Analog Devices’ (ADI) fiscal third quarter

earnings were in line with the Zacks Consensus Estimate. However,

revenue fell short of expectations.

Revenue

Analog Devices generated revenue of $683.0 million, which was up

1.2% sequentially but down 9.9% year over year and just within

management’s revenue guidance range of $682 million to $702 million

(a 1% -4 % sequential increase).

Revenue by End Market

The industrial market generated 47% of Analog

Devices’ total revenue (down 0.4% sequentially and 11.4% year over

year). This is a very diversified market for Analog Devices,

including the industrial automation, instrumentation, energy,

defense and healthcare segments. Demand from distribution was

relatively steady right through the quarter, with order patterns

strengthening slightly toward the end. Analog’s customers do not

expect further deterioration in their businesses.

Communications generated 20% of total revenue,

up 9.2% sequentially but down 9.0% year over year. Analog’s

communications business now constitutes infrastructure sales alone.

Management attributed the sequential increase to strength at

wireless customers driven by baseband deployment in the U.S., Japan

and other Asian countries. Analog Devices has offerings for both

the traditional and 4G networks, so it stands to gain when there is

any increase in demand. Additionally, it has higher content in the

4G segment, which, along with its position at leading OEMs, should

remain a positive factor influencing revenue growth.

The automotive segment generated around 17% of

Analog Devices’ second quarter revenue, down 2.8% sequentially and

up 13.0% from the year-ago quarter. Sluggish demand in Europe

impacted results in the last quarter. However, an increase in

vehicle sales, growing electronic content in vehicles and growing

dollar content per vehicle remain longer-term positives.

Consumer, which includes the computing (1% of

fiscal 2011 revenue) and handset (3% of fiscal 2011 revenue)

businesses, generated 16% of revenue, up 0.8% sequentially and down

23.2% from a year ago. The weak point here was digital cameras,

with growth in portable media supported by other segments (home

entertainment and computing), which came in flat. The positive was

strong order growth, which grew the backlog and resulted in a book

to bill ratio of over 1.

Revenue by Product Line

The year-over-year decline in revenue was broad-based across

product lines. The "Other" analog category was the only one posting

any substantial increase.

Analog signal processing products (85% of total revenue) were up

1.5% sequentially and down 10.4% year over year. Converters were

rather flat sequentially while declining 11.2% year over year.

Amplifiers, on the other hand, grew slightly (1.8%) on a sequential

basis, while declining 8.4% from last year. Other analog products

jumped 8.2% from the previous quarter, but remained 7.9% below the

year-ago level. The three product lines generated 44%, 27% and 14%

of quarterly revenue, respectively.

Power management and reference products remained at roughly 7%

of revenue, down 1.4% and 17.3% from the previous and year-ago

quarters, respectively. These products are generally sold in the

consumer market. Management has refocused the business over the

last few years to concentrate on this fast-growing product

line.

DSPs (9% of total revenue) were down 2.6% sequentially and 4.4%

year over year.

Margins

Analog Devices generated a pro forma gross margin of 65.6%, up

33 basis points (bps) sequentially, down 167 bps year over year and

short of management’s guidance of a 50 bp sequential increase. The

sequential improvement was on account of slightly better

utilization rates. The decline from the year-ago quarter was mainly

on account of significantly lower volumes. Mix was relatively

neutral to both the sequential and year-over-year comparisons.

Operating expenses of $235.4 million were up 3.5% sequentially

and 2.0% from the July quarter of 2011. Special charges related to

restructuring activity were $5.8 million in the last quarter, which

was the main reason for the operating margin shrinking 43 bps

sequentially and 568 bps year over year to 31.1%.

Net Profit

The pro forma net income was $169.8 million, or a 24.9% net

income margin compared to $162.9 million or 24.1% in the previous

quarter and $219.9 million or a 29.0% in the year-ago quarter. The

fully diluted pro forma earnings per share were 56 cents, compared

to 53 cents in the previous quarter and 71 cents in the July

quarter of last year.

Since there were no one-time items in any of the quarters, the

GAAP and non GAAP net income and EPS were the same.

Balance Sheet

Inventories increased 2.7% to $345.8 million, with annualized

inventory turns dropping sequentially from 3.1X to 3.0X. Days sales

outstanding (DSOs) inched up to 46. Cash generated from operations

was around $137.7 million. Analog Devices spent $39.2 million on

capex, $89.5 million on cash dividends and $17.3 million on share

repurchases in the last quarter.

Guidance

Management expects fourth quarter revenue of $685 million

to $715 million (a 0-5% sequential increase) with the gross margin

of 65%, operating expenses of around $231 million and diluted EPS

of 54 cents to 60 cents. Analysts polled by Zacks expected earnings

of 60 cents per share when Analog Devices reported, at the high end

of the guided range.

Our Take

Given improving order trends toward the end of the quarter and

historic low lead times, Analog Devices expects most end markets to

turn around in the current quarter. Channel inventories also appear

lean, meaning that the company is shipping to consumption.

Despite the positive commentary, guidance was again below our

expectations likely reflecting conservatism. Particularly so, since

Analog’s end markets appear to be looking up. Nevertheless,

we expect some fine-tuning of estimates, which should keep the

company a Zacks #3 Rank (Hold rating over the next 1-3 months).

We note that other analog peers, such as Linear

Technology Corp (LLTC) and Maxim

Integrated Products (MXIM) are also ranked #3 (short-term

Hold).

ANALOG DEVICES (ADI): Free Stock Analysis Report

LINEAR TEC CORP (LLTC): Free Stock Analysis Report

MAXIM INTG PDTS (MXIM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

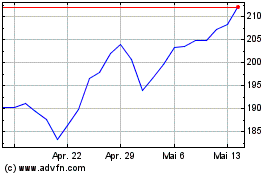

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

Von Jul 2023 bis Jul 2024