Yen Falls Amid BoJ Rate Hike Uncertainty

16 Dezember 2024 - 4:15AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Monday, as traders continue to doubt the Bank of

Japan's (BoJ) plan to further tighten its monetary policy this

week.

Market waits for Thursday's BoJ interest rate decision. The bank

expects the interest rate to remain unchanged at 0.25 percent.

Traders react negatively to the latest batch of stimulus

measures from the Chinese government that left much to be desired.

They also remain cautious ahead of the U.S. Fed's upcoming interest

rate decision later in the week.

The Fed is widely expected to lower interest rates by another 25

basis points on Wednesday, although traders are likely to pay close

attention to the accompanying statement for clues about future rate

cuts. There is much uncertainty regarding outlook for 2025 due to

stubborn inflation.

CME Group's FedWatch Tool is currently indicating a 97.1 percent

chance the Fed will cut rates by a quarter point next week but an

81.0 percent chance the central bank will then leave rates

unchanged in late January.

In economic news, the value of core machine orders in Japan was

up a seasonally adjusted 2.1 percent on month in October, the

Cabinet Office said on Monday - coming in at 869.8 billion yen.

That beat forecasts for an increase of 1.2 percent following the

0.7 percent decline in September.

On a yearly basis, core machine orders climbed 5.6 percent -

again exceeding expectations for a gain or 0.7 percent after

slumping 4.8 percent in the previous month. For the fourth quarter

of 2024, core machine orders are seen higher by 5.7 percent on

quarter and 8.0 percent on year.

The Jibun Bank revealed that the manufacturing sector in Japan

continued to contract in December, albeit at a slower pace, with a

manufacturing PMI score of 49.5. That's up from 49.0 in November,

although it remains beneath the boom-or-bust line of 50 that

separates expansion from contraction. The report also said the

services PMI improved to 51.4 in December from 50.5 in

November.

In the Asian trading now, the yen fell to near 3-week lows of

161.99 against the euro and 153.98 against the U.S. dollar, from

last week's closing quotes of 161.35 and 153.64, respectively. The

yen may test support near 166.00 against the euro and 157.00

against the greenback.

Against the pound and the Swiss franc, the yen slid to 4-day low

of 194.57 and 172.77 from Friday's closing quotes of 193.86 and

172.07, respectively. If the yen extends its downtrend, it is

likely to find support around 199.00 against the pound and 177.00

against the franc.

The yen dropped to a 1-week low of 88.99 against the NZ dollar

from Friday's closing value of 88.51. On the downside, 92.00 is

seen as the next support level for the yen.

Against the Australia and the Canadian dollars, the yen slid to

more than 2-week lows of 98.21 and 108.29 from last week's closing

quotes of 97.73 and 107.94, respectively. The next possible

downside target for the yen is seen around 102.00 against the

aussie and 111.00 against the loonie.

Looking ahead, Flash Purchasing Managers' survey results from

various European economies and the U.K. for December are slated for

release in the European session.

In the New York session, Canada housing starts for November,

U.S. New York Empire State manufacturing index for December and

U.S. S&P Global flash PMI results for December are set to be

released.

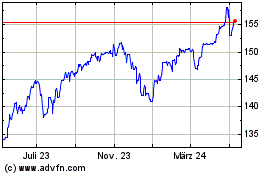

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Nov 2024 bis Dez 2024

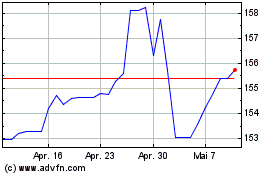

US Dollar vs Yen (FX:USDJPY)

Forex Chart

Von Dez 2023 bis Dez 2024