false

--05-31

0001144879

0001144879

2024-11-08

2024-11-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 8, 2024

APPLIED

DIGITAL CORPORATION

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31968 |

|

95-4863690 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 3811

Turtle Creek Blvd., Suite 2100 |

|

|

| Dallas,

TX |

|

75219 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 214-427-1704

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

APLD |

|

Nasdaq

Global Select Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As

previously disclosed, on September 23, 2024, Applied Digital Corporation, a Nevada corporation (the “Company”), entered into

a Dealer Manager Agreement with Preferred Capital Securities, LLC (the “Dealer Manager”), pursuant to which the Dealer Manager

agreed to serve as the Company’s agent and dealer manager for the Company’s registered offering (the “Series E-1 Offering”)

of up to $62,500,000 of the Company’s Series E-1 Redeemable Preferred Stock, par value $0.001 per share (the “Series E-1

Preferred Stock”).

On

November 8, 2024, the Company filed a Certificate of Designations of the Powers, Preferences and Relative, Participating, Optional and

Other Restrictions of Series E-1 Preferred Stock of the Company (the “Certificate of Designations”) with the

Secretary of State of the State of Nevada to establish the rights, privileges, preferences, and restrictions of the Series E-1 Preferred

Stock. As set forth in the Certificate of Designations, the Company designated 62,500 shares of preferred stock as Series E-1 Preferred

Stock. The Certificate of Designations was filed in connection with the initial settlement under the Series E-1 Offering. The Series

E-1 Offering remains ongoing.

As

previously disclosed, the Company designated 5,000,000 shares of its authorized capital stock as preferred stock and of those shares

designated (i) 70,000 shares of preferred stock as Series A Convertible Preferred Stock, par value

$0.001 per share (the “Series A Preferred Stock”), (ii) 50,000 shares of preferred stock as Series B Convertible Preferred

Stock, par value $0.001 per share (the “Series B Preferred Stock”), (iii) 660,000

shares of preferred stock as Series C Convertible Redeemable Preferred Stock, par value $0.001 per share (iv) 1,380,000 shares of preferred

stock as Series D Convertible Redeemable Preferred Stock, par value $0.001 per share (the

“Series D Preferred Stock”), (v) 2,000,000 shares of preferred stock as Series E Redeemable Preferred Stock, par value $0.001

per share (the “Series E Preferred Stock”) and (vi) 53,191 shares of preferred stock as Series F Convertible Preferred Stock,

par value $0.001 per share (the “Series F Preferred Stock”). As a result of filing the Certificate of Designations on November

8, 2024 and the filing of Certificates of Withdrawal of Certificate of Designations on October 24, 2024 of each of the Series A Preferred

Stock, the Series B Preferred Stock and the Series D Preferred Stock, the Company had 2,224,309 shares of undesignated preferred stock

as of the date of this Current Report on Form 8-K.

The

following is a summary of the principal terms of the Certificate of Designations:

Ranking

The

Series E-1 Preferred Stock ranks, with respect to the payment of dividends and rights upon the Company’s liquidation, dissolution

or winding up of the Company’s affairs: (i) prior or senior to all classes or series of the Company’s common stock, par value

$0.001 per share (the “Common Stock”), and any other class or series of equity securities, if the holders of Series E-1 Preferred

Stock are entitled to the receipt of dividends or of amounts distributable upon liquidation, dissolution or winding up in preference

or priority to the holders of shares of such class or series; (ii) on a parity with the Series E Preferred Stock and the Series F Preferred

Stock, in proportion to their respective amounts of accrued and unpaid dividends per share or liquidation preferences; (iii) on a parity

with other classes or series of the Company’s equity securities issued in the future if, pursuant to the specific terms of such

class or series of equity securities, the holders of such class or series of equity securities and the holders of Series E-1 Preferred

Stock are entitled to the receipt of dividends and of amounts distributable upon liquidation, dissolution or winding up in proportion

to their respective amounts of accrued and unpaid dividends per share or liquidation preferences, without preference or priority of one

over the other, or as otherwise expressed to be pari passu with the Series E-1 Preferred Stock; (iv) junior to any class or series of

the Company’s equity securities if, pursuant to the specific terms of such class or series, the holders of such class or series

are entitled to the receipt of dividends or amounts distributable upon liquidation, dissolution or winding up in preference or priority

to the holders of the Series E-1 Preferred Stock (none of which class or series is currently designated); and (v) junior

to all of the Company’s existing and future debt indebtedness.

Maturity

The

shares of the Series E-1 Preferred Stock have no stated maturity and once issued will remain outstanding indefinitely unless they

are redeemed by the Company. The Company is not required to set apart for payment funds to redeem the Series E-1 Preferred Stock and

may settle a redemption of the Series E-1 Preferred Stock in cash or shares of Common Stock; provided, however, that no Holder

Optional Redemption (as defined below) with respect to any share of Series E-1 Preferred Stock may be settled in Common Stock

prior to the first anniversary of the date of its issuance and the Company may not exercise the Company Optional Redemption (as

defined below) with respect to any share of Series E-1 Preferred Stock prior to the second anniversary of the date of its issuance (the

“Redemption Eligibility Date”).

Dividend

Rights

The

holders of the Series E-1 Preferred Stock are entitled to receive a cumulative dividend at a fixed annual rate of 9% per annum

of the Stated Value of the Series E-1 Preferred Stock, or $1,000.00, per year (computed on the basis of a 360-day year consisting

of twelve 30-day months). Dividends will be declared and accrued monthly. Dividends are payable upon the approval of the board

of directors of the Company, which may not be monthly, out of legally available funds in cash. The Series E-1 Preferred Stock ranks

on parity with the Series E Preferred Stock, the Series F Preferred Stock and any classes or series of preferred stock otherwise

expressed to be pari passu with the Series E-1 Preferred Stock with respect to the right to receive payment of any dividends in proportion

to their respective amounts of accrued and unpaid dividends per share. Unless full cumulative dividends on shares of Series E-1 Preferred

Stock for all past dividend periods have been paid (or set apart for payment), the Company may not declare or pay dividends with

respect to any shares of Common Stock or other stock ranking junior to the Series E-1 Preferred Stock for any period.

Liquidation

Rights

Subject

to the liquidation preference set forth in the Certificate of Designations, the Series E-1 Preferred

Stock is entitled to be paid out of the funds and assets available for distribution, an amount per share equal to the Stated Value,

plus an amount per share that is issuable as the result of accrued or unpaid dividends. After payment to the holders of the

Series E-1 Preferred Stock and to the holders of shares of any other class or series of capital stock ranking senior to or on a parity

with the Series E-1 Preferred Stock, including, without limitation, the Series E Preferred Stock, the Series F Preferred Stock and any

classes or series of preferred stock otherwise expressed to be pari passu with the Series E-1 Preferred Stock, the remaining funds and

assets available for distribution to the Company’s stockholders will be distributed among the holders of shares of Common

Stock, pro rata based on the number of shares of Common Stock held by each such holder.

Holder

Optional Redemption Rights

Each

holder of shares of Series E-1 Preferred Stock will be entitled to redeem any portion of the outstanding shares of Series E-1 Preferred

Stock held by such holder (the “Holder Optional Redemption”) at any time, subject to certain early redemption fees. Such

redemptions may be settled in either cash or Common Stock, at the Company’s option; provided, however, that (i) if required

by Rule 5635(d) of The Nasdaq Stock Market, the aggregate number of shares of Common Stock issuable to holders of Series E-1 Preferred

Stock for dividends and redemption shall not exceed 19.99% of the outstanding shares of Common Stock (the “Redemption Share Cap”),

unless approval by the Company’s stockholders is obtained to exceed the Redemption Share Cap, and (ii) no share of Series

E-1 Preferred Stock may be redeemed for Common Stock prior to the first anniversary of the date of its issuance. The Company will settle any Holder Optional Redemption it determines to redeem in cash by paying the holder

the Settlement Amount. The “Settlement Amount” means (A) the Stated Value, plus (B) unpaid dividends accrued to, but not

including, any business day after the last business day of the month after a notice of redemption (the “Holder Redemption Notice”)

is duly received by Preferred Shareholder Services, LLC, an affiliated of the Dealer Manager, (the “Holder Redemption Deadline”)

but before the next Holder Redemption Deadline (such date, the “Holder Redemption Exercise Date”), minus (C) the Holder Optional

Redemption Fee (as defined below) applicable on the respective Holder Redemption Deadline. The Company will settle any Holder Optional

Redemption the Company determines to redeem in Common Stock, subject to the Redemption Share Cap, by delivering to the holder

a number of shares of Common Stock equal to (1) the Settlement Amount divided by (2) the closing price per share of Common Stock on The

Nasdaq Global Select Market (“Nasdaq”), or other national securities exchange on which the Common Stock is listed, on the

last trading day prior to the Holder Optional Redemption Exercise Date.

Company

Optional Redemption Rights

The

Company may redeem a share of Series E-1 Preferred Stock at its option (the “Company Optional Redemption”) on or after the

Redemption Eligibility Date upon not less than 10 calendar days nor more than 90 calendar days written notice (the date upon which

such written notice is provided to holders, the “Company Optional Redemption Notice Exercise Date”) to the holders prior

to the date fixed for redemption thereof, at a redemption price of 100% of the Stated Value of the shares of Series E-1 Preferred Stock

to be redeemed plus accrued but unpaid dividends (at a rate equal to (1) the Settlement Amount divided by (2) the closing price of shares

of Common Stock on Nasdaq, or other national securities exchange on which the Common Stock is listed, on the last trading day prior to

the Company Optional Redemption Notice Exercise Date). In the Company’s sole and absolute discretion, the Company may determine

to settle a Company Optional Redemption in either cash or with fully paid and non-assessable shares of Common Stock, subject to

the Redemption Share Cap, if applicable. If the Company exercises the Company Optional Redemption for less than all of the outstanding

shares of Series E-1 Preferred Stock, then shares of Series E-1 Preferred Stock will be selected for redemption on a pro rata

basis or by lot across holders of the series of Series E-1 Preferred Stock selected for redemption.

Early

Redemption Fee

A

share of Series E-1 Preferred Stock will be subject to an early redemption fee if the holder elects to redeem it within

three years of its issuance (the “Holder Optional Redemption Fee”). The amount of the fee equals a percentage of the Stated

Value of the share of Series E-1 Preferred Stock to be redeemed based on the year in which the redemption occurs after the issuance

date of such share of Series E-1 Preferred Stock as follows:

| |

● |

Prior

to the first anniversary of the issuance of such share of Series E-1 Preferred Stock: 9% of the Stated Value,

which equals $90.00 per share of Series E-1 Preferred Stock; |

| |

|

|

| |

● |

On

or after the first anniversary but prior to the second anniversary: 7% of the Stated Value, which equals $70.00

per share of Series E-1 Preferred Stock; |

| |

|

|

| |

● |

On

or after the second anniversary but prior to the third anniversary: 5% of the Stated Value, which equals $50.00

per share of Series E-1 Preferred Stock; and |

| |

|

|

| |

● |

On

or after the third anniversary: 0%. |

The

Company is permitted to waive the Holder Optional Redemption Fee. Although the Company has retained the right to waive the Holder Optional

Redemption Fee, it is not required to establish any such waivers and it may never establish any such waivers.

Optional

Redemption Following Death of a Holder

Subject

to restrictions, beginning on the date of original issuance and ending on December 31st of the year in which the third anniversary of

the date of issuance occurs, the Company will redeem shares of Series E-1 Preferred Stock of a beneficial owner who is a natural person

(including a natural person who holds shares of Series E-1 Preferred Stock through an Individual Retirement Account or in a personal

or estate planning trust) upon his or her death at the written request of the beneficial owner’s estate (such date the request

is received by the Company, the “Optional Redemption Following Death of a Holder Notice Date”) at a redemption price equal

to the Settlement Amount without application of the Holder Optional Redemption Fee. In the Company’s sole and absolute discretion,

the Company may determine to settle such redemption in either cash or with fully paid and non-assessable shares of Common Stock

(at a rate equal to (1) the Settlement Amount divided by (2) the closing price of shares of Common Stock on Nasdaq, or other national

securities exchange on which the Common Stock is listed, on the last trading day prior to the Optional Redemption Following Death of

a Holder Notice Date), subject to the Redemption Share Cap, if applicable.

Other

Rights

The

Series E-1 Preferred Stock has no preemptive rights, no voting rights and no sinking fund or conversion provisions.

The

foregoing description of the Certificate of Designations is not complete and is qualified in its entirety by reference to the full text

of the Certificate of Designations, a copy of which is attached as Exhibit 3.1 hereto and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

|

APPLIED

DIGITAL CORPORATION |

| |

|

|

|

| Date: |

November

14, 2024 |

By:

|

/s/ Saidal L. Mohmand |

| |

|

Name: |

Saidal L. Mohmand |

| |

|

Title: |

Chief

Financial Officer |

Exhibit

3.1

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

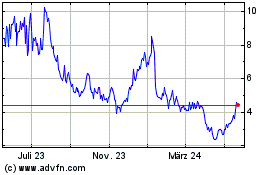

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Applied Digital (NASDAQ:APLD)

Historical Stock Chart

Von Jan 2024 bis Jan 2025