Yen Rises After BoJ Himino Comments

10 Oktober 2024 - 9:55AM

RTTF2

The Japanese yen strengthened against other major currencies in

the European session on Thursday, after the Bank of Japan deputy

Governor Himino said that the central bank would hike rates if it

had more confidence in forecasts.

Ryozo Himino, deputy governor of the Bank of Japan, stated that

if the board has "greater confidence" in the realization of its

pricing and economic projections, the central bank will take

interest rate hikes into consideration.

Himino also said that the "totality" of the facts presented at

each policy meeting will be taken into consideration by the BOJ

when determining when to hike interest rates.

Investors remain cautious ahead of the U.S. CPI data later in

the day that could influence the pace and size of interest-rate

cuts by the Federal Reserve.

In other economic news, producer prices in Japan were unchanged

in September, the Bank of Japan or BoJ said on Thursday - versus

expectations for a decline of 0.3 percent following the 0.2 percent

drop in August. On a yearly basis, producer prices rose 2.8 percent

- exceeding forecasts for an increase of 2.3 percent and up from

2.6 percent in the previous month.

Export prices fell 0.4 percent on month and rose 0.5 percent on

year, the bank said, while import prices slumped 1.3 percent on

month and 0.4 percent on year. The foreign exchange rate slumped

2.0 percent on month.

The BoJ also said the value of overall bank lending in Japan was

up 2.7 percent on year in September, the Bank of Japan said on

Thursday - coming in at 624.24 trillion yen. That was shy of

expectations for an increase of 2.9 percent and down from 3.0

percent in August. For the third quarter of 2024, overall lending

was up 3.0 percent on year, lending excluding trusts rose 3.3

percent and lending from trusts was up 0.6 percent

In the European trading today, the yen rose to 162.69 against

the euro, 194.52 against the pound and 148.78 against the U.S.

dollar, from an early near 2-month low of 163.61, a 3-day low of

195.50 and more than a 2-month low of 149.55, respectively. If the

yen extends its uptrend, it is likely to find resistance around

157.00 against the euro, 191.00 against the pound and 140.00

against the greenback.

Against the Swiss franc, the yen edged up to 179.09 from an

early low of 173.73. On the upside, 169.00 is seen as the next

resistance level for the yen.

Looking ahead, U.S. CPI data for September and U.S. weekly

jobless claims data are slated for release in the New York

session.

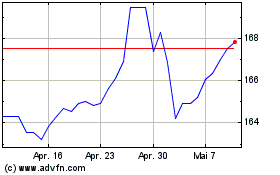

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Nov 2024 bis Dez 2024

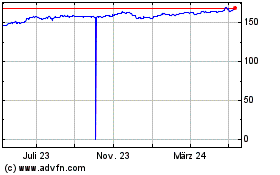

Euro vs Yen (FX:EURJPY)

Forex Chart

Von Dez 2023 bis Dez 2024