Absolute Announces Clearance Under Australia’s Foreign Acquisitions and Takeovers Act

12 Juli 2023 - 2:00PM

Business Wire

Absolute Software Corporation (NASDAQ: ABST) (TSX: ABST)

(“Absolute” or the “Company”) announced today that

1414364 B.C. LTD. (the “Purchaser”) has obtained a no

objection notification under Australia’s Foreign Acquisitions and

Takeovers Act 1975 (the “FATA”) in connection with the

previously announced acquisition of all of the outstanding shares

of Absolute (the “Shares”) by the Purchaser, an affiliate of

Crosspoint Capital Partners, L.P. (“Crosspoint”), by way of

a statutory plan of arrangement (the “Transaction” or the

“Arrangement”).

Following clearance under the FATA, the Arrangement remains

subject to customary closing conditions and is expected to close

later this month.

Further information regarding the Transaction is provided in the

Company’s management information circular dated May 26, 2023 (the

“Circular”). The Circular is available on SEDAR under the

Company’s profile at www.sedar.com and on the Company’s website at

https://www.absolute.com/company/investors/financials/.

About Absolute

Absolute Software (NASDAQ: ABST) (TSX: ABST) is the only

provider of self-healing, intelligent security solutions. Embedded

in more than 600 million devices, Absolute is the only platform

offering a permanent digital connection that intelligently and

dynamically applies visibility, control and self-healing

capabilities to endpoints, applications, and network connections -

helping customers to strengthen cyber resilience against the

escalating threat of ransomware and malicious attacks. Trusted by

nearly 21,000 customers, G2 recognized Absolute as a Leader for the

thirteenth consecutive quarter in the Spring 2023 Grid® Report for

Endpoint Management and for the third consecutive quarter in the G2

Grid Report for Zero Trust Networking.

About Crosspoint

Crosspoint Capital Partners is a private equity investment firm

focused on the cybersecurity, privacy and infrastructure software

markets. Crosspoint has assembled a group of highly successful

operators, investors and sector experts to partner with

foundational technology companies and drive differentiated returns.

Crosspoint has offices in Menlo Park, CA and Boston, MA. For more

information visit: www.crosspointcapital.com.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains certain forward-looking statements

and forward-looking information, as defined under applicable U.S.

and Canadian securities laws (collectively, "forward-looking

statements"). The words “will” and “expect”, and similar terms

and, within this press release, include, without limitation, any

statements (express or implied) respecting: the Company’s ability

to meet all conditions precedent set forth in the arrangement

agreement relating to the Arrangement (the “Arrangement

Agreement”); the proposed timing and completion of the

Transaction and other statements that are not statements of

historical facts. Forward-looking statements are not guarantees of

future performance, actions, or developments and are based on

expectations, assumptions and other factors that management

currently believes are relevant, reasonable, and appropriate in the

circumstances.

Although management believes that the forward-looking statements

herein are reasonable, actual results could be substantially

different due to the risks and uncertainties associated with and

inherent to Absolute’s business (as more particularly described in

the “Risk and Uncertainties” section of Absolute’s Q3 F2023

Management’s Discussion and Analysis, which is available at

www.absolute.com and under Absolute’s SEDAR profile at

www.sedar.com and on EDGAR at www.sec.gov), as well as the

following particular risks: risks that a condition to closing of

the Transaction may not be satisfied; the effect of the

announcement of the proposed Transaction on the ability of Absolute

to retain and hire key personnel and maintain business

relationships with customers, suppliers and others with whom they

each do business, or on Absolute’s operating results; the market

price of common stock and business generally; potential legal

proceedings relating to the proposed Transaction and the outcome of

any such legal proceeding; the inherent risks, costs and

uncertainties associated with transitioning the business

successfully and risks of not achieving all or any of the

anticipated benefits of the Transaction, or the risk that the

anticipated benefits of the Transaction may not be fully realized

or take longer to realize than expected; the occurrence of any

event, change or other circumstances that could give rise to the

termination of the Arrangement Agreement; the risk that the

Transaction will not be consummated within the expected time

period, or at all; competitive changes in the marketplace

including, but not limited to, the pace of growth or adoption rates

of applicable products or technologies; downturns in the business

cycle; and worldwide economic and political disruptions as a result

of current events.

Actual results or events could differ materially from those

contemplated in forward-looking statements as a result of, without

limitation, the following: the occurrence of a “Material Adverse

Effect” (as defined in the Arrangement Agreement); the failure by

either party to satisfy any other closing condition in favour of

the other provided for in the Arrangement Agreement, which

condition is not waived; general business, economic, competitive,

political and social uncertainties; and the future performance,

financial and otherwise, of Absolute. All forward-looking

statements included in this press release are expressly qualified

in their entirety by these cautionary statements. The

forward-looking statements contained in this press release are made

as at the date hereof and Absolute undertakes no obligation to

update publicly or to revise any of the included forward-looking

statements, whether as a result of new information, future events,

or otherwise, except as may be required by applicable securities

laws.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230712376084/en/

For more information: Media Relations Becki Levine

press@absolute.com 858-524-9443 Investor Relations Joo-Hun

Kim IR@absolute.com 212-868-6760

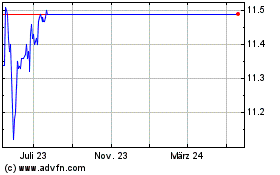

Absolute Software (NASDAQ:ABST)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

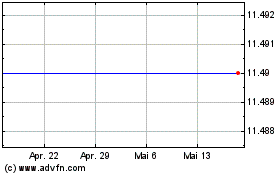

Absolute Software (NASDAQ:ABST)

Historical Stock Chart

Von Apr 2023 bis Apr 2024