false

0001860657

0001860657

2024-10-09

2024-10-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 9, 2024

ALLARITY THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-41160

|

|

87-2147982

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

24 School Street, 2nd Floor,

Boston, MA 02108

|

|

(Address of Principal Executive Offices)

|

(401) 426-4664

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.0001 per share

|

|

ALLR

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously reported, on June 18, 2024, Allarity Therapeutics, Inc. (the “Company”) received a letter from the Listing Qualifications Staff of The Nasdaq Stock Market LLC (“Nasdaq”) therein stating that for the 30 consecutive business day period between May 6, 2024 through June 17, 2024, the common stock of the Company had not maintained a minimum closing bid price of $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”).

On October 9, 2024, the Company received a letter from the Listing Qualifications Staff of Nasdaq informing the Company that for the 20 consecutive business day period between September 11, 2024 through October 9, 2024, the closing bid price of the Company’s common stock has been at $1.00 per share or greater. Accordingly, the Company has regained compliance with Listing Rule 5550(a)(2) and this matter is closed.

On October 10, 2024, the Company issued a press release announcing its compliance with the Bid Price Rule. The Company’s press release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Allarity Therapeutics, Inc.

|

|

|

|

|

|

|

|

Date: October 11, 2024

|

By:

|

/s/ Thomas H. Jensen

|

|

|

|

|

Thomas H. Jensen

|

|

|

|

|

Chief Executive Officer

|

|

Exhibit 99.1

Allarity Therapeutics Regains Compliance with NASDAQ Minimum Bid Price Requirement

Boston (October 10, 2024) — Allarity Therapeutics, Inc. (“Allarity” or the “Company”) (NASDAQ: ALLR), a clinical-stage pharmaceutical company dedicated to developing personalized cancer treatments, today announced that on October 9, 2024, it received a formal notice from The Nasdaq Stock Market, LLC’s Office of General Counsel (“Nasdaq”). The notice confirmed that the Company has regained compliance with the minimum bid price requirement as set forth in Nasdaq’s Listing Rule 5550(a)(2) (the “Bid Price Rule”). Nasdaq noted that since September 11, 2024, Allarity’s stock has maintained a closing bid price of $1.00 or more for 20 consecutive trading days, thereby meeting the requirements for regaining compliance with the Bid Price Rule.

Thomas Jensen, CEO of Allarity Therapeutics, stated, “We are pleased to report that Nasdaq has recognized our compliance with the minimum bid price requirement. With the resolution of this compliance issue, we can continue to build upon the great progress made during 2024 by concentrating our resources on advancing the stenoparib program, where the Phase 2 trial in advanced ovarian cancer has continued to deliver encouraging data. Our focus remains on progressing this novel therapy, as new treatment options are urgently needed for advanced ovarian cancer patients, who currently face very limited alternatives.”

About Stenoparib

Stenoparib is an orally available, small-molecule dual-targeted inhibitor of PARP1/2 and Tankyrase 1 and 2. At present, tankyrases are attracting significant attention as emerging therapeutic targets for cancer, principally due to their role in regulating the Wnt signaling pathway. Aberrant Wnt/β-catenin signaling has been implicated in the development and progression of numerous cancers. By inhibiting PARP and blocking Wnt pathway activation, stenoparib’s unique therapeutic action shows potential as a promising therapeutic. Allarity has exclusive global rights for the development and commercialization of stenoparib, which was originally developed by Eisai Co. Ltd. and was formerly known under the names E7449 and 2X-121.

About Allarity Therapeutics

Allarity Therapeutics, Inc. (NASDAQ: ALLR) is a clinical-stage biopharmaceutical company dedicated to developing personalized cancer treatments. The Company is focused on development of stenoparib, a novel PARP/Tankyrase inhibitor for advanced ovarian cancer patients, using its DRP® companion diagnostic for patient selection in the ongoing phase 2 clinical trial, NCT03878849. Allarity is headquartered in the U.S., with a research facility in Denmark, and is committed to addressing significant unmet medical needs in cancer treatment. For more information, visit www.allarity.com.

Follow Allarity on Social Media

LinkedIn: https://www.linkedin.com/company/allaritytx/

X: https://twitter.com/allaritytx

Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements provide the Company’s current expectations or forecasts of future events. The words “anticipates,” “believe,” “continue,” “could,” “estimate,” “expect,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predicts,” “project,” “should,” “would” and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. These forward-looking statements include, but are not limited to, statements regarding the expected clinical progress of stenoparib in advanced ovarian cancer, the potential for the drug to provide significant clinical benefit to patients, and the Company’s strategy to advance regulatory approval processes for stenoparib based on ongoing trial data. Any forward-looking statements in this press release are based on management’s current expectations of future events and are subject to multiple risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, challenges related to raising sufficient capital for clinical operations, uncertainties around the interpretation of clinical trial data, risks that initial positive data may not be replicated in larger trials, potential delays or failures in securing regulatory approvals, and the ability to bring stenoparib or other pipeline candidates to market. For a discussion of other risks and uncertainties, and other important factors, any of which could cause our actual results to differ from those contained in the forward-looking statements, see the section entitled “Risk Factors” in our Form S-1 registration statement filed on October 30, 2023, as amended and our Form 10-K annual report on file with the Securities and Exchange Commission (the “SEC”), available at the SEC’s website at www.sec.gov, and as well as discussions of potential risks, uncertainties and other important factors in the Company’s subsequent filings with the SEC. All information in this press release is as of the date of the release, and the Company undertakes no duty to update this information unless required by law.

###

Company Contact:

investorrelations@allarity.com

Media Contact:

Thomas Pedersen

Carrotize PR & Communications

+45 6062 9390

tsp@carrotize.com

v3.24.3

Document And Entity Information

|

Oct. 09, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ALLARITY THERAPEUTICS, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 09, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-41160

|

| Entity, Tax Identification Number |

87-2147982

|

| Entity, Address, Address Line One |

24 School Street

|

| Entity, Address, Address Line Two |

2nd Floor

|

| Entity, Address, City or Town |

Boston

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

02108

|

| City Area Code |

401

|

| Local Phone Number |

426-4664

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ALLR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001860657

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

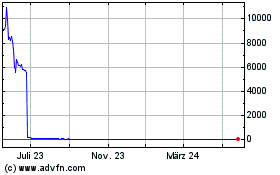

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

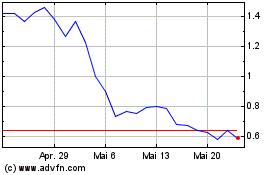

Allarity Therapeutics (NASDAQ:ALLR)

Historical Stock Chart

Von Dez 2023 bis Dez 2024