Commodity Currencies Fall As China Industrial Profits Drop

28 Oktober 2024 - 5:12AM

RTTF2

The Commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Monday, after data showed that the Chinese

industrial profits slid in September.

Sunday, data from the National Bureau of Statistics showed that

the industrial profits at large Chinese companies dropped 27.1

percent from a year earlier in September, accelerating from a 17.8

percent slump for the previous month. Profits fell 3.5 percent in

the first nine months from the same period last year.

The third quarter saw China's GDP grow at its slowest rate since

early 2023, and while Beijing scrambles to boost growth, the

crisis-hit real estate market is not showing many signs of

stabilizing.

Increased deflationary pressures, slower export growth, and

muted loan demand were all noted in recent data, which raised

concerns about the economic recovery and reinforced the argument

for fiscal stimulus to spur development.

Oil prices were down nearly 5 percent in Asian trade after

Israel's retaliatory strike on Iran over the weekend bypassed

Tehran's oil and nuclear facilities.

The uncertainty about the outcome of the upcoming U.S.

presidential election and rising geopolitical tensions in the

Middle East are weighing on market sentiment.

The Fed is still widely expected to lower rates by a quarter

point next month, but CME Group's FedWatch Tool currently indicates

a 24.0 percent chance the central bank will leave rates unchanged

in December.

Traders will focus on Bank of Canada (BoC) Governor Macklem's

speech, due later in the day for fresh impetus.

In the Asian trading today, the Australian dollar fell to more

than a 1-month low of 1.6391 against the euro, from Friday's

closing value of 1.6341. The aussie may test support near the 1.65

region.

Against the U.S. and the Canadian dollars, the aussie slid to

nearly a 2-1/2-month low of 0.6579 and nearly a 1-1/2-month low of

0.9149 from last week's closing quotes of 0.6603 and 0.9172,

respectively. If the aussie extends its downtrend, it is likely to

find support around 0.64 against the greenback and 0.90 against the

loonie.

The aussie edged down to 1.1039 against the NZ dollar, from

Friday's closing value of 1.1046. On the downside, 1.09 is seen as

the next support levels for the aussie.

The NZ dollar fell to nearly a 3-month low of 0.5957 against the

U.S. dollar and more than a 2-month low of 1.8102 against the euro,

from Friday's closing quotes of 0.5977 and 1.8055, respectively.

The kiwi may test support near 0.57 against the greenback and 1.84

against the euro.

The Canadian dollars slid to nearly a 3-month low of 1.3907

against the U.S. dollar, from Friday's closing value of 1.3891. The

loonie is likely o find support around the 1.40 region.

The loonie edged down to 1.5007 against the euro, from last

week's closing value of 1.4993. On the downside, the loonie may

test support near 1.51 against the euro.

Looking ahead, Canada wholesale sales data for September and

U.S. Dallas Fed manufacturing business index for October are slated

for release in the New York session.

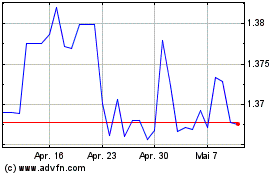

US Dollar vs CAD (FX:USDCAD)

Forex Chart

Von Nov 2024 bis Dez 2024

US Dollar vs CAD (FX:USDCAD)

Forex Chart

Von Dez 2023 bis Dez 2024