Latest Products in Avnet's Portfolio - Analyst Blog

24 August 2012 - 1:30PM

Zacks

Phoenix -based Avnet,

Inc.’s (AVT) operating unit, Avnet Electronics Marketing

Americas, has recently declared the accessibility of the latest

product ranges from Analog Devices, Inc. (ADI),

Freescale Semiconductor, Ltd (FSL) and TE

Connectivity (TE).

The company’s clients can now avail

various electronic component products such as AD5684R, designed by

Analog Devices, specifically for end applications; Freescale Tower

System and TE’s latest KOAXXA RF interconnects embedded with the

newest technologies through its e-commerce engine portal Avnet

Express. According to management, Avnet Express will provide a

user-friendly platform to the design engineers through which they

can easily access the latest products ranges.

The company’s broad portfolio of

products and services and its continued efforts to provide maximum

consumer satisfaction have both elevated its position and rendered

it more secure to hold a substantial market share in the present

scenario. During the fourth quarter of fiscal 2012, revenues from

Avnet’s Electronics Marketing (EM) declined 5.0% from the year-ago

quarter to $3.76 billion, within management’s guidance range of

$3.75 billion - $4.05 billion. We can be hopeful of a better

performance by this segment in the upcoming quarters. For the first

quarter of fiscal 2013, the company projects EM sales to be in the

range of $3.55 billion - $3.85 billion.

Avnet faces fierce competition from

big players in the semiconductor industry. One of the stalwarts

here is Arrow Electronics Inc. (ARW), which

remains an immensely formidable rival, especially in the current

times. In addition, there are several other big players such as

Wesco International Inc. (WCC) and Anixter

International Inc. (AXE) in the industry.

The current Zacks Consensus

Estimates for the first quarter of fiscal 2013 and for fiscal 2013

are 84 cents and $4.11, representing a year-over-year growth of

(6.79)% and 1.33%, respectively. The company currently retains a

Zacks #4 Rank, which translates into a short-term ‘Sell’ rating.

However, we are maintaining a long-term ‘Neutral’ recommendation on

the stock.

ANALOG DEVICES (ADI): Free Stock Analysis Report

ARROW ELECTRONI (ARW): Free Stock Analysis Report

AVNET (AVT): Free Stock Analysis Report

ANIXTER INTL (AXE): Free Stock Analysis Report

FREESCALE SEMI (FSL): Free Stock Analysis Report

WESCO INTL INC (WCC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

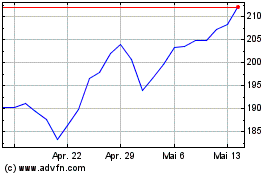

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024