TIDMUBG

RNS Number : 4747H

Unbound Group PLC

27 July 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART

DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO

DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF THAT JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

Unbound Group plc

(" Unbound", the "Company" or the "Group")

Issue of Equity and Warrants, Related Party Transaction, Total

Voting Rights and Board Changes

The Company announces that it has completed a fund raising of

GBP65,000 by way of a direct subscription from Richard Bernstein,

an existing investor in the Company ("Subscription"). The Company

has issued and allotted 6,500,000 new ordinary shares of 1 pence

each ("Ordinary Shares") at a price of 1 pence per share to Richard

Bernstein pursuant to the Subscription.

As stated in the announcement on 26 July 2023, the Company is

regarded, pursuant to the AIM Rules for Companies ("AIM Rules"), as

an AIM Rule 15 cash shell with no operating business. As previously

notified, the Company currently holds minimal cash balances. The

proceeds of the Subscription will therefore be applied to paying

ongoing adviser costs and other expenses over the coming weeks

whilst the Company explores the possibility of identifying and then

effecting an appropriate acquisition or acquisitions which would

constitute a reverse takeover under AIM Rule 14 ("Transaction").

The Ordinary Shares remain suspended from trading on AIM effective

17 July 2023 ("Suspension") pending clarification of the Company's

financial position.

The Company will require an injection of further funding for any

such Transaction to be completed. There can be no certainty that

further funding will be made available nor as to its terms. Nor can

there be any certainty that a Transaction will be identified or

ultimately completed.

Application will be made to the London Stock Exchange for

6,500,000 new Ordinary Shares, which will rank pari passu with the

Company's existing Ordinary Shares, to be admitted to trading on

AIM once the Suspension has been lifted. Dealings in the new

Ordinary Shares on AIM will not commence until this date and a

further announcement will be made once this date is known.

The Company has also granted 6,500,000 warrants over ordinary

shares of 1 pence each to Richard Bernstein ("Warrants"). The

Warrants have an exercise price of 1.5 pence per ordinary share and

have an exercise period of two years commencing on the date of

grant.

The new Ordinary Shares and the Warrants are being issued

pursuant to the shareholder authorities granted to the Directors at

the Company's 2022 Annual General Meeting.

Related Party Transaction

Prior to completion of the Subscription, Richard Bernstein held

8,200,000 existing ordinary shares representing approximately 12.59

per cent. of the existing ordinary shares in issue. As such,

Richard Bernstein is a substantial shareholder of the Company by

definition of the AIM Rules for Companies and therefore the issue

of 6,500,000 new Ordinary Shares pursuant to the Subscription and

granting of the Warrants are therefore related party transactions

pursuant to AIM Rule 13.

The Company's directors (each of whom is considered independent

of Richard Bernstein), having consulted with Singer Capital Markets

Advisory LLP (the Company's nominated adviser), consider the terms

of the Subscription and the Warrants are fair and reasonable

insofar as the Company's shareholders are concerned.

Richard Bernstein now holds 14,700,000 Ordinary Shares in the

capital of the Company, representing approximately 20.51 per cent.

of the issued share capital of the Company as enlarged by the

Subscription. In the event that Mr Bernstein subsequently exercises

the Warrants in full (and no other new Ordinary Shares are issued

by the Company in the meantime), his holding would increase to

21,200,000 Ordinary Shares, which would represent 27.13 per cent.

of the then further enlarged issued share capital of the

Company.

Total Voting Rights

Following admission of the new Ordinary Shares to trading on

AIM, the Company will have 71,655,980 ordinary shares of 1 pence in

issue. On admission, the figure of 71,655,980 may be used by the

Company's shareholders as the denominator for the calculations by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the Financial Conduct Authority's Disclosure Guidance and

Transparency Rules. The Company has no ordinary shares held in

treasury.

Board Changes

Following completion of the above arrangements, the Company

confirms that Neil Johnson, Ian Watson, and Baroness Kate Rock have

stepped down from the Company's board of directors with immediate

effect in order reduce ongoing costs and conserve cash. The

Company's board of directors now comprises Gavin Manson as Chief

Financial Officer and Alastair Miller as Independent Non-Executive

Director. The Company has chosen to adopt Quoted Companies Alliance

Corporate Governance Code (the "QCA Code"). As a result of these

changes, the Company is no longer compliant with the requirement

under the QCA Code for at least two independent non-executive

directors. The Company would seek to remedy this situation and

reconstitute its board of directors at the time that any

Transaction (as defined above) is completed, in order to ensure

compliance with this aspect of the QCA Code.

Further updates will be made as appropriate.

Enquiries

Unbound Group plc c/o Alma PR

Gavin Manson / Alastair Miller

Singer Capital Markets (Nominated Adviser

& Broker)

Peter Steel / Tom Salvesen / Alaina Wong

/ James Fischer +44 (0)20 7496 3000

Alma PR Limited (Financial PR) +44 (0)20 3405 0205

Josh Royston / Sam Modlin / Hannah Campbell unbound@almapr.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEFLFLRDDIDFIV

(END) Dow Jones Newswires

July 27, 2023 12:20 ET (16:20 GMT)

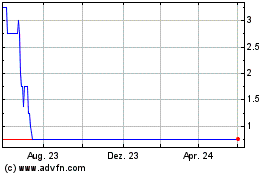

Unbound (LSE:UBG)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Unbound (LSE:UBG)

Historical Stock Chart

Von Dez 2023 bis Dez 2024