Anaptys Announces First Quarter 2024 Financial Results and Provides Business Update

09 Mai 2024 - 10:15PM

AnaptysBio, Inc. (Nasdaq: ANAB), a clinical-stage biotechnology

company focused on delivering innovative immunology therapeutics,

today reported financial results for the first quarter ended March

31, 2024 and provided a business update.

“This quarter, we continued to enroll patients globally across

three Phase 2 trials for our two best-in-class checkpoint agonists:

ANB032, our BTLA agonist, and rosnilimab, our PD-1 agonist. By year

end, we anticipate sharing top-line data from ANB032's Phase 2b

trial in atopic dermatitis, as well as moving our two preclinical

immune cell modulators, ANB033 and ANB101, into clinical

development,” said Daniel Faga, president and chief executive

officer of Anaptys. “Additionally, we are excited to further

strengthen our balance sheet by adding $50 million through a capped

non-recourse monetization of Jemperli royalties as well as share

incremental data from the imsidolimab Phase 3 program.”

Updates on Wholly Owned Immune Cell Modulator

Pipeline

ANB032 (BTLA agonist antibody)

- Enrollment ongoing for global Phase 2b trial in

moderate-to-severe AD

- 160-patient placebo-controlled trial assessing three dose

levels of subcutaneously administered ANB032 (randomized 1:1:1:1)

for a 14-week treatment duration and then followed for a six-month

off-drug follow-up period

- Reiterating top-line Week 14 data

anticipated by year-end 2024

- Primary endpoint in Phase 2b trial

to be updated from absolute change in EASI score to EASI-75 at Week

14, which is a well-accepted registrational endpoint that enables

more relevant comparisons to benchmark therapies

- Presented posters on previously reported ANB032 preclinical

data supporting the modulation of dendritic cell (DC) maturation

and function and preclinical graft vs. host disease (GvHD) data at

the 2024 American Academy of Dermatology (AAD) Annual Meeting in

March 2024 and American Association of Immunologists (AAI) Annual

Meeting in May 2024

- Poster presentations are available

here

Rosnilimab (PD-1 agonist antibody)

- Enrollment ongoing for global Phase 2b trial in

moderate-to-severe RA

- 420-patient placebo-controlled trial assessing three dose

levels of subcutaneously administered rosnilimab (randomized

1:1:1:1) for a 12-week treatment duration on well-established

endpoints, including DAS28-CRP, CDAI and ACR20/50/70

- At Week 14, rosnilimab-treated patients who achieve low disease

activity, defined as CDAI<=10, are eligible to be dosed for an

additional 16-week all-active treatment period and then followed

for a three-month off-drug follow-up period

- Reiterating top-line Week 12 data

anticipated by mid 2025

- Enrollment ongoing for global Phase 2 trial in

moderate-to-severe UC

- 130-patient placebo-controlled trial assessing two dose levels

of subcutaneously administered rosnilimab (randomized 1:1:1) for a

12-week treatment duration on well-established endpoints, including

clinical response on modified Mayo score (mMS), clinical remission

on mMS and endoscopic remission

- Rosnilimab and placebo-treated patients who achieved clinical

response on mMS are eligible to continue on their assigned

treatment for an additional 12 weeks, while patients on placebo who

are non-responders will be crossed over to the high-dose rosnilimab

treatment arm, in an all-active treatment period and then followed

for a three-month off-drug follow-up period

- Reiterating top-line Week 12 data

anticipated by H1 2026

- Presented poster on previously reported rosnilimab Phase 1 data

and membrane proximal binding epitope to optimize PD-1 agonist

signaling at the 19th Congress of the European Crohn’s and Colitis

Organisation (ECCO) in February 2024

- Poster presentation is available

here

ANB033 (anti-CD122 antagonist antibody)

- Plan to submit an Investigational New Drug (IND) application in

Q2 2024

ANB101 (BDCA2 modulator antibody)

- Plan to submit an IND application in H2 2024

Updates on Legacy Clinical-Stage Cytokine Antagonist

Programs Available for Out-Licensing

- Announced positive top-line results

from its global GEMINI-1 and GEMINI-2 Phase 3 trials evaluating the

safety and efficacy of investigational imsidolimab (IL-36R mAb) in

patients with generalized pustular psoriasis (GPP)

- See full press release here

- Plan to submit a comprehensive data

abstract for GEMINI-1 and GEMINI-2 to a H2 2024 medical

meeting

- Intend to out-license imsidolimab in

2024

Updates on GSK Immuno-Oncology Financial

Collaboration

- Announced a $50 million capped non-recourse monetization from

amended agreement with Sagard in exchange for additional Jemperli

(dostarlimab) royalties

- See full press release here

- GSK anticipates top-line data in H2

2024 from the FIRST Phase 3 trial for platinum-based therapy with

dostarlimab and niraparib versus platinum-based therapy as

first-line treatment of Stage III or IV nonmucinous epithelial

ovarian cancer

- GSK anticipates top-line data in

2025 from COSTAR Lung Phase 3 trial comparing cobolimab, a TIM-3

antagonist, plus dostarlimab, a PD-1 antagonist, plus docetaxel to

dostarlimab plus docetaxel to docetaxel alone in patients with

advanced NSCLC who have progressed on prior anti-PD-(L)1 therapy

and chemotherapy

First Quarter Financial Results and Cash

Runway

- Excluding the $50 million in proceeds from the capped

non-recourse monetization of Jemperli royalties by Sagard, cash,

cash equivalents and investments totaled $370.1 million as of March

31, 2024, compared to $417.9 million as of December 31, 2023, for a

decrease of $36.9 million relating primarily to cash used for

operating activities as well as a one-time non-operating cash

payment of $10.9 million during the quarter.

- Reiterating cash runway through

year-end 2026

- Collaboration revenue was $7.2

million for the three months ended March 31, 2024, compared to $1.4

million for the three months ended March 31, 2023. The change is

due primarily to increased royalties recognized for sales of

Jemperli.

- Research and development expenses

were $37.0 million for the three months ended March 31, 2024,

compared to $35.0 million for the three months ended March 31,

2023. The increase was due primarily to development costs for

rosnilimab, ANB032 and ANB033 offset by a decrease in development

costs for imsidolimab. The R&D non-cash, stock-based

compensation expense was $3.5 million for the three months ended

March 31, 2024 as compared to $2.8 million in the same period in

2023.

- General and administrative expenses

were $12.3 million for the three months ended March 31, 2024,

compared to $10.8 million for the three months ended March 31,

2023. The G&A non-cash, stock-based compensation expense was

$6.7 million for the three months ended March 31, 2024 as compared

to $6.1 million in the same period in 2023.

- Net loss was $43.9 million for the

three months ended March 31, 2024, or a net loss per share of

$1.64, compared to a net loss of $44.3 million for the three months

ended March 31, 2023, or a net loss per share of $1.58.

About Anaptys

Anaptys is a clinical-stage biotechnology company focused on

delivering innovative immunology therapeutics. It is developing

immune cell modulators, including two checkpoint agonists for

autoimmune and inflammatory disease: ANB032, its BTLA agonist, in a

Phase 2b trial for the treatment of atopic dermatitis and

rosnilimab, its PD-1 agonist, in a Phase 2b trial for the treatment

of rheumatoid arthritis and in a Phase 2 trial for the treatment of

ulcerative colitis. Its preclinical immune cell modulator portfolio

includes ANB033, an anti-CD122 antagonist antibody, and ANB101, a

BDCA2 modulator antibody, for the treatment of autoimmune and

inflammatory diseases. In addition, Anaptys has developed two

cytokine antagonists available for out-licensing: imsidolimab, an

anti-IL-36R antagonist, that has completed Phase 3 trials for the

treatment of generalized pustular psoriasis, and etokimab, an

anti-IL-33 antagonist that is Phase 2/3 ready. Anaptys has also

discovered multiple therapeutic antibodies licensed to GSK in a

financial collaboration for immuno-oncology, including an anti-PD-1

antagonist antibody (Jemperli (dostarlimab-gxly)) and an anti-TIM-3

antagonist antibody (cobolimab, GSK4069889). To learn more, visit

www.AnaptysBio.com or follow us on LinkedIn and X.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to: the timing of the release of data from the Company’s

clinical trials, including ANB032’s Phase 2b clinical trial in

atopic dermatitis and rosnilimab’s Phase 2b clinical trial in

rheumatoid arthritis and Phase 2 clinical trial in ulcerative

colitis; the timing of IND filings for ANB033 and ANB101; the

timing of a presentation of Phase 3 clinical data at a medical

conference; the potential to receive any additional royalties from

the GSK collaboration; the Company’s ability to find a licensing

partner for imsidolimab or etokimab and the timing of any such

transaction; and the Company’s projected cash runway. Statements

including words such as “plan,” “intend,” “continue,” “expect,” or

“ongoing” and statements in the future tense are forward-looking

statements. These forward-looking statements involve risks and

uncertainties, as well as assumptions, which, if they do not fully

materialize or prove incorrect, could cause its results to differ

materially from those expressed or implied by such forward-looking

statements. Forward-looking statements are subject to risks and

uncertainties that may cause the company’s actual activities or

results to differ significantly from those expressed in any

forward-looking statement, including risks and uncertainties

related to the company’s ability to advance its product candidates,

obtain regulatory approval of and ultimately commercialize its

product candidates, the timing and results of preclinical and

clinical trials, the company’s ability to fund development

activities and achieve development goals, the company’s ability to

protect intellectual property and other risks and uncertainties

described under the heading “Risk Factors” in documents the company

files from time to time with the Securities and Exchange

Commission. These forward-looking statements speak only as of the

date of this press release, and the company undertakes no

obligation to revise or update any forward-looking statements to

reflect events or circumstances after the date hereof.

Contact:Nick MontemaranoSenior Director,

Investor Relations and Strategic Communications

858.732.0178investors@anaptysbio.com

|

AnaptysBio, Inc.Consolidated Balance

Sheets (in thousands, except par value

data)(unaudited) |

| |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

ASSETS |

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

53,695 |

|

|

$ |

35,965 |

|

|

Receivables from collaborative partners |

|

7,089 |

|

|

|

6,851 |

|

|

Short-term investments |

|

300,970 |

|

|

|

354,939 |

|

| Prepaid

expenses and other current assets |

|

10,666 |

|

|

|

9,080 |

|

|

Total current assets |

|

372,420 |

|

|

|

406,835 |

|

| Property

and equipment, net |

|

1,954 |

|

|

|

2,098 |

|

|

Operating lease right-of-use assets |

|

15,732 |

|

|

|

16,174 |

|

|

Long-term investments |

|

15,473 |

|

|

|

27,026 |

|

| Other

long-term assets |

|

256 |

|

|

|

256 |

|

|

Total assets |

$ |

405,835 |

|

|

$ |

452,389 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

4,582 |

|

|

$ |

4,698 |

|

| Accrued

expenses |

|

25,903 |

|

|

|

30,967 |

|

| Current

portion of operating lease liability |

|

1,813 |

|

|

|

1,777 |

|

|

Total current liabilities |

|

32,298 |

|

|

|

37,442 |

|

|

Liability related to sale of future royalties |

|

310,184 |

|

|

|

310,807 |

|

|

Operating lease liability, net of current portion |

|

15,575 |

|

|

|

16,037 |

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.001 par value, 10,000 shares authorized and no

shares, issued or outstanding at March 31, 2024 and

December 31, 2023, respectively |

|

— |

|

|

|

— |

|

| Common

stock, $0.001 par value, 500,000 shares authorized, 27,317 shares

and 26,597 shares issued and outstanding at March 31, 2024 and

December 31, 2023, respectively |

|

27 |

|

|

|

27 |

|

|

Additional paid in capital |

|

706,407 |

|

|

|

702,969 |

|

|

Accumulated other comprehensive loss |

|

(624 |

) |

|

|

(797 |

) |

|

Accumulated deficit |

|

(658,032 |

) |

|

|

(614,096 |

) |

|

Total stockholders’ equity |

|

47,778 |

|

|

|

88,103 |

|

|

Total liabilities and stockholders’ equity |

$ |

405,835 |

|

|

$ |

452,389 |

|

|

AnaptysBio, Inc. Consolidated Statements

of Operations and Comprehensive Loss(in thousands,

except per share data) (unaudited) |

| |

| |

Three Months EndedMarch 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Collaboration revenue |

$ |

7,179 |

|

|

$ |

1,374 |

|

| Operating expenses: |

|

|

|

|

Research and development |

|

37,042 |

|

|

|

34,957 |

|

|

General and administrative |

|

12,338 |

|

|

|

10,818 |

|

|

Total operating expenses |

|

49,380 |

|

|

|

45,775 |

|

|

Loss from operations |

|

(42,201 |

) |

|

|

(44,401 |

) |

| Other (expense) income,

net: |

|

|

|

|

Interest income |

|

4,584 |

|

|

|

4,486 |

|

|

Non-cash interest expense for the sale of future royalties |

|

(6,317 |

) |

|

|

(4,336 |

) |

|

Other expense, net |

|

(2 |

) |

|

|

(4 |

) |

|

Total other (expense) income, net |

|

(1,735 |

) |

|

|

146 |

|

|

Net loss |

|

(43,936 |

) |

|

|

(44,255 |

) |

|

Unrealized gain on available for sale securities |

|

173 |

|

|

|

1,979 |

|

|

Comprehensive loss |

$ |

(43,763 |

) |

|

$ |

(42,276 |

) |

|

Net loss per common share: |

|

|

|

|

Basic and diluted |

$ |

(1.64 |

) |

|

$ |

(1.58 |

) |

|

Weighted-average number of shares outstanding: |

|

|

|

|

Basic and diluted |

|

26,801 |

|

|

|

27,953 |

|

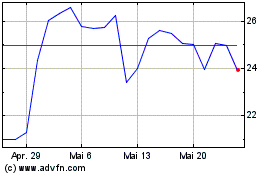

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

AnaptysBio (NASDAQ:ANAB)

Historical Stock Chart

Von Jan 2024 bis Jan 2025