stockholders assuming the sale of all of the shares of Common Stock covered

by this prospectus; and |

| |

● |

the

percentage of our issued and outstanding shares of Common Stock to be owned by the Selling Stockholders assuming the sale of all

of the shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued and outstanding as

of November 20, 2024. |

Except

as described above, the number of shares of Common Stock beneficially owned by the Selling Stockholders has been determined in accordance

with Rule 13d-3 under the Exchange Act and includes, for such purpose, shares of Common Stock that the Selling Stockholders have

the right to acquire within 60 days of November 20, 2024.

All

information with respect to the Common Stock ownership of the Selling Stockholders has been furnished by or on behalf of the Selling

Stockholders. We believe, based on information supplied by the Selling Stockholders, that except as may otherwise be indicated

in the footnotes to the table below, the Selling Stockholders have sole voting and dispositive power with respect to the shares

of Common Stock reported as beneficially owned by the Selling Stockholders. Because the Selling Stockholders identified

in the table may sell some or all of the shares of Common Stock beneficially owned by them and covered by this prospectus,

and because there are currently no agreements, arrangements or understandings with respect to the sale of any of the shares of Common

Stock, no estimate can be given as to the number of shares of Common Stock available for resale hereby that will be held by

the Selling Stockholders upon termination of this offering. In addition, the Selling Stockholders may have sold, transferred

or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of Common Stock

they beneficially own in transactions exempt from the registration requirements of the Securities Act after the date on which

they provided the information set forth in the table below. We have, therefore, assumed for the purposes of the following table,

that the Selling Stockholders will sell all of the shares of Common Stock owned beneficially by them that are covered by

this prospectus, but will not sell any other shares of Common Stock that they presently own. Except as set forth below,

the Selling Stockholders have not held any position or office, or have otherwise had a material relationship, with us or

any of our subsidiaries within the past three years other than as a result of the ownership of our shares of Common Stock or other securities.

| Name of Selling

Stockholder | |

Shares

Beneficially

Owned prior

to Offering | | |

Shares

Offered by this Prospectus | | |

Shares

Beneficially

Owned after

Offering(4) | | |

Percentage

of Shares

Beneficially

Owned after

Offering(5) | |

| YA II PN, LTD.(1) | |

| 13,188,980 | (2) | |

| 13,088,980 | (3) | |

| 100,000 | | |

| * | % |

| Northland Securities, Inc. | |

| 528,541 | (6) | |

| 528,541 | | |

| 0 | | |

| - | % |

| * | Indicates

beneficial ownership of less than 1%. |

| (1) |

YA

II PN, Ltd. (“YA Fund”) is a fund managed by Yorkville Advisors Global, LP (“Yorkville LP”). Yorkville Advisors

Global II, LLC (“Yorkville LLC”) is the General Partner of Yorkville LP. All investment decisions for YA Fund are made

by Yorkville LLC’s President and Managing Member, Mr. Mark Angelo. The business address of YA Fund is 1012 Springfield Avenue,

Mountainside, NJ 07092. |

| |

|

| (2) |

The

number of shares owned prior to the offering, consisting of (i) 100,000 shares of

Common Stock, and (ii) up to 13,088,980 shares of Common Stock issuable upon

conversion and assuming conversion of all 53,191 shares of Series F Preferred Stock issued to YA Fund in the Series F Private Placement,

at a conversion price at or above the Minimum Price (and not to exceed the Initial Conversion Price). The actual number of shares

of Common Stock that may be issued to YA Fund in connection with the Series F Preferred Stock conversion is not currently known.

In addition, the Selling Stockholder is the holder of certain YA Notes, with an outstanding principal balance of $6.9 million,

which are not currently convertible into shares of Common Stock absent approval by the Company’s shareholders in accordance

with their terms. Therefore, no shares of Common Stock underlying the YA Notes are included in the number of shares beneficially

owned prior to the offering. |

| |

|

| (3) |

The

number of shares of Common Stock offered by this prospectus, consisting of the number of shares of Common Stock issuable upon conversion

of 53,191 shares of Series F Preferred Stock issued to YA Fund in the Series F Private Placement, assuming a conversion price at or above

the Minimum Price (and not to exceed the Initial Conversion Price). The actual number of shares of Common Stock that may be issued to

YA Fund in connection with the Series F Preferred stock conversion is not currently known. |

| |

|

| (4) |

Assumes

the sale of all shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus. |

| |

|

| (5) |

Percentage

is based on 211,245,607 shares of Common Stock outstanding as of November 20, 2024 (and rounded to the nearest tenth

of a percent) and assumes the sale of all shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus. |

| |

|

| (6) |

The

securities are directly held by Northland. Mr. Dustin Alden has voting and investment control over the securities. As such, Mr. Alden

may be deemed to beneficially own these securities. The business address of Northland is 150 South Fifth Street, Suite 3300, Minneapolis,

MN 55402. |

USE

OF PROCEEDS

The

Common Stock to be offered and sold using this prospectus will be offered and sold by the Selling Stockholders named in

this prospectus. Accordingly, we will not receive any proceeds from any sale of shares of our Common Stock in this offering. However,

we received total proceeds of $50.0 million, prior to fees paid to Northland for their role as placement agent in an amount

equal to 3.5% of the total proceeds, from our issuance of the shares of Series F Preferred Stock to YA Fund. We intend to

use the net proceeds from our issuance of the shares of Series F Preferred Stock for working capital and general corporate

purposes. Subject to the terms and conditions of the Purchase Agreement applicable to the use of proceeds from the issuance of the

shares of Series F Preferred Stock, our management has broad discretion over the allocation of the net proceeds from the issuance of

the shares of Series F Preferred Stock. We will pay all of the fees and expenses incurred by us in connection with this registration.

PLAN

OF DISTRIBUTION

Each

Selling Stockholder of the Common Stock and any

of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their Common Stock covered hereby

on Nasdaq or any other stock exchange, market or trading facility on which the Common Stock is traded or in private transactions.

These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling

Common Stock:

| ● |

ordinary

brokerage transactions and transactions in which the broker dealer solicits purchasers; |

| ● |

block

trades in which the broker dealer will attempt to sell the Common Stock as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| ● |

purchases

by a broker dealer as principal and resale by the broker dealer for its account; |

| ● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| ● |

privately

negotiated transactions; |

| ● |

settlement

of short sales; |

| ● |

in

transactions through broker dealers that agree with the Selling Stockholders to sell a specified number of such Common Stock at a

stipulated price per share; |

| ● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| ● |

a

combination of any such methods of sale; or |

| ● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell the Common Stock under Rule 144 or any other exemption from registration under the Securities

Act, if available, rather than under this prospectus.

Broker

dealers engaged by the Selling Stockholders may arrange for other brokers dealers to participate in sales. Broker dealers may

receive commissions or discounts from the Selling Stockholders (or, if any broker dealer acts as agent for the purchaser of the Common

Stock, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an

agency transaction not in excess of a customary brokerage commission in compliance with Rule 2121 of the Financial Industry Regulatory

Authority, or FINRA, and in the case of a principal transaction a markup or markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the Common Stock or interests therein, the Selling Stockholders may enter into hedging transactions with

broker dealers or other financial institutions, which may in turn engage in short sales of the Common Stock in the course of hedging

the positions they assume. The Selling Stockholders may also sell the Common Stock short and deliver the Common Stock to close out their

short positions, or loan or pledge the Common Stock to broker dealers that in turn may sell the Common Stock. The Selling Stockholders

may also enter into option or other transactions with broker-dealers or other financial institutions or create one or more derivative

securities which require the delivery to such broker-dealer or other financial institution of the Common Stock offered by this prospectus,

which Common Stock such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended

to reflect such transaction).

The

Selling Stockholders and any broker dealers or agents

that are involved in selling the Common Stock may be deemed to be “underwriters” within the meaning of the Securities Act

in connection with such sales. In such event, any commissions received by such broker dealers or agents and any profit on the resale

of the Common Stock purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act. The Selling

Stockholders have informed us that they do not have any written or oral agreement or understanding, directly or indirectly,

with any person to distribute the Common Stock.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the Common Stock. We have agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep this prospectus effective until the earlier of (i) the date on which the Common Stock may be resold by

the Selling Stockholders without registration and without regard to any volume or manner-of-sale limitations by reason

of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under

the Securities Act or any other rule of similar effect or (ii) all of the Common Stock have been disposed of pursuant to this

prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The Shares will be sold only through

registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the Shares

covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the

registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the Shares may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions

of the Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales

of the Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling

Stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time

of the sale (including by compliance with Rule 172 under the Securities Act).

DESCRIPTION

OF SECURITIES

The following summary of the rights of our capital

stock is not complete and is subject to and qualified in its entirety by reference to our Articles of Incorporation and our third amended

and restated bylaws, as amended from time to time and currently in effect (the “Bylaws”), copies of which are filed as exhibits

to our Annual Report on Form 10-K for the year ended May 31, 2024, as filed with the SEC on August 30, 2024, which is incorporated by

reference herein.

We

are authorized to issue 410,000,000 shares of capital stock, $0.001 par value per share, of which 400,000,000 are Common

Stock and 10,000,000 are preferred stock (the “Preferred Stock”). For a description of the terms of the Preferred

Stock, see Exhibit 4.8 to our Annual Report on Form 10-K, filed with the SEC on August 30, 2024, as supplemented by the Series F

Certificate of Designation which is filed as Exhibit 3.1 to our Current Report on Form 8-K filed with the SEC on August 30, 2024

and the Series E-1 Certificate of Designation which is filed as Exhibit 3.1 to our Current Report filed with the SEC on November 14,

2024.

As

of November 20, 2024, there were 211,245,607 shares of Common Stock outstanding and 361,223 shares of

Preferred Stock outstanding.

Common

Stock

Holders

of our Common Stock are entitled to such dividends as may be declared by our board of directors out of funds legally available for such

purposes. Holders of our Common Stock are entitled to receive proportionately any dividends as may be declared by our board of directors,

subject to any preferential dividend rights of any series of Preferred Stock that we may designate and issue in the future. There are

no redemption or sinking fund provisions applicable to our Common Stock. The holders of our Common Stock have no conversion rights. Holders

of Common Stock have no preemptive or subscription rights to purchase any of our securities. The rights, preferences and privileges of

holders of our Common Stock are subject to and may be adversely affected by the rights of the holders of shares of any series of Preferred

Stock that we may designate and issue in the future. Each holder of our Common Stock is entitled to one vote for each such share outstanding

in the holder’s name. No holder of Common Stock is entitled to cumulative votes in voting for directors.

In

the event of our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive a pro rata share of

our assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding shares

of our Common Stock are fully paid and non-assessable.

Anti-Takeover Effects of the Articles

of Incorporation, the Bylaws and Nevada Law

We

are a Nevada corporation and are generally governed by the Nevada Revised Statutes, or NRS. The following is a brief description of the

provisions in our Articles of Incorporation, Bylaws and the NRS that could have an effect of delaying, deferring, or preventing a change

in control of the Company.

The

provisions of the NRS, our Articles of Incorporation, and Bylaws could have the effect of discouraging others from attempting hostile

takeovers and, as a consequence, they may also inhibit temporary fluctuations in the price of our Common Stock that often result from

actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in our management. It is

possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in

their best interests.

Combinations

with Interested Stockholders

Nevada’s

“combinations with interested stockholders” statutes, NRS 78.411 through 78.444, inclusive, prohibit specified types of business

“combinations” between certain Nevada corporations and any person deemed to be an “interested stockholder” for

two years after such person first becomes an “interested stockholder” unless the corporation’s board of directors approves

the combination (or the transaction by which such person becomes an “interested stockholder”) in advance, or unless the combination

is approved by the board of directors and sixty percent of the corporation’s voting power not beneficially owned by the interested

stockholder, its affiliates and associates. Further, in the absence of prior approval certain restrictions may apply even after such

two year period. However, these statutes do not apply to any combination of a corporation and an interested stockholder after the expiration

of four years after the person first became an interested stockholder. For purposes of these statutes, an “interested stockholder”

is any person who is (1) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding

voting shares of the corporation, or (2) an affiliate or associate of the corporation and at any time within the two previous years was

the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the corporation.

The definition of the term “combination” is sufficiently broad to cover most significant transactions between a corporation

and an “interested stockholder.” These statutes generally apply to Nevada corporations with 200 or more stockholders of record.

However, a Nevada corporation may elect in its articles of incorporation not to be governed by these particular laws, but if such election

is not made in the corporation’s original articles of incorporation, the amendment (1) must be approved by the affirmative vote

of the holders of stock representing a majority of the outstanding voting power of the corporation not beneficially owned by interested

stockholders or their affiliates and associates, and (2) is not effective until 18 months after the vote approving the amendment and

does not apply to any combination with a person who first became an interested stockholder on or before the effective date of the amendment.

Our Articles of Incorporation do not include such an election to opt-out of these provisions.

Acquisition

of Controlling Interests

Nevada’s

“acquisition of controlling interest” statutes (NRS 78.378 through 78.3793, inclusive) contain provisions governing the acquisition

of a controlling interest in certain Nevada corporations. These “control share” laws provide generally that any person that

acquires a “controlling interest” in certain Nevada corporations may be denied voting rights, unless a majority of the disinterested

stockholders of the corporation elects to restore such voting rights. Our Bylaws provide that these statutes do not apply to us. Absent

such provision in our Bylaws, these laws would apply to us as of a particular date if we were to have 200 or more stockholders of record

(at least 100 of whom have addresses in Nevada appearing on our stock ledger at all times during the 90 days immediately preceding that

date) and do business in the State of Nevada directly or through an affiliated corporation, unless our Articles of Incorporation or Bylaws

in effect on the tenth day after the acquisition of a controlling interest provide otherwise. These laws provide that a person acquires

a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these

provisions of the NRS, would enable that person to exercise (1) one fifth or more, but less than one third, (2) one third or more, but

less than a majority or (3) a majority or more, of all of the voting power of the corporation in the election of directors. Once an acquirer

crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the 90 days immediately

preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares”

to which the voting restrictions described above apply.

Articles

of Incorporation and Bylaws

The

provisions of our Articles of Incorporation and Bylaws, taken together with the applicable provisions of the NRS:

| |

● |

Authorize

our board of directors to issue “blank check” Preferred Stock, the terms of which may be established and shares of which

may be issued without stockholder approval; |

| |

● |

Require

supermajority disinterested stockholder approval of certain business combinations with related persons (each as defined in the Articles

of Incorporation); |

| |

● |

Permit

removal of directors only for cause and require the affirmative vote of not less than 75% of the voting power of all of the then

outstanding shares of stock entitled to vote in the election of directors, voting as a single class, to remove any director (the

NRS does not include a cause concept in NRS 78.335 and the provision of our Articles of Incorporation exceeds the minimum two thirds

(2/3) threshold vote required by that statute); |

| |

● |

Require

the affirmative vote of not less than two thirds (2/3) of the voting power of all of the then outstanding shares of stock entitled

to vote in the election of directors, voting as a single class, to adopt, amend, alter or repeal our Bylaws; and |

| |

● |

Do

not provide for cumulative voting in the election of directors. |

NRS

78.139 also provides that directors may resist a change or potential change in control of the corporation if the board of directors determines

that the change or potential change is opposed to or not in the best interest of the corporation upon consideration of any relevant facts,

circumstances, contingencies or constituencies pursuant to NRS 78.138(4).

In

addition, our authorized but unissued shares of Common Stock are available for our board of directors to issue without stockholder approval.

We may use these additional shares for a variety of corporate purposes, including future public or private offerings to raise additional

capital, corporate acquisitions and employee benefit plans. The existence of our authorized but unissued shares of Common Stock could

render more difficult or discourage an attempt to obtain control of our Company by means of a proxy contest, tender offer, merger or

other transaction. Our authorized but unissued shares may be used to delay, defer or prevent a tender offer or takeover attempt that

a stockholder might consider in its best interest, including those attempts that might result in a premium over the market price for

the shares held by our stockholders. Our board of directors is also authorized to adopt, amend or repeal our Bylaws, which could delay,

defer or prevent a change in control.

Series

F Preferred Stock

Rank

The

Series F Preferred Stock ranks, with respect to the payment of dividends and rights upon our liquidation, dissolution or winding up of

our affairs: (i) prior or senior to all classes or series of our Common Stock and any other class or series of equity securities; (ii)

on a parity with the Series E Preferred, in proportion to their respective amounts of accrued and unpaid dividends per share or liquidation

preferences; (iii) on a parity with other classes or series of our equity securities issued in the future if, pursuant to the specific

terms of such class or series of equity securities, the holders of such class or series of equity securities are entitled to the receipt

of dividends and of amounts distributable upon liquidation, dissolution or winding up in proportion to their respective amounts of accrued

and unpaid dividends per share or liquidation preferences, without preference or priority of one over the other; (iv) junior to any class

or series of our equity securities if, pursuant to the specific terms of such class or series, the holders of such class or series are

entitled to the receipt of dividends or amounts distributable upon liquidation, dissolution or winding up in preference or priority to

the holders of the Series F Preferred Stock; and (v) junior to all our existing and future debt.

Dividend

Rights

Each

outstanding share of Series F Preferred Stock is entitled to receive, in preference to the Common Stock, cumulative dividends (“Preferential

Dividends”), payable quarterly in arrears, at an annual rate of 8.0% of $1,000.00 per share of Series F Preferred Stock (the “Stated

Value”). Preferential Dividends shall be payable, at the option of the Company, either in-kind through an accrual on the Stated

Value or in cash. In addition, each holder of Series F Preferred Stock will be entitled to receive dividends equal to, on an as-converted

to shares of the Common Stock basis, and in the same form as, dividends actually paid on shares of the Common Stock when, as, and if

such dividends are paid on shares of the Common Stock. Preferential Dividends shall commence accruing on the issuance date of such Series

F Preferred Stock. In addition to Preferential Dividends, from and after the issuance date of the Series F Preferred Stock, holders of

the Series F Preferred Stock shall be entitled to receive, concurrently with any dividends or distributions paid to the holders of Common

Stock to the same extent as if such holders had converted the Series F Preferred Stock into Common Stock.

We

shall not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series F Preferred Stock,

redeem or repurchase any equity interests ranking junior to the Series F Preferred Stock (subject to exceptions).

Liquidation

Rights

Upon

any dissolution, liquidation or winding up of our affairs, whether voluntary or involuntary, holders of the Series F Preferred Stock will be

entitled to receive distributions out of the assets of the Company, whether capital or surplus, before any distributions shall be

made on any shares of the Common Stock, in an amount per share equal to the greater of (i) the then-current Stated Value, and (ii)

the amount that would have been received had such Series F Preferred Stock been converted immediately prior to such liquidation at

the then effective conversion price.

Voting

Rights

If,

and only if, the Series F Preferred Stock becomes convertible (upon and subject to receipt of Nasdaq Stockholder Approval, the holders

of Series F Preferred Stock will vote together with holders of Common Stock on an as-converted to Common Stock basis using the then effective

conversion price subject to a cap on the maximum voting power as required under the Nasdaq Stock Market rules and regulations and set

forth in the Series F Certificate of Designation. Therefore, to ensure compliance with Nasdaq Listing Rule 5640 and to prevent disparate

voting effect of the Series F Preferred Stock voting on an as converted to Common Stock basis, the conversion price for purposes of voting

only shall never be below $4.0638, the Minimum Price, as calculated in accordance with the Nasdaq Listing Rules (whether or not we receive

Nasdaq Stockholder Approval). The foregoing limitation notwithstanding, however, as long as any shares of Series F Preferred Stock are

outstanding, we shall not, without the affirmative vote of the holders of a majority of the then outstanding shares of Series F Preferred

Stock, (i) alter, waive or change adversely the powers, preferences or rights given to the Series F Preferred Stock or alter or amend

the Series F Certificate of Designation, (ii) authorize or create or issue any class of stock ranking as to dividends, redemption or

distribution of assets upon a liquidation senior to the Series F Preferred Stock, (iii) increase or decrease the authorized number of